FBS Review 2026

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

FBS Evaluate - research result

Key Takeaways

FBS is a well-established broker, established in 2009.

FBS has provided its service to some 27 million traders in over 150 countries.

The broker can offer exceptionally high leverage, as much as 3000:1 (for non-EU customers only) and no commissions accompanying the majority of instruments.

FBS traders enjoy some of the lowest capital requirements in the industry and will appreciate a thorough selection of trading education videos and articles on the FBS website, as well.

The FBS Standard account helps to adapt FBS and its services to nearly any trader.

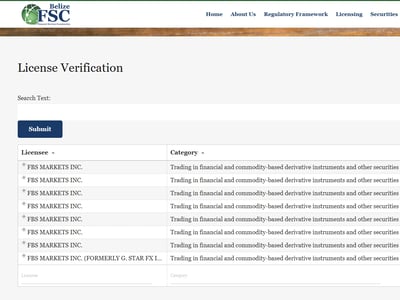

FBS group companies are regulated by the Financial Services Commission, Belize (FSC), the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC).

Clients are able to access a wide range of assets for trading, but mainly in the form of CFDs, with no direct ownership of financial assets offered.

FBS offers one account type, which could be limiting for some traders, but has been developed to cater to as many types of traders as possible.

The minimum deposit is as low as $5.

At FBS, customer service is more than adequate, with a wide range of contact points 24/7.

Spreads offered by FBS vary by account type and region, but popular FOREX pairs start as low as 1.1 pips.

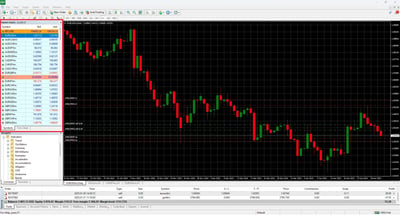

FBS uses a Non-Dealing Desk (NDD) system with Straight Through Processing (STP) for rapid order execution. Following registration and login, clients have a choice of two desktop platforms to access the markets, the vastly-popular MetaTrader4 (MT4) and MetaTrader5 (MT5).

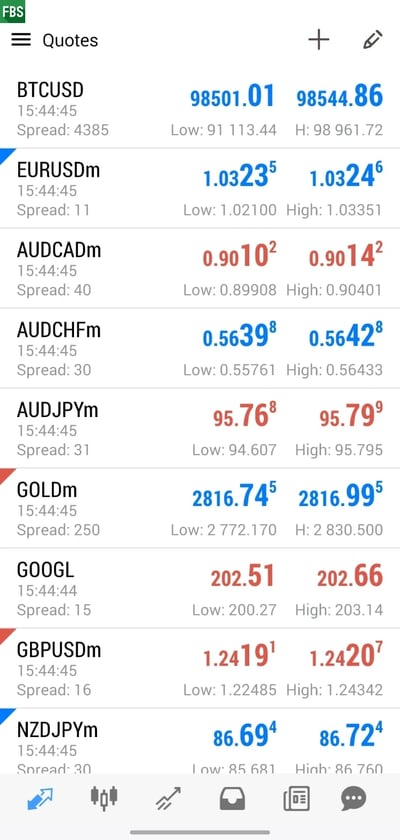

FBS’ proprietary mobile trading app is considered to be a solid and reliable mobile platform featuring over 90 technical indicators.

The FBS website contains an analysis section with rich resources, including FOREX-related news and regular market updates.

In the area of education, there are the standard offerings of market analysis and calculators, as well as an economic calendar. These services are more than enough to keep most traders occupied, especially its unique and vibrant Telegram group.

The broker’s 90+ awards show the trust, loyalty, and respect the broker’s clients, partners, and the global trading community have placed in it.

Last Reviews

Overall Summary

During my research, I discovered that FBS was launched in 2009 and is a CFD and FOREX broker with a global client base. The company offers access to more than 550 tradable instruments, including CFDs on currencies, stocks, indices, commodities, and cryptocurrencies. FBS supports trading through the popular MT4 and MT5 platforms and also offers its own proprietary mobile app.

FBS is regulated by three entities: CySEC (Cyprus), ASIC (Australia), and FSC (Belize), covering both Tier-1 and Tier-3 jurisdictions. Negative balance protection and segregated accounts are standard across all entities, but investor compensation is only available under CySEC, with coverage up to €20,000. Leverage offerings vary by region, ranging from 500:1 under CySEC and ASIC to 3000:1 under the FSC of Belize.

The broker offers a low minimum deposit of $5, no inactivity or withdrawal fees, and a streamlined account opening process that can be completed in a day. Clients have access to a single main account, along with demo and swap-free Islamic accounts. Commission-free FOREX trading is available, with EUR/USD spreads starting from 1.1 pips, while stock CFDs incur a 0.7% commission.

In my view, while FBS doesn’t offer a proprietary desktop or web platform, it compensates with a highly rated mobile app that features over 90 technical indicators. FBS has strong educational content, including structured courses, webinars, live trading sessions, and a dedicated Telegram group. Although spreads on index CFDs and some shares are wider than competitors', FBS is a strong choice for beginners and active CFD traders alike.

FBS is a well-regulated broker with licenses from CySEC, ASIC, and FSC. Clients under CySEC benefit from compensation coverage up to €20,000, while all users are protected by negative balance safeguards and segregated funds across all regions. FBS also strengthens client safety with modern encryption, two-step logins, and a secure order execution model using NDD and STP technologies.

Is FBS Safe?

