eToro Review 2026

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

Etoro Evaluate - research result

Key Takeaways

eToro started operations in 2007.

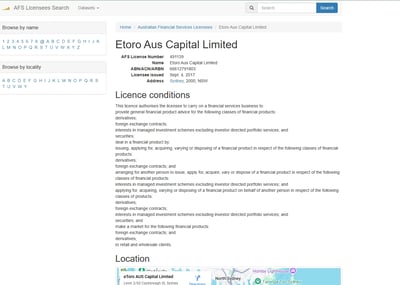

eToro Europe is regulated by the Cyprus Securities and Exchange Commission (CySEC). eToro UK is authorized and regulated by the Financial Conduct Authority (FCA). eToro Australia Capital is regulated by the Australian Securities and Investments Commission (ASIC). eToro USA is registered with the Financial Crimes Enforcement Network (FinCEN).

eToro is a signatory to the EU's Anti-Money Laundering (AML) Directive, and the Markets in Financial Instruments Directive (MiFID).

European Economic Area (EEA) traders are protected by the Investor Compensation Fund (ICF), with a maximum coverage of €20,000.

UK traders get the benefit of protection from the Financial Services Compensation Scheme (FSCS) up to £85,000.

eToro is currently valued at $4.5 billion as of its IPO filing in March 2025.

eToro has a multilingual website available in 19 languages.

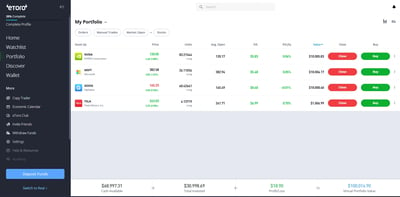

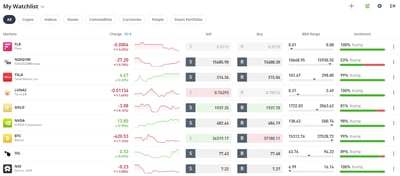

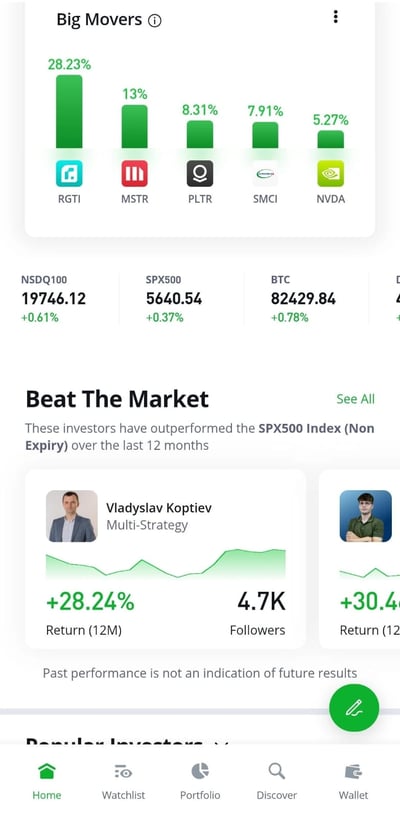

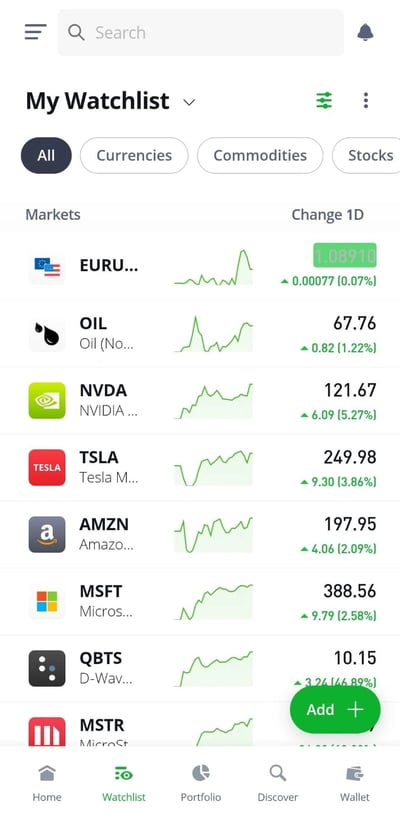

The broker uses its proprietary eToro Trading Platform for its web and mobile platforms.

eToro has processed over 35 million users worldwide who can invest in 7,000+ instruments with advanced trading tools.

eToro offers one main account type that is suitable for both retail and professional traders.

eToro offers over 7,000 tradable assets made up of 6,265 stocks, 56 Currencies, 711 ETFs, 24 Indices, 43 Commodities, and 141 Cryptocurrencies

eToro customers can trade in Contracts for Difference (CFD) or purchase the underlying asset in classes such as indices, cryptocurrencies, stocks, commodities, currencies, and Exchange-Traded Funds (ETF).

eToro offers mostly competitive spreads and commissions across its account types, although its rates are on the higher end.

eToro customers can access a highly detailed research and education resource that is complemented by third-party material from TipRanks.

US residents in qualifying states can trade cryptocurrencies.

US-based traders receive no investor-fund protection.

