ICM Capital Review 2026

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

ICM capital Evaluate - research result

Key Takeaways

ICM Capital Limited a London-based broker with several support offices worldwide.

ICM Capital, established in 2009 and regulated in many jurisdictions, provides a secure and transparent trading environment for retail and institutional traders.

Key features of this broker consist of a wide product variety: Over the Counter (OTC) Spot FOREX, OTC Precious Metals, OTC US Stocks, OTC Energy Futures, OTC Index Futures, Cash CFDs, etc.

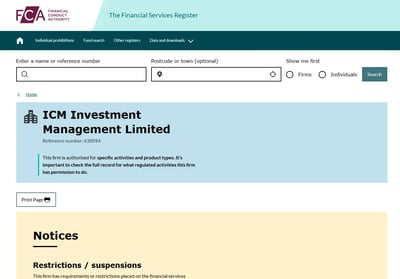

ICM Capital Ltd. is regulated and authorized by the UK’s Financial Conduct Authority (FCA), which means it is a transparent and secure firm.

ICM Capital offers three ways to trade: FOREX trading, spread betting, and share dealing.

Although ICM Capital targets institutional traders, it also caters to retail traders, allowing them to start trading with as little as a $200 deposit.

ICM offers three account types: ICM Direct (ECN), ICM Zero, and ICM Micro.

ICM Capital supports a wide range of languages, including English, Arabic, Chinese, and Spanish, among others. This makes it an excellent provider of customer support.

Last Reviews

Overall Summary

During my research, I discovered that ICM Capital Limited is a broker that was established in the UK in 2009 and now operates around the world, including locations in Europe, Asia, Oceania, and Africa. This international online brokerage firm provides 24-hour access to a diverse range of trading products, including FOREX, commodities, futures, and indices. ICM Capital has grown rapidly, now serving over 300,000 clients worldwide.

The company has earned over 40 international awards, reflecting its dedication to innovation and raising industry standards. ICM Capital caters to many clients, including retail and institutional traders, asset managers, fund managers, and hedge fund managers.

By combining advanced technology with deep liquidity through its ECN model, ICM Capital offers a secure and efficient trading environment, ensuring the protection of clients' funds through multiple regulations and segregation with highly rated financial institutions.

The company prides itself on offering high liquidity, tight spreads, mobile trading, and advanced technical analysis through the renowned MetaTrader trading tools. With a commitment to maintaining high standards and strict regulation, ICM Capital ensures complete support and transparency for its traders.

Is ICM Capital Safe?

This broker is considered safe. It has a verifiable track record of success, and it is well-regulated, even for a mid-sized broker. However, be sure to tread carefully when dealing with its subsidiaries in regions that do not have tier-1 regulators.

Yes, in my view, ICM Capital is safe. It is a well-regulated broker, which I will explain in detail in the next section. The company is known for being dedicated to innovation and raising industry standards. Its leadership has gone to great lengths to ensure that your money is kept secure through regulations or through the insurance scheme in which the company has enrolled.

How ICM Protects You from Reckless Leverage and Margin Trading

Leverage and margin are two tools in the trader’s arsenal that, if misused, can lead to heavy losses for the trader. Many irresponsible brokers offer high leverage that can ruin uninformed traders.

How you are protected

I found that ICM Capital offers varying leverage levels to its clients, tailored to specific instruments and regulatory jurisdictions. For major currency pairs, the maximum leverage is 200:1, meaning a $1,000 margin deposit can control a $200,000 position. However, in the UK, where ICM Capital operates under the Financial Conduct Authority (FCA) regulations, leverage is capped at 30:1 for major FOREX pairs; 20:1 for non-major pairs, gold, and major indices; and 10:1 for commodities other than gold and non-major equity indices. You should know that you can get practical leverage of up 200:1 in other jurisdictions besides the UK home branch.

These restrictions align with regulatory standards to protect retail investors from excessive risk. It's important to note that ICM Capital does not provide services to residents of the USA, North Korea, China, and a few other countries due to regional restrictions. Clients should consult the specific terms applicable in their jurisdiction to understand the leverage options and any associated limitations.

Regarding margin calls, I discovered that ICM Capital does not make margin calls but instead has an automatic stop-out system in place. This means that if the capital in your account falls below the stop-out level, the system will automatically start closing out your open positions, starting with the order that makes the greatest loss.

Regulation and other security measures

ICM Capital is regulated by multiple financial authorities across various jurisdictions. These regulations ensure that ICM adheres to stringent standards of conduct and prudential obligations across its global operations.

It is a broker that is regulated in the following areas.

ICM Capital Limited in the UK is regulated by the FCA.

