FxPro Review 2026

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

FxPro Evaluate - research result

Key Takeaways

FxPro is a well-regulated broker founded in 2006.

FxPro is regulated by the UK’s Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), the Financial Sector Conduct Authority (FSCA) of South Africa, and the Securities Commission of the Bahamas (SCB), and the Financial Services Authority of Seychelles (FSA).

FxPro has raked in 136 international awards for service and innovation since its inception.

FxPro’s No Dealer Desk (NDD) execution model speeds up trades immensely.

FxPro also offers spread betting in its UK home market, which can have tax advantages for clients there.

FxPro provides high-quality access to financial markets, with Contracts for Differences (CFD) on over 2,100 instruments in eight asset classes.

With 75 hefty FOREX pairs, as well as a range of cryptocurrencies, futures, commodities, and stock indices, FxPro customers have a wealth of choice.

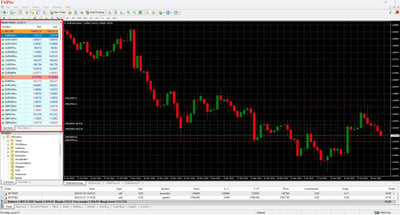

FxPro uses the well-recognized third-party trading platforms MetaTrader4 (MT4) and MetaTrader5 (MT5).

The broker has so far opened 11 million client accounts in 170 countries and has executed over 786 million orders and counting.

FxPro offers traders a robust range of account types for different traders.

FxPro tenders high-quality, multilingual customer support on a 24/5 basis through live chat, email, and phone.

FxPro offers competitive levels of spreads and commissions across its account types.

FxPro prides itself on fee transparency and tries to keep fees transparent while also offering a range of calculators to help traders make better investment decisions.

Traders can access a wealth of research and education tools. The material covers all asset classes and is sourced from reputable third-party information providers.

FxPro clients can easily download the full range of FxPro’s web and mobile platforms through common vendors like Windows, the Apple App Store, or the Google Play Store for Android.

Last Reviews

Overall Summary

While researching this broker review, I discovered that FxPro was established in 2006 and has since become a leading online broker with a global presence. Headquartered in London, the company serves clients across more than 170 countries and has won over 136 prestigious industry awards.

FxPro offers traders an extensive array of investment opportunities, featuring over 2,100 CFD instruments spanning eight diverse asset classes, including FOREX, futures, indices, shares, metals, energies, and cryptocurrencies. The company prides itself on delivering excellent liquidity and lightning-quick trade execution. These speeds are partly because the broker does not go through a dealing desk, which significantly reduces transaction times.

Traders at FxPro have access to popular, industry-standard platforms like MT4 and MT5. Additionally, FxPro provides its proprietary FxPro Trading Platform, available seamlessly on both web and mobile devices, and supports cTrader, renowned for its intuitive and user-friendly interface.

The broker offers a powerful range of advanced tools, such as the All-In-One FX Calculator, which helps traders perform important trading calculations like margin, swap, pip value, and cTrader commissions.

I was impressed by the sheer wealth of educational materials. These include free online courses tailored for both beginners and advanced traders, covering topics like the basics of trading, fundamental and technical analysis, trader psychology, and more.

FxPro places a major focus on customer service. It offers multilingual customer support via email, callback, and live chat on a 24/5 basis. This is a broker whose global reach has allowed it to open over 11 million trading accounts and execute over 786 million orders to date, with most orders executed in less than 11 milliseconds.

FxPro is widely considered a safe and reputable broker, operating under stringent regulatory oversight across multiple jurisdictions. The company emphasizes transparency and strong governance by keeping client funds fully segregated in leading banks. Clients benefit from additional safety measures, including negative balance protection in line with EU guidelines and investor protection schemes like the UK's FSCS (£85,000 coverage).

Is FxPro Safe?

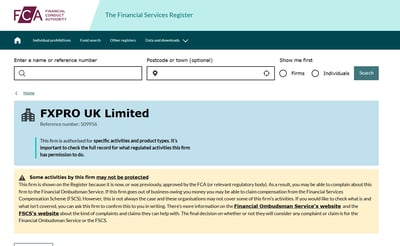

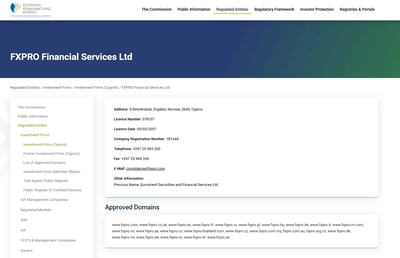

In my view, FxPro is a well-established broker that is very safe. The broker operates under stringent regulatory oversight in multiple jurisdictions:

United Kingdom: FxPro UK Limited is authorized and regulated by the FCA, ensuring compliance with some of the most rigorous financial standards globally.

Cyprus: FxPro Financial Services Limited is licensed and regulated by CySEC, facilitating operations across the European Union under the MiFID directive

South Africa: The company received approval from FSCA in 2015, expanding its reach into the African market

The Bahamas: FxPro Global Markets Limited is regulated by SCB, further extending its international regulatory framework.

Seychelles: Invemonde Trading, Ltd in partnership with FxPro Global Markets Ltd., is authorised and regulated as an Investment Dealer by the Seychelles Financial Services Authority (FSA).

The company has worked hard to earn a five-star reputation. It is respected and globally recognized through its trading record of accomplishment and marketing efforts.

FxPro is also a vigorous advocate of transparency and good governance. It has set up the highest safety standards for client investments. As part of this governance approach, client funds are ring-fenced and kept in top-tier banks, and there is total segregation from company funds.

Besides subjecting itself to stringent regulation, FxPro offers further protection to clients, as detailed below:

It offers a negative balance protection policy as part of EU guidelines that cut instances where clients lose more money than they had deposited.

Global big four consulting firm, PWC, audits its financial reports.

FxPro UK Limited is a member of the Financial Services Compensation Scheme (FSCS), which guarantees affected traders up to £85,000 if a broker goes insolvent.

FxPro Financial Services Limited is a member company of the Investor Compensation Fund (ICF).

It segregates client funds from company funds and holds them in premier banks, like Barclays and the Royal Bank of Scotland.

