XM Review 2026

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

XM Evaluate - research resu

Key Takeaways

XM is a globally regulated online broker, founded in 2009

The platform offers trading access to over 1,400 CFDs, including 55 FOREX pairs, 26 indices, 14 commodities, over 1,300 share CFDs, and such multiple thematic indices as the AI Giants US Index and Electric Vehicles US Index

XM has serviced more than 10 million clients across 190+ countries since its inception, executing over 2.4 billion trades

The broker has won several industry accolades

XM is regulated by Tier-1 authorities such as ASIC (Australia) and CySEC (Cyprus), as well as by the Tier-2 IFSC (Belize) and DFSA (UAE)

Through CySEC’s Investor Compensation Fund, qualifying clients may receive up to €20,000 in compensation in case of broker insolvency

XM offers both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), available for demo and live accounts on desktop and mobile platforms

Trade execution speeds are strong, with over 99% of orders executed in under one second, and XM offers VPS hosting for optimized speed

There are two main account types: XM Ultra Low, and XM Zero. Minimum deposits start at just $5

Customer support is available in more than 25 languages via live chat, email, and phone on a 24/5 basis

XM is known for fee transparency, with no withdrawal fees and low index CFD costs. However, it does apply an inactivity fee

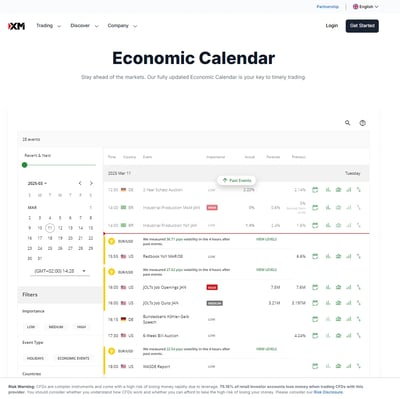

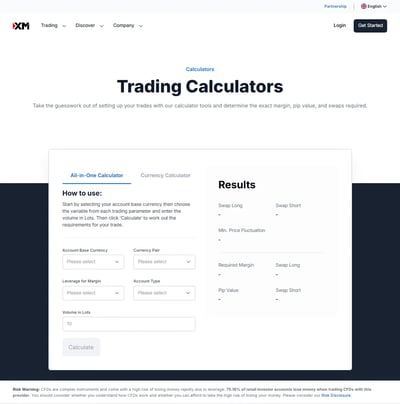

Research tools include daily video briefings, trading ideas, webinars, a news screener, and economic calendars. These are well suited for both beginners and experienced traders

The XM MT4 and MT5 trading apps are free and can be downloaded from the Apple App Store and Google Play for mobile trading

Last Reviews

Overall Summary

During my research, I learned that the broker XM Group was launched in 2009 and offers access to over 1,400 CFD instruments across currencies, commodities, indices, and share CFDs. XM is a MetaTrader-only broker—supporting both MT4 and MT5—without offering any proprietary platforms.

Traders can open an account with as little as $5, and XM holds several regulatory licenses, including CySEC (Cyprus), ASIC (Australia), DFSA (Dubai), and FSC (Belize). These regulators span Tier-1 to Tier-3 classifications, with CySEC and ASIC considered top-tier.

Negative balance protection and segregated accounts are standard across all entities. However, investor compensation schemes apply only under CySEC, covering clients up to EUR 20,000.

The broker offers some core account types: XM Ultra-Low and XM Zero, which support Islamic (swap-free) options. XM doesn't support cryptocurrencies or ETFs, which limits its diversification appeal. It does, however, offer thematic indices like the Crypto 10 Index and the Artificial Intelligence Giants Index—rare among brokers.

While testing this broker, I found it to be a reliable choice for CFD and FOREX traders seeking solid infrastructure and globally recognized platforms, even though there is room for product expansion.

XM is a well-regulated and long-established broker. It holds licenses from such respected authorities as CySEC in Cyprus and ASIC in Australia. XM enhances client safety through practices like fund segregation with top-tier banks and providing negative balance protection for EU clients. Overall, its regulatory coverage and operational transparency make XM a trustworthy choice for traders concerned about capital security.

Is XM Safe?

In my opinion, XM is a safe and well-regulated broker with a solid operational history dating back to 2009. Longevity in this space matters, and XM has steadily expanded its regulatory footprint over the years—a positive signal for traders evaluating broker reliability.

