IC Markets Review 2026

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

IC Markets Evaluate - research result

Key Takeaways

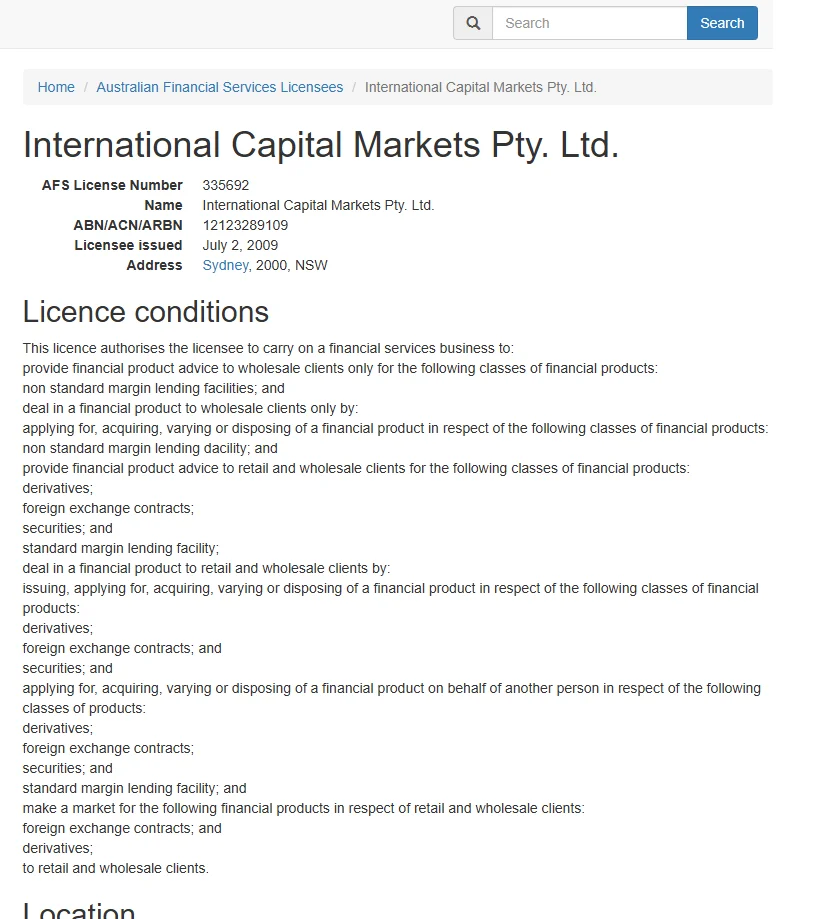

IC Markets was founded in 2007 and is headquartered in Australia.

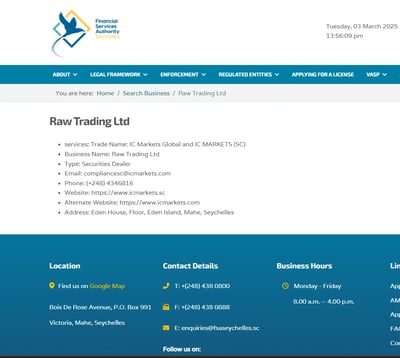

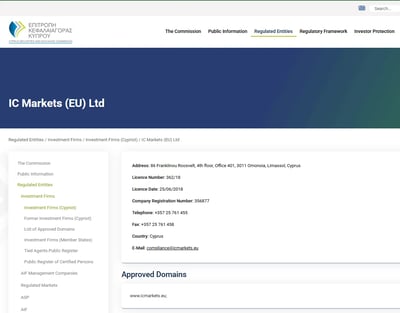

The broker operates under three key entities: International Capital Markets Pty Ltd,, regulated by the Australian Securities and Investments Commission (ASIC); IC Markets (EU) Ltd , regulated by the Cyprus Securities and Exchange commission (CySEC); and Raw Trading Ltd,, regulated by the Financial Services Authority (FSA) in the Seychelles.

Clients under IC Markets (EU) Ltd are protected by the Investor Compensation Fund (ICF), which offers up to €20,000 in compensation per eligible account. Raw Trading Ltd provides private indemnity insurance of up to $1 million. There is no compensation protection for clients under the ASIC-regulated entity.

IC Markets provides CFD access to over 2,250 tradable instruments across such asset classes as FOREX, indices, commodities, stocks, bonds, cryptocurrencies, and futures.

IC Markets offers extremely competitive pricing, with spreads as low as 0.002 pips on selected commodities and 0.8 pips on EUR/USD, and low commissions.

There are no deposit or withdrawal fees charged by the broker, and no inactivity fees.

Execution speeds are bolstered by servers hosted in New York (Equinix NY4) and London (Equinix LD5), making the broker suitable for high-frequency and algorithmic traders.

