XTB Review 2026

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

XTB Evaluate - research result

Key Takeaways

Founded in 2002 as Poland's first-ever leveraged FOREX brokerage house, XTB serves more than 1,000,000 clients worldwide.

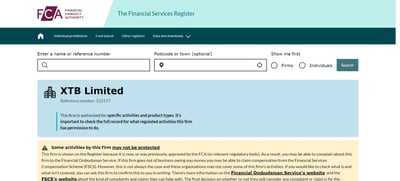

XTB is regulated by several financial authorities worldwide, most notably the top-tier UK Financial Conduct Authority (FCA).

XTB is considered low risk; it is a publicly traded company authorized by high-trust regulators.

XTB is a strong choice for traders who want to minimize their costs.

Deposits and withdrawals are fast and mostly free, and multiple options are available, including credit cards, debit cards, Skrill, and Neteller. Account opening is also rapid and user friendly.

XTB offers three different account types: a Standard Account, Pro version and an Islamic Account.

xStation 5, the native trading platform offered by XTB, is impressive, and contains many industry-leading features.

As of March 2024, XTB (UK) Limited removed MT4 from its offerings, transitioning existing accounts to its proprietary xStation platform.

For clients under XTB International Limited (MENA Clients), MT4 accounts remain operational and supported.

Relative to research, XTB competes among the tops in the industry, thanks to high-quality analysis from both its in-house staff and third-party providers.

Overall, XTB's education offering is striking because of its extensive library of written content and video materials.

The mobile version of xStation 5 includes most of the functionality available in the desktop application.

Last Reviews

Overall Summary

Established in 2002 as Poland's first brokerage house, X-Trade transformed into X-Trade Brokers in 2004 to comply with new Polish regulations. It rebranded to XTB Online Trading (XTB) in 2009 and went public, listing on the Warsaw Stock Exchange (WSE) in 2016 under the ticker symbol XTB. The company serves more than 1,000,000 clients.

The Polish brokerage firm is regulated by several financial authorities worldwide, including the top-tier UK FCA. As with many FOREX brokers, XTB does not accept US traders.

XTB's flagship platform is called xStation 5, and it is a highly developed and responsive platform with many superior features. You should know that after offering it for many years, XTB is moving away from MT4 in most markets in favor of its own proprietary platform.

Meanwhile, the deposit and withdrawal processes are fast and mostly free. Our experts at Arincen also liked the seamless and hassle-free account-opening process.

XTB offers free educational materials to clients to help them learn how to trade. It also offers multiple packages, like a Trader’s Library, Day Trading Guide, and how to trade during important world events that may impact the markets from its online Trading Academy (which is accessible from both the website and the platform).

Is XTB Safe?

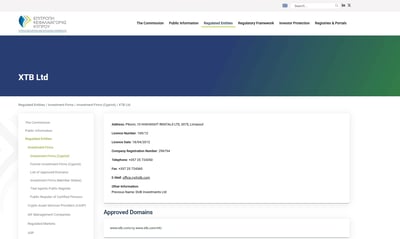

XTB is regulated by top-tier authorities such as the UK FCA and Cyprus CySEC. It provides up to £85,000 protection for UK clients through the Financial Services Compensation Scheme (FSCS). With operations in 12 countries across three continents and with over one million clients, XTB offers robust risk-management features, including negative-balance protection, partnerships with top-tier banks, and two-factor authentication.

Yes, as noted earlier, XTB is considered safe. It is a publicly traded company that is authorized by several trusted regulators. In addition, given that XTB is listed on the WSE, it is required to disclose its financials periodically. XTB has a long track record, is listed on an international stock exchange, and publishes its financial statements transparently.

XTB UK offers its clients protection through the UK’s FCA. Among other things, XTB has to keep funds of its clients in separate accounts from the company’s funds. Client funds are protected up to £85,000 through the Financial Services Compensation Scheme (FSCS) in case of XTB’s insolvency.

Because this broker is a publicly listed company, it adheres to strict capital requirements and external audits, adding an essential layer of security. Client deposits remain fully segregated from corporate funds at all subsidiaries. XTB is a trustworthy broker, but the protection of client deposits exists only at the UK and Cyprus entities.

How XTB Protects You from Reckless Leverage and Margin Trading

Leverage and margin are two tools in the trader’s arsenal that, if misused, can lead to heavy losses for the trader. Many irresponsible brokers offer high leverage that can ruin uninformed traders. As with many of the best brokers, margin levels vary depending on the trader, the trading account, and the instruments being traded.

