Saxo Bank Review 2026

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

Evaluate Saxobank - research result

Key Takeaways

Denmark's Saxo Bank Group (Saxo Bank), established in 1992, operates several regulated banks and is licensed in six tier-1 jurisdictions, making it a very safe broker (low-risk) for trading FOREX and Contract for Differences (CFD).

Saxo Bank is best suited to advanced traders. It offers a broad range of brokerage services designed for sophisticated traders, professionals, investors, and institutions. Holders of smaller accounts will run into a number of obstacles that include higher account minimums, a variety of fees, and fewer customer support options.

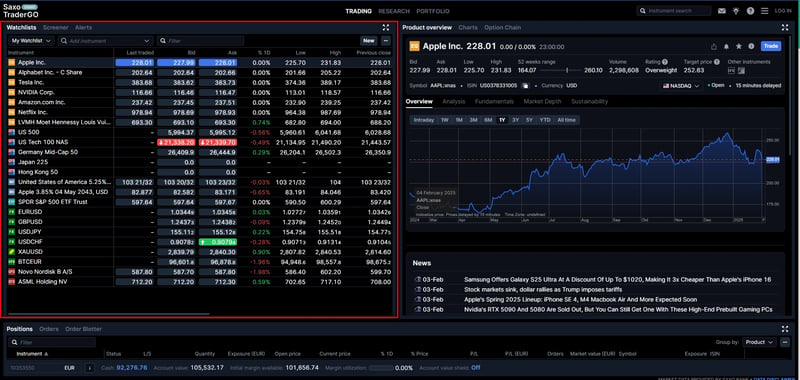

Saxo built its own proprietary platforms, SaxoInvestor (web), SaxoTraderPRO (download), and SaxoTraderGO (web).

The award-winning financial institution is trusted by 1,200,000+ clients worldwide, giving them secure access to more than 71,000 financial instruments with more than USD 100 billion in client assets.

Keeping its headquarters in Denmark, it has expanded its reach to have more than 70 nationalities employed in offices in 15 countries.

Saxo Bank offers three different account types to all retail traders, with a joint account option and a professional account choice.

Saxo Bank offers credit and debit card deposits in addition to wire transfers, but e-wallets are not available.

Saxo Bank has attempted to create an insightful trading environment where support is not required and traders can self-direct.

For extremely high-volume traders, the broker provides traders with very competitive spreads.

Saxo Bank combines high-quality, in-house research with top-tier third-party providers to offer an exceptional research experience. At the same time, Saxo Bank provides a diverse selection of quality educational materials in both written and video formats.

Saxo Bank does a great job unifying the excellent SaxoTraderGO web-based platform experience across devices. Indeed, Saxo Bank’s SaxoTraderGO mobile app is a favorite of ours and ranks among the best from FOREX brokers for cell devices.

For high-volume traders who can afford the high minimum deposits on the relevant accounts, Saxo Bank offers competitive pricing, brilliant research, excellent trading platforms, reliable customer service, and over 71,000 instruments to trade.

Last Reviews

Overall Summary

Denmark's Saxo Bank (part of Saxo Group) was established in 1992 and considers itself “a leading Fintech specialist focused on multi-asset trading and investment and delivering ‘Banking-as-a-Service’ to wholesale clients.”

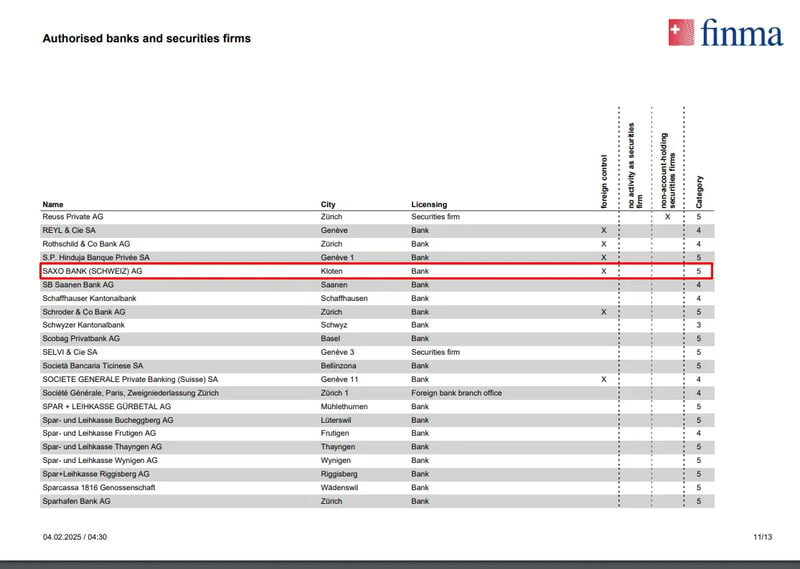

Saxo Bank operates multiple regulated affiliates and is licensed in several tier-1 jurisdictions, making it a very safe broker (low-risk) for trading FOREX, CFDs, and a host of other financial assets.

Saxo Bank is an “exclusive” broker, although there is no minimum deposit for its entry-level Classic Account; its Platinum and VIP Accounts require high initial funding of USD 200,000 and USD 1,000,000, respectively.

Minimum deposits aside, the full Saxo trader client experience is excellent. Alongside access to a wide range of offerings, including a breathtaking 71,000 instruments from which to choose, Saxo Bank offers advanced user interfaces, reliable customer service, superior research amenities, and competitive pricing across the board.

An extraordinary product catalog includes FOREX, shares, commodities, indices, options, bonds, futures, and more. FOREX spreads are extremely competitive across all retail account tiers (Classic, Platinum, and VIP).

Saxo's flagship platform is SaxoTraderPRO, a downloadable offering that is ideal for advanced traders.

Meanwhile, SaxoInvestor and SaxoTraderGO are lower-level web-based platforms equipped with functional trading features and user-friendly interfaces, as well as a highly functional mobile application.

Saxo also offers access to third-party tools that can enhance the trading experience and Application Programming Interfaces (API) the client can use to build bespoke applications. Through these integrations, the broker powers 200+ banks and brokers and 400+ financial intermediaries. It uses its top-end technology to connect banks, brokers, financial advisors, and fintechs to global exchanges.

Is Saxo Bank Safe?

Saxo Bank is a low-risk broker recognized as a Systemically Important Financial Institution (SIFI) in Denmark and rated investment-grade by S&P. It protects client funds with segregated accounts held at top-tier banks, offering additional coverage through the FSCS (up to £85,000) and the Danish Depositor Guarantee Scheme (up to €100,000). Traders benefit from negative-balance protection under ESMA regulations. Saxo Bank combines robust regulatory oversight with state-of-the-art technology to protect its clients.

Yes. Saxo Bank is considered low-risk. The broker is designated as a SIFI in Denmark and has a coveted investment-grade rating from S&P.

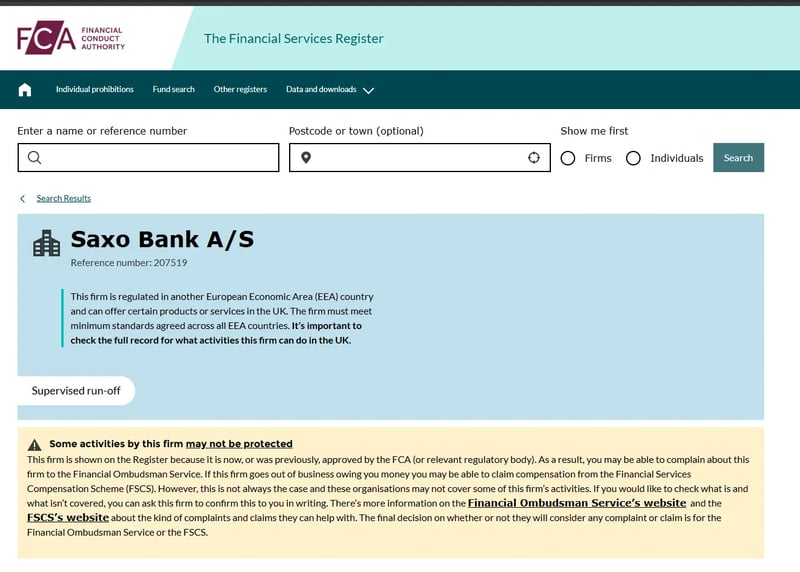

Although a Danish company, Saxo Bank has operated a strategically important office in the UK since 2006 through its subsidiary Saxo Capital Markets UK Ltd. (SCML). Like many FOREX brokers, it does not accept US traders.