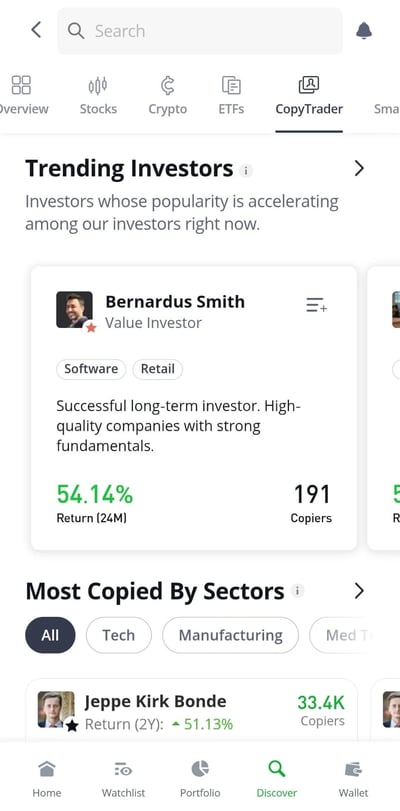

Traders can follow and copy the trades of designated top investors on the platform.

Qualifying top investors can make significant commissions if traders who copy their trades are successful.

Last Reviews

Overall Summary

I was interested to discover that eToro first emerged in 2007, the brainchild of three entrepreneurs who wanted to change the landscape of financial trading. Today, the broker is one of the world’s most recognized broker names and a powerhouse in social trading.

A true pioneer of copy trading, eToro has stayed committed to social trading innovation. This focus has paid off, with the broker now boasting over 35 million users across more than 140 countries. Its social trading platform remains the jewel in its crown, offering users the chance to follow and automatically copy the trading strategies of top investors through its highly intuitive web and mobile apps.

Notably, eToro is one of the rare brokers that has successfully navigated the complex U.S. regulatory landscape. U.S. clients can trade cryptocurrencies and spot Bitcoin ETFs, although access to other products like CFDs remains restricted. Even so, millions of U.S. users from over 40 states actively use the platform, with exceptions in states like New York and Nevada.

For traders outside the U.S., eToro offers a broader range of assets (most are CFD based), including real stocks, ETFs, FOREX, indices, commodities, and crypto assets. Its proprietary platform, designed with beginners and professionals in mind, combines self-directed trading with seamless copy trading capabilities.

Since introducing cryptocurrency trading in 2018, eToro has continued to build out its digital asset offering. Strategic acquisitions of blockchain firms like Firmo and Delta have strengthened its crypto wallet and portfolio tracking services.

eToro’s value has also skyrocketed, from a $800 million valuation in 2018 to a staggering $5.5 billion more recently. Although its fees, especially for non-trading activities like withdrawals and currency conversions, are a bit higher than some competitors, eToro’s unparalleled social trading features and strong regulatory standing help it stay a favorite among traders globally.

eToro is considered a low-risk broker, regulated by top-tier authorities like CySEC, FCA, ASIC, and offers added insurance for eligible clients in Europe and Australia. Investors benefit from compensation schemes depending on their region, although U.S. clients and non-CFD crypto holdings are not covered under eToro’s additional private insurance. The broker enforces strict leverage limits, typically 30:1 for major currency pairs, aligning with ESMA regulations to promote responsible trading practices.

Is eToro Safe?

In my view, eToro is a low-risk broker and a safe option for traders around the world. Established in 2007, it has stood the test of time and operates under the supervision of several top-tier regulators.

● eToro (UK) Ltd is regulated by the FCA, one of the world’s most respected financial regulators, overseeing financial services and ensuring consumer protection.

● eToro (Europe) Ltd is regulated by the CySEC, which enforces EU financial regulations and offers client-fund protection through the Investor Compensation Fund.

● In Germany, eToro offers crypto trading, which is supervised by BaFin.

● eToro Money Malta Ltd is authorised by Malta Financial Services Authority (MFSA)

● eToro (ME) Ltd is licensed by the Abu Dhabi Global Market (ADGM)’s Financial Services Regulatory Authority (FSRA)

● eToro AUS Capital Ltd is regulated by the Australian Securities and Investments Commission (ASIC)

● eToro (Seychelles) Ltd is licensed by the Financial Services Authority Seychelles (FSAS)

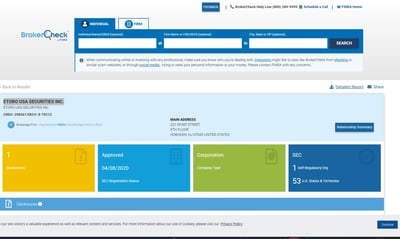

● eToro USA Securities Inc. is a registered broker-dealer with the SEC and a member of FINRA, overseeing compliance and investor protection.

European traders benefit from CySEC’s Investor Compensation Fund (ICF) protection, which covers up to €20,000. UK clients are protected under the FSCS scheme up to £85,000, and U.S. traders enjoy protection under the SIPC up to $500,000, including a $250,000 cash limit. Australian clients, while not covered by a compensation fund, are still protected by stringent ASIC oversight.

While eToro has generally maintained a clean regulatory record, it is worth mentioning that it settled a €50,000 fine with CySEC in 2013 related to operational structure issues. Since then, no further major regulatory actions have been reported. Taking all these factors into account, eToro is widely seen as a trustworthy and safe broker for traders across different regions.

How eToro Protects You from Reckless Leverage and Margin Trading

As a fully regulated broker, eToro applies strict leverage limits across all its instruments, ensuring it promotes responsible trading practices. It follows the guidance of leading regulatory authorities, setting maximum leverage for major currency pairs at around 30:1 for retail clients, in line with ESMA regulations. In contrast, clients of eToro entities operating in jurisdictions like Seychelles may be offered higher leverage, up to 400:1.

