IG Broker Review 2026

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

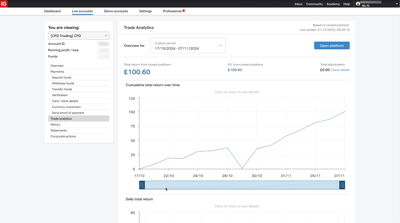

Evaluate IG - research result

Key Takeaways

IG Group is a comprehensive multi-asset broker and is one of the world’s premier brokers for Contract for Differences (CFD) trading across multiple assets.

IG Group offers multiple trading platforms through which more than 17,000 assets, spread across 11 categories, are available for trade.

IG Group is considered low-risk. The broker is a publicly traded company in London, operates a regulated bank and is authorized by six high-trust regulators.

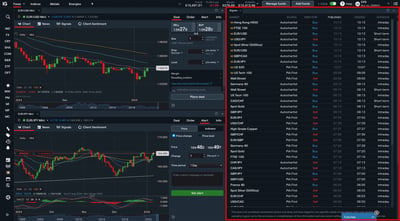

The broker operates multiple platforms, including its proprietary web-based platform, the L2 Dealer for Direct Market Access (DMA) trading, the retail-favorite MetaTrader 4 (MT4), the advanced ProRealTime platform, and TradingView.

Deposit and withdrawal options include bank wires, credit/debit cards, and e-banking deposits. The broker stopped accepting PayPal in the UK in 2024.

The minimum deposit is $250.

IG Group institutes a minimum spread for all its transactions.

IG Group uses its scale to provide traders with competitive pricing across the board, regardless of the product they trade.

For the most savvy traders seeking more significant discounts than those offered in the CFD Account, the DMA account is a powerful option.

IG Group's platform functionality is excellent and serves traders of all experience levels.

IG Group offers clients its IG client sentiment, an indicator that displays the long and short positions from IG traders across assets and can provide valuable insight into key trends.

IG Group gives traders a vast selection of excellent quality market research from both in-house and third-party providers.

Trading costs at IG Group are competitive, with spreads starting at 0.6 pips for major FOREX pairs.

Last Reviews

Overall Summary

If you are a sports fan, you may have seen the IG Group logo on the shirts of professional cycling, soccer, rugby, or cricket teams, especially in the UK. As a retail trader, you will likely know IG Group as one of the most recognizable broker brands out there.

Established in 1974 and headquartered in London, IG Group (referred interchangeably as IG Markets or simply IG) is a premier provider of online trading services, with access to over 17,000 financial markets through its family of brands. The company serves hundreds of thousands of clients globally and is publicly traded on the London Stock Exchange under the IGG ticker.

There are some numbers to back up the size of the broker, too. As of November 2024, IG Group's market capitalization stood at approximately £3.31 billion. The company freely branded itself as the “World’s No. 1 CFD provider,” which it based on “revenue from published financial statements, October 2023.” The company also laid claim to being the “Best Multi-Platform Provider and Best Platform for the Active Trader” as awarded at the ADVFN International Financial Awards 2024.

Operating in multiple regions, including the United States, EU, Australia, Singapore, South Africa, Switzerland, Japan, and Dubai, IG Group manages some 17 sales offices worldwide. The company offers a wide range of leveraged and investment products.

The company offers clients a navigable and well-organized website with fully disclosed services and fees, intuitive platform offerings, an unwavering dedication to client education, and valuable research tools. This comprehensive approach ensures clients have the resources and support to make informed trading decisions.

In this broker review, we will tell you everything you need to know about IG Group so you can consider it when looking for a trading broker.

IG Group is considered safe. The broker also has a verifiable track record of success and has gone the extra mile with regard to safety, as it segregates your trading funds with tier-1 banks and offers compensation to eligible traders, to mention just two security measures. It is regulated by entities like FCA, ASIC, and FINMA, to mention a few.

Is IG Group Safe?

Yes, IG Group is widely regarded as a low-risk broker. As a London-based publicly traded company listed on the FTSE 250, IG operates a regulated financial services company and is authorized by multiple tiers of global regulators. Note that IG Group has many subsidiary companies that operate in different parts of the world, and the regulators we are about to mention deal with the applicable IG subsidiaries in each country.

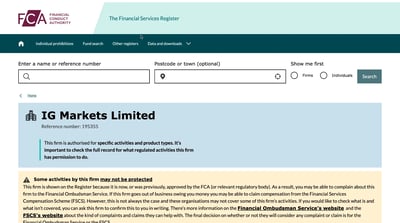

Its tier-1 regulatory authorizations include:

The Japanese Financial Services Authority (JFSA)·

The Monetary Authority of Singapore (MAS).

The UK’s Financial Conduct Authority (FCA).

The Commodity Futures Trading Commission (CFTC) in the U.S.

Other regulatory authorizations include:

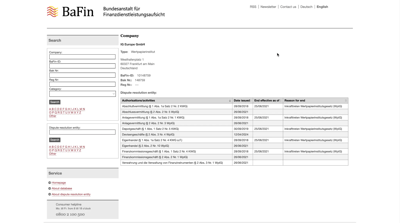

The German Federal Financial Supervisory Authority (BaFin) and Deutsche Bundesbank in Germany.

The Dubai Financial Services Authority (DFSA) in Dubai.

The Financial Sector Conduct Authority (FSCA) in South Africa.

The Monetary Authority of Singapore (MAS) in Singapore.

The Financial Markets Authority (FMA) in New Zealand.

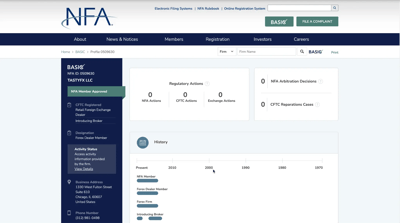

The Financial Industry Regulatory Authority (FINRA), Securities Investor Protection Corporation (SIPC), and National Futures Association (NFA) all in the U.S.