Saxo also ensures that client funds are not mixed with corporate funds, in accordance with the UK’s FCA client money rules as well as rules imposed by Danish and Pan-European regulations. This provides a guarantee that client assets are protected, in the unlikely event that Saxo goes bust, by holding those funds in segregated accounts at regulated, often tier-1 banks. Clients also have additional asset protection through the Financial Services Compensation Scheme (FSCS) up to £85,000.

Saxo Bank is also a member of the Danish Depositor and Investor Guarantee Scheme (DGS). Under the DGS, the fund covers depositors’ registered cash deposits up to an amount equivalent to EUR 100,000 per depositor in case Saxo goes under. Traders should know that the DGS covers deposits from all clients of Saxo’s parent company, Saxo Bank A/S, and its UAE, Czech Republic, French, Belgian, and Dutch branches.

Saxo provides clients with a guarantee that they will never lose more than they have in their accounts via the “negative balance protection” rules mandated under the European Securities and Markets Authority (ESMA), in effect since 2018. However, guaranteed stop-loss (GSLO) protection is not available, exposing accounts to potentially grave losses in extreme market conditions, such was the case with the 2015 Swiss franc currency shock.

Finally, Saxo's software security is aligned with the best the industry has to offer. In addition to two-factor and biometric authentication, the user will be logged out of both the web-based and mobile applications if not being used for a user-specified period of time. Web releases include company procedures to ensure the best executions possible, underpinned by a broad range of Direct Market Access (DMA), aggregated, and in-house liquidity providers.

How Saxo Bank Protects You from Reckless Leverage and Margin Trading

Leverage and margin are two tools that, if misused, can lead to heavy losses for the trader. Many irresponsible brokers offer high leverage that can ruin uninformed traders. As with many of the best brokers, margin levels vary depending on the trader, the trading account, and the instruments being traded.

The maximum trading leverage offered by Saxo Bank varies depending on the type of trading instrument, the client's location, and the regulatory environment. Here’s an overview:

Retail Clients (Under ESMA Regulations in the EU/EEA):

Major FOREX pairs: Up to 30:1

Non-major FOREX pairs, gold, and major indices: Up to 20:1

Commodities (other than gold) and minor indices: Up to 10:1

Individual stocks and other equities: Up to 5:1

Cryptocurrencies: Up to 2:1

Professional Clients:

FOREX: Up to 100:1

Indices: Up to 50:1

Commodities: Varies, generally up to 50:1

Outside the EU/EEA:

For clients in parts of Asia or the Middle East, leverage can vary and may be higher than for retail clients in the EU. You can check the exact margin rates for specific instruments directly on the Saxo Bank platform or website.

As far as margin trading goes, the broker offers its professional clients a portfolio-based margin (PBM) model, which is an alternative to the standard margin model.

Instead of applying a predefined margin requirement to each position or strategy, the portfolio-based model calculates the overall risk level of a portfolio based on individual risk factors. The model then applies a margin requirement to the total exposure in any given underlying asset. This puts professional traders in the driving seat as it recognizes that their margin requirements are more sophisticated than the average trader.

How you are protected

Saxo Bank has developed an extensive range of risk-management features to help you manage trading risk effectively, helping to secure potential profits and minimize losses.

Saxo Group has a strong commitment to information security. To meet its high level of security standards as well as those of the legal bodies regulating its business sector, Saxo Group offers 2FA and several other industry-best cyber security practices.

The broker offers negative balance protection, which has become a fairly standard feature offered by most online brokers. This was most likely due to the SNB event of January 15, 2015, that shook the markets, especially the highly leveraged retail FOREX market.

Here are some of the primary measures the broker takes to protect your funds and information:

Segregated funds: Your capital is segregated from the company’s funds and is never used for the company’s business interests.

Top-tier banks: The broker only partners with top-tier, low-credit-risk banks to ensure clients’ funds are protected.

Capital adequacy: Saxo Bank maintains sufficient liquid capital to safeguard clients’ funds and assets.

Security of funds: The broker is licensed by multiple financial regulatory bodies worldwide. This oversight means that it sticks to strict guidelines to protect our clients and their funds.

Security of accounts: The broker offers a range of measures to detect and prevent potential security breaches. One of these methods is two-factor authentication.

Risk awareness and education: Saxo Bank encourages responsible trading, ensuring all of its clients are informed and educated about potential risks a trading activity may involve.

Regulation and other security measures

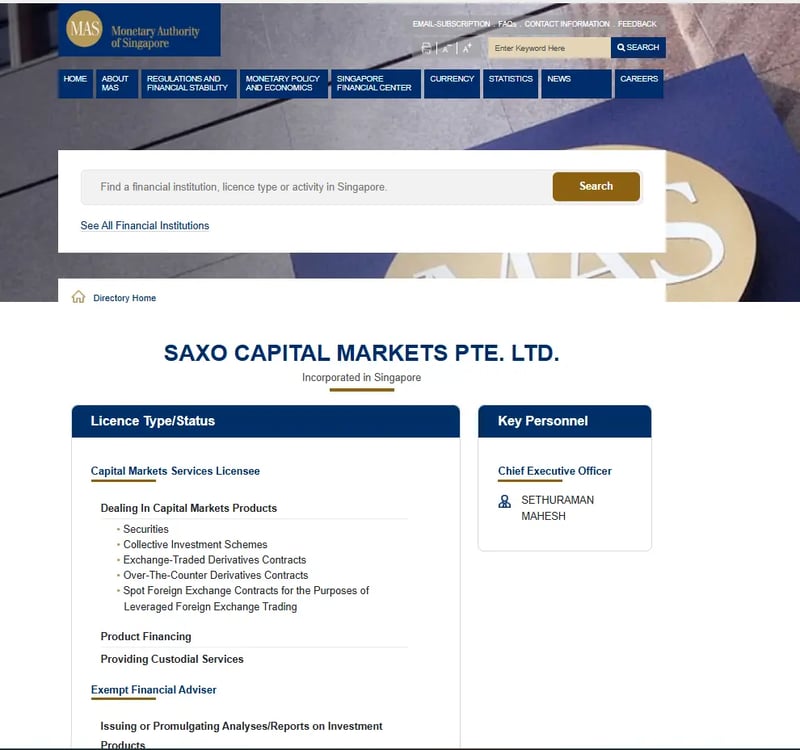

While Saxo Bank is not publicly traded, it does operate an investment bank and is authorized by six tier-1 regulators (high trust) and one tier-2 regulator (average trust). Saxo Bank is licensed by the following tier-1 regulators:

The Securities Futures Commission (SFC).

The Japanese Financial Services Authority (JFSA).

The Monetary Authority of Singapore (MAS).

The UK’s Financial Conduct Authority (FCA).

Additionally, the broker endorses responsible investing as it is dedicated to promoting the practice of conscious investment strategies and cybersecurity measures in all countries where it provides services.

Unfortunately, scam activity is a reality in retail trading, so it’s always sound advice to work with a regulated broker. In totality, Saxo Bank shows a high degree of dedication to being regulated by some of the strictest regulators in the business.

Top broker features

Powerful proprietary platforms to suit all traders.

Investment grade status from S&P.

Tight spreads and zero fees for account maintenance.

Has a healthy product catalog with up to 71,100 tradable instruments.

Regulated by several top-tier regulators.

Excellent customer service.

Offers negative balance protection.

More than 30 years of experience.

The level and depth of educational and analytical material are designed to meet the needs of all traders.

It is a financially stable company with a robust balance sheet.

It is a multi-award winner, has been recognized by its industry, and has won the highest accolades.

For Whom Is Saxo Bank Recommended?

For Whom Is Saxo Bank Recommended?

Saxo Bank is best suited for advanced traders. It offers a broad variety of brokerage services geared toward active traders, professionals, investors, and institutions.

Smaller account holders are also well taken care of, but they do not get the red-carpet treatment that elite traders get with tiered account types and personalized service. Tiered accounts for professionals certainly lower trading costs and add benefits as equity grows, but the majority of retail traders will have a tough time reaching the higher customer tiers that, for UK-based accounts, begin at £200,000 (Platinum) and £1,000,000 (VIP).

Saxo Bank offers clients access to a comprehensive catalog, comprising both leveraged and investment products, that covers a multitude of asset classes. Indeed, it might be easier to list what Saxo Bank does not offer. As advertised on its UK and international websites, the available instruments include, but are not confined to:

185+ FOREX spot pairs.

25,000 stocks.

6 crypto coins.

20 commodity CFDs.

28 Indices

7,000 Exchange Traded Funds (ETF).

