FXCM Review 2026

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

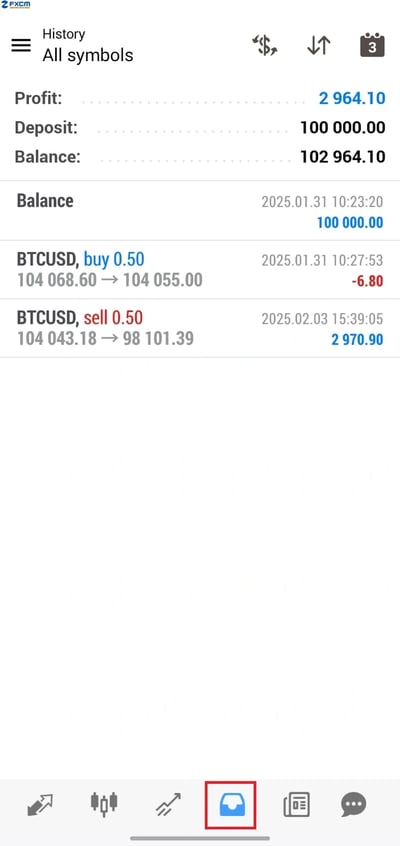

FXCM Evaluate - research result

Key Takeaways

FXCM is a mid-sized, UK-headquartered broker founded in 1999

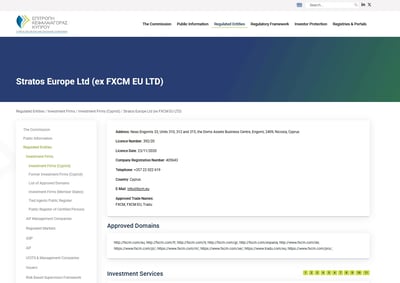

FXCM is regulated by the UK’s Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), the Financial Sector Conduct Authority of South Africa (FSCA), and the Australian Securities and Investments Commission (ASIC)

FXCM has won, among many more awards, the International Business Awards “Most Trusted Trading Platform Middle East 2023”

FXCM’s strong slate of liquidity partners helps drive its prices down

FXCM provides good access to financial markets, with Contract for Differences (CFD) in five asset classes

FXCM customers have hundreds of investment options from which to choose, including FOREX, share CFDs, commodities, cryptocurrencies, and indices.

FXCM offers spread betting in its UK home market, which can have tax advantages for clients in that country

FXCM uses the well-known third-party trading platform MetaTrader4 (MT4) to supplement its proprietary Trading Station platform for desktop and web trading

FXCM claims to have an average trade execution speed of 0.019 seconds

FXCM offers traders a strong range of five different account types.

FXCM supplies quality 24/5 customer support

FXCM offers competitive levels of spreads and commissions across its account types.

FXCM prides itself on trade execution transparency and markets the mechanics of its speed as a differentiator

Traders can access a strong knowledge base of quality research and education tools on FXCM’s trading platforms. FXCM’s in-house teams produce its educational materials, and it supplements this with market news and analysis from Trading Central

Last Reviews

Overall Summary

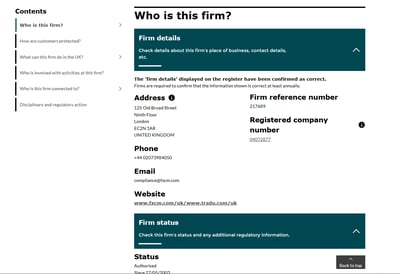

FXCM, established in 1999, is a growing provider of online FOREX trading, CFD trading, spread betting, and related services. Headquartered in London, FXCM operates under the regulation of the UK's FCA, meaning it is compliant with stringent financial standards.

The company's stated mission is to offer global traders access to the world's largest and most liquid markets by providing innovative trading tools and educational resources. It lives up to this promise. Over the years, FXCM has expanded its global footprint, establishing a presence in various countries to cater to a diverse clientele. Although not the biggest broker, by any stretch of the imagination, FXCM is still a dependable player in the FOREX trading industry, attracting both retail and institutional clients.

FXCM offers a wide array of trading services, including access to major indices and commodities such as gold and crude oil. The company provides various account types and platforms tailored to meet the diverse needs of its clients. By sticking to industry best practices, FXCM offers its clients secure deposits and withdrawals, competitive leverage, tight spreads, and rapid execution.

FXCM's dedication to offering exceptional online trading services and products has solidified its reputation as a reliable broker in the FOREX trading field. The company's focus on innovation, education, and regulatory compliance continues to attract a growing number of clients worldwide, contributing to its sustained success in the competitive financial markets.

Yes, FXCM is considered safe, as it is regulated by several top-tier authorities, including the UK's FCA and Australia's ASIC. Clients in the UK benefit from automatic negative balance protection, but this feature is not guaranteed for clients trading under other jurisdictions, such as Australia or South Africa. UK clients are covered by the Financial Services Compensation Scheme (FSCS) for up to £85,000 in case of broker insolvency.