The maximum trading leverage while using XTB depends on the jurisdiction under which the account operates. For UK-registered accounts, FCA rules tightly control leverage and caps it at 30:1.

XTB offers negative-balance protection, which is mandated under European Securities and Markets Authority (ESMA) rules that came into effect in 2018, but no guaranteed stop-loss orders (GSLO).

XTB has a deep resource of trading information that is available to anyone interested in learning. Its detailed and up-to-date educational resources come as trading guides for traders of any level.

How you are protected

XTB is a large and successful broker, boasting a market presence in 12 countries on three continents. At last count, the broker serves over one million investors. A broker of this scale will almost always take your security very seriously, which is what this broker does.

XTB has developed an extensive range of risk-management features to help you manage trading risk effectively, helping to secure potential profits and minimize losses. Here are some of the primary measures the broker takes to protect your funds and information:

Segregated funds: Your capital is segregated from the company’s funds and is never used for the company’s business interests.

Top-tier banks: The broker only partners with top-tier, low-credit-risk banks to ensure clients’ funds are protected.

Capital adequacy: XTB maintains sufficient liquid capital to safeguard clients’ funds and assets.

Security of funds: The broker is licensed by multiple financial regulatory bodies worldwide. This oversight means that it sticks to strict guidelines to protect our clients and their funds.

Security of accounts: The broker offers a range of measures to detect and prevent potential security breaches. One of these methods is two-factor authentication.

Risk awareness and education: XTB encourages responsible trading, ensuring all of its clients are informed and educated about potential risks a trading activity may involve.

Regulation and other security measures

XTB is a safe broker that provides its clients with a wide range of protections. Here is the broker’s regulation and licensing information:

XTB UK is regulated by the FCA in the UK.

XTB Europe is regulated by the Cyprus Securities and Exchange Commission (CySEC)

XTB International is regulated by the Belize International Financial Services Commission (IFSC)

XTB Poland is overseen by the Polish Financial Supervision Authority (Komisja Nadzoru Finansowego).

XTB Spain is regulated by the Comisión Nacional del Mercado de Valores

XTB South is regulated by the Financial Services Conduct Authority (FSCA)

Additionally, the broker endorses responsible investing as it is dedicated to promoting the practice of conscious investment strategies and cybersecurity measures in all countries where it provides services.

Unfortunately, scam activity is a reality in retail trading, so it’s always sound advice to work with a regulated broker. In totality, XTB shows a high degree of dedication to being regulated by some of the strictest regulators in the business.

Top broker features

The power of its xStation 5 platform.

Tight spreads and zero fees for account maintenance.

Has a healthy product catalog with up to 7,100 tradable instruments.

Regulated by several top-tier regulators.

Excellent customer service, which includes 24/5 telephone support with access to live brokers and chat service.

Stellar educational offerings that continually grow.

Offers negative balance protection, which is vital in the highly-leveraged retail FOREX market.

More than 20 years of experience.

The level and depth of educational and analytical material designed to meet the needs of all traders

For Whom Is XTB Recommended?

XTB is a solid selection for traders who want to minimize their costs, whether it be the inherent cost of placing a trade (bid/ask spread) or not being burdened with extraneous charges such as wire fees. XTB offers maximum leverage of up to 500:1 for non-UK and non-EU accounts, while UK and EU accounts get up to 30:1 leverage.

Here are some major considerations of which you should be aware before you invest with this broker:

-

20-year history of operation.

-

Regulated by the FCA (UK) and CySEC in Cyprus.

-

Globally recognized, having won multiple awards.

-

Some of the lowest FOREX spreads in the market.

-

Offers protection for client accounts.

-

Emphasis on customer service.

-

Excellent support, as well as learning and research tools.

-

Does not accept US clients.

-

Number of instruments offered is average-sized.

-

No GSLO.

-

No back-testing or automated trading capabilities.

-

No social trading.

Offering of Investments

XTB offers access to over 7,100 financial instruments, including 2,100 CFDs on FOREX, indices, commodities, stocks, and ETFs, as well as 3,600+ real stocks and 1,360+ ETFs. FOREX traders can access 70+ CFD currency pairs with spreads starting as low as 0.00008 and micro-lot trading from 0.01 lot.