To help traders manage risk, eToro has built-in tools like stop-loss and take-profit settings, giving users more control over their trading outcomes.

Each asset class at eToro has its own specific leverage range, and you should always review the relevant limits carefully before opening a position. Overall, eToro’s layered risk management measures help shield you from the dangers of excessive leverage and uncontrolled margin trading.

How you are protected

I was pleased to discover that eToro entities provide negative balance protection for retail clients, meaning you can never lose more money than you deposit. Client funds are also kept in segregated accounts at top-tier banks, ensuring that your money remains separate from eToro’s own operational funds.

Through a combination of regulatory oversight, strict fund segregation, and negative balance protection, eToro has proven its commitment to protecting your capital and providing a safer trading environment.

Regulation and other security measures

All financial transactions on the eToro platform are secured using up-to-date encryption protocols, ensuring that sensitive data is protected during every stage of trading and account management.

eToro’s mobile apps also include enhanced security features, such as two-step login procedures and biometric authentication like Face ID and fingerprint recognition.

On top of regulatory protections, eToro also offers additional private insurance through Lloyd’s of London for eligible European and Australian clients. This covers up to €1 million, GBP 1 million, or AUD 1 million, applying to cash, CFD positions, and securities. It's important to note, however, that non-CFD crypto holdings are excluded from this insurance, and U.S. clients are not covered.

Top Broker Features

In my opinion, there are many compelling reasons to choose this broker. Here are some of them:

Commission-free stock and ETF trading: eToro charges no commission on U.S. stocks and ETFs for most clients.

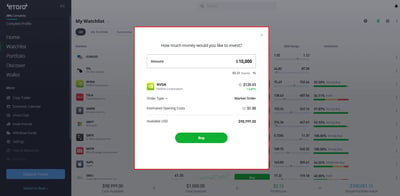

Low minimum deposit: With a minimum deposit starting at just $50 for most countries, eToro remains highly accessible for beginners and casual traders.

Fast account opening: Opening an account at eToro is a seamless, fully digital process that can be completed in a day.

Negative balance protection: eToro offers negative balance protection to retail clients from the EU and Australia.

Highly rated mobile and web platforms: eToro’s proprietary trading platforms are designed to be intuitive and user-friendly, with excellent social trading features and seamless syncing between web and mobile.

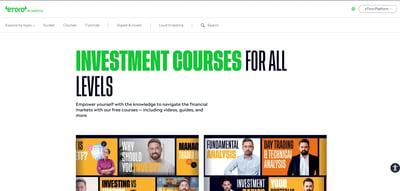

Comprehensive educational resources: The eToro Academy provides a wide range of learning materials, from beginner courses to market analysis videos and webinars.

Multi-language support: While customer service can sometimes be hard to reach, eToro offers help in multiple languages, and its detailed Help Center covers a wide range of topics.

For Whom Is eToro Recommended?

In my view, eToro is ideally suited for traders who are drawn to the concept of social trading. As one of the pioneers in this field, eToro continues to lead the way with user-friendly platforms, seamless copy-trading functionality.

The broker encourages traders to tap into the so-called “wisdom of the crowds,” allowing users to follow and copy top-performing investors in real time. This makes it particularly attractive for beginners or those who prefer a more passive approach to investing.

That said, eToro may not be the best fit for every type of trader. Those focused on keeping costs to a minimum might find eToro's trading environment relatively expensive.

Spreads are higher than average, and non-trading fees like withdrawal and currency conversion fees can add up. Additionally, while the $50 minimum deposit is accessible in many countries, higher minimums apply elsewhere, and active traders looking for ultra-low-cost execution might feel constrained.

Here are the pros and cons of using this broker:

-

Commission-free stock and ETF trading for most users.

-

Low minimum deposit starting from $50 in some regions.

-

Seamless account opening process, fully digital, and completed within one day.

-

User-friendly mobile and web platforms that support social trading and copy trading.

-

Extensive social trading features, including CopyTrader and Smart Portfolios.

-

Strong regulatory oversight by such top-tier authorities as FCA, ASIC, CySEC, and SEC.

-

Negative balance protection for retail clients in the EU and Australia.

-

Private insurance up to €1 million for eligible clients through Lloyd’s of London.

-

Wide selection of tradable assets.

-

Good educational content through eToro Academy.

-

Innovative copy-trading ecosystem with detailed trader performance stats.

-

Higher-than-average spreads compared to some competitors.

-

$12 withdrawal fee on every wire transfer withdrawal.

-

Inactivity fee of $10 per month after 12 months of non-use.

-

Limited base currency options (only USD, EUR, GBP).

-

Crypto assets (non-CFD) are not insured.

-

Relatively small stock universe compared to traditional stockbrokers.

-

No futures or bonds trading available.

-

Does not support EAs.