The group’s regulatory timeline highlights its strategic growth:

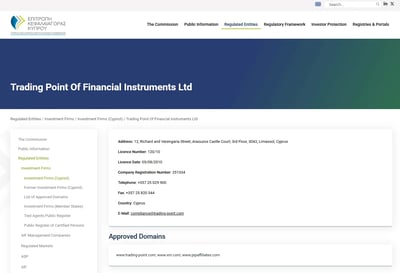

In 2009, XM’s first entity, Trading Point of Financial Instruments Ltd., was established under CySEC regulation in Cyprus.

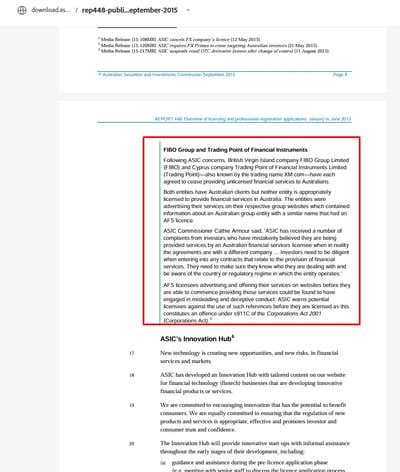

In 2015, it expanded into the Asia-Pacific region via ASIC oversight in Australia.

By 2017, XM Global Limited was launched under IFSC regulation in Belize.

XM is also regulated by the DFSA in the UAE, broadening its compliance coverage across major trading regions.

These licenses span from Tier-1 to Tier-3 regulatory classifications, with CySEC and ASIC ranking as top-tier authorities. This means that, depending on the jurisdiction under which a client signs up, they may enjoy varying levels of investor protection. For example, CySEC-regulated clients qualify for coverage under the Investor Compensation Fund, which protects up to €20,000 in the event of broker insolvency.

XM also adheres to client fund segregation, using top-tier banks like Barclays to ensure your money remains separate from the broker’s operating capital. Negative balance protection is standard for EU clients, preventing losses beyond the amount deposited.

While no brokerage is without risk, XM’s regulatory structure, operational transparency, and long-standing track record point to a broker that takes safety seriously and gives you good reason to trust your capital in its hands.

How XM Protects You from Reckless Leverage and Margin Trading

Leverage and margin can be powerful tools for traders, but if not used right, they can result in hefty losses. Some unreliable brokers offer simply too much leverage, which can be dangerous for new traders.

How you are protected

I found that this broker works with a carefully tiered leverage structure and strict regulatory safeguards. Maximum leverage at XM varies by jurisdiction and account type but is capped at 30:1 for retail clients under CySEC and ASIC regulations, aligning with EU and Australian investor protection rules.

Combined with negative balance protection and margin call mechanisms that trigger at 50% and stop-outs at 20%, XM’s risk management controls are designed to prevent clients from spiraling into unsustainable losses due to overleveraging.

Regulation and other security measures

XM operates under a multi-jurisdictional regulatory framework that includes oversight from CySEC, ASIC, DFSA, and FSC—a mix of top-tier and mid-tier financial regulators that enforce strict operational standards

Additionally, XM maintains robust internal policies to guard against data breaches and unauthorized access, and clients are encouraged to use two-factor authentication on their trading platforms.

The broker’s strong security posture also means that they are likely to protect you from common trading scams. These measures, combined with transparent execution policies and real-time monitoring of trade activity, offer you a secure and professionally managed trading environment.

Top broker features

Here is a list of things I believe make this broker stand out:

Strong regulatory oversight: XM holds licenses from respected financial authorities.

A diverse range of over 1,400 CFD instruments: covering FOREX, indices, stocks, commodities, and thematic baskets—although ETFs, bonds, options, and cryptocurrencies are not available.

Execution speed: with over 99% of trades filled in under one second, reflecting XM’s investment in stable infrastructure and automated processing.

Strong educational offering: this is tailored to both novice and experienced traders, featuring webinars, daily video briefings, research insights, and trade ideas in multiple languages.

For Whom Is XM Recommended?

