ActivTrades Review 2026

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

ActivTrades Evaluate - research result

Key Takeaways

ActivTrades is an online broker founded in 2001 and now headquartered in the UK.

The broker is regulated in the UK by the Financial Conduct Authority (FCA). It is also regulated by the Commission de Surveillance du Secteur Financier (CSSF) in Luxembourg. Additionally, the broker is under the oversight of the Securities Commission of the Bahamas (SCB).

ActivTrades clients are covered by the Financial Services Compensation Scheme (FSCS) up to £85,000.

The broker works with a No Dealer Desk (NDD) trading model.

The broker provides Contract for Differences (CFD) access to over 1,000 market instruments, such as FOREX, indices, commodities, shares, financials, and Exchange-Traded Funds (ETF).

ActivTrades offers a single integrated account type known as the Individual Account.

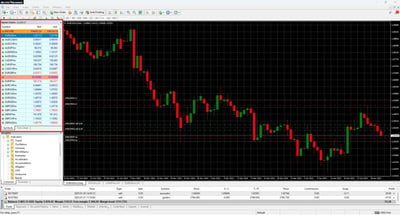

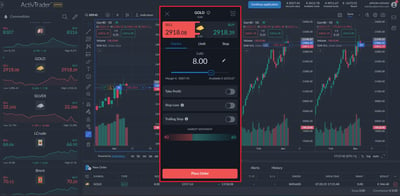

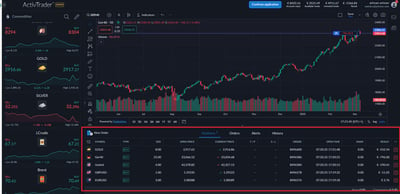

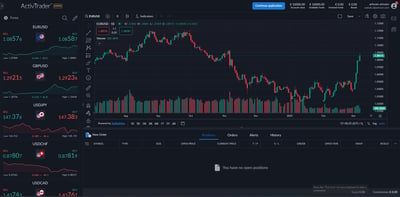

The broker provides clients with trading platforms, such as its proprietary ActivTrader, as well as MetaTrader4 (MT4) and MetaTrader5 (MT5).

ActivTrades offers competitive spreads and commissions across its account types.

The broker puts a lot of emphasis on trade execution speed.

Last Reviews

Overall Summary

While reviewing this broker, I came to learn that it was established in Switzerland in 2001 by founder Alex Pusco, ActivTrades relocated its headquarters to London in 2005, solidifying its presence in the global financial services industry. Over the years, the company has expanded its offerings beyond traditional FOREX services to include CFDs on indices and commodities, catering to a diverse clientele.

ActivTrades has experienced significant growth, serving clients in over 140 countries. The company's commitment to investor fund safety led it to become the first UK broker to establish excess Financial Services Compensation Scheme (FSCS) insurance, providing an additional layer of protection.

Regulated by the UK's FCA, ActivTrades also holds licenses from the CSSF in Luxembourg and the SCB of the Bahamas. The broker has its offices in the UK, Luxembourg, the Bahamas, Italy, and Bulgaria.

I found out that the firm's excellence had been recognized with more than 20 awards across markets, including the UK, Germany, and Italy.

Clients of ActivTrades have access to over 1,000 CFDs or spread-betting instruments across FOREX, indices, shares, commodities, financials, and ETFs. Retail, professional, and institutional traders can call this broker home.

It offers the globally acclaimed MetaTrader platforms (MT4 and MT5), enhanced with proprietary Smart Tools for an enriched trading experience. Also, ActivTrades provides its own feature-rich platform, ActivTrader, which is suitable for traders of all levels and can be used on desktop, smartphone, and tablet.

Emphasizing excellence, ActivTrades focuses on rapid execution, exceptional customer support, innovation, education, and safety. The broker's robust IT infrastructure ensures low latency and swift trade execution, as I can confirm from testing its platforms.

Yes, ActivTrades is a safe and reputable broker regulated by the FCA (UK), SCB (Bahamas), and CSSF (Luxembourg), and licensed in Mauritius, Portugal, and Brazil. UK clients are protected under the FSCS for up to £85,000 in case of broker insolvency, and Excess of Loss Insurance covers losses between $10,000 and $1,000,000 at no extra cost. The broker provides Negative Balance Protection, which resets account balances to zero if they become negative due to trading losses.

Is ActivTrades Safe?

In my view, ActivTrades is a safe broker. It is a reputable broker operating under stringent regulatory oversight across multiple jurisdictions, ensuring a secure trading environment for its clients. If there is one criticism, it is that, aside from the FCA, there are no other top-tier regulators governing the broker’s activities.

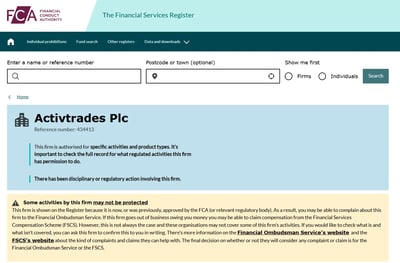

FCA, UK: ActivTrades is authorized and regulated by the FCA under registration number 434413. This top-tier regulatory body enforces the segregation of client funds, making sure they are held in separate accounts from the company's operational funds.