Is FXCM Safe?

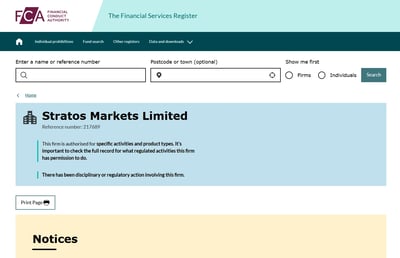

Yes, by all accounts, FXCM is thought to be safe. Brokers regulated by the most stringent authorities are typically seen as reliable because they have demonstrated the ability to comply with high regulatory standards. FXCM meets this standard through its compliance with key global regulators:

- FCA, UK

- ASIC, Australia

- CySEC, Cyprus

- FSCA, South Africa

As with all FOREX brokers or CFD brokers regulated in the UK, FXCM clients benefit from negative balance protection, meaning they cannot lose more than the funds available in their trading account. However, the broker does not automatically provide negative balance protection for clients trading under other regulatory jurisdictions, such as Australia or South Africa. The company takes responsibility for managing extreme market volatility that could lead to excessive losses.

FXCM adheres strictly to its regulatory obligations. For non-European Economic Area (EEA) customers, FXCM operates through its Australian and South African entities. is the home regulator of FXCM’s Australian arm, and does not require deposit insurance. In the UK, however, clients are protected under the FSCS up to £85,000 in the event of broker insolvency.

However, it is important to note that UK and EEA clients may be protected by mandated investor compensation schemes, but countries like South Africa and Australia do not enforce similar guardrails, so traders from these countries need to be extra careful.

For the sake of balance, investors should know that the FCA fined FXCM UK £4 million in 2014 for allowing its US affiliate, FXCM Group, to withhold profits worth £6 million from FXCM UK’s clients. Authorities in the US were also investigating another member of the FXCM Group for similar crimes.

FXCM UK eventually settled its dues, paving the way for its then parent company to become defunct, and for the Jefferies Financial Group to take over. All FXCM Group affiliates have followed all regulations since then.

In 2017, owing to continued regulatory challenges in the United States, FXCM withdrew from the U.S. market. However, the company has continued to operate successfully in other regions, adapting to changing regulatory landscapes and maintaining its commitment to providing quality trading services.

How FXCM Protects You from Reckless Leverage and Margin Trading

Leverage and margin are two tools in the trader’s arsenal that, if misused, can lead to heavy losses for the trader. Many irresponsible brokers offer high leverage that can ruin uninformed traders.

How you are protected

FXCM takes steps to protect traders from the dangers of high leverage by tailoring risk management strategies according to the trader's jurisdiction. The broker imposes region-specific leverage limits to prevent traders from taking on excessive online trading risk. In the European Union and UK, retail clients are subject to regulatory leverage caps of:

30:1 for major currency pairs

20:1 for non-major currency pairs, gold, and major indices

10:1 for commodities other than gold and non-major equity indices

5:1 for individual equities and other reference values

These restrictions are in line with guidelines from the European Securities and Markets Authority (ESMA) and the FCA to promote responsible trading practices.

In South Africa, FXCM offers leverage up to 400:1 for certain instruments, giving traders greater market exposure while emphasizing risk management. In other regions, FXCM Markets provides tiered leverage depending on the trader's equity. You should consult the broker’s website in your region for full details.

For jurisdictions outside of the EU and UK, otherwise known as "FXCM Markets", the maximum leverage available for Forex trading is set based on the equity balance in the account. In some areas, accounts with equity below $5000 can get leverage as high as 1000:1.

Regulation and other security measures

FXCM is subject to strict regulatory standards across its operating regions. As we have said, in the UK and the EU, traders are automatically granted negative balance protection, ensuring that losses cannot exceed the funds available in the account.

FXCM actively manages margin requirements to reflect market conditions. If the equity in an account drops below the maintenance margin level, FXCM may initiate a margin call or stop out to restore the necessary balance, reducing the risk of forced liquidations and major losses.

One good thing with this broker is that leverage is not a given. FXCM assesses individual experience, trading history, and customer loyalty before setting the leverage level. The goal is to provide balanced market exposure while minimizing the risks associated with over-leveraged positions.

Top broker features

Strong regulation and safety: FXCM operates under the oversight of several top-tier regulatory authorities, ensuring a secure trading environment for its clients

Diverse instruments: FXCM offers traders access to a broad spectrum of financial instruments, including FOREX pairs that come with competitive spreads. The broker also provides CFDs on global indices, commodities, and cryptocurrencies, among other assets.