The Bermuda Monetary Authority in Bermuda.

How IG Protects You From Reckless Leverage and Margin Trading

Leverage and margin are two tools in the trader’s arsenal that, if misused, can lead to heavy losses for the trader. There are many irresponsible brokers who dole out high leverage that can ruin uninformed traders.

How you are protected

IG Group protects traders from the dangers of high leverage. Although requirements vary based on jurisdiction, retail traders still get tailored risk management options. For example, in the U.S., leverage is capped at 50:1 for major FOREX pairs, reflecting the conservative approach mandated by regulators.

European traders, by contrast, can access leverage up to 30:1 under ESMA rules, while Australian clients may trade with up to 30:1 leverage for major pairs under ASIC regulations. IG Group will not hesitate to implement margin calls to ensure traders maintain enough equity in their accounts, reducing the risk of forced liquidations and significant losses. The maximum leverage offered by this broker is 200:1, which can be accessed in regions overseen by Tier-2 and Tier-3 regulators.

Regulation and other security measures

If you choose IG Group as your broker, you benefit from a robust regulatory framework and client protection measures across all its international operations.

Client fund security is a top priority for IG, which complies with the FCA’s client money rules in the UK by segregating client funds from corporate accounts at regulated banks. In the unlikely event of insolvency, client funds are protected up to £85,000 through the Financial Services Compensation Scheme (FSCS).

Further, the broker guarantees that clients cannot lose more than their account balances under negative balance protection rules put in place in 2018 by the European Securities and Markets Authority (ESMA).

The company also emphasizes robust cybersecurity measures, including multi-factor authentication, biometric login options, and automatic session timeouts for inactive users. IG operates a counterparty dealing desk for clients with large accounts, allowing it direct access to the interbank system via a dedicated platform. Traders should be comforted by the fact that the broker adheres to the FX Global Code of Conduct and is aligned with top-tier global regulations. The risk of scammers is real, so these security measures should be a source of comfort.

For even further safety, IG Group offers guaranteed stop-loss orders (GSLO) to manage risks during extreme market events, such as the 2015 Swiss Franc shock. It should be noted that IG in the U.S. does not provide negative balance protection or GSLO, and client funds in the U.S. are not insured by the Federal Deposit Insurance Corporation (FDIC) or Securities Investor Protection Corporation (SIPC). However, U.S. traders who are not afforded negative balance protection due to regulatory differences still benefit from IG’s strict adherence to CFTC and National Futures Association (NFA) rules.

Top Broker Features

Along with all the regular features that any regular broker would offer, we should mention some top features that set IG apart.

Personalized watchlist: allows traders to find the currencies they want by name or symbol on IG’s app.

Bespoke app appearance: find your most frequent currency pairs on the home screen when you open the app.

IG Community: a vibrant social trading space with forums, blogs, and IG's internal TV channel access. As many as 80,000 IG traders visit the community.

Social trading signals: replicate the buy and sell strategies of other traders. If you want to learn more about Arincen's slant on signals, go here.

IG client sentiment.: real-time trading data from IG showing trader sentiment across key markets.

Real-time price alerts and push notifications: these allow you to stay informed about market movements without constant monitoring.

Tipranks integration: use this comprehensive research tool for more informed, data-driven decisions. The tool is easy to use and gives you "Analyst's consensus ratings" and a "Smart score." The tool covers markets in Australia, UK, U.S., Canada, Germany, Spain, and Singapore.

Overall, IG's extensive range of tradable assets, user-friendly platforms, and strong regulatory framework make it a compelling choice for traders seeking a reliable and comprehensive brokerage service.

For Whom Is IG Group Recommended?

IG is a large and versatile broker catering to a wide range of traders, from newbies to experienced professionals. Its comprehensive offerings make it particularly suitable for those interested in trading CFDs across various asset classes. As we have said, the company is the self-styled “Largest CFD broker in the world.”

IG Group CFDs can be used while trading FOREX, shares, indices, commodities, and cryptocurrencies. You should note that in the United States IG Group focuses only on FOREX trading, providing access to over 80 currency pairs. Here are some pros and cons you should think about:

-

Intuitive mobile and tablet platforms.

-

Low spread costs.

-

Client education offering extensive research materials.

-

Regulated by many reputable authorities.

-

UK and EU clients get negative balance protection.

-

Financially stable and publicly-listed.

-

Rapid response to customer service queries.

-

Extensive range of trading assets.

-

Powerful social trading community.

-

U.S. clients are limited to FOREX trading only.

-

U.S. clients do not receive negative balance protection.

-

IG CFD prices can be high by industry standards.

-

Limited product portfolio of only CFD and options in many countries.

IG is an excellent choice for both small traders and market professionals, with competitive spreads, thousands of trading instruments, and state-of-the-art news, research, and educational materials. At the same time, clients can choose from a variety of platform options and are able to easily upgrade as their accounts build equity. Further, professionals will appreciate the DMA offering that bypasses the dealing desk. New traders will love IG’s intuitive desktop and mobile platforms, while advanced traders will revel in the platform’s selection of indicators and charting tools.

Offering of Investments

IG Group is recognized as a broker offering a wide array of financial instruments in excess of 17,000 to accommodate various trading preferences. You can expect access to 80 FOREX pairs, multiple futures, many major world indices, commodities, crypto, stocks, and ETFs.

IG provides a comprehensive suite of investment products tailored to meet the diverse needs of traders across various regions. The availability of specific instruments may vary depending on the client's country of residence and the corresponding IG entity. Although we do our best to give you the most accurate number of financial assets offered, many brokers change their offerings regularly, while others do not publicize exactly how many specific assets they work with.