While many instruments are able to be traded through multiple venues and order-routing techniques, some locations will generate higher-than-average costs. Nonetheless, the product suite is quite impressive and is sure to please a global-markets aficionado.

Saxo Bank offers a Loyalty Program, something rather unique among our reviewed brokers. Depending on the asset you trade and in what volume, you can receive points after each trade you execute. If you earn a certain number of points, you can upgrade to a Platinum or VIP account. You would need 120,000 points for a Platinum and 500,000 for a VIP Account upgrade. The points are linked to your trade volume in monetary terms.

Here are some major considerations of which you should be aware before you invest with this broker:

-

Extensive range of offerings.

-

Offers portfolio-based margin trading for pros.

-

Regulated by top regulators.

-

Excellent trading platforms.

-

Diverse account types.

-

Among the industry’s best research tools.

-

Offers protection for client accounts.

-

No inactivity fee.

-

No platform fees.

-

No minimum funding for entry-level accounts.

-

Some bonds, options, and futures fees are high.

-

With so many assets, fees can be confusing.

-

High minimum deposit for Platinum and VIP accounts.

-

Does not accept US clients.

-

No MT4 for traders who are used to the platform.

-

No GSLO.

-

No Islamic accounts.

FCA

Offering of Investments

Saxo Bank offers an impressive range of investment and leveraged products across multiple asset classes, including FOREX, stocks, ETFs, bonds, options, and commodities. Investors can access over 25,000 stocks globally and ETFs from 30+ exchanges. For leveraged products, Saxo provides competitive offerings like FOREX trading on 185+ pairs and futures contracts from over 250 global exchanges. Clients can also trade CFDs on 8,500+ assets, and crypto ETFs for Bitcoin and Ethereum.

Saxo Bank gives clients access to an extensive range of offerings, comprising both leveraged and investment products, which span a multitude of asset classes. Among other things, clients have access to FOREX, shares, commodities, ETFs, options, indices, bonds, forwards, and futures. Here is a breakdown of the financial assets offered by this broker:

Investment products

Stocks

Choose stocks from over 25 countries with the assistance of daily insights from in-house analysts. Saxo Bank gives you stock access to all the main US stock exchanges at a trading commission of 0.08% at a minimum of USD 1. For Euronext exchanges, the trading commission is also 0.08% at a minimum of EUR 2.

ETFs

Invest in ETFs with this broker with commissions from just EUR 1. You can choose ETFs from 30+ exchanges across major sectors. The broker offers helpful tools to filter, compare, and analyze ETFs. Commissions on the London Stock Exchange come in at 0.08%, with a minimum of GBP 3

Trade on the Deutsche Börse Xetra with 0.08% commission and a EUR 3 minimum. As always, you will get top-notch daily insights from in-house analysts

Bonds

Saxo Bank offers over 5,200 government and corporate bonds for you to trade online. The minimum trade size is as low as USD 100. Get access to ultra-fast execution with smart-order routing. Your money is also protected, and commissions start from EUR 20 (0.2% per trade).

Mutual funds

Get access to over 18,300 funds from the world’s top money managers. Pay zero commission and no custody fees. The broker offers an easy-to-use screener to filter for the funds you want. Get daily insights from in-house analysts, and remember that product availability and pricing may vary depending on the country of residence.

Crypto ETFs

You can always trade cryptocurrencies easily with Saxo Bank. With this broker, you do not have to deal with the inconvenience of a crypto exchange account or crypto wallet. Get access to a range of ETF crypto products such as Bitcoin, Ethereum, Stellar, Polkadot, Solana, Ripple, and more.

By investing in crypto ETFs, you can track the price movement of Bitcoin, Ethereum, and other leading cryptocurrencies without the need for a crypto wallet. The underlying coins are owned by the ETF providers, which use a tier-1 custodian to hold the cryptocurrency.

Remember that ETFs aren’t traded on leverage, your losses are never amplified. You can also access smaller trades and own as little as 1/20th of a Bitcoin. This is perfect for under-capitalized traders.

Leveraged products

Options

Saxo Bank offers you listed options from 28 exchanges across the US, Europe, and Asia-Pacific. You can get access to:

Stock options

Index options

Futures options

Commissions on European contracts start as low as EUR 0.75. Commissions for popular instruments such as Vodafone Group PLC are GBP 3.00. For Shell PLC, you can expect to pay EUR 0.75. Note that there are no minimum commissions.

Futures

Futures are contracts between buyers and sellers to trade an underlying asset at a specified price and date in the future. Futures give you the opportunity to speculate in markets such as oil, agriculture, or currencies.

You can access 250+ futures from 25 global exchanges, covering equity indices, energy, metals, agriculture, rates, and more. Get ultra-competitive pricing and trade futures from USD 1, Euro 1, or GBP 1 per contract. Saxo Bank allows you to take advantage of time and sales, futures spread orders, and depth trades. Plus, you can trade directly from charts.

FOREX

Saxo Bank offers an average execution speed of 0.013 seconds on a wide range of 185+ FOREX market orders. You can get tight spreads across spots, options, swaps, and forwards. The broker’s professional-grade platforms give you access to advanced tools for free. Trade FOREX on spot, crypto, and options.

Popular FOREX pairs such as EUR/USD attract a minimum spread of 0.9 pips and an initial margin of 3.33%. FOREX pairs such as the GBP/USD attract a spread of 1 pip and an initial margin of 4%.

Options

Saxo Bank allows you to trade 45+ FOREX vanilla options with maturities from one day to 12 months on its award-winning platform. Get ultra-competitive pricing that includes tight, all-inclusive FOREX option spreads. You can take your pick from three levels of pricing, depending on your account tier.

Crypto FX

Invest in cryptocurrencies and go long or short with leverage to capitalize on rapid price movements, or invest long-term in crypto on mobile or desktop. Saxo Bank gives you extra security because you can keep your focus on price movement. You don’t own or store the coins, so you don’t need to worry about crypto exchange hacks or losing access.

You can trade Bitcoin, Ethereum, and more coins against the major fiat currencies. You get the extra flexibility of taking advantage of both rising and falling markets.

CFDs

Trade more than 8,500 stocks and ETF CFDs. You don’t own the underlying asset, so speculating on the up or down movement of the asset gives you flexibility and security. Saxo Bank offers commission-free trading on index, commodity, or bond CFDs. Trade on bourses like the S&P500, the NASDAQ, and the DAX 40, with minimum spreads as low as USD 0.70 and initial margin as low as 5%.

With Saxo Bank, you can go long or short with 20 commodity CFDs covering energy, agriculture, metals, and emissions, using a leverage ratio up to a max of 5:1. Other types of CFDS for you to access with this broker include Futures, Options, Spot metals, and Stocks, where you can buy shares in a wide range of companies intrinsically tied to the commodity market, including mining and oil firms.

Commodities

Trade a wide range of commodities such as CFDs, futures, options, spot pairs, or exchange-traded commodities (ETC). The broker gives you tight spreads and low commissions across its entire commodity range. Use Saxo Bank to trade:

Spot metals

Commodity CFDs

Commodity Futures

Commodity options

Commodity ETCs

Turbos

Turbos are a derivative product that lets you take a position of leverage at the upside (Turbo Long) or at the downside (Turbo Short) on an underlying product like shares, indexes, or commodities. They can be used for hedging, portfolio diversification, or even for speculative purposes. These assets are only for experienced investors who are well-informed about how turbos work and who closely follow price trends.

Available Assets

| Markets | Available | Number of Assets |

| Currency Pairs | 185 | |

| Stocks | 25000 | |

| Commodities | 20 | |

| Crypto | 6 | |

| Indices | 28 | |

| ETFs | 7000 |

Account Types

Saxo Bank offers a range of account types tailored to different trader needs, including Classic, Platinum, VIP, Professional, Joint, and Corporate accounts. The Classic account has no minimum deposit. Platinum accounts require a $200,000 deposit, while VIP accounts demand $1,000,000, granting exclusive access to SaxoStrats and personalized expert advice. Professional accounts provide higher leverage and advanced trading options but waive retail protections.

Saxo Bank offers three different account types to all retail traders, with a joint account option and a professional account choice. Each comes with a different pricing model, service approach, and overall package.

Classic account:

The Saxo Classic account comes with no minimum deposit and is the account where most retail traders will find their comfort zone. You can get tight entry prices and best-in-class digital service and support. You can also access 24/5 technical and account support.