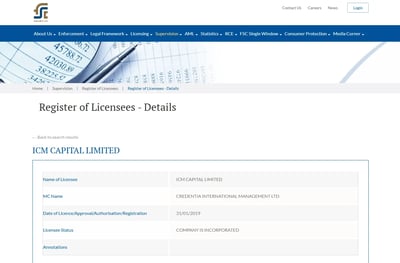

ICM Limited in Abu Dhabi, UAE, is regulated by the Abu Dhabi Global Markets (ADGM) Financial Services Regulatory Authority (FSRA).

In Mauritius, ICM Capital Limited is regulated and authorized by the Financial Services Commission of Mauritius.

ICM Seychelles is regulated by the Financial Services Authority (FSA) of Seychelles.

In the UK, ICM Capital is registered by the Financial Services Authority of Saint Vincent and the Grenadines.

In South Africa, ICM is regulated and authorized by the Financial Sector Conduct Authority (FSCA) of South Africa.

In Switzerland, ICM House AG is a member of the Association Romande des Intermediaires Financiers (ARIF).

This means that your exposure to high leverage is limited per differing regulations in each location. In the UK and EU, you cannot go over 30:1, whereas in the rest of the world, such as Africa and Asia, you can get up to 200:1. There is also a section of the broker's international site where it suggests that "flexible leverage of up to 400:1 is allowed." although this is not to be taken as the norm.

In addition to regulation, ICM Capital offers a comprehensive Civil Liability Insurance Program to protect its clients and third parties. This program covers financial losses up to £5 million, which can arise from errors, omissions, negligence, fraud, or failure to perform services. The insurance is underwritten by Lloyd’s of London and covers any one loss, including legal defense costs and expenses. This scheme is available to all live account holders at no additional cost, ensuring clients have an added layer of security and peace of mind.

Top broker features

Safety: ICM Capital is a global broker with multiple regulations and its own civil liability insurance program. Also, there is segregation of client’s funds as well as safekeeping of funds with major global banks.

Trading: You get access to multiple financial products from a single account. You will also find different account types to suit your individual needs. There are tight spreads and good overall fees.

Technology: Fast market execution with no re-quotes and mobile platforms. Get expert advisors and trade through VPS. Multi-Account Manager (MAM) and Percentage Allocation Management Module (PAMM) technologies are available.

Support: Get the benefit of dedicated multilingual customer support via multiple channels. Fast and simple account opening process. Multiple easy and reliable funding options.

Education: Extensive free educational resources. Read daily market reports and news. Access free educational seminars. Beginner and advanced webinars.

For Whom Is ICM Capital Recommended?

During my research, I found that ICM Capital is tailored for traders who desire access to a wide range of financial instruments, including FOREX, commodities, cryptocurrencies, and stocks. The broker’s offerings are good for both novice and experienced traders who value tight spreads, rapid execution, and a user-friendly platform. However, potential clients should be aware of regional restrictions, as ICM Capital does not provide services to residents of the USA, North Korea, China, and certain other countries.

ICM Capital gives its client three principal ways to trade. You can choose to take advantage of any or all three of FOREX trading, spread betting, and share dealing. While you can register for a demo account to familiarize yourself with the ICM Capital platform, ICM Capital can also accommodate various levels of traders in live accounts, whether experienced or beginners.

Here are some key factors to consider before opening an account with this broker:

-

Segregated client funds.

-

Regulated by the UK’s FCA.

-

Long trading history from 2009.

-

More than 300,000 traders, showing trust.

-

Decent funding options.

-

No swaps.

-

MetaTrader4 (MT4) desktop and mobile download.

-

Competitive spreads

-

ECN spreads starting from zero pips.

-

Fast execution and no-requotes.

-

No proprietary platform.

-

No US services.

-

Limited cryptocurrency offerings.

-

Inactivity fees which deter casual traders.

Offering of Investments

You will find a good range of financial assets in which to trade, even though it is not the widest in the market. International traders may have access to a slightly different array of financial assets than UK traders. Be sure to check the ICM Capital website that is relevant to you.

In my experience, ICM Capital is recognized as a broker offering diverse financial instruments to accommodate various trading preferences. Here is an overview of the available primary asset classes and some regional considerations. Remember that the ICM Capital UK office has its own website, while the rest of the world gets to trade from its international site.