How FxPro Protects You from Reckless Leverage and Margin Trading

Leverage and margin can be powerful tools for traders, but if not used right, they can result in hefty losses. Some unreliable brokers offer simply too much leverage, which can be dangerous for new traders.

How you are protected

FxPro manages leverage carefully to protect you from too much exposure. The broker adjusts leverage limits based on your location, aligning with local regulatory guidelines to promote responsible trading.

In the European Union and the UK, retail clients face leverage caps set by the European Securities and Markets Authority (ESMA) and the FCA. Leverage is limited to 30:1 for major currency pairs; 20:1 for non-major currency pairs, gold, and major indices; 10:1 for other commodities and non-major equity indices; and 5:1 for individual stocks.

Since the broker does not only operate in Europe, it must offer appropriate leverage for other jurisdictions. Depending on where you are registered, other max leverage figures are published at up to 200:1 for many instruments under a global (non-EU/UK) entity.

Regulation and other security measures

FxPro is committed to the safety of client funds and adheres to the following practices:

Segregation of funds: All client funds deposited with FxPro are fully segregated from the company’s own funds and are kept in separate bank accounts. This ensures that client funds cannot be used for any other purpose.Investor protection: FxPro UK Limited is a member of the FSCS, which insures customer deposits up to £85,000 per client.

Regarding margin requirements, FxPro actively monitors and adjusts them to reflect market volatility. The company provides a Margin Calculator tool that allows traders to calculate the exact margin required for their positions. This tool helps traders manage their leverage and assess the funds needed to maintain open positions.

If the equity in a trading account falls below the maintenance margin level, FxPro may issue a margin call, requesting additional funds to restore the account balance. Failure to meet a margin call may result in the automatic closure of positions to prevent further losses. You are encouraged to regularly monitor your accounts and use risk management strategies to reduce potential losses

Top broker features

True NDD execution broker: Unlike many of its competitors, FxPro executes client orders with no dealing-desk intervention. The company positions this as a big differentiator for those who understand it.

Uses STP but remains an NDD broker: STP is a post-execution, post-trade communication process between executing counter parties that does not impact the speed or price of trade execution. FxPro uses STP technologies, but it prefers to be called an NDD broker as it most closely aligns with its order-execution style.

Strong regulation and safety: FxPro is regulated by top-tier financial authorities, providing strict oversight.

Powerful data center: The broker’s advanced LD4 London data centre and Quotix aggregator deliver ultra-fast, efficient trade execution at optimal prices.

Diverse instruments: The broker offers access to FOREX and CFD instruments, as well as equities, funds, bonds, options, futures, and cryptocurrencies.

Fast and transparent execution: FxPro uses advanced trading technology to provide low-latency order execution with minimal slippage.

Low-cost trading: Traders can get competitive spreads and low-commission structures, making FxPro a cost-effective choice for both high-volume and retail traders.

Comprehensive education and support: FxPro provides a full suite of educational resources, including webinars, trading tutorials, market analysis, and research reports.

Customer support: The broker offers multilingual customer service via phone, email, and live chat, with responsive and knowledgeable support available 24/5 to assist with technical and account-related issues.

For Whom Is FxPro Recommended?

I believe FxPro is ideal for traders who enjoy a wide range of trading markets and expect superior platform functionality.

Clients have the flexibility to customize their trading environment and leverage sophisticated tools, including advanced analytical features, algorithmic trading capabilities, and comprehensive charting packages, all designed to meet the demands of both novice and experienced traders.

Novice traders can just as easily find a place in the FxPro stable as there are many welcoming resources for new clients. Its combination of competitive fees, high number of investment choices, and emphasis on customer service will suit traders from any end of the experience spectrum.

FxPro’s robust range of over 75 FOREX pairs and its ability to offer traders access to equity indices, cryptocurrencies, commodities, and futures, puts it in a good light against all its competitors. Users can trade on over 2100 CFD instruments on a mostly commission-free basis, depending on the platform they use. They only must pay spreads and swaps.

With its strong range of tools that are equally useful on desktop applications, web, and mobile, traders with any device preference can benefit. Clients can also access a range of different trading tools, such as calculators and earnings calendars.

This total package means that it caters to every level of trader. Combining its competitive offering, wealth of choices, and successful history, there is little FxPro cannot offer in the industry.

Here are the pros and cons of using this broker:

-

Its NDD execution model speeds up trades

-

The FxPro VPS Service offers automated trading solutions

-

Advanced algorithmic trading through cTrader

-

Real-time news feeds

-

Above-average breadth of product offering

-

Transparent pricing

-

Globally regulated by top-tier regulators

-

Commission-free trading available

-

Wide range of trading platforms available

-

Competitive spreads with no commission

-

Rapid execution with most orders filled in under 11ms

-

Ultra-low latency third-party data center colocation speeds up trades

-

Tier-1 level liquidity

-

The lowest trading costs are mainly with the Raw+ and Elite account types

-

MT4 and MT5 accounts have marked-up spreads

-

Does not offer guaranteed stop-loss orders

-

Full CFDs on shares are only available on MT5

-

Does not accept clients from the US

Offering of Investments

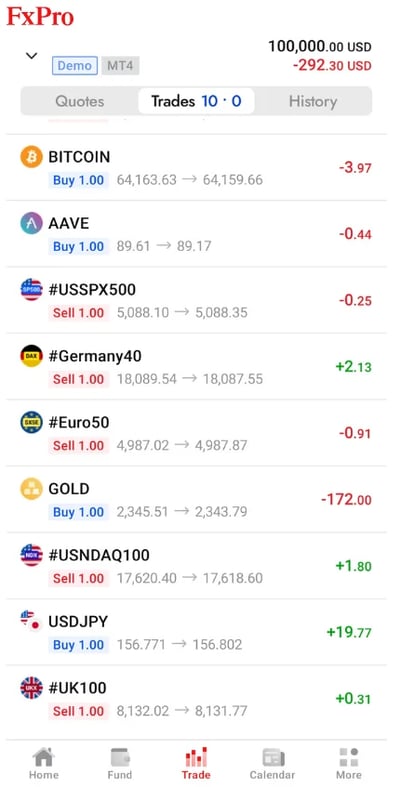

FxPro offers traders access to over 2,100 CFD instruments across eight asset classes, including FOREX, shares, energy, futures, cryptocurrencies, indices, metals, and ETFs. Traders benefit from FxPro’s advanced execution model, featuring competitive spreads, dynamic leverage based on account and asset type, and efficient order execution. Also, FxPro provides spread betting services, which are particularly attractive to UK clients due to potential tax benefits.

