Table Of Contents

- What Is a Pip?

- Related Terms

- Broker Quoting Styles

- How to Calculate Pip Value

- Pips and Profitability

- Pip Value in Non-FOREX Markets

- Pips and Trading Costs

- Pips in Risk Management

- Trading Strategies in Terms of Pips

- Platform and Broker Considerations

- Common Mistakes and How to Avoid Them

- Advanced Pip Topics

- Quick Reference

- The Bottom Line

What are Pips? The Trader's Intro to Basics in 2026

If, like me, you are a FOREX trader, it is likely you will hear the term “pip” every day of your trading life. As you become more experienced, you will learn how to apply this term, and you will get better at making pip calculations like they are second nature. This article intends to strip the term and its application down to the basics so you can understand what a pip is and how to use it.

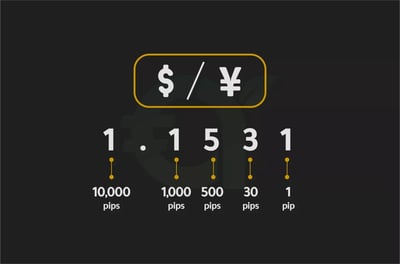

In my experience, a pip (percentage in point) is the smallest price movement in most currency pairs, typically measured to the fourth decimal place (0.0001). For pairs involving the Japanese yen (JPY), a pip is measured to the second decimal place (0.01). The value of a pip depends on the lot size and the currency pair's volatility, which affects profit and loss calculations. Understanding pip movement helps you set accurate stop-loss and take-profit levels, making it a fundamental concept for risk management and trade execution.

A pip is the smallest price increment in most currency pairs, typically the fourth decimal place (0.0001), and the second decimal (0.01) for yen pairs.

Pip values depend on the currency pair and the lot size you trade, affecting profit and loss size directly.

Knowing pip movement helps you set accurate stop‑loss and take‑profit levels to manage risk better.

In EUR/USD, a move from 1.0532 to 1.0533 represents a one‑pip gain of 0.0001.

Pips matter because FOREX trading often uses high leverage, so even small price changes can affect account balances significantly.

Profits in pips translate into currency gains based on your position size and exchange rate levels.

Applying pip calculations becomes intuitive with experience, empowering traders to size positions and measure performance effectively.

Grasping pip fundamentals builds a strong foundation for advanced FOREX strategies and risk‑management discipline.

What Is a Pip?

As I have done as a longtime trader, you will encounter the term 'pip' often in FOREX trading. Let us remember what the FOREX world is about – people and organizations trade pairs of global currencies to make it easier to tell how strong or weak one currency is relative to the other. In the FOREX world, a pip is a unit of change in the value of a currency pair.

As I've said, the relative value of currency pairs is displayed as a number with 4 decimal places. A pip represents the last of those four decimals and is, therefore, a small unit of change. Why bother with such small values? Well, the FOREX world uses generous leverage and high volumes of FOREX change hands. So, pips, as small as they are, matter.

Here is an example. Let's say that at today’s exchange rate, one euro will buy you 1.0532 US dollars. If you were trading the euro against the US dollar, one pip would be the smallest movement that could take place between the two currencies. If the EUR/USD (you always quote the base currency first) moved from 1.0532 to 1.0533, or even 1.0534, that 0.0001 change in value is one pip.

Related Terms

When you first encounter the concept of a pip, you quickly run into other terms that sound similar but carry different meanings. Getting these right is crucial for avoiding confusion, especially when jumping between FOREX and other asset classes.

Pipettes (fractional pips):A pipette is exactly one-tenth of a pip. This is a tiny unit of measurement. So, if a standard pip is measured at the fourth decimal place (0.0001 in EUR/USD), a pipette extends this precision to the fifth decimal place (0.00001).

Some brokers now quote currency pairs with pipettes because it allows for even tighter spreads and more accurate pricing. Here’s an example: if EUR/USD moves from 1.10542 to 1.10547, that is a shift of 0.5 pipettes, or half a pip.

Points vs Ticks in other markets:Outside of FOREX, different instruments have their own “smallest move” terminology. In equities, traders talk about points, with one point equaling one unit of price movement in the stock (e.g., Apple rising from $175 to $176 equals one point).