Fast and transparent execution: FXCM is committed to providing swift and transparent trade executions. While specific execution statistics, such as stating that over 87% of orders have zero or positive slippage. All this is with an average execution time of 0.019 seconds

Low-cost trading: FXCM strives to keep trading costs competitive: It offers variable spreads on currency pairs and CFDs, with opportunities for active traders to receive discounts based on trading volume

Comprehensive education and support: The broker places a strong emphasis on trader education and support: It offers live market webinars, on-demand videos, and a variety of trading guides suitable for traders of all levels

Customer Support: FXCM provides dedicated 24/5 customer support, ensuring assistance is available when needed

For Whom Is FXCM Recommended?

Like many brokers, FXCM’s range of services is broad enough to accommodate any type of trader across the experience spectrum. However, the broker goes out of its way to sweeten the deal for high-volume traders.

Clients who trade enormous volumes qualify for the low spread Active Trader Account. The broker states that between November 2022 and October 2023, it paid out over USD 2.1 million in trading rebates to active traders. High-volume traders are eligible for the broker’s competitive monthly cash rebates. If you meet the minimum combined notional volume of USD 10 million on a monthly basis, you get reimbursed for the trades you place. Rebates will be credited directly to the trader’s accounts in the following month.

Another type of trader who could find a good niche with FXCM is the sophisticated algorithmic trader. By offering no fewer than seven third-party platforms with a focus on machine learning and Artificial Intelligence (AI)-driven algorithmic trading, FXCM is aligning itself with the next generation of traders.

As far for as institutional clients, the FXCM Pro account also provides retail brokers, small hedge funds, and emerging market banks access to wholesale execution and liquidity, while providing high and medium frequency funds access to prime brokerage services via FXCM Prime.

Here are the pros and cons of using this broker:

-

Good regulation by relevant authorities in its chosen markets

-

Quality educational material

-

Dependable desktop and web trading platforms

-

Availability of demo accounts for testing

-

Excellent liquidity partners

-

Access to five asset classes for investment

-

Competitive and transparent pricing

-

Low minimum deposits needed

-

Spread betting for UK and Ireland clients

-

Relatively small product portfolio

-

No direct ownership of shares

-

Does not offer managed accounts

-

Does not deal with certain key markets, including the US

-

Once fined by the FCA for defrauding customers

Offering of Investments

FXCM offers CFD trading on a variety of asset classes, including FOREX (42 currency pairs), indices (13 global indices), commodities (15), cryptocurrencies (9), and treasuries (government bonds, corporate bonds, and interest rates). While it doesn’t provide direct stock ownership, it does offer access to stock CFDs. UK clients have the added benefit of spread-betting services for tax-efficient trading.

Stock traders may be disappointed to learn that the broker does not offer direct ownership in stocks, but it offers only CFD stocks access. As far as assets that are not available to all traders, only UK clients can benefit from FXCM's spread-betting services, providing tax-efficient trading options.

FXCM maintains transparency in its efforts to reduce spread costs by collaborating with multiple premier liquidity providers. These providers, including global banks and financial institutions such as Barclays Bank, Citadel Securities, Citibank N.A., Deutsche Bank AG, and UBS AG, compete in real-time to offer the best buy-and-sell prices. This competitive environment ensures that traders receive optimal pricing, enhancing the overall trading experience.

That apart, FXCM offers a diverse range of investment opportunities across multiple asset classes:

FOREX

FXCM allows traders to trade 42 currency pairs, including major, minor, and exotic pairs with excellent liquidity and rapid execution speeds.

Indices

Traders can get their hands on 13 global index CFDs, such as the US30, NAS100, GER30, and more. By using the broker’s high-level trading platforms, traders can ride the wave of global bulls and bears.

Commodities

With FXCM, you can engage in trading nine commodity CFDs, covering markets like gold, silver, and crude oil.

Cryptocurrency CFDs

Although the broker does not offer direct ownership of cryptos, which may be a good thing considering the challenge of keeping crypto wallets safe from scam activity, you can invest in five cryptocurrency CFDs and one cryptocurrency basket, offering exposure to digital assets.

Treasuries

FXCM clients can trade CFDs on government bonds, corporate bonds, and interest rates. Regarding corporate bonds, FXCM offers CFDs on high-yield corporate bond indices, enabling clients to speculate on the performance of corporate debt instruments. In terms of interest rates, FXCM provides CFDs on interest rate futures, allowing clients to trade based on expectations of future interest rate movements.

Available assets

| Markets | Available | Number of Assets |

| Currency Pairs | 42 | |

| Stocks | 150 | |

| Commodities | 15 | |

| Crypto | 9 | |

| Indices | 14 | |

| ETFs |

Account Types

FXCM offers several account types to cater to different trading needs. The CFD Standard Account suits entry-level traders with low commissions, while the Active Trader Account provides reduced spreads and market research for high-volume traders. The Professional Trader Account is for institutional clients meeting strict volume and revenue criteria. FXCM also offers a Demo Account with $20,000 in virtual funds and a swap-free Islamic Account with fixed markups on spreads.