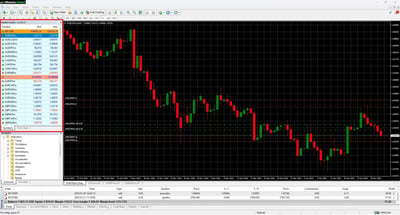

Clients can access the MT4, MT5, and cTrader platforms via desktop, web, and mobile. There is no proprietary trading platform.

IC Markets offers a swap-free (Islamic) account option for traders who require Sharia-compliant trading conditions.

The broker operates on a raw-spreads model, with no requotes or price manipulation, appealing to traders using automated and high-volume strategies.

Last Reviews

Overall Summary

I researched this broker with the goal of giving your detailed information on whether it would be a good fit for your trading needs. Founded in 2007 and headquartered in Australia, IC Markets has built its reputation on providing ultra-tight spreads and high-speed execution for active traders. With a raw-spread model that starts from 0.0 pips, the broker aims to attract scalpers, algorithmic traders, and high-frequency trading strategies by offering one of the most competitively priced trading environments in the market.

The broker uses Equinix NY4 (New York) and LD5 (London) data centers to host its trade servers, which are directly connected via fiber optic infrastructure to top-tier liquidity providers. This setup allows for low-latency execution and deep institutional-grade liquidity, a cornerstone of IC Markets’ technology-driven approach.

Traders will be pleased to know that all trading styles are welcome, like scalping, hedging, and automated trading. These are all fully supported across all account types. IC Markets does not impose any trading restrictions, making it especially appealing for expert advisors and bot traders.

I came to learn that clients can trade over 2,250 CFD instruments using the MT4, MT5, and cTrader platforms, available on desktop, web, and mobile. These platforms are complemented by such built-in tools as a spread monitor, risk calculator, and advanced order types for greater control over trades.

IC Markets is regulated by ASIC, CySEC, and the Seychelles’ FSA, providing protection in many jurisdictions. Clients under the EU entity are covered by the Investor Compensation Fund up to €20,000, while those under Raw Trading Ltd in Seychelles benefit from private indemnity insurance coverage up to $1 million.

I found IC Markets to deliver an institutional-grade trading experience for retail traders, combining sharp pricing, strong execution, and regulatory depth in a seamless package.

Yes, IC Markets is widely thought of as a safe broker, regulated by top-tier authorities like ASIC and CySEC, and follows strict financial standards, including fund segregation and negative balance protection. However, client protection varies by jurisdiction, with fewer safeguards for accounts held under the Seychelles entity.

Is IC Markets Safe?

In my opinion, IC Markets is a safe broker to trade with. It is regulated by two Tier-1 regulators: ASIC and CySEC. These top-tier regulatory bodies ensure that IC Markets adheres to strict financial standards, including the segregation of client funds and providing negative balance protection for certain entities.

Also, IC Markets has a long track record since its founding in 2007, pointing to the fact that it is stable in the financial markets. However, you should note that the level of protection varies depending on the regulatory entity under which your account is held, with less stringent protections available through its Seychelles entity.

How IC Markets Protects You from Reckless Leverage and Margin Trading

Many irresponsible brokers offer high leverage that can ruin uninformed traders. Leverage is a double-edged sword in trading, and IC Markets shows awareness of this by structuring its offerings to match regional regulatory frameworks.

How you are protected

During my research, I found that IC Markets offers varying levels of leverage and margin depending on the entity under which you register. While leverage can go as high as 500:1, particularly under the Seychelles entity, protections are built in for traders operating under the CySEC-regulated EU entity.

Here, traders are subject to leverage restrictions mandated by ESMA, typically capped at 30:1 for major FOREX pairs. This cap is designed to reduce the risk of rapid losses due to overexposure. Moreover, IC Markets provides negative balance protection for retail clients under EU regulations, ensuring that clients cannot lose more than their deposited funds—even in volatile market conditions.

Regulation and other security measures

For those trading under Raw Trading Ltd (Seychelles), IC Markets has arranged private indemnity insurance covering up to $1 million per account, providing a safety net where regulatory compensation doesn’t apply. Additionally, IC Markets segregates client funds in top-tier banks, preventing the misuse of customer assets and offering an added layer of operational security.

Top broker features

Low spreads and fees: IC Markets offers some of the lowest spreads in the industry, starting at 0.0 pips for Raw Spread accounts, combined with competitive commissions.

Diverse trading platforms: The broker supports MT4, MT5, cTrader, and TradingView, making up for the lack of its own proprietary platform

Wide range of instruments: IC Markets provides access to over 2,250 instruments, including FOREX, commodities, indices, share CFDs, bonds, cryptocurrencies, and futures CFDs.

Regulatory oversight: As mentioned, the broker is regulated by Tier-1 authorities, ensuring compliance with strict financial standards.

Free VPS Hosting: For traders using automated strategies, IC Markets offers free Virtual Private Server (VPS) hosting, thus allowing for low-latency trading and faster execution speeds.