In futures and commodities, traders often use ticks instead. A tick is the smallest upward or downward movement defined by the exchange for that instrument. Think of it this way: in the E-mini S&P 500 futures, one tick equals 0.25 index points, which corresponds to $12.50 per contract.

Understanding how these units translate across markets helps you avoid misinterpreting price action or overestimating potential gains and losses. A pip in FOREX is not the same as a point in equities or a tick in futures, but each has a major role to play as a standardized way to measure movement.

Broker Quoting Styles

If you’ve ever opened the same currency pair on two different trading platforms and noticed a slight difference in how prices are shown, then you’ve seen different broker quoting styles in action.

Traditionally, FOREX pairs were quoted with four decimals (or two for yen pairs), but today a lot of brokers use five and three (for Yen) decimals. By now you know that the extra digit represents a pipette, or one-tenth of a pip.

For example, EUR/USD might be shown as 1.10542 instead of 1.1054. The pip is still the fourth decimal (the “4” in this case), but the extra “2” at the end gives added precision. The same applies to yen pairs: instead of USD/JPY being quoted at 150.25, you might see 150.253. Here, the pip is still the second decimal, and the third decimal represents the pipette.

Platforms like MT4 and MT5 adopted this style to reflect the way liquidity providers and interbank systems operate, where tighter spreads and fractional pips are the norm. This allows brokers to show spreads as low as 0.1 or 0.2 pips, which can make execution look sharper and more competitive.

How to Calculate Pip Value

It’s important that you are comfortable calculating pip values on the fly. This is a useful skill in the hustle and bustle of rapid trading.

General formula

In my opinion, knowing where the pip sits in a quote is only part of the story. You would naturally ask: What is that pip worth in money terms? This is where the pip value formula becomes useful:

Pip Value = (Pip size ÷ Exchange rate) × Lot size

The pip size is fixed at 0.0001 for most major pairs (or 0.01 for yen pairs). The exchange rate refers to the current market price of the pair. The lot size is the volume of your trade, where one standard lot equals 100,000 units of the base currency, a mini lot is 10,000 units, and a micro lot is 1,000 units.

Let’s put this into practice with EUR/USD trading at 1.1000. The pip size is 0.0001, so the calculation for one standard lot looks like this:

(0.0001 ÷ 1.1000) × 100,000 = $9.09 per pip

That means every one-pip move in EUR/USD equals about $9 if you’re trading one standard lot. Scale it down to a mini lot, and each pip is worth about $0.90. With a micro lot, a single pip costs roughly nine cents.

The same logic applies to USD/JPY. If the pair trades at 150.00, then:

(0.01 ÷ 150.00) × 100,000 = $6.67 per pip for a standard lot.

Once you see the math, it becomes clear why lot size and the chosen pair both matter in risk management. A few pips can mean very different dollar outcomes depending on how you size your trades.

Lot sizes

What is a lot size? In FOREX, position sizing is standardized around the concept of lots. A standard lot is 100,000 units of the base currency, a mini lot is 10,000 units, and a micro lot is 1,000 units. These lot sizes are key for calculating pip values, because the bigger your position, the more money each pip movement is worth.

Take EUR/USD as an example, trading at 1.1000. Using the pip value formula, a one-pip move is worth about $9.09 per standard lot. Scale that down, and the same pip is $0.90 in a mini lot and just $0.09 in a micro lot. The smaller the lot size, the lower the risk exposure, making micro and mini lots a perfect method for new traders learning the ropes.

But, as you can probably see, you need to have your wits about you and you need to be conversant with what each term really means because each term means a different amount of money!

Then there is leverage, which can amplify things pretty fast. Some quick math shows how powerful leverage can be. A move of just 10 pips is only 90 cents in a micro lot, but nearly $91 in a standard lot. That’s why professional traders stress position sizing and risk management. Lot size decides whether a small swing in the market feels like a ripple or a tidal wave.

Recommended Brokers

Pips and Profitability

How do pips work when it comes to actually making money from trading? An investor who trades the EUR/USD will make a profit if the euro appreciates in value relative to the US Dollar.