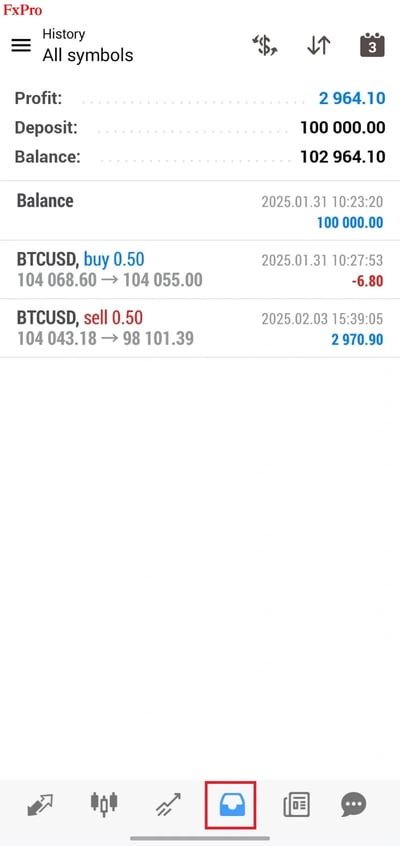

FxPro has many investment products on offer. During testing, I made sure to take advantage of FxPro’s high-quality access to global financial markets that it provides through its advanced execution model.

Traders at FxPro enjoy access to an extensive range of over 2,100 CFD instruments spanning eight asset classes, including more than 75 FOREX pairs, hundreds of global equities, cryptocurrencies, futures, commodities, and major stock indices, enabling diversified trading strategies.

FxPro also offers trading in spread betting, which is an exciting product in FxPro’s UK home market, as it can have tax advantages for UK clients. Trading costs, such as spreads, commissions and overnight fees, may differ per trader, depending on the instrument being traded and the account type opened.

Depending on the asset being traded, its lot size, and the accountis domicile, FxPro offers dynamic leverage. The broker’s website has a full list of all the assets and their available leverage so that you know what to expect before you get started.

Here are the asset classes that allow traders to run a diversified cross-asset portfolio:

FOREX

Get trading more than 75 currency pairs that are drawn from major, minor, and emerging markets. You can get flexible transaction sizes across all trading platforms, and orders can be placed through the trading desk during market hours. Benefit from competitive spreads, deep liquidity, and rapid execution, enabling effective risk management and robust trading strategies.

Shares

With FxPro, traders can invest in hundreds of global shares from leading international markets, including the US, UK, and EU exchanges. This broad selection allows investors to diversify their portfolios across multiple industries, capitalizing on growth opportunities and market volatility.

Energy

FxPro facilitates trading in key energy commodities like oil and natural gas. These instruments allow traders to speculate on price movements influenced by geopolitical events, supply-demand dynamics, and economic indicators, providing opportunities for both short-term and long-term strategies.

Futures

FxPro’s futures offerings include various commodities, currencies, and indices contracts. These futures instruments allow traders to speculate on future price movements and hedge against potential risks, taking advantage of market predictions and strategic market positioning.

Cryptocurrencies

FxPro provides access to popular cryptocurrencies, including Bitcoin, Ethereum, and Litecoin, via CFDs. Traders can benefit from crypto market volatility without owning the underlying assets, utilizing leverage and the ability to short sell, enhancing their trading flexibility and risk management.

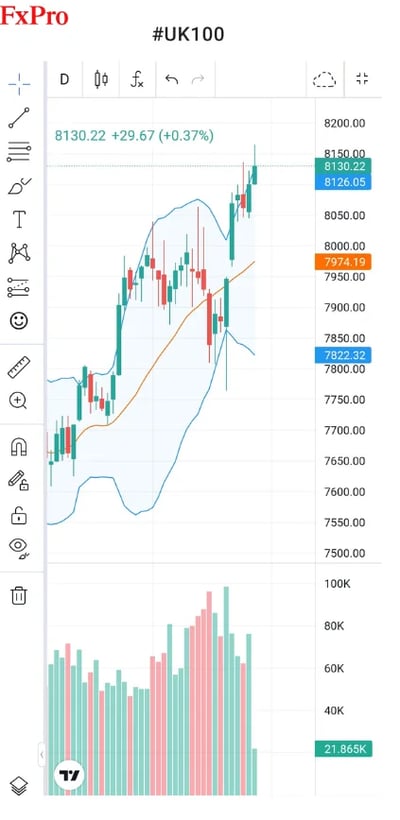

Indices

FxPro offers CFDs on major global indices such as the Dow Jones, S&P 500, NASDAQ, FTSE 100, and DAX. Trading indices allows investors to take positions on overall market performance, benefiting from macroeconomic trends, sectoral shifts, and broad market movements.

Metals

Traders at FxPro can trade such precious metals as gold, silver, platinum, and palladium. Metals trading provides a means of portfolio diversification, a hedge against inflation, and opportunities during times of economic uncertainty or volatility in currency markets.

ETFs

FxPro also offers access to a diverse selection of Exchange-Traded Funds (ETF), enabling traders to invest across various sectors, asset classes, and geographic regions. ETFs provide a cost-effective way to achieve portfolio diversification, combining the flexibility of stock trading with the benefits of mutual fund investing.

Available assets

| Markets | Available | Number of Assets |

| Currency Pairs | 75 | |

| Stocks | 1873 | |

| Commodities | 14 | |

| Crypto | 28 | |

| Indices | 18 | |

| ETFs |

Account Types

FxPro provides multiple account types catering to various trader preferences, including Standard accounts with competitive spreads, Raw+ and Elite accounts featuring raw spreads and commissions, and the cTrader account offering ultra-low spreads and advanced tools. Traders can also use demo accounts, while VIP accounts offer personalized benefits to high-deposit clients. Islamic accounts provide swap-free options for religious reasons upon request.

