Table Of Contents

- What is a Japanese Candlestick?

- Overview and History of Japanese Candlesticks

- Importance of Technical Analysis in Trading

- Components of a Candlestick

- Different Types of Candlestick Patterns

- Top 21 Candlestick Patterns

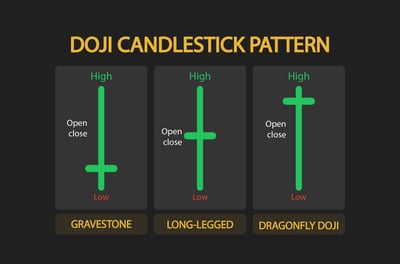

- 1. Doji

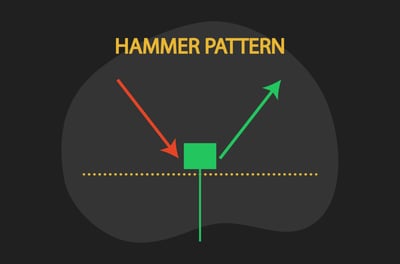

- 2. Hammer

- 3. Hanging Man

- 4. Shooting Star

- 5. Engulfing Pattern

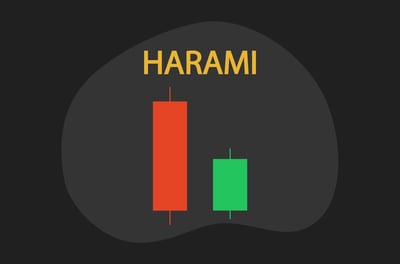

- 6. Harami Pattern

- 7. Piercing Pattern

- 8. Dark Cloud Cover

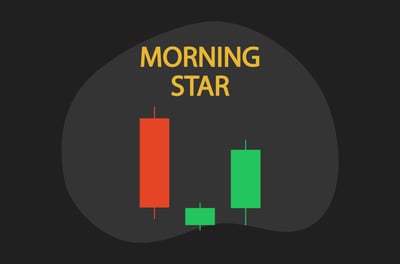

- 9. Morning Star

- 10. Evening Star

- 11. Three White Soldiers

- 12. Three Black Crows

- 13. Bullish Marubozu

- 14. Bearish Marubozu

- 15. Tweezer Tops

- 16. Tweezer Bottoms

- 17. Rising Three Method

- 18. Falling Three Method

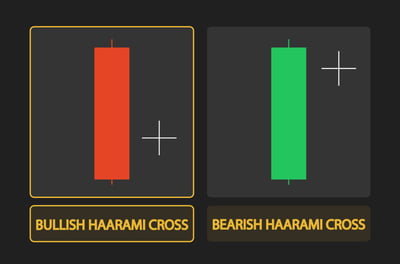

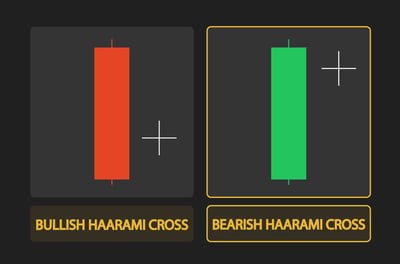

- 19. Bullish Harami Cross

- 20. Bearish Harami Cross

- 21. Inverted Hammer

- Reading Candlestick Patterns

- Single candlestick patterns:

- Multiple candlestick patterns:

- Application of Japanese Candlesticks in Trading

- Pros and Cons of Japanese Candlesticks

- Pros:

- Cons:

- The Bottom Line

What is a Japanese Candlestick?

As a longtime trader, I was intrigued to learn that Japanese candlestick patterns originated in Japan during the 18th century. They were first used for rice trading during a period when there were no automatic calculators to monitor trading volumes and prices. In time, they became useful in the financial markets, especially FOREX. What made them so good to work with was their ability to predict potential price movements. Having said that, there is no way to accurately predict any future price movement in trading. It is more likely that Japanese candlesticks provided a ready-made analysis tool for spotting patterns.