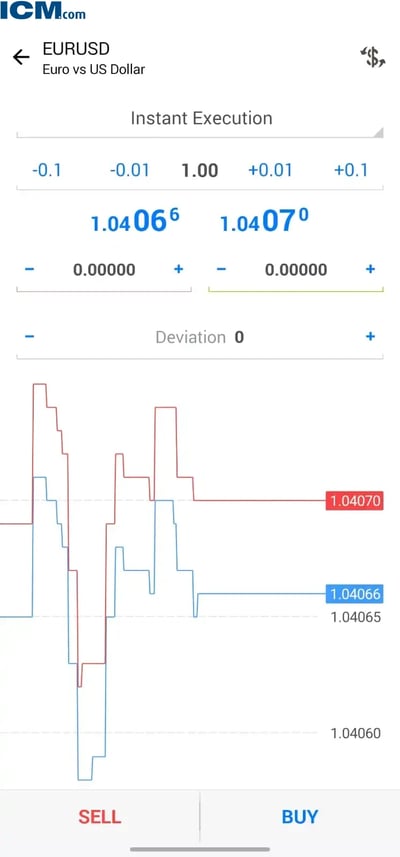

FOREX trading

ICM Capital offers the opportunity to trade on the FOREX market through its MT4 platform for UK traders and MT4/MT5 for international traders. FOREX trading is available 24 hours a day from Monday to Friday, allowing traders to engage in currency trading at their convenience. The broker provides tight spreads on Over The Counter (OTC) spot foreign exchange for all major currency pairs.

The broker supports trading from various devices, including iPhones, iPads, laptops, and PCs, ensuring accessibility anywhere in the world. Additionally, ICM Capital offers more than 60 currency pairs, including major, minor, and exotic, with features such as high leverage, fast execution, and deep liquidity. The broker uses the Electronic Communication Network (ECN) or Straight Through Processing (STP) model, providing direct market access with tight spreads, fast execution, and deep liquidity. Key benefits include no commissions, 24-hour trading, and high leverage for non-UK traders.

CFD contracts on oil (WTI & Brent)

ICM Capital provides trading opportunities on CFD contracts for both West Texas Intermediate (WTI) and Brent crude oil. WTI crude oil is a US domestic crude oil with a lower sulfur content, making it a higher quality fuel. The minimum price movement for WTI crude oil is USD 0.01 per barrel, with a standard contract size of 1,000 barrels per lot. Brent crude oil is the benchmark for Europe and OPEC pricing, with similar minimum price movement and contract size specifications. Both WTI and Brent contracts are CFDs based on exchange futures contracts that will expire and not be rolled into the next month.

With OTC trading on energy futures or CFDs you get to speculate on the price movements of energy products without owning the physical commodity. This method offers profit potential in both rising and falling markets, high leverage, and efficient use of capital. Always remember, though, that CFDs are highly complex instruments, and you can lose your money easily.

Indices

ICM Capital offers trading on a variety of indices through OTC Index Futures. This gives you the chance to trade the broad movement of a country's share market index rather than individual stocks. The broker provides tight spreads, low margin requirements, and instant dealing. Indices trading can track stocks, bonds, mutual funds, and other securities related to index trading. ICM Capital quotes prices on the most popular index futures 24 hours a day, allowing you to invest in a host of different companies worldwide.

Precious metals

ICM Capital offers OTC trading on spot precious metals, including gold and silver. These trades are conducted over the counter, directly between the involved parties, without the need for a central exchange market. This trading method allows for profit potential in both rising and falling markets.

ICM Capital provides tight spreads, fast execution, and deep liquidity, allowing traders to capitalize on price movements without owning the physical metals. Precious metals are quoted in Euro and USD per troy ounce, and trading is available with high leverage, no commissions, and no expiry dates. If you are new to precious metals trading, you can get a demo account with which to practice, in addition to news, charts, analysis, and a free VPS.

US stocks

ICM Capital provides OTC trading on a selection of major US stocks, including companies like Microsoft, Apple, Google, and Pfizer, allowing traders to speculate on share price movements without owning the shares. The broker offers high leverage, fast execution, and the ability to trade without a third party. With this type of trading, you can profit from both rising and falling markets.

Cash CFDs

ICM Capital offers Cash CFDs, which provide direct market access (DMA) with minimal variable spreads added to each asset. Cash CFDs do not have a predefined expiry date, unlike future CFDs, which renew every three months. The platform provides access to competitive bid and ask prices from major Tier 1 banks, allowing for diverse trading capabilities and optimal market execution. Cash CFDs are available on various indices and commodities, depending on the trader's strategy.

Cryptocurrency CFD trading

ICM Capital offers trading in seven cryptocurrencies, including Bitcoin, Ethereum, and Litecoin, through CFDs. This allows traders to access low-latency execution and low spreads, with a margin requirement of 50%. The platform supports trading from both PC and mobile devices, providing fast execution and various free indicators and tools. Cryptocurrency CFDs offer profit potential in both rising and falling markets, with no expiry dates. Traders can access free demo accounts to practice and refine their strategies.

ICM Securities

ICM Securities offers access to various stock markets worldwide, including the New York Stock Exchange, Nasdaq, and London Stock Exchange. This platform allows you to diversify their portfolios by area, sector, and company size. ICM Securities provides advanced charting, technical analysis, and news, available as a web portal and mobile apps. Investors can trade stocks on a single cutting-edge multi-market trading platform with integrated research and analysis tools, supported by 24/5 multilingual support.

