Table Of Contents

- Understanding the Basics of Technical Analysis

- Key Components of Technical Analysis

- Important Tools and Indicators in Technical Analysis

- Chart Patterns in Technical Analysis

- Common Chart Patterns

- The Role of Sentiment in Technical Analysis

- Limitations of Technical Analysis

- Practical Application of Technical Analysis

- How to Get Started With Technical Analysis

- Conclusion

What is Technical Analysis? Technical Analysis Explained

In my trading experience, Technical analysis (TA) is becoming a go-to method for retail traders who want to make smarter decisions in the financial markets. Simply put, technical analysis looks at past market data—such as price movements, trading volume, and chart patterns—to help predict where markets might go next. Unlike fundamental analysis, which digs into a company’s financials, TA focuses on using charts and patterns to spot opportunities.

If you’re a new or intermediate trader, learning technical analysis is key to understanding how the markets move. By knowing how to read historical data, you can better handle the ups and downs of trading, manage the risks of trading, and improve your overall decision-making. In this article, I will give you a detailed introduction to TA. As always, remember that past performance is no guarantee of future performance, and you should use a range of analytical methods to inform your decisions.

Understanding the Basics of Technical Analysis

What is TA? Why do you need to use it? How is it different from fundamental analysis? There are so many questions to be answered.

What is technical analysis?

Technical analysis is all about studying past price movements and trading volume to predict where prices might go next. By looking at patterns and trends, you can try to predict the market's direction using past data. Unlike fundamental analysis, which is concerned with exploring a company's financials to understand its value, TA zeroes in on how asset prices move and what the charts are telling us. While fundamental analysis might explain why an asset is moving, technical analysis focuses on how it is moving and what may come next.

Technical analysis is not just for stocks, and you can use it on a wide range of financial instruments, as long as they have enough price and volume history to analyze. Here are some popular choices:

Stocks: Individual stocks are perfect for technical analysis, letting you study price movements and trading volumes to find trends.

FOREX: Pairs like EUR/USD or GBP/JPY are highly liquid and make the FOREX market ideal for technical analysis, especially with their 24-hour trading nature.

Commodities: Assets like gold, silver, crude oil, and agricultural products offer strong data for technical analysis and can help you catch price swings in commodities trading.

Indices: Major indices like the S&P 500, NASDAQ, or DAX give insights into broader market trends and are popular choices for trend analysis. Remember, you can trade in indices and not just individual stocks.

Cryptocurrencies: With their volatility, cryptocurrencies like Bitcoin and Ethereum often suit technical analysis well, allowing you to capitalize on quick price changes if you get your analysis right.

Exchange-traded funds (ETF): ETFs track stocks, commodities, or other assets and are also great for technical analysis to spot trends or set entry and exit points.

Options and futures: While options and futures require a bit more knowledge due to time decay and expiration, they can be analyzed technically, especially with high-volume contracts.

Technical analysis works across these different markets, helping you spot trends, measure volatility, and find potential opportunities. So, if you’re interested in diving deeper, these asset classes offer plenty of ground for TA strategies.

Why traders use technical analysis

Traders like using technical analysis because it’s fast, objective, and easy to access. Charts, indicators, and patterns give quick signals, helping you to avoid emotional decisions that come with human psychology. The tools for TA are available on most trading platforms, so it’s simple to use and apply. What’s great about TA is that it works in both bullish (optimistic) and bearish (pessimistic) markets, meaning you can spot opportunities whether prices are going up or down. For retail traders, this flexibility makes technical analysis a must-have in their trading toolkit.

If you are daunted by the sound of technical analysis, don’t be, your broker will have most of these tools on its website. The broker will have the latest data, and they will even have education courses on how to understand what you are reading. Here’s an article we wrote about some of the best overall brokers.

Key Components of Technical Analysis

As traders, what do we mean when we talk about technical analysis? Which elements of a company’s reporting do we concentrate on? Here are some of the most common financial reports you can use to perform technical analysis.