Offering of Investments

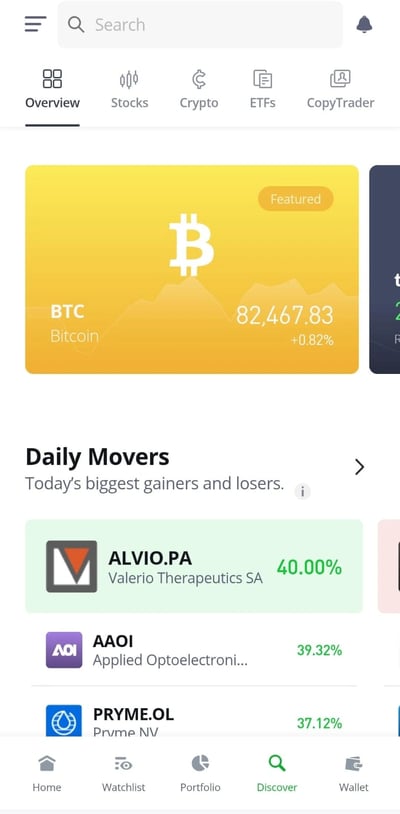

eToro gives traders access to over 7,000 instruments, offering a seamless experience that allows easy switching between CFD trading and real asset ownership. The broker covers a wide range of asset classes, including 56 FOREX pairs, major stock CFDs, indices such as the S&P 500, and commodities like gold and oil. It also supports around 130 cryptocurrencies for spot trading or CFD speculation, although U.S. clients are limited to buying real coins.

If you are looking for a broad range of tradable assets, eToro is the place to come. The broker provides access to over 7,000 tradable instruments, making it one of the most comprehensive multi-asset brokers on the market today.

You can access a wide range of asset classes, either trading them with leverage or buying them outright for short-, medium-, or long-term strategies.

FOREX

eToro offers 56 FOREX pairs, providing opportunities in the world's most liquid market. All FOREX trades are done via CFDs, with leverage options available.

The broker offers 30:1 leverage (or up to 400:1 as a Professional Client) to gain greater exposure with less capital.

Stock CFDs

I found that traders can trade stock CFDs with leverage for short selling. Popular names available include Apple, Tesla, Amazon, and many others. eToro also supports fractional share investing.

Regular stocks (direct ownership)

The broker allows you to invest in stocks from around the globe with fractional shares. Through this method, it’s easy to fill your portfolio with a variety of leading stocks from the world’s top exchanges.

Indices CFDs

Traders can access major global indices like the S&P 500, DJ30, and FRA40. Since indices are not direct financial assets, they are traded on eToro exclusively as CFDs.

Commodities

Traders can access commodities like gold, oil, and silver through CFDs. These allow for both long and short positions, with leverage available for enhanced exposure.

Commodity CFDs allow you to choose an investment amount without being limited to units, such as a whole barrel of oil or an ounce of gold.

Cryptocurrency CFDs

eToro offers access to as many as 130 cryptocurrencies, including major coins like Bitcoin and Ethereum, along with a variety of crypto crosses. Traders can buy the real coin (spot trading) or use CFDs to speculate on price movements. Note that U.S. clients can only buy real crypto assets, not CFDs.

ETFs

eToro allows users to invest in ETFs either by buying the real asset without leverage or trading them as CFDs. These instruments offer a diversified, lower-volatility way to invest across multiple sectors.

Available assets

| Markets | Available | Number of Assets |

| Currency Pairs | 55 | |

| Stocks | 1729 | |

| Commodities | 42 | |

| Crypto | 130 | |

| Indices | 18 | |

| ETFs | 703 |

Account Types

eToro structures its accounts according to the client’s jurisdiction, distinguishing between Retail and Professional clients based on regulatory requirements. Retail traders enjoy access to all trading instruments, though their leverage is capped by regulation. Professional clients, who must pass a qualification test, can access higher leverage but sacrifice certain protections. eToro offers Islamic accounts requiring a $1,000 minimum deposit and free demo accounts that allow users to practice trading strategies in real-time market conditions.

I discovered that eToro organizes its accounts based on the jurisdiction in which the client resides, carefully categorizing users as either Retail or Professional clients.

Retail clients can get access to the full range of trading instruments, including manual trading, copy trading through CopyTrader, and thematic investing via Smart Portfolios.

Retail clients benefit from important protections such as negative balance protection, margin closeout rules, and access to compensation schemes where applicable. However, leverage for retail traders is restricted in line with regulatory limits.

eToro’s retail accounts are where you can copy top-performing traders. The system is so easy. All you need to do is choose an investor to copy, and when they trade, so do you.

Professional clients must meet stringent criteria and pass a professional client test to qualify. Traders should note that EEA professional clients give up certain protections, including Investor Compensation Fund (ICF) coverage and access to the Financial Ombudsman Service.

To balance this, eToro promises that professional accounts can be reset to zero in extreme market events, similar to retail protections. Professional accounts can be held by skilled individuals who know that higher leverage options come with increased risks.

Islamic (Swap-free) accounts are also available upon request, but they require a minimum deposit of $1,000. These accounts comply with Islamic finance principles by eliminating interest-bearing charges while still offering access to the full suite of tradable assets.

Demo accounts are offered free of charge and simulate live market conditions with real-time quotes. Whether you are a beginner wanting to learn the platform or a seasoned trader looking to test new strategies, eToro’s demo environment provides a risk-free way to practice.

| Account Type | Minimum Deposit | Spread Commission | Commission | Swap Commission | Deposit Commission | Withdrawal Commission |

|---|---|---|---|---|---|---|

| Standard account | $50 | Starting from 1 pip | $0 | No | $0 | $5 |

| Professional account | $50 | Starting from 1 pip | $0 | No | $0 | $5 |

| Corporate account | $50 | Starting from 1 pip | $0 | No | $0 | $5 |

| Islamic account | $1000 | Starting from 1 pip | $0 | No | $0 | $5 |

Account opening

I can report that this process is fully digital, user-friendly, and can typically be completed in under 10 minutes if all documents are readily available.