Here are the steps involved. Let us say you are a FOREX day trader. On Monday morning, you use EUR10,000 from your euro-denominated FOREX account to buy USD10,053.90 at a EUR/USD rate of 1.0539. Now, you hold this USD amount in your account and wait for the market to swing your way.

At lunchtime on Monday, a major announcement in the US reveals that economic prospects are poor. The US dollar weakens based on pessimistic sentiment from market players. Now, the EUR/USD rate shifts to 1.0531, a change of 0.0008, or eight pips. Sensing an opportunity, you quickly convert the US 10,053.90 back to euros, at a rate of EUR/USD 1.0531. By the end of the day, you now have EUR10,007.60, more than you started with in the morning. You have thus made a profit of EUR7.60.

This very simplistic example does not consider fees and commissions and does not account for leverage. With some brokers, you can leverage your trades as much as 200 times over, using 200:1 leverage. The example here is meant to illustrate the function of a pip at its most basic level.

You might think this is a small profit for one trade, but the example does not show that day traders can easily enter and exit hundreds of trades per day with lightning-fast execution like ECN trading and even use algorithmic trading bots that place trades on your behalf. Additionally, when you trade on margin, you enter these large positions with some of the broker’s money and some of your own, so you don’t need as much capital.

Further, the amount of volatility between major currencies like the EUR and USD is very small compared to the amount of volatility (and number of pip differences) between a major currency and an emerging currency. This means you could make even more money if you successfully traded major currencies against minor currencies. There is a world of possibilities regarding how to make money in FOREX, and the humble pip is at the center of it all.

Pip Value in Non-FOREX Markets

While pips are the standard unit in FOREX, other markets have their own conventions for measuring price moves.

Commodities and metals

In my experience, commodities and metals are often quoted in dollars and cents per unit, but the principle is the same: every tick or point change translates into a specific dollar value depending on contract size.

Gold (XAU/USD):In spot gold trading, prices are quoted to two decimal places, like 2,350.25. A move from 2,350.25 to 2,350.26 is one cent, but most brokers define the minimum price movement as $0.01 per ounce. Since one standard lot of gold typically represents 100 ounces, a $0.10 move equals $10 per lot, and a $1 move equals $100 per lot. Some brokers display gold quotes with three decimals (e.g., 2,350.257), but the pip equivalent is always tied back to the dollar value per ounce.

Oil contracts (WTI or Brent):Crude oil is usually quoted to two decimal places, such as 75.20. In futures or CFD trading, the contract size dictates the pip value. For a standard futures contract of 1,000 barrels, a $0.01 move per barrel equals $10 per contract (0.01 × 1,000). If oil rises from 75.20 to 76.20, that’s a $1 move, or $1,000 per contract. Smaller CFD contract sizes scale proportionally, making it easier for retail traders to manage risk.

Indices and futures

When you step outside FOREX and into indices or futures, you won’t hear much about pips. Instead, the market talks in points and ticks, with contract specifications doing the heavy lifting to define value.

Take the S&P 500 E-mini futures as an example. The contract is quoted in index points, and the minimum tick size is 0.25 index points. Each tick is worth $12.50 because the contract represents $50 per full index point. That means if the S&P 500 moves from 4,500.00 to 4,501.00, the one-point change is equal to $50 per contract.

Other futures follow the same structure but with different tick sizes and contract values. For instance, crude oil futures trade in increments of $0.01 per barrel, and with 1,000 barrels per contract, that single tick is worth $10. In gold futures, the minimum tick is $0.10 per ounce, and with 100 ounces per contract, that tick equals $10.

Indices traded through CFDs are often simplified for retail traders. A broker might quote the NASDAQ 100 directly in index points, where a one-point move equals $1 per mini contract. The mechanics vary, but the principle is the same: the contract size determines the monetary impact of each incremental move.

The difference from FOREX is mainly terminology. A pip in EUR/USD always equals 0.0001, but in futures and indices, the tick size is set by the exchange, and the contract value translates that tick into dollars. Traders who move among markets need to pay close attention to these specifications because they dictate both potential profits and risks.

Pips and Trading Costs

Every trader quickly learns that the cost of entering a position isn’t hidden in commission alone.