I discovered that FxPro offers a variety of account types tailored to meet the diverse needs of traders. Here's an overview of each:

Standard account

The Standard Account is ideal for traders looking for competitive, all-inclusive spreads. It offers floating spreads starting from 1.2 pips on major FOREX pairs and allows micro lot trading from 0.01 lots. This account is compatible with the MT4 and MT5 platforms.

Raw+ account

Designed for traders who prefer raw spreads without markups, the Raw+ account provides spreads starting from 0 pips on FOREX majors. A commission of $3.5 per side per lot is applied. This account supports micro lot trading and is available on the MT4 and MT5 platforms.

Elite account

The Elite Account combines the features of the Raw+ Account with additional benefits for high-volume traders. It offers raw spreads from 0 pips with a $3.5 per side per lot commission and includes rebates starting from $1.50 per lot. This account is accessible on the MT4 and MT5 platforms.

cTrader account

For those who prefer the cTrader platform, this account offers ultra-low spreads starting from 0.2 pips. A commission of $35 per $1 million traded is charged on FOREX pairs. The cTrader Account supports micro lot trading from 0.01 lots and provides advanced trading features, including a user-friendly interface and over 55 technical indicators.

Demo account

I opened a Demo Account to test my strategies with no risk, and found the experience user-friendly and beneficial.

VIP account

These accounts are open to high-depositing individuals. Typically, $50,000 qualifies you as a VIP client. FxPro individually selects these account holders. The benefits include free VPS service and reduced spreads or commissions in specific instances.

Islamic account

FxPro gives traders the opportunity to open Swap-Free Accounts for Sharia trading. They simply need to contact customer support for quick help.

Other types of accounts

Corporate accounts: Traders can open a trading account in their company name using the normal sign-up process. They simply need to enter the details of the authorized representative and thereafter upload company documentation.

Joint accounts: FxPro also offers joint accounts. Each individual needs to open an individual FxPro account before they can lodge a joint account request. This is open to married couples or first-degree relatives only.

| Account Type | Minimum Deposit | Spread Commission | Commission | Swap Commission | Deposit Commission | Withdrawal Commission |

|---|---|---|---|---|---|---|

| Standard | $100 | Starting from 1.2 pips | $0 | Not mentioned | $0 | $0 |

| Raw+ | $1,000 | Starting from 0.0 pips | $3.5 | Not mentioned | $0 | $0 |

| Elite | $1,000 | Starting from 0.0 pips | $3.5 | Not mentioned | $0 | $0 |

Account opening

Opening an account with FxPro is easy. Clicking the “Register” button on the account page opens options for new traders to fill in their personal information and choose a password. To better serve its clientele, FxPro asks clients for information about their financial status and investment plans.

Trading experience matters in this section, as FxPro is intent on supplying the correct amount of support. There is even a quick test for financial markets knowledge that helps tell the broker what level of customer support the trader might need, and users can then set their own trading account settings. Of course, some of these processes may differ based on which jurisdiction the account is from.

From the client portal area, users can manage their trading accounts, open demo trading accounts, deposit and withdraw funds from the FxPro Wallet, and access different trading tools and resources.

What is the minimum deposit at FxPro?

I found some confusion about the broker's minimum deposit. On the one hand, it claims that "the standard account has no fixed minimum deposit requirement," while going on to say that it recommends that you start with $1,000 to cover your trading activities. However, on the other hand, some practical guidelines mention that a minimum deposit of $100 is enough to get the ball rolling.

How to open your account

Traders can see financial regulation in practice as the questions they answer are Know Your Customer (KYC) questions mandated by regulators. As is normal for a financial institution, FxPro will require photographic identification and proof of residence from applicants. You will also need access to a camera (phone, tablet, computer) for your digital authentication

Deposits and Withdrawals

The FxPro Wallet is a central tool that simplifies money management by protecting deposits from trading risks and allowing effortless fund transfers between trading accounts. You can deposit and withdraw funds through bank transfers, credit/debit cards, and e-wallets like PayPal, Skrill, and Neteller. Withdrawal options mirror deposit methods, with bank transfers and cards processed within one to five business days at no internal charge, while e-wallet withdrawals are quick but attract fees.

FxPro offers a selection of deposits for traders to top up their FxPro Wallets. The broker describes the FxPro Wallet as, “A money and risk management tool.” It is a useful central account from which you can transfer money to all your other trading accounts in a few simple steps.

The benefits of routing deposits through the FxPro Wallet, as opposed to depositing directly into accounts, is that trader deposits are protected from any open positions that may exist in the trading account. Traders can then effortlessly move funds between multiple trading accounts inside their FxPro Wallet.

FxPro offers a variety of deposit and withdrawal methods to accommodate traders' preferences, ensuring flexibility and convenience.

Account base currencies

FxPro offers trading accounts denominated in several base currencies: Euro (EUR), United States Dollar (USD), British Pound Sterling (GBP), Swiss Franc (CHF), Japanese Yen (JPY), Polish Zloty (PLN), Australian Dollar (AUD), and the South African Rand (ZAR).

Depending on your jurisdiction, you could also get accounts in Nigerian Naira (NGN), Vietnamese Dong (VND), Thai Baht (THB), Malaysian Ringgit (MYR), and Indonesian Rupiah (IDR)

FxPro deposit fees and options

I found that FxPro offers several funding methods, including bank transfers and credit/debit cards. Notably, the broker does not impose fees on deposits made via bank transfer.

Bank transfers: Suitable for large deposits. However, I found the processing times ranging between 1 and 7 business days to be somewhat lengthy. There is no charge for this deposit method.

Credit/debit cards: Visa, MasterCard, and Maestro are accepted, with deposits typically processed instantly. The applicable charge for this method is $0 + Bank commission.

E-Wallets: FxPro supports popular e-wallets such as PayPal and Neteller, offering instant deposit processing. Neteller and PayPal attract deposit and withdrawal fees of 2.5% and 3.4% plus a fixed fee, respectively.