الأصول المتاحة للتداول

| Markets | Available | Number of Assets |

| Currency Pairs | 60 | |

| Stocks | 300 | |

| Commodities | 10 | |

| Crypto | 6 | |

| Indices | 14 | |

| ETFs |

Account types

ICM Capital has created a range of trading accounts that offers something for every trader. The broker offers access to MetaTrader products as well as cTrader, allowing you to trade fast, tight prices. One thing to note is that the ICM Capital UK offers the ICM direct and ICM Zero accounts only, whereas the ICM Capital International site offers the additional ICM Micro account at 0.1 of a standard lot.

Based on my research, here are the account types you will find when trading with ICM Capital:

ICM Direct (ECN)

This account offers a versatile trading experience with a variety of features. It supports multiple currencies, including USD, EUR, GBP, and SGD, providing flexibility for traders from different regions. The account offers a leverage of 200:1 for non-UK traders, which can amplify trading potential. One of the key benefits of this account is the zero commissions, making it best for frequent traders.

The minimum transaction size is 0.01 lot, allowing for precise trade management. You can access a wide range of instruments, including FOREX, Metals, Futures, Shares, and Cash CFDs. Additionally, there are no minimum stop/limit levels for FOREX and Metals, providing greater flexibility in trade execution.

ICM Zero

The ICM Zero account is designed for traders who prefer a zero-spread trading environment. It supports the same range of currencies as the ICM Direct account: USD, EUR, GBP, and SGD. The leverage offered is also 200:1, although you should use it wisely. Unlike the ICM Direct account, the ICM Zero account charges a commission of $7 per round lot, which is a trade-off for the zero-spread benefit.

The minimum transaction size remains 0.01 lot, allowing for detailed trade control. This account type also provides access to a broad spectrum of instruments, including FOREX, Metals, Futures, Shares, and Cash CFDs. Similar to the ICM Direct account, there are no minimum stop/limit levels for FOREX and Metals, which are available to traders globally.

ICM Micro

The ICM Micro account is tailored for traders who prefer to start with smaller trade sizes. The spreads for this account can be viewed in the contract specifications of the asset you buy, and there are no commissions, making it an economical choice for new traders or those with smaller capital. The minimum transaction size is 0.01 micro lot, which is smaller than the standard lot size, allowing for more granular trade management.

Account Types

| Account Type | Minimum Deposit | Spread Commission | Commission | Swap Commission | Deposit Commission | Withdrawal Commission |

|---|---|---|---|---|---|---|

| ICM Direct | $200 | Starting from 0.1 pip | $0 | Not mentioned | Starting at $0 with credit cards and wire transfer, and up to to 2% with electronic banks. | 1.5% when using credit cards and/or electronic banks and up to 30$ with bank transfers. |

| ICM Zero | $200 | Starting from 0 pip | $7 | Not mentioned | Starting at $0 with credit cards and wire transfer, and up to to 2% with electronic banks. | 1.5% when using credit cards and/or electronic banks and up to 30$ with bank transfers. |

| ICM Micro | $200 | Not mentioned | $0 | Not mentioned | Starting at $0 with credit cards and wire transfer, and up to to 2% with electronic banks. | 1.5% when using credit cards and/or electronic banks and up to 30$ with bank transfers. |

Account opening

I found that opening an account with ICM Capital was easy, as it is with most brokers these days. The process is entirely online, user-friendly, and can be completed on a phone, tablet, or computer.

What is the minimum deposit at ICM Capital?

ICM Capital requires a minimum deposit of $200 to open a trading account, and this amount is consistent across all account types. Be sure to check the funding rules in your local area, and note that you will have to pay in local currency equivalent.

Clients can fund their accounts using various methods, including bank transfers, credit/debit cards, and e-wallets like Skrill, PayPal, and Neteller. It’s important to note that while ICM Capital does not charge withdrawal fees, there may be deposit fees depending on the chosen payment method. For example, credit card transactions typically incur a fee ranging from 1% to 3%, as charged by the payment processor. You should consider these potential costs when selecting your funding options.

How to open your account

The ICM Capital review process is fully digital, easy, and fast. An account should be ready within one to two business days. In addition to providing personal and account details, new clients must verify their identity and prove their place of residence, as is customary with modern Know Your Customer (KYC) regulations.

Deposits and Withdrawals

This broker offers a standard range of deposit and withdrawal options. You can use the normal range of funding options, from bank cards to electronic wallets. Withdrawals are free for bank cards, but you should consult our helpful table below to see the fees applicable to other methods.

ICM Capital offers multiple ways to deposit and withdraw funds from your trading account. There are some intricacies you need to get to know.

Account base currencies

ICM Capital offers you a wide range of account base currencies, including USD, EUR, GBP or SGD, depending on where you live and where your account is based. Selecting a base currency that aligns with your funding source can help minimize currency conversion fees.