Spreads

The spread, the difference between the bid and ask price, is measured in pips, and it represents the broker’s built-in charge for every trade.

Take EUR/USD, one of the most liquid pairs. If the bid is quoted at 1.1000 and the ask at 1.1002, the spread is 2 pips. That means the moment you enter the trade, you’re effectively down 2 pips, and the market has to move at least that far in your favor just to break even. Brokers quote spreads in pips precisely because pips are the universal yardstick of movement in FOREX.

The size of spreads depends heavily on the pair you trade. Majors like EUR/USD or USD/JPY typically carry the tightest spreads, often below 1 pip in liquid sessions. Crosses such as EUR/GBP or AUD/NZD tend to cost more, with spreads widening to 2-4 pips or more. Exotic pairs can go even further, sometimes 20 pips or higher, reflecting thinner liquidity and greater volatility.

Timing also matters. During the London and New York sessions, when liquidity is deepest, spreads tend to narrow. In quieter hours, such as the Asian session for non-yen pairs or right after New York closes, spreads can widen, making short-term trading more expensive.

Slippage

Just like spreads, slippage is quoted in pips because pips are the universal measure of price movement in FOREX. Slippage happens when the price at which your trade is executed differs from the price you clicked. If you place a buy order on EUR/USD at 1.1000 but it actually fills at 1.1003, that’s 3 pips of slippage, and it can work for or against you.

Slippage widens most often during high-impact news releases, when prices can jump multiple pips in a fraction of a second. Think of non-farm payrolls or central bank announcements; liquidity providers may not be able to honor the original price because the market is moving too quickly. Slippage also becomes more common in periods of thin liquidity, such as after New York closes, during holidays, or when trading exotic currency pairs.

For traders, understanding slippage in pip terms makes risk easier to quantify. A couple of pips of slippage on EUR/USD in normal conditions may be tolerable, but ten or twenty pips during a news spike can turn a winning trade into a loss.

Brokers often advertise “low slippage” as part of their execution model, but the reality is that slippage is an unavoidable part of live markets. What matters is recognizing when it’s most likely to hit and planning accordingly with stop-loss buffers or by avoiding volatile news windows.

Pips in Risk Management

Risk management in FOREX ultimately comes down to how many pips you’re willing to put on the line.

Stop-loss and take profit

In my experience, traders don’t think of stops or targets in vague terms; they measure them in pips because that’s the most precise way to translate chart levels into monetary risk.

For example, if you’re trading EUR/USD with a stop-loss 30 pips below your entry and a take-profit 60 pips above, you’re effectively running a 1:2 risk-to-reward ratio. The math is simple: if each pip is worth $9 on a standard lot, the maximum loss is $270, while the potential gain is $540. By setting stops and targets in pip terms, you lock in both your downside and upside before the trade even begins.

Stops and targets are often tied to market structure. A swing trader might place a stop 50–100 pips behind the last support level, while a scalper may risk only 5–10 pips, aiming for a quick 10–20 pip move. The key is consistency: adjusting lot size to ensure the pip distance you choose aligns with the percentage of capital you’re willing to risk, often no more than 1–2% per trade.

Position sizing

Once you know your pip value, position sizing is just a matter of connecting it to your stop distance. The formula is simple:

Stop distance (in pips) × Pip value = Dollar risk per trade

Say you’re trading EUR/USD with a 50-pip stop. On a standard lot, each pip is worth about $9, so your total risk is 50 × $9 = $450. If that number is too high relative to your account size, you can scale down to a mini lot (risking about $45) or a micro lot (risking just $4.50).

This is why professional traders always start with the stop distance, not the other way around. They define risk in percentage terms and then adjust lot size to match. For example, with a $10,000 account and a 1% risk rule, the maximum you should lose on a single trade is $100. If your stop is 25 pips, you work backward: $100 ÷ 25 = $4 per pip. That translates into a position size of roughly half a mini lot.

By measuring stops in pips and converting them into dollars, you take guesswork out of the equation. Position sizing becomes a mechanical process, protecting your capital while still giving your trades room to breathe.

Without this link between pips and dollars, traders risk overleveraging and blowing up accounts on what should have been minor moves.