In my assessment, FBS is a safe and well-regulated broker, boasting a reliable operational history dating back to 2009. Longevity in brokerage services is important, and FBS has consistently expanded its regulatory credentials. This should reassure traders wondering about a broker's safety.

The group’s regulatory milestones confirm its international credibility:

In 2009, FBS launched its first entity, FBS Markets Inc., regulated by the FSC of Belize.

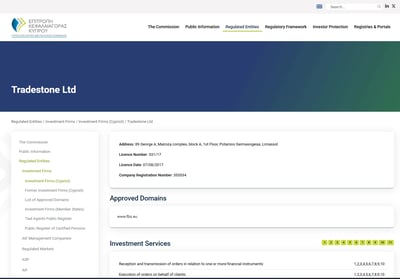

Tradestone Ltd., established under CySEC oversight in Cyprus, extended FBS’s regulatory framework into the EU market.

Further solidifying its regulatory footprint, FBS obtained a license from ASIC in Australia, ensuring robust oversight in the Asia-Pacific region.

These regulatory licenses span Tier-1 to Tier-3 jurisdictions, with ASIC and CySEC being top-tier regulators. Client protection varies significantly depending on the regulatory entity under which the client registers. Something to know is that CySEC-regulated clients benefit from coverage under the Investor Compensation Fund, covering them up to €20,000 in cases of broker insolvency, whereas clients under other regulatory entities aren’t nearly as protected.

FBS adheres strictly to client-fund segregation practices, making sure that your funds stay completely separate from the company’s operating capital. Also, negative balance protection is standard across all regulatory entities, another safety net against account deficits.

Remember, no broker is entirely without risk, but FBS’s solid regulatory oversight, transparent operational practices, and lengthy industry presence should be ample assurance that your capital is managed securely.

How FBS Protects You from Reckless Leverage and Margin Trading

Leverage and margin can be powerful tools for traders, but if not used correctly, they can lead to significant losses. Some unreliable brokers offer simply too much leverage, which can be dangerous for new traders.

The broker offers leverage up to a whopping 3000:1 for clients trading through the Belize office. As with many brokers, margin requirements depend on the specific market, account balance, and the size of the trade. Some of the financial assets the broker offers require fixed leverage; for example, stock leverage is always set at 100:1, indices and energies at 200:1, and metals at 500:1.

How you are protected

As I've mentioned, all entities within the FBS group provide negative balance protection, ensuring your losses can never exceed your deposited amount. Additionally, client funds are held in segregated accounts, separating your money from the broker’s operational capital, reducing risk in case of financial distress.

Also, FBS is regulated by three regulators across its areas of operation. The level of investor compensation varies by jurisdiction. Under CySEC regulation, clients benefit from the Investor Compensation Fund, safeguarding up to €20,000 should the broker face insolvency. Clients under ASIC and FSC do not receive protections.

Overall, through robust regulatory oversight, fund segregation, and negative balance protection, FBS demonstrates a solid commitment to protecting your trading capital.

Regulation and other security measures

Beyond regulation and client fund segregation, FBS employs some operational and technological safeguards to enhance your security.

First, all financial transactions on the platform are encrypted using modern security protocols. The broker also incorporates enhanced authentication procedures on its mobile app, such as two-step logins, although biometric login features like Face ID are not yet supported.

FBS’s order execution model also contributes to account safety. It uses an NDD and STP model, which routes orders directly to liquidity providers without intervention. This minimizes the risk of price manipulation and ensures trades are executed at true market prices. Orders are typically processed in under 30 milliseconds, but have been recorded to be as fast as 0.01 seconds.

Another thing to know is that traders on MetaTrader platforms benefit from built-in security features like encrypted data transmission and customizable account access controls.

Top broker features

In my view, here are some compelling reasons to choose this broker:

No deposit or withdrawal fees: FBS charges zero fees for deposits and withdrawals, allowing traders to move their funds freely without eating into profits.

Ultra-low minimum deposit: With a minimum deposit starting at just $5, FBS is highly accessible to beginners and low-capital traders looking to start small.

Fast order execution: Rapid trade execution of as little as 0.01 seconds helps reduce slippage and is critical for scalpers and active traders.

Negative balance protection: All FBS clients are protected from incurring debt on their accounts, providing peace of mind in volatile conditions.

Solid range of platforms: Although there is a lot to be said about having your proprietary app, FBS customers can still trade with third-party staple platforms like MT4 and MT5. That said, the broker has a proprietary mobile app.

Excellent educational resources: FBS offers structured courses, webinars, tutorials, and a Telegram group, making it a strong choice for traders who want to continuously improve their skills.

24/7 customer support: Round-the-clock support in multiple languages ensures that traders worldwide get help when they need it.

For Whom Is FBS Recommended?

I would recommend FBS for beginner and intermediate traders looking for a low-cost, accessible entry into the FOREX and CFD markets. Its familiar platforms, low minimum deposit, and commission-free trading on most accounts make it particularly attractive to new traders.

Traders who scalp and perform algorithmic trading will also find FBS an interesting option due to its fast order execution speeds—under 30 milliseconds—alongside support for Expert Advisors (EA) and Virtual Private Server (VPS) hosting.

