HYCM Review 2026

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

HYCM Evaluate - research result

Key Takeaways

HYCM is a mid-sized broker with a multi-decade trading history.

HYCM executes fast trades with an average execution time of 12 milliseconds.

HYCM provides good access to financial markets, with over 1,250 tradable assets in five classes.

With access to 70 currency pairs and hundreds of Contract for Differences (CFD) on indices, commodities, cryptocurrencies and stocks, HYCM customers have many investment options from which to choose.

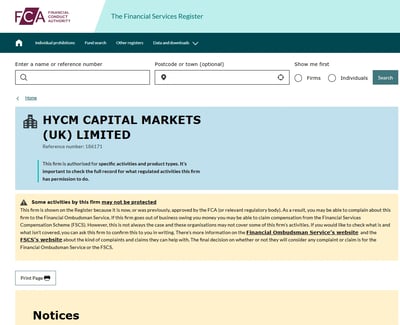

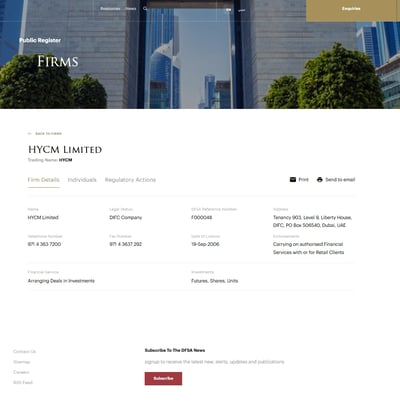

Henyep Capital Markets (UK) Limited is regulated by the Financial Conduct Authority (FCA); and Henyep Capital Markets Limited is authorized and regulated by the Dubai Financial Services Authority (DFSA).

HYCM offers competitive spreads and commissions across most account types, with spreads as low as 0.1 pips on its Raw account.

HYCM prides itself on providing a secure trading environment with respectable investment in cybersecurity.

Traders can access a base of quality research and education tools on the broker’s website, supplemented by market news from such third parties as Trading Central.

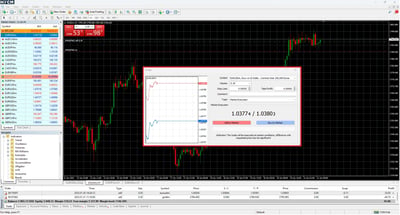

HYCM uses the well-known third-party trading platforms MetaTrader4 (MT4) and MetaTrader5 (MT5).

HYCM offers traders a choice of three different account types for different types of traders.

HYCM supplies quality multilingual 24/5 customer support.

Last Reviews

Overall Summary

I researched Henyep Capital Markets (HYCM) and found it to be a reputable global broker with over 40 years of experience, providing FOREX and CFD trading across multiple markets. Authorized by leading regulators, including the UK's Financial Conduct Authority (FCA), HYCM enjoys a solid reputation, making it a reliable choice for traders worldwide.

The broker offers straightforward and recognizable trading conditions via MetaTrader platforms (MT4 and MT5), complemented by its user-friendly proprietary mobile app, HYCM Trader. Traders benefit from competitive pricing, especially on the Raw account, which has an attractive spread cost 0.1 pip on EUR/USD. The minimum deposit of just $20 makes HYCM accessible even to newcomers with little capital.

In my view, you can gain access to valuable research resources, including third-party technical analysis from Trading Central. However, in our research, we found that the product range was rather narrow, restricted primarily to FOREX and CFDs. Recent regulatory changes mean HYCM no longer serves EU clients due to the renunciation of its Cyprus license in June 2024. Nevertheless, HYCM’s overall offering remains robust, combining affordability, security, and solid research support.

Is HYCM Safe?

HYCM is safe and holds licenses from respected regulators such as the UK’s FCA. The broker offers negative balance protection to all clients. However, investor compensation varies by jurisdiction. Leverage is pre-set based on region and account type, with regulated regions like the UK capped at 30:1 for FOREX, while offshore clients can access leverage up to 500:1, allowing flexibility for advanced traders.

In my opinion, HYCM is a safe and trustworthy broker. As mentioned, it holds licenses from top-tier regulators, including the UK's FCA and the Dubai Financial Services Authority (DFSA).

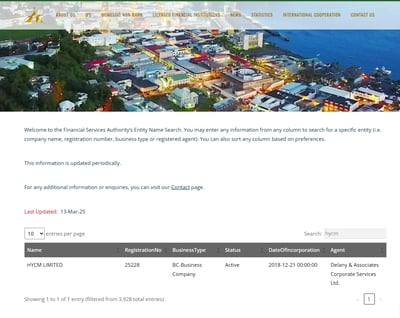

The broker offers negative balance protection, meaning that you will never lose more than your deposited funds. However, while traders in the UK enjoy investor protection, newer international clients, particularly those onboarded through its St. Vincent and the Grenadines entity, do not benefit from the same level of regulatory safeguards.