Platinum account:

This account calls for a minimum deposit of USD 200,000, but, by extension, the spreads are decreased by up to 30%. This makes a big difference to the growth of portfolios. Major FOREX pairs attract a spread of 0.8 pips, which is not the lowest on the market by any means. To find out more about pips in trading, read our article here.

VIP account:

Opening deposits for this account come in at an eye-watering USD 1,000,000. It is noteworthy that with Platinum and VIP Accounts, traders can enjoy more favorable pricing structures and have their own dedicated contact person. Traders on this account can even get one-on-one access to SaxoStrats, which is a service that includes access to human experts who provide elite advice. You will also get access to best-in-class digital service and support and 24/5 technical and account support.

Professional account:

Professional accounts come with more leverage less protection, and require a minimum portfolio size of USD 500,000. Here are the main requirements for a professional account:

One year of professional experience in finance is required.

As are 40 significant trades placed over the past 12 months.

Work, or have worked, in the financial sector for at least one year.

Qualifying traders elect to waive regulatory protections designed for less experienced traders. Protections you’ll keep include being eligible for protection from the Guarantee Fund for up to USD 100,000 for cash deposits.

Protections you’ll waive include leverage restrictions applicable to retail clients. You will not have negative balance protection, but you can take advantage of the portfolio-based margin model.

Joint account:

You can create an account with first-line family members, such as spouses, siblings, parents, and children. All applicants must be at least 18 years old. This allows you to trade, hedge, and invest together. The minimum deposit for opening a joint account is USD 50,000.

Corporate account:

The corporate account gives you optimized liquidity and dedicated support. You can trade via a professional-grade platform with one-on-one support from expert account managers. Traders get the broker’s tightest spreads and lowest commissions from its Platinum pricing tier.

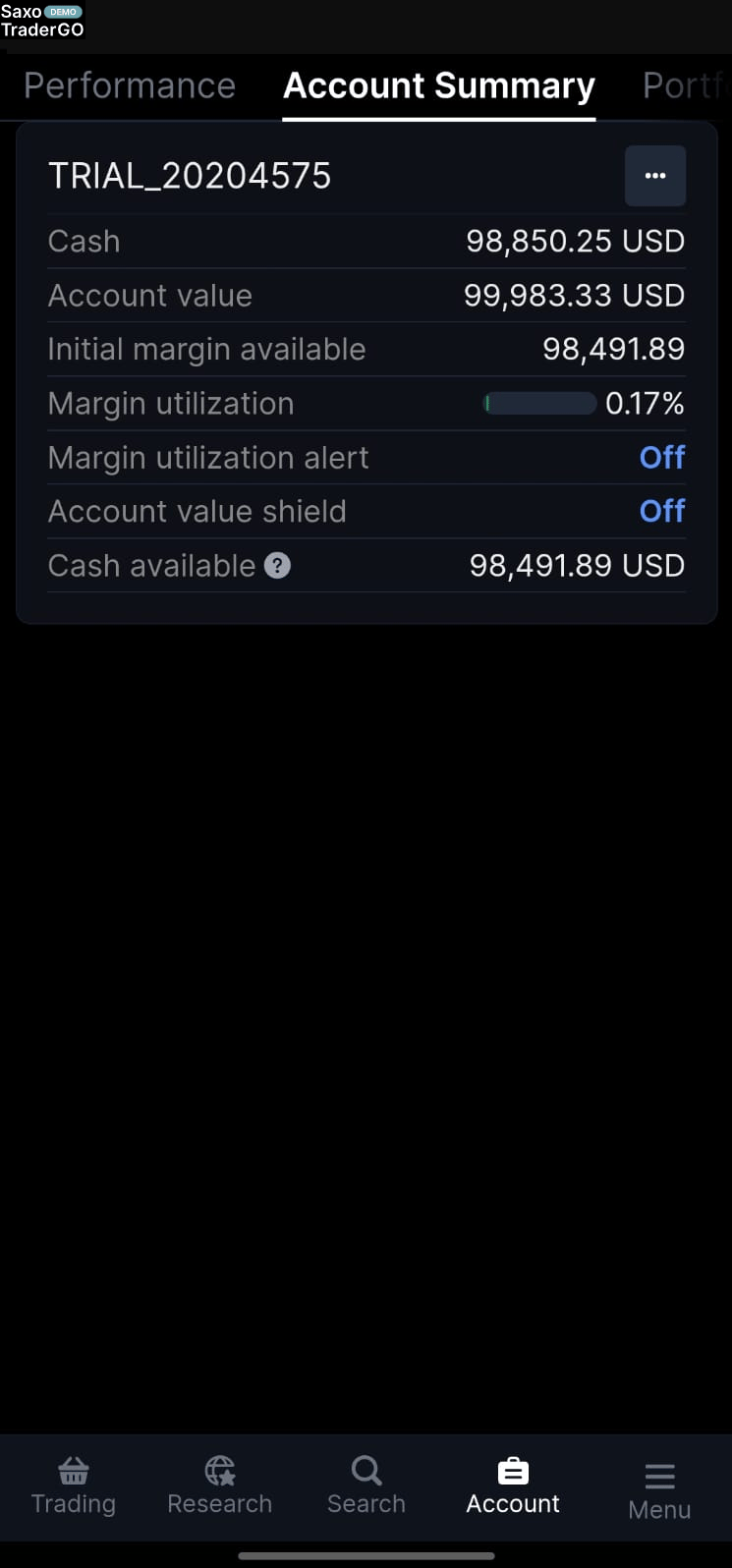

Demo account:

The broker offers the option of a demo account that allows you to trade without risk. You can sign up for a 20-day demo account with USD 100,000 in simulated funds.

Islamic accounts:

Unfortunately, Saxo Bank does not offer Islamic (swap-free) accounts. Muslim clients seeking Sharia-compliant trading options may need to consider alternative brokers that provide such accounts.

| Account Type | Minimum Deposit | Spread Commission | Commission | Swap Commission | Deposit Commission | Withdrawal Commission |

|---|---|---|---|---|---|---|

| Classic account | $0 | Starting from 0.7 pips | Not mentioned | Not mentioned | $0 | $0 |

| Platinum account | $200,000 | Starting from 0.6 pips | Not mentioned | Not mentioned | $0 | $0 |

| VIP account | $1,000,000 | Starting from 0.5 pips | Not mentioned | Not mentioned | $0 | $0 |

Account opening

Opening new accounts is through an online application process. Account verification is mandatory to comply with regulator-mandated Anti-Money Laundering (AML)/Know Your Customer (KYC) requirements. Opening an account with Saxo Bank is easy, as it is with most brokers these days. The process is entirely online, user-friendly, and can be completed on a phone, tablet, or computer. Once approved, you can log in, fund your account, and make your first trade.

What is the minimum deposit at Saxo Bank?

Saxo Bank requires no minimum deposit to open a Classic account, allowing you to start trading with any amount that works for you. This flexibility allows traders to embark on their trading journey without needing a large initial investment.

However, the good news ends there. To trade on any other account type with this broker demands a frightening amount of capital. The Platinum account requires a minimum deposit of USD 200,000, whereas the VIP requires a cool USD 1,000,000.

How to open your account

The Saxo Bank review process is fully digital, easy, and fast. An account should be ready within one to two business days. To open an account at Saxo Bank, follow these steps:

Go to the broker’s website and choose your preferred account.

Fill out the application form.

Submit identification documents.

Fund your account according to the account type.

Begin trading from a wide range of instruments.

If you need any assistance during the account opening process, you can contact Saxo Bank's customer support.

Deposits and Withdrawals

Saxo Bank offers flexible deposit options, including bank transfers, card funding, and Quick Payment (available only in Denmark), with no deposit fees. Clients can choose from 26 account base currencies and open sub-accounts in different currencies, a standout feature compared to other brokers. Withdrawals are free of charge on Saxo’s end, but third-party banks may impose fees; however, direct card withdrawals are not supported.

Saxo Bank offers credit and debit card deposits, as well as wire transfers. E-wallets are not available. In some countries, credit/debit card withdrawal is not available either. Traders are advised to consult the Saxo Bank website for full details. Please note that you can only deposit money from accounts that are in your name.

Account base currencies

At Saxo Bank, you can choose from 26 base currencies. You can also open several sub-accounts in different currencies, which is a great option if you plan to trade assets in more than one currency. This selection is great compared to that of other brokers.

In FOREX trading terminology, the “base” currency is always listed first in a FOREX pair, with the “quote” currency listed second. The base currency is always equal to one, while the quote currency represents the current price of the pair.

