Table Of Contents

- What Is Leverage Trading?

- How Does Leverage Trading Work in Practice?

- What is The Relationship Between Leverage and Margin?

- What are the Benefits of Using Leverage?

- What are the Risks of Using Leverage?

- What are Leverage Ratios?

- How to Calculate Leverage?

- Leverage in Different Markets

- What is The Relationship Between Leverage and Risk Management?

- What are Some Common Mistakes Traders Make with Leverage?

- Is Leverage Halal or Haram?

- How do Leverage Tools Work?

- The Bottom Line

What is Leverage in Trading?

I believe that most traders will have heard of the term leverage. It is a widely used word that applies to industries as varied as accounting and management consulting. It is also a term widely employed in financial circles and the online trading world. In my view, the definition is simple – leverage is any type of trading that involves borrowing your broker’s money to trade more assets than you could afford with your own money.

Leverage is typically expressed as a ratio, such as 10:1, 50:1, or even 100:1, indicating how much capital a trader can control relative to their own investment. While leverage magnifies potential profits, it also significantly increases risk, as losses can exceed the initial deposit if trades move in the wrong direction. Different markets and brokers have varying leverage limits, with FOREX often offering the highest levels due to its liquidity. Responsible traders manage leverage carefully by using stop-loss orders, position sizing, and risk management strategies to avoid excessive exposure and protect their capital. I've written this short article to explain what leverage is and how to use it effectively.

Leverage lets you borrow your broker’s money to trade positions much larger than your own capital allows

It is typically expressed as a ratio like 10:1, 50:1 or 100:1, depending on the broker and asset class

While leverage can significantly amplify profits, it also magnifies losses and can exceed your initial deposit

FOREX often offers the highest leverage levels due to its liquidity, while other markets may cap ratios at lower levels.

Responsible traders limit leverage use by applying stop‑loss orders, position sizing and broader risk-management tools

Margin acts as the collateral for leveraged trades, and brokers can issue margin calls or stop‑outs if losses accumulate

Leverage is ideal for fast-paced strategies like scalping, allowing traders to amplify small market moves

Traders using lower-frequency strategies like swing or position trading may require less leverage to capture larger moves

What Is Leverage Trading?

As I've mentioned, leverage is the facility by which you can use the broker’s money to buy assets whose value is much higher than what you can afford on your own. Typically, leverage works closely with margin, when the broker asks you to put up some of your own money as collateral. After all, the broker’s money is being used to enter a risky financial transaction, and the broker must protect its interests by ensuring that if you lose, as happens very often with new traders, it can recover some of the loss.

With leverage, you only put down a percentage of the capital in your account, with the broker topping it up with funds of its own. Leverage trading becomes more attractive depending on the type of trader you are. If you are a scalper, a trader who enters hundreds of trades per day to make small profits from selling stocks, cryptos, or FOREX, then leverage is exactly what you need to amplify your trading efforts.

Take scalping cryptos, for example. Scalpers must find the optimal balance between the length of their exposure and the leverage they employ. Some scalpers trade in intervals as brief as 1 minute to take advantage of the high volatility in the crypto market. As you can imagine, not much profit can be generated from a one-minute trade, but with leverage as high as 200:1, earnings can be multiplied several times over.

By contrast, if you are a trader who works with much slower forms of trading, such as swing trading, you are investing more funds with each trader and are going for a larger swing (profit) over a longer period, meaning that you do not need leverage quite as much as do your scalping counterparts.

Leverage across asset classes

In my experience, leverage is not a one-size-fits-all concept. It varies quite a lot depending on the market you’re trading.

FOREX market: Leverage is typically high, often ranging from 50:1 to 500:1, depending on the broker and jurisdiction. That means FOREX traders can control very large positions with relatively small deposits, which explains both the popularity and the danger of this market.

Stock trading: Leverage is far more restricted. In most developed markets, equities are capped at around 2:1 under margin trading rules, reflecting the higher volatility and regulatory caution around retail speculation in shares.

Commodities like oil or gold: These usually fall somewhere in between, with leverage typically offered at 10:1 to 20:1.

Cryptocurrency: These markets are the wild card; some offshore brokers and exchanges offer leverage as high as 100:1 or 500:1 in unregulated markets, while regulated jurisdictions impose stricter limits to protect retail traders from wipeouts.