FXCM offers several accounts that range from basic to complex. It aims to cater to the entry-level client while supplying a high-performing account for seasoned traders, too. Depending on the asset being traded, and where the account is domiciled, margins and leverage can change. FXCM regularly updates its margin requirements on its website in the interests of transparency and reliability. These are the accounts on offer:

The CFD Standard Account: It is aimed at retail customers who require a high-functioning account for daily use. This account, with an easy-to-follow buy-and-sell layout, features commissions that are priced at the lower-end of the market for the entry level trader who aspires to become serious.

The Active Trader Account: This account is designed for high-volume traders on the lookout for lower commissions. For this account, spreads are drastically reduced according to usage tiers, which are laid out on the broker’s website. Users of this account have access to comprehensive market research information and powerful customer support.

The Professional Trader Account: This account is targeted at institutional clients moving substantial trade volumes. Professional traders are hand-picked by FXCM. Traders must pass strict volume and revenue criteria to qualify for this account.

Demo Trading Account: The live Demo Account offers new traders $20,000 of dummy capital. Apart from the US dollar, the account supports trading in other popular currencies, like the EUR and the GBP. Traders can immerse themselves in daily trading using the trading platform of their choice. With the demo account, you can trade online, 24 hours a day, 5 days a week

| Account Type | Minimum Deposit | Spread Commission | Commission | Swap Commission | Deposit Commission | Withdrawal Commission |

|---|---|---|---|---|---|---|

| Standard Account | $50 | Starting from 0.8 pips | $0 | Yes | $0 | $0 |

| Active Trader Account | $25,000 | Starting from 0.3 pips | $30 | Yes | $0 | $0 |

| Professional Trader Account | Portfolio value based | Starting from 0.3 pips | $0 | Yes | $0 | $0 |

Account opening

FXCM makes it easy to open accounts. Traders complete an online application and must undergo a three-step application process. Traders can see financial regulation in practice as the questions they answer are Know Your Customer (KYC) questions mandated by regulators. As is normal for a financial institution, FXCM will require photographic identification and proof of residence from applicants.

What is the minimum deposit at FXCM?

As mentioned, the minimum deposit at FXCM is as low as $50. Naturally, traders are advised to trade with more funds if they can afford it so they are not limited by inadequate capital. In saying that, the minimum deposit invites traders to trade with what they are comfortable.

How to open your account

The FXCM review process is fully digital, easy, and fast. An account should be ready within one to two business days. In addition to providing personal and account details, new clients are required to verify their identity and prove their place of residence, as is customary with modern KYC regulations.

Deposits and Withdrawals

FXCM allows deposits and withdrawals via credit/debit cards, bank wire transfers, and e-wallets like Skrill and Neteller. Deposits are typically processed within one business day, with a $30,000 limit per transaction, and FXCM does not charge fees, though third-party charges may apply. Withdrawals are processed within one to two business days, with bank wires taking up to five business days and potential fees of up to $40 for wire transfers. FXCM supports eight account base currencies, including USD, EUR, GBP, and JPY.

FXCM provides traders with the following methods to make deposits or withdrawals on their accounts.

The name of the payment processor must match the account name. Bank wire transfers take one to two days, with international banks often taking longer. Internet transfer service providers, such as Skrill and Neteller funds, take one day to reflect in your account.

Account base currencies

FXCM offers you access to eight account base currencies (USD, EUR, GBP, CHF, CAD, AUD, NZD, and JPY)

FXCM deposit fees and options

FXCM offers clients a variety of deposit methods to fund their trading accounts. These include credit and debit cards, bank wire transfers, and e-wallet options such as Skrill and Neteller. Deposits via credit or debit cards are typically processed within one business day, often sooner, with a maximum limit of $30,000 per transaction or per calendar month.

Traders should know that while FXCM does not charge a fee for deposits, third-party fees might apply. Debit and credit card deposits are linked to the transaction limits on those cards. Even though the broker offers crypto only on a CFD basis, it can still accept crypto deposits through the MyFXCM client portal. Any crypto deposits will be automatically converted to fiat amounts.

FXCM withdrawal fees and options

Withdrawals are easy. Clients must access their MyFXCM dashboard and click “Withdraw Funds.” Withdrawals are free, but as with deposits, third-party bank charges may apply. For withdrawals, FXCM supports methods such as credit or debit cards, bank wire transfers, and e-wallets like Skrill and Neteller.