FxPro withdrawal fees and options

My withdrawal experience proved to me that the time it takes for funds to reach your bank account varies depending on the destination country and the banking institutions. The following withdrawal methods are supported:

Bank transfers: Suitable for large withdrawals, processing times range from one to five business days. Withdrawals through this method are free of charge.

Credit/debit cards: I experienced firsthand that withdrawals are typically processed within one business day but may take up to five days to reflect, depending on the bank. The applicable charge for this method is $0 + Bank commission.

E-Wallets: Withdrawals via PayPal and Neteller are generally processed within one business day, offering one of the fastest withdrawal methods. Neteller and PayPal attract deposit and withdrawal fees of 2.5% and 3.4% plus a fixed fee, respectively.

FxPro does not charge internal fees for withdrawals; however, third-party charges may apply depending on the payment provider.

| Method | Credit Card | Wire Transfer | Skrill | Neteller | Cryptocurrency | PayPal |

| Deposit fee | $0 | $0 + Bank commission | Unavailable | 2.5% | Unavailable | 3.4% + fixed fee |

| Withdrawal fee | $0 | $0 + Bank commission | Unavailable | 2.5% | Unavailable | 3.4% + fixed fee |

Customer Support

FxPro’s multilingual support team is available 24/5 through various channels, including live chat, email, callbacks, phone calls, with toll-free options for multiple countries. Additionally, FxPro provides a robust FAQ section and easy access to live support within its mobile app.

According to the FxPro website, its vision is to, “Place our clients' needs at the heart of our operations to retain our reputation as one of the most reliable and trusted brokers.”

I was able to reach FxPro customer support through the live-chat feature. You can also request a callback, or they can place a call, email, or even visit a UK office location.

The multilingual support team is available 24/5. While some brokers offer 24/7 customer help, it is debatable whether it is any better than a 24/5 offering. Traders from as far afield as France, Germany, the UAE, and Russia can access its toll-free facilities.

FxPro also has a powerful FAQ section that handles the usual questions traders ask. Within the FxPro mobile app, users can initiate live chats directly by selecting the “More” menu and tapping “Live Support.”

| Live Chat | Phone | |||

| Available | Available | Available | Available | Not Available |

| Quick response | Slow | Moderate | Slow | Moderate |

Commissions and Fees

FxPro is transparent about its trading costs, offering commission-free trading on many instruments and highlighting its no-dealing-desk model to reduce costs for traders. Spread costs vary by platform and asset class, with FOREX spreads starting from 0.4 pips and other assets like stocks starting from 0.53 pips, while commodities and indices also feature competitive spreads. While standard accounts include costs in the spread, Raw+, Elite, and cTrader accounts charge commissions, with possible rebates for high-volume traders.

Like most brokers, FxPro does not levy commissions on several trades. The company is at pains to advertise its lack of an expensive dealing desk, thus allowing it to pass on cost savings to traders. FxPro is transparent on all trading costs and shows positive and negative swap rates. Traders can verify swap rates for themselves on the broker’s platforms.

On the cTrader platform, traders can check detailed commissions and a range of more information from the deal ticket. They simply need to click on the “Information” button when placing an order.

Below is an overview of the fees and commissions associated with various asset classes:

Spreads

FxPro's spread costs vary depending on the account type and trading platform chosen. FOREX spreads start from 0.4 pips, while stock spreads start from 0.53 pips. Commodities start from 0.15 pips and indices start from 0.14 pips.

It's important to note that spreads are variable and can fluctuate based on market conditions. You should carefully consider the account type and associated costs to align with your trading strategies and cost expectations.

Commissions

For the standard account, there are no additional commissions as costs are incorporated into the spread. For commodities, commissions come in at $0.35 per $10,000 traded.

Swap fees and Islamic accounts

The broker applies overnight financing charges, commonly known as swap fees, to positions held open beyond the trading day. The specific swap rates can vary depending on the instrument and market conditions.

FxPro offers Islamic, or swap-free, accounts tailored for traders who adhere to Sharia law, which prohibits earning or paying interest. To open an Islamic account, traders must contact FxPro's customer support to request this service.

Inactivity fee

An inactivity fee of 15 units of the base currency is charged monthly after six months of dormancy. If the account remains inactive, a monthly fee of $5 is applied for each additional month of inactivity.

Other commissions and fees

FxPro offers VPS hosting for automated trading strategies at a subscription fee of $30 per month. This service is free for Premium Account holders.

| Spread | Commission | Swap | Islamic Account | |

| Currencies | Starting from 0.4 Pips | $0 | Yes | Available, but with terms |

| Stocks | Starting from 0.53 Pips | $0 | Yes | Unavailable |

| Commodities | Starting from 0.15 Pips | 0.35$ per 10K traded | Yes | Available, but with terms |

| Indices | Starting from 0.14 Pips | $0 | Yes | Unavailable |

Platforms and Tools

FxPro offers a robust suite of platforms including MT4, MT5, cTrader, and its proprietary WebTrader. Each platform provides a range of advanced features, such as customizable charting tools, technical indicators, trading widgets, and smart order types, catering to both new and experienced traders. Security and usability are strong points, with encrypted logins, two-factor authentication, and intuitive interfaces across desktop, web, and mobile platforms.

I felt like I got to experience FxPro’s stated strategy, which is to “Evolve with the times. To continuously refine our services to cater to the needs of traders in this highly dynamic industry.” The broker offers clients a wide range of desktop trading platforms, including MT4, MT5, cTrader, and its proprietary platform, FxPro Webtrader. The user experience for its Web-based platforms is at the top-end of the market. Here are some of the beneficial tools that traders can get from FxPro’s platforms:

Insightful market indicators.

Charting tools with timeframe functionality.

Detachable chart windows.

Innovative trading widgets.

Customizable layouts and themes.

Traders also have the choice to make customizable watchlists and place conditional orders. FxPro gives traders a view of how the rest of the market is trading. This market positioning is a handy tool for inexperienced users who are unsure of their strategies.

Demo Account trading allows new and veteran traders to test out their strategies. One unique FxPro feature is its ability to give traders a real-time audio alert box that highlights key market changes. Traders can also activate an industry news ticker that features all the latest market headlines.