SCB, The Bahamas: For international operations, ActivTrades is regulated by the SCB and adheres to standards of financial conduct, including maintaining adequate capital reserves and transparent operations.

CSSF, Luxembourg: ActivTrades is also regulated by the CSSF; therefore, it tries to remain in compliance with stringent financial regulations within the European Union.

Comissão do Mercado de Valores Mobiliários (CMVM), Portugal: ActivTrades Europe SA is regulated by the CMVM, extending investor protection measures to clients within Portugal.

The broker also has local affiliates in Mauritius and Brazil that are in good standing.

As far as client protection goes, the broker offers the following:

FSCS, UK: In the event of broker insolvency, qualifying clients under FCA regulations are entitled to compensation of up to a maximum of £85,000 through the FSCS.

Excess of Loss Insurance: ActivTrades has arranged additional protection by offering Excess of Loss Insurance, covering clients' losses between $10,000 and $1,000,000 at no extra cost. This insurance is underwritten by participating syndicates at Lloyd’s of London, an "A"-rated insurance market, providing traders with unparalleled peace of mind.

As per UK rules, ActivTrades offers Negative Balance Protection to all retail clients, ensuring that traders cannot lose more than their account balance. When account balances become negative due to trading losses, the broker resets the balance to zero, even if clients hold multiple accounts.

In my experience, ActivTrades offers a robust IT infrastructure based on IBM Cloud. This means traders are likely to achieve low latency, rapid pricing delivery, and swift trade execution.

How ActivTrades Protects You from Reckless Leverage and Margin Trading

Maximum leverage is mandated by the regulators in each region, but traders can control their leverage levels within those parameters. Trading on the margin can increase earnings dramatically, but it can also magnify losses. However, with negative balance protection, traders cannot lose more than the funds in their accounts.

How you are protected

The broker has the room to decide margin rates and maximum leverage for professional traders. As normal, professional traders do not get investor fund protection. Each customer’s permitted leverage depends on the equity in their account.

As mentioned, ActivTrades aligns its leverage offerings with the regulatory guidelines of each operating region:

United Kingdom and European Union: For retail clients, leverage is capped in accordance with the FCA and European Securities and Markets Authority (ESMA) regulations:

Major currency pairs: Up to 30:1

Non-major currency pairs, gold, and major indices: Up to 20:1

Commodities (excluding gold) and minor indices: Up to 10:1

Individual equities: Up to 5:1

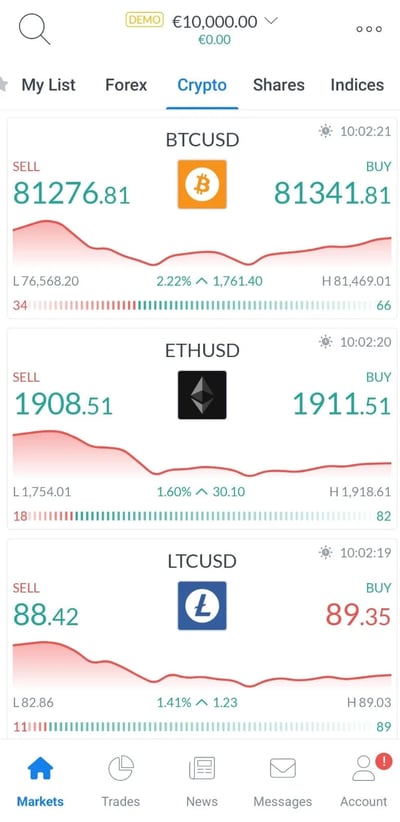

Cryptocurrencies: Up to 2:1

These limits are designed to protect retail investors from excessive risk. However, traders who qualify as professional clients may access higher leverage levels, subject to ActivTrades' assessment of their experience and trading history. Specific leverage ratios for professional clients are determined on a case-by-case basis.

In regions outside the EU and UK, ActivTrades offers higher leverage levels:

Individual accounts: Up to 200:1

Professional accounts: Up to 400:1

Margin requirements and risk management

The broker actively manages margin requirements to reflect current market conditions. Suppose an account's equity falls below the maintenance margin level. In that case, ActivTrades may initiate a margin call or automatically close positions to restore the necessary balance, thereby mitigating the risk of forced liquidations and substantial losses.

Regulation and other security measures

As we have listed above, ActivTrades is subject to strict regulatory standards across its operating regions. As we have said, in the UK and the EU, traders are automatically granted negative balance protection, ensuring that losses cannot exceed the funds available in the account. ActivTrades places paramount importance on the safety of client funds:

Client funds are maintained in segregated accounts with top-tier banks, ensuring they are kept separate from the company's operational funds.