Traders must provide proof of identity, such as a government-issued ID, and proof of residence, such as a utility bill or bank statement. Verification times vary depending on the client’s jurisdiction but are usually finalized within one business day.

In our review, we found significant variation in minimum deposit requirements depending on the country of residence. For most users, the minimum deposit is $50. However, U.S. clients benefit from even lower minimums after the first deposit, with subsequent deposits allowed from just $1. Clients from countries like New Zealand, Kuwait, and others face a $1,000 minimum deposit, while traders in Israel are required to deposit as much as $10,000.

Although eToro advertises account opening as "free," this refers to the absence of account management or ticketing fees—it does not mean there is no minimum deposit.

What is the minimum deposit at eToro?

For many regions, the minimum first-time deposit is $50. However, deposit thresholds vary significantly depending on your country, and minimum deposits in some areas can go into the thousands.

How to open your account

Visit eToro’s website or mobile app. Register by providing basic personal details like name, email, and phone number. Complete identity and residency verification. Fund your account and start trading.

Deposits and Withdrawals

Depositing funds with eToro is simple, with traders accessing options like credit cards, PayPal, Neteller, and local bank transfers, although availability depends on the country of residence. Most deposits are processed instantly, except for bank wires, which can take several business days. Withdrawals are also straightforward, must be made to the same source as the deposit, and are typically processed within one business day, though receiving funds can take several business days, depending on the method.

I was pleased to find that depositing with eToro is simple. After logging into your account, you need only click “Deposit Funds” to access the range of deposit methods. Not all methods are available to all traders, depending on their location. Processing times and fees vary. Traders should study the broker rate card for full information.

Account base currencies

eToro processes payments mainly in USD and EUR, with GBP, depending on your region and eligibility. Additionally, eToro provides a EUR account (eToro Money) for EU residents, allowing them to deposit, hold, and fund trades in EUR or USD, offering flexibility in managing currency exposure and potentially reducing conversion fees

eToro deposit fees and options

Available options depend on the trader’s country of residence, and processing times and fees can vary. Traders are advised to consult the eToro rate card for detailed information.

Deposit methods include:

Credit/Debit cards (Visa, Mastercard)

PayPal

Neteller

Skrill

Local bank transfers

Regional services

Most deposit methods are processed instantly, although bank wires can take several business days.

eToro withdrawal fees and options

I found that my withdrawal requests were typically processed by eToro within one business day, provided all necessary documents were submitted. The payout time depends on the withdrawal method:

Online payment services (PayPal, Neteller, Skrill): 1–2 business days

Bank wire, credit/debit cards: This tool as long as 8 business days

Withdrawals are subject to a fixed $5 withdrawal fee and require a minimum withdrawal amount of $30. Although the withdrawal fee is flat and not percentage-based, withdrawals in currencies other than USD incur a currency conversion fee.

| Method | Credit Card | Wire Transfer | Skrill | Neteller | Cryptocurrency | PayPal | Apple Pay |

| Deposit fee | $0 | $0 | $0 | $0 | Unavailable | $0 | Unavailable |

| Withdrawal fee | $5 | $5 | $5 | $5 | Unavailable | $0 | Unavailable |

Customer Service

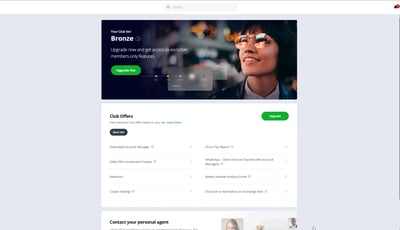

Customer support is tiered based on account balance, with traders holding under $5,000 limited to online help, while higher-balance clients receive prioritized service and dedicated account managers. The eToro Club further incentivizes account growth, dynamically adjusting membership levels daily based on realized equity and offering perks like exclusive webcasts, fee waivers, and personalized account management.

To my disappointment, customer support at eToro is structured around account balance levels. Traders with account balances under $5,000 can submit inquiries online and open service tickets via the Help Center. Higher-tier clients, however, enjoy faster response times and more personalized service, including access to dedicated account managers.

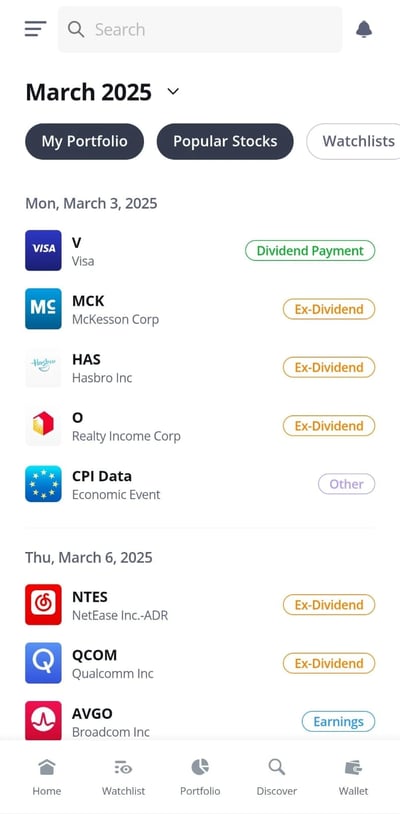

eToro offers a helpful Market Hours and Events page that lists major global holidays and events that could impact trading hours in various financial markets. This feature can save traders time and confusion when certain instruments become temporarily unavailable due to public holidays.