Here are the pros and cons of using this broker:

-

Low capital requirements

-

No deposit and withdrawal fees

-

Ultra-fast order execution speed

-

Negative balance protection across accounts

-

Excellent educational resources

-

Familiar and reliable platforms, plus a proprietary mobile app

-

24/7 multilingual customer support

-

VPS hosting offered

-

Product range is CFD-heavy, and could be more diverse

-

No proprietary desktop platform

-

Wider spreads on index CFDs and some stocks

-

No investor protection outside the EU

-

Few base currency options

-

Key markets such as the USA, UK, and Israel not covered

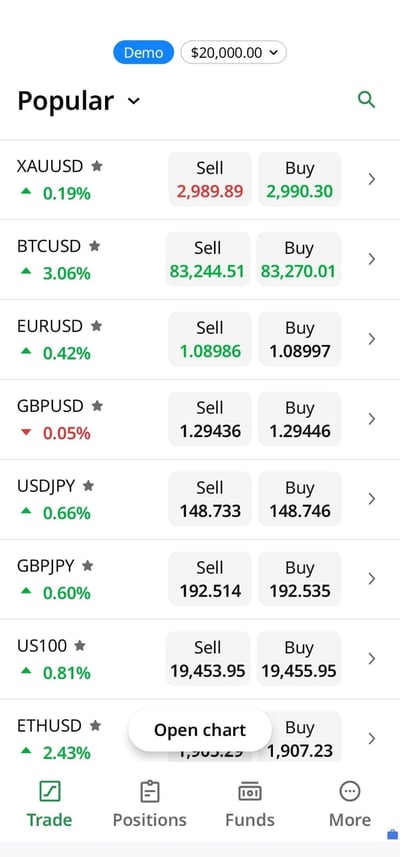

Offering of Investments

FBS offers a strong lineup of over 550 CFD instruments, including FOREX, stocks, indices, commodities, and cryptocurrencies, though it lacks real equities, ETFs, bonds, and options. FOREX traders benefit from 72 currency pairs with leverage up to 3000:1 (under the Belize entity) and spreads starting around 1.1 pips. Stock CFDs feature well-known U.S. and European names, while index CFDs like the S&P 500 and Dow Jones are commission-free but carry variable spreads.

I believe that while the lack of real equities, ETFs, bonds, and options limits FBS’s appeal to long-term investors, the broker makes up for it with a strong CFD offering across FOREX, stocks, indices, commodities, and crypto, covering more than 550 total instruments. Here's a breakdown of the financial assets FBS offers:

FOREX

FBS offers 72 currency pairs, including major, minor, and exotic pairs. Popular pairs include EUR/USD, GBP/USD, and USD/JPY. This breadth makes FBS especially attractive to FOREX traders looking to diversify strategies across different currency markets. Leverage on FOREX trades can go as high as 3000:1 (under the Belize entity), with spreads starting from 1.1 pips on major pairs like EUR/USD.

Stock CFDs

Clients can trade several stock CFDs from U.S. and European exchanges. These include well-known names like Facebook, Goldman Sachs, and Nike. Unlike some brokers, FBS charges a 0.7% commission per round turn on stock CFD trades, in addition to the spread. Spreads on individual stocks are competitive—e.g., Apple CFDs averaged 16 cents during live testing.

Indices CFDs

FBS provides access to 11 global stock indices as CFDs. Examples include the S&P 500, Dow Jones (US30), and DAX 40. Index CFDs are commission-free, with spreads embedded into the price.

Metals and Energy CFDs

The platform supports 11 commodity CFDs, covering both metals and energy products. You can trade gold (XAU/USD), silver, Brent oil, and WTI oil, among others.

Cryptocurrency CFDs

FBS offers a limited cryptocurrency CFD pair range: not one of the strongest crypto lineups among CFD brokers. Major cryptos like Bitcoin, Ethereum, Litecoin, and Dash are available.

Available Assets

| Markets | Available | Number of Assets |

| Currency Pairs | 72 | |

| Stocks | 127 | |

| Commodities | 11 | |

| Crypto | 10 | |

| Indices | 11 | |

| ETFs |

Account Types

FBS offers a single Standard account type designed to meet the needs of both experienced and new traders, featuring variable spreads from 1.1 pips, no commissions, and compatibility with MT4 and MT5. In addition, FBS provides a free demo account for risk-free strategy testing and an Islamic (swap-free) account for traders who follow Sharia law.

FBS offers a single account type that is comprehensive enough to cater to different trading needs and experience levels. The account type suits traders with some experience who want low-friction, spread-based trading without commissions. Here’s a breakdown of the main account type:

Standard account

In my opinion, this account is best suited for seasoned traders seeking a traditional trading experience, though new traders can and must learn to use it as well.

Spreads are variable and have been known to start as low as 1.1 pips. There is no commission charged. The order volumes accommodated range from 0.01 to 500 lots. This account works with MT4 and MT5.

Demo account

If you want to test strategies or learn the platform risk-free, the demo account simulates live market conditions with real-time quotes and is free of charge. The demo account can work for beginners and pros alike, offering a way to test new strategies without risking real money.

Islamic (Swap-free) accountThis account complies with Islamic finance principles, ensuring that interest-bearing positions are not incurred for religiously observant clients.

| Account Type | Minimum Deposit | Spread Commission | Commission | Swap Commission | Deposit Commission | Withdrawal Commission |

|---|---|---|---|---|---|---|

| Cent Account | $5 | Starting from 1.1 pips | $0 | Not mentioned | $0 | $0 |

| Standard Account | $100 | Starting from 0.5 pips | $0 | Not mentioned | $0 | $0 |

| Micro Account | $5 | Starting from 3 pips | $0 | Not mentioned | $0 | $0 |

| Zero Spread Account | $500 | Starting from 0 pips | $20/lot | Not mentioned | $0 | $0 |

| ECN Account | $1000 | Starting from 1 pip | $6 | Not mentioned | $0 | $0 |

Account opening

I found FBS's account opening process to be hassle-free, fully digital, and straightforward. You can start using your account on the same day, provided all verification steps are completed.

