Table Of Contents

- What Is Margin?

- What Does it Mean to Trade on Margin?

- Which Assets Can You Trade on the Margin?

- Margin Is Not a Free Lunch

- How Margin and Margin Trading Work

- Practical Considerations When Trading on Margin

- Step-by-Step Guide to Buying on Margin

- Real-world Worked Example

- Key Elements of Margin Trading

- Important Considerations for Margin Investors

- Beyond Trading, Other Uses of “Margin”

- How to Manage Risk with Margin Trading

- The Pros And Cons of Margin Trading

- Strategies for Trading on the Margin

- Start slowly

- Practice with demo trading

- Don't keep positions open for too long

- Don't risk too much on each trade

- Set stop-loss and take profit levels

- Stay informed

- The Bottom Line

Top Facts Every Trader Must Know About Margin Trading

Margin trading is a fast-paced and exciting part of retail trading. In the financial landscapes of FOREX, cryptocurrencies, and other financial assets, margin trading has emerged as a potent tool for investors aiming to amplify their returns. However, with high potential comes high risk. It’s a balancing act for traders, as the promise of bigger gains comes with the potential for bigger losses.

In this article, I will explore margin trading, examining its risks and rewards, its mechanics, and how to utilize it in conjunction with sound investment strategies. I will also discuss which markets are best suited to margin trading. Like many investments, finding out if margin trading is for you will come down to how you feel about its pros and cons after conducting thorough research.

Margin trading lets you borrow funds from your broker to control larger positions using your existing capital as collateral

Leverage increases both profit potential and the size of possible losses which makes risk management essential.

If your account value drops below the broker’s maintenance requirement you will face a margin call requiring additional funds.

Margin trading is available across all asset classes

Successful traders typically limit risk to a small portion of their total capital per trade often no more than 1 to 2 percent.

Using margin effectively requires staying on top of market news economic reports central bank decisions and technical trends.

While margin offers opportunities like short selling or increased market exposure it also raises the risk of significant losses

Beginners must use demo accounts and follow a risk management plan before trading with margin.

What Is Margin?

Trading on margin involves borrowing money from a reputable broker to purchase financial assets. In essence, it's a loan from your broker that allows you to leverage your investment to potentially achieve larger returns. This is usually expressed as a ratio - for example, a 2:1 margin would mean that you can borrow twice as much money as you have in your account.

When trading on margin, you use your investment as collateral for the borrowed money. If the investment increases in value, you stand to gain more than if you had only invested your own money because you control a larger position. However, this comes with increased risk. If the investment decreases in value, you will lose more than if you had just used your own money.

Further, you still owe the borrowed amount to the broker, and you might need to deposit more money into your account to meet a margin call, which is when your broker asks for their loan back when you hit a pre-determined stop out level. Traders should know that interest is usually charged on the borrowed money, and the terms can vary from broker to broker. Additionally, not all securities can be purchased on margin (we will cover which ones later), and there are regulations that set minimum margin requirements.

Overall, while trading on margin has the potential to magnify profits, it also can amplify losses. You should only engage in it with a clear understanding of the risks and requirements involved.

What Does it Mean to Trade on Margin?

Trading on margin means you borrow from your broker to trade with more firepower than your cash alone allows. You start by depositing cash (or marginable securities) into a margin account. That deposit becomes the collateral for the loan. The broker lends the remainder, and you pay interest on the amount you borrow.

The practical effect is extra buying power. Your deposit, combined with the loan, allows you to hold a larger position than you would otherwise be able to. The securities you buy then automatically serve as further collateral for the loan, which is why brokers closely monitor your account value. If values fall, your equity shrinks, and you may face a margin call, where the broker can then liquidate positions to protect the loan.

Use margin deliberately. It amplifies returns, and it amplifies losses and interest drag. If the trade doesn’t beat the borrowing cost, you lose money faster than you might expect.

Which Assets Can You Trade on the Margin?

Margin trading is available for a wide variety of financial assets, and the specific types of assets available may depend on the brokerage or trading platform you are using. Here are some of the most commonly traded assets:

Stocks

Margin trading is most commonly associated with stock trading. Many brokerages allow their clients to borrow money to purchase more shares than they could with just their available cash.

