Table Of Contents

- What Is the Difference Between MT4 and MT5?

- Video explanation of how to use the MetaTrader platform

- How To Use MT4

- MT4 interface sections

- How to start trading with MT4

- How to enter a short position on MT4

- How to close a trade in MT4

- How to set stop-loss in MT4

- How to set orders by pips as default in MT4

- How to change the volume of a trade in MT4

- How to customize MT4 charts

- How to add indicators in MT4

- How to change a timeframe in MT4

- How to set up a price alert in MT4

- How to view your trade history in MT4

- How To Use MT5

- How to start trading with MT5

- How to place an order with MT5

- How to set stop loss and take profit in MT5

- Market analysis with MT5

- How to set indicators on MT5

- Fundamental analysis on MT5

- Customization on MT5

- Expert advisors

- The Bottom Line

What is Metatrader and How To Use MT4 and MT5

As a longtime trader, I am sure that no matter who your broker is or which trading platforms it uses, you have likely heard of MetaQuotes, the parent company of MetaTrader, which offers two primary trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

MT4 and MT5 have become staples in online trading for their user-friendliness, execution speed, and advanced tools. These two platforms have been around for many years, and although some of their services overlap, they were initially created for different purposes. MT4 was created in 2005 as a FOREX trading platform, while MT5 was released in 2010 as a complementary family tool that offered multi-asset trading.

Although MT4 was introduced as a FOREX-only tool, it has since been expanded to offer other instruments, like stocks, indices and commodities. MT5 was created from inception as a diversified trading tool. In this article, I will provide a helpful guide to getting started with each platform, along with an explanation of its key features.

In my experience, each trading platform can seem complicated at first, but with practice, you will learn to use its features. This guide is not exhaustive and cannot replace hands-on practice with MT4 and MT5, and I would encourage you to spend as much time as you need to attain mastery on these platforms, be that via demo trading or live trading. Further, your broker will likely offer bespoke versions of MT4 and MT5 that are aligned with your broker’s brand and functionality preferences. You will need to understand what those are.

MT4 is built for FOREX trading, but now supports stocks, indices and commodities as well

MT5 supports multi-asset trading including cryptos, bonds, futures and FOREX

Both platforms are free to download and widely supported by brokers worldwide

MT4 has a simpler layout ideal for FOREX traders, while MT5 offers more features and asset classes

Traders can set stop-loss, take-profit and volume levels directly in the order window on both platforms

MT5 offers more technical indicators and timeframes for advanced market analysis

You can automate trading on both platforms using Expert Advisors and custom scripts

Choosing between MT4 and MT5 depends on your asset preferences and how much complexity you want

What Is the Difference Between MT4 and MT5?

In my view, the main difference between the two platforms is that MT4 was originally a one-instrument platform geared toward FOREX traders. MT4 has since been expanded to offer trading in stocks, indices, and commodities. MT5 is the newer platform of the two and it came onto the scene as a platform designed to offer more diverse assets, like stocks, futures and cryptocurrencies.

MT5 is not a direct upgrade of MT4, but merely the result of the market’s requirement for a more comprehensive platform to cater to the increasing range of trading instruments. Today, while MT4 remains largely a FOREX platform, MT5 caters to FOREX, futures, options, stocks, bonds and cryptos.

The two platforms share near-identical branding and the same overall graphical interface, but this is unavoidable since they are part of the same product family. MT5’s initial role was to take on parts of the market that MT4 was not well-suited to handle.

Video explanation of how to use the MetaTrader platform

How To Use MT4

For the purposes of this guide, I will demonstrate how to trade FOREX on MT4. You can create an MT4 account with your chosen broker on Windows, Linux or Mac. MT4 also has a handy mobile app you can download on an Android or iPhone device.

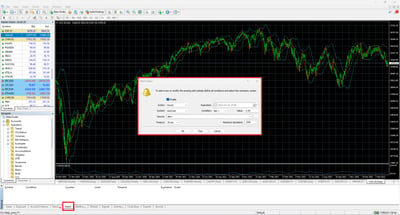

MT4 interface sections

Bear in mind that your broker may have asked MetaQuotes to make subtle changes to the version of MT4 it offers on its platform. However, the agnostic version of the MT4 platform is built as follows.

1. The menu: All MT4 actions are contained in this overall view.

2. The toolbar: Here, traders can find some of the most common functions, like adjusting timeframes, selecting technical tools, customizing a chart’s look and feel and more.

3. Market watch: Here you will find all available assets listed. You can also customize the assets you want to display.

4. The navigator: Primarily a source of all your account information, you can also find access to indicators, scripts and more.

5. The terminal: This is where you can find your active trades and positions that need to be managed. You can also locate your account history and streaming market news and analysis. This is also where you will find third-party add-ons.

6. The chart workspace: This is your main workspace, and it is the place you will carry out all your technical analysis. You can change the appearance to the layout so that it suits you.