Price chartsPrice charts are the backbone of technical analysis, giving you a way to see market movements at a glance. There are a few types of charts you’ll come across in TA. Line charts are the simplest, connecting closing prices over time to give you a clear look at overall trends. Bar charts dig a little deeper, showing the open, high, low, and close for each trading period.

Then there are candlestick charts—probably the most popular—offering the same info as bar charts but in a way that really highlights market sentiment. Our experts have written a detailed article on Japanese candlestick charts. These charts show how prices change over time, helping you spot trends, reversals, and patterns that might signal your next trading opportunity.

Time framesTechnical analysis works across different time frames, giving you different insights depending on your trading style. If you’re a short-term trader, like a day trader, you might focus on charts that track minutes or hours, looking for quick gains in fast-moving markets.

Medium-term traders tend to look at daily or weekly charts to catch trends that develop over weeks. Long-term traders, however, use monthly or even yearly data to spot bigger market trends. This is called swing trading. By analyzing different time frames, you get a fuller picture of market behavior, helping you understand both the short-term swings and long-term trends before making your move.

VolumeTrading volume, which is the number of shares or contracts traded over a certain period, is critical to confirming price trends. When volume is high, it shows strong interest in a stock or asset, backing up the price movement. For example, if a stock’s price jumps on high volume, it’s usually seen as a solid bullish signal.

On the other hand, if the price moves but the volume is low, the trend might be weak or short-lived. Keeping an eye on volume helps you gauge the strength of a trend, giving you more confidence in your trading decisions.

Important Tools and Indicators in Technical Analysis

By mastering the following tools and indicators, you can get a very good view of how best to carry out your journey of technical analysis.

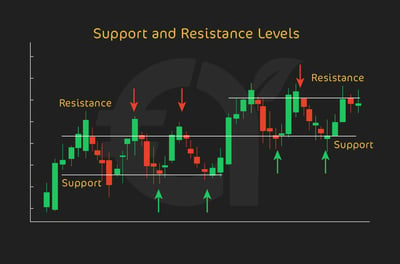

Support and resistance levelsSupport and resistance are crucial concepts in technical analysis. You should know that support is the price level where an asset tends to stop dropping because demand picks up, while resistance is where the price usually stops climbing due to selling pressure.

You should keep a close eye on these levels to figure out the best times to enter or exit trades. If the price breaks through resistance, it’s often seen as a bullish signal. But if it drops below support, that could point to bearish momentum. Knowing these levels helps you decide when to buy, sell, or hold your position with more confidence. Just remember that the best thing about TA is that you can trade many different financial instruments, so you can try to make money from both bullish and bearish signs.

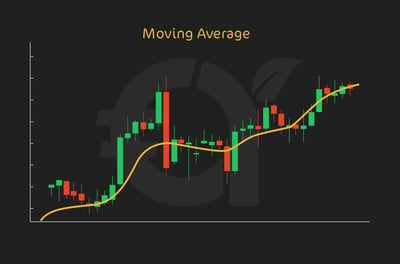

Moving averagesMoving averages are go-to indicators for smoothing out price data and spotting trends. The two main types are the simple moving average (SMA) and the exponential moving average (EMA). The SMA looks at the average price over a certain number of periods, treating all data points equally.

The EMA, on the other hand, pays more attention to recent prices. That’s why it reacts faster to current market conditions. In the real world, you would be using moving averages to find trends and possible reversal points. For instance, if the price crosses above a moving average, it might signal a good time to buy, while a drop below might mean that it’s time to sell.

Relative strength index (RSI)The RSI is a momentum indicator that helps you gauge whether an asset is overbought or oversold by looking at how quickly and how much the price has moved recently. It runs on a scale from 0 to 100. Be aware that readings over 70 suggest the asset might be overbought, and readings below 30 hint that it could be oversold. You should use the RSI to spot possible reversals or confirm a trend's strength. When the price hits those extreme levels, it could be a sign that a correction or rally is on the way.