Regulators worldwide take very different approaches to leverage. In Europe, the European Securities and Markets Authority (ESMA) restricts retail FOREX traders to a maximum of 30:1. In Australia, the Australian Securities and Investments Commission (ASIC) has similar rules, capping leverage at 30:1 for major FOREX pairs and 20:1 for minors and commodities.

The US National Futures Association (NFA) and CFTC impose even stricter conditions: maximum 50:1 leverage on major FOREX pairs and 20:1 on minors. Meanwhile, brokers operating in loosely regulated markets can offer 500:1 or higher, but this comes with additional counterparty and regulatory risk.

How Does Leverage Trading Work in Practice?

Leverage works hand in hand with margin, as I've said. Margin is simply collateral that your broker can call in through a stop-out when it sees you are making heavy losses. Different brokers ask for different amounts of margin. Some can ask you to put up 50% of any amount you want them to match. Other brokers in less well-regulated regions can ask you to put up only a small percentage of the amount they will loan you, but in that case, they rarely offer you negative-balance protection, meaning you could trade on leverage until your account goes into the negative.

Worked example

Let me illustrate how leverage works. Perhaps you want to invest $100 in a stock you think is performing well and has a high upside. You are expecting an earnings report for the stock to be released in a matter of days, and you are certain the report will show positive growth, which will drive the share price higher. Your $100 investment is a small amount, but that is all you can afford, even though the broker topped up your initial funds with additional margin.

You are so sure of your strategy that you feel comfortable leveraging your trade by 20:1, meaning you have $2,000 worth of stock. The earnings report is released, and your predictions come true. The share price climbs 5%. This means you have earned $100 if you choose to exit the trade at that point by selling the stock. Without leverage, you would only have made $5, which seems hardly worth the trouble. You can see how leverage helps traders like you. Note that this example does not account for fees.

What is The Relationship Between Leverage and Margin?

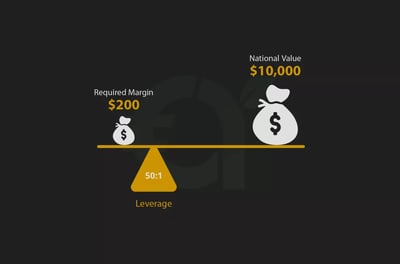

Leverage and margin are two sides of the same coin. Leverage is the ratio that tells you how much exposure you can control with a given amount of capital. Margin is the actual amount of money you must set aside as collateral to open and maintain that leveraged position. The higher the leverage offered by a broker, the lower the margin required from you.

What is margin?

Margin is not a fee. It’s a security deposit your broker locks up to keep your trade open. Think of it as “skin in the game.” By setting aside this small portion, your broker allows you to borrow the rest and gain much larger market exposure.

What is the margin requirement?

Brokers set margin requirements as percentages, commonly 2%, 5%, or 10% of the total trade size. This percentage determines the maximum leverage available:

A 2% margin requirement = 50:1 leverage

A 5% margin requirement = 20:1 leverage

A 10% margin requirement = 10:1 leverage

So, if you want to open a $100,000 FOREX position and your broker requires a 2% margin, you’ll need to deposit $2,000. The broker effectively lends you the remaining $98,000 exposure.

What are Margin calls and stop-outs?

Margin call: This occurs when your equity (account balance plus open P/L) falls below the broker’s required maintenance margin. The broker warns you to either add funds or close positions.

Stop-out: If losses continue and equity drops even further, the broker will automatically start closing your positions to prevent your account from going negative.

Real-world example of margin call

Suppose you have $1,000 in your account and open a $50,000 trade with 50:1 leverage. The broker requires $1,000 margin for that trade. If the trade goes against you by just 200 pips (worth $1,000 in losses at that size), your equity falls to zero. Long before that point, say when equity drops to $400, the broker will trigger a margin call. If you don’t act, the stop-out level (often 50% of margin, so $500) will force the broker to close your trade.

This chain reaction shows why margin and leverage must always be managed with caution. They allow you to multiply returns but also accelerate losses at lightning speed.

What are the Benefits of Using Leverage?

What’s the big deal with leverage? Why do traders use it so much? Here is what I've learned in my career:

Much bigger profit potential

Leverage gives retail traders a powerful way to amplify market opportunities. By allowing you to control a much larger position with relatively little capital, it creates the possibility of far bigger profits than with unleveraged trading. For example, with $1,000 and 100:1 leverage, you can open a $100,000 position, meaning even a small price movement can result in meaningful gains.