What is the minimum deposit at FBS?

The minimum deposit to trade with FBS is $5, making it one of the most accessible brokers for new and budget-conscious traders.

While you can get started with as little as $5, the broker recommends depositing at least $100 so you have some capital with which to trade. This higher amount can help cover margin requirements and provide more flexibility in managing trades.

How to open your account

In my experience, opening an account with FBS is fast, fully digital, and beginner-friendly. The entire process can be completed in under 10 minutes, with account approval typically finalized within one business day. Here’s how it works:

Start by visiting the FBS website or mobile app to register. You’ll be asked to enter basic information such as your full name, email address, and phone number. You can choose to open a demo or live account at this stage. From there, the remainder follows a familiar pattern — choose your account type, verify your identity, deposit funds, and start trading.

FBS’s streamlined onboarding makes it easy for both newbie and experienced traders to get started quickly, with no deposit or withdrawal fees and strong multilingual support throughout the process.

Deposits and Withdrawals

FBS offers a fast and cost-effective deposit and withdrawal process with a wide range of payment methods, including bank transfers, credit/debit cards, e-wallets, and regional services. While FBS does not charge fees for deposits or withdrawals, third-party providers like Skrill and Neteller may apply their own charges. Most transactions are processed instantly or within 15–20 minutes, though bank transfers may take longer.

I found that FBS offers a smooth and cost-effective deposit and withdrawal process, with a myriad of available payment methods catering to a global client base. Both deposits and withdrawals are fee-free on FBS’s side, although third-party payment systems may charge their own fees depending on the method used. You can only deposit and withdraw to/from accounts in your own name.

Faster processing and zero FBS fees make the platform attractive to both casual and high-frequency traders. Overall, FBS stands out for the speed, variety, and cost efficiency of its deposit and withdrawal methods, though its limited base currency selection could pose a challenge for some traders.

Account base currencies

Base currencies are limited, with FBS processing payments in EUR and USD, with AUD available for Australian clients. You should know that using a base currency different from your deposit currency could result in conversion fees, depending on the payment method used.

FBS deposit fees and options

You can fund your FBS account using:

● Bank wire transfers

● Credit and debit cards (Visa, Mastercard)

● E-wallets like Skrill and Neteller

I found that most deposit methods are instant, though bank wires can take a few business days.

FBS withdrawal fees and options

Withdrawal methods are similar to deposit options and include:

● Bank wire

● Credit/debit cards

● E-wallets (Skrill, Neteller, Sticpay)

I discovered that withdrawal processing is generally quick, something like 15 to 20 minutes, although it may take up to 48 hours depending on the payment provider. FBS itself does not charge withdrawal fees, but providers like Neteller and Skrill may impose small commissions.

| Method | Credit Card | Wire Transfer | Skrill | Neteller | Cryptocurrency | PayPal | Apple Pay |

| Deposit fee | $0 | $0 | $0 | $0 | $0 | Unavailable | Unavailable |

| Withdrawal fee | $0 | $0 | Unavailable | $0 | $0 | Unavailable | Unavailable |

Customer Support

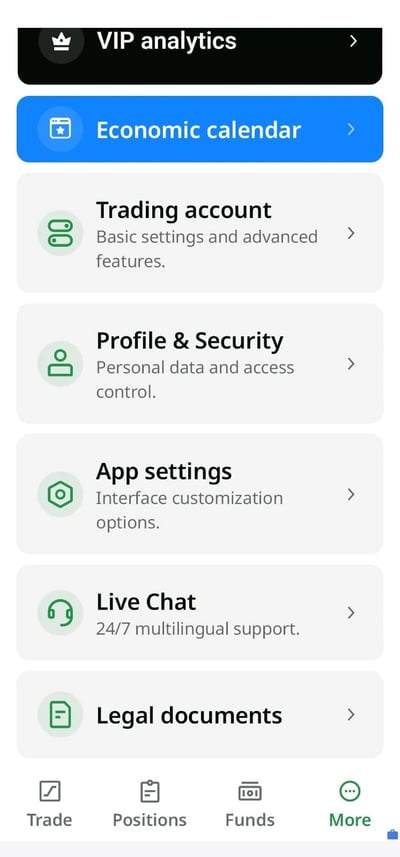

FBS provides 24/7 multilingual customer support through live chat, email, phone, and a callback service, ensuring traders can get help whenever they need it. The broker also maintains a comprehensive Help Center filled with FAQs and guides on topics like account setup, trading, and funding. For general inquiries and updates, traders can connect with FBS on major social media platforms like Facebook and X.

In my experience, FBS offers a comprehensive and multilingual customer support system designed to assist traders across various channels and time zones. You can access live-chat support directly through the FBS website and trading platforms. The live-chat feature provides real-time assistance for immediate queries and technical issues. This service is available 24/7, ensuring that you can receive support at any time.

