Table Of Contents

- What Is Swing Trading?

- What Is a Swing Trading Indicator?

- Swing Trading Indicators Explained

- 8 Best Indicators for Swing Trading

- 1. Moving average indicator (MA)

- 2. SMA

- 3. EMA

- 4. Volume

- 5. Bollinger Bands (BB) indicator

- 6. Ease of Movement (EoM)

- 7. RSI

- 8. Stochastic Oscillator

- Best Swing Trading Tools to Use

- Support and resistance lines

- Chart Patterns

- Conclusion

8 Best Indicators for Swing Trading and How to Use Them

In my trading experience, market swings can provide plenty of opportunities for profit – but to take advantage of them, you will need to learn your swing-trading indicators well. This is not a walk in the park, as the process involves a steep learning curve. Alongside day trading and position trading, swing trading is one of the most popular market trading strategies. For beginners, this trading style is often more user-friendly and less hectic than day trading, which is largely the domain of professional traders. That said, swing trading is still considered attractive enough for traders to take advantage of price (albeit smaller) fluctuations. Needless to say, traders who favor this trading style usually rely heavily on swing-trading technical indicators, as it is essential for them to identify support and resistance levels when the trend shifts.

Unlike day trading, position trading is undertaken with a longer-term approach. As its name suggests, traders take a position that is largely unconcerned with daily fluctuations, preferring instead to use longer-term charts, as well as trends and tools, in order to buy and hold until an investment or asset reaches a new peak. By extension, when position trading, entry and exit prices are identified in advance, and stop-loss orders can mitigate risks.

In my view, swing trading sits comfortably between day trading and position trading. A somewhat speculative strategy, swing trading entails holding an asset for a certain period of time, typically ranging from a few hours to several weeks or even a couple of months, in an effort to capture short- to medium-term gains from price changes, or “swings.” It works on the principle that price action is almost never linear – instead, the tension between “bulls” and “bears” causes it to constantly oscillate. Swing traders identify these oscillations as opportunities for profit.

When swings occur, traders capitalize on them for relatively small gains and exit the trade before a significant trend shift. Although the profit from these trades may be small compared to, for example, day trading, if executed consistently over the period, swing trading can still yield substantial gains. It is noteworthy that, just like day trading, swing trading aims to profit from both positive and negative market direction.

Swing trading targets price swings over hours, days, or weeks, focusing on support and resistance shifts rather than intraday volatility.

Trend indicators like moving averages help identify the market direction and smooth out price noise.

The simple moving average (SMA) and exponential moving average (EMA) are both essential for spotting trend changes and dynamic support or resistance.

Volume-based indicators reveal the strength behind price moves

Bollinger Bands highlight periods of high and low volatility and can signal breakouts or reversals when price reaches the bands’ extremes.

Ease of Movement (EoM) combines volume and price range to indicate how effortlessly price is shifting, useful for spotting early trend moves.

The Relative Strength Index (RSI) gauges momentum by measuring overbought or oversold conditions, guiding entry and exit timing.

The Stochastic Oscillator tracks closing price relative to its range, offering insights into potential turning points based on momentum shifts.

What Is Swing Trading?

I believe that the key to swing trading is being able to identify or predict an asset’s movement over time, ride the wave, and then exit the wave at the right moment in order to be ready for the next wave. These otherwise normal price fluctuations or swings define markets, which can rise and fall in response to market forces. If you can spot when a market trends upward or downward, then you can capitalize on gains and, at the same time, cut your losses just as quickly.

As is widely known to anyone familiar with financial markets, cryptocurrency markets can be extremely volatile. This means that swing trading within the crypto context can be inherently profitable or risky and is, therefore, a reflection of the volatility potential of market conditions themselves. Luckily, traders have a number of tools at their disposal that both minimize risk and ensure the best chances of making a profitable trade. Whereas technical analysis (TA) can be used to look for attractive trading opportunities, fundamental analysis (FA) is useful when analyzing fundamental price trends and patterns.

What Is a Swing Trading Indicator?

Before analyzing the best indicators for swing trading, let us go back to the basics of the swing-trading process. Swing trading is a trading strategy that is all about getting the timing of a trade right. While it is typically applied in FOREX and stock trading, it can also work well with cryptocurrencies, as will be explained below.