Moving average convergence divergence (MACD)MACD is a trend-following momentum indicator that tracks the relationship between two moving averages of the price of an asset. Traders often watch for MACD crossovers as signals to buy or sell. When the MACD line crosses above the signal line, it might point to a bullish trend, while a crossover below could suggest a bearish shift. This tool helps you spot changes in momentum and confirm trends.

.webp)

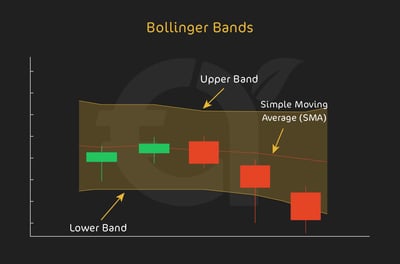

Bollinger BandsBollinger Bands, another popular indicator, are made up of three lines: a moving average in the middle, with two bands set two standard deviations away from that average. These bands stretch out and tighten up depending on market volatility. When prices get close to the upper band, the asset might be overbought, while moves near the lower band can signal it’s oversold. Traders use Bollinger Bands to measure market volatility and spot potential reversals, making it a handy tool for finding entry and exit points.

Chart Patterns in Technical Analysis

In this section, I will tell you more about chart patterns in TA. These are very handy indicators that provide a shorthand for understanding what an asset's price is doing.

TrendlinesTrendlines are key tools for spotting and confirming a market's direction. By connecting a series of price points, trendlines give you a clear view of whether an asset is trending up, down, or just moving sideways.

In an uptrend, trendlines slope upward, showing that prices are rising. In a downtrend, they slope downward, indicating the market is falling. A sideways trend, or consolidation, means prices are bouncing around within a defined range, with little movement. Traders rely on trendlines to find potential buy or sell opportunities based on the market's direction.

Common Chart Patterns

Chart patterns are formations created by an asset's price movements and are used by traders to predict future price direction. I mention only a few of the most common chart patterns in this article, but there are many more. If you want to read a much more comprehensive article on candlestick chart patterns, read our article here.

Head and shoulders patternThe head-and-shoulders pattern is a classic reversal signal (a potential change in the trend of an asset) that hints at a trend reversal. It’s made up of three peaks: the middle one (the head) is the highest, while the two on the sides (the shoulders) are a bit lower.

When you see this pattern in an uptrend, it could be a sign that a bearish reversal is coming. On the flip side, an inverted head-and-shoulders pattern during a downtrend often signals a potential bullish reversal.

Double tops and bottomsDouble tops and bottoms are another set of reversal patterns to watch for. A double top happens after an uptrend when the price hits a high twice but can't push through, signaling a possible drop ahead. On the other hand, a double bottom shows up after a downtrend when the price hits a low twice but doesn’t fall any further, hinting at a potential bounce back up.

Flags and pennantsFlags and pennants are continuation patterns that indicate a brief consolidation before the trend resumes. A flag looks like a rectangle sloping against the current trend, while a pennant forms a small symmetrical triangle. Both patterns suggest that after this short pause, the price will likely keep moving in the direction of the original trend.

The Role of Sentiment in Technical Analysis

Market sentiment is all about the overall mood of investors toward a specific market or asset. For all the technology and vast amounts of data that underpin modern retail trading, you can never get away from the human element.

Therefore, sentiment reflects traders' emotions and mindset, which can have a significant impact on price movements. Even the most seasoned and professional traders can be victims of human emotions!

How powerful can sentiment be? Well, perhaps you remember the GameStop short squeeze in early 2021. In this case, retail traders from a Reddit community sparked a buying frenzy for GameStop stock, which had been heavily shorted by institutional investors.

The sentiment around GameStop quickly turned highly optimistic among retail traders, driven by a mix of enthusiasm, collective action, and a hard-to-explain desire to oppose institutional investors who were betting against the stock.

As buying momentum grew, many seasoned traders and hedge funds were forced into a short squeeze. To cover their losses, they had to buy back the stock at increasingly high prices, further driving up GameStop’s value. The intense sentiment among retail traders led to extreme volatility, forcing even experienced investors to depart from their typical strategies. Hedge funds, caught in the squeeze, suffered significant losses as GameStop's stock price skyrocketed from under $20 in early January 2021 to an intraday high of nearly $500 later that month.