Withdrawal requests can be submitted online through the MyFXCM portal and are typically processed within one to two business days. The time it takes for funds to reach your account depends on the withdrawal method: credit or debit card refunds may take up to one billing cycle, while bank wire transfers usually arrive within one to five business days. However, bank wire withdrawals may incur fees of up to $40, depending on the currency and location of your bank account.

| Method | Credit Card | Wire Transfer | Skrill | Neteller | Cryptocurrency | PayPal | Apple Pay |

| Deposit fee | $0 | $0 + Bank commission | Deposits initiated via Skrill to FXCM are not subject to a processing fee. | $0 | $0 | $0 | $0 |

| Withdrawal fee | $0 | $40 | Not mentioned | Not mentioned | Not mentioned | Not mentioned | Not mentioned |

Customer Support

FXCM provides 24/5 customer support through live chat, email, phone, and WhatsApp, with quick response times and knowledgeable staff. Traders can also place and manage orders over the phone via the trading desk. FXCM’s customer service is highly rated for its responsiveness and effectiveness.

FXCM offers expert customer service support on a 24/5 basis. It does, however, encourage traders to consult the help section on its website before they reach out to the customer service department.

When contacting the live-chat service, traders will need to verify their names and email addresses as a means of security. The live desk is well-staffed, and traders normally do not face any significant waiting times. FXCM takes customer service seriously, and its service consultants are well-trained and knowledgeable.

FXCM offers multiple customer support channels to assist clients effectively. Clients can reach out via email for general and account-specific inquiries. Live web-chat support is available 24 hours a day, five days a week, providing real-time assistance. Additionally, clients can request a call through the FXCM website.

For immediate assistance, FXCM provides international phone support with local numbers for various countries. Clients can also send messages via WhatsApp. The trading desk is available for live account holders to place and manage orders over the phone when necessary, operating from Sunday 5:00 PM ET to Friday 4:55 PM ET.

FXCM's customer service has been rated highly for its responsiveness and helpfulness, with support available through multiple channels.

| Live Chat | Phone | |||

| Available | Available | Available | Available | Available |

| Quick response | Moderate | Moderate | Moderate | fast |

Commissions and Fees

FXCM offers commission-free trading on spread betting, CFD, and FOREX accounts, with spreads starting from 0.7 pips for FOREX, 4 pips for commodities, and 1.5 pips for indices. An inactivity fee of up to 50 units of the account's base currency applies after 12 months of inactivity, and Virtual Private Server (VPS) hosting costs 30 units per month, reimbursed for traders averaging 500K in volume over three months.

Trading costs with FXCM differ depending on the instrument being traded and the account type that it is being used. Spread betting, CFD, and FOREX trading accounts offer commission-free trading with only spreads and swaps payable.

Like most brokers, FXCM earns the bulk of its revenues from mark-ups on spreads. FXCM heavily motivates high volumes, and users of the Active Trader Account can get significantly reduced spreads, as much as 0.3 pips lower on a popular pair like the EUR/USD.

FXCM charges an inactivity fee of $50 on accounts that have been dormant for 12 months straight. The cost of VPS Hosting is $30 for traders using the service. The broker keeps an updated rate card so that traders can stay informed about what they must pay.

The broker works hard to provide good fee options set up differently for each account type.

Spreads

The broker tries its best to keep spreads low. Spreads start from 0.7 pips for FOREX, 4 pips for commodities, and 1.5 pips for indices.

Commissions

Spread betting, CFD and FOREX trading accounts offer commission-free trading with only spreads and swaps payable.

Swap fees and Islamic accounts

FXCM offers swap-free Islamic accounts but substitutes the lack of overnight financing with fixed markups to its spreads. FOREX traders pay 0.4 pips over swap-based alternatives or $4.00 per day per 1.0 standard round lots.

Inactivity fee

FXCM charges an inactivity fee of “up to 50 units” of the account's base currency (e.g., $50 for USD accounts) or the remaining account balance, whichever is lower, on accounts that have been inactive for 12 consecutive months.

Other commissions and fees

The cost of FXCM's VPS hosting is 30 units of the account's base currency (e.g., $30 for USD accounts) per month. However, traders who maintain a notional volume averaging 500K of their base currency per month over the previous three months are eligible to have this VPS fee reimbursed.

| Spread | Commission | Swap | Islamic Account | |

| Currencies | Starting from 0.7 Pips | $0 | Yes | Available |

| Stocks | Not Mentioned | Not Mentioned | Not Mentioned | Unavailable |

| Commodities | Starting from 4 Pips | Not Mentioned | Not Mentioned | Not Mentioned |

| Indices | Starting from 1.5 Pips | $0 | Yes | Not Mentioned |

Platforms and Tools

FXCM offers four trading platforms: Trading Station, MT4, TradingView Pro, and Capitalise AI, each catering to different trading needs. Trading Station is FXCM's proprietary platform. MT4 remains a popular choice for its user-friendly design. TradingView Pro offers modern charting and social trading features, while Capitalise AI allows traders to automate strategies with real-time market monitoring and backtesting.