Despite this, HYCM’s long operating history since 1977 and its continued adherence to global best practices support its reputation as a secure broker for FOREX and CFD trading.

How HYCM Protects You from Reckless Leverage and Margin Trading

I was pleased to learn that at HYCM, leverage policies are tailored to balance opportunity with protection, depending on your location and the regulatory entity under which you are registered. Clients trading through the UK face capped leverage levels in line with regulatory standards—up to 30:1 on major FOREX pairs and 5:1 on stocks and ETFs.

Meanwhile, traders onboarded through HYCM’s offshore entity in St. Vincent and the Grenadines can access leverage up to 500:1, giving experienced traders more flexibility. This tiered approach gives aggressive trading options for advanced traders, while still protecting less-experienced clients.

Unlike some brokers, HYCM does not allow clients to manually adjust leverage settings themselves within the platform. This is a good thing. Rather, leverage is pre-set based on the account type and the instrument class. The end result? The combination of negative balance protection and built-in margin requirements helps provide HYCM traders with a structured, risk-conscious environment.

How you are protected

As I've said, HYCM protects you with a negative-balance protection policy. Additionally, the broker enforces strict fund segregation practices

Formal investor compensation, however, depends on where you are based. Clients trading under HYCM UK benefit from the Financial Services Compensation Scheme (FSCS), with protection up to £85,000, Previous HYCM Europe clients used to be covered by CySEC’s Investor Compensation Fund up to €20,000, but this no longer applies.

If you register under HYCM's St. Vincent and the Grenadines entity, you won’t have access to investor compensation schemes.

Regulation and other security measures

As mentioned, HYCM operates under a decent level of regulatory coverage, although it could be better. When it comes to technology security, HYCM uses encrypted channels to protect all financial transactions on its platforms.

However, similar to many brokers operating through MT4 and 5, HYCM does not yet offer advanced two-factor authentication (2FA) or biometric login options like fingerprint or Face ID recognition through its platforms.

But those same traders using MetaTrader platforms benefit from encrypted data transmission, customizable permissions for account access, and secure order execution environments.

Top broker features

There are many reasons I would recommend considering this broker. Here are some of them:

Competitive raw account pricing: Spreads start from just 0.1 pips on major FOREX pairs with a low $4 round-turn commission.

Low minimum deposit: A $20 entry point makes the broker accessible to cost-conscious traders.

Multi-platform access: Traders can choose among MT4, MT5, and HYCM Trader app.

Rich research tools: Account holders get access to premium resources like Trading Central, Seasonax, and Financial Source.

Fractional share trading: HYCM Invest allows you to buy fractional shares commission-free across nearly 1,000 global stocks.

No fee deposits and withdrawals: Most payment methods carry no fees, helping traders keep more of their money.

Negative balance protection: HYCM guarantees that traders cannot lose more than their account balance.

For Whom Is HYCM Recommended?

I recommend HYCM to traders who value strong regulatory backing, low entry costs, and straightforward trading conditions. As a beginner, you will surely appreciate the low $20 minimum deposit, the user-friendly HYCM Trader app, and access to educational resources like HYCM Academy’s video courses.

Active FOREX and CFD traders looking for competitive spreads, especially on the super-competitive Raw account, will find HYCM a cost-effective option. If you are interested in fractional share trading without commissions, you’ll also benefit from HYCM Invest, which offers over 1,000 stocks to diversify your portfolios.

That said, HYCM does not offer the most attractive proposition to traders looking for an ultra-wide product range. Rather, this broker is best for cost-conscious traders who prioritize transparent pricing and access to a trading experience without the extra frills.

Here are the pros and cons of using this broker:

-

Decent regulatory oversight with top-tier authorities like the FCA

-

Low minimum deposit of only $20

-

Competitive raw account spreads from 0.1 pips

-

Multi-platform trading with MT4, MT5, and the HYCM Trader app

-

Good research tools providing valuable market insights

-

Fractional share trading to nearly 1,000 global stocks

-

Mostly no fee deposits and withdrawals

-

CFD-dominant, with no access to real stocks or mutual funds

-

Inactivity fee of $10 per month after 90 days

-

No 2FA, meaning security is weaker compared to other brokers

-

Does not serve EU-based clients or clients from Canada and the USA

-

Platforms are limited to MetaTrader platforms and a proprietary app

-

Some assets are only available on specific platforms or account types

Offering of Investments

HYCM offers access to over 1,250 tradable instruments, with availability varying by platform and regulatory region. FOREX traders can choose from more than 70 currency pairs, while stock CFD traders have access to around 1,000 shares from major global exchanges, alongside commission-free fractional share trading via HYCM Invest. Index CFDs include global benchmarks like the S&P 500 and DAX 30.

I was pleased to find that HYCM offers a range of tradable instruments across asset classes. Traders can access CFD trading on FOREX, stocks, indices, and commodities, with a total offering of over 1,250 tradable symbols.