FOREX

IG offers access to over 80 currency pairs, including major, minor, and exotic pairs, facilitating 24-hour trading across global markets. The platform enables traders to capitalize on fluctuations in exchange rates. Although this is an IG review, there is a whole world of FOREX brokers out there, so be sure to do lots of research.

CFD stocks

Through CFDs, IG lets you speculate on the price movements of over 13,000 international shares without ever owning the underlying assets. This includes equities from major markets such as the U.S., U.K., and Hong Kong, to mention a few. You can trade with zero commissions and competitive spreads, and you can capitalize on both rising and falling markets by carefully monitoring support and resistance levels.

Regular stocks

Although known primarily as a CFD broker, IG also offers direct access to share trading on global stock exchanges, allowing you to buy and sell actual shares. The platform provides access to a vast array of stocks, including those listed on the London Stock Exchange, New York Stock Exchange, and NASDAQ, among others.

Click here to see more about regular and CFD stocks

Indices

With this broker, you can get access to as many as 80 major and minor global indices for CFD trading. Here are some of the indices on which you can trade with your IG account:

Major indices

Wall Street

US Tech 100

FTSE 100

Germany 40

France 40

Minor indices

Singapore Blue Chip

Emerging Markets Index

South Africa 40

Netherlands 25

Denmark 25

This is not an exhaustive list. Visit the broker's website to understand the full range of its services in this area. If you are stuck for how to choose which stocks to invest in, go to our helpful article here.

Commodities and metals

Commodities are what keep global trade going. With IG, you can trade many different types of commodities, including energy products like oil and natural gas, as well as precious metals such as gold and silver. By trading on these markets, you can unlock diversification and hedging opportunities against other asset classes.

Cryptocurrencies

According to IG's website, you can "...trade CFDs on 11 major cryptocurrencies, two crypto crosses and a crypto index - an index tracking the price of the top ten cryptocurrencies, weighted by market capitalization."

Bonds

The broker gives you the chance to trade in government and corporate bonds, giving you valuable exposure to fixed-income securities across a range of different countries. Some key bond markets you can access include the U.S., U.K., and European markets.

Options

Options trading involves speculating on the future price movements of different assets with defined risks. Options can be traded on indices, commodities, and FOREX pairs, providing flexibility in trading strategies.

Exchange-Traded Funds (ETF)

IG exposes you to a broad selection of ETFs, allowing you to invest in diversified portfolios of assets, including key sectors like technology, healthcare, retail, and emerging markets. This can give you targeted exposure to specific market segments.

Interest rates

Through IG's platform, you can speculate on changes in global interest rates, engaging with interest rate percentages based on central bank policies and economic indicators. This includes trading on interest rate futures and options, which is a good trading form to pursue if you stay on top of the news and understand economic indicators.

Regional Specifics

Products vary by region due to differing national regulations. For example:

EU

IG branches in this region provide turbo warrants, which are venue-traded (not over-the-counter) leveraged securities. The price of a turbo is tracked against an underlying financial asset on a one-for-one basis, and traders can use a turbo to go long or short.

U.S.

After being absent for some time, IG re-entered the U.S. in 2019, through its acquisition of tastytrade. IG U.S. offerings are focused exclusively on spot FOREX trading, providing access to over 80 currency pairs categorized into majors, minors, Australasian, Scandinavian, exotic, and emerging markets.

UK

Clients can access various products, including FOREX, CFDs, indices, commodities, cryptocurrencies, bonds, options, ETFs, industry sectors, and interest rates. Additionally, IG offers share dealing services, enabling direct investment in real stocks and ETFs.

UAE

Traders can invest in FOREX, regular shares, CFD shares, indices, commodities, and more. Retail clients benefit from negative balance protection. Professional clients can get up to 200:1 leverage while retail traders get 30:1. Clients can pay $0 commission on all U.S. shares up to 50 trades per month.

Professional and Institutional Services

IG caters to professional and institutional clients with services that exceed industry standards. All account levels can engage in long-term investments through IG Smart Portfolios, which include savings and retirement programs, as well as low-fee ETFs.

You should know that the availability of specific products and services may vary based on regional regulations and the chosen IG entity. Always consult the IG Group website or contact its helpful customer support for detailed information tailored to their location. That said, there is such a wide range of assets to trade with IG that you will always find something that fits your trading strategy.

Available assets

| Markets | Available | Number of Assets |

| Currency Pairs | 81 | |

| Stocks | 21714 | |

| Commodities | 39 | |

| Crypto | 11 | |

| Indices | 49 | |

| ETFs | 12858 |

Account Types with IG

IG Group gives you access to powerful CFD accounts, which provide access to a wide range of markets using leverage. Get a tax-free Spread-Betting Account if you live in the UK. Each of the aforementioned account types carries a minimum deposit is $250 or local equivalent.

Most traders using IG manage their portfolios through CFD accounts, offering leveraged access to a broad range of markets. UK-based clients have the added option of opening a tax-free Spread-Betting Account, a unique feature that allows profits to be free from capital gains tax. For both account types, the minimum deposit is $250, making it accessible to a wide range of traders. Although it should be noted that the broker mentions that in certain jurisdictions, brokers opening accounts and funding them with card payments (debit/credit), the minimum is US $50.

IG also provides traditional, non-leveraged products for long-term investors, such as share dealing accounts, Individual Savings Accounts (ISA), IG Smart Portfolios, and Self-Invested Personal Pensions (SIPP). Availability of these account types depends on where you live, and you may request professional status upgrades to access higher leverage and additional features.