While more than 7,100 assets are available, FOREX traders can access 70+ CFD pairs. Though this is not the highest number of pairs offered by a FOREX broker Arincen has reviewed, it should be more than adequate for most traders.

You can trade over 2,100 CFDs on FOREX, Indices, Commodities, Stocks & ETFs. You can also invest in 3,000+ real stocks and ETFs with 0% commission if your account has a monthly turnover up to EUR 100,000, otherwise it is 0.2% commission). XTB is an excellent choice for equity traders and asset managers who prefer equity trading and well-sourced, cross-asset diversification opportunities.

FOREX

XTB excels in FOREX trading, through CFDs. This means you do not get to own the underlying asset. With this broker, you get access to 70+ CFD currency pairs where you can open leveraged long and short positions on currency pairs from developed and emerging markets.

You’ll find competitive fees with spreads as low as 0.00008.. The broker also facilitates low swaps fees, plus, you can trade micro-lots thanks to trade volumes available from 0.01 lot.

Stocks

For those looking to trade stocks, you can find 3,600+ stocks in 14 markets. Invest in the likes of Apple, Tesla, and Alphabet with 0% commission up to 100,000 EUR of monthly turnover for accounts in any currency. For investments above this limit, there is only 0.2% commission (min. 10 EUR). Please note that investing in companies quoted in different currencies incurs a 0.5% conversion fee. If you are looking for lesser-known stocks, you can find stocks from several countries, including: USA, Poland, Germany, and Great Britain.

ETFs

XTB allows you to invest in ETFs in 1,360+ funds with 0% commission. Traders can buy their favorite ETFs and enjoy 0% commission. You can invest from just 10 EUR to turn even small amounts into assets that will work for you.

Commodities

Through CFD trading, XTB gives you the opportunity to trade in over 25 commodities. You can go long or short on CFDs for gold, oil and many more commodities. Spreads can be as low as 0.008 pips and you can trade in micro-lots from 0.01 lot.

CFD Indices

Get in on the action by trading 30+ CFD Indices. Traders can open leveraged long and short positions on the largest indices from the US, Europe, and Asia. Spreads are as low as 0.012 pips, and you can keep your positions open for longer with minor swap values.

Cryptocurrency CFDs

UK traders with XTB can access CFD trading in cryptocurrencies. The broker offers nine individual coins and 16 crypto crosses. You can trade cryptocurrencies against the US dollar or against each other - choose from Bitcoin, BitcoinCash, Ethereum, Ethereum Classic, Dash, EOS, Ripple, Litecoin, and Stellar. Remember, with CFD trading, you don’t get the hassle of owning a crypto wallet, and you can enjoy leverage of 2:1 and go both long (buy) and short (sell) with CFDs.

Available assets

| Markets | Available | Number of Assets |

| Currency Pairs | 71 | |

| Stocks | 2348 | |

| Commodities | 25 | |

| Crypto | 41 | |

| Indices | 34 | |

| ETFs | 449 |

Account Types

XTB offers three main account types: Standard (commission-free with spreads starting at 0.3 pips), Pro (spreads from 0.1 pips plus $3.5 per lot commission), and Islamic (swap-free with $10 per lot fixed commission for most instruments). Traders can also use a demo account for risk-free practice. Account opening is a simple, fully digital process that takes as little as 15 minutes.

XTB offers three distinct account types. There is zero commission on equity CFDs and ETFs in all three, and the maximum leverage is 500:1 (for non-UK accounts).

Standard account:

This commission-free FOREX, commodities and indices option, with an advertised minimum spread of 0.3 pips. To find out more about pips in trading, read our article here. Trades placed on a Standard account are free from commission. The cost of trading is already built into the spread.

Pro version account:

Fees on this account start from 0.1 pips with a commission of $3.5 per lot ($7 round trip). A 0.5% fee applies when trading instruments denominated in a currency different from your account's base currency.

Swap free account:

The third type of account, the Islamic Account, is a swap-free alternative with a minimum mark-up of 0.7 pips and a fixed-commission of $10 or a currency equivalent for equity CFDs and ETFs. FOREX, commodities and indices face a $10 per lot charge, and cryptocurrencies face a charge of $4 per predetermined volume.