As I’ve mentioned, while the selection leans heavily toward FOREX and CFDs, HYCM does provide exposure to the top emerging technologies, including fractional share trading on around 1,000 global stocks commission-free through HYCM Invest.

The availability of specific products can vary depending on your region and regulatory jurisdiction, but the broker tries to ensure competitive access to popular markets with tight spreads and flexible trading options.

FOREX

HYCM offers a solid FOREX lineup with access to over 70 currency pairs, including majors, minors, and exotics. You can operate across both MT4 and MT5 platforms, though some exotic pairs are only available on MT5.

Stock CFDs

The broker provides access to approximately 1,000 stock CFDs from major exchanges in the US, UK, Germany, and Spain. Traders can speculate on big-name companies without owning the underlying shares.

The offering is decent compared to many brokers focused purely on FOREX, though actual stock CFD availability can vary depending on the platform and jurisdiction. As mentioned, fractional share trading is available through HYCM Invest, allowing traders to enter positions in global stocks commission-free.

Index CFDs

For those looking to trade the broader markets, HYCM offers 15+ index CFDs, covering major global indices like the S&P 500, NASDAQ 100, FTSE 100, and Germany’s DAX 30.

These products allow traders to gain diversified market exposure with tight spreads and relatively low margin requirements. Spreads on indices like the S&P 500 can be as low as 0.5 points.

Commodity CFDs

HYCM offers trading on 14 commodities, including key metals like gold and silver, plus energy products such as oil and natural gas. Traders can speculate on both spot and futures pricing through CFDs.

You should know that commodities serve as an important diversification tool in volatile markets, and HYCM provides flexible margin requirements depending on asset class and account type.

Cryptocurrency CFDs

Traders can access 28 crypto pairs, including major assets like Bitcoin, Ethereum, and Litecoin. Be aware that crypto trading is not available under HYCM's FCA license, only its offshore entities. Crypto spreads and margin settings vary, with lower leverage levels applied compared to FOREX pairs.

Available assets

| Markets | Available | Number of Assets |

| Currency Pairs | 70 | |

| Stocks | 1000 | |

| Commodities | 14 | |

| Crypto | 29 | |

| Indices | 28 | |

| ETFs |

Account Types

HYCM offers three main live account types, each with a low minimum deposit of $20 and tailored to different trading styles. The Fixed account provides zero-commission trading with spreads from 1.5 pips, while the Classic account features variable spreads from 1.2 pips, also commission-free. The Raw account targets active traders, offering tight spreads from 0.1 pip with a $4 round-turn commission per lot.

HYCM offers three main live account types — Fixed, Classic, and Raw — each designed to suit different trading styles and tolerances for risk management. All accounts require a low minimum deposit of just $20, making HYCM accessible to a wide range of traders.

Fixed account: features spreads starting from 1.5 pips with zero commission charges. It's best suited for traders who prefer the predictability of fixed spreads, especially during volatile market conditions.

Classic account: operates with variable spreads starting from 1.2 pips, also with no additional commissions. This account offers more competitive pricing during normal market conditions and is ideal for traders who want slightly tighter spreads without paying a commission per trade.

Raw account: This is HYCM’s most competitive option for active traders. It offers ultra-tight spreads from as low as 0.1 pip, but charges a $4 round-turn commission per standard lot. For traders prioritizing cost efficiency and fast execution, especially in FOREX trading, the Raw account delivers the best all-in pricing structure HYCM has available.

All accounts allow access to both MT4 and MT5 platforms. Overall, HYCM’s account structures are simple, transparent, and cost-effective, offering options for both newer traders looking for ease of use and experienced traders hunting for lower spreads and faster execution.