In FOREX trading terminology, the “base” currency is always listed first in a FOREX pair, with the “quote” currency listed second. The base currency is always equal to one, while the quote currency represents the pair's current price.

ICM Capital deposit fees and options

ICM Capital offers multiple deposit and withdrawal methods, all geared toward inclusive trading. The broker promises to develop as many methods as possible for the comfort of its clients. I was pleased to discover that credit cards attract a deposit fee of zero. Meanwhile, the wire transfer is $0 + bank commission. Skrill is 1.9% and Neteller is 2.5%. Paypal is 3.75%. The broker also allows Bitcoin and MonetixAPM to be deposited.

ICM Capital withdrawal fees and options

In my experience, the broker tries to process withdrawals as quickly as possible. This is normally on the same day; however, the broker warns its clients that once the funds leave their ICM account, the banking system may take up to 3 to 5 working days to return the funds to their bank account. ICM Capital will only return funds to clients using the same method by which they were received. In practice, this means, for example - credit card in, credit card out. Additionally, ICM Capital may require a credit card statement to verify ownership of the card. Consult the table that follows for more details about funding methods and fees.

| Method | Credit Card | Wire Transfer | Skrill | Neteller | Cryptocurrency | PayPal |

| Deposit fee | $0 | $0 + Bank commission | 1.9% | 2.5% | Unavailable | 3.75% |

| Withdrawal fee | $0 | $15 | 1% | $0 | Unavailable | 2% |

ICM Capital provides excellent customer support. You can receive multi-lingual assistance, and the trading desk operates 24 hours a day.

I found that ICM Capital provides customer service in a wide range of languages, including English, Chinese, Arabic, and Spanish, to name a few. The multilingual support, provided via telephone, email, and/or live chat, is suitable for beginners and advanced traders.

If you are experiencing technical difficulties while trading, remember that this broker’s trading desk operates 24 hours a day, Monday to Friday. For security and to protect your data, when calling ICM Capital, be ready to confirm your identity.

Customer Support

| Live Chat | Phone | |||

| Available | Available | Available | Available | Available |

| Quick response | Very Fast | Very Fast | Very Fast | Very Fast |

Commissions and Fees

You can find good value from ICM Capital’s range of accounts. Be sure to check the contract specifications of your trade when it comes to the spread, as this could affect how attractive you think a deal is.

I discovered that ICM Capital principally offers variable fees depending on the asset class with which you are working.

Spreads

Regarding spread, you pay zero spreads with the ICM Zero account. When you work through the ICM Direct and the ICM Micro account, the broker instructs you to watch the contract specifications according to the financial asset. Typical spreads you will find include FOREX starting from 0.1 pips and stocks starting from 1.8 pips.

Commissions

The ICM account charges the following commissions:

Zero commission on the ICM Direct account, on a transaction size of 0.01 per lot.

Zero commission on the ICM Micro account, on a transaction size of 0.01 per lot.

Note that all these rates apply to trading FOREX, metals, futures, shares, and cash CFDs on all accounts.

Swap fees and Islamic accounts

ICM Capital offers Islamic accounts to clients following the Muslim faith. FOREX Islamic accounts are also known as swap-free accounts as they imply no swap or rollover interest on overnight positions, which is against the Islamic faith.

Due to isolated cases of abuse, the broker states that it reserves the right to discontinue an Islamic or swap-free account without warning. In rare cases like these, the broker may decide to close all open positions in the account and deduct or add swaps for all transactions currently and/or previously made in the account and decline to accept any further requests from the client. For this reason, you should be well aware of the broker’s terms and conditions.

Inactivity fee

ICM Capital's policy on inactivity fees is not abundantly clear. Some sources indicate that ICM Capital does not charge inactivity fees for dormant accounts. However, other reports suggest that certain branches may impose a fee after a period of inactivity. For example, a $50 monthly fee after 180 days of inactivity. Given these discrepancies, you should consult the ICM Capital's official website in your jurisdiction.

Withdrawal fee

The withdrawal fee depends on the payment method that you use to withdraw.

Skrill: 1%

Neteller: $0

PayPal: 2%

Debit or credit card withdrawals are free.

| Spread | Commission | Swap | Islamic Account | |

| Currencies | Starting from 0.1 Pips | $0 | No | Available |

| Stocks | Starting from 1.8 Pips | $0 | Yes | Unavailable |

| Commodities | Starting from 2.3 Pips | $0 | No | Available |

| Indices | Starting from 4 Pips | $0 | Yes | Unavailable |

Platforms and Tools

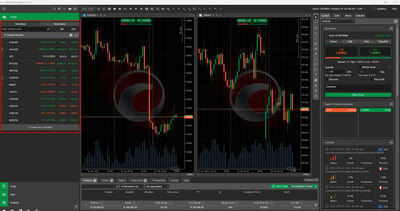

Managing your ICM Capital account is easy. The broker offers MT4 to its UK clients and MT4, MT5, and cTrader to its international clients. With these platforms, you can trade fast and get tight prices on a range of financial assets.