FxPro offers a diverse selection of trading platforms, each tailored to meet the unique needs of traders. Below is an overview of these platforms:

Platforms types

FxPro MT4

MT4 provides over 50 pre-installed technical indicators, three chart types, and nine timeframes, facilitating comprehensive market analysis. MT4 supports automated trading through Expert Advisors (EAs) and offers one-click trading directly from charts, enhancing trading efficiency. You can also activate trading robots.

FxPro MT5

Building on is sister product, MT5 offers advanced trading functions and superior tools for both technical and fundamental analysis. It features an expanded set of technical indicators, additional timeframes, and more order types, catering to traders seeking enhanced analytical capabilities. MT5 also supports automated trading and provides a comprehensive strategy tester for backtesting trading strategies.

cTrader

cTrader is designed for traders who prioritize a transparent and intuitive trading environment. It offers full Depth of Market (DoM), six chart types, and 28 timeframes, along with over 55 pre-installed technical indicators. The platform is renowned for its fast entry and execution speeds, making it suitable for high-frequency trading strategies.

FxPro WebTrader

FxPro WebTrader provides a browser-based trading solution, allowing traders to access their accounts without the need for software installation. It offers a customizable chart layout, three chart types, and nine timeframes, along with 30 technical indicators and 24 analytical tools. Secure data transmission ensures safe and reliable trading directly from web browsers.

Additional Trading tools

FxPro delivers an extra section that the promises “Everything traders need to know for decision making.” It gives a detailed “how-to” look at each of FxPro’s Web and mobile trading platforms.

Trader’s Dashboard: This area introduces traders to the list of helpful widgets that will enhance their trading experience.

FxPro Calculators: It introduces traders to a range of calculators, and the material explains each of their use cases. The section has helpful practical examples.

FxPro Direct App: Here, traders are shown how to manage their trading accounts on the go. It gives a detailed breakdown of the benefits and applications of the FxPro mobile app.

FxPro VPS: This section introduces the virtual 24/7 server for EAs. VIP clients get free access to this function, while everyone else must pay for it.

Download Center: In this section, traders can select and download the trading platform that is exactly right for them.

Look and feel

FxPro’s platforms are designed with a clean, intuitive interface that caters to both beginners and experienced traders. MetaTrader platforms feature a more traditional desktop layout, ideal for detailed chart analysis, while cTrader offers a sleek, modern interface with enhanced visual clarity and customization options. WebTrader and the FxPro mobile app prioritize accessibility and responsiveness, with streamlined dashboards and mobile-optimized layouts for efficient trading on the go.

Login and security

I found the login process with this broker to be very secure. All FxPro platforms use secure login procedures with encrypted data transmission to protect user information and funds. Traders can access their accounts using single sign-on (SSO) via the FxPro Direct portal, and mobile apps support biometric login (fingerprint or face recognition) for added convenience and safety. Two-factor authentication (2FA) is also available, particularly for FxPro Direct and the mobile app, ensuring enhanced account security.

Search functions

FxPro’s platforms include efficient search functionality to help traders quickly locate instruments and tools. In MT4 and MT5, users can search through the Market Watch panel, while cTrader provides an even more dynamic search bar that auto-filters available symbols and tools. The WebTrader and mobile apps include smart search functions that categorize results by asset class, making it easy to find and trade your desired instrument.

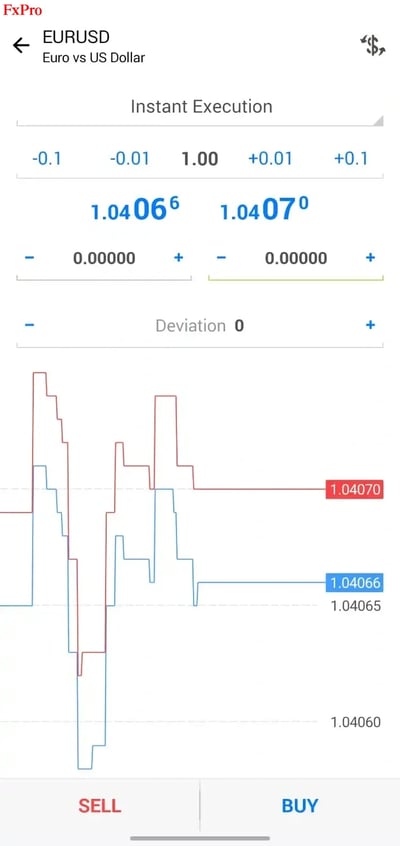

Placing orders

Placing orders on FxPro platforms is straightforward and flexible. MT4, MT5, and cTrader all support one-click trading, market, limit, stop, and trailing stop orders, while cTrader also offers advanced order types and Depth of Market functionality. WebTrader and the mobile app make order execution intuitive with a simple trade ticket layout, real-time quotes, and visual order confirmation, supporting fast, accurate trade placement.

Alerts and notifications

FxPro platforms allow traders to set price alerts and trading signals based on technical indicators or custom criteria. In MT4 and MT5, users can configure alerts via the terminal or scripts, while cTrader offers built-in smart alerts and email/push notification support. The FxPro mobile app enhances this with real-time push notifications on executed trades, account updates, and price movement alerts, keeping traders informed wherever they are.

Mobile Trading

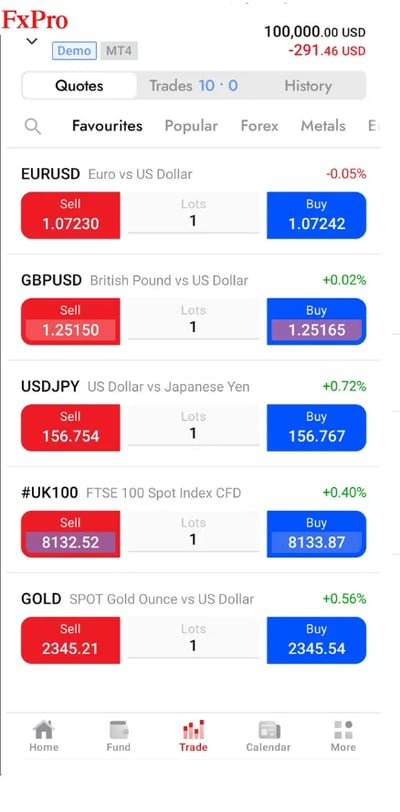

The FxPro mobile trading app offers a complete, all-in-one solution for trading and account management, available on both iOS and Android. It features advanced charting, real-time economic calendar updates, seamless deposit/withdrawal functions, and built-in trading calculators. The app is designed with a clean, intuitive interface and includes secure login options like biometric access and two-factor authentication.