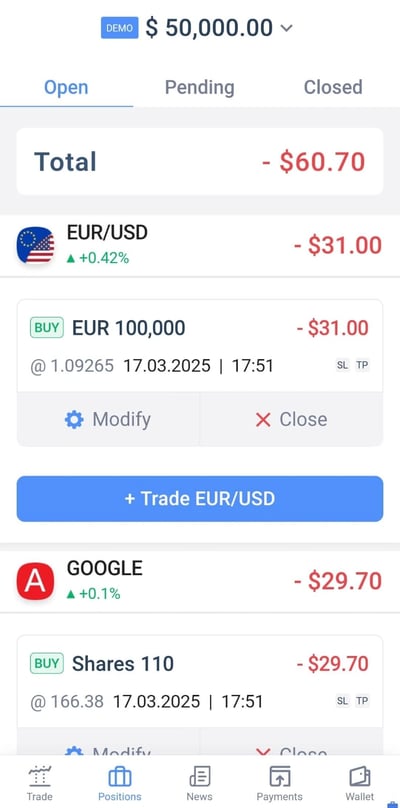

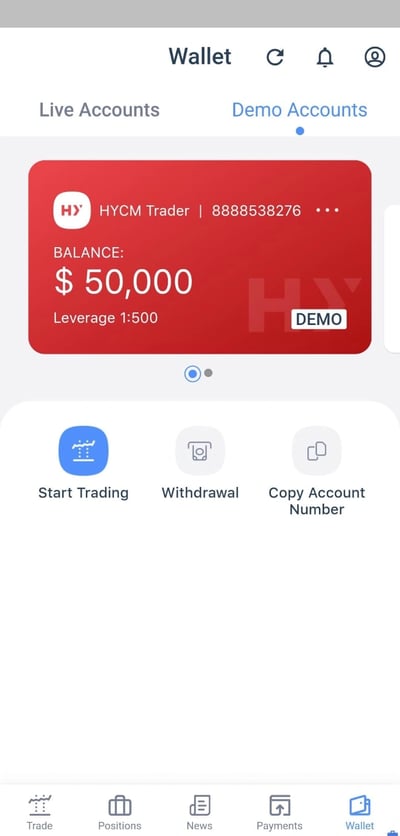

Demo account

HYCM provides a free demo account that allows traders to practice in a risk-free environment using virtual funds. The account mirrors real market conditions and is available across all major platforms, including MT4, MT5, and the HYCM Trader app.

Islamic (Swap-Free) account

For traders adhering to Islamic finance principles, HYCM offers Islamic accounts that comply with Sharia law by eliminating overnight interest charges (swaps).

| Account Type | Minimum Deposit | Spread Commission | Commission | Swap Commission | Deposit Commission | Withdrawal Commission |

|---|---|---|---|---|---|---|

| Classic | $20 | Starting from 1.2 pips | $0 | No | $0 | $0 |

| Fixed | $20 | Starting from 1.5 pips | $0 | No | $0 | $0 |

| Raw | $20 | Starting from 0.1 pips | Starting from $4 | No | $0 | $0 |

Account opening

I found opening an account with HYCM is a straightforward, fully digital process designed to get you up and running quickly.

What is the minimum deposit at HYCM?

The minimum deposit required to open an account with HYCM is $20, applicable to the Fixed, Classic, and Raw account types. This low entry point makes HYCM accessible to a wide range of traders, including beginners.

There is one quirk of which you need to be aware, which is that the minimum deposit may vary depending on the chosen payment method; for instance, bank wire transfers typically require a higher minimum deposit of $250.

How to open your account

Just as I did, you need to visit the HYCM website and click on "Open An Account." Enter your country of residence, date of birth, and residential address. After that, you must choose your desired account type (Fixed, Classic, or Raw), trading platform (MT4, MT5, or HYCM Trader), preferred base currency, and leverage level.

Upload the required identification documents to verify your account. HYCM typically processes verifications promptly, often within one business day. Once these easy steps are completed, you can fund your account and begin trading.

Deposits and Withdrawals

HYCM supports a wide range of deposit and withdrawal methods, including credit cards, bank transfers, e-wallets like Skrill and Neteller. Most deposits are processed within an hour and are free of charge, except for bank wires, which require a higher $250 minimum and can take 1–7 business days. Withdrawals are generally free, though bank transfers incur a $12 fee.

HYCM offers a range of deposit and withdrawal options designed for speed, flexibility, and cost-efficiency.

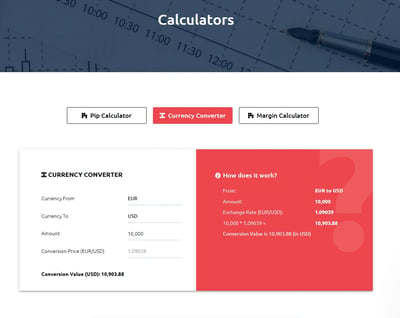

Account base currencies

You can access accounts denominated in the following base currencies: USD, EUR, GBP, AED, and JPY. Remember that selecting a base currency that aligns with your local currency can help minimize conversion fees and simplify your trading experience.

HYCM deposit fees and options

I was happy to learn that the broker offers a range of convenient deposit and withdrawal methods. Deposits are generally fee-free across all major payment methods, including bank wire transfer, credit and debit cards, Skrill, and Neteller.

You can also fund your accounts with cryptocurrency options like Bitcoin and Ethereum via selected channels, although crypto deposits are mostly available for users registered under HYCM’s offshore entity.

The minimum deposit at HYCM is low — just $20 — making it easy for traders to get started. Bank wire transfers typically require a slightly higher minimum deposit of $250 and I found they could take between 1–7 business days to process, whereas electronic payments like Skrill, Neteller, and credit cards are usually processed within one hour.