Market access

Another advantage is market access. Without leverage, trading expensive assets like global indices, gold, or oil would be out of reach for many individuals. Leverage effectively lowers the entry barrier, letting traders participate in markets previously reserved for institutional players with large capital bases.

Efficient use of capital

Finally, leverage enables efficient use of capital. Instead of locking up all your funds in a single position, you can spread your capital across multiple trades. That means you can diversify, holding positions in FOREX, commodities, and indices at the same time, while still keeping enough margin available to manage risks or take advantage of new opportunities as they arise.

What are the Risks of Using Leverage?

I would caution that although leverage is a powerful tool, it comes with risks.

Amplified losses

The biggest danger of leverage is that it magnifies losses just as quickly as it magnifies profits. A move of just 1% against you on a $100,000 leveraged trade, funded by $1,000 of your own money at 100:1 leverage, would obliterate your entire capital. This means that traders can be wiped out by relatively small market fluctuations that would be harmless if positions were unleveraged.

Volatility risk

Volatility risk is another factor. Currency pairs, commodities, and even indices can swing dramatically within minutes. A sudden price move of 50 pips may not seem large, but under high leverage, it can completely deplete your margin and trigger automatic liquidation of your position. This is why margin calls and stop-outs exist: they protect the broker but often leave traders with heavy losses.

Emotional pressure

On top of the financial risk, there is the psychological strain. Trading with borrowed money adds emotional pressure that can lead to poor decision-making. Fear of losing and the temptation to chase losses can make traders abandon their strategy and overtrade. Emotional discipline is difficult enough in trading, but leverage can amplify stress to dangerous levels.

What are Leverage Ratios?

The leverage ratio simply tells you how much larger your position is compared to the capital you put down. Think of it as a multiplier. For example, with a 10:1 ratio, every $1 of your own money controls $10 in the market. At 100:1, your $1 controls $100 worth of assets. Some brokers go as high as 500:1 or even 1000:1, meaning very small deposits can open massive positions.

Here are some examples: with $1,000 in trading capital, here’s how different leverage levels amplify exposure and potential outcomes:

At 10:1 leverage, you control $10,000 in the market. A 1% move equals $100 profit or loss.

At 50:1 leverage, exposure grows to $50,000, and a 1% move swings $500.

At 100:1 leverage, you’re managing $100,000, meaning $1,000 profit or loss per 1% move.

At 500:1 leverage, that same $1,000 controls $500,000, so a 1% move means $5,000 up or down.

Regional restrictions

As I’ve said, different regions impose different restrictions on how much leverage retail traders can access. Understanding leverage ratios is key because they dictate both your profit potential and your exposure to risk. A higher ratio offers more firepower but also raises the chances of losing your entire capital on small market moves. That’s why regulators in advanced markets prefer conservative caps, while traders seeking higher risk often turn to offshore accounts.

How to Calculate Leverage?

At its simplest, leverage is calculated with the formula:

Leverage = Position Size ÷ Equity

This shows how much larger your market exposure is compared to the money you actually have in your account.

Worked examples

Leverage looks a little different when applied to different asset types:

FOREX example (lot sizes): Suppose you have $1,000 in equity and open a 1 standard lot position in EUR/USD (worth $100,000). Your leverage is $100,000 ÷ $1,000 = 100:1.If you instead opened a 0.1 lot trade (worth $10,000), leverage falls to 10:1.

Stock CFD example: If you buy $20,000 worth of Tesla CFDs with $2,000 in your account, the leverage used is $20,000 ÷ $2,000 = 10:1.

These calculations matter because they show how leverage dynamically shifts depending on your trade size relative to your available capital. The same trader might use different levels of leverage depending on the instrument and position size, even within the same account.

Leverage in Different Markets

Here are a few more things you need to keep in mind as you try leverage in different financial assets:

FOREXLeverage is most common in FOREX, where retail traders often access ratios as high as 500:1 at the top end. This is because currency markets move in small increments (pips), so amplification is necessary to make trades meaningful.

StocksIn equity markets, leverage is far more conservative. Retail brokers often allow 2:1 to 5:1 on stock CFDs, while traditional margin accounts might cap it at 50% loan-to-value. Because stocks can gap sharply overnight, regulators are stricter, and traders must maintain margin levels to avoid forced liquidations.