Saxo Bank deposit fees and options

Depositing cash into your Saxo account is easy. Here are the different options to deposit cash into your Saxo account:

Bank transfer

Deposit with Quick payment (only possible from Danish banks)

Card funding

Saxo Bank does not charge for deposits, although there may be bank commissions applicable. The broker does not accept payments from accounts or cards that are not in your name. Any payments made by a third party will be returned to the source card or bank account. Transfers made in different currencies will be eligible for currency conversion.

For clients from UAE, KSA, and Qatar, your first funding must originate from your bank account held in your country of residence. Then, for any subsequent funding after your account has been funded the first time, you may fund your Saxo account from a bank account held outside of your country of residence.

It's worth noting that the broker does not allow crypto deposits.

Saxo Bank withdrawal fees and options

Withdrawals are handled free of charge, although corresponding banks may charge fees. To withdraw funds from your Saxo account, select the Saxo account from which you want to withdraw money and wait for an SMS with a code that will be sent to your registered phone number.

Note that Saxo does not offer the ability to withdraw funds directly to a bank card. However, clients can perform cash transfers to the bank account to which the card is linked by using the withdraw funds module in its trading platforms.

| Method | Credit Card | Wire Transfer | Skrill | Neteller | Cryptocurrency | PayPal | Apple Pay3 |

| Deposit fee | $0 | $0 + Bank commission | Unavailable | Unavailable | Unavailable | Unavailable | Unavailable |

| Withdrawal fee | $0 | $0 + Bank commission | Unavailable | Unavailable | Unavailable | Unavailable | Unavailable |

Customer Support

Saxo Bank supports clients in over 180 countries through offices in major financial hubs and offers multilingual customer service and trading platforms to cater to its global clientele. Clients can access support via a chatbot, create support tickets directly within the trading platform, or use global phone support when needed.

Saxo Bank supports clients in more than 180 countries from offices in major financial hubs. The broker has tried to create an intuitive trading environment, where support would not be required, and, therefore, a comprehensive online database has been created, covering all key support topics. A chatbot is available, while live chat is not. A support ticket can also be created from inside the trading platform and if necessary, there is phone support around the world. An extensive language selection is available, not only on Saxo's trading platforms, but also in customer support.

| Live Chat | Phone | |||

| Available | Available | Unavailable | Available | Unavailable |

| Quick response | Slow | Unavailable | Moderate | Unavailable |

Commissions and Fees

Saxo Bank’s trading costs are competitive, with spreads included in pricing or added as commissions, though some fees lean toward the higher end of industry standards. Commissions include $1 for US stocks and ETFs, 0.05% for bonds, and $0.75 per contract for options across 3,100+ instruments. Saxo Bank does not charge inactivity fees, and it does not offer Islamic (swap-free) accounts in the truest sense, although it has tried to work with some Shariah-compliant investments.

Saxo Bank’s trading costs are either included in the spread, which is primarily how the broker generates its profits or added as commissions, which are broadly on par with industry standards, if a little on the higher end. Overall, Saxo Bank provides traders with good all-around pricing, considering the robustness of its features.

Spreads

You can get competitive spreads across all asset classes, with even better rates as your volume increases. For active traders and those with large account balances, Saxo Bank offers among the lowest pricing in the industry. At the time of writing, the average EUR/USD spreads were 0.7, 0.6, and 0.5 pips, for the Classic, Platinum, and VIP accounts, respectively.

We found that the Classic account is mostly in line with the industry average, while the Platinum and VIP Accounts rank among the best FOREX brokers, especially when the volume discounts apply.

Average spreads drop while benefits rise for the higher-tiered Platinum and VIP Accounts, offering the potential for substantial active-trader discounts, but the USD 200,000 minimum to upgrade tiers will be off-putting to the average retail client. Commission charges added to the listed spread come into play when trading other instruments.

Commissions

Here are some pricing examples. US stocks attract commissions from USD 2 across 23,000+ stocks on 50+ exchanges worldwide. US-listed ETFs attract a commission as low as USD 2 across more than 7,400 exchange-traded funds from 30+ exchanges.

Swap fees and Islamic accounts

As mentioned, this broker does not support Islamic trading as it does not offer swap-free accounts.

Inactivity fee

The broker does not charge an inactivity fee.

| Spread | Commission | Swap | Islamic Account | |

| Currencies | Starting from 0.9 Pips | $0 | Yes | Unavailable |

| Stocks | Starting from $0.02 | $6 | Yes | Unavailable |

| Commodities | Starting from $0.6 | $6 | Yes | Unavailable |

| Indices | Starting from $0.7 | $6 | Yes | Unavailable |

Platforms and Tools

Saxo Bank offers three proprietary trading platforms—SaxoInvestor, SaxoTraderGO, and SaxoTraderPRO—designed to cater to traders of varying skill levels and needs. SaxoTraderGO, a web-based platform optimized for mobile, provides advanced tools like 58 chart indicators, margin alerts, and synced settings across devices, while SaxoTraderPRO offers high-performance features for professionals, such as support for six monitors, streaming Level-2 order books, and algorithmic orders. Security is robust with website encryption and two-factor authentication.

Saxo Bank offers clients its proprietary trading platform, developed in-house, which comes in three versions: SaxoInvestor, SaxoTraderGO, and SaxoTraderPRO.

Saxo Bank has made a great attempt to deliver its global traders a state-of-the-art trading platform, which is also available as a White Label Solution for partners.

However, FOREX traders who have grown accustomed to the popular MT4 or MT5 trading platforms or who deploy Expert Advisors (EA) will be disappointed because Saxo Bank does not support the MetaTrader family.

Platforms types

Saxo Bank offers the following trading platforms:

SaxoInvestor:

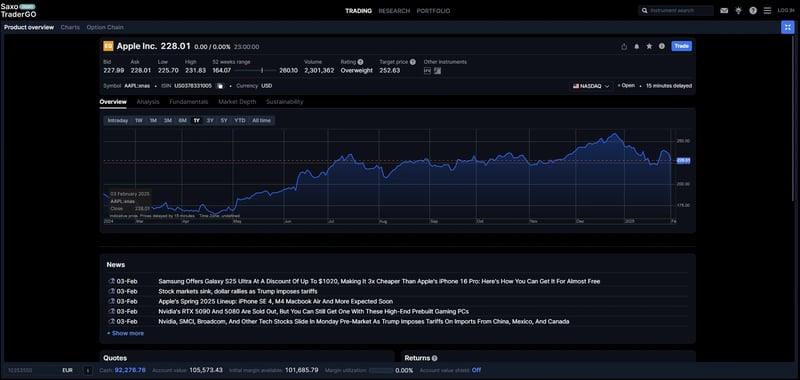

This workmanlike version of the platform is a simple, low-cost way to invest in financial assets. It is a user-friendly web and mobile investment platform that gives traders everything they need to invest quickly and securely in one place. You can get access to stocks, mutual funds, ETFs, bonds, and the rest of the Saxo Bank slate.

With SaxoInvestor, you can view curated stock lists to easily identify potential investments within your preferred sector. Use professional analyst ratings from FactSet and Morningstar to identify your next investment. You can also get expert one-to-one support from Saxo’s in-house Sales Traders or a dedicated contact point from your own relationship manager if you qualify.