HYCM withdrawal fees and options

Withdrawals at HYCM are mostly free of charge, with zero internal withdrawal fees; however, wire transfer withdrawals cost $12. You can withdraw funds using the same methods as deposits, including bank cards, e-wallets, and bank transfers, depending on regional availability. Processing times are typically fast, with many withdrawals completed instantly or within 24 hours. Similar to deposits, make sure that you initiate withdrawals in the name of the trader.

| Method | Credit Card | Credit Card | Skrill | Neteller | Cryptocurrency | PayPal | Apple Pay |

| Deposit fee | $0 | $0 | $0 | $0 | $0 | Unavailable | Unavailable |

| Withdrawal fee | $0 | $12 | $0 | $0 | $0 | Unavailable | Unavailable |

Customer Service

HYCM provides reliable customer support available 24 hours a day, five days a week, through live chat, email, and telephone, with quick and professional response times. Email inquiries are typically answered within an hour, and live chat connects swiftly to knowledgeable agents. Support is also available via Telegram, while the broker’s social media channels focus more on updates than direct assistance.

I learned that the broker offers a reliable customer support experience, with services available 24 hours a day, five days a week. Clients can reach the support team through live chat directly on the HYCM website, email, or telephone, with prompt response times across all channels. During testing, email queries were typically answered within one hour, and live chat sessions connected quickly to knowledgeable agents.

For those who prefer messaging platforms, HYCM also offers support via Telegram. The broker maintains an active presence on social media, including Facebook and LinkedIn, although these channels are more suited for company updates than direct client support.

While HYCM’s support is generally professional and helpful, it’s important to note that service availability is limited to Monday through Friday, meaning clients who need urgent assistance over the weekend will have to wait until the next business day. This is standard across much of the industry but may be a limitation for traders in markets that experience volatility outside traditional trading hours.

| Live Chat | Phone | |||

| Available | Available | Available | Available | Available |

| Quick response | Fast | Fast | Moderate | Fast |

Commissions and Fees

HYCM offers competitive spreads, with the Raw account providing spreads from 0.1 pips plus a $4 round-turn commission, while the Classic and Fixed accounts are commission-free with spreads starting from 1.2 and 1.5 pips respectively. Islamic accounts are available to avoid interest charges, with a fixed fee applied after 14 days. The broker charges a $10 monthly inactivity fee after 90 days of dormancy, and while deposits and most withdrawals are free, exceptions include a $12 fee for bank transfers.

Here's a detailed breakdown of the fees and commissions associated with HYCM:

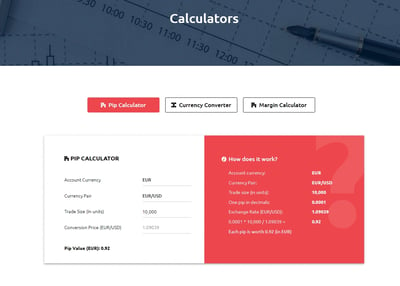

Spreads

The broker offers competitive spreads across its account types. The Raw account provides ultra-tight spreads starting from 0.1 pips on major FOREX pairs, ideal for active traders seeking low-cost execution. The Classic account features variable spreads starting from 1.2 pips, while the Fixed account offers fixed spreads from 1.5 pips, providing stability during volatile market conditions.

Commissions

Commission structures at HYCM vary by account type. The Raw account charges a $4 round-turn commission per standard lot, aligning with industry standards for ECN-style accounts. Both the Classic and Fixed accounts are commission-free, with trading costs incorporated into the spreads.

Swap fees and Islamic accounts

HYCM applies overnight swap fees for positions held beyond the trading day, reflecting the cost of rolling over positions. For traders adhering to Islamic finance principles, HYCM offers swap-free Islamic accounts.

These accounts shield traders from overnight interest charges; however, a fixed fee may apply if positions are held open beyond a specified period, typically after 14 days.

Inactivity fee

If an account remains dormant for 90 consecutive days, a monthly fee of $10 is charged. This fee continues until the account is reactivated or the balance reaches zero.

Other commissions and fees

HYCM generally does not charge fees for deposits and withdrawals. However, certain conditions apply. With bank wire withdrawals, a $12 fee is levied.

| Spread | Commission | Swap | Islamic Account | |

| Currencies | Starting from 0.1 Pips | $4 | No | Available |

| Stocks | Not Mentioned | $0 | Yes | Available |

| Commodities | Starting from 35 pips | $0 | Yes | Available |

| Indices | Starting from 1 pip | $0 | Yes | Unavailable |

Platforms and Tools

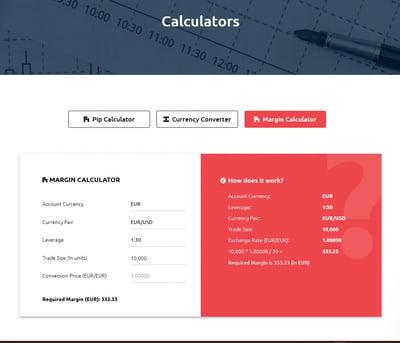

HYCM offers trading through MT4 and 5 as well as its own HYCM Trader app, providing desktop, web, and mobile access. MT4 is known for its reliability and simplicity, with features like one-click trading, Expert Advisors, and 30 indicators, while MT5 expands functionality with 80 indicators, 21 timeframes, and access to more instruments like stock and ETF CFDs. Both platforms integrate Trading Central tools and additional services like Seasonax and Financial Source for deeper market insights.