Social and copy trading: IC Markets integrates platforms like ZuluTrade, Myfxbook AutoTrade, and IC Social, allowing traders to follow and replicate successful strategies, perfect for those into passive trading.

Is IC Markets Safe?

I believe IC Markets is well-suited to active, high-frequency, and algorithmic traders thanks to its ultra-low spreads, fast execution, and support for scalping, hedging, and automated trading with no restrictions.

That said, the broker also delivers a good experience for intermediate traders and well-informed beginners who are ready to move beyond entry-level platforms and are looking for an institutional-grade trading environment.

With support for MT4, MT5, TradingView, and cTrader, IC Markets gives you a flexible, professional-grade platform lineup across web, desktop, and mobile.

So, whether you’re a hands-on discretionary trader or running automated strategies, IC Markets offers the low-cost, fast-access infrastructure you need—just be sure to select the right regulatory entity based on your protection needs.

Here are the pros and cons of using this broker:

-

Ultra-low spreads starting from 0.0 pips on Raw Spread accounts

-

No restrictions on trading strategies – scalping, hedging, and automated trading are fully supported

-

Excellent execution speed, with servers hosted at Equinix data centers in New York (NY4) and London (LD5)

-

Access to over 2,250 CFDs across FOREX, indices, commodities, stocks, cryptocurrencies, bonds, and futures

-

Choice of professional-grade platforms, including MT4, MT5, TradingView, and cTrader

-

No deposit, withdrawal, or inactivity fees, with the broker covering most associated transaction costs

-

Multijurisdictional regulation, including ASIC, CySEC, and FSA

-

Swap-free Islamic accounts available for traders who require Sharia-compliant trading

-

No investor compensation protection for clients under ASIC and Seychelles-regulated entities

-

No proprietary trading platform

-

Lack of tier-one regulation in major financial hubs outside of Australia and the EU

-

Educational resources are basic, especially when compared to similar-sized brokers

Offering of Investments

IC Markets offers a wide range of financial assets, allowing clients to trade across multiple markets and align with various strategies. Traders can access 61 FOREX pairs, including majors, minors, and exotics, as well as global indices, precious metals, energies, and agricultural commodities. The broker also provides over 2,100 share CFDs, 21 cryptocurrency CFDs, and bond instruments from the US and Europe. Additionally, IC Markets offers futures CFDs on key indices and commodities.

From my research perspective, I found that a diverse range of financial assets allows IC Markets clients to trade across multiple markets and asset classes, catering to various trading strategies and preferences.

FOREX

Minor, major, and exotic currency pairs (61 pairs in total), including EUR/USD, GBP/JPY, AUD/USD, USD/CHF, and USD/JPY.

Indices

US 30, Germany 40, France 40, Canada 60, and South Africa 40 are typical of the Global stock indices available when trading with this broker.

Commodities

Metals: Gold, Silver, Palladium.

Energy: Crude Oil (Brent and WTI).

Agriculture: Wheat, Sugar, Corn, Coffee.

Share CFDs

Over 2,100 share CFDs from major markets like the US, Europe, and Asia, including Apple, Tesla, Intel, Coca-Cola, Siemens, Allianz, and Heineken.

Cryptocurrencies

21 crypto CFDs, including Bitcoin, Ethereum, Ripple, Litecoin, Solana, and Cardano.

Bonds

Bonds from Europe and the US, such as UK Long Gilt, US T-Note 10 Yr, Euro BTP Italian 10 Yr.

Futures CFDs

Futures contracts on indices and commodities, including ICE Dollar Index, CBOE VIX Index, Brent Crude Oil, and WTI Crude Oil.

Available assets

| Markets | Available | Number of Assets |

| Currency Pairs | 61 | |

| Stocks | 2100 | |

| Commodities | 20 | |

| Crypto | 21 | |

| Indices | 25 | |

| ETFs |

Account types

IC Markets provides three main account types—Standard, Raw Spread (MetaTrader), and Raw cTrader—each tailored to different trading styles and experience levels, with a minimum deposit of $200. All accounts support major base currencies (USD, EUR, GBP), allow scalping and automated trading, and are available in Islamic swap-free versions upon request. The Standard Account is commission-free with spreads from 0.8 pips, while the Raw Spread and Raw cTrader accounts offer tighter spreads from 0.0 pips.

In my view, IC Markets offers a streamlined selection of account types designed to suit traders of various experience levels and strategies. All accounts come with a minimum deposit requirement of $200 and offer access to the full suite of trading platforms (MT4, MT5, and cTrader). Traders can choose among USD, EUR, and GBP as their base currency, and Islamic (swap-free) versions are available for each account type.

Each account supports demo versions, making it easy for new traders to get a feel for the platform before committing real capital. IC Markets also supports tight risk management by setting a margin call level at 100% and a stop-out level at 50% across all accounts.

