Tickmill Review for 2026

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

Tickmill Evaluate - research result

Key Takeaways

Tickmill was founded in the Seychelles in 2014 and has key affiliates in the UK and Cyprus.

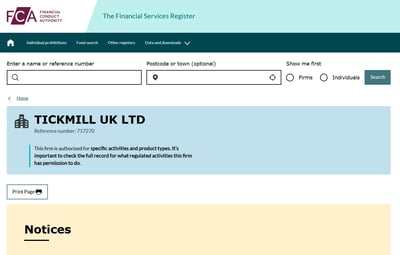

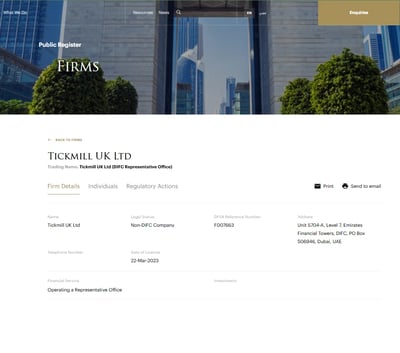

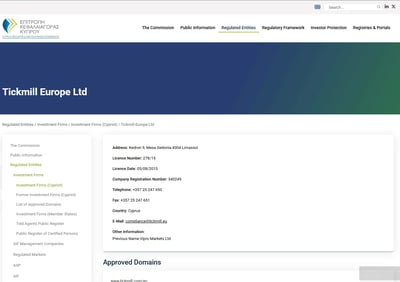

The broker is regulated in the UK by the Financial Conduct Authority (FCA), in Cyprus by the Cyprus Securities and Exchange Commission (CySEC), in South Africa by the Financial Sector Conduct Authority (FSCA), in Seychelles by the Financial Services Authority (FSA), and in the UAE by the Dubai Financial Services Authority (DFSA).

Through its Cyprus-registered affiliate Tickmill Europe, European Economic Area (EEA) traders are protected by the Investor Compensation Fund (ICF) with a maximum coverage of €20,000.

Tickmill UK clients are covered by the Financial Services Compensation Scheme (FSCS) up to £85,000.

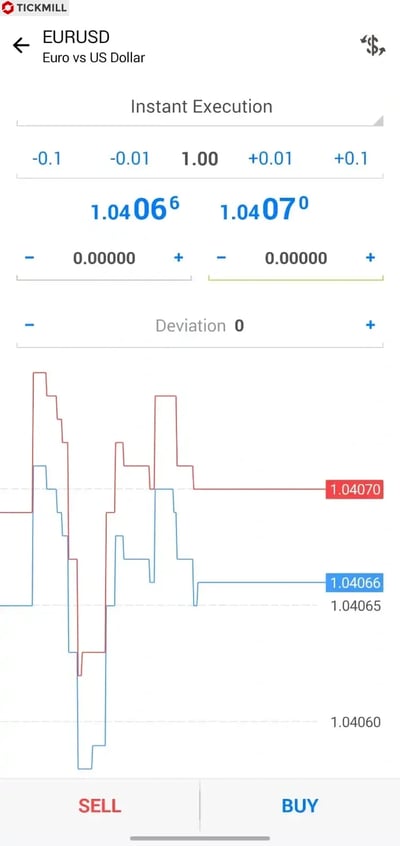

The broker claims to have an average execution time of 0.2 seconds.

The broker says it has executed 668 million+ trades via 940,000+ registered accounts.

The broker website is available in 14 languages.

Tickmill offers multiple account types, including Classic and Raw, each catering to different trader profiles, from beginners to professionals.

Tickmill offers market access covering five asset classes.

Tickmill customers can trade in Contracts for Difference (CFD) in classes such as FOREX, stock indices, metals, and bonds.

Tickmill offers mostly competitive spreads and commissions across its account types.

Tickmill customers can access high-quality research and education materials.

Trader funds are insured with Lloyd’s from $20,000 to $1,000,000 in the unlikely event of insolvency.

Last Reviews

Overall Summary

I researched this broker to help you decide if it is a fit for your needs. I discovered that Tickmill was founded in 2014. It has strong ties to the tiny African island nation of the Seychelles, where the group was incorporated and has since expanded. The broker has set up affiliate offices that are regulated in the UK, Cyprus, Malaysia, and South Africa.

The company boasts some impressive numbers for a relatively young broker formed in an outlying territory. All told, it has executed 668 million+ trades via 940,000+ registered accounts.

The broker also reports having over 250 staff globally. While there is no way to verify these figures for this review, traders can take comfort in the fact that, at face value, this broker has grown steadily in the highly competitive global market of the best brokers.

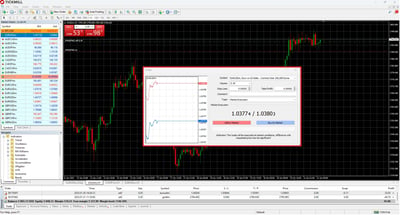

Tickmill offers a solid range of platforms for beginner and advanced traders. Its primary platforms are MetaTrader 4 (MT4) and MetaTrader 5 (MT5), available on desktop, web, and mobile. Tickmill Trader is currently only available to clients under its Seychelles entity. The broker recently announced that it had added TradingView to its slate of platforms. Tickmill supports TradingView — but only under certain account types (i.e., “Tickmill Trader Raw” accounts, and it is not available to clients from the UK/EU.