Here is my overview of the HYCM desktop and web trading platforms in terms of key usability features:

Platforms

HYCM gives traders access to two of the industry's leading platforms — MT4 and MT5 — alongside its own proprietary HYCM Trader app for mobile trading. Together, these platforms cater to both beginner and experienced traders, offering a flexible trading environment across desktop, web, and mobile devices.

MT4: This platform remains the broker’s most widely used platform, favored for its stability, speed, and broad range of technical tools. You can benefit from 30 built-in technical indicators, nine timeframes, one-click trading, and automated trading through Expert Advisors (EA).

Customizable charts and a variety of order types provide enough flexibility for detailed strategy development.

MT5: This platform has powerful features like 21 timeframes, 80 technical indicators including Bollinger Bands, Moving Averages, Fibonacci Sequences, RSI Indicators, and more. It also supports complex pending orders. MT5 also allows access to a broader range of instruments, including more stock CFDs and ETF CFDs that aren’t available on MT4.

Both MT4 and MT5 are available as downloadable desktop applications, web-based platforms (WebTrader), or mobile apps for Android and iOS.

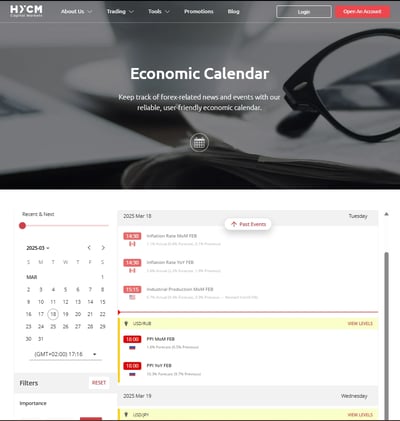

Beyond platform choice, HYCM enhances the trading experience with access to Trading Central research tools, including Analyst Views and an Economic Calendar integrated into the MetaTrader suite. Active live account holders also gain access to Seasonax and Financial Source, two services that provide valuable data-driven insights for market timing and macro analysis.

Login and security

Login security on both HYCM’s desktop platforms is basic. Traders log in with a username and password, but there is no 2FA or biometric login options like fingerprint or Face ID.

While the platforms themselves are encrypted and secure for transactions, the absence of 2FA or biometric security is a shortcoming compared to brokers offering stronger login protection.

Search functions

Both MetaTrader platforms provide solid search functionality. I was able to easily find instruments either by scrolling through categorized lists or using a direct search bar to locate FOREX pairs, commodities, indices, or CFDs.

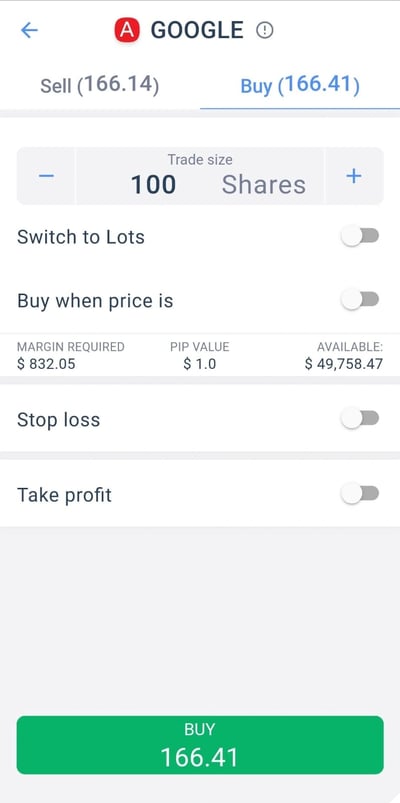

Placing orders

I found that HYCM supports a variety of order types across both desktop and mobile. Traders can place market orders, limit orders, and stop orders, with advanced time-in-force options like Good ‘Til Canceled (GTC) and Good ‘Til Time (GTT) available.

On the desktop MT4 platform, trailing stop orders are also supported. The HYCM Trader app simplifies the order placement process with intuitive tabs, ensuring that even mobile users can execute trades confidently and efficiently.

Alerts and notifications

On desktop MetaTrader, traders can configure email and push notification alerts through the platform settings. The HYCM Trader app also supports price alerts directly from the mobile interface, helping traders stay informed about market movements in real time.

However, it's worth noting that push notifications and alert setups on MetaTrader require manual configuration, which may not be as seamless as modern, integrated alert systems found on some newer apps.