Demo account:

The broker offers the option of a demo account that allows you to trade without risk.

| Account Type | Minimum Deposit | Spread Commission | Commission | Swap Commission | Deposit Commission | Withdrawal Commission |

|---|---|---|---|---|---|---|

| Standard account | 0$ | Starting from 0.0009 pip | 0$ | Not mentioned | 0$ | 1.5% |

| Islamic account | 1$ | Starting from 0.7 pip | 10$ | Not mentioned | 0$ | 1.5% |

Account opening

Opening new accounts is through an online application process. Account verification is mandatory to comply with regulator-mandated Anti-Money Laundering (AML)/Know Your Customer (KYC) requirements. Opening an account with XTB is easy, as it is with most brokers these days. The process is entirely online, user-friendly, and can be completed on a phone, tablet, or computer. The broker promises to “complete the process in 15 minutes without unnecessary formalities.”

What is the minimum deposit at XTB?

XTB requires no minimum deposit to open an account, allowing you to start trading with any amount that works for you. This flexibility allows traders to embark on their trading journey without needing a large initial investment. Although there is no enforced minimum, it is advisable to deposit at least $10 to have something to trade with as you start your trading journey with this broker.

How to open your account

The XTB review process is fully digital, easy, and fast. An account should be ready within one to two business days. To open an account at XTB, follow these steps:

Go to the broker’s website and choose your preferred account.

Fill out the application form.

Submit identification documents

Fund your account with at least $10 or the equivalent in your currency.

Begin trading from a wide range of instruments.

If you need any assistance during the account opening process, you can contact XTB's customer support.

Deposits and Withdrawals

XTB offers flexible deposit and withdrawal options, including bank transfers, credit/debit cards, Skrill, and Neteller. Deposits via bank transfers may take a few days, while card and e-wallet deposits are processed instantly; deposits via e-wallets incur a 1% fee, but other methods are fee-free. Withdrawals are processed within 24 hours, with fees of 1.5% for card withdrawals and $30 for wire transfers.

XTB accepts bank wires, credit and debit cards, Skrill, and Neteller. Regional options may be available in select geographical locations. Indeed, your country of residence determines which electronic wallets are available for you.

For example, deposits via Sofort are available for German customers only. A bank transfer can take several business days, while payment with credit and debit cards and e-wallets is instant. You can deposit money from sources that are in your name only.

Although deposits via bank wire and credit and debit cards do not incur a fee, e-wallet deposits bear a charge of 1% of the deposit amount. Withdrawal charges also apply, both from XTB and payment providers, and are processed within 24 hours.

Account base currencies

XTB's account base currency selection includes the USD, EUR and GBP. Further, HUF and PLN accounts are also available. This selection of account base currencies is average compared to similar brokers.

In FOREX trading terminology, the “base” currency is always listed first in a FOREX pair, with the “quote” currency listed second. The base currency is always equal to one, while the quote currency represents the current price of the pair.

XTB deposit fees and options

For stocks and ETFs, you can deposit funds via major bank cards and bank transfers. Supported currencies include GBP/USD/EUR and card payments must be made from a card issued in the client's name from a bank account that is the same as the client’s country of residence.

For CFD instruments, you can also deposit funds via major debit and credit cards through major currencies like GBP/USD/EUR. XTB does not charge any deposit fees, however, in all cases like this, any bank commissions that may apply from the trader’s bank would be for the trader’s account.

XTB withdrawal fees and options

XTB charges withdrawal fees of 1.5% for major bank cards, and $30 for wire transfers. Neteller and Skrill withdrawals attract a fee of 1%. For security reasons, withdrawals can only be processed to bank accounts in the client's full name and matching their registered address.

You can withdraw any amount to your bank account. Depending on when you placed your order, your money will be sent to you on the same or next business day.

| Method | Credit Card | Wire Transfer | Skrill | Neteller | Cryptocurrency | PayPal | Apple Pay3 |

| Deposit fee | $0 | $0 + Bank commission | 1% | 1% | Unavailable | Unavailable | Unavailable |

| Withdrawal fee | 1.5% | $30 | 1% | 1% | Unavailable | Unavailable | Unavailable |

Customer Support

XTB offers customer support in 18 languages, available Monday through Friday via email, chat, or phone. Clients are also assigned a dedicated account manager for personalized assistance with account-related matters. Supported languages include English, French, German, Spanish, Arabic, and many more.