A big part of eToro’s client service model is the eToro Club, an incentive program that dynamically tracks realized equity at GMT midnight each day. Club membership levels offer a range of exclusive perks, and traders can move up or down tiers depending on their equity levels. This gamified approach encourages higher account funding and deeper platform engagement.

| Live Chat | Phone | |||

| Available | Unavailable | Available | Unavailable | Available |

| Quick response | Unavailable | Moderate | Unavailable | Moderate |

Commissions and Fees

eToro’s fees are generally higher than many competitors, with FOREX spreads starting at around 1 pip for major pairs like EUR/USD, which can be costly for high-frequency traders. While its fee structure is mixed, with some charges like crypto conversion fees at just 0.1%, the broker charges 1% per side for crypto trades and applies a currency conversion markup of roughly 50 pips for non-USD transactions. Traders face a $5 fixed withdrawal fee, and a $10 monthly inactivity fee after a year of no trading activity.

Overall, I would say that eToro’s fees are at the higher end compared to many of its competitors. As a Market Maker broker, its typical spreads are slightly wider than the industry average. For example, spreads on major FOREX pairs like EUR/USD start around 1 pip. For high-frequency or high-volume traders, this spread may feel expensive relative to tighter spread brokers.

However, traders are drawn to eToro not for its spreads, but for its industry-leading social copy trading platform. Its fee structure is a genuine mixed bag: while some charges are relatively low, others are quite high.

When it comes to cryptocurrency trading, eToro's fees are slightly above average for buying or selling the underlying asset. A 1% fee is charged on each crypto trade (open and close). On the plus side, converting from one cryptocurrency to another incurs a low conversion fee of just 0.1%, plus prevailing spreads.

Withdrawals are subject to a $5 fixed fee, from which U.S. traders are exempt. Depending on where you live, the wire transfer withdrawal fee could be as high as $12. This flat fee structure can actually benefit high-volume traders since it’s not percentage-based. In addition, eToro charges a $10 inactivity fee per month after 12 consecutive months of no trading activity.

For leveraged positions held overnight, swap fees apply. These fees are standard across the industry, but, unlike some competitors, eToro does not offer a transparent breakdown of how these charges are calculated, which may frustrate more detail-oriented traders.

Spreads

Typical spreads start from around 1 pip for EUR/USD, making it more expensive for frequent FOREX traders.

Commissions

eToro offers commission-free trading for stocks and ETFs but charges 1% for each side of a crypto transaction. Zero commission in this case means that no additional fee has been charged on top of the market spread. eToro never charges any management, administration, or ticketing fees.

Swap fees and Islamic accounts

Swap fees apply to overnight leveraged positions. Islamic (swap-free) accounts are available but only after application and meeting specific criteria.

Inactivity fee

There is an inactivity fee of $10 per month after 12 months of inactivity. This monthly fee applies to accounts with no logins in the previous calendar year.

Other commissions and fees

Currency conversion fees apply if your deposit or withdrawal is not in USD. Regarding copy trading fees, the same spreads and overnight fees apply to positions opened via CopyTrade as with regular manual trades.

| Spread | Commission | Swap | Islamic Account | |

| Currencies | Starting from 1 Pip | $0 | Yes | Available |

| Stocks | $0 | 0.09% annually on the total value of the open position | Yes | Available |

| Commodities | Starting from 3 Pips | $0 | Yes | Available |

| Indices | Starting from 0.75 Pips | $0 | Yes | Unavailable |

Platforms and Tools

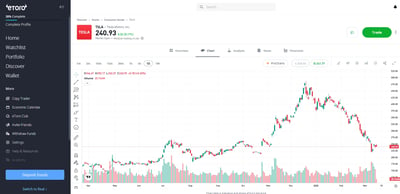

The eToro Trading Platform is a proprietary, user-friendly system that supports self-directed trading and social copy trading, but it does not offer access to MetaTrader platforms or automated trading options. Traders can easily create watchlists, set price alerts, and access tools like TipRanks and ProCharts for deeper manual analysis, while also benefiting from CopyPortfolios curated by eToro’s investment team. The platform provides a clean interface, two-factor authentication, biometric login, and smooth navigation across asset classes.

The eToro Trading Platform is the broker’s proprietary trading app, seamlessly combining all key features into an intuitive and easy-to-use package. Traders can access a wide range of financial instruments through self-directed trading or by engaging in eToro’s signature social copy trading system. Unlike many brokers, eToro does not offer access to MetaTrader platforms (MT4 or MT5), choosing instead to focus entirely on its in-house technology.

During my research, I found that while the platform excels at simplicity and social trading functionality, traders used to automated trading might be disappointed. eToro does not support autotrading or the use of Expert Advisors (EA). Instead, it places full emphasis on manual trading and copy trading, meaning users must manually enter and manage trades, even if they are copying another trader’s strategy.

The platform itself is well-optimized for both web and mobile use. Basic functions like creating watchlists, setting price alerts, and adding new instruments are smooth and user-friendly. Enhancements like TipRanks—providing insights from over 15,000 expert analysts—and ProCharts, a robust manual charting tool for technical analysis, add depth for more active traders.