Standard AccountThis account is commission-free and is ideal for casual traders who prefer simplicity. Spreads start from 0.8 pips, and there is no commission on trades. It supports all trading styles, including Expert Advisors (EA), hedging, and scalping. It's a good option for those who want a straightforward trading experience with predictable costs.

Raw Spread Account (MetaTrader)Tailored for high-frequency traders, scalpers, and users of automated trading strategies, this account type charges a commission of $7 per round turn per standard lot traded. It offers ultra-tight spreads starting from 0.0 pips. Execution is precise and fast, powered by servers located in New York and London.

Raw cTrader AccountThis account is nearly identical to the Raw Spread account but is designed for traders who prefer the cTrader platform. It offers slightly lower commission fees at $6 per round turn per standard lot, with spreads also starting from 0.0 pips. It’s well-suited for day traders and scalpers who want a modern interface and access to advanced order types.

Islamic AccountAll three account types can be converted into Islamic accounts upon request. These accounts are swap-free, complying with Shariah law. Instead of overnight swap charges, a flat commission may be applied if a position is held overnight.

Account types

| Account Type | Minimum Deposit | Spread Commission | Commission | Swap Commission | Deposit Commission | Withdrawal Commission |

|---|---|---|---|---|---|---|

| Standard account | $200 | Starting from 0.8 pips | $0 | Yes | $0 | $0 |

| Raw account | $200 | Starting from 0.0 pips | $3.5 | Yes | $0 | $0 |

| cTrader account | $200 | Starting from 0.0 pips | $3 | Yes | $0 | $0 |

Account opening

Opening an account with IC Markets was straightforward and fully digital, ensuring a quick and user-friendly experience.

What is the minimum deposit at IC Markets?

The minimum deposit required to open a live trading account with IC Markets is $200 across all account types. This applies to the Standard, Raw Spread (MetaTrader), and Raw cTrader accounts. It's a flat requirement regardless of the platform or account style you choose.

How to open your account

Start by visiting the IC Markets website and clicking on “Create an Account.” After filling in your personal information, you can select your account type and base currency.

Choose the type of account you want to open and select your preferred base currency. The broker will then ask you to answer questions about your trading experience and financial background to help IC Markets understand your trading needs.

Once these steps are completed, your account will be reviewed and typically approved within one business day. You can then proceed to fund your account and start trading. The minimum deposit required to open an account is $200, making it accessible for most traders.

Deposits and Withdrawals

IC Markets offers a wide range of free deposit and withdrawal methods, including bank transfers, credit/debit cards, PayPal, Neteller, Skrill, and more. All transactions must be made from accounts in the trader’s name, and while IC Markets does not charge fees, third-party banking charges may still apply. Most withdrawals are processed within 24 hours, offering fast and flexible fund management.

IC Markets offers a variety of deposit options, all free of charge. Processing times vary depending on the method chosen. Deposits and withdrawals can only be made from accounts in the trader's name.

Third-party banking fees may apply for certain transactions. IC Markets provides a wide range of payment options, ensuring convenience and flexibility for its clients.

Account base currencies

IC Markets offers a wide selection of 10 base currencies for its trading accounts. These include:

● USD (United States Dollar)

● EUR (Euro)

● GBP (British Pound)

● AUD (Australian Dollar)

● SGD (Singapore Dollar)

● NZD (New Zealand Dollar)

● JPY (Japanese Yen)

● CHF (Swiss Franc)

● HKD (Hong Kong Dollar)

● CAD (Canadian Dollar)

IC Markets deposit fees and options

All IC Markets deposits are executed free of charge. Here are the deposit methods:

● Bank Transfer

● Credit/Debit Card

● PayPal

● Neteller

● Skrill

IC Markets withdrawal fees and options

Withdrawal processing times are generally quick, with most methods completed within 24 hours. IC Markets provides free withdrawals for all methods, with processing times varying by method. Below are the available options:

● Bank Transfer

● Credit/Debit Card

● PayPal

● Neteller

● Skrill

| Method | Credit Card | Wire Transfer | Skrill | Neteller | Cryptocurrency | PayPal | Apple Pay |

| Deposit fee | $0 | $0 | $0 | $0 | $0 | Unavailable | Unavailable |

| Withdrawal fee | $0 | $0 | $0 | $0 | $0 | Unavailable | Unavailable |

Customer Support

IC Markets provides responsive, multilingual customer support 24/7 through live chat, email, and a detailed Help Center. While agents are quick to reply—especially via live chat—some answers may lack depth, making the Help Center a valuable backup for common queries.

IC Markets offers multilingual customer support that is available 24/7 through various channels. The broker’s customer support is reliable and accessible, making it suitable for traders who may need assistance at any time.

Using a secret shopper method, I established that IC Markets agents are knowledgeable and respond quickly, though answers may not always be comprehensive. Live chat is particularly fast, with agents connecting within seconds after navigating the automated bot.