Other support channels include email, phone, and a callback service. The broker's website also includes a help center with an extensive library of articles and FAQs covering account management, trading operations, deposits and withdrawals, and technical troubleshooting. This self-service option allows you to find answers to common questions without direct contact. Finally, you can find the broker on all of the major social media platforms, like Facebook and X, which is a great option for general inquiries, updates, and community engagement.

| Phone | Phone | |||

| Available | Unavailable | Available | Unavailable | Unavailable |

| Quick response | Unavailable | fast | Unavailable | Unavailable |

Commissions and Fees

FBS offers a cost-efficient trading environment, especially for FOREX and commodity traders, with commission-free trading on most instruments and no hidden fees. While spreads on stock CFDs and indices can be higher, such as 4.1 pips on the Dow Jones, core FOREX pairs like EUR/USD remain competitive at around 1.1 pips. Stock CFDs carry a 0.7% commission per round turn, and swap fees vary by asset, though Islamic (swap-free) accounts are available.

FBS offers a competitive and transparent fee structure that makes it appealing to both beginners and active traders. The broker charges no deposit, withdrawal, or inactivity fees, and most trading costs are built into the spreads. There are no hidden fees, and the broker absorbs the cost of most deposit and withdrawal methods. The cost structure is designed to appeal to both low-budget retail traders and more active, cost-sensitive professionals.

Spreads

Spreads at FBS are built into the pricing, with no additional commission on most instruments. For EUR/USD, the typical spread is around 1.1 pips, which, to be fair, is not that competitive in today's retail trading landscape. Commodities like gold (XAU/USD) saw spreads of 30 to 38 cents during testing, which is slightly better than the industry average of 42 cents.

Commissions

Most trading at FBS is commission-free, with the cost built into the spread. However, stock CFDs incur a 0.7% commission per round turn in addition to the spread. This applies to equities like Apple and Tesla, making the total cost higher compared to some brokers that offer flat-fee stock CFD trading.

Swap Fees and Islamic Accounts

Swap (overnight) fees are relatively modest compared to industry standards. For EUR/USD, swap long is a $5.46 charge, and swap short results in a $0.61 credit. For GBP/JPY, a swap short incurs a significant $35.39 charge, while the long position earns $7.60.

These swaps are standard practice, but FBS offers Islamic (swap-free) accounts upon request, allowing traders to avoid interest-based charges in accordance with Sharia law.

Inactivity fee

FBS stands out for its no inactivity fee policy. Unlike many brokers who charge if an account remains dormant for a set period, FBS allows traders to step away from the platform without penalty, a notable benefit for occasional or seasonal traders.

Other commissions and fees

There are no deposit or withdrawal fees for most methods, including credit cards, Skrill, Neteller, and bank transfers.

| Spread | Commission | Swap | Islamic Account | |

| Currencies | Starting from 1.1 Pips | Starting from $0 | Yes | Available |

| Stocks | Not mentioned | Starting from 16 Cents | n/a | Unavailable |

| Commodities | Starting from 38 Cents | Starting from $0 | Yes | Unavailable |

| Indices | Starting from 4.1 Pips | Starting from $0 | Yes | Unavailable |

Platforms and Tools

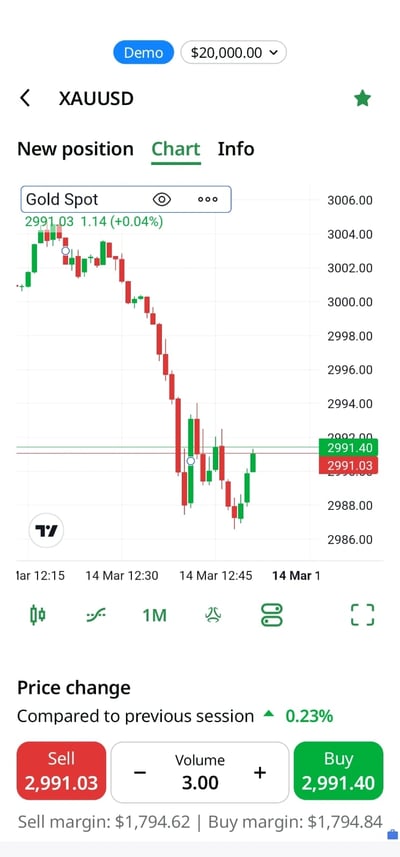

FBS offers a flexible trading experience through MT4, MT5, and its proprietary FBS Trader mobile app, all of which support major asset classes and fast execution speeds under 30 milliseconds. The platforms are user-friendly and feature-rich, with MT5 offering 38 indicators and 21 time frames, while the FBS Trader app delivers a modern mobile interface with over 90 indicators. Security is solid, with two-step authentication on the mobile app, although neither biometric login nor full alert functionality is available.

I discovered that FBS offers a mix of industry-standard and proprietary trading platforms to suit different trader profiles. Clients can choose among MT4, MT5, and the broker’s own FBS Trader mobile app. MT4 and MT5 are available across desktop, web, and mobile devices, while the FBS mobile app is designed for simplicity and mobility. These platforms support all major asset classes offered by FBS and provide fast execution.

Look and feel

The platforms are intuitive and user-friendly, making them accessible for both beginners and experienced traders. MT5, tested during live review, impressed with robust charting features, 38 technical indicators, 21 time frames, and 3 chart types (bar, line, candlestick).

Login and security

The MetaTrader platforms do not currently support biometric login (Touch ID or Face ID), which would offer greater convenience. Desktop platforms lack two-step login, a minor drawback for more security-conscious users.

Search functions

Both MetaTrader platforms offer efficient search functionality. Users can search by instrument name or asset class, allowing for quick navigation among FOREX pairs, indices, commodities, and cryptocurrencies. Instruments are clearly categorized, and features like watchlists help traders monitor favorites with ease.

