Table Of Contents

- What Is Crypto Margin Trading?

- What Is an Exchange in the Cryptocurrency World?

- Practical Considerations When Trading Crypto On Margin

- How to Manage Risk with Margin Trading

- Have a trading plan

- Insert stop-loss orders

- Don’t risk more than you can lose

- Take profit when you can

- The Pros and Cons of Margin Trading Cryptocurrencies

- Strategies for Trading Cryptos on the Margin

- Conclusion

What is Margin Trading Cryptocurrency? A Detailed Explanation

Early on in my crypto trading career, I too was looking for ways to place bigger orders, but I just didn’t have the capital. Margin trading cryptocurrency really helped me up my game. In short, it involves using money that you borrow from a crypto exchange so you can “trade on the margin.”

Margin trading allows you to make bigger profits with a comparatively small investment. Conversely, you can also incur big losses. Like many investments, finding out if margin trading is for you will come down to how you feel about its pros and cons after conducting thorough research.

To succeed with this type of trading, you will need to know what you are doing and understand the rules of the game. You need to understand the risks. I've written this brief article to help you get to grips with margin trading. After reading the article, you should be better placed to make the right decisions about how you can integrate margin trading into your investment strategy.

Margin trading lets you borrow money from a crypto exchange to place larger trades and increase your potential profit.

Exchanges typically match your deposit amount one-to-one and hold your original funds as collateral against potential losses.

Borrowed funds must be repaid with interest, and margin calls can liquidate your positions and seize your assets without warning.

Reputable exchanges offering margin trading include Binance, Kraken, Coinbase, IG, XTB and Dukascopy.

Risk management tools like stop-loss and take-profit orders are essential to avoid major losses in volatile crypto markets.

Strategies such as starting with small trades, using demo accounts and capping trade sizes can help protect your capital.

Leveraged trading can amplify both profits and losses, so traders should never invest more than they can afford to lose.

Despite its risks, margin trading can be a valuable tool when paired with discipline, planning and strong emotional control.Margin trading lets you borrow money from a crypto exchange to place larger trades and increase your potential profit.

Exchanges typically match your deposit amount one-to-one and hold your original funds as collateral against potential losses.

Borrowed funds must be repaid with interest, and margin calls can liquidate your positions and seize your assets without warning.

Reputable exchanges offering margin trading include Binance, Kraken, Coinbase, IG, XTB and Dukascopy.

Risk management tools like stop-loss and take-profit orders are essential to avoid major losses in volatile crypto markets.

Strategies such as starting with small trades, using demo accounts and capping trade sizes can help protect your capital.

Leveraged trading can amplify both profits and losses, so traders should never invest more than they can afford to lose.

Despite its risks, margin trading can be a valuable tool when paired with discipline, planning and strong emotional control.

What Is Crypto Margin Trading?

I would liken a margin to collateral used to secure a loan. Crypto exchanges like Binance lend traders money to enable larger trades. When we speak of margin, we mean the security a trader must provide to their crypto exchange to cover the risk they pose when buying and selling financial instruments with borrowed funds.

When you borrow funds from a crypto exchange to trade cryptos, you represent a credit risk to that exchange. When you “buy on margin,” you are trading using a sum of money lent to you by the exchange for the chance to make bigger profits for you and the exchange.

Typically, before crypto traders can get a loan from a cryptocurrency exchange, they must put up an amount of their own of roughly equal amount in order to qualify for a loan. Your initial payment becomes the collateral for any future trades you make. How does this work? Well, if you open an account with $1,000 of your own money, the crypto exchange will typically loan you an additional $1,000 with which you can start to trade. Different exchanges have different opening amounts.

Your first $1,000 is put “on ice” in your account and stays there as collateral in case you make losses. But why do it this way? Crypto exchanges and, indeed, online brokers before them realized that if traders used their own $1,000 and lost all that money, they would never return. However, by lodging that $1,000 and trading with $1,000 of the house’s money, traders can make bigger profits more quickly, increasing their chances of getting into the black and continuing to trade.

Margin Is Not a Free Lunch

I would caution that if margin trading sounds like a freebie, it is not. Traders must service the funds they borrow from the crypto exchange by paying regular interest and facilitation fees. The loan made to you by the exchange becomes payable in full as soon as you make profits, and your crypto account balance increases to a level where you can trade with your own money.

If you make a loss in the early stages, the crypto exchange can make a “margin call” at any time without negotiation, which is when they take the $1,000 collateral you gave them when you began. This margin call also allows the exchange to take ownership of any securities in your account, including crypto you bought but have not sold yet. Margin trading is not a passive exercise. The crypto market swings quickly, so you will need to take your margin seriously and watch your investments closely.

What Is an Exchange in the Cryptocurrency World?