While the support team is responsive, live chat may occasionally experience delays in providing detailed answers. The Help Center is a useful resource for resolving common issues without contacting support.

| Live Chat | Phone | |||

| Available | Available | Available | Available | Unavailable |

| Quick response | Moderate | Moderate | Moderate | Unavailable |

Commissions and Fees

IC Markets offers a transparent and cost-effective fee structure suited to both new and experienced traders. Spreads are highly competitive, with Standard account EUR/USD spreads averaging 0.8 pips—faring well against the industry norm—while Raw accounts offer spreads from 0.0 pips with low commissions. Swap fees apply to overnight positions, though traders can opt for swap-free Islamic accounts across all account types. There are no inactivity, deposit, or withdrawal fees.

I believe IC Markets has built a fee structure that is transparent, cost-effective, and tailored for both beginners and experienced traders alike. Here’s a detailed breakdown of IC Markets’ commissions and fees:

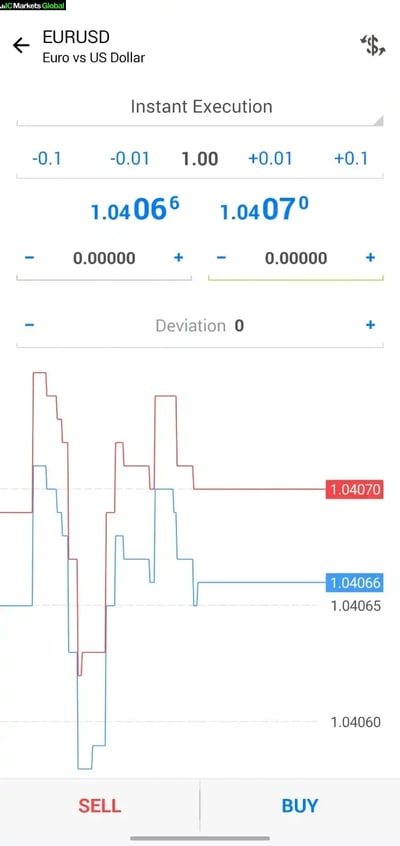

Spreads

IC Markets delivers extremely competitive spreads across its range of instruments. For example, I performed live spread tests on EUR/USD and received spreads of 0.8 pips during both London and New York sessions. Spreads are especially low for currency pairs, share CFDs, indices, and cryptocurrencies.

Commissions

IC Markets offers three main account types:

Standard Account: Commission-free, with spreads starting from 0.8 pips.

Raw Spread Account (MetaTrader): Commission is $3.5 per side (or $7 round turn) per 100,000 traded units, with spreads from 0.0 pips.

cTrader Raw Spread Account: Commission is $3.0 per side (or $6 round turn), with spreads also from 0.0 pips.

These fees place IC Markets below or on par with industry standards, and its structure benefits high-frequency or high-volume traders, especially in the Raw accounts.

Swap fees and Islamic accounts

Swap fees apply to overnight positions. For example, a long EUR/USD position incurs a $6.25 charge, while a short position earns a $2.56 credit. IC Markets' overnight charges are rated low-to-average across the board. The broker also offers swap-free Islamic accounts for traders who comply with Shariah law, across all account types.

Inactivity fee

There are no inactivity fees at IC Markets. This is ideal for traders who operate seasonally or sporadically, as they won’t be penalized for periods of inactivity.

Other commissions and fees

IC Markets does not charge deposit, withdrawal, or account maintenance fees. Traders should note, however, that third-party banking fees may still apply depending on their payment method or financial institution.

| Spread | Commission | Swap | Islamic Account | |

| Currencies | Starting from 0.8 Pips | $0 | No | Available |

| Stocks | Not Mentioned | $0 | Yes | Available |

| Commodities | Starting from 0.002 Pips | $0 | Yes | Available |

| Indices | Starting from 0.14 Pips | $0 | Yes | Unavailable |

Platforms and Tools

IC Markets does not offer its own proprietary platform but supports a robust suite of third-party platforms, including MT4, MT5, cTrader, and TradingView, catering to both beginners and advanced traders. Each platform supports manual and automated trading, with features like advanced charting, algorithmic tools, and social or copy trading through services like ZuluTrade and IC Social. While the mobile platforms are intuitive and well-designed for basic trade management, they lack enhanced security features like two-factor authentication and don’t support alerts or notifications.

IC Markets does not offer a proprietary trading platform. All platforms are compatible with both manual and automated trading strategies. Mobile versions of the platforms are primarily useful for managing existing positions or manually opening new trades.

IC Markets' trading platforms cater to a wide range of trading styles, making it an excellent choice for both beginner and advanced traders. Below are the details of the platforms:

Platforms types

MT4:

Easy order execution and basic technical analysis. Supports automated trading via EAs) Available for desktop, web, and mobile (iOS and Android). Offers 30+ technical indicators and multiple timeframes.

Best For: Beginner traders and those using automated trading strategies.