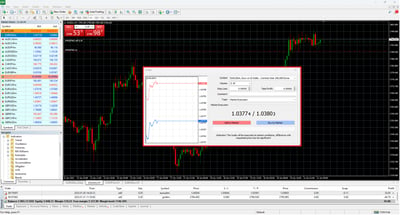

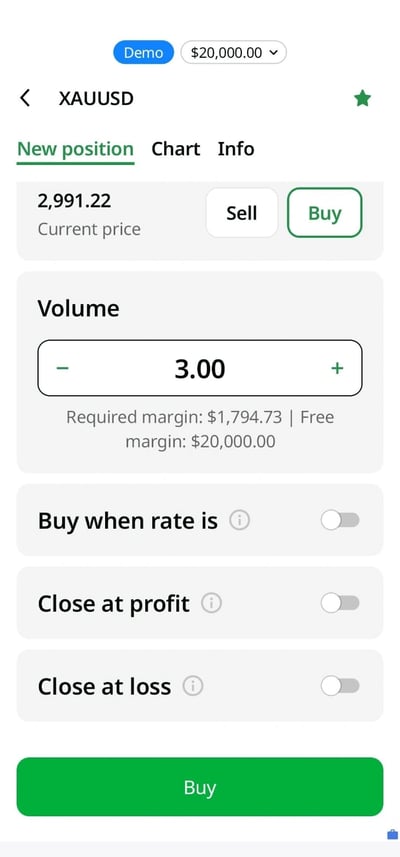

Placing orders

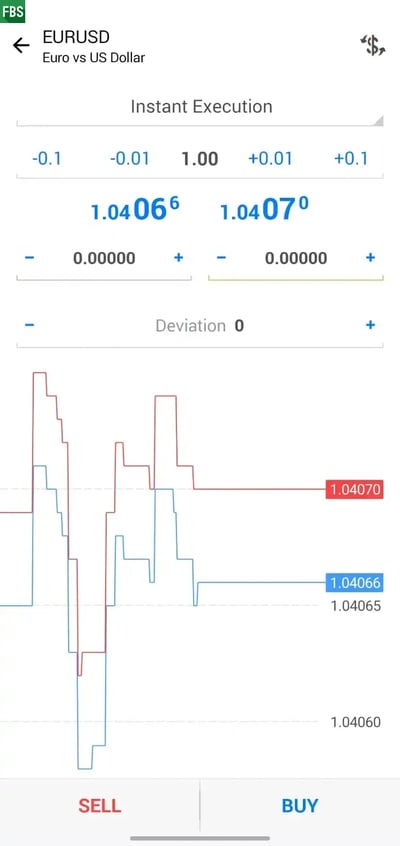

FBS platforms support a wide range of order types suitable for all strategies. MT5 and MT4 allow market, limit, stop-loss, and trailing stop orders. One-click trading and chart-based order placement are available on both desktop and web versions, enabling fast execution and risk management.

Alerts and notifications

This is one area where I found FBS platforms are slightly lacking. On the desktop MT5 platform, users can set alerts via email or mobile push notifications, but configuration requires some setup via the “Options” menu.

Mobile Trading

The FBS mobile trading experience is intuitive and beginner-friendly, especially through its proprietary FBS mobile app, which features strong charting tools powered by TradingView and over 90 technical indicators. While the app is cleanly designed and allows for fast order execution with market, limit, and stop-loss orders, it lacks advanced features like trailing stops, custom alerts, and push notifications, which may deter more experienced traders. Security is solid with two-step login and modern encryption, though biometric login options are not supported.

In my view, The FBS mobile trading experience is polished and user-friendly, especially on the proprietary FBS Trader app. It’s well-suited to newer traders and those seeking a high-quality mobile charting experience, but more advanced users may miss features like trailing stops and custom alerts.

Platforms

FBS offers mobile trading through two primary apps: the FBS Trader app and the MT4 and MT5 mobile apps. While each caters to traders on the go, the proprietary FBS Trader app stands out for its intuitive interface, integration with TradingView, and strong charting capabilities.

Look and feel

The FBS Trader app is cleanly designed and easy to navigate. All key features, like account balances, trading history, and open positions, are readily accessible, and the layout prioritizes ease of use without overwhelming the user. Charting is powered by TradingView, delivering high-quality visuals and more than 90 technical indicators, which is impressive for a mobile platform.

Login and security

The FBS mobile app supports a two-step login process, providing an extra layer of protection for user accounts. However, it does not support biometric login,such as Touch ID or Face ID, which could have added convenience for users. Despite that, the app remains secure, leveraging modern encryption protocols to protect client data and financial transactions.

Search functions

Search functionality on the FBS app is quick and intuitive. You can search for instruments using keywords or category filters, making it easy to locate FOREX pairs, indices, commodities, or cryptocurrencies. Watchlists can also be customized, helping users monitor preferred assets in real time.

Placing orders

The FBS Trader app supports the core order types: Market orders, Limit orders, and Stop-loss orders. Execution is fast and responsive, with order placement integrated directly into charts. That said, trailing stop-loss orders are not available on mobile and must be placed via the desktop platform.

Alerts and notifications

One major limitation of the FBS Trader app is the lack of price alerts or push notifications.This means traders cannot set alerts for price thresholds or receive real-time updates on market movements, which is a drawback for those who rely on mobile trading as their primary method.

Research and Development

According to my assessment, FBS offers a comprehensive suite of research and analysis tools that support traders at all skill levels, from beginners to experienced market participants. The tools are accessible via the broker’s website and trading platforms, offering both educational insight and actionable market analysis.