Commodities and IndicesCommodities and indices typically fall in the middle ground. Brokers may offer leverage from 10:1 up to 50:1 depending on the instrument and jurisdiction. Oil, gold, and index futures are popular leveraged plays, but price volatility means risk is magnified. For example, a 1% move in gold could translate into a 20% swing in equity if trading with 20:1 leverage.

CryptocurrencyLeverage in crypto is the most extreme. Some exchanges allow up to 125:1. While this attracts traders chasing quick profits, it also means accounts can be liquidated in seconds if the market swings against them. Regulators are now stepping in. Many regions are limiting crypto leverage to protect retail traders from catastrophic losses.

What is The Relationship Between Leverage and Risk Management?

Leverage magnifies both opportunity and risk, which makes risk management non-negotiable. The same tool that allows you to control large positions with small capital can wipe out an account in minutes if trades aren’t managed with discipline.

Setting stops in a leveraged tradeStop-loss orders are essential in leveraged trading because they define the maximum loss you are willing to take. Without them, even a minor market swing can cause disproportionate damage to your equity. A trader using 100:1 leverage, for example, can lose their entire margin on a 1% market move if no stop is in place.

Position sizingCorrect position sizing ensures that leverage does not overwhelm your capital. The formula is simple:

Position Size = Risk Per Trade / Pip Value × Stop Distance

For example, if you decide to risk $100 on a trade, with a pip value of $10 and a stop set 20 pips away, your maximum position size should be 0.5 lots. This keeps your exposure aligned with your risk tolerance.

Practical tips

Never risk more than 1–2% of your account balance on a single trade.

Use lower leverage until you have mastered consistency. High leverage ratios may be tempting but often lead to reckless overtrading.

Combine stop-losses with take-profit targets, so you trade with defined boundaries rather than emotions.

What are Some Common Mistakes Traders Make with Leverage?

In my view, leverage is often where new traders trip up, not because it is inherently bad, but because it is poorly understood and misapplied. Some of the most frequent mistakes include:

Misunderstanding margin vs free marginMany beginners confuse the margin they’ve committed to a trade with the “free margin” they still have available. This often leads to overconfidence, as they believe they have more room to maneuver than they actually do. When the market moves against them, they quickly face margin calls.

Trading too large a positionThe temptation to control massive positions with small deposits is strong, but it is also the fastest way to wipe out an account. Overleveraging means even minor price movements can erase weeks of gains in minutes.

Ignoring volatilityMarkets don’t move in straight lines. Volatility, especially in FOREX and crypto, can cause sudden spikes that trigger stops or liquidate positions. Traders who don’t account for volatility when sizing their trades or setting stop losses end up losing not because their idea was wrong, but because they didn’t give their trade room to breathe.

Emotional decision-makingLeverage magnifies emotions just as much as profits and losses. Fear of missing out (FOMO) and panic selling are amplified when borrowed funds are at stake. Many traders abandon their strategy in the heat of the moment, which turns leverage into a weapon against their own discipline.

Is Leverage Halal or Haram?

In Islamic finance, the question of leverage is complex because it touches on several Sharia principles. At its core, leverage involves borrowing funds to control larger positions, and borrowing almost always raises the issue of riba (interest), which is prohibited. Conventional trading accounts often apply swap or rollover fees when positions are held overnight, making them haram for Muslim traders.

To address this, many brokers offer Islamic or “swap-free” accounts, which eliminate overnight interest charges and instead apply alternative fee structures compliant with Sharia law. Even so, scholars stress that leverage itself introduces another concern: excessive risk-taking (gharar). If leverage magnifies exposure to the point where a trader is essentially gambling rather than engaging in informed risk-sharing, the practice veers into haram territory.

The general guidance is that Islamic trading is permissible if structured responsibly: no overnight swaps, no speculative gambling, and risk shared fairly between broker and trader. For devout traders, choosing a broker that offers Sharia-compliant accounts is essential to ensure their leveraged trades remain within the bounds of halal finance.

How do Leverage Tools Work?

Because leverage can be confusing, most brokers provide tools to help traders calculate their exposure before placing an order. A leverage calculator allows you to input your capital, trade size, and leverage ratio to see exactly how much market exposure you are controlling. This helps traders avoid unintentional overexposure when opening a position.