Today, Japanese candlestick patterns in FOREX trading and other forms of trading serve as a useful method for deciding on possible trade entry and exit points. You can also use them to identify reversals or trend continuations, and to understand market psychology. There are well over two dozen patterns, each showing the push-and-pull relationship between buyers and sellers over a specific time frame. As you come to understand how the patterns work in markets better, you can also learn who is gaining the trading advantage between buyers and sellers. At this point, it is important to note that no pattern guarantees success, and each requires proper interpretation within its market context. In this article, I will discuss the 21 most important Japanese candlestick patterns.

A Japanese candlestick visualizes open, high, low and close prices in a single bar, providing a compact view of price action and market sentiment.

The candlestick body shows the difference between open and close while the wicks display the extremes reached during the period.

Candlestick patterns help traders spot potential trend reversals or continuations

Single-candle formations like Doji, Hammer, Shooting Star and Hanging Man signal indecision or turning points in the market.

Multi-candle patterns such as Engulfing, Harami, Piercing Line, Morning Star and Three White Soldiers offer stronger indications of momentum shifts.

Continuation patterns like Rising Three Method and Falling Three Method suggest the current trend may persist after a brief pause.

Candlesticks work across all markets and timeframes

Effective use of candlesticks comes from combining them with trend lines, support and resistance levels, and technical indicators for better decision making.

What is a Japanese Candlestick?

From what I know, the Japanese candlestick is a visual representation of price movements within a certain trading timeframe. Candlesticks can provide a clear, visual understanding of market dynamics.

Each candlestick consists of a “body,” which shows the opening and closing prices, and “wicks” or “shadows” at either end, representing the highest and lowest prices reached during the period. If the closing price is higher than the opening price, the candlestick is typically filled or colored (often green or white), indicating a price increase or a “bullish” or positive market. On the other hand, if the closing price is lower than the opening price, the candlestick is usually empty or differently colored (often red or black), signaling a price decline or a “bearish,” or depressed, market.

In my view, Japanese candlesticks offer a quick way to read market sentiment. By studying the pattern of candlesticks over time, traders can get a sense of whether buying or selling pressure is dominant, which can help them more intelligently predict possible price movements.

Overview and History of Japanese Candlesticks

As I have mentioned, Japanese candlestick charting techniques were invented by rice traders in 18th-century Japan. The beauty of their use was to reflect the concepts of the open, close, high and low prices into a single candlestick figure. This graphical representation made it much easier for traders to read price patterns instantly.

For centuries, Japanese merchants and traders used candlesticks as a normal part of their daily lives until in the 1980s a technical analyst from the Western world picked up on these ideas and wrote a book about them. Today, Japanese candlesticks are widely used in global financial trading, including FOREX, stocks, and commodities.

Traders use these patterns to decide on the best entry and exit points for their trades, giving them the chance to more accurately manage their risk and potentially increase their returns. I should say at this point that no single tool can predict market movements. However, Japanese candlesticks, when used with other technical analysis tools and indicators, can significantly improve a trader's ability to capture market trends.

Importance of Technical Analysis in Trading

Here at Arincen, we often speak about the importance of technical analysis, which is crucial in retail trading for several reasons:

Identifying trends: By analyzing the market, you can spot price trends. Trendspotting is one of the most common calls to action in trading. Once you identify a trend, you can make a call to go long in an uptrend or short in a downtrend.

Timing trades: You can decide on what will be the best entry and exit points for your trades. By analyzing patterns and using technical indicators, you can develop a good understanding of when the price's trading direction is likely to change.

Risk management: If you can easily decipher the prevailing support and resistance levels of a financial asset, you can become better at setting stop loss and take profit levels, which can help you manage risk.

Predict future price movements: No analysis method is foolproof, but with good technical analysis, you can use historical price movements to make educated guesses about future price behavior. Patterns often repeat in markets, making this a useful tool for forecasting. In fact, as you become more experienced, much of your skill will be based on knowing how to respond to patterns you have seen before.