The Trade Ideas section delivers concise, technically driven setups based on indicators like price/oscillator divergence, support and resistance zones, and potential breakout levels. These ideas help traders interpret chart patterns and plan entries or exits with real-time context.

FBS’s Market Insights articles blend fundamental and technical analysis, giving you a broader perspective on market direction. These reports incorporate major economic developments, central bank policy expectations, and geopolitical factors affecting markets.

The broker hosts live trading streams on YouTube, led by in-house analysts. These sessions often center around key economic releases like Nonfarm Payrolls (NFP) and include live trade setups, Q&A sessions, and real-time chart analysis.

The platform includes a comprehensive economic calendar, covering global macroeconomic events, corporate earnings (for stock CFDs), and dividend payment dates. FBS offers several practical trading tools: A FOREX calculator to compute position sizes, pip values, and margin requirements, and a currency converter to assist with international transactions.

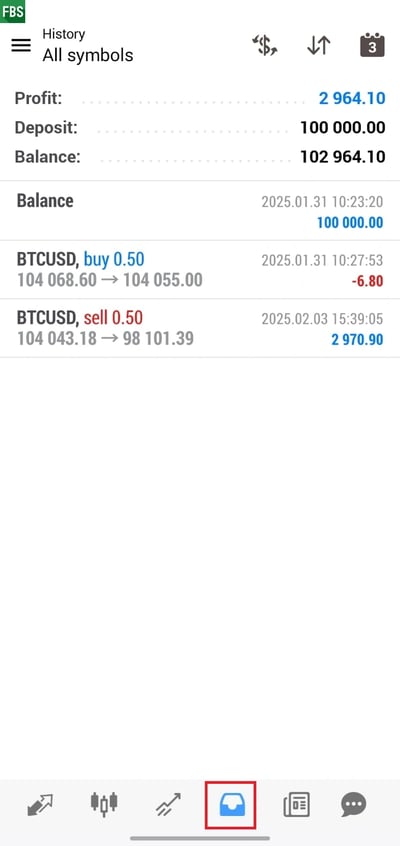

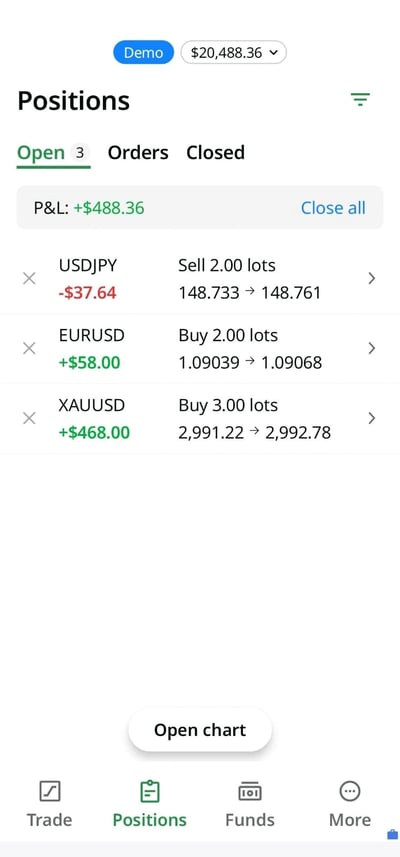

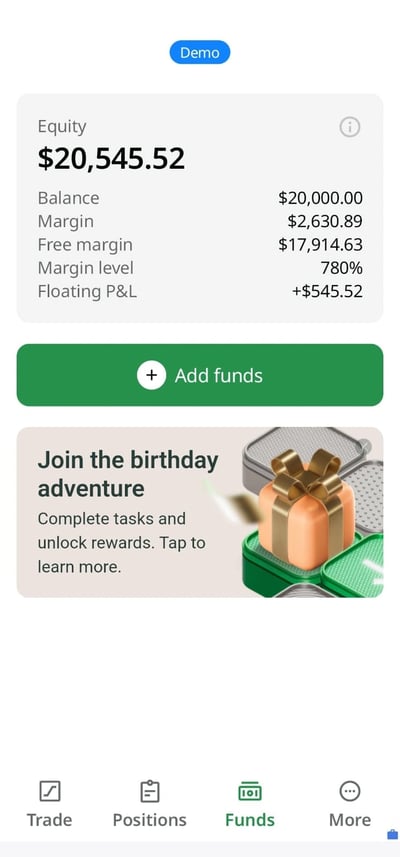

Trading statistics

Clients can access detailed statistics such as account equity, margin, free margin, floating profit/loss (P&L), and used leverage. These metrics help traders manage risk and assess their account exposure in real time.

FBS provides execution speed statistics, with most orders filled in under 30 milliseconds. This is particularly relevant for high-frequency traders and scalpers who rely on speed to capture small market moves. Additionally, FBS uses NDD and STP technologies, which contribute to transparent and efficient execution.

Trading signals

FBS offers trading signals, but they are provided through the MT4 and MT5 platforms, rather than a proprietary system. Traders can access MetaTrader’s built-in Trading Signals feature, which allows them to automatically copy the trades of thousands of other signal providers in real time.

FBS supports access to over 3,200 free and commercial trading signals. Each signal includes detailed performance statistics, such as: Win/loss ratio, Monthly returns, Maximum drawdown, Number of subscribers, and Trading frequency.These metrics help traders evaluate and compare signal providers before choosing to follow one. While FBS does not offer its own standalone signal service, its integration with MetaTrader’s ecosystem gives clients broad access to automated copy trading and community-driven trading ideas.