Traders have access to four trading platforms, with each offering something slightly different. FXCM’s proprietary platform, known as Trading Station, is underrated, but provides a high-quality gateway to enjoyable trading. Developed and iterated over FXCM’s many years in the market, the platform features a quality chart package, advanced automated trading, insightful indicators, and constantly updated market data. The other main platform on offer is the feature-rich MT4, which is a much-loved industry staple.

Platforms types

FXCM offers a variety of trading platforms to cater to the diverse needs of its clients. Here's an overview of each:

Trading Station

Trading Station is FXCM's proprietary platform, designed to provide a comprehensive trading experience. It offers robust charting tools, allowing traders to analyze markets with precision. The platform supports automated strategies and backtesting. Available on desktop, web, and mobile devices, Trading Station ensures flexibility and accessibility for traders on the go.

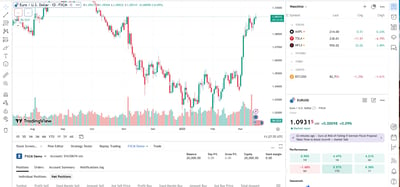

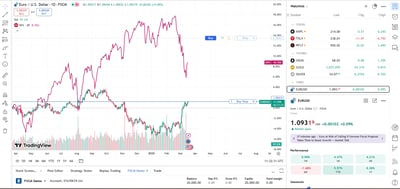

TradingView Pro

Through its integration with TradingView, FXCM provides clients with access to advanced charting and analysis tools. TradingView Pro offers interactive charts, technical analysis indicators, and a social network for traders to share ideas and signals. FXCM clients can trade directly from TradingView's platform, benefiting from real-time data and a seamless trading experience.

MT4

MT4 is a widely recognized trading platform known for its user-friendly interface and extensive range of tools. FXCM's MT4 offering includes features such as automated trading through Expert Advisors (EA), customizable charts, and a variety of technical indicators. Traders can also access free EAs and VPS hosting to enhance their trading strategies.

Capitalise AI

Capitalise AI is a platform that allows traders to automate their strategies without any coding knowledge. By simply typing their trading ideas in plain language, users can create automated strategies that execute trades based on predefined conditions. Capitalise AI also offers features like backtesting and real-time market monitoring, giving you the chance to refine your strategies and stay informed about market movements.

Look and feel

Trading Station has an intuitive user interface designed for both newbie and experienced traders. The platform supports advanced charting tools, technical indicators, and automated trading capabilities. However, some users feel that the interface appears dated compared to more modern platforms.

MT4 is renowned for its customizable layout and extensive range of plugins, appealing to traders who prefer a tailored trading environment. The integration with TradingView offers a modern, web-based interface with advanced charting and social trading features.

Login and security

FXCM platforms use standard security protocols, including password protection and data encryption. However, the desktop version of Trading Station does not appear to have two-factor authentication (2FA), which is a notable security feature that is lacking from the platform. Users who are worried about enhanced security may need to be extra careful and take on some of the burden of security themselves..

Search functions

The platforms feature comprehensive search functionalities, allowing users to quickly locate financial instruments, indicators, and tools. In Trading Station, the asset search is straightforward, enabling efficient navigation across various markets. MT4 and TradingView also give you robust search capabilities.

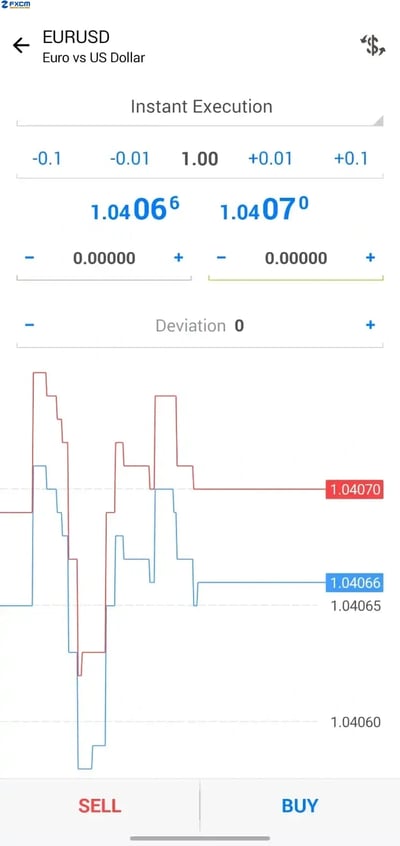

Placing orders

FXCM platforms support a variety of order types, including market, limit, stop, and trailing stop orders. Trading Station offers one-click trading from where you can execute trades directly from charts, enhancing the trading experience. MT4 provides similar functionalities with the extra benefit of EAs for automated trading strategies.