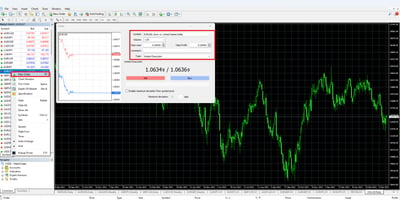

The MetaTrader interface and especially its “Order” window can seem complex at first. These are the main elements you will need to get used to (note these terms largely apply to both MT4 and MT5):

Symbol – This easy drop-down menu is where you choose the market in which you want to trade.

Volume – This refers to the number of contracts you want to trade.

Stop loss – This is where you can insert your stop-loss level according to your trading strategy.

Take profit – This is where you insert the threshold at which you want to lock in profits.

Comment – Here you can leave a comment or reminder relating to how you want to manage the trade.

Type – You can select the type of action that must happen to your order, such as instant execution, buy, sell or pending order.

How to start trading with MT4

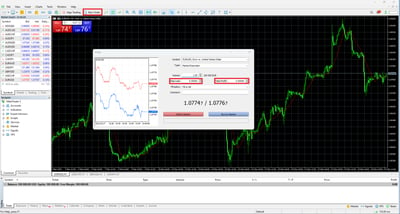

In my experience, the easiest way to open a trade in MT4 is to utilize the “Order” window to place an immediate market order on the “Terminal” section of the interface. Select the currency pair you wish to trade by clicking “New Order” on the toolbar or pressing F9 to access an order window. Once an order window opens, you can easily buy and sell currencies, trade at the market bid/offer, enter your expected trade size in lots, and open the order type you want.

How to enter a short position on MT4

Going short is when you have chosen not to take up a long position. To go short, you simply need to mark a sell trade as “open.”

How to close a trade in MT4

To close a trade, select the “Trade” tab from the “Terminal” window. You will be able to view any open trades. Right-click on the order you wish to close and select “Close Order.”

How to set stop-loss in MT4

Within the “Order” window there are fields provided for you to enter a stop-loss level and a take-profit level. If you click on either the up or down arrow in the stop-loss field, the box will automatically populate with the current market price.

How to set orders by pips as default in MT4

If you add a stop-loss or a take-profit order when you open a trade, the standard functionality is for the order levels to be shown in absolute market levels. To change this, you can navigate to the “Trade” tab in the “Terminal” window and right-click to “Modify” or “Delete Order.” Here you can amend your order levels in terms of pips and not the current market price.

How to change the volume of a trade in MT4

When you open a trade, you must state your desired “Volume” in the “Order” window. You can alter the volume by opening another position in the same direction on the same market at a new price. Alternatively, you can lessen the volume by partly closing your position.

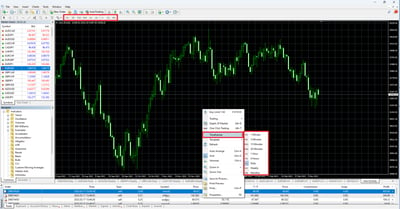

How to customize MT4 charts

You can use several tools to customize charts. MT4 allows you to draw on charts using a wide array of objects such as a cursor, crosshair, vertical line, horizontal line or trendline.

Recommended Brokers

How to add indicators in MT4

You can add indicators as Relative Strength Index (RSI), stochastic oscillator, Fibonacci Indicator, and Bollinger bands to charts. Drag the indicator from the “Navigator” window and drop it on your chosen chart to open the window and customize.

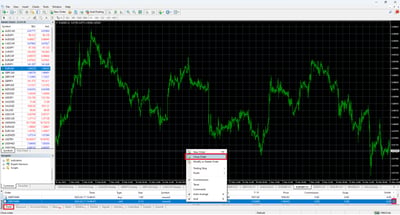

How to change a timeframe in MT4

To alter the time frame on a price chart, you will need to right-click on the chart, click “Timeframe,” and then select your desired option from the drop-down menu. Timeframes range from minutes to months.

How to set up a price alert in MT4

For price alerts, navigate to the “Terminal” window then go to “Alerts.” Right-click within this window and choose “Create” from the menu. This will summon the “Alert Editor” window where you can request your price alert according to your requirements.

How to view your trade history in MT4

To do this, open the “Terminal” window and go to the “Account History” tab where you can alter the date range by right-clicking in the window and choosing your custom periods, such as a month or three months.

In my view, there are many additional features you can use with this software. For example, you can save your work as a detailed report that could include items like drawdown and profit factor. You can select between thousands of indicators and add-ons. Indicators are technical analysis tools that are designed to help in your decision-making during your time on the markets. Examples are pivot points and order history. Add-ons help you customize the MT4 platform according to your own strategy, such as the ever-popular Expert Advisors.

How To Use MT5

MetaQuotes released the MT5 platform in 2010 as a complementary multi-asset platform to the wildly popular MT4. MT5 connects retail traders to multiple markets: stocks indices, cryptocurrency, commodities, FOREX and contracts for difference (CFD).