The broker’s custom service team provides support in 18 languages and is available Monday through Friday via email, chat, or phone. Further, clients are assigned an account manager to assist with any account-related matters. XTB support is available in the following languages: Czech, English, French, German, Hungarian, Italian, Portuguese, Polish, Russian, Romanian, Spanish, Slovak, Turkish, Vietnamese, Thai, and Arabic, just to name a few.

| Live Chat | Phone | |||

| Available | Available | Available | Available | Unavailable |

| Quick response | Very Fast | Moderate | Moderate | Unavailable |

Commissions and Fees

XTB offers competitive spreads starting at 0.2 pips for Standard Accounts (commission-free) and 0.1 pips for Pro Accounts. Spreads on commodities begin at 8 pips, while indices start at 4 pips, and swap-free Islamic accounts are available for clients in specific regions. An inactivity fee of €10 applies after one year without trading, and withdrawals below $50 incur a $30 charge.

XTB advertises minimum FOREX spreads of 0.2 and no commission for its Standard Accounts. For a Pro Account, with commission, the comparable figure stands at 0.1.

Fees and commissions depend on the type of service and type of account you want to use. For example, XTB’s FOREX or index-trading with the Pro Account offers very competitive spreads. But, the ETF trading and equity trading commission can be costlier than other brokers.

Swap rates on leveraged overnight positions apply. Withdrawals from the cash account that are below $50 bear an extra cost of $30. Third-party charges may also apply. Scalping is allowed, but scalpers must determine if the spreads are tight enough to make the process profitable.

Here is a detailed breakdown of the different types of fees:

Spreads

XTB generates most of its income from spreads, which start as low as 0.2 pips. Spreads on commodities start from 8 pips and spreads on indices start from 4 pips. To learn more about pips in trading, read our detailed article here.

Commissions

Trades placed on a Standard account are free from commission. The cost of trading is already built into the spread (except for equity trades). For all other asset classes, such as FOREX, Indices and commodities, the cost of commission is already built into the spread. The zero commission on stocks and ETFs dispensation exists up to a limit of €100,000 invested per month. All transactions above this limit are subject to a 0.2% commission.

However, you are charged a commission per open and closed lot traded for the Pro account- which operates with market spreads. The cost of commission varies depending on your base currency.

Swap fees and Islamic accounts

The broker allows Islamic trading through swap free accounts. Positions held overnight do not incur swap charges. To make up for the lack of swap fees, XTB, like all brokers, implements wider spreads or administrative fees on certain instruments. The exact fee structure can vary, so it's essential to review the specific terms associated with your account.

XTB's Islamic accounts are available to clients from specific countries, including the UAE, Saudi Arabia, Kuwait, Oman, Qatar, Jordan, Bahrain, Lebanon, Egypt, Algeria, Morocco, Tunisia, and Malaysia. They are not offered to UK/EU residents under XTB Ltd.

Inactivity fee

There's a monthly fee of €10 charged after one year of inactivity, provided no deposit has been made in the last 90 days.

Other costs

Currency conversion fees:

A 0.5% fee applies when trading instruments denominated in a currency different from your account's base currency.

| Spread | Commission | Swap | Islamic Account | |

| Currencies | Starting from 0.2 Pips | $0 | No | Available |

| Stocks | Not Mentioned | $0 | Yes | Unavailable |

| Commodities | Starting from 8 Pips | $0 | No | Available |

| Indices | Starting from 4 Pips | $0 | Yes | Unavailable |

Platforms and Tools

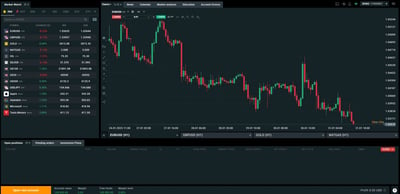

XTB’s proprietary trading platform, xStation 5, is a highly advanced tool. It offers features like real-time performance analytics, sentiment heatmaps, a stock screener, and an advanced trading calculator, alongside unique tools like candlestick countdown timers and integrated economic news. xStation 5 supports market, limit, and stop orders with options for "take profit" and "stop-loss" attachments.

Judging by the growth of the size of XTB’s technology department over the years, as shared on its website, the broker devotes massive resources to the development of its proprietary trading platform.