Top broker features

Strong regulation and safety: ActivTrades operates under the oversight of several regulatory authorities, ensuring a secure trading environment for its clients

Diverse instruments: The broker offers over 1,000 trading instruments across FOREX, indices, shares, commodities, financials, ETFs, and cryptocurrencies, providing a wide range of market access

Low-cost trading: The company features competitive spreads starting from 0.5 pips on major currency pairs with no commissions for most trades, helping traders minimize costs

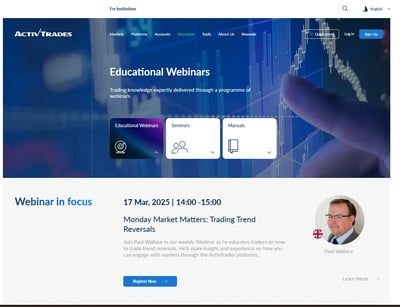

Comprehensive education and support: The broker provides a full range of educational materials, including webinars, video tutorials, and market analysis, ensuring traders are equipped with the knowledge they need to succeed

Customer Support: ActivTrades offers 24/5 multilingual customer support via phone, email, and live chat.

For Whom Is ActivTrades Recommended?

ActivTrades serves retail clients adequately, but is highly geared toward providing the best solutions to professional and institutional traders. After all, these are the segments that trade the highest volumes by far.

In my opinion, brokers like ActivTrades cannot be unwelcoming to retail traders, as every elite trader started out as an entry-level retail trader. However, the broker reserves its best services for the wide array of organizations to which it offers class-leading investment and brokerage solutions. These organizations include:

Hedge funds: Offering advanced trading solutions and liquidity access

Asset managers: Providing tailored platforms and tools for efficient portfolio management

Banks: Making sure there is robust trading infrastructure to support banking operations

Other brokers: Delivering white-label solutions and technological support

Private investment vehicles: Facilitating customized trading strategies and execution

Professional traders: Offering high-frequency trading capabilities and sophisticated tools

Fintechs: Collaborating on innovative financial technologies and solutions

These institutional services are designed to meet the complex requirements of professional market participants, guaranteeing them access to only the highest-quality execution, deep liquidity, and dedicated support.

It is clear that ActivTrades more than keeps itself busy with professional and institutional clients. Entry-level retail clients who need a high degree of assistance and handholding may want to look elsewhere. Here are the pros and cons of using this broker:

-

Comprehensive market access

-

Customizable and responsive account types

-

Competitive fees

-

Fast trade execution speed

-

Strong regulation

-

Enhanced funds protection

-

Limited funding methods

-

Some non-trading funds are high

-

Little to incentivize new traders

Offering of Investments

ActivTrades offers over 1,000 CFD and spread-betting instruments across FOREX, indices, shares, commodities, bonds, ETFs, and cryptocurrencies. FOREX spreads start from 0.5 pips on over 50 currency pairs, with commission-free mini and micro lot trading. The broker provides transparent pricing on global indices, ETFs, and CFDs, with no hidden fees or swaps on Futures CFDs. ActivTrades also offers competitive crypto CFDs and bond trading.

ActivTrades has a powerful collection of products that gives traders of all levels comprehensive market access. With over 1,000 CFD or spread-betting instruments covering Indices, FOREX, shares, financials, commodities, and ETFs, traders are well accommodated.

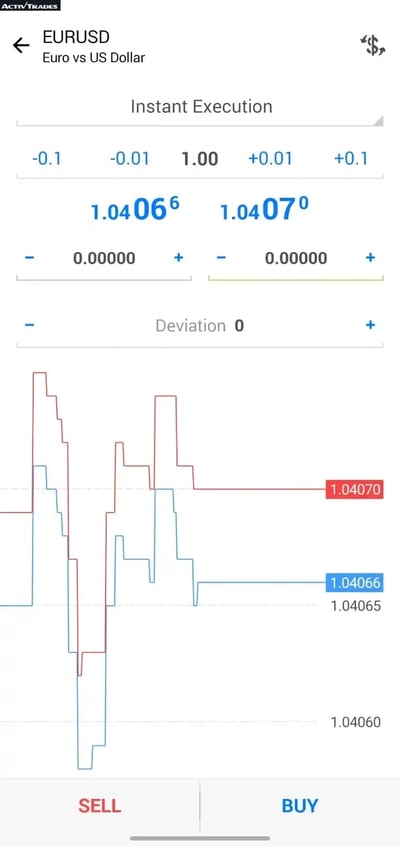

FOREX

I found the broker to offer low spreads from 0.5 pips. Clients can trade over 50 currency pairs on a commission-free basis. Mini and micro lot trading is supported. All this is done with swift execution and no requotes.

Indices

ActivTrades provides access to global index markets, including the US, EU, UK, and Chinese indices, rather than individual stocks. Clients benefit from transparent pricing, attractive spreads, and low margins, facilitating efficient trading strategies.