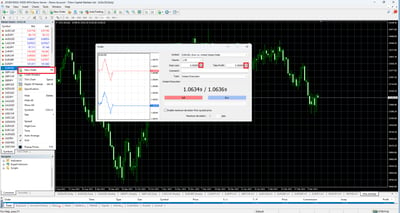

How to start trading with MT5

To open an order, select “New Order” on the toolbar at the top of the screen. You will see the “Order” window. Now you can set up an order the way you want.

How to place an order with MT5

The simplest way to open a trade in MT4 is to utilize the “Order” window to place an immediate market order on the “Terminal” section. Select the asset you wish to trade by going to the “Market Watch” window and clicking “New Order” on the toolbar. When the “Order” screen is open, you can select from either the Market Execution or Pending Execution order types. The MT5 platform has six pending order types as follows: Buy Stop, Sell Stop, Buy Limit, Sell Limit, Buy Stop Limit, and Sell Stop Limit.

How to set stop loss and take profit in MT5

You can insert stop-loss and take-profit orders on all your trades. A stop loss helps contain your maximum loss when the asset price does not go in your favor. A take-profit order allows you to book profits when the asset price moves your way. You can do this within the “Order” window.

Market analysis with MT5

MT5 has a powerful range of tools for users to perform detailed technical analysis on any asset that will help you isolate potential price patterns that have a probability of working in your favor. MT5 has 38 technical indicators, 44 graphical objects, and 21 timeframes. The “Chart” workspace is the best place for you to work with technical indicators.

How to set indicators on MT5

With MT5, you can deploy indicators and mathematical tools that help you make more sense of price action. Indicators are applied automatically on MT5 charts, and, for your convenience, they have been classified into various groups that denote their application. These groups include trends, oscillators, volume and custom indicators. You can also use graphical objects, such as geometric shapes, trading channels, Gann tools, as well as Fibonacci and Elliot tools, to assist with your analysis. You can also add your own custom tools on the MT5 platform. To access indicators, start by clicking on the “Toolbar” and selecting your desired indicator.

Fundamental analysis on MT5

With MT5, you can also study the way in which different economic, social and political factors affect the demand and supply forces of the asset you are trading. This is known as fundamental analysis, and you can do it in real-time on MT5 by going to the “Terminal”.

Customization on MT5

MT5 has been created with personalization in mind. You can personalize the look and feel of the platform, including choosing between the light and dark modes. More importantly, you can insert custom indicators and scripts.

Expert advisors

With MT5, you can deploy automated trading through Expert Advisors. The MQL5 programming language allows you to activate algorithms to execute trades automatically on your behalf. You can also carry out back testing and further analysis.

The Bottom Line

In my experience, choosing between MT4 and MT5 depends on what you want to trade most. MT4 is a powerful, market-leading FOREX learning platform with reliable, recognizable software. Once a FOREX-only tool, you can now trade stocks, indices, and commodities on MT4.

MT5 is more advanced and built to serve more markets, which has inevitably made it more feature-rich. As these two platforms belong to the same company, they share many aesthetic similarities. Still, there are enough subtle differences to warrant spending some time practicing on your platform of choice to make the most of it. Besides the differences between the two versions of the platform, you will also find that different brokers like to configure them according to their own tastes.

FAQ

No. MetaTrader platforms are free to download.

No. Having an MT4 login does not automatically allow you to access MT5, and vice versa, as the two platforms are not interchangeable in this way. You must have a separate login for each platform. Some brokers offer both platforms and can arrange for internal migration of your account details when you are ready.

No. There are no plans to phase it out. Several years ago, MetaQuotes said that it would be offering progressively less support for MT4, but this message does not appear to remain valid as the enduring popularity of the platform means it continues to enjoy full support.

In short, MT4 was built for FOREX trading but can now handle indices and commodities trading, while MT5 was built to trade other instruments like futures, options, stocks, bonds and cryptocurrencies, plus FOREX. The newer MT5 does not replace MT4, but merely offers trading access to a broader range of markets.

Each platform makes a compelling case. MT4 is very well regarded as a FOREX trading platform. It has a provable record of accomplishment and innovation and has shaped much of the FOREX trading landscape today. It also offers stocks, indices and commodities. MT5 caters to a broader market (FOREX included) and tries to take on the arduous task of providing a unified platform for several different markets with differing requirements.

Yes. You can trade FOREX in MT5, along with other instruments, like stocks, futures, bonds and cryptos.

With most brokers, you simply need to register for an account and, once approved, go to the MT4 or MT5 page on its Website, from where you can download your chosen platform. Some brokers offer a bespoke version of these MetaTrader platforms, complete with add-ons the broker feels most suit its approach. Other brokers only provide the agnostic versions.

MetaTrader platforms have been around for many years and are considered safe. Be sure to download MT4 and MT5 from official sources.

You need to download it from your broker, which should be free of charge but could be time- limited for a period, commonly for a month. Most brokers give you access with a simple sign-up process, while some require more information for Know Your Customer (KYC) and marketing purposes. New traders are advised to keep a trading journal, documenting what does and does not work.