Gauging Market Sentiment Through Technical Indicators

Technical analysts use various indicators to assess market sentiment by interpreting patterns in price and volume data:

Volume analysisTrading volume shows the strength behind buying or selling pressure. When volume is high during a price increase, it suggests strong bullish sentiment, indicating that many investors are confident and buying in. On the other hand, high volume during a price drop signals strong bearish sentiment, as more investors sell. If volume is low, it could mean there's little confidence in the current trend, and a reversal may be around the corner.

Advance-decline IndicatorsThese indicators compare the number of rising stocks to the number of falling stocks within a specific index or market. If more stocks are advancing, it signals bullish sentiment, while more declining stocks point to bearish sentiment. This gives you a clearer picture of the overall market movement.

Put/call ratioThe put/call ratio compares the trading volume of put options to that of call options. A higher ratio means more traders are buying puts, betting on price drops, which signals bearish sentiment. A lower ratio points to bullish sentiment, with more traders snapping up call options, expecting prices to rise.

Sentiment Tools in Technical Analysis

Looking beyond traditional indicators, there are other novel and interesting tools designed to measure market sentiment:

Fear-and-greed indexYou might have heard of this index, developed by CNNMoney, that measures the emotions driving the market by combining seven indicators, such as market volatility, stock price momentum, and demand for safe-haven assets. It ranges from 0 (extreme fear) to 100 (extreme greed). It’s a different and somewhat interesting look at technical analysis.

Volatility indexOften called the "fear gauge," or the VIX. it measures how much volatility the market expects over the next 30 days based on S&P 500 options. When the VIX rises, it suggests investors are feeling more fear and uncertainty, while a falling VIX probably indicates greater confidence and calm.

Bullish percent index (BPI)It’s in the name. The BPI measures the percentage of index stocks trading above their point-and-figure buy signals. A high BPI shows strong bullish sentiment, with many stocks in uptrends, while a low BPI signals bearish sentiment. You can use this to get a sense of the overall health of the market.

Applying sentiment analysis to trading

Now that you understand market sentiment through these tools and indicators, you can make more informed decisions. Let’s tell you how:

Confirming trends: Sentiment indicators can back up trends spotted through other technical analysis tools. Think about it this way, if price charts show an uptrend and sentiment indicators also point to bullishness, you might feel more confident about entering long positions.

Identifying reversals: Extreme sentiment readings can hint at potential market reversals. When sentiment hits high levels of fear or greed, it might be a sign that the current trend is overextended, and a reversal could be on the way.

Risk management: Awareness of market sentiment helps you handle risk management better. In highly volatile or uncertain markets, as suggested by sentiment tools, you could choose to reduce position sizes or employ tighter stop-loss orders.

Limitations of Technical Analysis

While TA can offer great insights into market trends and price movements, it’s important to remember its limits. As I have shown, technical analysis doesn’t always predict market behavior perfectly. Financial markets are influenced by many factors, such as economic events, political changes, and sudden shifts in investor sentiment. These external factors can cause price swings that don’t align with technical indicators, leaving you exposed.

Remember, no technical indicator or chart pattern is perfect, because markets can behave irrationally or unpredictably. Indicators like moving averages, RSI, and MACD are based on past data, meaning they look backward to forecast future moves. This approach might miss real-time changes, especially in volatile markets.

Relying too much on a TA can be risky since it might cause you to overlook key data found in financial reports or broader economic conditions. It’s a good idea to combine technical analysis with other research methods, like fundamental analysis, to get a fuller picture of the market. Plus, using solid risk-management strategies, like stop-loss orders, is key to protecting against potential losses. These strategies help you avoid taking on too much risk based solely on technical signals.

Practical Application of Technical Analysis

That said, technical analysis really does shine when you put it into practice. One popular way to do this is through backtesting, where you apply your TA strategies to historical price data to see how well they would have worked. You can get this feature on most good trading broker platforms.