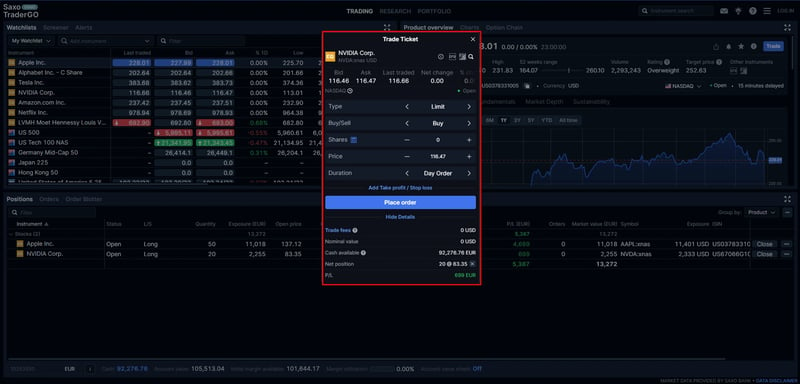

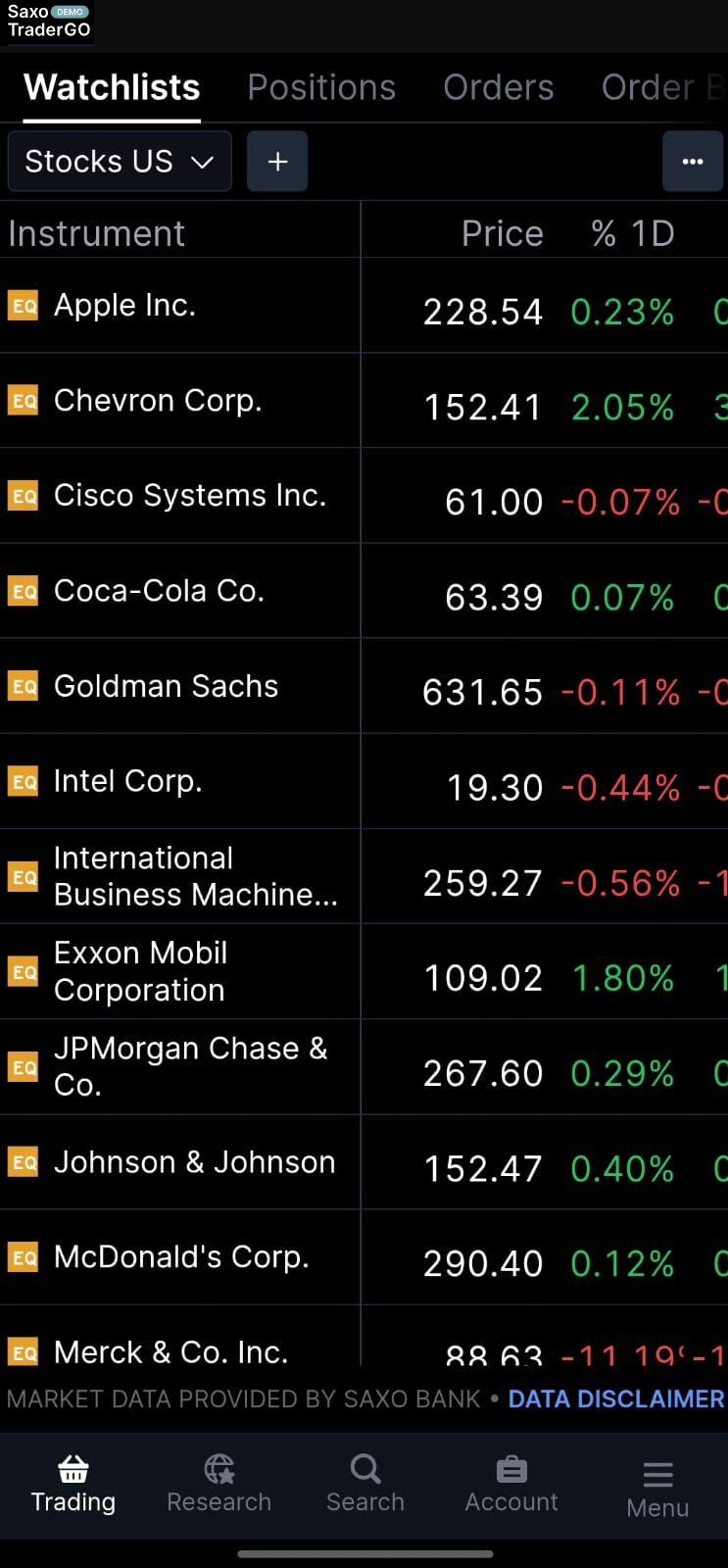

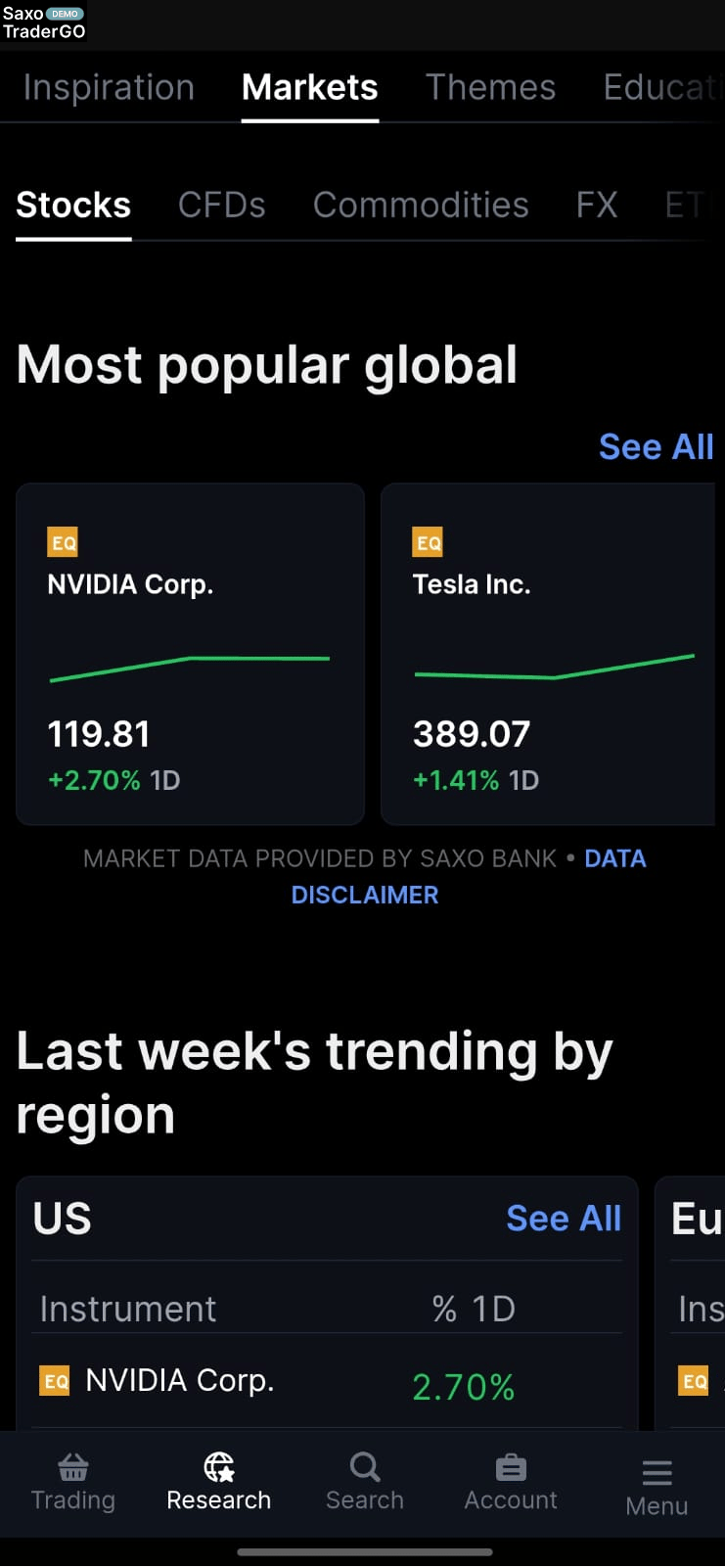

SaxoTraderGO:

SaxoTraderGO is web-based and can be accessed through any browser, with no download necessary. This version of the platform is optimized for mobile, tablet, and single-screen laptops. It also offers native applications for iOS and Android. All your personal settings, watchlists, orders, and positions are synced with SaxoTraderGO, allowing you to trade wherever and whenever from a single account.

SaxoTraderGO is easy to use, but also able to deliver advanced trading capabilities. The watchlist, screener, and alerts work together in concert. Charts come with 58 indicators and nearly 20 drawing tools. There are nine chart types from which to choose, and charts sync with the mobile version. As with the platform itself, charts are also versatile. Swapping among instruments is a breeze, and we really liked the product overview section, which shows related news and trade signals from Autochartist.

The comprehensive account overview, in addition to a portfolio summary, includes performance analysis and a returns breakdown. It allows traders to identify necessary adjustments to their trading strategy and improve overall profitability.

Protecting the bottom line is a set of risk management tools featuring a margin breakdown on each position, margin alerts, and an account shield. SaxoTraderGO represents an excellent trading platform for manual traders, while automated trading solutions are not supported.

A comprehensive range of trading and investing features comes with a user-friendly interface:

Fundamental analysis tools

News and expert research

Technical analysis tools

Extensive charting package

Option chain

Account-overview-front-desktop

Comprehensive account overview

SaxoTraderPRO:

SaxoTraderPRO is the broker’s most advanced trading platform, suitable for high-volume, active traders. It is a downloadable application only. This flagship desktop platform resembles SaxoTraderGO in terms of look and feel. Functionality is similar. However, the PRO platform offers a larger selection of professional trading features. For example, PRO supports as many as six monitors, streaming Level-2 order books, streaming time and sales, in addition to algorithmic orders. It is noteworthy that additional data subscriptions are required to use tools like the streaming Level-2 order book, which is a standard industry practice.