FOREX

The FOREX market is another market where margin trading is actively used. Traders can take on prominent positions in currency pairs with a relatively small amount of capital, thanks to the use of leverage.

Cryptocurrencies

With the rise of digital assets, many cryptocurrency exchanges now offer margin trading. This enables traders to amplify their trading positions in cryptocurrencies such as Bitcoin, Ethereum, and others.

Futures contracts

Futures are contracts that obligate the buyer to buy or the seller to sell an asset at a specified price on a future date. Many futures contracts are traded on margin, meaning that traders only need to deposit a fraction of the total contract value to take a position.

Options

Options are derivatives based on the value of underlying securities, like stocks. Buying on margin is not typically done with options, but selling options can be done on margin as long as you have an approved margin account.

Exchange Traded Funds (ETF)

These are investment funds traded on stock exchanges, similar to individual stocks. Some brokerages allow margin trading for ETFs.

Bonds

While less common than stocks or FOREX, some brokerages do allow margin trading for bonds. The investor can borrow money to buy more bonds than they could afford outright.

Commodities

Just like futures, commodities such as oil, gold, and agricultural products can also be traded on margin.

For traders, it’s essential to understand the risks associated with margin trading in these various markets. While the potential for higher profits is alluring, there is also the risk of substantial losses, particularly given the volatility of specific markets, such as cryptocurrencies and commodities.

Margin Is Not a Free Lunch

You should know that margin trading is not a financial handout. Traders must repay the funds borrowed from the broker, and there may be regular interest payments and handling fees. As soon as you turn a profit, the broker's loan becomes due in full.

If you encounter losses early on, the broker can issue a “margin call,” seizing the collateral you put down when enrolling. The terms of the margin call also allow the exchange to assume ownership of any assets within your account.

Margin trading is a practice that requires active involvement. Many financial markets fluctuate constantly, making it doubly important to remain diligent and monitor your investments at all times.

How Margin and Margin Trading Work

Margin is the equity you actually own in your brokerage account. Buying on margin means you top up that equity with money borrowed from your broker, but you need a margin account to do it, not a plain cash account. In practice, the broker lets you buy more assets than your cash would allow by using the cash and securities already in your account as collateral.

Margin only helps when you expect the investment’s return to outpace the interest you’re paying on the loan. Otherwise, the interest drag can turn a winning trade into a losing one.

Here's an explanation of a trade I carried out myself:

I had $200 of my own cash in a margin account, and I used it to buy $1,000 worth of stock. That meant my total exposure was $1,000, even though only $200 of it was my own money. The broker lent me the remaining $800, which put me at 5× leverage, since $1,000 divided by $200 equals 5. I knew I’d be paying interest on the $800 I borrowed.

Once I was in the trade, the math became very clear. When the stock rose by 10%, the position value increased from $1,000 to $1,100. That gave me a gross profit of $100. Because that $100 gain was made on my $200 of equity, my return on equity was 50%.

But the leverage worked both ways. When the stock fell by 10%, the position value dropped to $900, leaving me with a $100 loss. That loss was still measured against my $200 equity, which meant I was down 50% on my capital.

I also had to factor in interest. The broker charged 6% per year on the $800 loan, which came to $48 annually. If I held the position for a full year and the stock rose 10%, my net profit after interest was only $52. That worked out to a 26% return on my $200 equity. If the stock hadn’t moved at all, I still would have paid the $48 in interest, which amounted to a 24% drag on my capital just for holding the leveraged position.

Takeaway: margin multiplies upside and downside. With $200 of equity and $1,000 exposure, a modest price swing produces big percentage moves on your cash, and interest drags that compound the risk over time.Keep that equation front of mind: margin magnifies returns, and it magnifies pain.

Practical Considerations When Trading on Margin

Traders must be aware of the unique set of practical considerations involved in margin trading. The following are some of the key factors:

Initial margin requirement

This is the percentage of the total trade value that the broker requires as a deposit to initiate a margin trade. This requirement varies between brokers and can range from 10% to 50% or more. For example, if you want to buy $1,000 worth of Tesla stock, and the initial margin requirement is 30%, you would need to deposit $300 into your margin account.