Another standout feature is CopyPortfolios, eToro’s fund-like investment offering where traders are grouped into managed portfolios based on specific strategies. These portfolios are curated by eToro’s internal investment committee and provide an attractive, passive investment opportunity for users who want exposure to diversified strategies without active management.

Look and feel

I believe that the platform’s clean interface and simple navigation make it suitable for beginners and experienced investors alike. Features like easy-to-navigate watchlists, one-click trading, and asset discovery tools ensure a smooth experience.

Login and security

Two-factor authentication is available for enhanced account protection, and biometric login features like Face ID and fingerprint login are supported on the mobile app.

Search functions

Both MetaTrader platforms offer efficient search functionality. Users can search by instrument name or asset class, allowing for quick navigation among FOREX pairs, indices, commodities, and cryptocurrencies. Instruments are clearly categorized, and features like watchlists help traders monitor favorites with ease.

Placing orders

eToro allows users to place market, limit, and stop-loss orders. One-click trading and easy chart-based order placement are standard, helping traders act quickly on market opportunities.

Alerts and notifications

Price alerts and notifications can be set through the platform, keeping traders updated on market movements, though more advanced notification settings are somewhat limited compared to other specialized trading platforms.

Mobile Trading

The eToro mobile trading app closely follows the web platform’s design and functionality, offering an intuitive experience for both beginners and seasoned traders on Android and iOS devices. It supports trading, portfolio management, watchlists, copy trading, and access to a wide range of assets like stocks, FOREX, commodities, and cryptocurrencies, all organized through a clean, efficient interface. Security is robust with two-factor authentication and biometric login options.

In my view, the eToro mobile trading app delivers a smooth and enjoyable experience that mirrors the design and functionality of its web platform. Whether on Android or iOS, the app maintains a consistent visual identity and intuitive navigation, making it easy for both new and experienced traders to manage their investments on the go.

Platforms

The mobile app offers access to all of eToro’s major features, including trading, portfolio management, watchlists, social feed, and copy trading. Users can research and place trades across a wide range of asset classes, including stocks, ETFs, FOREX, commodities, indices, and cryptocurrencies.

Look and feel

The app is cleanly designed and user-friendly. Even though the smaller screen space presents limits, eToro has managed to present its most important tools in a well-organized interface that mirrors its web offering.

Login and security

Security features are solid. Users can log in using two-factor authentication and have the option to enable biometric login through Face ID or fingerprint recognition for quicker and safer access to their accounts.

Search functions

The app includes an efficient search bar, allowing you to quickly find instruments by name or asset class. Instruments are also grouped into categories, making the discovery of new trading opportunities easier.

Placing orders

All standard order types are available in the mobile version, including market and limit orders, as well as stop-loss and take-profit settings. Trades execute quickly, and one-click trading helps streamline execution during fast market conditions.

Alerts and notifications

You can set price alerts and get real-time notifications to stay on top of market movements. These alerts sync across the Web and mobile platforms, ensuring you don’t miss opportunities while away from your desk.

eToro Wallet App

In addition to the trading app, eToro offers the eToro Money crypto wallet, a separate mobile application designed for storing, sending, and receiving cryptocurrencies. The wallet is managed by eToroX, the company’s crypto subsidiary, and supports a wide range of coins. It features a similar design to the main app and even includes elements of social trading.

While the mobile app does not support advanced charting tools or drawing features found in some desktop platforms, it is still one of the most accessible and well-integrated trading apps in the industry.

Research and Development

I discovered that eToro’s research and education offering is functional and moderately detailed, but it doesn't quite stack up against some of its larger competitors. The broker appears to have intentionally embedded many of its educational and analytical tools directly into the trading interface to bolster its focus on self-directed trading and community-based learning.

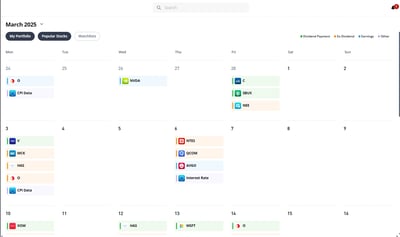

The platform provides access to a standard economic calendar, an earnings calendar, and a news section with real-time updates on market developments. Traders can also tap into daily market commentary and market sentiment tools, which are curated based on the behavior of top-performing traders. What do you get from this? A feedback loop where newbie traders can gauge what experienced users are doing in real time.

One of the more unique features is the eToro News Feed, a public, social media-style stream of posts and comments from eToro users related to specific assets. While the content is user-generated and not considered expert analysis, it gives a sense of community and highlights which instruments are getting attention across the platform.

For more formal insights, eToro integrates third-party content from TipRanks, offering analyst ratings, price targets, and stock forecasts based on aggregated data from Wall Street professionals. Another great feature is the Daily Market Review, which offers sentiment snapshots from leading eToro portfolios, providing a quick read on what eToro’s top investors are tracking.

Trading statistics

eToro provides trading statistics that help users make informed decisions, particularly through features like performance metrics of top traders and sentiment data drawn from the platform’s leading investors. Traders can view detailed statistics such as portfolio performance, risk scores, and historical returns before choosing to copy a trader’s strategy.

Trading signals

I discovered that eToro does signals differently. It does not offer traditional trading signals in the way many brokers do, but it provides alternative tools that help guide trader decisions. Through its integration with TipRanks, eToro users gain access to analyst ratings, price targets, and stock forecasts based on aggregated professional data. The platform also shares sentiment information drawn from the trading activity of its top-performing investors, giving traders a sense of market direction based on peer behavior.