Volatility adjustment

Not all market conditions are created equal, and neither should your stop-losses. Some traders use fixed-pip stops, say, always risking 30 pips on EUR/USD regardless of the setup. While simple, this approach ignores the reality that volatility expands and contracts across sessions and news events. A 30-pip stop might be too tight in a volatile New York session, but unnecessarily wide during the quiet Asian hours.

That’s where Average True Range (ATR)-based stops come in. The ATR measures recent volatility in pips, giving traders a dynamic way to size their stops. For instance, if the 14-period ATR on EUR/USD reads 40 pips, you might set your stop at 1× ATR (40 pips) or 1.5× ATR (60 pips). The advantage is that your risk adapts to current conditions: you’re not strangling trades in volatile markets, nor overexposing yourself when price barely moves.

The formula for risk control stays the same—stop distance in pips × pip value = dollar risk—but the stop distance itself flexes with volatility. This keeps position sizing consistent while making sure stops are placed beyond random market noise.

In practice, fixed-pip stops suit scalpers who thrive on speed and consistency, while ATR-based stops give swing and position traders a more market-aware framework. Both methods can work, but tying stops to volatility often means fewer premature stop-outs and a clearer read of market structure.

Trading Strategies in Terms of Pips

What’s your trading style? Are you into the thrill-seeking of scalping or the steady accumulation of position trading? You might reside somewhere between those two. Either way, your pip strategy should be adjusted accordingly.

Scalping

In my view, scalping is the purest example of trading in pip terms. Scalpers hunt for tiny moves, often just 3 to 10 pips at a time, and rely on executing dozens of trades per session. Because the targets are so small, the cost of doing business becomes critical. A spread of 2 pips on EUR/USD may seem trivial to a swing trader aiming for 200 pips, but for a scalper chasing 5, it eats up almost half the potential profit.

That’s why scalping strategies gravitate toward the most liquid pairs, EUR/USD, GBP/USD, USD/JPY, during the busiest market sessions. These periods, particularly the London–New York overlap, offer the tightest spreads and fastest execution, both of which are vital when profits are measured in single-digit pips.

A scalper might, for instance, go long EUR/USD at 1.1000, close at 1.1006, and capture a quick 6-pip gain. On a standard lot, that’s about $54. Repeat this process successfully across multiple trades in a session, and small wins add up. But the flip side is that costs, spread, slippage, and even commissions, can make or break results.

Scalping demands precision, discipline, and lightning-fast decision-making. In this style, every pip matters, and traders quickly learn that managing costs is as important as spotting the right entry.

Day trading

Day trading takes a step back from the razor-thin margins of scalping and instead looks for 20- to 50-pip swings within a single trading day. The idea is to capture meaningful intraday moves without holding positions overnight, which avoids the risk of unexpected news or swap charges.

For example, if EUR/USD opens the London session at 1.1000 and rallies to 1.1040 by midday, that’s a 40-pip move, right in the sweet spot for a day trader. On a standard lot, this translates to about $364. Unlike scalping, spreads of 1–2 pips are less damaging here because the profit target is larger. Still, keeping costs low remains important, especially for traders who might place several trades in a day.

Day traders usually anchor stops and targets to intraday support and resistance levels, or use tools like moving averages and Fibonacci retracements to spot setups. Stops might be set at 15–25 pips, with targets placed 2–3 times that distance away, preserving a favorable risk-to-reward ratio.

The style demands patience compared to scalping, waiting for setups to play out, but it also rewards discipline. For many retail traders, day trading strikes a balance between the fast pace of scalping and the longer horizons of swing trading, making pips the daily yardstick for defining both opportunity and risk.

Swing trading

Swing trading stretches the time horizon further, aiming to capture 100-pip or larger moves that unfold over several days or even weeks. Instead of trying to squeeze profit out of every tick, swing traders position themselves to ride broader trends, whether it’s EUR/USD breaking out after an ECB decision or GBP/USD trending lower on shifting rate expectations.

For example, if EUR/USD rises from 1.0800 to 1.0950 over three trading days, that’s a 150-pip swing. On a standard lot, the gain would be around $1,364, dwarfing the smaller wins of scalping or day trading. Stops are typically wider, often 40-100 pips away from entry, to allow trades room to breathe and absorb normal volatility.