Maintenance margin requirement

This is the minimum account balance that you must maintain after the trade has been initiated. If the account value drops below this level due to losses, the broker may issue a margin call, requiring you to provide additional funds to maintain the margin. The exact maintenance margin requirement will depend on the broker, but it typically ranges from 25% to 30% of the total trade value.

Margin calls

As I've mentioned, if your investment dips below the maintenance margin, your broker will issue a margin call requiring you to deposit additional funds to meet the minimum balance. If you can’t meet the margin call, the broker may liquidate your position to cover the shortfall.

Interest rates

When you borrow funds from your broker, you'll have to pay interest on the borrowed amount. These rates can vary widely from broker to broker, so it's essential to understand these costs before opening a margin account.

Leverage

Leverage is the ability to control large amounts of a security or contract value with a comparatively small amount of capital. However, while higher leverage can magnify potential profits, it also amplifies potential losses. Leverage can be tightly controlled in certain markets. In Europe, you typically cannot get leverage of more than 30:1.

Market volatility

Given the highly volatile nature of many financial markets, particularly the FOREX and crypto markets, you must be prepared for constant fluctuations in your account value.

Risk of loss

Margin trading can lead to losses that exceed your initial investment. If a trade goes against you, you're still responsible for repaying the loan.

Broker's terms and conditions

Each broker has its own set of rules and regulations around margin trading. Traders should familiarize themselves with these to avoid surprises.

You should strive to have a thorough understanding of the associated costs and risks before engaging in margin trading. Having a good risk management strategy and sticking to it is one way to ensure you don’t fall victim to irresponsible margin trading.

Step-by-Step Guide to Buying on Margin

Buying on margin is simple in idea and real in consequences: you borrow from your broker to buy a bigger position. Below are the concrete steps you should follow, along with a worked example to illustrate the math.

Open and approve a margin account. Contact your broker, complete the margin account application, and read the margin agreement. The agreement outlines initial margin rules, maintenance thresholds, and the interest rate you’ll pay.

Fund the account. Deposit cash or marginable securities. These assets act as collateral for the loan.

Check the broker’s margin rules. Confirm the broker’s initial margin requirement (common in many jurisdictions: 50% or 0.50) and the maintenance margin (often 25% or higher). Also note the broker’s margin interest rate and how it usually accrues.

Calculate buying power. Use this formula:Maximum purchase = deposit ÷ initial margin requirement.Example: deposit = $5,000; initial margin requirement = 0.50.Step by step: 5,000 ÷ 0.50 = 10,000.You can buy up to $10,000 of securities because the borrowed amount is $5,000, which is $10,000 minus the $5,000 margin requirement.

Place the margin order. When you submit the buy order, select margin financing (if your platform offers this option). The broker executes the trade and records the loan.

Monitor the maintenance margin continuously. If market value falls, your equity falls and may trigger a margin call. Example: you bought $10,000 of stock financed with a $5,000 loan. If the market value drops to $7,000, then the equity is calculated as follows: Equity = market value − loan, which is $ 7,000 − $ 5,000 = $2,000.Equity percentage = 2,000 ÷ 7,000, which is 2/7 = 0.285714… therefore 28.57% (above a 25% maintenance threshold).If the market value falls to $6,000, then the equity is $6,000 − $5,000 = $1,000.Equity percentage = 1,000 ÷ 6,000 = 1/6 = 0.166666… therefore 16.67% (below 25% - margin call).

Respond to margin calls promptly. The broker may require you to deposit cash or sell positions. If you do nothing, please be aware that the broker can liquidate your holdings, and they may do so without your approval.

Manage interest and repayment. Interest accrues on the borrowed $5,000. Selling securities typically repays the loan first and returns any leftover equity to you. You should always factor interest into your expected return. Why? Because margin only helps if your investment return exceeds the interest and fees.

Use risk controls. Set stop losses, size positions so a single trade doesn’t jeopardize your portfolio (as we always say, risk no more than 1–2% of total capital), and prefer short holding periods to limit interest drag.

Follow these steps exactly, run the simple arithmetic before you trade, and keep an eye on maintenance ratios and interest costs. That discipline keeps margin a tool, not a trap.