MT5:

Advanced version of MT4, with additional tools like market depth and alarm settings. Supports multi-asset trading, including FOREX, stocks, and commodities. Enhanced strategy tester for algorithmic trading. Available for desktop, web, and mobile (iOS and Android).

Best For: Advanced traders and those seeking multi-asset trading.

cTrader:

Advanced technical analysis tools and customization options. Integrated copy trading via cTrader Copy. Supports automated trading through cAlgo. Available for desktop, web, and mobile (iOS and Android).

Best For: Day traders, scalpers, and algorithmic traders.

TradingView:

Renowned for its "Supercharts" and advanced technical analysis tools. Supports social trading and backtesting. Available for desktop and web.

Best For: Social traders and those who prioritize charting capabilities.

Additional Tools and Plugins:

A suite of 20+ tools for enhanced trade execution and management. Includes advanced market data and alarm settings.

Autochartist: Provides actionable trading signals and market analysis.

Trading Central: Offers technical analysis and market sentiment data.

VPS Hosting:

Free VPS hosting for traders completing at least 15 standard lots per month. Reduces latency for faster execution speeds (below 5 milliseconds).

Best For: High-frequency and algorithmic traders.

Social and Copy Trading Platforms:

ZuluTrade: Allows traders to follow and copy successful strategies.

IC Social (Powered by Pelican Exchange): Mobile-only app for social trading.

Signal Start: Platform for social and copy trading.

Look and feel

IC Markets offers a well-designed and user-friendly mobile trading platform through MT4. The interface is sleek and intuitive, with easily accessible features and responsive navigation, which makes it suitable for both beginners and experienced traders. The platform is available in multiple languages, including Arabic, Chinese, Spanish, and more.

Login and security

Security on IC Markets' mobile platform is somewhat limited. It only offers a one-step login process, without two-factor authentication (2FA) or biometric login options like fingerprint or facial recognition. While functional, the absence of enhanced security measures is a drawback that the broker should consider addressing.

Search functions

The search functions on the mobile trading platform are effective and straightforward. Users can find assets either by typing the asset name directly or by navigating through categorized folders. This makes locating instruments easy and efficient.

Placing orders

IC Markets supports a variety of order types, including market, limit, and stop-loss orders. Traders can also set order time limits like Good 'til Cancelled (GTC) and Good 'til Time (GTT), providing flexibility for different trading strategies and time horizons.

Alerts and notifications

Unfortunately, alerts and notifications cannot be set on the mobile platform. This feature is only available on the desktop version of the MetaTrader platforms. Traders who rely heavily on mobile trading may find this limiting, especially if they require real-time updates on price movements or order executions.

Mobile Trading

IC Markets offers mobile trading apps for all its supported platforms—MT4, MT5, cTrader, TradingView, and IC Social—giving traders access to markets and position management while on the move. While each app is well-designed and supports core trading functions like placing market, limit, and stop-loss orders, mobile platforms are best used for monitoring trades rather than running complex algorithms. Features like multiple timeframes, technical indicators, and copy trading are available, though mobile security is limited to a basic one-step login without 2FA or biometric authentication.

IC Markets provides mobile trading apps for all the platforms it supports, ensuring traders can manage their positions and access the markets on the go. Below are the details of the mobile trading offering I was able to test:

IC Markets' mobile trading offering is robust, providing access to all major platforms with essential features for trading on the go. However, it is best suited for monitoring positions and executing manual trades rather than advanced algorithmic trading.

Platforms

MT4:

User-friendly interface with basic technical analysis tools. Supports market, limit, and stop-loss orders. Includes 30+ technical indicators and multiple timeframes.Available for both iOS and Android.

Best For: Beginner traders and those using automated trading strategies.

MT5:

Advanced version of MT4 with additional tools like market depth. Allows traders to monitor and adjust open positions. Includes 30+ technical indicators and multiple timeframes. Available for both iOS and Android.

Best For: Advanced traders and multi-asset trading.

cTrader:

Advanced technical analysis tools and customization options. Integrated copy trading via cTrader Copy. Allows manual trading and position management. Available for both iOS and Android.

Best For: Day traders, scalpers, and algorithmic traders.

TradingView:

Renowned for its advanced charting tools and "Supercharts." Supports social trading and technical analysis. Available for both iOS and Android.

Best For: Social traders and those who prioritize charting capabilities.

IC Social (Powered by Pelican Exchange):

Mobile-only app for social and copy trading. Allows traders to follow and copy strategies from other traders.

Best For: Social and copy traders.

Look and feel

The mobile trading platform provided by IC Markets—powered by MT4—offers a modern, clean, and intuitive interface. It is easy to navigate, responsive, and well-suited to both novice and experienced traders. The platform supports multiple languages, enhancing accessibility for global users.

Login and security

Login on the mobile platform is single-step only. It lacks such more advanced features as two-step verification or biometric login options (like fingerprint or facial recognition). While functional, the absence of additional security layers may be a concern for users seeking enhanced protection on mobile devices.