As aforementioned, with swing trading, you will hold your position open for several hours, days or weeks, as long as the trend carries on in your favor. Traders would start closing their position when the trend starts showing signs of waning. Given that swing traders operate with longer timeframes, they are not interested in short-term price volatility the same way as day traders are. For swing traders, the only thing that matters is that swing highs go higher in a bullish market while swing lows go lower in a bearish market.

There are two swings for which traders of this style will specifically watch:

Swing highs: When a market hits a peak before retracing, providing an opportunity for a short trade.

Swing lows: When a market hits a low and bounces, providing an opportunity for a long trade.

Naturally, identifying these movements demands a system of analysis. These are the very swing trading indicators about which we speak. Any analysis tools that allow you to make informed decisions about swing trading are based around indicators.

Swing Trading Indicators Explained

In my experience, a swing-trading indicator involves using mathematical computations to analyze price action based on historical data. It can be implemented on a daily chart or any other chart type used by swing traders to assess the market situation.

These indicators help traders discern whether the trend is bullish or bearish, and if it still has momentum, among other factors. While some swing traders rely on FA to validate the logic of their overall approach, technical indicators help determine the best entry and exit points for individual trades. The three most important types of swing-trading indicators are:

Trend indicators – these indicators show you which direction the market is going and whether you can identify a trend at all. Generally, trend indicators are used to smooth price volatility to highlight the primary trend. Moving averages are the most common type of trend indicators.

Momentum indicators – these indicators show how strong a trend is and whether a reversal might be on the horizon. They can also show the overbought or oversold levels. The Relative Strength Index (RSI) is a popular momentum indicator that you will learn more about below.

Volume indicators – volume is an important indicator that shows how many traders are buying and selling an asset at any given point in time. This can help you confirm the strength of a trend. High volume means high strength, while low volume indicates the exact opposite. Tools like Fibonacci indicators and Bollinger bands can also infer what the market is doing at any given time.

8 Best Indicators for Swing Trading

In what follows, I have compiled the eight best swing-trading indicators that stand out due to their simplicity and efficiency. However, it is worth noting that these in no way guarantee consistent profits. That is mainly because technical indicators do not predict the future, but rather help you better visualize the present and past.

1. Moving average indicator (MA)

A MA is the first technical indicator. It has been used for decades for TA of the commodities and company shares. As the name suggests, swing traders use MA to calculate the average of an asset’s price movement over a given period of time. As a result, MAs smooth out the short-term volatility that may otherwise confuse traders.

It is important to understand that MAs are lagging indicators and rely on past price action. Thus, it would help if you used them to confirm a trend rather than try and predict future moves.

Notwithstanding, you should distinguish between short-, medium- and long-term MAs, depending on how many periods you monitor. For example, short-term MAs have a period between five and 50, while medium-term MAs have up to 100. There are two main types of MAs: Simple Moving Averages (SMA) and Exponential Moving Averages (EMA).

2. SMA

The SMA is one indicator variation that informs the trader of the trend direction of a particular asset. It can tell the trader if the asset is bearish or bullish. Understanding the market’s direction gives swing traders an advantage in placing their trades.

3. EMA

The EMA is another variation of the moving average indicator that swing traders can consider when trading. The indicator emphasizes the most recent price points more heavily than past price levels. The EMA can pinpoint a more accurate way for swing traders to enter and exit trades by revealing support levels.

In short, and before we move on to the next indicator, it is important to reiterate that the best way to use MA is to look when a short-term MA crosses a longer-term MA. If the former crosses the more extended MA from bottom to top, this is a bullish signal, and vice versa.

4. Volume

Volume is an essential tool for swing traders as it provides insight into the strength of a new trend. Basically, the volume indicator shows how many traders are buying or selling a cryptocurrency or asset at a given point. Thus, the higher the volume, the stronger the trend.

Volume is especially useful with breakout strategies, i.e., when an asset’s price “breaks” above a resistance line or below a support line. More on this below. If the breakout is accompanied by high volume, then the new trend is expected to be substantial. The principle here is straightforward: a trend with high volume is going to be stronger than one with weak volume. With more traders buying or selling, there is a better basis for the price action.