Indeed, xStation 5 was voted “Best Trading Platform” by many industry bodies over the years. Here is more information about its platform offerings:

Platforms types

XTB offers the following trading platforms:

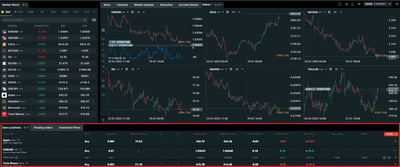

xStation 5:

This platform is an industry leading tool that the broker has spent vast time and resources improving. It features a free-market audio commentary, as well as an advanced trading calculator that instantly determines every aspect of your trade. It also has a comprehensive video tutorial section, a stocks screener, sentiment heatmaps, and real-time performance stats that break down your trading behavior, showing you where your strengths and weaknesses are as a trader.

xStation 5 is available across desktop, tablet, mobile, and even your smartwatch, and has a variety of innovative technical tools to help you with your trading. However, it does not natively support automated trading strategies or the use of Expert Advisors (EA).

You should also note that xStation 5 lacks built-in tools for automated trading and backtesting of trading strategies, making it less suitable for algorithmic traders.

Trading tool highlights include heat mapping (view top movers by color), a versatile stock screener, and sentiment analysis that shows the percentage of XTB clients that are long or short per instrument.

MT4:

XTB previously offered the MT4 platform to its clients. However, as of March 15, 2024, XTB (UK) Limited removed MT4 from its offerings, transitioning existing accounts to their proprietary xStation platform. For clients under XTB International Limited (MENA Clients), MT4 accounts remain operational and supported.

Look and feel

Beyond its modern and responsive design, several unique features help xStation 5 stand out. For example, charts include a countdown timer showing the remaining time left in each candlestick. Other examples of unique features include economic news releases appearing along the bottom axis within charts, providing traders insights during important economic events. In total, 29 drawing tools and 37 technical indicators are available.

Login and security

XTB follows industry-standard security procedures, including website encryption and two-factor authentication, to protect sensitive client data.

Search functions

The xStation 5 platform is full of features and well-suited for advanced traders. While beginner traders may find the level of features daunting, video tutorials and quick-start manuals are available. The search function is intuitive and provides comprehensive findings.

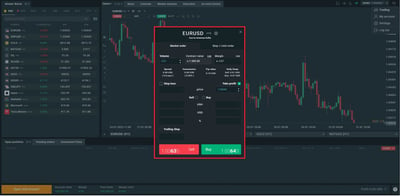

Placing orders

xStation 5 has three basic order types with the option of attaching "take profit" and/or "stop-loss" orders to them. Additionally, the trader can choose to make the regular stop-loss a trailing stop-loss prior to or after execution of a trade.

Market – The simplest order, where a trader signals that their trade request should be executed at the prevailing market rate.

2. Limit – A pending order, where the entry is at a predetermined point below or above the prevailing market rate, depending on whether it is a buy or sell. The trader also may opt to select the expiration time of this order.

3. Stop – A pending order, where the entry is at a predetermined point above or below the prevailing market rate, depending on whether it is a buy or sell. The trader also may opt to select the expiration time of this order.

Alerts and notifications

Traders can set up price alerts by right-clicking on a chart and selecting “Price Alert.” This feature allows users to specify the instrument, desired price level (bid or ask), and the condition that triggers the alert.Alerts are displayed within the xStation 5 platform, providing immediate on-screen notifications to keep traders informed without the need to monitor the markets continuously.

It's important to note that while price alerts are displayed within the platform, setting up external notifications (e.g., email or phone alerts) for price movements is not supported.

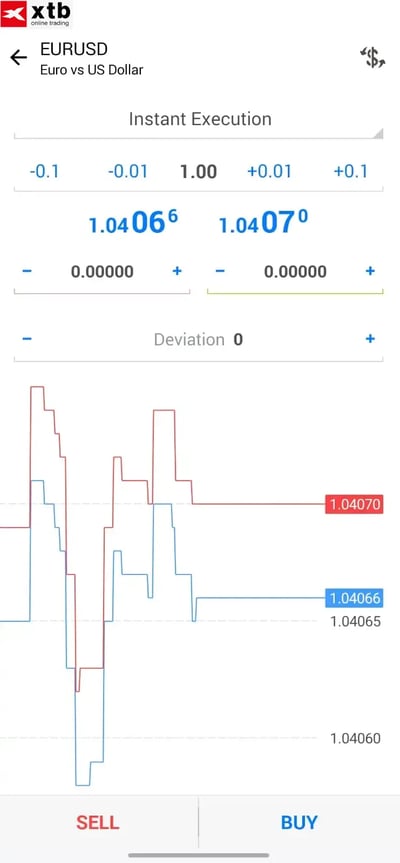

Mobile Trading

The xStation 5 mobile app replicates most desktop features, providing access to XTB’s trading instruments, order types, account details, and advanced charting on Android and iPhone. Traders benefit from tools like market sentiment analysis, top movers, a stock scanner, and a heat map for streamlined trading on the go. The platform supports market and pending orders, along with chart-based trading.