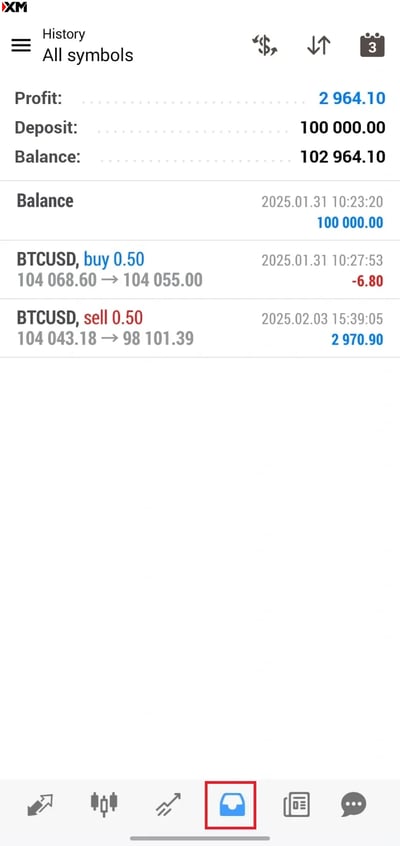

In my opinion, XM is a solid choice for both beginner and experienced traders looking for a regulated, accessible, and well-resourced broker. Newcomers can start with a demo account funded with $100,000 in virtual capital, providing a risk-free way to explore the MT4 and MT5 platforms. With access to over 1,400 CFD instruments—including FOREX, indices, stocks, commodities, and thematic baskets—there’s a broad enough range to suit most trading interests.

For those focused on learning, XM’s multi-language education portal includes webinars, video tutorials, and market commentary, making it ideal for traders eager to sharpen their skills. More advanced users will appreciate the fast execution speeds, with over 99% of trades filled in under one second, as well as transparent pricing, including no hidden fees and competitive spreads from 0.8 pips on standard accounts.

In my view, here are the pros and cons of using this broker:

-

Licensed by CySEC, ASIC, DFSA, and FSC, offering a mix of Tier-1 and Tier-2 protections

-

Trade over 1,400 CFDs, including FOREX, indices, shares, and commodities

-

Low minimum deposit of as little as $5 (except Shares Account)

-

Fast execution with over 99% of orders executed in under one second

-

Transparent fee structure with zero deposit/withdrawal fees and clearly published spreads

-

Access webinars, daily videos, market analysis, and multilingual content

-

Uses the globally trusted MetaTrader platforms across desktop and mobile

-

Customer service available 24/5 in over 25 languages via chat, phone, and email

-

Only MT4 and MT5 are available—there’s no custom-built trading interface

-

No trading in ETFs, options, bonds, or cryptocurrencies

-

Investor protections like compensation funds only apply under CySEC regulation

-

An inactivity fee is charged after 90 days of no trading activity

-

Shares Account Requires $10,000, which is a higher entry barrier for stock investors

Offering of Investments

XM offers over 1,400 CFD instruments, covering key markets like FOREX, indices, commodities, stocks, and thematic indices, though it excludes crypto, ETFs, and bonds. It’s designed for traders focused on short- to medium-term CFD strategies rather than long-term investing. FOREX trading is a core strength, with 55 currency pairs and tight spreads, while stock CFDs number over 1,300 from global exchanges.

I belive XM offers a well-rounded selection of over 1,400 CFD instruments, catering to retail and professional traders looking to access global markets from a single platform. While it doesn’t offer cryptocurrencies, ETFs, or bonds, the broker covers the essentials well. XM’s lineup is built for traders who value variety in traditional markets, especially those who prefer short- to medium-term CFD speculation rather than long-term investing. Below is a detailed overview of the financial assets available for trading with XM.

FOREX

XM provides 55 FOREX pairs, including majors, minors, and exotics. With tight spreads starting from 0.8 pips on standard accounts, FOREX is a key offering at XM. The broker supports flexible leverage, and traders can choose from micro lots to standard lots across multiple account types.

Indices

There are 26 equity indices available as CFDs. These include popular benchmarks like the S&P 500, FTSE 100, and Nikkei 225. Traders can go long or short on these instruments with no re-quotes, and the offering includes both cash and futures contracts.

Commodities

XM offers 14 commodities, which include 8 agricultural commodities, 4 energy products, and 4 metals. You can trade instruments like gold, silver, oil, and wheat—all as CFDs with competitive spreads. These are useful for portfolio diversification or trading macroeconomic themes.

CFD stocks

You can access over 1,300 share CFDs from global stock exchanges, including companies listed in the U.S., U.K., Germany, and beyond. Share CFDs allow for short-term speculation without owning the underlying asset. The Shares Account, specifically tailored for equity traders, requires a higher minimum deposit of $10,000.