I discovered that ICM Capital clients can enjoy the widely popular MetaTrader range, an industry-leading platform traders prefer because of its impressive charting and analysis package.

Platforms types

ICM Capital offers a suite of platform tools designed to enhance the trading experience across various financial markets. Here is an overview of these tools:

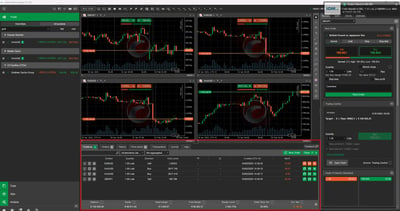

MT4 for Desktop

MT4 is a highly reliable trading platform that was developed for trading FOREX. Renowned for its diverse technical analysis capabilities, MT4 offers one-click trading and the ability to run FOREX robots, making it an ideal choice for both novice and experienced traders. The platform can be customized to suit individual preferences and is easy to navigate.

Key features of the MT4 desktop version include a stable and secure trading environment; algorithmic trading for developing, testing, and applying expert advisors and technical indicators; and a comprehensive technical analysis package with a wide range of inbuilt indicators and charting tools. Additionally, MT4 supports various custom indicators and different time periods, from minutes to months.

MT5 for Desktop

MT5 is a multi-functional platform designed for successful trading on financial markets. It offers a wide range of innovative features available to all desktop PC users, making it an institutional platform that provides advanced trading possibilities and technical analysis tools. MT5 supports automated trading systems (trading robots) and copy trading, making it an all-in-one platform for trading FOREX, stocks, and futures. The platform ensures reliable data protection measures to keep user details safe at all times.

cTrader for Desktop

cTrader is an independent trading platform for the 21st century. CTrader has helped countless traders within the industry by providing access to fast, tight prices when trading FOREX, as well as products based on such futures contracts as gold, silver, oil, commodities, and indices.

The platform can be securely downloaded directly from the website to a PC. cTrader is highly regarded for its diverse technical analysis capabilities and the ability to run cTrader FOREX robots while ensuring ongoing data protection.

Key features of the cTrader desktop version include true ECN technology via servers located in the LD5 IBX Equinix Data Centre. The platform also offers depth-of-market pricing, multiple order types, detachable charts, expanded symbol display, real-time reports, and one-click trading.

ICM Securities

ICM Securities platform is an easy-to-use web portal and mobile application for trading stock company shares. With its exclusive design and user-friendly navigation, the platform provides the best compatibility with any type of screen.

The application is a unique and efficient featured trading platform that is tailored for active traders and investors. Key features include trading stocks on a single cutting-edge multi-market trading platform. Traders can also get access to advanced charting, technical analysis, and news.

Look and feel

In my view, both MT4 and MT5 platforms prioritize intuitive design and accessibility. MT4 features a clean interface tailored for quick navigation, making it suitable for beginners. Charts are interactive, allowing for seamless analysis and customization.

MT5 has an enhanced visual experience, offering more advanced charting capabilities and streamlined navigation for professional traders. The platforms are accessible on PC, Mac, and mobile devices, ensuring flexibility for users.

Login and security

ICM Capital prioritizes user security across all platforms. Secure login protocols, including two-factor authentication (2FA), are available to safeguard user accounts. The platforms employ encryption technology to protect sensitive data during transactions and trading activities.

Search functions

Efficient search functionality helps traders navigate the vast array of instruments. MT4 features a streamlined search bar where users can quickly locate currency pairs, commodities, indices, and other assets. MT5 enhances search capabilities by integrating advanced filters, allowing traders to sort instruments by categories, volatility levels, or trading volume for more targeted results.

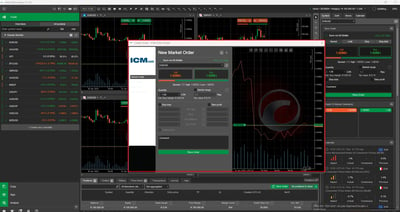

Placing orders

In my opinion, ICM Capital’s platforms offer versatile options for placing orders. MT4 supports multiple order types, including market, limit, and stop orders and one-click trading for rapid execution. MT5 expands on MT4’s capabilities with such additional order types as Buy Stop Limit and Sell Stop Limit.

Alerts and notifications

Keeping traders informed is a key focus. Both platforms allow users to set customizable price alerts and trading notifications. Notifications can be delivered via email, SMS, or push notifications on mobile devices, ensuring traders stay updated on market movements or order execution statuses. MT5 additionally includes calendar-based alerts and integrates economic event reminders to help traders plan ahead.