Above all else, eToro emphasizes self-directed learning and community-based insights over direct buy or sell recommendations.

Education

eToro’s education offering, in my view, is fairly strong. The broker hosts weekly webinars that explain the basics of trading stocks, FOREX, and cryptocurrencies. However, access to these webinars varies by region, U.S. traders, for example, can only view them on-demand, as they’re not available directly through the American version of the site.

The eToro Academy provides a modest selection of educational resources, including video tutorials, blog posts, podcasts, and how-to guides. While the content is informative, it suffers from scattered navigation, as materials are spread across different sections of the website rather than centralized in a dedicated learning hub.

The broker also offers a Trading School with video lessons covering the basics of shares and crypto, and a commissioned “Complete Guide to FinTech” targeted at new retail traders. While these resources are helpful, most of the content remains fairly introductory, with little progression for more advanced learners.

eToro is a global multi-asset broker known for its market-leading social trading platform, offering access to over 7,000 instruments across stocks, FOREX, commodities, cryptocurrencies, indices, and ETFs. Regulated by top-tier authorities and equipped with strong risk management tools, eToro combines self-directed and copy trading features within a user-friendly, proprietary platform.

Final Thoughts on eToro

During my research for this review, I discovered that eToro is a long-standing broker with strong regulatory credentials across key financial jurisdictions. Its proprietary platforms are well-crafted and easy to navigate. What truly sets eToro apart is its market-leading social trading ecosystem, a feature that remains the broker’s flagship strength. The seamless integration of CopyTrader and Smart Portfolios gives users powerful tools to mimic top-performing investors, setting eToro apart from more generic rivals.

Market access is broad, with over 7,000 instruments available, though U.S. clients are limited to cryptocurrencies only, and these do not come with the same investor protections as other regions. Still, the broker’s commitment to innovation, particularly in cryptocurrency trading, is noteworthy, with a diverse range of coins and a secure crypto wallet to match.

The fee structure is mixed. eToro’s spreads and withdrawal fees are on the higher side, but the value of its social trading platform arguably justifies the cost for many users. Educational and research content is functional but could benefit from more structure and depth.

Conclusion

In my view, eToro is, first and foremost, a social trading platform. It has carved out a unique niche by focusing on delivering an exceptional copy-trading experience, underpinned by a robust proprietary platform and an easy-to-use mobile app. For beginners, the appeal lies not just in the tools but in the opportunity to emulate top traders and gradually become part of eToro’s elite. That aspirational pull keeps users engaged and invested.

The broker continues to gain traction in the social trading space with growing trading volumes and product innovation. While it may not offer the tightest spreads or deepest research tools, its well-regulated status, strong platform design, and unmatched copy-trading capabilities make eToro a solid choice for those who are interested in community-driven investing.

Review Methodology

The team at Arincen collected more than 120 pieces of data covering in excess of 100 licensed FOREX companies. Data collection was done in three ways:

1. Companies’ websites.2. Other websites that have ranked FOREX companies.3. A survey questionnaire (referred to here as Survey “1”) was sent to the companies invited to participate in the exercise. We have identified 12 criteria for our assessment, each containing several aspects and carrying its own relative weight. These include licensing, deposits and withdrawals, number of assets, etc.

Afterward, we validated the data by:

1. Registering with FOREX companies as a secret shopper and/or as Arincen.2. Survey number “2,” in which we asked these companies’ customers for critical feedback and past experience.

The next step involved evaluating and ranking each company, relying on the work of 15 Arincen employees. We were very careful in ensuring the most accurate assessment possible, including taking into account different languages, as well as the various mobile-app operating systems, e.g., Apple, Samsung, etc.

To add credibility to our research project, we sent a final and third survey (referred to here as Survey “3”) to enable participating FOREX companies to evaluate our own research and whether it accurately reflects the realities on the ground. We were fortunate enough to receive a mark of 9.9 out of 10! We have kept the margin of error to a minimum, which stood at a measly 1%. To learn more on how we came up with the evaluation, please click here.

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

FAQ

Yes. eToro is regulated by top-tier financial authorities. Client funds are held in segregated accounts, and negative balance protection is offered to retail clients in applicable regions. Additional private insurance of up to €1 million is available for eligible users in Europe and Australia.

The minimum deposit varies by region. For most countries, it is $50. In some places, it can go into the thousands.

eToro offers access to over 7,000 financial instruments, including stocks, ETFs, cryptocurrencies, commodities, FOREX pairs, and indices. U.S. clients can only trade real cryptocurrencies.

eToro charges zero commission on stock and ETF trades (in most regions). Other fees include spreads on trades, withdrawal fees, and a $10 monthly inactivity fee after 12 months of no activity.

Yes. eToro’s is the master of copy trading, hence its powerful CopyTrader system, which allows you to automatically replicate the trades of top-performing investors. You can review trader performance stats, risk scores, and portfolios before deciding whom to copy.

Yes. eToro offers a free demo account that simulates live-market conditions with real-time pricing. It’s available indefinitely and is ideal for beginners or those testing new strategies.

Yes. eToro offers an Islamic account that complies with Sharia principles. However, it requires a minimum deposit of $1,000 and must be requested separately.

Withdrawal requests are usually processed by eToro within one business day. The time to receive funds depends on the method: PayPal, Skrill, Neteller: 1–2 business days, and Bank wires and credit/debit cards will have to wait for up to 8 business days