The FxPro mobile trading app gives traders a complete solution for managing their accounts and funds, all from an integrated platform. The FxPro mobile offering is available in both iOS and Android.

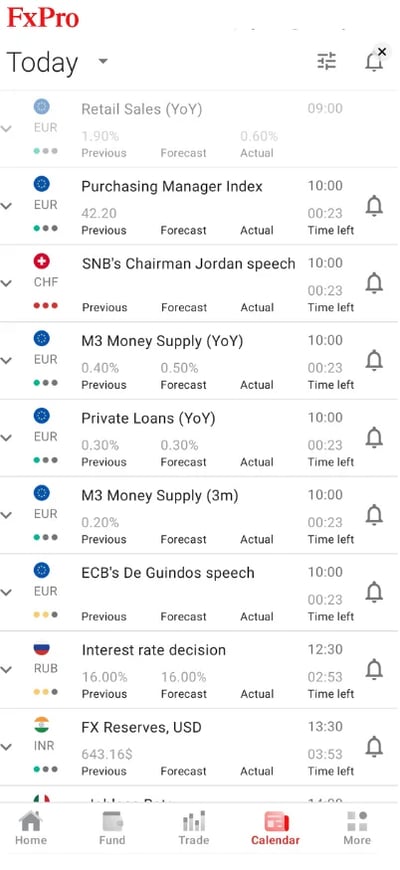

The FxPro app has several helpful features. Traders can stay up to date with economic events with real-time data releases from the natively integrated economic calendar.

The FxPro mobile trading app offers the following features:

Available for iOS and Android.

Simple sign-up.

One-stop trading platform.

In-built economic calendar.

Open and manage accounts.

Deposit and withdraw easily.

Enable volatility push notifications.

Platforms

The FxPro Mobile App delivers a comprehensive trading experience on the go, integrating advanced TradingView charting tools with full account and fund management functionalities. Available for both iOS and Android devices, the app enables traders to execute trades, monitor markets, and manage their accounts seamlessly from their smartphones or tablets.

Look and feel

FxPro's mobile app boasts a user-friendly interface designed for intuitive navigation. I did not encounter any challenges while working on the platform, which is not to say there will never be any glitches..

Login and security

All FxPro platforms use secure login procedures with encrypted data transmission to protect user information and funds. The mobile app supports biometric login (fingerprint or face recognition) for added convenience and safety. Two-factor authentication (2FA) is also available in the mobile app, ensuring enhanced account security.

Search functions

The mobile app allows for filtering and browsing of a broad range of investment products based on preferred criteria. FxPro’s platforms include efficient search functionality to help traders quickly locate instruments and tools.

Placing orders

The order placement option on the FxPro mobile app is good by industry standards. Traders can choose the time frames they wish to watch, and they can easily add other trading indicators, such as moving averages. Once your preferences have been set up, you can place orders from the chart in a few simple steps.

Alerts and notifications

Helpful event alerts ensure traders miss nothing. For volatile markets, push notifications can give traders insights into market movements. Traders can activate mobile price alerts. They simply need to select the trading instruments and choose whether to be alerted to the bid or ask price. Traders will also receive help from multiple calculators that will at once help them decide on margins on selected currency pairs, as well as supplying insight on leverage and lot sizing.

Research and Development

FxPro's research and insights tools are streets ahead of what much of the industry offers. Like many brokers, FxPro platforms have functionality to track major market movements. Traders can also find easily digestible research produced by third-party information hub Trading Central that can help inform their decisions.

To cement its international appeal, FxPro hosts multilingual webinars on its YouTube channel. Its real-time news coverage is also above the industry standard. The educational section is fully stocked, and the company updates its channels with daily news and updates.

The broker’s News and Analysis section holds the following categories:

Economic calendar: It is easy to follow and provides traders with an overview of all events scheduled for the live session and their potential market impact. It is well structured and holds digestible explanations and a small selection of historical data.

Earnings calendar: This helpful tool is split by sections called Earnings, Shares Ex-Dividends, and Spot Indices Dividend Adjustment. It is a quite easy to follow and useful calendar that helps traders interested in share trading and spot indices.

Market Holidays: Diligent traders often wish to project what impact market holidays will have on their investments. This starts with knowing when each market holiday and market interruption is scheduled.

FxPro Market News: Traders will find insightful research and analysis that is constantly updated throughout the day. The FxPro Market News section makes for essential reading. Traders can choose to pay attention to Daily Outlook, Market Snapshots, or the Crypto Review.

Technical analysis by Trading Central: Traders often spend a lot of time analyzing the market and trying to produce usable forecasts. Keeping up to date with the stream of news updates is difficult, even for the most committed investor. This is where high-quality, reliable analytics are so important. Partnering with Trading Central, FxPro has created an invaluable technical analysis resource for its clients.

Trading statistics

FxPro provides traders with access to detailed trading statistics through its advanced trading platforms. These platforms offer real-time data analysis, allowing traders to monitor market trends, assess asset performance, and evaluate their own trading activities. By utilizing these statistics, traders can make informed decisions and refine their trading strategies effectively.

Trading signals

In collaboration with Trading Central, a renowned technical analysis firm, FxPro delivers high-quality trading signals to its clients, much like Arincen’s own signals. These signals encompass analyses of support and resistance levels, as well as intraday and long-term forecasts across various financial instruments. Traders can access these insights directly through FxPro's trading platforms, allowing them to incorporate professional analyses into their trading strategies.