Because swing traders hold positions longer, spreads and slippage matter less in the big picture. What matters more are market fundamentals, macroeconomic drivers, and technical trend signals. Many swing traders use higher timeframes, 4-hour or daily charts, to spot setups, while keeping an eye on economic calendars to avoid being blindsided by major news.

The trade-off is patience. It can take days for a swing trade to develop, and drawdowns are a normal part of the process. But for traders with the discipline to stick with a plan, swing trading offers the chance to capture significant pip movements with less screen time. It’s a strategy where pips become a measure of momentum, not just noise, and where the rewards can justify the wait.

Platform and Broker Considerations

It’s a good thing to know that the terms I have shared with you are often presented slightly differently according to the platform on which you are trading.

How platforms display pips

As I've come to learn, how you see pips on screen depends not just on the market you trade but also on the platform your broker provides. While the pip itself never changes, it’s still the fourth decimal for most pairs and the second decimal for yen pairs; the way platforms display price quotes can differ.

MT4 and MT5: These platforms are FOREX staples, and most brokers quote in 5 decimal places for majors and 3 decimal places for yen pairs. That extra digit represents the pipette—one-tenth of a pip. For example, EUR/USD might be displayed as 1.10542, where the “4” is the pip and the “2” is the fractional pip. In MT4/MT5, the last digit is often displayed in a smaller font, making it easier to spot the pip’s location.

cTrader: This platform also uses fractional pip pricing but is known for its clean interface. Traders can customize how quotes are displayed, and cTrader makes it easy to highlight spreads directly in pips. Many scalpers prefer this transparency, since their strategies depend on cost sensitivity at the pip level.

TradingView: Primarily a charting platform, TradingView integrates broker feeds that may display pricing with either 4 or 5 decimal places. Pips aren’t highlighted separately, so traders rely on the price scale and built-in tools to measure movements in pips. Drawing tools like the “long position” or “short position” automatically calculate stop-loss and take-profit distances in pips, which helps plan trades visually.

The bottom line: the pip itself never changes, but the presentation does. Platforms either emphasize precision with fractional pips or lean on charting tools to make pip measurement easier. Knowing how your platform displays them ensures you’re not misreading the smallest, yet most important, unit of FOREX movement.

Setting orders in pips

When it comes to placing trades, most platforms let you set stop-loss and take-profit orders directly in pip values. This makes it easier to align your risk and reward without manually converting levels into absolute prices.

On MT4 and MT5, for example, you can open an order ticket and specify that your stop should be 30 pips away from entry and your target 60 pips away. The platform automatically converts those pip distances into the corresponding price levels based on the pair’s decimals. If EUR/USD is at 1.1000 and you set a 30-pip stop, the platform places it at 1.0970 for a long trade.

This pip-based input saves time and prevents mistakes. Instead of calculating the math yourself, or worse, misplacing a decimal, you’re simply telling the platform how many pips of risk or reward you want to build into the trade.

It also makes strategy execution consistent. Scalpers might set automated orders at just 5 or 10 pips, while swing traders routinely enter 100+ pip stops and targets. By working in pip terms, every trader, from micro lot beginners to standard lot veterans, can scale orders to their strategy without worrying about misreading prices.

The key is to always double-check the platform’s decimal system, especially when dealing with pipettes. A 30-pip stop on a 5-digit broker feed still means 0.0030, not 0.00030. Once you’re clear on where the pip sits in the quote, entering stops and limits in pip values becomes second nature.

Common Mistakes and How to Avoid Them

From my own experience, I can attest that working with pips is second nature to experienced traders, but beginners often make avoidable mistakes that can distort their risk calculations and lead to costly errors.

Confusing pips with pipettes:The most common slip-up is misreading quotes with fractional pips. A move from 1.10001 to 1.10011 is one pip, not ten. The fifth decimal (or third in yen pairs) represents a pipette — one-tenth of a pip. Always anchor your calculation on the fourth decimal for majors and the second for yen pairs to avoid exaggerating your profits or losses.

Ignoring account currency conversions:Trading pairs where your account isn’t denominated in the quote currency require a conversion step. For example, if your account is in EUR and you’re trading USD/JPY, your pip value is calculated in USD first, then converted to EUR. Forgetting this step can cause you to underestimate your true exposure.