Education

I learned that FBS hosts a comprehensive library of courses that walk users through topics such as: Introduction to Online Trading, FOREX Basics, Trading Psychology, Risk Management, and Algorithmic Trading with MQL5.Each course is broken down into short, digestible lessons, often ending with a recap, making them ideal for learners who prefer bite-sized, progressive content.

The broker regularly hosts live webinars and market commentary streams featuring in-house analysts. These sessions cover major events like Nonfarm Payrolls (NFP), include live trading setups, and offer opportunities for trader Q&A. Webinars are especially valuable for visual learners and those looking to apply theory in real-time market conditions.

The Trader’s Blog is packed with written content. FBS offers step-by-step guides and video tutorials to help users navigate the MT 4/5 platforms and the proprietary FBS Trader app.

Finally, FBS maintains a Telegram group where traders can engage with analysts, receive trade ideas, and interact with a broader trading community.

FBS has a good product range, even if it does not include real stocks, ETFs, or bonds. The broker compensates with competitive spreads on major FOREX pairs, a well-rated proprietary mobile app, and a standout education and research suite. With 24/7 multilingual customer support and robust regulation across CySEC, ASIC, and FSC, FBS is a solid choice for traders who prioritize cost-efficiency, trading speed, and educational support.

Final Thoughts on FBS

FBS is a globally regulated broker with a 16-year track record and a client base exceeding 27 million traders across 150+ countries. Known for its low entry barriers, FBS offers a minimum deposit starting from just $5, with zero fees on deposits, withdrawals, and inactive accounts, making it one of the most accessible platforms for new traders.

While its CFD-only product offering is more limited than some competitors, FBS still provides access to over 550 tradable instruments, including 72 FOREX pairs, 474 stock CFDs, 11 indices, 11 commodities, and 5 cryptocurrencies. Its pricing is competitive, particularly on FOREX and gold, and spreads start from 1.1 pips on EUR/USD with no commission on most accounts. Stock CFDs, however, incur a 0.7% commission per round turn.

FBS operates under the oversight of CySEC, ASIC, FSC (Belize), ensuring segregated client funds, negative balance protection, and, for EU clients, investor compensation up to €20,000. Its infrastructure supports fast execution and runs on trusted platforms like MT4, MT5, and a proprietary mobile app.

One of FBS’s standout features is its strong educational and research ecosystem, including structured learning courses, webinars, trade ideas, and live market analysis sessions. For traders looking for a blend of low-cost trading, platform versatility, and strong support resources, FBS offers a reliable and well-rounded solution.

Conclusion

In my opinion, FBS is a user-friendly, globally accessible broker that offers a strong combination of affordability, platform versatility, and educational support. With a minimum deposit as low as $5 and commission-free trading on most accounts, FBS makes it easy for traders of all levels to get started.

Its regulatory coverage provides a reassuring layer of oversight, while features like negative balance protection and segregated client funds enhance safety.

While its product lineup may not cater to long-term investors seeking real assets like ETFs or bonds, FBS shines as a cost-efficient and technically reliable broker for FOREX and CFD traders. Add to that a powerful mobile app, competitive spreads, and a rich library of educational content, and it’s clear that FBS delivers a compelling trading environment for both beginners and active traders alike.

Review Methodology

The team at Arincen collected more than 120 data points across more than 100 licensed FOREX companies. Data collection was done in three ways:

1. Companies’ websites.

2. Other websites that have ranked FOREX companies.

3. A survey questionnaire (referred to here as Survey “1”) was sent to the companies invited to participate in the exercise.

We have identified 12 criteria for our assessment, each containing several aspects and carrying its own relative weight. These include licensing, deposits and withdrawals, and the number of assets.

Afterward, we validated the data by:

1. Registering with FOREX companies as a secret shopper and/or as Arincen.

2. Survey number “2,” in which we asked these companies’ customers for critical feedback and experience.

The next step involved evaluating and ranking each company, relying on the work of 15 Arincen employees. We were very careful to ensure the most accurate assessment possible, including consideration of different languages and mobile operating systems (e.g., Apple, Samsung).

To add credibility to our research project, we sent a final and third survey (referred to here as Survey “3”) to enable participating FOREX companies to evaluate our own research and whether it accurately reflects the realities on the ground. We were fortunate enough to receive a mark of 9.9 out of 10! We have kept the margin of error to a minimum, which stood at a measly 1%. To learn more on how we came up with the evaluation, please click here.

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

FAQ

FBS Markets Inc. is registered in Belize and regulated by the IFSC to be able to provide safe and compliant trading to several jurisdictions outside the EU. By contrast, FBS.eu is operated by the Cypriot firm TradeStone Ltd. – which is authorized and regulated by the tier-1 (high trust) CySEC and can provide passport brokerage services to countries across the entire EU

FBS covers traders with the ICF scheme, meaning traders would be compensated by up to €20,000 if the company becomes insolvent. In the EU, the broker also offers Negative Balance Protection to retail clients.

FBS enjoys a presence in more than 190 countries. However, it does not accept traders from the US, Brazil, Thailand and Japan.

Yes. At the time of writing, the broker offered a “Level Up Bonus,” which entitled traders to an amount of $140 to open their account and start trading.

Several deposit and withdrawal methods are available, including wire transfer (EU only), in addition to Visa and electronic payment systems, such as Skrill and Neteller.

FBS provides access to two platforms to access the markets: MT4 and MT5.

Clients can find a customer representative available on several international numbers. Other contact options include live chat, call back and WhatsApp via the company's global Website.