5. Bollinger Bands (BB) indicator

The BB is a momentum indicator that consists of three lines – a moving average and two standard deviations, one positive and one negative. Swing traders prefer this indicator because it quickly detects a trend, the overbought and oversold levels, as well as the volatility. Also, it looks visually pleasing on the chart.

The width of the BB increases in tandem with the volatility and declines when the market calms down. The closer the bands are to each other, the lower the volatility.

While BBs work well in trending markets, they do a great job when the price ranges, i.e., moving up and down inside a horizontal channel. In this case, when the price touches the BB’s upper line, swing traders may go short. When the price touches the lower line of the indicator, this may precede a rebound.

The point is that the price would always tend to move toward the center of the BB. If the band starts expanding, it means that a new trend is forming, and you should not be trading in a range anymore.

Recommended Brokers

6. Ease of Movement (EoM)

7. RSI

8. Stochastic Oscillator

Stochastic is another momentum indicator, and in my view it works quite similarly to the RSI, though it has different calculations. While you will effectively look at the same zero-to-100 range as the RSI, the overbought and oversold levels fall at 80 and 20, respectively.

Instead of a single line on a chart, you will have two. The first, of course, is the stochastic oscillator. The other is a three-day MA. Why? When the two lines close in on each other and end up crossing, it indicates a reversal is coming.

Best Swing Trading Tools to Use

Though the above-mentioned trading indicators can do a great job of providing relevant signals, they will become even more efficient if you combine them with other charting tools. Here are the most important ones:

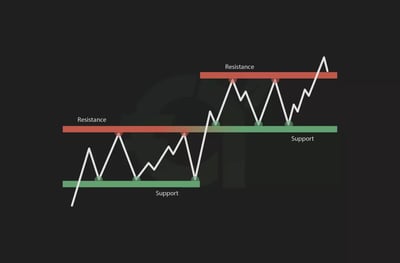

Support and resistance lines

A swing trader should always operate with support and resistance lines because these are the most relevant when determining an asset’s price range. In other words, the resistance level is an imaginary line that the price finds challenging to break and usually pulls back. While the support level is an imaginary line made of recent lows, which shows the price stops declining and bounces back. If there is a breakout within these lines, the price usually moves in the breakout direction.

Chart Patterns

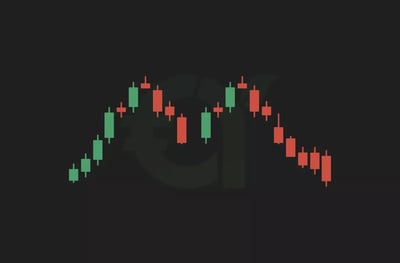

Swing traders can also look for chart patterns, usually observed on candlestick charts. There are two main categories of patterns:

Trend continuation patterns, which anticipate the continuation of a trend. Some examples are triangles, rectangles, flags and pennants.

Trend reversal patterns, which signal the reversal of a trend. Some examples are double tops or bottoms, as well as head and shoulders.

Conclusion

In my view, as a longtime trader, swing trading is almost tailor-made for beginners and/or those traders who don’t have the time to sit on the trading screen throughout a day’s trading session. However, you must be prepared to invest time in understanding these often-complex indicators. Traders can combine swing trading with their nine-to-five job or another business to generate a side income. Even though the price moves in swing trading are not always pronounced, you should not ignore basic risk management techniques. For example, using a stop-loss can prevent your balance from being wiped out in a matter of minutes.

While some traders might feel that these indicators do not work as they expect, it is important to emphasize that technical indicators were not designed to forecast future price moves with 100% accuracy, but to help you make better decisions based on in-depth market insights.

FAQ

The eight types of indicators for swing trading are MA, SMA, EMA, Volume, Bollinger Bands, Ease of Movement, RSI, and Stochastic Oscillator. They can be used individually, but work best when used in conjunction to provide a holistic picture of your asset’s behavior over time.

Different indicators serve different purposes and use slightly differing lenses to view the same picture. Rather than proclaim which one is the best, we can confirm that the RSI and the family of MAs are well-used by a cross-section of traders.

Swing trading, by definition, is based on identifying a swing in the value of an asset. This could take days, weeks or months to play out. Hence, there is no time frame that is most suitable. Each trader must choose their market and develop their own time frame that gives them the best sense of comfort and the best results.