Using fixed pip stops regardless of volatility:Markets don’t move in straight lines, and volatility expands and contracts. A fixed 30-pip stop might work in quiet Asian hours but can be wiped out instantly because of a U.S. news release. Adapting stop distances to volatility, often through ATR-based stops, keeps your trades alive when markets are noisy without oversizing risk in calmer sessions.

Forgetting to account for spread in pip-based targets:If you target 20 pips but the spread is 2 pips, your net gain is closer to 18 pips. For scalpers chasing 5–10 pips at a time, ignoring spread costs can turn a winning system into a losing one. Always factor the spread into your break-even calculations before setting targets.

By staying precise about pip versus pipette, being mindful of account currency, being flexible with stops, and being disciplined about spreads, you can prevent these small mistakes from becoming significant drains on your performance.

Advanced Pip Topics

Pips can become very complex the more you get into them. They sometimes have complicated relationships with other trading terms.

Relationship to basis points

At some point, traders encounter another small unit of measurement: the basis point (bp). While pips dominate FOREX price quotes, basis points are the language of interest rates and bond markets. Understanding how the two relate is essential, especially since central bank rate decisions often ripple into pip-sized moves in currency pairs.

A basis point equals 1/100th of a percent, or 0.01%. For example, if the Federal Reserve raises rates from 5.25% to 5.50%, that’s a 25 bp hike. In FOREX terms, that single decision can trigger hundreds of pips of movement as traders reprice currency pairs to reflect the new yield differential.

The comparison is straightforward:

One pip in EUR/USD (0.0001) equals 0.01% of the exchange rate when the pair trades near 1.0000.

One basis point (0.01%) is effectively the same scale, but it applies to interest rates rather than exchange rates.

Think of pips as the heartbeat of the market on your trading screen, while basis points are the unit policymakers and economists use to describe rate changes. When analysts say the ECB is likely to cut rates by 50 bps, experienced traders are already thinking about how many pips EUR/USD might slide in response.

Bridging pips and basis points helps traders connect short-term price action to long-term macro drivers. Both are tiny increments, but in FOREX, those tiny increments are where opportunities and risks live.

Execution and microstructure

In my view, not all brokers handle your trades the same way, and those differences become most apparent at the pip level. The two main execution models, ECN and market maker, define how your orders are filled and how tight the spreads can realistically get.

An ECN broker routes your orders directly to liquidity providers, matching you against banks, hedge funds, or other traders. Spreads can be razor-thin, often close to zero pips on majors during liquid sessions, with the broker charging a small commission instead. Because fills happen in a competitive order book, execution is usually more transparent, but slippage can still occur in fast-moving markets. At the pip level, ECN trading gives you precision: if EUR/USD is quoted at 1.10001, you can often be filled at that exact fractional pip.

A market maker, by contrast, takes the other side of your trade. Prices are quoted internally, and spreads are typically wider, say, 1–2 pips on majors, and more on crosses. The advantage is instant execution, even in thin markets, but the cost is less transparency. Market makers may also re-quote during volatile periods, meaning you might not get the pip-level fill you expect.

For traders, the microstructure matters. Scalpers chasing 5–10 pip moves depend on ECN-style precision to stay profitable. Longer-term traders may tolerate market-maker spreads if execution is stable. Either way, recognizing how your broker handles orders is critical, because at the smallest scale, one pip can be the difference between a strategy that works and one that fails.

Carry trades and pips

For most traders, profit and loss are measured in pips, the rise or fall of the price on the chart. But in carry trades, there’s another layer: the swap, or the overnight interest rate differential between two currencies. Understanding the distinction is vital because pips and swaps both affect your bottom line, but they’re not the same thing.

A carry trade involves buying a higher-yielding currency against a lower-yielding one, aiming to collect daily interest payments while holding the position. For example, if you go long AUD/JPY, you’re effectively borrowing yen at a low rate to buy Australian dollars, which historically pay more. Each day you hold the trade, you may receive a positive swap credited to your account. Reverse the trade, and the swap might be negative, eating into your balance.