In case it is unclear, a cryptocurrency exchange is a digital marketplace that acts like a stocks broker or an online broker. It provides you with a platform on which to buy and sell digital currencies, like Bitcoin, Ethereum, and Ripple. Well-known crypto exchanges include Kraken, Coinbase and Binance. A good exchange is one that is mature enough to have developed its tools and services to make buying and selling cryptos easy and seamless. Like the best online platforms, crypto exchanges invest money and time to improve their platforms and provide traders with features that differentiate them from rivals.Naturally, exchanges charge fees for these services, and, as with all marketplaces, some exchanges are more expensive than others. Security is an important feature, too, as you should feel as if your information and investments are protected. Just like with online brokers, exchanges become more attractive as they improve their services, like supplying good withdrawal options and increasing the number of supported currencies.

Once you have chosen your exchange, you would need to open an account in the normal process that involves supplying your personal details. Once your account is approved, you can fund it with the fiat currency in which the account is denominated.

Recommended Brokers

Practical Considerations When Trading Crypto On Margin

In my experience, on most exchanges, you can borrow up to 50% of the purchase price of an instrument. Naturally, you can borrow less than 50% if you don’t need a loan of that size. Be sure to check what your exchange offers in this regard.

A crypto exchange typically requires you to maintain a specified minimum balance in your account, known as the maintenance margin requirement. This is the initial investment I mentioned earlier. The exchange will use this amount if it issues a margin call. When the exchange needs its money back, it will “call in” or liquidate your margin trade once you reach a price at which you would start losing the borrowed money. No exchange would allow you to trade indefinitely until you lose all the funds it advanced you, including your own.

To avoid a margin call, simply top up your account to a safe level. Of course, it is not always this simple, as some traders run out of money. Be aware that as your debt level rises, your interest and fee liabilities rise, too. Crypto exchanges offer leverage anywhere from 2:1 to 100:1. As it is an unregulated space, some exchanges give traders leverage of up to 200:1 or even more. Losses can stack up very quickly. That’s why margin trading is only recommended for controlled, short-term use where traders take advantage of crypto volatility.

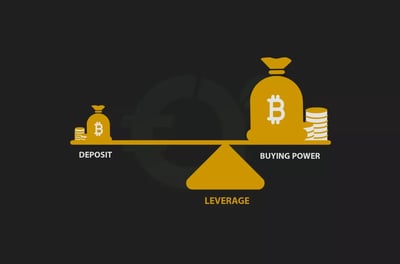

What Buying Power Looks Like

Leveraging a purchase of crypto allows you to take advantage of big market swings by magnifying your profits. Let’s work out an example of how this looks. If you started with $1,000 in your account, that might be enough to cover a maintenance margin requirement of $500, depending on your exchange's requirements. This would leave you with $500 available to trade.

With $500 of your own money, a typical exchange could match that number by loaning you an additional $500. Now you have $500 frozen as collateral, and $1,000 to spend. You have doubled your effective spending power, despite $500 of your money being locked away.

You need to know that once you start buying crypto, your account balance is not static. If your account holds $1,000 in crypto, its value may fluctuate with market volatility, dropping to $900, for example, as the market price changes. This underscores that trading crypto on margin is an active investment, not a passive one.

How to Manage Risk with Margin Trading

As attractive as making large profits seems, you could just as easily suffer heavy losses. This comes with the territory in the trading world, and more so with crypto. However, there are ways to build smart risk management measures. Here are some ways to manage your risk:

Have a trading plan

It’s vital to have a trading plan in the highly volatile crypto market. Working to a plan will keep you consistent so that you can scale up to making profits in a sustainable way. A good trading plan includes a comprehensive method of how to enter and exit positions. This must account forentry and exit indicators, position sizing, and stop-loss placements.

I cannot stress enough the advantages of trading to a plan. Not only are you more relaxed in the act of trading, but you will make more rational and controlled decisions. It is essential to stick to your trading strategy. You will inevitably suffer losses, as all traders do. However, the key is to know how to react when that happens. Will you abandon your plans when you start to lose money? You could make impulsive and ill-advised tradesto try to claw back some ground.

Insert stop-loss orders

Risk management includes doing things that will stop you from suffering catastrophic losses. A stop-loss is a type of order that allows you to put a cap on potential losses by naming a price limit that triggers an automatic sell-off of your position. This could look like buying a Bitcoin futures contract for the price of $500. In order to reduce the chances of a loss, you could insert a stop-loss order at 20% below the purchase price, or$400. If the price of Bitcoin plummets below $400, the stop-loss order is activated. The exchange immediately sells the contract. Remember, thetrigger is for you to exit at $400, but by the time the exchange sells your contract, it could have gone below $400. At least you will be within the range of your loss tolerance level.

A stop-loss just allows you to apply the brakes as you approach a certain level of loss. You don’t have to think about it or get caught up in a trading psychology trap of waiting for the price to rise again.

Don’t risk more than you can lose

It is one of the fundamentals of trading. Do not trade with money you cannot afford to lose. Invest with excess savings or a predetermined amount with which you are comfortable never seeing again. In volatile markets like crypto, you can lose money quickly, so you need to ringfence the amounts you are comfortable with losing and don’t dip into cash you need.

Take profit when you can

When the going is good, make a habit of taking profit. A take-profit order lies on the opposite side of a stop-loss. You can set your account to close its position when the profit on a contract hits a specific amount. This stops you from becoming greedy and gives you the chance to walk away with profits before the price changes through unexpected swings.