Opening an account with IG is straightforward and designed to be user-friendly, even for newbies. The process can be completed entirely online, with IG's intuitive sign-up system guiding you through uploading identity verification documents and linking bank details to fund your accounts. Most users can open an account in just a few minutes using a phone, tablet, or desktop device.

We mentioned leverage earlier. You should be aware that different account types come with different leverage levels. Professional clients often enjoy higher leverage limits, but these accounts take a lot of work to get as you would have to prove that you either have an account with a massive balance or that you can prove that you are a vastly experienced trader.

Direct Market Access (DMA) account

The DMA account, known as FOREX Direct, is tailored for experienced traders seeking enhanced market transparency and potentially lower trading costs. This account gives you direct access to FOREX liquidity providers, allowing traders to view and interact with the order books of major banks and institutions.

Market Access: Traders can place orders directly into the market, allowing for greater control over trade execution and the ability to interact with market depth.

Platform Availability: FOREX Direct is accessible through IG's L2 Dealer platform, which is designed for advanced trading strategies and offers comprehensive market data.

Commission Structure: Unlike standard CFD accounts that incorporate costs into the spread, the DMA account works on a commission-based model. Commissions are charged per trade, with rates varying based on monthly trading volumes. For instance, higher trading volumes may qualify for reduced commission rates.

Minimum Deposit: A minimum deposit of £1,000 is required to open a FOREX Direct account. This ensures that traders have sufficient capital to engage in direct market trading.

Spreads and Pricing: Since trades are executed directly in the market, spreads can be tighter compared to regular accounts. However, you should account for the commission fees when evaluating overall trading costs.

Rebates: Traders achieving specific monthly trading volumes may be eligible for rebates. For example, trading volumes exceeding $100 million in a month could qualify for a 5% rebate, with higher percentages available for larger volumes.

Accounts types

| Account Type | Minimum Deposit | Spread Commission | Commission | Swap Commission | Deposit Commission | Withdrawal Commission |

|---|---|---|---|---|---|---|

| Standard account | $250 | Starting from 0.6 pips | $0 | Not mentioned | $0 | $0 |

Account Opening

Opening an account with IG is simple and accessible, even for beginners. The process is entirely online, user-friendly, and can be completed on a phone, tablet, or computer.

Minimum deposit

The minimum deposit for an IG account is $250, although some regional variations may exist. This applies to standard trading accounts, including CFD accounts. Specific account types, such as those for professional clients or region-specific offerings like tax-free Spread-Betting Accounts in the UK, may have different requirements.

How to open an account

Here are the steps describing how to open an account with the broker:

Visit the IG website and complete the online application form. You’ll need to provide personal information, including your name, address, and financial details, to assess suitability for trading.

Upload identification documents such as a passport or driver’s license and proof of residence to verify your account.

Link your bank account to enable funding and withdrawals.

Make your initial deposit via bank transfer, credit/debit card, or other payment options supported by IG in your region.

Once the account is verified, and funds are deposited, you can access IG’s trading platforms and begin trading across multiple asset classes.

The entire process typically takes just a few minutes for most users, ensuring that traders can quickly access IG’s platforms and start managing their portfolios.

Deposits and Withdrawals

This broker offers a standard range of deposit and withdrawal options, allowing you to use the normal range of funding options, from bank cards to electronic wallets. For Credit/Debit cards, expect a daily transaction limit of £20,000 with zero deposit fees. In regions where IG works with it, PayPal deposits attract a 3.4% charge plus a fixed fee.

IG offers multiple ways to deposit and withdraw funds from your trading account. There are some intricacies you need to get to know.

Account base currencies

IG offers you a wide range of account base currencies, including USD, GBP, EUR, and others, depending on where you live and where your account is based. Selecting a base currency that aligns with your funding source can help minimize currency conversion fees.

Also note that in FOREX trading, the base currency is the first currency listed in a currency pair and represents the currency being bought or sold in a FOREX transaction. For instance, in the currency pair EUR/USD, the euro EUR is the base currency, while the USD is the quote currency.

Deposit fees and options

Bank Transfers: Typically processed within 1-3 business days. IG charges no fees, but your bank may apply charges.

Credit/Debit Cards: Deposits are usually immediate. IG does not charge for card deposits; however, card issuers may impose fees. A daily transaction limit of £20,000 applies to card deposits.

PayPal: Available in certain regions (not the UK or South Africa), offering instant deposits. Traders using PayPal for deposits can expect to encounter a 3.4% + fixed fee. IG Group does not accept popular services like Skrill and Neteller.

E-Banking: Supports local e-banking options with immediate processing. Fees depend on the e-banking provider.

The minimum deposit is $250 or the equivalent in your chosen currency. While IG doesn't impose deposit fees, third-party charges from banks or payment providers may apply.

While some brokers have canceled deposit requirements in recent years, others still have it anywhere up to £5,000, making IG an affordable entry with a competitive trading environment. Those who genuinely want to build their portfolio may opt for quarterly, semi-annual, or annual deposits. Creating and executing a plan remains paramount to the success of traders.

Withdrawal fees and options

Bank Transfers: Processing time is typically 1-3 business days. IG does not charge for bank withdrawals, but your bank might.

Credit/Debit Cards: Withdrawals usually take 2-5 business days. IG does not charge for card withdrawals; however, card issuers may apply fees.

PayPal: Available in certain regions, with withdrawals processed within 24 hours. Traders using PayPal for withdrawals can expect to encounter a 3.4% + fixed fee.

IG does not impose withdrawal fees, but third-party charges may apply. The minimum withdrawal amount is $150 or the equivalent in your base currency. You can withdraw the remaining funds if your account balance is less than $150.