This professional, fully customizable trading platform gives you a range of high-performance tools built to manage and execute orders, with in-depth market analysis features such as:

Depth trader

Time and sales data

Algorithmic orders

Charting package

Option chain

There are dedicated dashboards to visualize your profits and losses, as well as returns and performance history for any account and timeframe. The account value shield acts as a stop loss on your entire account value. If triggered, it will close all your open positions (except bonds and mutual funds holdings) and cancel all orders.

Look and feel

Saxo built its trading platforms with the end-user in mind. They offer seamless integration with third-party tools that release a host of possibilities for advanced traders. With a modern and responsive design, the Saxo trading experience is propelled by an excellent, well-thought-out trading platform. At the same time, the research service is superb, with Saxo's proprietary research team constantly churning out new trade ideas. Saxo has a wide-ranging product portfolio, meeting the needs of even heavyweight traders.

Login and security

Saxo Bank follows industry-standard security procedures, including website encryption and two-factor authentication, to protect sensitive client data.

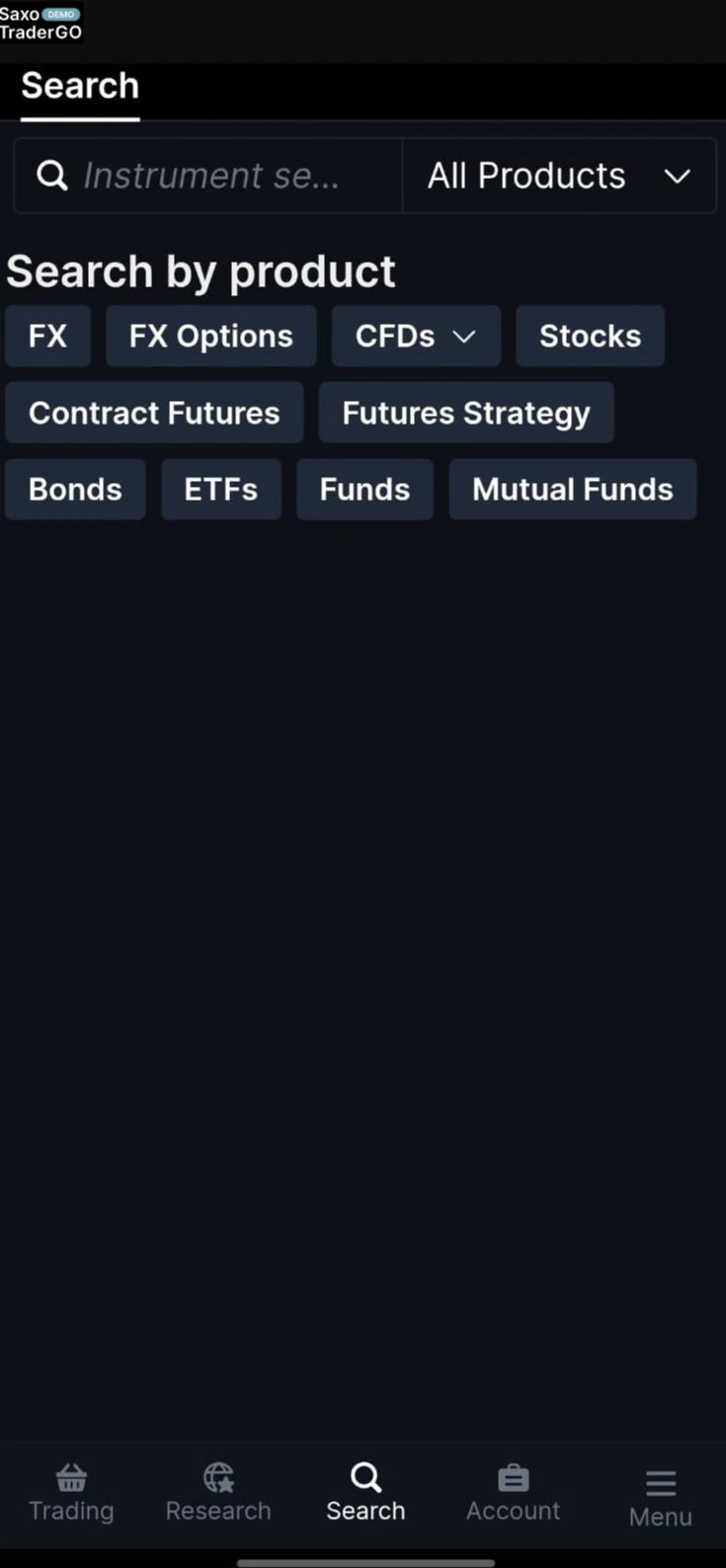

Search functions

Saxo's search functions are very good. The search results are relevant and grouped according to asset class. Thus, if you search for “Google,” the results will show Google stocks, CFDs, as well as options.

There is a drop-down button on the right side of the search box for filtering results. Further, you can narrow stock search results to specific countries or filter FOREX search results for major currency pairs.

Placing orders

Each platform’s order ticket has five basic order types, with the option of attaching “take profit” and/or “stop-loss” orders to them. Additionally, the trader can choose to make the stop-loss order a trailing stop-loss or a stop-limit.

The one omission to an otherwise impressive array of order types is the lack of GSLO order. This might deter new traders, but advanced traders would understand that guaranteeing a stop-loss order defies market dynamics.

Market – The simplest order, where a trader signals that their trade request should be executed at the prevailing market rate. The platform offers a variant of this called “quick trade,” which allows the trader to “hit the bid” or “pay the offer” to place a trade without any pending stop-loss or take profit attached. This is there to satisfy the trader's need for speed.

Limit – A pending order where the entry is at a predetermined point below or above the prevailing market rate, depending on whether it is a buy or sell. The trader also has the option of selecting the expiration time of this order.

Stop – A pending order where the entry is at a predetermined point above or below the prevailing market rate, depending on whether it is a buy or sell. The trader also has the option of selecting the expiration time of this order.

Stop-Limit – A pending order where the entry is at a predetermined point above or below the prevailing market rate, depending on whether it is a buy or sell, but where the trader can select the tolerance range for execution. For example, if the market gaps over the selected rate and the tolerance interval, then this order is immediately cancelled. The trader also has the option of selecting the expiration time of this order.

One-Cancels-the-Other Order (OCO) – A pair of pending orders (one an entry stop and the other an entry limit), where the execution of one automatically cancels the other. The trader also has the option of selecting the expiration time of this order.

Alerts and notifications

Saxo Bank provides robust alerts and notifications across its trading platforms, designed to help users stay informed and react promptly to market developments. Here’s an overview:

Price alerts

Margin alerts

Order execution notifications

Market news alerts

Portfolio performance alerts

Economic calendar events

These alerts can be delivered in several different ways:

Push notifications: Real-time updates via mobile and desktop apps.

Email alerts: Detailed notifications are sent directly to the user’s inbox.

In-App notifications: Integrated alerts within the SaxoTraderGO and SaxoTraderPRO platforms.

Mobile Trading

Saxo Bank’s SaxoTraderGO mobile app delivers a seamless experience across devices, closely mirroring the web platform's functionality. The app includes advanced charting tools with 58 indicators, nearly 20 drawing tools, and synced watchlists and charts, allowing traders to move effortlessly between mobile and desktop. Features like real-time news, economic calendars, pattern-recognition analysis from Autochartist, and a comprehensive order suite enhance on-the-go trading are available.

Saxo Bank does a great job of unifying the excellent SaxoTraderGO web-based platform experience across devices. Saxo Bank’s SaxoTraderGO mobile app ranks among the best FOREX brokers for mobile.

Platforms

Saxo Bank's user-friendly mobile platform has the same look and very similar functionalities as the web platform. The indicator list is shorter but comprehensive, and traders can read real-time news and research with a few swipes.

The app provides fingerprint ID entry, but this useful feature is not part of a two-tier authentication process. The platform is available in the same languages and has similar search functions, order types and alerts as the web trading platform. It provides a two-step authentication.

Look and feel

Nearly all features found in the web version of the platform are available in the SaxoTraderGO mobile app, including the trade ticket window, watchlist and screener features, and all research tabs. Also, the economic calendar, market news, and pattern recognition analysis from Autochartist, along with educational videos, are all accessible via mobile just as they are on the Web version.