Independence: You can make independent decisions without relying on external advice or tips. This is a powerful ability. Yes, there is a lot of helpful advice out there, such as trading signals, but reading and interpreting price charts and indicators will help give you an edge over other traders.

Applicable to any market: Japanese candlesticks are not just a FOREX thing. Whether you are trading stocks, commodities, FOREX, or cryptocurrencies, the principles of technical analysis stay the same and can be applied in any market.

Efficiency: With modern charting software and trading platforms, technical analysis can be carried out consistently and highly efficiently. This allows traders to respond quickly to changing market conditions.

Technical analysis is a vital part of modern retail trading. It gives traders like you the tools required to interpret price movements, manage risk, and make informed decisions. When all this is combined with a stress-tested strategy, you can increase your chances of success in the markets.

Components of a Candlestick

Different Types of Candlestick Patterns

From my experience, I can say that Japanese candlestick patterns can be broadly categorized into three categories: Bullish, Bearish, and Indecision/Neutral.

This has been the case since the beginning of the time these were used. Each pattern reflects market sentiment and can help traders forecast future price movements.

Bullish patterns: These patterns signal that buying pressure exceeds selling pressure and prices may rise. Traders look for these patterns in a downtrend as an indication that the trend might reverse. Examples include the hammer, bullish Harami, and morning star.

Bearish patterns: These patterns signal that selling pressure exceeds buying pressure and prices may fall. Traders look for these patterns in an uptrend to potentially signal a trend reversal. Examples include: Shooting Star, bearish Harami, and Evening Star.

Indecision or neutral patterns: These patterns signal market indecision, where buying and selling pressures are relatively balanced, and a clear trend is not apparent. Traders look for these patterns to signal potential reversals or trend continuations. Examples include the Doji, Harami Cross, and Spinning Top.

These patterns can provide valuable insights into market sentiment and potential price reversals or continuations. However, they should always be used in conjunction with other technical analysis tools to increase their reliability. Next, we will discuss 21 of the top Japanese Candlestick patterns.

Top 21 Candlestick Patterns

1. Doji

2. Hammer

If you see a Hammer after a downtrend, it suggests that the market is attempting to find a bottom. The hammer's long lower wick shows that sellers pushed prices down, but buyers managed to push the prices back up to near the open. This could be a good time to consider entering a long position. The Hammer is an example of a popular reversal indicators. A Hammer signals a bullish reversal after a downtrend, while a Hanging Man, which I will explain next, indicates a bearish reversal after an uptrend. Their limitations are that they are single-candle patterns, which might lead to false signals.

3. Hanging Man

4. Shooting Star

5. Engulfing Pattern

6. Harami Pattern

7. Piercing Pattern

8. Dark Cloud Cover

9. Morning Star

A Morning Star pattern appearing during a downtrend indicates a potential bullish reversal. The small candle or Doji suggests the trend is slowing, and the following large bullish candle suggests a reversal, possibly making it a good time to buy. The Morning Star, like the Evening Star which I discuss next, are both reliable reversal indicators over three periods, which makes them more trustworthy than single-candle patterns. The downside is that you are likely to see them less often.

10. Evening Star

11. Three White Soldiers

Recommended Brokers

12. Three Black Crows

13. Bullish Marubozu

14. Bearish Marubozu

15. Tweezer Tops

16. Tweezer Bottoms

17. Rising Three Method

18. Falling Three Method

19. Bullish Harami Cross

20. Bearish Harami Cross

21. Inverted Hammer

As a trader you should always remember that the popularity of Japanese Candlestick patterns does not necessarily translate to higher success rates in trading. Effective trading often involves combining candlestick patterns with other forms of technical analysis like trendlines, moving averages, Fibonacci indicators, and Bollinger bands to confirm signals and improve the chances of success.

Reading Candlestick Patterns

In my view, reading Japanese candlestick patterns involves understanding the price action each pattern represents, which can be broken down into two categories: single- and multiple-candlestick patterns.