Thematic indices

I think this is a unique feature of XM is its inclusion of thematic indices, such as the Crypto 10 Index, Artificial Intelligence Giants Index, Cannabis Index, and Electric Vehicles (EV)) Index. These baskets offer a simplified way to trade emerging sectors without having to select individual companies.

Available assets

| Markets | Available | Number of Assets |

| Currency Pairs | 55 | |

| Stocks | ||

| Commodities | 14 | |

| Crypto | ||

| Indices | 26 | |

| ETFs |

Account Types

XM offers four core account types—Micro, Standard, Ultra Low, and Zero—designed to suit traders of varying experience levels and strategies. Each account supports key trading techniques like hedging, scalping, and automated trading on both MT4 and MT5 platforms. The Micro and Standard accounts start with a $5 minimum deposit, while the Ultra Low and Zero accounts cater to traders seeking tighter spreads or raw pricing with slightly higher minimum deposits.

In my experience, XM keeps its account offering streamlined, providing a manageable range of core account types designed to cater to traders of different experience levels and trading styles. The simplicity of the lineup is a welcome contrast to the often overly complicated account structures found elsewhere in the CFD and FOREX space. Whether you're a beginner testing the waters or a seasoned trader with a refined strategy, there's an account that fits the bill.

All XM accounts support such varied trading strategies as hedging, scalping, and automated trading, including the use of bot trading on both MT4 and MT5 platforms.

XM Ultra Low AccountDesigned for tighter spreads, the Ultra Low Account offers spreads starting from 0.8 pips, with no commission. The minimum deposit is $5, and traders can choose between Micro Ultra (1,000 units) and Standard Ultra (100,000 units) lot sizes. However, you should know that base currency choices are limited to six options: USD, EUR, GBP, AUD, ZAR, and SGD.

XM Zero AccountThis account is built for traders who want raw spreads starting from 0.0 pips, paired with a commission of $3.50 per side per standard lot (i.e., $7 per round trip). The minimum deposit is $10, and it’s available in USD, EUR, and JPY. This setup suits scalpers and high-frequency traders who prioritize execution costs.

All accounts offer Islamic (swap-free) options and are accessible on both MT4 and MT5. Further, XM supports negative balance protection, helping you avoid losses that exceed your deposits.

| Account Type | Minimum Deposit | Spread Commission | Commission | Swap Commission | Deposit Commission | Withdrawal Commission |

|---|---|---|---|---|---|---|

| XM Ultra Low Account | $5 | Starting from 0.8 pips | $0 | Available | $0 | $0 |

| XM Zero Account | $10 | Starting from 0 pips | Starting from $7 | Available | $0 | $0 |

Account opening

I found XM's account opening process to be hassle-free, fully digital, and straightforward. You can start using your account on the same day, provided all verification steps are completed.

XM's account opening process is designed to be user-friendly and efficient, making it accessible for traders worldwide.

What is the minimum deposit at XM?

XM offers a variety of account types to accommodate different trading preferences and experience levels. The minimum deposit required to open an account with XM is $5. However, it's important to note that the minimum deposit amount may vary depending on the chosen payment method.

How to open your account

Click on "Open an Account" on the XM website. Provide your country of residence, email address, and password, then verify your email.

After email verification, you will gain access to the Members Area. Fill in your personal details and financial information, and answer questions about your financial knowledge. Upload a copy of your national ID, passport, or driver's license to verify your identity. Submit utility bills or bank statements as proof of residency.

XM verifies accounts quickly, often on the same day. Once verified, you can deposit funds and start trading.

Deposits and Withdrawals

XM provides a cost-efficient and flexible funding system, offering a range of deposit and withdrawal options, including credit/debit cards, e-wallets like Skrill and Neteller, and bank transfers. Deposits are processed instantly for cards and e-wallets, and withdrawals are typically handled within 24 hours, ensuring quick access to funds. XM charges no fees for most transactions.

I believe that XM offers a flexible and cost-efficient funding environment, with a broad selection of deposit and withdrawal methods accessible through the XM Member’s Area.

Traders can fund their accounts using major credit cards such as Visa, MasterCard, and Maestro, as well as e-wallets like Skrill and Neteller. Bank wire transfers and local bank options are also available, depending on your region.

One of XM’s standout features is its zero-fee policy on deposits and withdrawals via Skrill, Neteller, credit cards, and bank transfers.