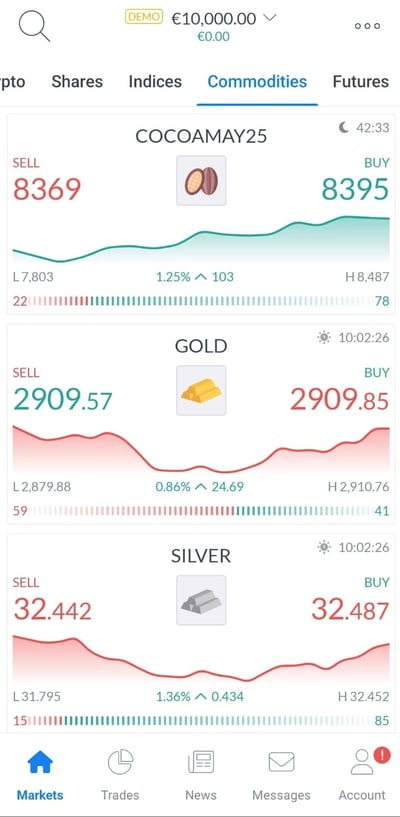

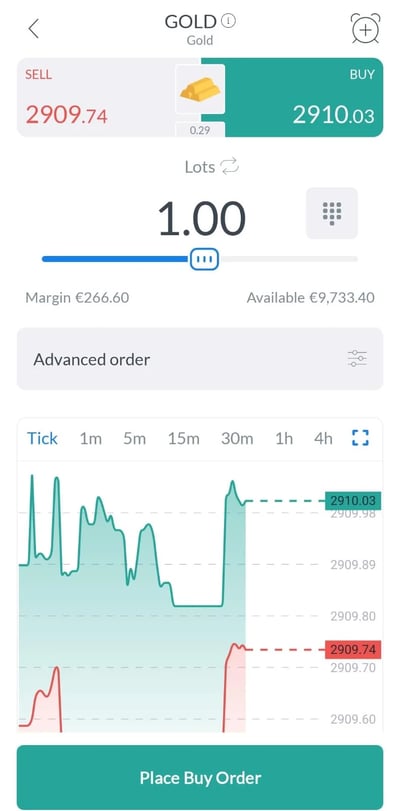

Commodities

The broker offers access to CFD trading on commodities, such as metals, energy, grains, and gas. Based on futures contracts, clients can trade mini or micro lots to access major markets with managed exposure.

CFDs

Traders can enjoy several benefits from this type of transaction, such as flexible margins and mini and micro lot trading. There are no hidden fees, commissions, or swaps on Futures CFDs. Clients can trade CFDs in FOREX, gold, silver, and several prestigious global stock exchanges. Notably, there are no hidden fees, commissions, or swaps on Futures CFDs, enhancing cost efficiency for traders.

Bonds

Clients can access CFDs on fixed-income markets, allowing them to trade bonds and diversify their investment portfolios. The bond market is often considered a reliable indicator of economic health, providing valuable insights for traders.

ETFs

ActivTrades allows clients to invest in ETFs regardless of account size, with transparent pricing and no hidden fees for opening or closing trades. This flexibility makes ETF trading accessible to a wide range of investors.

Shares

Trade over 1000 CFDs on company shares from around the world. Traders can go short or long when trading shares on a CFD basis. Unleveraged trading is commission-free, and clients can access worldwide exchanges in financial centers such as New York, London, and Frankfurt.

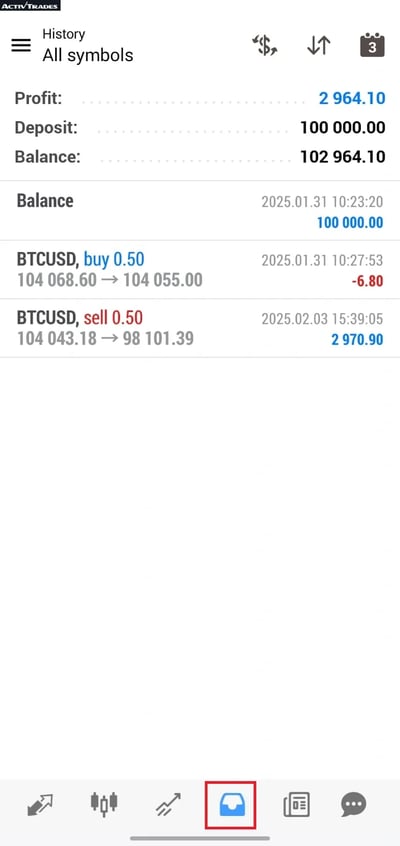

Cryptocurrencies

Described by the broker as “the most volatile asset class in history,” ActivTrades offers competitive CFD contracts on a variety of the largest and most relevant crypto assets.

Available assets

| Markets | Available | Number of Assets |

| Currency Pairs | 51 | |

| Stocks | 1000 | |

| Commodities | 20 | |

| Crypto | 15 | |

| Indices | 20 | |

| ETFs | 100 |

Account Types

ActivTrades offers Individual, Islamic, Demo, and Professional accounts to cater to different trading needs. The Individual account allows trading on MT4, MT5, and ActivTrader with low spreads from 0.5 pips and access to Smart Tools. The Islamic account is Sharia-compliant, available to clients from eligible countries, and offers commission-free overnight positions. The Professional account provides higher leverage up to 400:1 and a cashback program. Opening an account is fast and requires standard ID and address verification.

ActivTrades has a simple and unfussy account set up and offers a straightforward selection of account types to cater to diverse trading needs: Here are the main account types:

Individual Account

During testing, I found that this highly functional and flexible account allowed me to work with the proprietary ActivTrader, as well as MT4 and MT5. With a multi-currency account, you can trade in the currency of your choice and have access to low spreads from 0.5 pips. You can trade in mini and micro lots with consistently swift execution.