It's advisable to develop a consistent deposit plan—monthly, quarterly, or annually—to support your trading objectives. Always think about potential third-party fees from banks or payment providers when planning deposits and withdrawals.

| Method | Credit Card | Wire Transfer | Skrill | Neteller | Cryptocurrency | PayPal |

| Deposit fee | $0 | $0 + Bank commission | Unavailable | Unavailable | Unavailable | 3.4% + fixed fee |

| Withdrawal fee | $0 | $0 + Bank commission | Unavailable | Unavailable | Unavailable | 3.4% + fixed fee |

Customer Support

IG Group offers 24/5 global customer support via phone, live chat, email, and social media, with a robust FAQ section for quick assistance. US clients benefit from 24-hour support from Saturday 3 am to Friday 5 pm EST. A dedicated complaint procedure and region-specific contact options further enhance IG Group’s commitment to effective customer service.

IG Group offers robust and accessible customer support tailored to meet the needs of its global client base.

Global Support Services: Customer service is available 24/5, starting at 8 am on Saturday through 10 pm on Friday (UK time). Clients can reach out via a toll-free UK phone number. Live chat support is accessible during platform operating hours, allowing prospective and active clients to talk directly with company representatives. Email and social media support channels further enhance accessibility, and the website’s comprehensive FAQ section provides quick answers to common queries.

For unresolved issues, IG Group has a helpful customer complaint procedure designed to assist in effective grievance resolution. Online customer support is available in several languages, increasing IG Group's appeal to a diverse client base. The company also operates satellite offices to support its licensed operations in multiple regions.

US-Specific Support: IG Group's US clients benefit from 24-hour customer support, available from 3 am Saturday to 5 pm Friday EST. Support is provided through telephone, email, and social media sites.

IG Group also provides multiple phone numbers for customer support, and clients are advised to verify the appropriate number based on their region and query type.

| Live Chat | Phone | |||

| Availability | Available | Available | Available | Not Available |

| Quick response | Fast | Very Fast | Moderate |

Commissions and Fees

IG Group offers a spread-based pricing model with average FOREX spreads as low as 0.6 pips for EUR/USD. Traders can access margin trading with varying percentage requirements based on currency volatility. CFD fees include commission-free options for share spread bets, while S&P 500 index CFDs have an average spread of 0.4 points during peak trading hours. Additional fees include a £12 monthly inactivity charge after 24 months and optional services like ProRealTime charts (£30/month, waived with four trades monthly) and live data feeds.

IG Group offers a comprehensive fee structure designed to cater to various trading preferences. Like most other brokers focused on FOREX, IG Group follows the spread pricing model. IG instituted a minimum spread for all its transactions. Its spreads are, on average, on par with direct competitors.

The company also offers margin trading for FOREX accounts. Margin availability is high, as with most FOREX brokers. Instead of requiring a set dollar amount in your account to access margin trading, IG requires traders to maintain at least a certain percentage of their margin power in their accounts. Percentage margin requirements vary, depending on base currency and traded currency, with the highest margin requirements being associated with currencies that frequently fluctuate in value.

Due to the importance and complexity of broker fees, we would always encourage you to be well versed in your broker’s fee structure as this can change at any time and has a major impact on your profitability.

FOREX fees

IG operates on a spread-based pricing model for FOREX trading, with no additional commissions. Spreads are competitive, averaging around 0.6 pips for major currency pairs like EUR/USD, positioning IG favorably among its peers.

CFD fees

Indices and Commodities: Fees are embedded within the spread. For instance, the S&P 500 index CFD has an average spread of 0.2 points during peak trading hours.

Stock CFD commissions vary by region

IG offers commission-free trading on some instruments, and some trades have lower commissions. For example, share spread bets are commission-free, but have a spread applied . For US shares, trade is commission-free if traded three or more times per month. In terms of lower commission trading, share CFD commission ranges from 0.1% to 0.35% based on company size. For UK share trades, commission starts at £3.

Islamic accounts

IG does not offer Islamic accounts, but instead offers swap-free accounts compliant with Islamic principles. These accounts do not incur overnight financing charges; alternative fees may apply to offset the absence of swaps.

Inactivity fee

An inactivity fee of £12 per month is levied after 24 months of account inactivity.

Withdrawal fees

IG does not charge for withdrawals. However, third-party fees from banks or payment providers may apply.

Other fees

ProRealTime Charts: A fee of £30 per month is applicable, but this charge is waived if at least four trades are executed within the month.

Live Price Data Feeds: Charges may apply for access to live market data, depending on the exchange and asset class.

Currency Conversion Fee: A 0.5% fee is applied to trades involving currency conversion.

Additional fee considerations

GSLO: IG offers GSLOs, which guarantee the closure of a position at a specified price, even during market gaps. A premium is charged for this service, which is refunded if the GSLO is not triggered.

Overnight Financing: Positions held overnight may incur financing charges, commonly known as swap fees. These are calculated based on the size of the position and the prevailing interest rates of the currencies involved.

| Asset kind | Spread | Commission | Swap | Islamic Account |

| Currencies | Starting from 0.6 Pips | $0 | Yes | Unavailable |

| Stocks | Starting from 2.4 Pips | $0 | Yes | Unavailable |

| Commodities | Starting from 0.1 Pips | $0 | Yes | Unavailable |

| Indices | Starting from 0.2 Pips | $0 | Yes | Unavailable |

Platforms and Tools

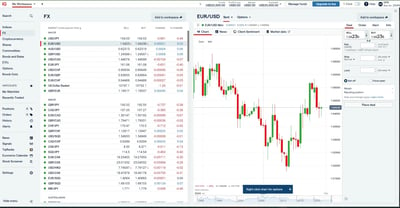

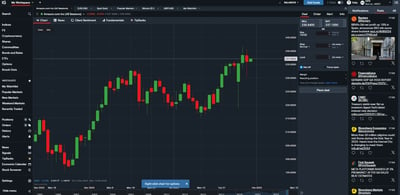

IG Group provides traders with access to over 17,000 markets, including FOREX, commodities, indices, and shares, through its user-friendly proprietary web-based platform. Efficient search functionality helps users locate instruments quickly, while personalized watchlists enable streamlined market monitoring. The platform supports various order types, including market, limit, and trailing stops, with an integrated trade ticket displaying risk/reward ratios for precise trade adjustments.