Single candlestick patterns:

As the name suggests, these consist of just one candlestick and are often easier to spot. They can provide valuable information about market sentiment.

Doji: A Doji has a very small or non-existent body, meaning that the opening and closing prices were nearly identical. This pattern indicates indecision in the market, suggesting a potential shift in the price trend.

Hammer/Inverted Hammer: A Hammer candlestick occurs when a security trades significantly lower than its opening, but gets stronger later in the day to close either above or close to its opening price. You will see a hammer-like shape with a long lower wick and a small body. An Inverted Hammer looks the same, but it occurs at the bottom of a downtrend. Both patterns suggest a potential bullish reversal.

Shooting Star/Hanging Man: A Shooting Star and Hanging Man have small bodies near the low with a long upper shadow and little to no lower shadow. The Hanging Man graphic typically forms during an uptrend and can suggest a potential reversal downward, while the Shooting Star typically forms during a downtrend and can signal a potential reversal upwards.

Multiple candlestick patterns:

These patterns are formed from two or more candlesticks and can provide traders with a deeper understanding of market dynamics.

Bullish/Bearish Engulfing: These patterns occur when a small candle is followed by a large candle of the opposite color that completely engulfs the prior candle. A Bullish Engulfing pattern indicates a possible reversal from a downtrend to an uptrend, while a Bearish Engulfing pattern suggests a possible reversal from an uptrend to a downtrend.

Morning Star/Evening Star: These are three-candlestick patterns. A Morning Star pattern occurs after a bearish trend and signals a possible bullish reversal, of which you should be aware. It consists of a large bearish candle, a small candle or a Doji, and a large bullish candle. An Evening Star pattern is exactly the opposite, signaling a potential bearish reversal after a bullish trend.

Harami: This pattern consists of a large candle followed by a smaller candle that is entirely within the range of the first candle's body. You should know that the Bearish Harami occurs at the top of an uptrend, and the Bullish Harami occurs at the bottom of a downtrend, signaling possible reversals.

Application of Japanese Candlesticks in Trading

In my experience, Japanese candlesticks are a valuable tool in trading because they can help identify potential trend reversals and provide insights into market psychology. Here's how some key elements apply:

Identifying Trend Reversals: Reversals indicate that an ongoing trend might be ending and a new one beginning. Japanese candlestick patterns, such as Doji, Hammer, Inverted Hammer, Hanging Man, and Shooting Star, can often signal these potential reversals. Think of this example - a Doji candlestick at the top of an uptrend may suggest that the bullish momentum is getting weaker, and a bearish reversal may happen soon. On the other hand, a Hammer at the end of a downtrend can signal a potential bullish reversal.

Hammer and Hanging Man: The Hammer and Hanging Man are single-candlestick patterns used to identify potential price reversals. The Hammer occurs after a downtrend and signals a potential bullish reversal.

Visually, it has a small body and a long lower wick, indicating a period when sellers were outperformed by buyers, pushing the price back upward. By contrast, the Hanging Man happens after an uptrend and suggests a potential bearish reversal. It also has a small body and a long lower wick, indicating that even though there was a large sell-off during the period, buyers successfully pushed the price back up. Remember, the presence of selling pressure during an uptrend can suggest a trend reversal.

Engulfing Patterns: Two-candle patterns that can signal potential reversals. The Bullish Engulfing pattern, characterized by a small bearish candle completely engulfed by a subsequent larger bullish candle, suggests that buyers have overtaken sellers and that a bullish reversal may occur. I've often seen it at the end of a downtrend. Quite the opposite: the Bearish Engulfing pattern, marked by a small bullish candle completely covered by a larger bearish candle, signals that sellers have overwhelmed buyers and that a bearish reversal may be on the horizon. It is often spotted at the end of an uptrend.

Pros and Cons of Japanese Candlesticks

Pros:

1) Versatility: Candlestick patterns can be used in any market, including FOREX, commodities, stocks, etc., and on any timeframe, from 1-minute charts to monthly charts. Further, you will often find clear visualization of price action.