Supported currencies include the EUR, USD, GBP, and CHF. As an NDD broker, there is no human intervention in your trades. Additionally, traders have access to bespoke Smart Tools, such as SmartForecast and SmartTemplate, enhancing their trading experience. The account also provides a robust educational platform, offering online workshops and personalized training sessions to help traders improve their skills.

Islamic Account

ActivTrades has an Islamic Account designed to cater to the needs of traders in the Arab and Islamic world. Its Shariah-compliant Islamic Account does not levy interest on contracts lasting longer than 24 hours. In addition, there are no extra rollover commissions.

Clients can still trade in mini and micro lots, and traders can access the multi-currency benefits of trading on MT4 and MT5. This account type is available to clients from eligible countries, including the UAE, Saudi Arabia, Kuwait, Oman, Qatar, Jordan, Bahrain, Lebanon, Egypt, Algeria, Morocco, Tunisia, and Malaysia.

Demo Account

For those looking to practice and refine their trading strategies without financial risk, ActivTrades offers a free Demo Account. This account allows clients to test different strategies and become familiar with the platform's features in a risk-free environment.

Professional Account

Tailored for experienced traders who meet specific eligibility criteria, the Professional Account offers higher leverage options and additional benefits. Clients can access leverage up to 400:1, depending on their equity and jurisdiction. This account type also provides a cashback program that can reduce trading costs by up to 20%, along with exclusive tools to enhance the trading experience. To qualify, traders must meet certain criteria related to trading experience, portfolio size, and professional background.

| Account Type | Minimum Deposit | Spread Commission | Commission | Swap Commission | Deposit Commission | Withdrawal Commission |

|---|---|---|---|---|---|---|

| Standard account | $0 | Starting from 0.5 pips | $0 | Yes | $0 | $0 |

| Islamic account | $0 | Starting from 0.8 pips | $0 | No | $0 | $0 |

Account opening

Opening an account with this broker is fast and convenient. The registration involves providing personal details, including name, email, phone number, and setting a password. Subsequent steps require additional information, such as date of birth, nationality, residential address, and financial details.

What is the minimum deposit at ActivTrades?

I was pleased to confirm that at ActivTrades, there is no minimum deposit to activate your account. This applies to global clients, UK clients, and European clients. However, for residents of China and Brazil, a minimum deposit of $500 is required. This flexibility makes ActivTrades accessible to a wide range of traders.

How to open your account

I simply had to access the broker’s website and click “Open account.” After reading and accepting all the terms and conditions, I chose my account type, demonstrated my trading experience, and provided the required documentation to obtain approval. Naturally, the process is somewhat different for institutional clients, who must present extensive documentation regarding their trading entity.

To comply with regulatory standards, ActivTrades requires identity and address verification, typically achieved by submitting a valid ID document and a recent utility bill. Once these documents are reviewed and approved, clients can proceed to fund their accounts and commence trading.

Deposits and Withdrawals

This broker allows deposits via bank transfer, credit/debit cards, e-wallets, and cryptocurrencies, with most deposits processed within 30 minutes and no fees applied except for a 1.5% fee on card deposits. The broker supports multiple base currencies, including EUR, USD, GBP, CHF, and SEK, with a 0.5% conversion fee for deposits in non-base currencies. Withdrawals can be made using the same methods, with a $12 fee for bank transfers but no fees for card, e-wallet, or crypto withdrawals.

During testing, ActivTrades offers several ways to fund my account, including bank transfer, credit/debit card, crypto, Neteller, and Skrill. The broker tries not to pass on bank fees, but admits that if bank fees on a low-trading account are exceptionally high, they reserve the right to pass these fees on to the client.

Account base currencies

ActivTrades supports multiple base currencies, including EUR, USD, GBP, CHF, and SEK. Selecting a base currency that matches your funding source can help avoid currency conversion fees.

ActivTrades deposit fees and options

I was able to fund my account using the following methods:

Bank transfer: Processed on the same working day with no fees applied by the broker, although your bank may charge commissions.

Credit/debit cards: Visa and Mastercard deposits are processed within 30 minutes; a 1.5% fee is applied.

E-wallets: Options include Neteller, Skrill, AstroPay, and Sofort, with deposits processed within 30 minutes and no fees charged by the broker.

Cryptocurrencies: Deposits processed within 30 minutes, no fees applied by the broker.

While ActivTrades does not impose fees for most deposit methods, clients should be aware of potential charges from their payment providers. Additionally, a 0.5% currency conversion fee applies to deposits made in a currency other than the account's base currency.

ActivTrades withdrawal fees and options

You can withdraw funds using the following methods:

Bank transfer: Processed on the same working day; a fee of $12 is applied.

Credit/debit cards: I was pleased to find my withdrawal request processed on the same working day; no fees were applied by ActivTrades.

E-wallets: Options include Neteller, Skrill, and AstroPay, with withdrawals processed on the same working day and no fees charged by ActivTrades.

Cryptocurrencies: Withdrawals processed within 30 minutes with no fees applied by ActivTrades.