IG Group offers a comprehensive suite of trading platforms and tools, catering to traders across all experience levels.

Platform types

IG's proprietary web-based platform is renowned for its user-friendly interface and extensive features, providing access to over 17,000 markets, including FOREX, commodities, indices, and shares, all within a single account. It's called the IG Platform, and it is well-loved by many traders because of its sleek functionality and wide range of features. For those traders seeking advanced functionalities, IG integrates with the following:

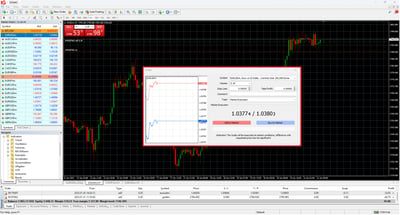

MetaTrader: MetaTrader 4 (MT4) offers a range of charting tools, automated trading capabilities, and a customizable interface.

ProRealTime: a third-party charting software integrated with the IG trading platform for technical analysis and trading. ProRealTime offers a fully customizable interface and trading experience where you can analyze everything from price to volatility with over 100 indicators.

L2 Dealer: IG's DMA platform. You can trade share or FOREX CFDs, straight through the order books of international exchanges. Get tiered pricing direct from the exchange.

TradingView: unlock advanced charting with a range of features, including:

Supercharts that you can customize using candlesticks, bars, or lines.

Access over 100 indicators and innovative drawing tools for thorough market analysis.

Social features let you connect with fellow traders.

Use of a powerful screener that filters markets using 100+ criteria.

Real-time news, economic calendars, and fundamental data across global markets.

Look and feel

The web platform boasts a clean and intuitive design, allowing traders to easily monitor price movements, trade directly from charts, and manage open positions. The layout is customizable, meaning that you can create multiple workspaces and navigate through tabs seamlessly.

Login and security

IG prioritizes security by implementing strong login measures, including two-factor authentication, to protect user accounts. The platform utilizes 256-bit SSL encryption, the industry standard for online financial transactions, ensuring that traders can operate with confidence.

Search functions

The platform features a quick search function, allowing traders to efficiently locate instruments by name or symbol. This functionality extends to creating personalized watchlists, enabling users to monitor their preferred markets conveniently.

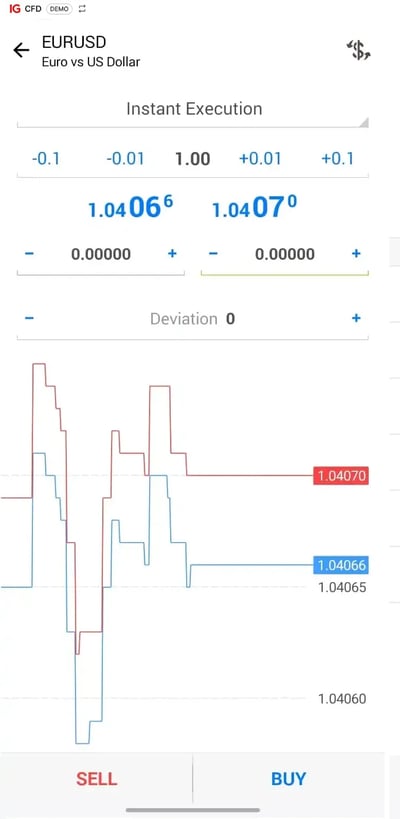

Placing orders

IG supports many different order types, including market orders, limit orders, and trailing stops. The integrated trade ticket displays risk/reward ratios and allows for precise adjustments of stops and limits directly from the chart. You can execute market orders for immediate entry, set limit and stop orders to control entry or exit levels and use trailing stops to lock in profits as prices move in your favor.

Alerts and notifications

You can stay in the loop by setting up price alerts and receiving notifications via email, SMS, or push notifications, ensuring you stay informed about market movements. Customizable alerts can be set for price levels, percentage changes, or technical indicator triggers across various asset classes.

.webp)

Mobile Trading

IG Group’s mobile trading apps for iOS and Android offer an intuitive interface with advanced features like customizable watchlists, real-time alerts, and technical charting tools. Security is enhanced with biometric authentication, such as Face ID and Touch ID, ensuring account protection. The apps support 20 drawing tools, 30 technical indicators, and five chart types, with synchronized watchlists and integrated research tools, including Reuters news and Autochartist signals.

As far as mobile trading goes, IG Group offers a comprehensive suite of mobile trading applications for iOS and Android devices, including tablets. Traders will love the intuitive mobile platform, while advanced traders will revel in the wide selection of indicators and charting tools.

With IG's award-winning trading app, you can:

Trade on the move and get exclusive analysis from an in-house team and the Reuters live feed.

React instantly to volatility by setting price alerts.

Enjoy the secure 256-bit SSL encryption technology.

Check your account balance and see your running profit or loss.

Manage your risk with stop-losses and limit orders.

Have a clear view of your open orders and trade history.

Platforms and user experience

The IG mobile apps are user-friendly, featuring customizable watchlists, real-time price alerts, and advanced technical charting tools. If you are looking for advanced capabilities, IG supports third-party platforms like MT4 and ProRealTime, offering algorithmic trading and sophisticated analytical tools. Also, you should know that IG's mobile trading app mirrors the functionality of its web platform. This way, you can trade on the go. This interrelated experience ensures a seamless and flexible trading journey across devices.