The key point is that pips reflect price movement, while swaps reflect interest rate differentials. You might earn 20 pips on AUD/JPY because the price moved in your favor, but you lose part of that gain if the negative swap drags your P&L lower. Conversely, you could see the price go sideways while still earning a positive return through daily swap credits.

For carry traders, the challenge is balancing the two. A trend that adds 200 pips looks attractive, but if the swap is heavily negative, holding that position for weeks can quietly erode profits. Smart carry traders weigh both—the pip potential from charts and the swap flows from interest rates—before committing capital.

Quick Reference

At the end of the day, traders want to know: what’s one pip worth in dollars? While the formula never changes, it’s handy to keep a cheat sheet for the most common pairs and lot sizes. Below is a quick reference for majors (EUR/USD, GBP/USD, etc.) and JPY pairs (USD/JPY), showing approximate pip values.

These values shift slightly as exchange rates move. EUR/USD at 1.1000 gives a pip value of about $9.09 per standard lot, not a perfect $10, but the table is close enough for quick decision-making. For precision, especially when risk-managing larger positions, you should still run the pip-value formula.

Pips may be small, but they scale quickly with lot size. Whether you’re testing strategies on a micro account or running standard lots in live markets, this cheat sheet puts the math at your fingertips.

Quick rules of thumb (USD as Quote Currency)

When USD is the quote (e.g., EUR/USD):

Standard lot (100,000) ≈ $10/pip; mini ≈ $1/pip; micro ≈ $0.10/pip.

Shortcut: Value traded × 0.0001 = pip value (for 4-dp pairs). Example: 10,000 × 0.0001 = $1.

When the U.S. dollar is the quote currency, pairs like EUR/USD, GBP/USD, or AUD/USD, pip value calculations become almost effortless. For most traders, the rule of thumb is simple:

Standard lot (100,000) ≈ $10 per pip

Mini lot (10,000) ≈ $1 per pip

Micro lot (1,000) ≈ $0.10 per pip

This shortcut works because for four-decimal pairs, the pip size is always 0.0001, and multiplying it by your trade size gives you the pip value. Put another way:

Pip Value = Value traded × 0.0001

So if you’re trading a mini lot of EUR/USD (10,000 units):10,000 × 0.0001 = $1 per pip.

On a standard lot (100,000 units):100,000 × 0.0001 = $10 per pip.

The math only needs adjusting for pairs where the USD isn’t the quote currency, like USD/JPY or cross-currency pairs. But, for the bulk of major dollar pairs, these quick rules save you from grabbing a calculator every time.

The Bottom Line

In my view, as a trader, you will need to become accustomed to this very important term. Pips are the smallest unit of change in value between two currencies. Learning how to use this term so that it becomes second nature will serve you very well over the course of your trading career. Even if you change FOREX brokers, the rules of pips do not change, meaning you can easily read charts and indicators from any broker with whom you choose to work. Also, knowing your way around trading terms in FOREX allows you to be a better trader in other financial assets, too.

FAQ

A pip is the smallest standardized unit of price movement in FOREX, usually the fourth decimal place (0.0001) for most pairs and the second decimal (0.01) for JPY pairs.

A pipette is one-tenth of a pip, shown at the fifth decimal place in most pairs (or the third in yen pairs). Pipettes give brokers more precise pricing and tighter spreads.

On USD-quoted majors, one pip is about $10 on a standard lot, $1 on a mini lot, and $0.10 on a micro lot. Pip values for JPY pairs and crosses vary slightly depending on the exchange rate.

Yes. Spreads are measured in pips. If EUR/USD has a 1.1000 bid and 1.1002 ask, that’s a 2-pip spread you pay as a trading cost.

Pips are the foundation for calculating profits, losses, risk, and position sizing. They allow traders worldwide to measure trades in a universal way.

Not usually. Stocks and indices use points, and futures/commodities use ticks. The idea is the same, a smallest unit of movement, but the terminology differs.

Most platforms let you enter stop-loss and take-profit orders in pip distances. For example, a 30-pip stop below entry on EUR/USD at 1.1000 would place the stop at 1.0970.

On majors where USD is the quote, think $10 per pip per standard lot, $1 per pip per mini lot, and $0.10 per pip per micro lot.