Search functions

Search functionality is effective and user-friendly. Users can either type the name of the instrument or browse through categorized folders to locate specific assets. This dual-approach system simplifies the process of finding and adding new trading instruments.

Placing orders

Order placement through the mobile app is simple and well-supported. Traders can execute market, limit, and stop-loss orders, and apply order time limits such as GTC and GTT. This provides sufficient flexibility for mobile traders managing multiple positions or strategies.

Alerts and notifications

Alerts and notifications are not available on the mobile trading platform. This limitation means that users cannot set or receive push alerts about price movements or trade executions on their mobile devices. These functions are only accessible through the desktop version of MetaTrader.

Research and Development

During testing, I found that IC Markets delivers a good research experience by combining in-house insights with third-party expertise. Its research content is designed to cater to the needs of day traders and swing traders. One of the best aspects of this we found was its clear emphasis on actionable technical analysis.

The broker publishes multiple articles daily on its blog, covering technical and fundamental forecasts. Market sentiment updates, detailed chart analyses, and curated trading ideas from industry names like Autochartist and Trading Central round out its offerings.

Video content is an important part of IC Markets' research suite. You can access updates and technical rundowns through the broker’s YouTube channel, including a Web TV section and live trading sessions. Complementing this is the “IC Your Trade” podcast series, which offers on-the-go learning with expert commentary and broader market perspectives.

While the content quality has improved steadily year over year, it is particularly strong in technical depth. Traders looking for well-structured, visually supported, and frequent updates will find the research tools at IC Markets robust and highly usable.

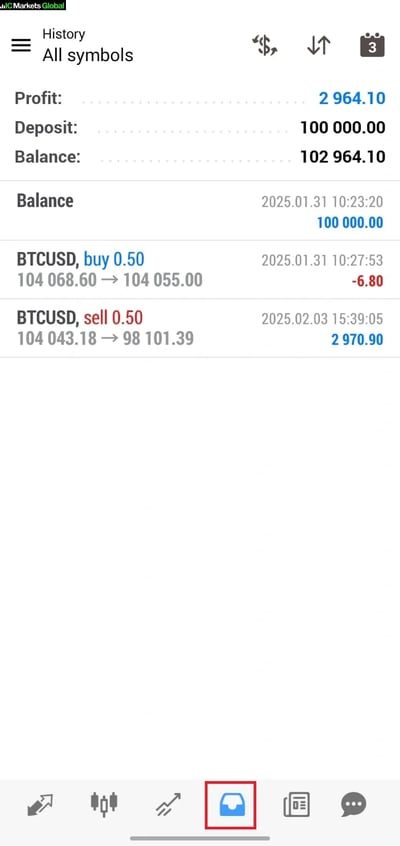

Trading statistics

IC Markets doesn’t provide traditional performance trading statistics directly on its platform (e.g., win/loss ratios or individual trader stats). However, it supports high-frequency and algorithmic trading, which inherently involves statistical backtesting and live performance tracking via integrated platforms like MetaTrader and TradingView.

Clients can use tools such as Autochartist and Trading Central for real-time chart analysis and pattern recognition, effectively giving them the statistical edge when building strategies. Additionally, VPS services are offered for free to traders executing at least 15 standard lots per month, supporting low-latency execution crucial for strategy testing and algorithm performance tracking.

Trading signals

IC Markets provides a robust ecosystem for trading signals and copy trading. Clients can access trading signals through several platforms:

MetaTrader’s native Signals Market

cTrader Copy, which allows users to follow and copy other traders

ZuluTrade, a well-known third-party platform offering autotrading strategies

Myfxbook AutoTrade, integrated for signal following

IC Social, a newer mobile-only social trading platform powered by Pelican Exchange and available in select jurisdictions.

Education

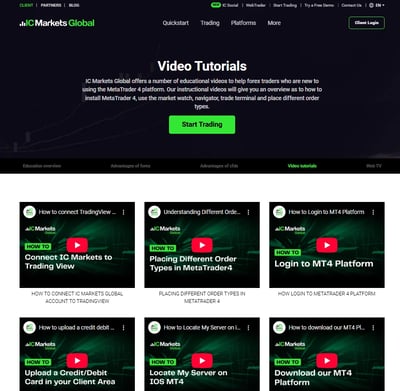

In my view, IC Markets offers a well-rounded educational experience that is particularly rich in video content. The broker has published over 250 webinars in multiple languages, including English, Arabic, Chinese, and Thai. These webinars span a wide spectrum of trading topics, from technical and fundamental analysis to trading psychology.

Beyond webinars, IC Markets maintains a comprehensive educational blog and provides an extensive glossary for quick reference. Traders can also access a series of platform tutorial videos to better understand the technical aspects of trading on MT4, MT5, and cTrader. The broker’s “IC Your Trade” podcast is another standout offering. It gives traders the ability to learn passively—on the go—by listening to expert discussions about the markets. This hands-off learning model is particularly useful for those who want to stay informed while managing a busy lifestyle.