Deposits via credit card and e-wallet are processed instantly, meaning funds will appear in your trading account without delay. Withdrawal requests are typically processed by XM within 24 hours, maintaining a fast and reliable turnaround.

Overall, XM’s approach to funding is both transparent and trader-friendly, particularly for those using digital wallets or depositing in larger amounts. Its policy of covering all transfer fees above set thresholds helps ensure that traders keep more of their capital, instead of losing it to banking fees.

Account base currencies

XM offers the following 10 account base currencies: USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, and SGD.

This selection is just about in line with competing brokers and allows you to avoid currency conversion fees by choosing a base currency that matches your bank account or trading assets.

XM deposit fees and options

XM offers deposit options through Credit/Debit Cards, Wire Transfers, Neteller, and Skrill.

XM charges no deposit fees, and deposits can only be made from accounts in your name. Processing time is instant, and major currencies like EUR, USD, and GBP are supported.

XM withdrawal fees and options

XM offers the following withdrawal methods:

Credit/Debit Card: During my research, I found that the processing time was predictably up to 24 hours

Wire Transfer: Processing Time: 2-5 business days

Neteller: Processing Time: Up to 24 hours

Skrill: Processing Time: Up to 24 hours

| Method | Credit Card | Wire Transfer | Skrill | Neteller | Cryptocurrency | PayPal | Apple Pay |

| Deposit fee | $0 | $0 | $0 | $0 | Unavailable | Unavailable | Unavailable |

| Withdrawal fee | $0 | $0 | $0 | $0 | Unavailable | Unavailable | Unavailable |

Customer Support

XM provides multilingual customer support 24 hours a day, five days a week, through live chat, email, and phone, covering over 25 languages to serve a global clientele. The support team is known for being responsive and helping traders with technical issues, account management, and platform navigation. Additionally, XM offers a comprehensive self-service hub with FAQs, educational resources, and account tools for users who prefer finding answers independently.

I was pleased to discover that XM offers multilingual customer support available 24/5. Traders can reach out through live chat, email, or phone, with service provided in over 25 languages to accommodate its global client base.

The support team is described as responsive and professional, making it easy for both beginners and experienced traders to resolve platform-related issues, get help with account management, or ask technical questions. This level of access and linguistic flexibility is especially useful for international clients trading across different time zones.

In addition, XM’s website and Member’s Area provide a robust self-service support hub, including FAQs, account management tools, and access to educational resources, ensuring that clients can often find answers without needing to speak to an agent.

| Live Chat | Phone | |||

| Available | Available | Available | Available | Unavailable |

| Quick response | Moderate | Fast | Moderate | Fast |

Commissions and Fees

XM offers transparent pricing across its account types, with options for spread-only trading or raw spreads plus commission, depending on the trader's preference. Ultra Low accounts are commission-free, while the Zero account offers raw spreads with a $7 round-trip commission per lot. Swap fees apply for overnight positions, but Islamic (swap-free) accounts are available on request, and an inactivity fee of $5 per month is charged after 90 days of no activity.

I discovered that XM is upfront about its pricing model, offering a mix of account types that either include spreads-only trading or a combination of raw spreads plus commission. There are no hidden fees, and the broker absorbs the cost of most deposit and withdrawal methods. The cost structure is designed to appeal to both low-budget retail traders and more active, cost-sensitive professionals, depending on the account selected.

Spreads

Spreads at XM vary depending on the account type:

- The Ultra Low account also has no commission and offers even tighter spreads, starting from 0.8 pips or lower depending on market conditions.

- Zero accounts offer raw spreads as low as 0.0 pips, best suited for traders who want interbank pricing and don’t mind paying a commission instead.

Commissions

Commissions are charged only on the XM Zero account. Here, traders pay $3.50 per side per standard lot, totaling $7 per round turn. All other account types are commission-free, relying entirely on the spread to generate broker revenue.

Swap Fees and Islamic Accounts

Overnight swap fees apply when holding positions past market close. However, XM offers swap-free Islamic accounts for all account types upon request. These accounts do not charge interest, in accordance with Shariah principles, but may include an administration fee in place of traditional swaps depending on the trading instrument.

Inactivity fee

XM applies an inactivity fee of $5 per month after 90 calendar days of no trading activity or login to the client portal. If the account remains dormant long enough to reach a zero balance, it is archived automatically.