A margin calculator works slightly differently: it tells you the exact margin requirement for a trade based on the asset, lot size, and leverage chosen. For example, a 2% margin requirement on a $100,000 position means you must set aside $2,000 of your equity as collateral, leaving the rest as free margin. This visibility is critical for preventing margin calls.

Beyond these, professional traders often rely on risk management software that combines leverage and margin data with stop-loss placement and position sizing formulas. These tools ensure that every trade is sized consistently with the trader’s risk appetite, whether that’s 1% or 2% of account equity per trade. By integrating calculators and software, traders gain control over leverage rather than letting leverage control them.

Example: Using leverage tools

Here’s a step-by-step worked example showing how all these concepts come together. Let’s use a small account ($1,000) and apply 50:1 leverage to see exactly how the numbers flow through a leverage calculator, a margin calculator, and then into risk management.

Step 1: Input your account balanceYou start with $1,000 equity in your trading account.

Step 2: Choose leverage ratioYou select 50:1 leverage, which means you can control positions worth up to $50,000.

Step 3: Select trade size (position size)Let’s say you want to trade 1 standard lot of EUR/USD (100,000 units).

Step 4: Use a margin calculatorThe broker requires a 2% margin for EUR/USD at this leverage.

Required margin = Position size × Margin requirement

$100,000 × 0.02 = $2,000

Because your account only has $1,000, the calculator will show that you cannot open 1 standard lot.

Step 5: Adjust the trade sizeYou reduce to 0.5 lots (50,000 units).

Required margin = 50,000 × 0.02 = $1,000

Now your position is possible, but it uses up all your equity as margin, leaving no free margin for losses.

Step 6: Use a leverage calculatorIt shows your actual leverage being used:

Position size ÷ Equity = 50,000 ÷ 1,000 = 50:1 (maximum available).

Step 7: Factor in pip valueOn EUR/USD, 1 pip = $10 per standard lot. For 0.5 lots, 1 pip = $5.If the price moves against you by 20 pips, you lose $100, which is 10% of your account.

Step 8: Apply risk management softwareIf you want to risk only 2% per trade ($20), you would set a stop-loss at 4 pips for 0.5 lots. Clearly unrealistic. A calculator would tell you to reduce size further, maybe to 0.1 lots (10,000 units), where 1 pip = $1. Then a 20-pip stop means risking $20 = exactly 2%.

Recommended Brokers

The Bottom Line

In my experience, leverage is an excellent way to grow your profits. However, it is a risky exercise that carries the risk of losing big if you do not use leverage with discretion. You should always test your trading strategies on a demo account first to see how you would have performed in the real world.

Leverage can be a powerful tool in retail trading, amplifying both gains and losses. Used wisely, it allows traders to maximize opportunities with limited capital, but reckless use can wipe out an account in moments. Understanding leverage ratios, managing risk, and setting stop-loss orders are crucial to staying in the game. Remember, it’s not just about how much you can borrow—it’s about how well you control it!

FAQ

Leverage allows a trader to control a larger position than the capital they deposit. For example, with 100:1 leverage, $1,000 can control $100,000 in the market.

Not necessarily. While higher leverage magnifies profit potential, it also increases the risk of large losses. Many professional traders use modest leverage (10:1 or less) to preserve capital.

Leverage is the ratio of borrowed funds to your own capital, while margin is the collateral your broker requires to open a leveraged trade. They are two sides of the same concept.

A margin call occurs when your account equity falls below the broker’s maintenance requirement. If you don’t add funds or close positions, the broker may liquidate trades to protect against further losses.

Regulation sets limits: in the EU, FOREX leverage for retail traders is capped at 30:1, in the US it is 50:1, while offshore brokers may allow up to 500:1 or even 1000:1.

Yes, but limits vary. FOREX offers the highest leverage, stocks are much more restricted (often 2: to 5:1), commodities and indices range from 10:1 to 50:1, while some crypto exchanges allow up to 100:1.

Always use stop-loss orders, size positions according to your account balance, and avoid risking more than 1–2% of equity on a single trade. Risk management is what makes leverage sustainable.

Conventional leveraged accounts with swaps (interest) are considered haram. However, some brokers offer Islamic, swap-free accounts that comply with Sharia law. Still, excessive risk-taking (gharar) must also be avoided.