Education

I like how this broker's education section is a well-designed, interactive learning section. New traders can broaden their knowledge base by applying themselves to the course. The educational material does an outstanding job of introducing students to a broad range of trading concepts. Here are some of the core topics covered:

Basics: This introductory course holds topics such as “What is a financial market?” “How to trade on the financial market,” “What is margin?” and “What is a CFD?”

Fundamental analysis: In this section, new traders get to learn how to analyze the market using important numbers. Examples of topics are “What is a fundamental analysis”? “Leading and lagging indicators” etc.

Technical analysis: This section explains how to make sense of trend lines and patterns in financial graphs.

Psychology: To the broker’s credit, this key area receives a lot of attention. The material alerts new traders to biases under which they may work, such as the sunk cost effect on trading strategies. Of particular note is the section on “Novice trader mistakes.”

Trading tests: The trading tests start out with multiple-choice questions covering what traders have learned. The questions test simple recall functions, and students cannot progress until they select the right answer.

FxPro is a premium online broker that has built a formidable reputation based on excellent customer service, innovative tools and sustained growth. It is suitable for traders of all levels who will enjoy its competitive pricing, rapid trades and extensive research and educational tools.

Final Thoughts on FxPro

In my opinion, FxPro is a safe and well-regulated broker, subject to the stringent rules of four major regulators. The broker’s stellar growth since its inception owes a lot to its comprehensive investment offering. It clearly understands the trading world and works hard to develop tools that enhance the client's trading experience. Traders benefit from consistently fast and secure trade execution through the NDD model FxPro employs. With broadly competitive fees and tight spreads in the cTrader platform, especially, traders can forgive the odd hefty charge. FxPro’s powerful and diversified asset base across eight classes will keep even the most seasoned traders satisfied.

Meanwhile, the FxPro Wallet is a useful tool that makes moving funds across accounts fast and painless. FxPro’s highly skilled and diverse customer service team can be contacted through a variety of methods. The broker is a darling of awards panels for a good reason. With over 136 international awards to its name, FxPro has reaped the rewards of its consistent customer-centric focus. In partnership with Trading Central, the broker has created a comprehensive, detailed research and education package that sometimes lacks structure.

FxPro is a place for new traders and seasoned traders alike. FxPro is a market-leading broker with an ever-expanding number of accounts and completed trades. Its wide selection of trading platforms has something for every type of user, and the broker continues to improve the functionality and utility of these tools. FxPro is an example of how consistent and skilled leadership and adherence to a plan can take a broker to the heights of its industry, and I was lucky to have test for signs of the broker's growth.

Conclusion

FxPro continues to be a hard act for its competitors to follow. The group is successful because it lacks an apparent weakness. Traders of all levels can find a niche among the range of investment products. The company’s trading tools are mature and user-friendly, and they are continually improving with additional functions and widgets under development.

If traders need help and direction, then FxPro’s comprehensive customer desk is on hand to assist. For further guidance, its educational repository is filled with well-constructed resources that traders can use at their own pace.

In the meantime, FxPro’s fees are broadly competitive, and their fee transparency keeps traders informed about what they are signing up for. With continued investment in infrastructure, such as data center partnerships and its emphasis on eking out competitive edges in trade execution speeds, FxPro is a formidable industry player here to stay.

Review Methodology

The team at Arincen collected more than 120 pieces of data covering in excess of 100 licensed FOREX companies. Data collection was done in three ways:

1. Companies’ websites.2. Other Websites that have ranked FOREX companies.3. A survey questionnaire (referred to here as Survey “1”) we had sent to the companies invited to participate in the exercise. We have identified 12 criteria for our assessment, each containing several aspects and carrying its own relative weight. These include licensing, deposits and withdrawals, number of assets etc. Afterward we validated the data by:1. Registering with FOREX companies as a secret shopper and/or as Arincen.2. Survey number “2,” in which we asked these companies’ customers for important feedback and past experience. The next step saw us evaluate and rank each company, relying on the hard work of 15 Arincen employees. We were very careful in ensuring the most accurate assessment possible, including taking into account different languages, as well as the various mobile-app operating systems, e.g., Apple, Samsung etc.To add credibility to our research project, we sent a final and third survey (referred to here as Survey “3”) to enable participating FOREX companies evaluate our own research and whether it accurately reflects the realities on the ground. We were fortunate enough to receive a mark of 9.9 out of 10! We have kept to a minimum the margin of error, which stood at a measly 1%. To learn more on how we came up with the evaluation, please click here.

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

FAQ

FxPro offers several account types, including Standard, Raw+, and Elite accounts on MT4 and MT5, as well as a cTrader account and a proprietary FxPro Edge CFD platform. Each account is tailored for different trading styles, with varying spreads and commission structures.

Yes, FxPro is a well-regulated broker. It is authorized and regulated by several top-tier financial authorities, including the UK's Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and the Financial Sector Conduct Authority (FSCA) in South Africa.

FxPro claims not to have a minimum deposit yet recommends that you get started with a deposit of $1,000, though the actual minimum may be more like $100.

That depends on the account type. Standard accounts are commission-free with spreads included in the pricing, while Raw+ and cTrader accounts have low spreads with added commissions — for example, $3.50 per lot per side on Raw+ and $35 per $1 million traded on cTrader.

FxPro supports MT4, MT5, cTrader, and its proprietary web and mobile platforms. These platforms offer a range of features like one-click trading, charting tools, technical indicators, and algorithmic trading support.

You can deposit and withdraw using bank transfers, credit/debit cards, and e-wallets like PayPal, Skrill, and Neteller. Most deposits are processed instantly, while withdrawals typically take 1–5 business days, depending on the method.

Yes, FxPro offers demo accounts on all major platforms. These allow users to practice trading and test strategies in a risk-free environment using virtual funds.

Aside from spreads and possible commissions, FxPro may charge overnight swap fees for holding positions open beyond the trading day and an inactivity fee after six months of no trading activity ($15 one-time, then $5 monthly). E-wallet withdrawals may also incur third-party fees.

Yes, FxPro offers Islamic trading accounts that comply with Sharia law by removing interest-based swap fees. Traders must request this feature through customer support.

FxPro provides 24/5 multilingual support via live chat, phone, email, and callback requests. The mobile app also includes integrated live- chat support, and there's an extensive online help center for self-service queries.