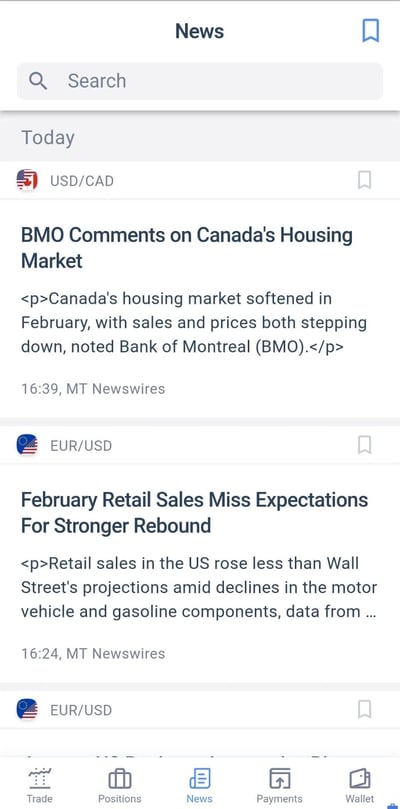

Mobile Trading

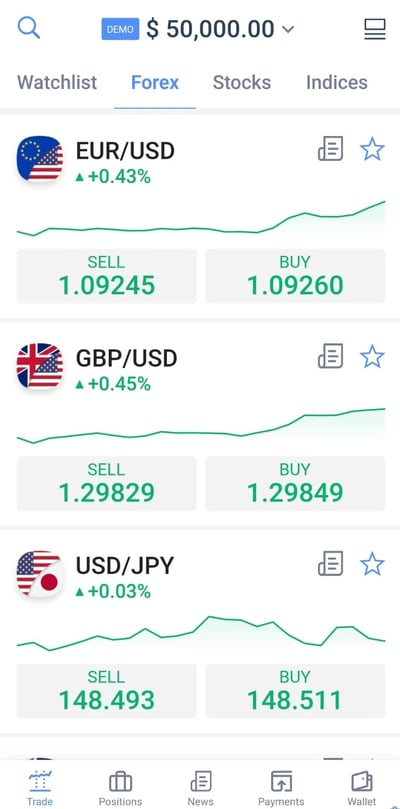

HYCM offers mobile trading through both the MetaTrader apps and its proprietary HYCM Trader app, with the latter providing a cleaner, more intuitive interface tailored for speed and simplicity. The HYCM’s app makes it easy to navigate between quotes, positions, and account management. Order placement is straightforward across all platforms, with quick-trade options and real-time alerts available, although MetaTrader requires manual setup for push notifications.

Here’s a dedicated section focused specifically on HYCM’s mobile trading tools,

Platforms

HYCM Trader app: This in-house mobile trading solution. The app is user-friendly, well-designed, and supports full trading capabilities, including real-time quotes, trade execution, and account management.

While the app currently lacks advanced login security, it remains a solid mobile solution for traders who want to monitor and manage their accounts on the go.

Look and feel

I feel that the MetaTrader mobile apps are powerful but carry an older design look, focused more on functionality than modern visual appeal.

You’ll find charts, indicators, and watchlists easy to access, but the interface can feel cluttered for new users.

By contrast, the HYCM Trader app offers a cleaner, more intuitive layout, making it faster to navigate among account details, open positions, and market quotes. The HYCM Trader app is a good fit for traders who want speed and simplicity from their mobile trading experience.

Login and security

Login security on all HYCM mobile platforms is basic. Users authenticate with a standard username and password combination. While the underlying platforms use encrypted connections to secure user data and transactions, the absence of enhanced login security is a drawback compared to brokers that have adopted stronger protection measures on mobile.

Search functions

On mobile, the HYCM Trader app’s search feature is particularly well-optimized, making it quick to access markets even on smaller screens.

Placing orders

Placing trades on HYCM’s mobile platforms is efficient and user-friendly. Traders can execute market orders, limit orders, and stop orders with a few taps. The order screens are clear, with fields for setting price levels, lot sizes, and take-profit or stop-loss parameters.

The HYCM Trader app simplifies the process even further by offering quick-trade buttons from the quote screen, ideal for scalpers or fast-moving day traders.

Alerts and notifications

As a mobile user, I found that I could set price alerts directly within both the MetaTrader apps and the HYCM Trader app. But remember that on MetaTrader, setting up push notifications requires some manual configuration.

The HYCM Trader app makes setting alerts easier, allowing traders to configure notifications for price movements quickly from the main trading dashboard. However, mobile push alerts are not as customizable or integrated as those offered by some of the newer fintech-focused trading apps.

Research and Development

Traders at HYCM can access third-party research from Trading Central, which delivers daily market insights, technical analysis, and an economic calendar embedded into the MetaTrader platform suite. This gives traders a dependable stream of actionable information without having to leave their trading terminals.

HYCM has also partnered with Seasonax and Financial Source, both of which provide advanced analytics and news flow. Seasonax offers intelligent pattern recognition to help traders identify seasonal trends across FOREX, commodities, and indices, while Financial Source delivers real-time macroeconomic news tailored to market-moving events.