Look and feel

The interface is intuitive, allowing traders to navigate markets and execute trades efficiently. While the "Trade" menu offers essential order types, it currently lacks more complex conditional orders. However, UK clients have the option to place GSLOs directly through the app.

Security and authentication

Security is a priority for IG's mobile platforms. The apps support biometric authentication methods, such as Face ID and Touch ID, enhancing account protection. This feature aligns with industry standards, providing traders with confidence in the security of their transactions.

Search functionality and order placement

The search function within the app is robust, enabling users to quickly locate instruments by name or symbol. Order placement is straightforward, with the ability to execute trades directly from charts. While the app supports standard order types, more advanced conditional orders may be needed for some traders.

Alerts, notifications, and additional features

Traders can set up personalized alerts and notifications to stay informed about market movements and account activities. The app also includes each instrument's economic calendar, sentiment readings, and detailed market information. Watchlists synchronize seamlessly with IG's web platform, ensuring a cohesive trading experience across devices.

Charting and research tools

The mobile app offers extensive charting capabilities, featuring 20 drawing tools, 30 technical indicators, and 16 timeframes across five chart types, including tick charts. Research tools are integrated, providing news headlines from Reuters and trading signals from Autochartist and PIA First.

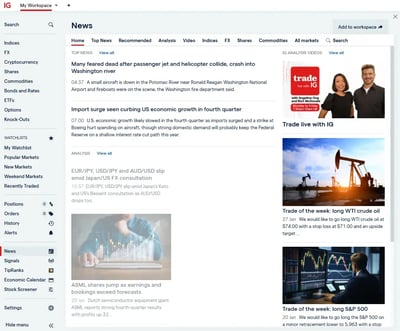

Research and Development

IG Group offers a comprehensive suite of research and development tools designed to help traders make informed decisions across various asset classes.

News and market analysis

You can access real-time streaming news from Reuters, staying updated on global financial developments. The platform features an economic calendar that highlights key market events and data releases, aiding in strategic planning. A customizable screener allows users to filter and analyze a wide range of instruments, including CFDs on global stocks, forex, and cryptocurrencies.

Personalized content

The "Recommended News" section tailors headlines based on individual account traits, providing a personalized news feed that aligns with each trader's interests and holdings. Additionally, IGTV offers multiple daily streaming videos covering global financial markets, delivering expert insights and analyses.

Technical analysis tools

IG integrates Autochartist and PIA First into its platform, offering automated pattern recognition and technical analysis. These tools generate trade signals that traders can implement with a single click, streamlining the trading process.

Premium research access

Clients who deposit at least $500 get access to premium research from Real Vision TV, while those with deposits of $5,000 or more receive additional in-depth analyses. These resources provide valuable perspectives from industry experts.

Economic calendar

This powerful tool offers a detailed schedule of global market events and economic data releases. Traders can customize the calendar to focus on relevant data, filtering events by region, impact level, or asset class. This tool helps you to anticipate potential market movements. Integrated directly into IG’s platforms, the economic calendar ensures that you can align your strategies with upcoming market conditions, providing a significant edge in timing trades.

Risk calculator

A crucial tool for traders focused on minimizing potential losses while optimizing gains. The calculator allows users to assess their risk exposure by inputting position size, entry price, and stop-loss levels. It automatically works out potential profit or loss and required margin, helping you to stay within their risk tolerance. For traders employing leveraged instruments like CFDs or FOREX, the calculator is especially helpful as it provides a clear view of how market volatility could affect their positions.

Education tools

IG's educational tools are superior to any other online brokers Arincen has researched. An extensive trader's library, spearheaded by the impressive “IG Academy,” will quickly get beginners up to speed, while seasoned practitioners will find advanced trading strategy articles quite useful. A robust roster of online Webinars (between 30 minutes and 60 minutes in length) covers topics from platform walk-throughs to upcoming trade opportunities.

IG Academy

IG Academy's course is designed to cover material for people at different levels of the trading spectrum, and it succeeds in delivering on this ambition. Clients can also access courses and articles through the handy IG Academy mobile app. These courses cover a range of topics, from fundamental trading concepts to advanced strategies. Interactive quizzes and practical exercises help reinforce understanding.

Webinars and seminars

IG carries out regular webinars and seminars led by industry experts, covering diverse subjects, including platform navigation, technical analysis, and market insights. These live sessions allow participants to interact directly with presenters, facilitating a deeper comprehension of complex topics.

Video content

IG maintains an extensive library of video content, including archived webinars and educational series available on its YouTube channels. These resources cover a wide array of topics, enabling traders to learn at their own pace. The content is organized by experience level, making it easy for users to find material that suits their needs.

IG community

The IG Community platform serves as a forum where traders can share insights, discuss strategies, and access IG-curated educational articles. This collaborative environment fosters peer learning and provides additional perspectives on trading practices. It's not unlike our own Arincen network, where traders with differing strategies get to learn from each other.

Integrated newsfeed

IG's trading platform includes a native newsfeed that delivers real-time articles and updates pertinent to the instruments being viewed. This feature ensures that traders remain informed about market developments directly within the trading interface.

IG Group is a globally recognized broker that gives you access to a high-quality trading experience. From its advanced trading platforms and many educational resources to its strong regulatory memberships, IG can meet the needs of traders at all levels.

The company is committed to innovation, transparency, and client support. This makes it a trustworthy choice of broker for both new and seasoned traders. Its accolades and awards only give testament to its position as one of the best multi-asset brokers in the financial industry.

.webp)

Final Thoughts on IG Group

IG Group is a globally recognized broker that gives you access to a high-quality trading experience. From its advanced trading platforms and many educational resources to its strong regulatory memberships, IG can meet the needs of traders at all levels.