Clients should note that withdrawals can only be made to accounts in the same name as the ActivTrades account holder. While ActivTrades processes withdrawals promptly, the time it takes for funds to reach the client's account may vary depending on the payment method and the receiving institution's processing times.

| Method | Credit Card | Wire Transfer | Skrill | Neteller | Cryptocurrency | PayPal | Apple Pay |

| Deposit fee | 1.5% | $0 + Bank commission | $0 | $0 | $0 | Unavailable | Unavailable |

| Withdrawal fee | $0 | $12 | $0 | $0 | $0 | Unavailable | Unavailable |

Customer Support

ActivTrades provides 24/5 customer support through live chat, email, and phone, with quick response times and knowledgeable staff. FXCM’s customer service is highly rated for its responsiveness and effectiveness.

ActivTrades is committed to providing exceptional customer service, offering multilingual support in 14 languages, including English, Italian, German, and French. Its highly skilled support desk operates 24 hours a day, five days a week, ensuring timely responses to client inquiries. Clients can reach the support team through various channels, including live chat, phone, and email. This comprehensive support structure reflects ActivTrades' dedication to addressing client needs promptly and effectively.

| Live Chat | Phone | |||

| Available | Available | Available | Available | Unavailable |

| Quick response | Fast | Very Fast | Moderate | Unavailable |

Commissions and Fees

ActivTrades offers competitive fees with no commissions on FOREX, commodities, indices trading, and spreads starting from 0.5 pips for major pairs like EUR/USD. Swap fees apply to overnight positions, but Islamic accounts are available for traders seeking swap-free options.

ActivTrades’s FOREX fees are well placed in the market. The company charges swap fees on leveraged overnight positions. As is fairly standard, the broker does not charge any commission on FOREX trading. With fully automated trading on a no-human-intervention NDD basis, there are no midway costs to account for between placing the trade and execution. This is how the broker strives to keep its FOREX rates competitive.

Spreads

For major currency pairs, ActivTrades provides attractive spreads, with the EUR/USD pair starting from as low as 0.5 pips during peak trading hours. Commodities and indices spreads start from 0.25 pips.

Commissions

With this broker, FOREX, stocks, commodities, and indices trading are commission-free.

Swap fees and Islamic accounts

ActivTrades charges swap fees for positions held overnight, which can vary depending on the instrument and market conditions.

Inactivity fee

Although this was difficult for me to verify, it appears that to encourage active trading, ActivTrades imposes an inactivity fee of £10 per month on accounts that have been dormant for over one year and have a remaining balance. This fee is common industry practice, even though traders don’t like it.

Other commissions and fees

ActivTrades maintains a transparent fee structure with no hidden charges. While the broker does not impose fees for deposits or withdrawals, clients should be aware that third-party charges may apply, depending on the payment method and financial institution used. Additionally, a currency conversion fee applies when converting profits and losses from instruments quoted in a currency different from the account's base currency.

| Spread | Commission | Swap | Islamic Account | |

| Currencies | Starting from 0.5 Pips | $0 | No | Available |

| Stocks | Not Mentioned | $0 | Yes | Available |

| Commodities | Starting from 0.25Pips | $0 | Yes | Available |

| Indices | Starting from 0.25 Pips | $0 | Yes | Unavailable |

Platforms and Tools

ActivTrades offers three main platforms: ActivTrader, MT4, and MT5, not accounting for the partnership with TradinView. ActivTrader features advanced tools like Progressive Trailing Stop, Hedging, and Market Sentiment indicators, while MT4 and MT5 support automated trading, with MT5 offering access to over 500 CFDs and more advanced order types. The platforms are secured with two-factor authentication (2FA) and encrypted communication, while customizable alerts and one-click trading provide a seamless and responsive trading experience.

ActiveTrades offers a variety of trading platforms to cater to the diverse needs of its clients. Fans of the third-party trading platform TradingView will be thrilled to know they can trade deep multi-asset liquidity on ActivTrades’ advanced trading infrastructure with rapid execution and market-beating spreads.

With the TradingView partnership, ActiveTrades customers can enjoy the powerful, feature-rich charting interface and make the most of every single trade. The broker website tells you how to connect your ActivTrader account to TradingView and enjoy the best of both worlds.

Here's an overview of the remainder of the platforms:

Platforms types

ActivTrader

ActivTrader is ActivTrades' proprietary platform, offering an intuitive interface suitable for beginners and advanced features for seasoned traders. This web-based platform is also available as a mobile app, ensuring seamless trading across devices. Key features include:

Progressive trailing stop: An advanced risk management tool that adjusts the trailing stop distance as the market reaches predefined trigger prices. This helps lock in your profits.Hedging: Allows traders to open multiple positions in the same instrument, both long and short, to mitigate risk associated with volatile price movements.Market sentiment indicator: Provides insights into the collective behavior of other traders, aiding in informed decision-making.Advanced charting tools: Offers multiple chart types and various precise indicators to analyze historical data and identify trends.

These features make ActivTrader a comprehensive platform for traders seeking both functionality and flexibility.

MT4

MT4 is a widely recognized platform known for its user-friendly interface and robust functionality. ActivTrades enhances this platform with additional tools. MT4 supports automated trading strategies, allowing for algorithmic trading. Comprehensive language support is available in 21 different languages, catering to a global clientele. For technical analysis, there are 50 pre-installed indicators and 9 timeframes for in-depth market analysis.