Trading statistics

HYCM does not publish such detailed, real-time trading statistics as average execution speeds, order rejection rates, or slippage metrics on its public-facing platforms.

Trading signals

HYCM enhances client decision-making by offering access to Trading Central’s signal service. Signals cover a wide range of asset classes including FOREX, commodities, indices, and stocks, with updates issued regularly throughout the trading day.

Additionally, HYCM clients benefit from access to Seasonax for seasonal trading patterns and Financial Source for real-time macroeconomic news, although these tools are more focused on analysis and market timing rather than direct trade signals.

Importantly, Trading Central’s signals can be viewed directly inside the MetaTrader terminal, making it seamless for traders to monitor and act on opportunities without switching among multiple platforms.

Education

On the educational side, HYCM runs the HYCM Academy, offering over 20 video courses structured by experience level. These courses cover everything from trading basics to more advanced strategies, giving beginners a good starting point while offering some additional depth for intermediate traders.

HYCM also maintains a YouTube channel with recorded webinars and tutorials, though it should be noted that the channel is not always regularly updated

While HYCM’s educational resources are solid for onboarding newer traders, they are still relatively basic compared to industry leaders who offer more frequent live webinars, interactive workshops, or AI-driven learning paths.

HYCM is a mid-sized broker that adequately services new and intermediate traders with its simple account types and well-known platforms. With good regulation, competitive fees, and acceptable market access, it provides a solid option to traders looking for a safe start.

Final Thoughts on HYCM

I feel that HYCM offers a balanced trading environment that combines regulatory strength, accessible pricing, and multi-platform flexibility. The broker provides a level of security that should give traders peace of mind, even though it is not as well regulated as many major brokers.

The broker’s low $20 minimum deposit, commission-free account options, and access to over 1,000 stock CFDs and 70 FOREX pairs make it attractive for both beginners and cost-conscious active traders.

Overall, HYCM is a reliable and decentlyl-regulated broker. What you will certainly get with this broker is simplicity, cost efficiency, and core market access.

Conclusion

In my research for this review, I found that HYCM is good at many things but outstanding at none. It has a foothold in the competitive MENA space, as evidenced by its awards. However, it may struggle to differentiate itself in wider markets.

Notwithstanding, with decent regulation, adequate market access, and good educational and research tools, the broker can keep its existing client base satisfied. However, as trader demands increase and they look for platform variety, advanced analytics, and an ever-growing range of assets, this broker may leave modern traders wanting more.

Review Methodology

The team at Arincen collected more than 120 pieces of data covering in excess of 100 licensed FOREX companies. Data collection was done in three ways:1. Companies’ websites.2. Other Websites that have ranked FOREX companies.3. A survey questionnaire (referred to here as Survey “1”) we had sent to the companies invited to participate in the exercise. We have identified 12 criteria for our assessment, each containing several aspects and carrying its own relative weight. These include licensing, deposits and withdrawals, number of assets etc. Afterwards we validated the data by:1. Registering with FOREX companies as a secret shopper and/or as Arincen.2. Survey number “2,” in which we asked these companies’ customers for important feedback and past experience. The next step saw us evaluate and rank each company, relying on the hard work of 15 Arincen employees. We were very careful in ensuring the most accurate assessment possible, including taking into account different languages, as well as the various mobile-app operating systems, e.g., Apple, Samsung etc.To add credibility to our research project, we sent a final and third survey (referred to here as Survey “3”) to enable participating FOREX companies evaluate our own research and whether it accurately reflects the realities on the ground. We were fortunate enough to receive a mark of 9.9 out of 10! We have kept to a minimum the margin of error, which stood at a measly 1%. To learn more on how we came up with the evaluation, please click here.

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

FAQ

The minimum deposit at HYCM is $20 for most account types, such as Fixed, Classic, and Raw accounts.

HYCM offers three main account types: Fixed, Classic, and Raw. The Fixed account features fixed spreads, the Classic account provides access to variable spreads with no commissions, and the Raw account offers tight spreads with a commission per trade.

HYCM provides access to around 1,250 tradable symbols, including FOREX pairs, stock CFDs, commodities, indices, and ETFs. Clients using HYCM Invest can also trade real stocks commission-free on around 1,000 global shares.

Yes. HYCM offers a free demo account that simulates live-trading conditions and allows new traders to practice strategies risk-free with virtual funds.

Traders can deposit and withdraw funds via credit and debit cards, e-wallets like Skrill and Neteller, wire transfers, and other regional payment services. Most deposit methods process quickly, but wire transfers can take 1 to 7 working days.

HYCM offers access to both MT4 and MT5 platforms. These platforms support features like automated trading with Expert Advisors (EA), advanced charting tools, and one-click trading.

Yes. HYCM provides Islamic account options for traders who require swap-free trading conditions in accordance with Sharia law. These accounts can be requested during the account setup process.