The Pros and Cons of Margin Trading Cryptocurrencies

There are pros and cons to trading cryptos on margin. I highly recommend that you understand this before you begin.

Pros

You can make large profits.

You can diversify your portfolio through increased buying power.

You can trade with limited funds.

It teaches you discipline and risk management.

Cons

You can lose a lot of money.

It is always risky.

You can lose money quickly.

New traders face a steep learning curve.

Even though crypto trading remains relatively unregulated, many exchanges are proactively adopting responsible practices by providing traders with extensive educational materials. Most of the best crypto exchanges have invested in detailed educational materials that allow new traders to always make informed decisions as they come to learn the pros and cons of margin trading cryptocurrencies.

Strategies for Trading Cryptos on the Margin

Now that you know the fundamentals of margin trading, it is important to understand which strategies you can use to start margin and leverage trading in cryptocurrency. Here are some strategies that worked for me that you could also consider:

Slowly increase your trade sizes: It makes sense to start small before taking on larger trades. Starting small and navigating a few successful trades gives you confidence to increase the trade sizes.

Improve your skills through demo trading: In the same way that online brokers allow you to practice risk-free, demo trading is available on most good exchanges.

Split your positions: It is often a good strategy to divide them strategically. This could mean managing your take-profit and stop-loss orders in tandem, so you are neither overexposed nor overly greedy. Limit how long your positions stay open: Don’t hold on to positions for too long,especially in the crypto space.

Keep a set limit of capital per trade: It is always good advice to not risk more than 5% of your capital on a single trade, no matter how attractive it seems. This is not to say you should always invest 5%, you can invest as little as 1-2% of your capital on a given trade, especially as you are getting to grips with the market.

Conclusion

In my view, margin trading cryptos is a very exciting space. Crypto is a highly dynamic market, with daily and even hourly swings and counter-swings. It can be exhilarating to go on a string of wins, but remember that trading on margin can lead to devastating losses.

The market can be intimidating for new traders, but with a focus on self-education and research, anyone can learn how to navigate the market. Money management and discipline are going to be keystone traits if you are to thrive in this area.

Recommended Brokers

FAQ

Crypto leverage trading strategy The short answer is, yes, trading cryptocurrency is halal. However, there has been much debate amongst Islamic scholars and thinkers about how this new form of trading coheres with the teachings of the Holy Quran. For starters, trading in general is accepted within Islam as you are allowed to pursue activities that lead to the improvement of your personal situation. The main caveat is that you are not allowed to earn interest, which is why swap-free or interest-free accounts in FOREX trading have been created as this complies with Sharia Law. There is a consensus among scholars that crypto trading can be treated just the same as FOREX, and is, for that reason, halal. Cryptocurrency is seen as a digital form of money and, therefore, is halal to trade. As per the Sharia Law, forms payment similar to real money are recognized by the majority of scholars in Islam as halal. However, as we have mentioned, there is no universal agreement that crypto trading is halal. Some bodies, such as the National Council of Islamic Scholars in Indonesia, have purported that because crypto lacks a physical form, it is hence haram to trade in it. That said, this appears to be a minority finding in the world of Islam,

Though there are many crypto leverage trading strategies, here are four evergreen pieces of advice that will keep you in a good position. Remember, there are always more ways to protect yourself, not only the ones we are listing here. First, always start slowly. Don’t increase the size of your trades before you are ready. Grow your confidence from notching up a few small wins before you go big. Second, practice trading as much as you can. Normally this involves getting to know the market using a demo account provided to you by your broker. Third, split your positions. Go long on some trades and short on others. Diversify your positions by inserting take-profit orders on some trades and stop-losses on others. In the fourth and final case, limit the duration of your exposure. Don’t hold on to positions for too long because of the volatility in the crypto market.

Well-known crypto exchanges include Kraken, Coinbase, Crypto.com, and Binance. When choosing a crypto exchange, make sure they are reputable and have developed a strong suite of features. The best crypto exchanges have invested time and money to give you the best trading experience. Some of the most important features related to crypto trading on an exchange are security and fees. When performing your due diligence, ensure that you understand these areas clearly so that you can make the most informed decisions.

Isolated margin is the amount of margin that is allocated to an individual position. Cross margin is margin that is shared between open positions with the same denominated cryptocurrency. With isolated margin, traders can manage the risk on individual positions by restricting the amount of margin allocated to each one. With cross margin, a position can draw more margin from the total account balance of the corresponding cryptocurrency to avoid liquidation. Daily interest rates Traders must pay interest for the benefit of the margin they receive from brokers. This interest rate is typically calculated hourly and rolled up into a daily average rate. Traders can find out how much interest they are liable to pay by consulting the fees section of the crypto exchange or broker they are using.

With most crypto exchanges, a trader has a running margin score that denotes how well they are doing with the money they have borrowed from the house. Margin score is typically calculated using three main levers: wallet balance, total amount borrowed, and total outstanding interest. Each crypto firm will have its own risk profile that governs how strict the firm is with executing a margin call when a trader is in trouble.