Other commissions and fees

There are no deposit or withdrawal fees for most methods—including credit cards, Skrill, Neteller, and bank transfers.

| Spread | Commission | Swap | Islamic Account | |

| Currencies | Starting from 0.8 Pips | $0 | Yes | Available |

| Stocks | Starting from 0.39 Pips | $0 | Not Mentioned | Unavailable |

| Commodities | Starting from 1.6 Pips | $0 | Yes | Available |

| Indices | Starting from 2.6 Pips | $0 | Yes | Available |

Platforms and Tools

XM provides a stable and reliable trading environment built entirely around the MT4 and MT5 platforms, without offering a proprietary alternative. These platforms are accessible via desktop, web, and mobile; and while their interface is functional rather than flashy, they prioritize speed, precision, and customization. Traders can place a variety of order types and set alerts, though some features—like push notifications and email alerts—require manual configuration, which may be less user-friendly for beginners.

In my view, XM offers a focused but reliable trading environment centered entirely on MetaTrader platforms. XM does not offer a proprietary platform, but it provides full support for MT4 and MT5, the industry’s most widely used third-party platforms.

XM’s platform ecosystem is simple, stable, and geared toward MetaTrader enthusiasts. With full mobile, web, and desktop integration across MT4 and MT5, traders can easily manage their accounts and execute trades from anywhere.

Look and feel

During testing, I felt that XM’s trading platforms—MT4 and MT5—offered a clean, familiar, and highly functional interface. While not flashy or visually modern, both platforms are designed with a simple feel that prioritizes speed, stability, and charting precision. Traders can customize the layout, color schemes, and chart styles, allowing for a personalized trading experience.

Login and security

Login is straightforward, using standard username and password credentials for access to the desktop, web, or mobile platforms. XM does not require or offer built-in two-step authentication (2FA) on MetaTrader itself. However, the XM Member’s Area uses its own secure environment.

Search functions

The search functionality on both MT4 and MT5 is basic but effective. Users can scroll through the list of instruments or type in a symbol directly to locate specific assets. Asset categories are sorted in a vertical panel, and MT5 improves slightly on MT4 by organizing instruments more intuitively and supporting a larger asset range. Still, the search tools are not as advanced or filter-rich as those found in proprietary platforms offered by other brokers.

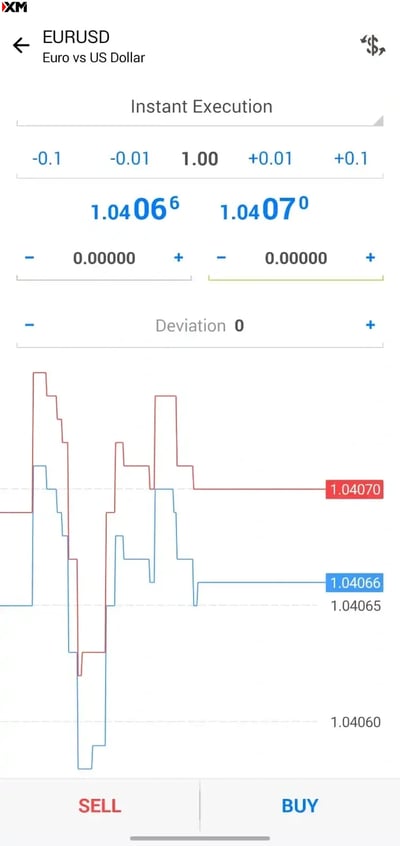

Placing orders

Order placement on XM’s platforms is quick, seamless, and supports a wide range of order types. Traders can place market, limit, stop, and trailing stop orders. The platforms also allow for one-click trading, which is particularly useful for scalping or high-frequency strategies. Each trade ticket provides such key information as volume, stop loss, take profit, and slippage tolerance—empowering traders to execute with precision.

Alerts and notifications

Alerts and notifications can be set up directly within MT4 and MT5, though they are more robust in MT5. Traders can configure price alerts and sound notifications, but push notifications to mobile devices require manual setup through MetaTrader’s mobile apps. Email alerts can also be enabled, but it's not as plug-and-play as modern, proprietary trading platforms.

Mobile Trading

XM’s mobile trading platforms, available through MT4 and MT5, are user-friendly and well-designed for trading on the go, offering core features like efficient navigation, basic order types, and solid usability. However, they lack advanced features such as biometric login, two-factor authentication, and the ability to set alerts directly within the app, which may limit their appeal to experienced traders.