Backtesting lets you test how your chosen indicators, such as moving averages or RSI, would have performed in past market conditions. It gives you insights into potential profitability and helps fine-tune your strategy before using it in live trading. While backtesting can’t guarantee future success, it’s a data-driven way to build confidence in your strategies.

As I’ve said, most modern trading platforms come with built-in tools that make technical analysis easier to use. Platforms like MetaTrader, Thinkorswim, and TradingView offer a range of charts, indicators, and automated features that help traders analyze price movements and trends. With just a few clicks, you can apply TA concepts like support and resistance, moving averages, or chart patterns. These platforms also let you customize indicators and set alerts so you can stay on top of your strategy without missing a beat.

By combining backtesting with the use of advanced trading platforms, you can sharpen your TA skills and gain confidence as you turn theory into actionable trades.

How to Get Started With Technical Analysis

In my view, for beginners ready to dive into technical analysis, taking actionable steps is crucial for building a strong foundation. First, pick a reliable trading platform that offers solid charting tools and a variety of indicators. The best platforms give you access to price charts, historical data, and the key technical analysis features you’ll need to analyze market trends effectively.

Once you have your platform, start by learning to read basic price charts, such as line, bar, or candlestick charts. Understanding how prices move on these charts is essential for applying technical analysis. Then, try out simple indicators like moving averages and the RSI. These tools help you to spot trends and possible price reversals without adding too much complexity.

Before you invest any real money, it’s a good idea to use a demo account. Most platforms offer these accounts, letting you practice technical analysis in real-time market conditions without any financial risk. Testing your strategies in a simulated environment helps you gain confidence and learn from mistakes without risking your hard-earned cash. This hands-on approach gives you the chance to refine your skills and be better prepared for real-world trading with a solid understanding of technical analysis.

Conclusion

As I’ve shown in this article, technical analysis is a powerful tool that helps you understand market trends and make more informed decisions. TA provides a structured framework for interpreting price movements, identifying trends, and spotting potential opportunities.

However, as with any skill, mastering technical analysis requires continuous learning and practice. The more you dive into charts, indicators, and patterns, the better equipped you’ll be to navigate the markets with confidence. That said, don’t rely solely on technical analysis. Combining it with other strategies, like fundamental analysis, can give you a more balanced approach to trading and help you make smarter, well-rounded decisions. Keep learning, practicing, and refining your strategies to stay ahead in the game!

FAQ

TA is a method traders use to study past price movements and trading volumes to predict where prices might go next. By looking at charts, patterns, and indicators, you can get a better sense of market trends and make informed decisions on when to enter or exit trades.

While technical analysis focuses on price movements and market trends, fundamental analysis looks at a company’s financial health—like earnings, revenue, and growth potential. TA is all about reading the charts, while fundamental analysis digs into the numbers behind a stock or asset.

Start with simple indicators like moving averages and the Relative Strength Index (RSI). These tools are easy to understand and give you a solid foundation for spotting trends and potential reversals without getting overwhelmed by too much complexity.

Yes, TA can be applied to various markets—stocks, FOREX, cryptocurrencies, and commodities. The principles of reading charts and analyzing trends apply to any asset that has a history of price movements, making the approach a versatile tool.

While TA is a great tool, it’s risky to rely on it alone. Combining TA with fundamental analysis and keeping an eye on market sentiment will give you a more complete picture of the market and help you make smarter trading decisions.

Backtesting is key. It lets you test your strategies on historical data to see how they would’ve performed in the past. While it doesn’t guarantee future success, backtesting helps you refine your approach and build confidence before using real money.

The best way to practice is by using a demo account. Most platforms offer these accounts so you can apply your technical analysis skills in real-time markets without risking any actual capital. It’s a great way to learn, make mistakes, and improve.

One way to gauge the strength of a trend is by looking at trading volume. If prices are rising and volume is high, it shows strong interest and confidence. On the flip side, if prices are moving but volume is low, the trend might not be as reliable and could reverse soon. Keep an eye on volume to confirm your trend analysis.