Mobile Trading

While not revolutionary, ICM Capital’s mobile trading experience is entirely acceptable, as you simply use the mobile version of the well-established platforms it offers.

If you wish to trade on mobile, you have a choice between a few options:

Platforms

MT4 for mobile

The MT4 mobile app enables users to trade securely from anywhere and at any time. Not only does the mobile app offer many of the same capabilities as the desktop version, as well as full control over trading accounts, but traders also enjoy the benefits of such mobile-friendly features as one-touch trading and push notifications.

MT5 for mobile

With MT5 mobile, you can control your account, trade in the financial markets, use automated trading with expert advisors, and apply technical indicators for market analysis. Online trading tools include easy access to financial markets from anywhere in the world, all order types and execution modes, and 3 types of charts and 9 time frames. You can also get 30 technical indicators and 25 analytical objects.

cTrader for mobile

cTrader mobile gives you complete access to mobile FOREX trading. You can get real-time interactive charts with zoom and scroll. Chart types include Japanese candlesticks, bars, and line charts. You can also get a confidential and secure, retrievable history of completed trade transactions. You can also access cutting-edge technical analysis through 30 technical indicators.

Look and feel

Each tool has an enhanced visual experience, offering more advanced charting capabilities and streamlined navigation for professional traders. The platforms are accessible on PC, Mac, and mobile devices, ensuring flexibility for users.

Login and security

ICM Capital prioritizes user security across all platforms. Secure login protocols, including 2FA, are available to safeguard user accounts. The platforms employ encryption technology to protect sensitive data during transactions and trading activities.

Search functions

I discovered that efficient search functionality helps traders navigate the vast array of instruments. MT4 features a streamlined search bar where users can quickly locate currency pairs, commodities, indices, and other assets. MT5 enhances search capabilities by integrating advanced filters, allowing traders to sort instruments by categories, volatility levels, or trading volume for more targeted results. cTrader prioritizes intuitive design and accessibility and features a clean search interface.

Placing orders

ICM Capital’s platforms offer versatile options for placing orders. MT4 supports multiple order types, including market, limit, stop orders, and one-click trading for rapid execution. MT5 expands on MT4’s capabilities with such additional order types as Buy Stop Limit and Sell Stop Limit. It also provides depth-of-market (DOM) views, enabling traders to analyze liquidity levels before placing orders. cTrader gives you an exceptional view of your placed orders.

Alerts and notifications

Keeping traders informed is a key focus. All platforms allow users to set customizable price alerts and trading notifications. Notifications can be delivered via email, SMS, or push notifications on mobile devices, ensuring traders stay updated on market movements or order execution statuses.

Research and Development

To support the fast-growing retail FOREX market, an all-inclusive education center designed for traders at all levels is also available. ICM Capital uses Trading Central’s technical analysis package for its product offering and provides it free of charge for live account holders. Trading Central is a global benchmark for providing daily market reports and covering technical analysis for FOREX, precious metals, and oil.

The broker offers a daily look at market news (similar to the newsfeed offered by Arincen), up-to-date statistics on available currency pairs, an economic calendar, and a weekly webinar.

Trading Central

I discovered that ICM provides access to the powerful insights and trading signals from third-party provider Trading Central across financial instruments, including stocks, indices, currencies, and commodities. Trading Central is known for its transparent, educational content; customizable filters for tailored results; and the ability to identify trading opportunities across multiple indicators simultaneously.

Both demo and live-account clients can view the Daily Market Report, while live-account traders receive login details to access Trading Central's MT4 Indicator and News Portal. The MT4 Indicator can be used on real-time charts to identify trading opportunities, and the News Portal offers award-winning research to support informed trading decisions.

Trading Tools

I learned that ICM offers a range of analytical tools to help you evaluate market trends and track your trades. One key tool is the Pip Calculator, which calculates the value of a pip based on the currency pair and transaction lot size.

Another useful tool is the Pivot Calculator, which quickly and easily calculates pivot points. Additionally, you can access the Economic Calendar to track market-moving events.

Trading Signals

ICM provides access to trading signals, enabling you to follow the cues of successful investors. Many trading websites offer this service, including Arincen itself, which has a powerful signals community.

With ICM Capital, you can sell your own signals. Advanced ICM traders also have the option to monetize their trading signals. If you are confident in your performance, you can sell signals to thousands of subscribers worldwide. While there are no registration costs, it will take 30 days for MetaQuotes to review your trade history before a fee can be added to your service.

Education

ICM has a powerful selection of educational resources concentrated in its Trading Central package, as we have just described. The broker has taken the time to develop detailed resources on several trading topics. ICM Capital understands that traders have many questions about how to succeed, and it has curated an excellent slate of educational content across various media.