Real-world Worked Example

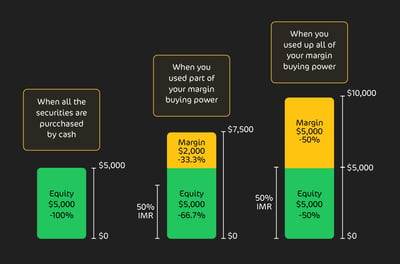

Look at the following graphic. If you put $5,000 into a margin account and your broker’s initial margin is 50%, your buying power is $10,000 (shown on the far right), because the broker will loan you up to the other half. If you buy $5,000 of stock, you still have $5,000 of purchasing power left.

You haven’t borrowed anything yet because your own $5,000 still covers the purchases. You only start using margin when your total purchases exceed your cash deposit. For example, buying $7,500 of stock would mean $2,500 (33% of your buying power as shown in the middle of the graphic) is financed by the broker.

One practical note: buying power isn’t fixed. It changes every trading day as the market value of your marginable securities moves, so check it before you place trades and keep a buffer to avoid accidental margin calls.

Key Elements of Margin Trading

Here are some essential elements to always remember about margin trading:

Minimum margin

Regulators and brokers insist that you sign a margin agreement before you can borrow. In practice, this typically involves opening a margin account (either as part of your primary account or as a separate agreement) and meeting the broker’s minimum deposit requirements. In many markets, the commonly quoted regulatory floor is $2,000, but many brokers set higher thresholds.

Initial margin

Initial margin is the portion of a purchase that you must fund yourself before the broker lends the remaining amount. A typical rule is 50%: put up $5,000 and you can buy $10,000 of stock; borrow $5,000 from the broker. You don’t have to borrow the maximum; you can use 10%, 25% or any level your broker allows, as we’ve shown. Remember: the loan accrues interest and remains on the account until it is repaid. When you sell, the proceeds are first used to pay off the loan.

Maintenance margin and margin call

The maintenance margin is the safety line you must keep above in your account; if you fall below it, your broker issues a margin call, a demand to top up your cash or sell holdings. If you ignore the call, the broker can liquidate your positions (and select which ones) without your consent. That can trigger commissions, tax events and real losses; you’re liable for any shortfall and for fees.

It’s always a good idea to determine your broker’s maintenance threshold, maintain a comfortable buffer above it, set price alerts, and be prepared to add cash quickly. Margin amplifies returns, but it also amplifies the speed at which your account can be wiped out.

Important Considerations for Margin Investors

I would always remind new traders that borrowing on margin costs you real money and requires your securities to be used as collateral. The headline cost is interest, which accrues on the loan and compounds until it is paid down. That means your debt can snowball. Higher principal leads to higher interest, which in turn raises the principal again if unpaid, so the margin is best treated as a short-term tool, not a buy-and-hold strategy. The longer you sit in a margin position, the bigger the return you need just to break even after interest and fees.

Always do the math before you borrow. Your target return must exceed the margin interest plus any trading costs. If it doesn’t, you are borrowing unnecessary risk. Also bear in mind that not every security is marginable and not every platform offers margin across all products. Brokers and exchanges set their own rules, and some assets, such as penny stocks, many IPOs, and a lot of crypto listings, are commonly blocked from margin trading because of extreme day-to-day volatility.

Beyond Trading, Other Uses of “Margin”

Since I am hoping that you walk away from reading this article with a complete appreciation of margin, here are other areas where this standard term shows up:

Accounting margin

In business accounting, margin is simply the gap between what a company sells and what it costs to run the business. Firms typically watch three margins closely because each tells a different story about profitability.

Gross margin looks at revenue minus cost of goods sold, expressed as a percentage, (Revenue − COGS) ÷ Revenue, and shows how efficiently a company turns inputs into product. Operating margin then folds in operating expenses (selling, general & admin, R&D): Operating income ÷ Revenue, which tells you how well the core business converts sales into operating profit. Net margin is the bottom-line figure, Net income ÷ Revenue, after interest, taxes and one-offs, and it shows what shareholders actually retain from every dollar of sales. Read them together and you get a clean, layered view of where profits are made and where pressure might be hiding.

Margin in mortgage lending

An adjustable-rate mortgage (ARM) gives you a fixed interest rate for a set introductory period, then lets the rate move afterwards. Lenders don’t guess the new number. They add a fixed spread (the margin) to a published index (the part that moves). The margin typically remains the same for the life of the loan; the index is what fluctuates in value.