2) Visual appeal: Candlestick charts are visually intuitive and easy to understand, making them appealing to many traders. They have very clear visualization. The various shapes and colors can quickly convey the dynamics of price movement.

3) Insight into market psychology: Candlestick patterns provide insights into market sentiment and trader psychology, offering clues about potential reversals or continuations.

4) Combination with other indicators: Candlestick patterns can be effectively combined with other forms of technical analysis, like trend lines, resistance and support levels, or technical indicators. This gives them more predictive power.

Cons:

Subjectivity and bias: Interpreting candlestick patterns can be a little subjective. Two traders may not always agree on the identification of certain patterns, leading to different trading decisions.

1) False signals: Like all technical analysis tools, candlestick patterns can sometimes provide false signals. A pattern that usually indicates a trend reversal might not always lead to a reversal, leading to potential trading losses.

2) Lack of quantitative indicators: Candlestick patterns are primarily qualitative and don't provide numerical such data as volatility, momentum or relative strength that other technical indicators offer.

3) Need for confirmation: Candlestick patterns often need confirmation from additional candles or other technical analysis tools, which might delay trading decisions. For this reason, candlesticks are sometimes known for giving false signals.

While Japanese candlestick patterns are a powerful tool for understanding market psychology and suggesting possible price movements, they should always be used as part of a comprehensive trading strategy that includes other technical analysis tools, risk management and sound trading principles.

The Bottom Line

Japanese candlesticks have survived for centuries in rice markets and have become an integral part of modern retail trading, especially in FOREX. Their visual representation of price action offers insight into the tug-of-war between buyers and sellers.

In my opinion, each candlestick and pattern tells a unique story about the market sentiment, providing traders with valuable insights into potential trend reversals or continuations. While they offer numerous advantages, their use comes with challenges, and the signals they provide are not infallible.

Therefore, as a responsible trader, you must combine them with other forms of technical analysis to confirm signals and enhance trading decisions. This helps you control for risk. Despite these complexities, the continued relevance of Japanese candlesticks shows how useful they remain in today’s fast-paced trading world. If you are intrigued by Japanese candlesticks and want to learn even more about these tools, we've written an even more comprehensive Japanese candlestick guide, which you can access here. Learning and mastering their meaning is an important skill for the modern retail trader.

FAQ

A Japanese candlestick is made up of a “body,” which shows the opening and closing prices. The “wicks” or “shadows” show the high and low prices during the given period. The body is filled (colored). If the asset closed lower than it opened (bearish candle), and empty (or differently colored) if the asset closed higher than it opened (bullish candle).

Reading Japanese candlestick patterns entails understanding the price action that each pattern carries. A pattern can indicate market sentiment, potential price reversals, or trend continuations. For instance, a doji” pattern normally suggests market indecision and this might precede a trend reversal, while a “bullish engulfing” pattern can suggest the start of an uptrend.

These include the Hammer, Bullish Engulfing, and Morning Star, all of which can signal a potential upward trend reversal. Bearish patterns include the Hanging Man, Bearish Engulfing, and Evening Star. These all suggest potential downward trend reversals.

Certain candlestick patterns indicate potential trend reversals. For example, a Doji or Hammer pattern following a downtrend could suggest a potential bullish reversal. On the other hand, a Hanging Man or Bearish Engulfing pattern following an uptrend might signal a bearish reversal. These patterns should be confirmed with other technical analysis tools.

The big pros include their versatility, visual appeal, ability to reveal market psychology and compatibility with other technical indicators. The cons include the fact that they have subjective interpretation. They also risk providing false signals, while they lack true quantitative indicators. All this means Japanese candlesticks often require confirmation from additional signals or tools.

Nothing guarantees trading success. The financial markets are beset by risk, and trading always exposes you to the possibility of losing money and winning money. Japanese candlesticks are merely one example of analysis that traders can use to get ahead in the markets.