Final Thoughts on ICM Capital

If you are seeking a reputable company that has over 13 years of experience in FOREX and CFD trading, then ICM Capital might be just for you. The firm has proven to be a great brokerage company over the past decade and a half and has even won multiple awards for its outstanding work. It is licensed by one of the best regulators in the world, the UK’s FCA, meaning that you do not need to worry about the safety of your funds when trading with ICM Capital.

Conclusion

During my research, I learned that ICM Capital has firmly established itself as a reliable global broker, offering a comprehensive selection of financial assets and trading platforms for retail and institutional traders. Regulated by the UK's FCA and other global authorities, it prioritizes client fund safety, transparency, and advanced technology to enable efficient trading. The broker’s diverse product range, including FOREX, commodities, indices, and CFDs, along with competitive spreads and multiple account types, makes it an attractive offering for many traders.

As I've noted, you should make every effort to understand the broker’s regional restrictions when signing up. While ICM Capital’s offerings are impressive, you should carefully evaluate its terms, fees, and suitability for your trading needs to ensure they align with your personal goals and strategies.

IICM Capital in Brief

ICM Capital, founded in 2009 and regulated by the FCA, offers a secure trading environment for retail and institutional clients. It provides access to FOREX, commodities, indices, and CFDs with competitive spreads and fast execution. Supporting traders globally, ICM operates arouind the world, delivering localized services and robust trading tools like MetaTrader and cTrader. The broker emphasizes client fund safety and aims to empower traders with efficient and reliable market access.

The team at Arincen collected more than 120 pieces of data covering more than 100 licensed FOREX companies. Data collection was done in three ways:

Companies’ websites.

Other websites that have ranked FOREX companies.

A survey questionnaire (referred to here as Survey “1”) was sent to the companies invited to participate in the exercise.

We have identified 12 criteria for our assessment, each containing several aspects and carrying its relative weight. These include licensing, deposits and withdrawals, number of assets, etc.

Afterward, we validated the data by:

Registering with FOREX companies as a secret shopper and as Arincen.

Survey number “2,” in which we asked these companies’ customers for meaningful feedback and past experience.

The next step saw us evaluate and rank each company, relying on the hard work of 15 Arincen employees. We were cautious in ensuring the most accurate assessment possible, including considering different languages and the various mobile-app operating systems, e.g., Apple, Samsung, etc.

To add credibility to our research project, we sent a final and third survey (referred to here as Survey “3”) to enable participating FOREX companies to evaluate our research and whether it accurately reflects the realities on the ground. We were fortunate enough to receive a mark of 9.9 out of 10! We have kept the margin of error to a minimum, which stood at a measly 1%. Please click here to learn more about how we came up with the evaluation.

Review Methodology

The team at Arincen collected more than 120 pieces of data covering more than 100 licensed FOREX companies. Data collection was done in three ways:

Companies’ websites.

Other websites that have ranked FOREX companies.

A survey questionnaire (referred to here as Survey “1”) was sent to the companies invited to participate in the exercise.

We have identified 12 criteria for our assessment, each containing several aspects and carrying its relative weight. These include licensing, deposits and withdrawals, number of assets, etc.

Afterward, we validated the data by:

Registering with FOREX companies as a secret shopper and/or as Arincen.

Survey number “2,” in which we asked these companies’ customers for meaningful feedback and past experience.

The next step saw us evaluate and rank each company, relying on the hard work of 15 Arincen employees. We were cautious in ensuring the most accurate assessment possible, including considering different languages and the various mobile-app operating systems, e.g., Apple, Samsung, etc.

To add credibility to our research project, we sent a final and third survey (referred to here as Survey “3”) to enable participating FOREX companies to evaluate our research and whether it accurately reflects the realities on the ground. We were fortunate enough to receive a mark of 9.9 out of 10! We have kept the margin of error to a minimum, which stood at a measly 1%. To learn more about how we came up with the evaluation, please click here.

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

FAQ

What is the minimum deposit to start trading with ICM Capital? The minimum deposit to open an account with ICM Capital is $200.

You can trade a wide range of instruments, including FOREX, precious metals, commodities, indices, and CFDs.

Yes, ICM Capital is regulated by the UK's FCA and other reputable authorities, ensuring a high level of client fund protection through segregated accounts.

ICM Capital supports MT4, MT5, and cTrader, each a popular and versatile platform equipped with advanced trading tools and features.

Some ICM Capital entities may charge inactivity fees after a specified period of no trading activity, so it’s important to review the terms applicable to your account.

Leverage varies based on the jurisdiction and instrument, with a maximum of 200:1 for major FOREX pairs globally and stricter caps, such as 30:1, under FCA regulations.

ICM Capital operates in several countries but does not provide services, due to restrictions, to residents of the USA, North Korea, China, and certain other regions.

ICM Capital offers competitive ECN spreads starting from zero pips, fast market execution with no requotes, and access to deep liquidity provided by tier-1 banks.