Put simply: new rate = index + margin. So with a 4% margin on a loan tied to a 6% Treasury index, your rate becomes 6% + 4% = 10%. That’s why the index matters: if it falls, your rate falls; if it climbs, your rate rises.

Before you sign, check which index your ARM uses, how often it resets, and any caps on rate changes; those details determine how volatile your payments can be.

How to Manage Risk with Margin Trading

As attractive as making large profits seems, you could just as easily suffer heavy losses. This is a common occurrence in the trading world. However, there are ways to be smart about the risks you take. Here are some ways to manage your risk:

Have a trading plan

A well-structured plan brings consistency to your trading activities and lays the groundwork for scaling up to profitable trading in a sustainable manner. An effective trading plan should include a detailed strategy for entering and exiting positions. Be sure to watch out for crucial aspects, such as entry and exit indicators, position sizing, and stop-loss placements.

From my experience, I cannot overemphasize the merits of sticking to a trading plan. If you do it right, trading can become less of a gamble and more of a calculated manoeuver, aided by rational and controlled decision-making. Losses are an inevitable part of your trading journey, but how you recover from them is key. Will you abandon your carefully crafted plans when the going gets tough?

Stop-loss orders

As I've mentioned, effective risk management is a crucial component of responsible trading. A vital part of this is the stop-loss order, a safeguard mechanism that caps losses by setting a predetermined price at which your position is sold.

Imagine you buy a Bitcoin futures contract at $500. To minimize losses, you can set a stop-loss order at 20% below your purchase price, say $400. If Bitcoin takes a dive and dips below $400, the stop-loss order is triggered. The broker offloads your contract. It's essential to note that, although your trigger point for exit is $400, the actual execution price may be lower due to market volatility. Regardless, you're ensuring that your losses are limited and controlled.

A stop-loss order acts as a self-imposed speed bump, slowing your journey toward a certain level of loss. The best part of it is that you can set it and forget it without having to be constantly vigilant.

Don’t risk more than you can lose.

Never gamble with funds you can't afford to lose. When it comes to investing, savvy investors only trade with funds they may never see again. Navigating volatile markets like FOREX and crypto is like walking a financial tightrope. You can lose your balance quickly, so it’s essential to set aside funds you are comfortable with potentially losing.

Remember this: trading should never endanger your financial well-being. Keep your trading capital separate from your essential funds. This will ensure that you can weather inevitable losses when they arise.

Take profit when you can

When good planning and fortune smile upon you, it's wise to pocket your winnings. The opposite of a stop-loss is a take-profit order, which allows you to automate the point at which you take a profit from winning trades. You can configure your account to take profit at a pre-determined level. This allows you to take profit and reduces the chances of you making an emotional decision to ride out a trade, which could turn against you. By setting a take-profit order, you're proactively managing your trading journey, ensuring that profitable moments don't slip through your fingers due to rapid market movements.

Recommended Brokers

The Pros And Cons of Margin Trading

Margin trading, while offering lucrative opportunities for traders, comes with its own set of risks and challenges. It's important to understand the pros and cons before embarking on this journey.

Pros of margin trading:

Leverage your capital. Margin lets you control a bigger position than your cash would allow, more exposure, bigger potential upside.

Seize more opportunities. With extra buying power, you can act on timely ideas you’d otherwise miss.

Flex both ways. Margin supports longs and shorts, so you can profit from rises and falls (shorting prominent names is a standard tactical play).

Diversify without new cash. Extra capital makes it easier to spread risk across positions, rather than concentrating your money in a single bet.

Amplified gains (and follow-on leverage). If your collateral increases, your usable leverage can expand, allowing you to scale winning trades.

Operational flexibility. Margin loans are typically open-ended until you close positions; there’s often no fixed repayment schedule like a term loan.

Efficient capital use. You use existing assets as collateral rather than tying up new capital, which can improve portfolio turnover and responsiveness.

Cons of margin trading:

Losses are magnified. Leverage doesn’t care which way the market moves, a small adverse swing can wipe out your equity far faster than in a cash account.

Margin calls force action. If your equity falls below the maintenance threshold, the broker will require additional cash or collateral, and you should have that spare capital on hand.