Alerts and notifications

You can set up price alerts and notifications across FXCM platforms. Trading Station allows for customizable alerts based on price movements or technical indicator conditions. MT4 supports alerts through its terminal window, enabling traders to stay informed about market conditions.

At the same time, TradingView offers real-time notifications via email, SMS, or in-app alerts, ensuring traders remain updated on market developments.

Mobile Trading

FXCM offers mobile trading through Trading Station and MT4, both available on iOS and Android. Trading Station Mobile provides real-time market data, multiple asset classes, trading signals, and analytics, while MT4 Mobile supports direct trading from charts. Both platforms feature intuitive interfaces, responsive controls, and customizable layouts.

FXCM offers mobile trading through its proprietary platform, Trading Station, and the widely used MT4 platform. FXCM’s mobile platforms are available for both iOS and Android devices, providing a flexible and responsive trading experience on the go.

Platforms

Trading Station Mobile: The FXCM Trading Station mobile platform can offer many of the features that can be found on Trading Station web or desktop. It is downloadable on Android and iOS and supplies users the ability to trade multiple asset classes, view real-time market pricing, manipulate different timeframes, and execute orders.

In addition, FXCM Trading Station mobile offers traders access to features such as 24/5 trading signals and a trading analytics indicator. Account holders can also download FXCM apps from the FXCM App Store. To offer as much choice as possible, FXCM gives traders who have a strong preference for the mobile version of MT4 the ability to download it and apply it to their FXCM accounts.

MT4 Mobile offers similar functionality, including charting tools, technical analysis indicators, and users can execute trades directly from charts. It supports automated trading through EAs, and traders can customize their trading environment using various plugins and add-ons. MT4 Mobile also allows for real-time alerts and notifications, ensuring that traders can respond quickly to market changes.

Look and feel

Trading Station and MT4 offer a clean and intuitive user interface. Trading Station Mobile is designed for ease of use, featuring responsive touch controls, straightforward navigation, and customizable chart layouts. MT4 Mobile retains its familiar look, making it easy for experienced traders to transition to mobile.

Login and security

FXCM’s mobile platforms use standard security measures, such as password protection and data encryption to protect user accounts. However, Trading Station Mobile does not offer 2FA. MT4 Mobile also relies on password-based security without 2FA.

Search functions

Trading Station Mobile allows traders to search for financial instruments quickly, using keywords or market categories. MT4 Mobile features a structured search process, enabling users to find instruments and indicators directly from the market watch panel.

Placing orders

Trading Station Mobile enables one-click trading directly from charts. MT4 Mobile offers similar capabilities and includes automated trading through EAs, which can execute trades based on predefined criteria even when the app is closed.

Alerts and notifications

MT4 Mobile supports alerts through push notifications, ensuring that traders stay updated on market changes in real time. Trading Station Mobile provides customizable alerts for price changes and technical indicator movements.

Research and Development

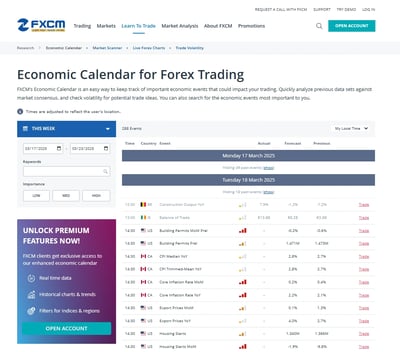

FXCM offers high-quality research and market news to traders of all levels. Besides a detailed economic calendar, FXCM provides traders with a comprehensive suite of research tools and market news, catering to various experience levels

The Market Scanner is a feature that allows traders to choose several technical indicators that result in usable buy and sell recommendations. FXCM Plus allows traders access to detailed trading signals and thorough technical analysis.

The Market News section is regularly updated with insights on key FOREX pairs, and the FXCM Research Team, comprising market and product specialists, offers valuable perspectives on market sentiment.

These resources underscore FXCM's commitment to educating both novice and seasoned traders, distinguishing it within the brokerage industry.

The quality of the research and analysis on FXCM makes it a standout in the medium-sized broker category. They spare no effort in educating both beginner and advanced traders.

Trading statistics

Through FXCM Plus, users can access comprehensive data on win rates, average trade duration, risk-to-reward ratios, and other key metrics. These insights allow you to identify patterns in your trading behavior, assess the effectiveness of your strategies, and make informed adjustments.

Trading Signals

Through the broker’s FXCM Plus platform, you can get actionable insights for various market conditions. These signals are backed by technical analysis and are designed to identify potential entry and exit points for trades. The signals cover major FOREX pairs, indices, and commodities, with detailed explanations to guide you.