In my assessment, XM’s mobile trading platforms are user-friendly and functional, offering essential tools for trading on the go. However, they lack advanced security features, direct alert settings, and sophisticated order types.

Platforms

XM provides mobile trading through MT4 and MT5. These platforms are designed for trading on the go, offering essential features for monitoring and executing trades.

Look and feel

XM’s mobile trading platforms are user-friendly and well-designed, making it easy to navigate and find features. The layout is intuitive, allowing you to access tools and execute trades quickly.

One drawback I found was that analyzing price action behavior on low-resolution mobile devices can be challenging, especially for detailed technical analysis.

Login and security

XM’s mobile platforms provide only a one-step login process, which is less secure compared to two-step authentication. Touch/Face ID login is not supported, which, as we have said, is a security gap.

Search functions

The search functions are efficient, allowing users to search by typing the name of the product or navigating through category folders. The search tool is straightforward and helps you quickly locate instruments.

Placing orders

Traders can place Market, Limit, and Stop orders on the mobile platform. The supported Order Time Limits include Good 'til Canceled (GTC) and Good 'til Time (GTT) orders.

Alerts and notifications

Alerts and notifications cannot be set directly on the mobile platform. Notifications can be configured on the desktop platform to appear on mobile devices. However, the inability to set alerts directly on mobile is a drawback for traders who rely on real-time updates.

Research and Development

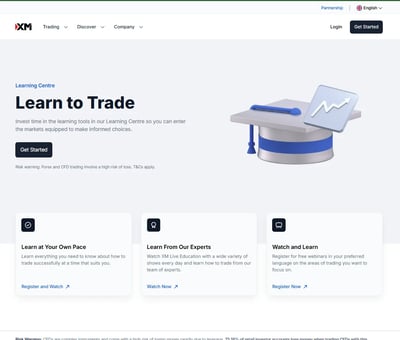

I believe that XM offers a well-rounded research and education suite that caters to both beginner and advanced traders, with content available in multiple languages and across a variety of formats. The broker takes education seriously, providing live, structured, and interactive learning environments to build long-term trading skills.

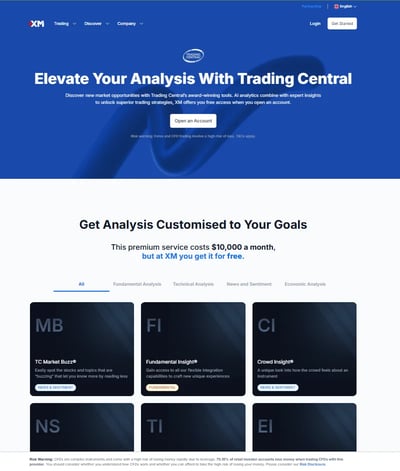

From a research standpoint, traders benefit from daily market analysis, technical breakdowns, and news-driven updates covering FOREX, commodities, stocks, and indices. These are delivered through articles, videos, and real-time charts. XM also provides a FOREX news feed, market outlooks, and a real-time economic calendar, helping traders stay ahead of key global events.

Trading statistics

XM does not offer third-party signal integration or automated trading alerts in the same way that dedicated signal services do. However, the broker compensates with a steady flow of in-house market intelligence designed to support informed trading decisions. This includes real-time technical analysis, price chart commentary, and daily briefings that serve as unofficial trading signals for many users.

Trading signals

While XM does not promote a formal “trading signals” package, traders can access a robust stream of insights via the Research and Education portal. These include:

- Daily market reviews

- Live market updates

- Technical chart assessments

- Economic event-driven analysis

These resources are crafted by XM’s internal team of analysts and often mirror the function of trading signals by helping traders identify key price levels, trend momentum, and potential entry or exit zones. Additionally, the economic calendar and news feed help traders anticipate volatility around major announcements.

XM does not feature social or copy trading functionality. It does, however, offer the XM Crowd Insight tool, which is a market sentiment indicator to give traders a real-time view of how other traders on the platform are positioned in various markets. It's a trader sentiment analysis tool designed to help you gauge the mood of the crowd, which can be useful when you're making trading decisions.

As far as the broker’s Trading Central package, XM integrates this service into its research offerings to help traders make informed decisions based on expert insights. You can get daily technical analysis, actionable trading ideas, and visual tools with annotated charts.