The company is committed to innovation, transparency, and client support. This makes it a trustworthy choice of broker for both new and seasoned traders. Its accolades and awards only give testament to its position as one of the best multi-asset brokers in the financial industry.

Conclusion

IG Group gives you the best of both worlds between comprehensive offerings and user accessibility. The broker has taken the time to offer many platforms, each with a slightly different appeal, to a range of traders with various needs. With its overall sleek design and advanced tools, you are empowered to trade confidently across a broad spectrum of financial markets.

While an excellent broker, IG does have a few limitations—such as the lower number of features for U.S.-based traders and slightly higher costs for certain CFDs. However, its security, education, and regulatory compliance strengths far outweigh any drawbacks. If you are looking to navigate global markets with a reliable and forward-thinking partner, you could do a lot worse than IG.

Review Methodology

The team at Arincen collected more than 120 pieces of data covering more than 100 licensed FOREX companies. Data collection was done in three ways:

Companies’ websites.

Other websites that have ranked FOREX companies.

A survey questionnaire (referred to here as Survey “1”) was sent to the companies invited to participate in the exercise.

We have identified 12 criteria for our assessment, each containing several aspects and carrying its relative weight. These include licensing, deposits and withdrawals, number of assets, etc.

Afterward, we validated the data by:

Registering with FOREX companies as a secret shopper and/or as Arincen.

Survey number “2,” in which we asked these companies’ customers for meaningful feedback and past experience.

The next step saw us evaluate and rank each company, relying on the hard work of 15 Arincen employees. We were cautious in ensuring the most accurate assessment possible, including considering different languages and the various mobile-app operating systems, e.g., Apple, Samsung, etc.

To add credibility to our research project, we sent a final and third survey (referred to here as Survey “3”) to enable participating FOREX companies to evaluate our research and whether it accurately reflects the realities on the ground. We were fortunate enough to receive a mark of 9.9 out of 10! We have kept the margin of error to a minimum, which stood at a measly 1%. To learn more about how we came up with the evaluation, please click here.

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

FAQ

IG is a London-based, publicly-traded company. It operates a regulated bank, and, as aforementioned, is authorized by six tier-1 regulators (high trust), three tier-2 regulators (average trust), and one tier-3 regulator (low trust). IG is authorized by the following tier-1 regulators: The ASIC. The Japanese FSA. The MAS. The Swiss FINMA. The UK’s FCA. The CFTC in the US. Furthermore, it is listed on the UK’s FTSE 250 and has signed up to the FX Global Code of Conduct, which establishes a common set of guidelines for good practice in the markets.

IG (UK) also takes steps to ensure that client funds are not co-mingled with corporate funds, in accordance with the UK's FCA client money rules. This ensures that client assets are protected in the unlikely event that IG becomes insolvent by holding those funds in segregated accounts at regulated banks. Clients also have additional asset protection through the Financial Services Compensation Scheme (FSCS) of up to £85,000. IG (UK) provides clients with a guarantee that they will never lose more than they have in their accounts via the negative balance protection rules mandated under the ESMA that went into effect in 2018. GSLO are also offered, which mitigate exposure to potentially catastrophic losses in extreme market conditions, like the 2015 Swiss Franc currency shock. By contrast, IG (US) offers neither negative balance protection nor GSLO. Client funds are not insured by the FDIC or the SIPC. IG's software security is aligned with the best that the industry has to offer. In addition to two-factor and biometric authentication, the user will be logged out of both the Web-based and mobile applications for inactivity. The broker operates a counterparty dealing desk, which is useful for clients, especially those with large accounts, who wish to trade directly with the interbank system through a dedicated platform.

A host of countries, including the US. IG is best suited to anyone wanting to trade CFDs. In the US, it is suited to clients who want to trade the FOREX markets. Low spread costs, emphasis on customer service and education, actionable research and functional user interfaces put this broker in a great position to compete in the online broker market.

Yes. Clients have access to FOREX, indices, shares, commodities, cryptocurrencies, bonds, ETFs, options, industry sectors and interest rates. IG accepts US clients, though only for FOREX.

IG (UK) also offers a variety of professional and institutional services, well above the industry average. Accounts at all levels can invest for the long term through IG Smart Portfolios, an account basket that includes savings and retirement programs, as well as low-fee ETFs.

Deposit and withdrawal options at IG are limited to bank wires, credit/debit cards, PayPal and e-banking deposits for certain countries.

IG provides an outstanding selection of trading platforms and tools. The functionality is widespread and serves traders of all experience levels. Besides the L2 Dealer and ProRealTime charting platform, IG's proprietary web-based platform comes loaded with a vast selection of features. Moreover, IG supports the retail-favorite MT4 trading platform. It allows full automation of trading strategies, and the broker provides a range of add-ons, which are generally required to unload the full functionality of this trading platform. Traders may take advantage of 18 unique indicators beside the Autochartist. The L2 Dealer, the IG platform that handles DMA trading, may come at an additional cost for live price feeds.

IG customer service is available through a toll-free UK phone number from 8am Saturday through 10pm Friday. Both prospective and active clients can talk to a company representative through live chat that is available when the platform is open. E-mail, social media, and a comprehensive set of FAQs round out above-average contact options. If all else fails, a well-documented customer complaint procedure should assist in grievance resolution. Online customer support is available in several languages, which enhances IG's appeal to a broader client base. The broker also runs satellite offices to support licensed operations in several regions. IG (US) offers customer support via telephone (24/5), e-mail or Twitter-client help. Additionally, the Website's FAQs and support pages are well-organized and informative. Customer support in the US is available by phone 24 hours a day from 3am Saturday to 5pm Friday EST. IG offers a variety of different phone numbers for its customer support team, so verify which number to call by checking the company’s website.