Education

FXCM deploys an in-house team to produce invaluable education resources. Users will find excellent value in the comprehensive articles on such important topics as macroeconomics and trading strategies.

FXCM shows its passion for economic education by investing a lot of time and resources in the production of such a wide range of articles. As a trader of any level, you can access digestible educational guides on topics such as “FOREX trading,” “how to become a better trader,” and “traits of successful traders.”

There are also several recorded webinars that will keep their educational value. Traders can access these webinars whenever needed, and they can also access the broker’s YouTube page, which additionally includes a rich trove of tutorials and instructional video guides.

FXCM is a small to medium-sized broker that has kept its competitive pricing and platform advantages as it adds new strings to its bow with improved liquidity and topical research resources. Modern traders will feel at home with the intuitive learning and trading experience on offer.

Final Thoughts on FXCM

FXCM is a dependable and growing broker. It has recovered from significant changes in its history and is now on a continued track of success. The high-quality research and education resources point to a broker that is intent on keeping its clients by investing in their success. It also wants to take its clientele into the future by offering niche trading platforms that will soon become mainstream.

FXCM offers competitive fees, and it is constantly trying to find the operating efficiencies that will make it even more competitive. Its fast execution, positive slippage rates, and robust trading platforms all point to a broker actively working toward an improvement aim.

Traders will also take confidence from the broker’s tier-1 liquidity partners, strong regulation, and well-staffed customer service desk. Although its investment range is limited, the broker does an excellent job on the asset classes on which it has focused. FXCM is, therefore, set to thrive in its chosen markets.

Conclusion

As a future-focused and customer-centric broker, FXCM is an attractive proposition to new and seasoned traders alike. Experienced traders in particular will approve of the heavily motivated high-volume trade pricing, as they will of the suite of specialty platforms.

FXCM is an excellent combination of the old and the new. Its long history and trading record stands alongside its emphasis on emerging platform tools. Granted, it may not be the biggest broker with the widest array of available assets, but if you live in one of the handful of territories in which this broker operates, you can still find a home with this broker, even if it may not be a household name in retail trading circles..

Review Methodology

The team at Arincen collected more than 120 pieces of data covering more than 100 licensed FOREX companies. Data collection was done in three ways:

1. Companies’ Websites.2. Other Websites that have ranked FOREX companies.3. A survey questionnaire (referred to here as Survey “1”) we had sent to the companies invited to participate in the exercise.

We have identified 12 criteria for our assessment, each containing several aspects and carrying its own relative weight. These include licensing, deposits and withdrawals, number of assets etc.

Afterward we validated the data by:

1. Registering with FOREX companies as a secret shopper and/or as Arincen.2. Survey number “2,” in which we asked these companies’ customers for important feedback and past experience.

The next step saw us evaluate and rank each company, relying on the hard work of 15 Arincen employees. We were very careful in ensuring the most accurate assessment possible, including taking into account different languages, as well as the various mobile-app operating systems, e.g., Apple, Samsung etc.

To add credibility to our research project, we sent a final and third survey (referred to here as Survey “3”) to enable participating FOREX companies evaluate our own research and whether it accurately reflects the realities on the ground. We were fortunate enough to receive a mark of 9.9 out of 10! We have kept to a minimum the margin of error, which stood at a measly 1%. To learn more on how we came up with the evaluation, please click here.

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

FAQ

FXCM offers a wide range of trading instruments, including FOREX pairs, commodities (like gold and oil), indices, and cryptocurrencies. You can also trade CFDs on these assets, allowing you to go long or short based on market movements.

The minimum deposit to open a standard FXCM account is $50. However, different account types may have different minimum requirements, so it’s best to check FXCM’s official site for details based on your account type and region.

FXCM offers four main trading platforms: Trading Station, MT4, TradingView, and Capitalise AI. Trading Station and MT4 are known for their advanced charting and automated trading options, while TradingView provides a social and customizable charting experience. Capitalise AI allows traders to automate strategies using plain language without coding.

Yes, FXCM provides a free demo account with virtual funds. This allows traders to practice strategies, test the platform's features, and become comfortable with market conditions before risking real money.

FXCM operates primarily on a spread-based pricing model, meaning there are no commissions on most trades — the broker earns from the difference between the bid and ask prices. For certain account types, a commission-based structure may apply with tighter spreads.

Yes, FXCM provides trading signals through FXCM Plus, which offers detailed technical analysis and market insights. The Market Scanner tool also generates buy and sell signals based on selected technical indicators.

FXCM allows funding through various methods, including bank transfers, credit/debit cards, and online payment services like Skrill and Neteller. Processing times and fees may vary depending on the payment method used.

Yes, FXCM is regulated by several top-tier financial authorities, including the UK’s FCA and the Australian ASIC. FXCM also uses encryption and other security protocols to protect user data and funds.