The mobile version of xStation 5 includes most of the functionality and features available in the desktop application.

Platforms

xStation 5 Mobile App:

Traders can access XTB's trading instruments, complex order types, account details, and charting from Android or iPhone apps.

However, as good as the overall platform is, xStation 5 has some limitations. It does not offer social trading, backtesting, or money-manager accounts. However, there are a few unique offerings worthy of a second look by some traders. The inclusion of "market sentiment," "top movers," "stock scanner," and "heat map" tools is impressive.

Look and feel

The mobile version offers a streamlined experience with essential features for trading on the go. XTB’s xStation 5 mobile platform is for instant market access with similar trading features as the xStation 5 desktop platform and is well-suited for traders who prefer easy access to trade, but with fewer features.

Login and security

Secure login and authentication processes to protect user accounts. These features are in line with industry norms.

Search functions

The xStation 5 mobile app allows you to efficiently locate and access a wide range of financial instruments like FOREX pairs, indices, commodities, stocks, and ETFs by entering relevant keywords or symbols into the search bar.

This intuitive search functionality is designed to streamline the trading process, enabling users to swiftly navigate the extensive array of available markets and make informed trading decisions on the go.

Placing orders

XTB's xStation 5 platform offers a comprehensive suite of order placement features designed to accommodate various trading strategies. Order types include market orders as well as pending orders, which can include buy stop, sell stop, buy limit, and sell limit instructions. You can also trade from charts on the app.

Alerts and notifications

In addition to platform-based alerts, xStation 5 supports setting up email, SMS, and push notifications for important events such as margin calls, deposits and withdrawals, and the status of open or closed positions.

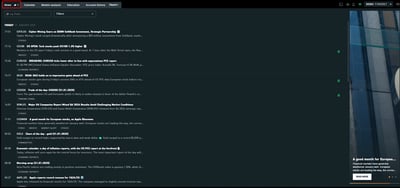

Research and Development

XTB rivals the best in the industry in high-quality analysis from both its in-house staff and third-party providers. Although Trading Central and Autochartist tools are not integrated into the platform, XTB compensates by offering exclusive strategies and insights through its Premium Research service. This includes streaming headlines from leading news providers, an economic calendar, market sentiment analysis, and platform-integrated research tools. Additionally, XTB offers written market commentary from its team and educational video content on YouTube.

Enhancing its reputation as a multi-asset broker, XTB provides a comprehensive stock screener. This tool enables traders to filter and sort through more than 1,700 tradable single-stock CFDs and cash equities, making it a valuable resource for identifying trading opportunities. Trading signals are also integrated into the news panel, featuring price analyses and updates from providers like Thomson Reuters, Barclays, and CitiGroup.

XTB provides regular market commentary and actionable trading ideas in its “Market News” section. Traders receive frequent updates throughout the trading day, including brief fundamental summaries, technical alerts, the "Trade of the Day," and the "Crypto Newsletter." These updates include text, charts, and trading ideas, making them accessible and informative. Most of this content is available for free, while select premium pieces require a registered XTB account.

Education

Overall, XTB's education offering is very impressive, primarily because of its extensive written content and video materials. XTB offers a wide range of educational materials to its clients. It offers educational videos, along with a “Trading Academy” section. The Trading Academy features lessons that include videos, written content, and charts to improve your technical analysis.

Lessons range from short overviews to more detailed modules lasting up to 20 minutes, providing in-depth knowledge without overwhelming learners. The Fundamental Analysis section offers 10 modules, while the Introduction to CFDs and FOREX is more concise but informative. With its 35 lessons, the Academy is user-friendly and highly recommended for beginner traders looking to develop their trading skills.

Final Thoughts on XTB

XTB offers current and prospective clients many of the tools that are needed to be successful in the online trading arena. What it does better than other firms is offer customers some of the lowest FOREX spread costs in the industry. The costs (made up of spreads plus commissions) for the other product offerings are more in line with the industry norm. xStation 5 is intuitive and functional, and certain unique features heighten its appeal to all types of traders.