Although the content is insightful and diverse, it lacks progress tracking or segmentation by experience level. These are features that other top-tier brokers often include, and IC Markets may improve its user experience by integrating them. Even so, the overall quality and breadth of educational resources make IC Markets a strong choice for traders seeking continuous learning.

IC Markets delivers a technologically advanced and cost-effective trading environment, with access to over 2,250 CFDs. The broker’s raw pricing model, multi-channel research, and broad regulatory footprint make it a dependable choice for traders seeking fast, fair, and flexible market access.

Final Thoughts on IC Markets

IC Markets is a well-established broker offering a blend of regional compliance and global accessibility. The broker delivers on its promise of low trading costs, with spreads and commissions, depending on the platform.

Traders gain access to over 2,250 instruments, including FOREX, commodities, indices, shares, cryptocurrencies, and futures, across MT4, MT5, and cTrader.

Its education and research tools, bolstered by Autochartist, Trading Central, Web TV, and the IC Your Trade podcast, provide actionable insights and continuous learning opportunities. Copy trading through ZuluTrade, Myfxbook AutoTrade, and cTrader Copy enhances versatility for traders at all levels.

All in, IC Markets offers a strong, low-cost trading environment backed by smart technology, institutional-grade liquidity, and useful trader resources—making it a top choice for serious retail traders worldwide.

Conclusion

After thorough testing, I'm of the opinion that IC Markets is a mature and globally active broker and has positioned itself as a preferred choice for high-frequency, algorithmic, and active traders by offering raw spreads from 0.0 pips, ultra-fast execution, and no restrictions on trading strategies like scalping or automated trading

Its trading infrastructure ensures low latency and consistent performance. While its educational resources lack tiered progression or interactivity, the broker compensates with strong research content and multiple copy trading options, including ZuluTrade, Myfxbook AutoTrade, and IC Social

Fees remain low and transparent, with no inactivity, deposit, or withdrawal charges, and accounts can be funded in 10 base currencies. The broker continues to refine its offering across platforms, execution, and research tools. With solid regulatory coverage and competitive pricing, IC Markets has proven it’s a broker committed to long-term client value.

Review Methodology

The team at Arincen collected over 120 pieces of data covering in excess of 100 licensed FOREX companies. Data collection was done in three ways:

Companies’ websites.

Other websites that have ranked FOREX companies.

A survey questionnaire (referred to here as Survey “1”) we had sent to the companies invited to participate in the exercise.

We have identified 12 criteria for our assessment, each containing several aspects and carrying its own relative weight. These include licensing, deposits and withdrawals, number of assets etc.

Afterward we validated the data by:

Registering with FOREX companies as a secret shopper and/or as Arincen.

Survey number “2,” in which we asked these companies’ customers for important feedback and past experience.

The next step saw us evaluate and rank each company, relying on the hard work of 15 Arincen employees. We were very careful in ensuring the most accurate assessment possible, including taking into account different languages, as well as the various mobile-app operating systems, e.g., Apple, Samsung etc.

To add credibility to our research project, we sent a final and third survey (referred to here as Survey “3”) to enable participating FOREX companies evaluate our own research and whether it accurately reflects the realities on the ground. We were fortunate enough to receive a mark of 9.9 out of 10! We have kept to a minimum the margin of error, which stood at a measly 1%. To learn more on how we came up with the evaluation, please click here.

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

FAQ

The minimum deposit is $200, which is considered low compared to other brokers that often require $2,000 or more.

IC Markets offers three account types: Standard Account: Commission-free with spreads starting at 0.8 pips. Raw Spread Account: Spreads starting at 0.0 pips with a $7 commission per round turn. Raw Spread cTrader Account: Spreads starting at 0.0 pips with a $6 commission per round turn.

Yes, IC Markets offers demo accounts that allow traders to practice trading in a risk-free environment and to test strategies before committing real funds.

IC Markets provides access to MT4, MT5, cTrader, and TradingView. These platforms are suitable for both beginner and advanced traders, offering features like technical analysis tools, automated trading, and social trading.

Yes, IC Markets is regulated by top-tier authorities such as ASIC (Australia) and CySEC (Cyprus). It ensures segregated client funds and offers negative balance protection for most entities, except its offshore entity in Seychelles.

IC Markets offers a wide range of tradable instruments, including FOREX (61 currency pairs) , Commodities (e.g., gold, oil), Stock CFDs (2,100+), Indices, Bonds, Cryptocurrencies, and Futures CFDs.

IC Markets does not charge fees for deposits or withdrawals. However, third-party processing fees may apply depending on the payment method used.

Yes, IC Markets offers mobile apps for MT4, MT5, cTrader, and TradingView, available for both iOS and Android. These apps allow traders to monitor positions, execute trades, and perform basic technical analysis on the go.