MT5

MT5 offers extended features for a more professional trading experience. With access to over 500 CFDs on stocks, MT5 offers 21 timeframes and 8 order types, enabling more precise trading strategies. Integrated news and alerts keep traders informed with breaking news headlines and customizable alerts.

Look and feelActivTrades’ desktop and web-based platforms feature a clean, professional design with an intuitive layout. Both the ActivTrader and MetaTrader platforms (MT4 and MT5) provide customizable dashboards, multiple chart types, and a wide range of technical indicators. The platforms are designed to be responsive and user-friendly, even when executing complex strategies.

Login and securityActivTrades ensures secure access to its platforms through two-factor authentication (2FA), SSL encryption, and biometric login, where supported. Login sessions are monitored for unusual activity, and automatic logout options are available to further enhance security.

Search functionsThe search function on both desktop and web platforms allows traders to locate instruments quickly by name, ticker symbol, or category. The results appear instantly, and traders can add instruments to watchlists or open trading windows directly from the search bar.

Placing ordersActivTrades supports a full range of order types, including Market, Limit, Stop, and Trailing Stop orders. The platforms allow one-click trading, and traders can place and modify orders directly from real-time charts. Advanced order execution options, such as Partial Close and Hedging, are also available.

Alerts and notificationsTraders can set up custom notifications for price movements, margin calls, and trade executions. Notifications can be configured to appear directly on the platform or sent as push notifications to linked mobile devices. The platform also offers sound alerts for key market events and news updates.

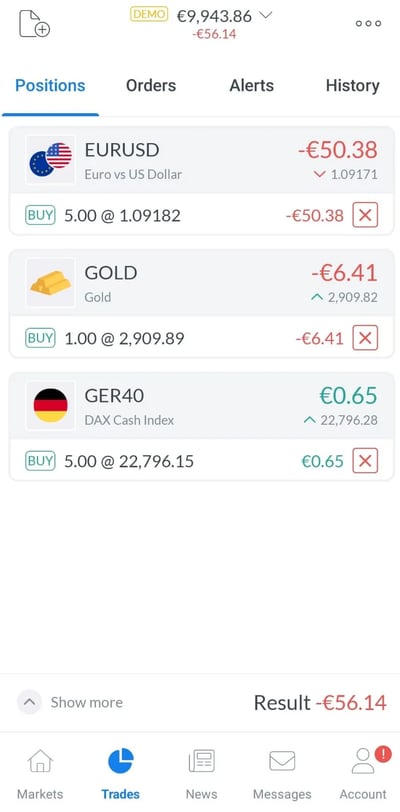

Mobile Trading

I was happy to discover that ActivTrades’ mobile ActivTrader app mirrors the desktop version, offering access to FOREX, stocks, indices, and commodities with real-time charts and market sentiment indicators. The app supports advanced order types, including Partial Close and Trailing Stop, which remain active even when the device is off. Secure access is ensured with biometric login and two-factor authentication, while the fast search function allows traders to find assets quickly. Customizable alerts and push notifications keep traders updated on price changes and order executions in real time.

The company provides “on-the-go” trading through the mobile version of its ActivTrader platform. Traders have access to many of the desktop features through the mobile version, which also supports tablet use. The mobile version is optimized for minimum battery and internet data consumption.

Platforms

The mobile application is designed to mirror the functionality of its desktop counterpart, providing access to a wide range of CFDs across FOREX, stocks, indices, and commodities.

Features such as Partial Close and Trailing Stop, which remain active even when the device is off, help in effective risk management. Users can create personalized watchlists to monitor preferred instruments and stay updated with daily price changes in percentages and pips.

The ActivTrader mobile application is available on both iOS and Android devices, allowing traders to manage their portfolios anytime, anywhere.

Look and feel

I found that ActivTrades' mobile trading platform offers a sleek, user-friendly interface with an intuitive layout that allows for seamless navigation. As we have said, the design mirrors the desktop version. Charts and trading tools are fully customizable to suit individual preferences.

Login and security

ActivTrades ensures secure access to its mobile platform through biometric login (Face ID and fingerprint) and two-factor authentication (2FA). Personal data and transaction details are encrypted with advanced SSL technology to prevent unauthorized access and protect client privacy.

Search functions

The platform features a fast, responsive search function that allows traders to find instruments and markets quickly. Users can search by asset class, ticker symbol, or market name, and results are delivered in real time, with related trading details clearly displayed.

Placing orders

ActivTrades' mobile app supports a variety of order types, including Market, Limit, Stop, and Trailing Stop orders. Traders can execute trades with one-click functionality and modify existing orders directly from the chart view. Partial Close and Hedging options are also available for more strategic order management.

Alerts and notifications

Traders can set real-time push notifications and alerts for price changes, margin calls, and order executions. The app allows for detailed customization of alerts, ensuring traders receive relevant updates without being overwhelmed by excessive notifications.

Research and Development

ActivTrades has a well-stocked research section. Traders can take advantage of the Market Analysis page that provides up-to-date trading news from key markets, including macroeconomic discussions on such topics as inflation.