The charting capabilities are rich, with nearly 20 drawing tools and 58 indicators, matching the experience of the web-based version of the platform. In addition to syncing watchlists, mobile charts in SaxoTraderGO mobile also sync with the browser-based version of the platform.

Login and security

Secure login and authentication processes to protect user accounts. These features are in line with industry norms.

Search functions

Saxo's mobile search functions are grouped according to asset class. This intuitive search functionality is designed to streamline the trading process, enabling users to swiftly navigate the extensive array of available markets and make informed trading decisions on the go.

Placing orders

Saxo's platforms offer a comprehensive suite of order placement features designed to accommodate various trading strategies. Order types include market orders as well as pending orders, which can include buy stop, sell stop, buy limit, and sell limit instructions. You can also trade from charts on the app.

Alerts and notifications

In addition to platform-based alerts, Saxo's platforms support setting up email, SMS, and push notifications for important events such as margin calls, deposits and withdrawals, and the status of open or closed positions.

Research and Development

Saxo Bank combines high-quality, in-house research with top-tier third-party providers to offer an outstanding research experience. Overall, Saxo Bank continues to be one of the best choices for FOREX research. The broker offers a rich, diverse research offering across its website, as well as its different platforms.

The research consists of various types of content formats (video, articles, podcasts) from in-house analysts who publish daily updates through Saxo Bank’s Market Analysis section.

Multiple real-time, streaming news services, a variety of market reports in varying time formats, trading idea generators (Trade Signals by Autochartist and trade ideas from Sales Traders and SaxoStrats), and access to analyst rating reports should satisfy even the most seasoned traders.

Generally speaking, any research that a client would need in order to make an informed trading decision is likely offered by Saxo Bank.

Research materials can be accessed through the website or directly through the platforms. Saxo has an impressive roster of in-house analysts who provide regular market updates, ratings, and timely commentary.

Video research is seamlessly integrated into Saxo Bank’s website and platforms, which we found to be of high quality. Saxo Bank also includes playlists on YouTube, although it is worth mentioning that many of Saxo Bank’s videos are unlisted on purpose and thus not easy to identify.

Saxo Bank’s focus on its websites and trading platforms instead of YouTube makes sense, as we think it provides a much cleaner customer experience (bouncing between a trading platform and YouTube is anything but efficient).

Saxo Bank’s research team delivers quarterly outlooks and yearly forecast reports in PDF format, which include accompanying videos. These reports are excellent for traders and investors seeking to take a theme-based position based on quality research.

The interactive chart function is great and user-friendly. You will find 50 technical indicators and can add many editing tools, such as trend lines or Fibonacci tools. Further, there is a trading signal tool that gives you a chance to buy or sell signals based on technical indicators. This feature is powered by Autochartist, a third-party research company.

A news feed and an economic calendar are also available on Saxo's trading platforms. One slight drawback is that you cannot filter news by assets. Another is that the calendar is not interactive, as noted earlier.

Saxo Bank provides additional materials for your research. Quarterly outlooks provide an in-depth analysis of potential market movements. These are both general predictions or tied to world events. The daily podcasts can also give you some insights into current market trends.

Portfolio analysis, including performance data, risk assessment, and portfolio breakdowns, is available across all of Saxo's platforms. The platform reporting suite allows clients to export all historical positions and trade and performance data in PDF or Excel format. This reporting functionality offers the opportunity to consolidate holdings in an external spreadsheet or third-party reporting software.

Education

Judging by its research tools, it is no surprise that Saxo Bank provides a diverse selection of quality educational materials in both written and video formats. Overall, the depth of educational resources is above the industry average and comparable to category frontrunners.

Under its Insights section, Saxo Bank provides market analysis articles powered by the firm’s in-house Saxo Strategy (Saxo Strats) team. You can filter articles by analyst, as well as by asset class, with multiple updates per day alongside client sentiment data and market movers.

Educational materials focus primarily on platform and product tutorials and introductory coverage of fundamental and technical analysis topics, with few skill-building resources. However, that fits with what appears to be Saxo's unstated goal of attracting advanced, well-funded traders.

Final Thoughts on Saxo Bank

Saxo Bank is a highly trusted, global brand that understands its traders very well. Not only is the client experience seamless, but it is also rich with advanced tools and high-quality market research. Saxo Bank also does an excellent job of unifying its desktop, web, and mobile platforms.

For traders who can afford the high minimum deposits, Saxo Bank offers competitive pricing, excellent trading platforms, deep research, reliable customer service, and over 71,000 instruments to trade.

Conclusion

Established in 1992, Saxo Bank is one of the leading retail FOREX and multi-asset brokerages, servicing more than 1,200,000 clients from its regulated entities and across 15 international jurisdictions, including the UK, Denmark, and Singapore, to name a few.

Furnishing both retail and institutional clients, the multi-tier classification is an appealing incentive for frequent and high-volume traders. Saxo Bank is well-capitalized, gives clients great investor protection, and has innovative educational courses, as well as a top-class research team. No wonder this broker is a go-to choice for clients worldwide.

It does not mean the broker is free of drawbacks. A confusing array of fee schedules makes it difficult to estimate bottom-line costs. While there is a certain “arrogance” to Saxo's approach that might be justified, given its track record, it can be quite off-putting to a new trader seeking access to its service. Small and lower-skilled traders can find better deals elsewhere due to Saxo's surcharges for small trades, high account minimums, and higher-than-average trading costs for all but the most high-volume clients. However, for a sophisticated, well-funded market professional, Saxo's extensive product catalog, advanced user interfaces, and superior research offerings would be quite attractive.

Saxo Bank in Brief

Saxo Bank is considered one of the best investment banks in the area of financial markets and currencies, as it offers some of the very best trading platforms and tools from all the companies we have reviewed. Meanwhile, its high-volume spread discounts are attractive to elite, well-capitalized traders. The broker offers an enormous number of asset classes, making it an all-round excellent choice.

Review Methodology

The team at Arincen collected more than 120 pieces of data covering in excess of 100 licensed FOREX companies. Data collection was done in three ways:

Companies’ Websites.

Other Websites that have ranked FOREX companies.

A survey questionnaire (referred to here as Survey “1”) we had sent to the companies invited to participate in the exercise.

We have identified 12 criteria for our assessment, each containing several aspects and carrying its own relative weight. These include licensing, deposits and withdrawals, number of assets etc.

Afterward we validated the data by:

Registering with FOREX companies as a secret shopper and/or as Arincen.

Survey number “2,” in which we asked these companies’ customers for important feedback and past experience.

The next step saw us evaluate and rank each company, relying on the hard work of 15 Arincen employees. We were very careful in ensuring the most accurate assessment possible, including taking into account different languages, as well as the various mobile-app operating systems,e.g., Apple, Samsung etc.

To add credibility to our research project, we sent a final and third survey (referred to here as Survey “3”) to enable participating FOREX companies evaluate our own research and whether it accurately reflects the realities on the ground. We were fortunate enough to receive a mark of 9.9 out of 10! We have kept to a minimum the margin of error, which stood at a measly 1%. To learn more on how we came up with the evaluation, please click here.

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

FAQ

Yes, Saxo Bank is considered low-risk. It is licensed in six tier-1 jurisdictions and follows strict regulations, including segregated client funds and membership in compensation schemes like the Danish Depositor and Investor Guarantee Scheme.

There is no minimum deposit for the Classic account. However, the Platinum account requires a minimum deposit of $200,000, and the VIP account requires $1,000,000.

Saxo Bank provides access to over 71,000 financial instruments, including FOREX, stocks, bonds, ETFs, mutual funds, commodities, options, futures, and CFDs.

No, Saxo Bank does not offer Islamic (swap-free) accounts. Traders seeking Sharia-compliant options would need to explore other brokers.

No, Saxo Bank does not support MetaTrader (MT4/MT5). Instead, it offers its proprietary platforms, which include advanced tools and features.

Yes, Saxo Bank’s SaxoTraderGO platform is optimized for mobile use. It includes synced watchlists, advanced charting, and trading features, providing a seamless experience across devices.

Yes, Saxo Bank provides a 20-day demo account with $100,000 in simulated funds. This allows traders to practice and familiarize themselves with the platform without any financial risk.

Yes, Saxo Bank offers multilingual customer support and provides platform interfaces in multiple languages. Support is available through chat, email, phone, and a comprehensive online help center.

Saxo Bank offers competitive pricing for high-volume traders, including lower spreads, personalized account management, and access to advanced tools like SaxoTraderPRO. Platinum and VIP accounts come with additional perks, such as reduced commissions and one-on-one expert support.