Education

I'm of the opinion that XM provides a comprehensive selection of educational tools designed to cater to traders of all experience levels. The broker releases highly insightful webinars several times a week. Topics cover a wide spectrum of subjects related to technical analysis, fundamental analysis, and trading psychology.

The broker also includes educational videos that explain trading concepts, strategies, and platform usage. The good thing is that they are easy to digest and available for viewing at any time.

Daily market analysis provides continual videos, podcasts, and detailed articles on market trends and trading opportunities. You can also get access to XM Live Education, where you will find broadcasts of high-quality videos in nine languages, traders with whom to interact, and experts to ask questions.

XM combines competitive pricing, multi-asset market access, and a commitment to regulatory integrity. It supports fast and reliable order execution and stands out for its transparent fee structure and extensive research and education ecosystem.

Final Thoughts

I found XM to be a well-regulated, globally trusted broker with a robust infrastructure and a client base that has surpassed 10 million traders across 190+ countries. Its pricing remains competitive, with zero commissions on most account types and raw spreads with low commissions on the XM Zero Account. Spreads start from 0.8 pips on standard accounts and 0.0 pips on Zero, offering flexibility for both casual and active traders.

Traders have access to a diverse lineup of over 1,400 CFD instruments, including 55 FOREX pairs, 26 indices, 14 commodities, and more than 1,300 share CFDs, along with several thematic stock baskets covering AI, electric vehicles, and cannabis.

XM’s multi-jurisdictional regulation under authorities like CySEC, ASIC, DFSA, and FSC provides peace of mind, backed by features like segregated funds, negative-balance protection, and investor compensation where applicable. Its long-standing presence since 2009 speaks to stability in a fast-changing industry.

A particular strength is its commitment to fee transparency, which remains a consistent theme throughout its operations. For traders at all levels, XM’s multilingual education and research tools, including live webinars, daily briefings, and a full-time education room, add serious value.

Conclusion

In my opinion, XM is a well-established global broker that caters to traders across the spectrum. Its execution speeds are impressive—over 99% of orders are filled in under one second—and both MT4 and MT5 platforms provide the stability and flexibility traders expect.

The broker’s emphasis on transparent pricing, low entry barriers (from just $5), and multi-tiered regulation under respected bodies like ASIC and CySEC makes it a trustworthy choice for many traders.

XM invests heavily in trader development, with live education rooms, multilingual webinars, and expert-led market insights that enhance both learning and engagement. Combined with responsive, 24/5 multilingual customer support, the overall experience is polished and accessible.

Review Methodology

The team at Arincen collected more than 120 data points across more than 100 licensed FOREX companies. Data collection was done in three ways:1. Companies’ websites.2. Other websites that have ranked FOREX companies.3. A survey questionnaire (referred to here as Survey “1”) was sent to the companies invited to participate in the exercise. We have identified 12 criteria for our assessment, each containing several aspects and carrying its own relative weight. These include licensing, deposits and withdrawals, and the number of assets. Afterward, we validated the data by:1. Registering with FOREX companies as a secret shopper and/or as Arincen.2. Survey number “2,” in which we asked these companies’ customers for critical feedback and experience. The next step involved evaluating and ranking each company, relying on the work of 15 Arincen employees. We were very careful to ensure the most accurate assessment possible, including consideration of different languages and mobile operating systems (e.g., Apple, Samsung).

To add credibility to our research project, we sent a final and third survey (referred to here as Survey “3”) to enable participating FOREX companies to evaluate our own research and whether it accurately reflects the realities on the ground. We were fortunate enough to receive a mark of 9.9 out of 10! We have kept the margin of error to a minimum, which stood at a measly 1%. To learn more on how we came up with the evaluation, please click here.

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

FAQ

The minimum deposit is $5.

XM accepts clients from most countries worldwide. However, residents of the USA, Canada, China, Japan, New Zealand, and Israel cannot open accounts with XM.

XM offers the full MetaTrader suite, including MT4 and MT5.

XM offers over 1,400 tradable instruments, including FOREX (55 currency pairs), Commodities (14 CFDs), Stock CFDs (1,300+), and Indices (26 CFDs).

XM offers instant or same-day withdrawals for verified accounts. Withdrawals via bank wire, credit, or debit card typically take 2-5 business days.

XM does not charge deposit or withdrawal fees. However, bank wire transfers below $200 incur a $15 fee.

Yes, XM is suitable for beginners due to its user-friendly account opening process, extensive educational tools, and demo accounts for practice.