Brokers can liquidate without consent. If you ignore a margin call or can’t top up, the broker may sell positions for you, choosing which holdings to close and potentially crystallizing losses.

Interest stacks up. Margin is a loan. Interest accrues whether you win or lose, so the longer you hold, the higher the return required just to break even.

You can owe more than you put in. Rapid falls can leave you short of covering the loan; you’re liable for any deficit plus fees and commissions.

Volatility and liquidity risk bite hardest. In fast, illiquid moves (such as crypto crashes or thinly traded small caps), forced selling can accelerate losses and worsen fill prices.

Costs, tax events and operational headaches. Liquidations can trigger commissions and taxable events, and broker rules, notifications and timings can work against you.

Strategies for Trading on the Margin

Margin trading presents exciting opportunities, but it's a high-stakes game that requires careful planning and execution. Here are some effective strategies to keep in mind when trading on margin:

Start slowly

Margin trading isn't a sprint. Start with a modest, manageable level of leverage, especially if you're new to margin trading. As you gain experience, you can gradually increase your margin.

Practice with demo trading

Many trading platforms offer demo or paper-trading accounts, where you can practice trading with virtual money. This risk-free environment is an excellent way to familiarize yourself with margin trading and to test and refine your trading strategies.

Don't keep positions open for too long

I can attest from my own trading career, the longer you keep a margin trade open, the more interest you'll accrue on the borrowed money. Be mindful of interest charges and consider closing positions within a short- to medium-term timeframe. You should always be aware of any additional broker fees and charges and treat them as part of your overall trading costs.

Don't risk too much on each trade

A cardinal rule in trading is never to risk more than you can afford to lose. Set a limit to the percentage of your total trading capital that you're willing to risk on each trade. Most seasoned traders will tell you not to risk more than 1-2% of your capital on any single trade.

Set stop-loss and take profit levels

As I've said, to manage risk effectively, make sure to set stop losses and take profit levels for every trade. This will automatically limit your losses and secure your profits.

Stay informed

Keep up to date with market news and updates. Financial markets are significantly influenced by economic indicators, geopolitical events, and even market rumors. Staying informed will help you make more educated trading decisions by staying abreast of the news and using technical analysis.

The Bottom Line

I remain of the view that margin trading is a very exciting space. Financial markets like FOREX, stocks, and cryptocurrencies are highly dynamic. They feature daily and even hourly swings and counter swings. It can be exhilarating to go on a string of wins, but remember that trading on margin can lead to devastating losses.

Trading markets can be intimidating for new traders, but with a focus on self-education and research, anyone can learn how to navigate them. Money management and discipline are going to be keystone traits if you are to thrive in this area.

FAQ

Margin trading is a method of trading assets using funds provided by your broker. It allows you to open larger positions than you could with your own capital alone, potentially amplifying profits, but also increasing the potential for losses.

Margin trading involves borrowing funds from a broker to purchase more assets than you could with just your own money. The assets you buy are, in effect, collateral for the loan. If the assets increase in value, you repay the loan and keep the profit. If the assets decrease in value, you'll need to repay the loan and could face a margin call, which may force you to deposit additional funds.

Leverage is the ratio of the trader's funds to the size of the broker's loan. It's expressed as a ratio, such as 2:1 or 10:1, indicating the amount a trader can borrow for every dollar they have in their account. In this equation, the borrowed amount is expressed first, and the trader’s capital is expressed second, i.e., 2:1.

A margin call comes about when the value of the trader's account falls below a certain level. This level is known as the maintenance margin. The broker will demand that the trader deposit more funds to cover potential losses.

Margin trading can provide higher potential returns due to the larger amount of capital at play. It also allows traders to open short positions and to diversify their portfolio more broadly as part of their risk management strategy.

The risks of margin trading include the potential for larger losses, the possibility of a margin call, and the burden of interest on the borrowed funds. Traders could also face the risk of having their positions unilaterally closed by the broker if a severe market downturn occurs.

Margin trading is most suited for experienced traders who have a high risk tolerance and a deep understanding of the market. Whilst it is not generally recommended for beginners, many newbies cannot resist its attraction. In this case, traders must work carefully to a well-structured plan.

Yes, many trading platforms offer demo accounts where you can practice trading with virtual money. This creates a risk-free environment where you can learn about margin trading and test your strategies.