Meanwhile, being FCA-regulated lends it credibility, while negative-balance protection gives clients much-needed peace of mind. The quality of customer service is above average, and the education catalog is impressive. Overall, XTB is best suited for cost-conscious and progressive technology clients wishing to engage in trading the retail FOREX markets.

Conclusion

Established in 2002, XTB is publicly traded and well-regulated in all the jurisdictions in which it operates. This makes it a safe broker (low-risk). With over 7,100 assets across multiple categories, new retail traders and professional asset managers alike will benefit from trading opportunities and diversification possibilities.

Traders will find a superior proprietary solution in the XTB proprietary xStation5. The broker offers ultra-competitive FOREX spreads and tools that cater to traders at every level. With negative balance protection and a transparent fee structure, XTB ensures a secure and reliable trading environment.

Add to this its stellar educational resources, lightning-fast deposits and withdrawals, and a responsive customer service team available in multiple languages, and you have a broker that truly delivers. Whether you’re a beginner looking to learn the ropes or an experienced trader seeking powerful tools, XTB checks all the right boxes.

XTB in Brief

Founded in 2002, XTB is a globally recognized broker offering over 7,100 financial instruments, including CFDs on FOREX, indices, commodities, stocks, and ETFs. It is publicly traded on the Warsaw Stock Exchange and regulated by multiple top-tier authorities, including the UK FCA. XTB’s proprietary platform, xStation 5, delivers cutting-edge tools for manual trading, while MT4 remains available in select regions. Known for low spreads, extensive educational resources, and user-friendly account processes, XTB is well-suited for cost-conscious traders and those seeking diverse trading opportunities.

Review Methodology

The team at Arincen collected more than 120 pieces of data covering more than 100 licensed FOREX companies. Data collection was done in three ways:

Companies’ websites.

Other websites that have ranked FOREX companies.

A survey questionnaire (referred to here as Survey “1”) was sent to the companies invited to participate in the exercise.

We have identified 12 criteria for our assessment, each containing several aspects and carrying its relative weight. These include licensing, deposits and withdrawals, number of assets, etc.

Afterward, we validated the data by:

Registering with FOREX companies as a secret shopper and as Arincen.

Survey number “2,” in which we asked these companies’ customers for meaningful feedback and past experience.

The next step saw us evaluate and rank each company, relying on the hard work of 15 Arincen employees. We were cautious in ensuring the most accurate assessment possible, including considering different languages and the various mobile-app operating systems, e.g., Apple, Samsung, etc.

To add credibility to our research project, we sent a final and third survey (referred to here as Survey “3”) to enable participating FOREX companies to evaluate our research and whether it accurately reflects the realities on the ground. We were fortunate enough to receive a mark of 9.9 out of 10! We have kept the margin of error to a minimum, which stood at a measly 1%. Please click here to learn more about how we came up with the evaluation.

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

FAQ

XTB is publicly traded and regulated by multiple top-tier authorities, including the UK Financial Conduct Authority (FCA). It adheres to strict capital requirements, segregates client funds, and offers protection up to £85,000 through the FSCS in case of insolvency.

XTB provides its proprietary xStation 5 platform, which is highly regarded for its advanced tools and user-friendly interface. While MT4 was offered previously, it is now only available for MENA clients, with xStation 5 being the main platform globally.

No, XTB does not require a minimum deposit to open an account. However, starting with at least $10 is recommended to begin trading effectively.

XTB offers three main account types: Standard (commission-free trading with costs built into spreads), Pro (lower spreads with a commission per lot), and Islamic (swap-free for compliance with Sharia law). Additionally, demo accounts are available for risk-free practice.

XTB provides access to over 7,100 instruments, including FOREX, indices, commodities, stocks, ETFs, and cryptocurrency CFDs. This makes it suitable for traders looking for diverse opportunities.

Yes, XTB offers an extensive Trading Academy, with 35 lessons covering beginner to advanced topics. The lessons include videos, written content, and examples to enhance your learning.

Leverage varies based on your location and account type. UK and EU clients can trade with leverage up to 30:1, while non-EU accounts can access leverage up to 500:1.

Deposits and withdrawals at XTB are fast and mostly free, with multiple options available, including bank transfers, credit/debit cards, and e-wallets like Skrill and Neteller. Withdrawals are typically processed within 24 hours.

Yes, XTB's mobile version of xStation 5 provides almost all the functionality of its desktop platform, allowing you to trade, monitor markets, and manage your account from your smartphone or tablet.