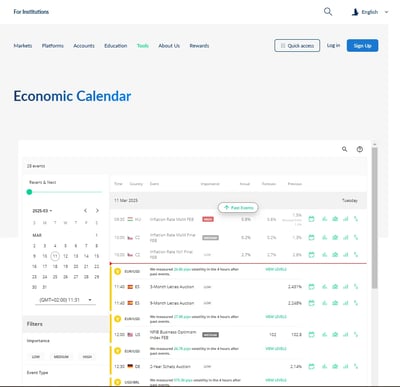

ActivTrades produces in-house video content that simplifies daily news, making it more accessible for traders. A detailed economic calendar is available, helping traders stay informed about upcoming economic events that could impact the markets.Through integration with TradingView, ActivTrades clients have access to advanced charting tools, real-time data, and a supportive community, enhancing their trading experience.

Trading statistics

The broker offers detailed trading statistics, allowing traders to analyze performance and refine their strategies.

Trading signals

ActivTrades provides trading signals based on technical indicators, fundamental analysis, or market movements, helping traders act quickly on profitable setups.

Education

The education section contains a powerful list of recorded webinars covering such subjects as Combining Price Action Trading Tactics and Correlations between pairs. The broker also offers a unique one-to-one training facility, featuring live expert support through personalized online training sessions.

The section is rounded out with helpful educational videos on topics such as How to Place a Market Order. In addition, there are specially produced handbooks and manuals that painstakingly explain topics that commonly trip up new traders, such as how to get to grips with MT4 and MT5. Detailed guides and manuals are provided to help traders navigate and use trading platforms like MT4 and MT5 effectively, enabling them to maximize the tools at their disposal.

ActivTrades offers a comprehensive set of features that will suit the expert trader and institutional investor. It has keenly developed, market-leading tools, and a pleasing selection of choice within its product basket. Professional and institutional traders especially will feel at home with the wide range of quality products on offer.

Final Thoughts

While testing this broker's platform, I found that it creates a high-end offering from a set of simple, accessible, and streamlined tools and products. Professional and institutional traders will love the deep liquidity, rapid execution, and attractive volume rates. Beginner traders may be less enthused by the lack of focus on their specific needs. While beginner traders may find the platform's educational resources beneficial, its advanced tools and features are particularly suited to more experienced traders.

ActivTrades has solid market access and a powerful centralized account to make the most of its chosen trading platforms. For traders in need of advice, they will find a good selection of resources in video and written formats that help them close any knowledge gaps they may have.

Clients can choose between the dependable MT4 or MT5 for desktop and mobile, or ActivTrades’ proprietary ActivTrader platform, which is web-enabled and requires no download. If they need help, traders can access quality support through multiple channels.

Conclusion

In my view, customers of this broker will find a long-established, well-regulated firm that is continually improving its products and clients' trading experience. With intuitive, immersive platforms, ample insightful market analysis, and trading signals, clients will find a home here. Fees are competitive, and the broker strives to improve everything in its stable, from execution speeds, platform robustness, and research capabilities. ActivTrades is a broker that is consistently getting better.

Review Methodology

The team at Arincen collected over 120 pieces of data covering in excess of 100 licensed FOREX companies. Data collection was done in three ways:Companies’ websites.

Other websites that have ranked FOREX companies.

A survey questionnaire (referred to here as Survey “1”) we had sent to the companies invited to participate in the exercise.

We have identified 12 criteria for our assessment, each containing several aspects and carrying its own relative weight. These include licensing, deposits and withdrawals, number of assets etc.

Afterward we validated the data by:

Registering with FOREX companies as a secret shopper and/or as Arincen.

Survey number “2,” in which we asked these companies’ customers for important feedback and past experience.

The next step saw us evaluate and rank each company, relying on the hard work of 15 Arincen employees. We were very careful in ensuring the most accurate assessment possible, including taking into account different languages, as well as the various mobile-app operating systems, e.g., Apple, Samsung etc.

To add credibility to our research project, we sent a final and third survey (referred to here as Survey “3”) to enable participating FOREX companies evaluate our own research and whether it accurately reflects the realities on the ground. We were fortunate enough to receive a mark of 9.9 out of 10! We have kept to a minimum the margin of error, which stood at a measly 1%. To learn more on how we came up with the evaluation, please click here.

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

FAQ

ActivTrades is a regulated broker offering Forex, CFDs, commodities, indices, ETFs, and cryptocurrencies through MT4, MT5, and ActivTrader.

Yes, ActivTrades is regulated by the FCA (UK), SCB (Bahamas), and CSSF (Luxembourg), with client funds held in segregated accounts.

There is no minimum deposit, except for clients in China and Brazil, who require a $500 deposit.

FOREX, stocks, indices, and commodities are commission-free.

ActivTrades provides ActivTrader, MT4, and MT5, all available on desktop, web, and mobile.

Yes, ActivTrades offers a free demo account to practice trading strategies with virtual funds.

Yes, ActivTrades ensures that traders cannot lose more than the funds in their account.

You can deposit and withdraw via bank transfer, credit/debit card, e-wallets (like Skrill and Neteller), and cryptocurrency.