I can confirm that the broker supports various strategies, including scalping, swing trading, and copy trading. While the breadth is strong in FOREX and popular CFDs, it still lags in areas like ETF CFDs and physical asset trading, which may matter for long-term investors.

Yes, Tickmill is considered safe. It is a well-regulated broker that prioritizes client safety by operating under multiple reputable authorities, including the FCA, CySEC, FSCA, DFSA, and FSA, and by offering negative-balance protection and segregated client funds across all entities. The broker structures its leverage offerings based on regional rules—capping it at 30:1 in Europe while allowing up to 1000:1 in jurisdictions like Seychelles, balancing flexibility with risk controls like margin calls and stop-out levels.

Is Tickmill Safe?

From my perspective, Tickmill ticks many of the boxes that serious traders look for when it comes to broker safety. It is regulated by multiple reputable authorities, including the UK’s FCA and CySEC in Cyprus—both considered Tier-1 regulators. It also holds licenses from the FSCA in South Africa, the DFSA in Dubai, and the FSA in Seychelles. These layers of oversight help reinforce client protection no matter from where you’re trading.

Crucially, all Tickmill entities enforce negative balance protection, meaning retail traders can’t lose more than they deposit. The broker also segregates client funds from its own operational accounts, an important measure that ensures customer funds are ringfenced in the event of insolvency.

Further, some clients benefit from compensation schemes: those under Tickmill UK are covered by the FSCS up to £85,000, while Tickmill Europe clients enjoy coverage under the ICF up to €20,000, plus additional protection of up to €1 million under an Excess of Loss insurance policy. Even clients of the offshore Seychelles entity are covered by an Excess of Loss Policy up to $1 million, an excellent benefit for a jurisdiction often seen as lower tier.

Transparency is another plus. Tickmill operates on a best-execution policy and outlines its safety policies clearly in public documentation. It may not be listed on a stock exchange or backed by a major bank, but its regulatory profile, fund segregation, compensation protections, and insurance-backed guarantees suggest that it takes client security seriously. For most retail traders, this is a broker that stands on firm regulatory ground. After all is said and done, I believe this broker is a safe bet.

How Tickmill Protects You from Reckless Leverage and Margin Trading

Many irresponsible brokers offer high leverage that can ruin uninformed traders. Leverage is a double-edged sword in trading, and Tickmill shows awareness of this by structuring its offerings to match regional regulatory frameworks.

How you are protected

During my research, I learned that retail clients under FCA and CySEC regulation, leverage is capped at 30:1, aligning with ESMA guidelines to ensure responsible trading. However, clients operating under the Seychelles or South African entities can access leverage as high as a whopping 1000:1, giving more experienced traders greater flexibility—though this naturally comes with outsized risk.

To mitigate some of this online trading risk, Tickmill enforces a 100% margin call and a 30% stop-out level across all its retail accounts. This is a common risk-control mechanism to help protect clients from devastating losses. The broker does not impose minimum distance restrictions for stop-loss or take-profit orders, which allows for tighter risk-management strategies.

All Tickmill entities also guarantee negative balance protection, ensuring that you cannot lose more than your account balance. So even if the markets move strongly against a position, your losses will be capped at your deposit. The broker's leverage policies strike a balance: it gives you the chance to pursue larger positions, but not without putting measures in place to prevent the kind of reckless overexposure that has hurt traders elsewhere.

Regulation and other security measures

Tickmill is subject to strict regulatory standards across its operating regions. As we have said, in the UK and the EU, traders are automatically granted negative balance protection, ensuring that losses cannot exceed the funds available in the account.

Tickmill actively manages margin requirements to reflect market conditions. If the equity in an account drops below the maintenance margin level, Tickmill will initiate a margin call or stop out to restore the necessary balance, reducing the risk of forced liquidations and major losses.

Traders should take note that while Tickmill offers generous leverage in certain regions, these high levels should be used with care. Unlike some brokers that grant high leverage without due caution, Tickmill offers a structured, transparent, and jurisdiction-specific approach that prioritizes your safety as a trader while still supporting more aggressive strategies for those who qualify.

Top broker features

Strong regulation and safetyTickmill is backed by some of the most respected regulators in the game. This means client funds are held securely, and you are protected from going into the red.

Plenty of markets to tradeWhether it is major FOREX pairs, global indices, commodities, or even crypto—Tickmill has an offer. With over 620 instruments on the platform, traders have enough variety to build a well-rounded strategy.

Fast, reliable executionOver 87% of trades are filled with zero or positive slippage, and the average execution time is just 0.2 seconds.

Costs that won’t weigh you downTickmill keeps spreads tight—for example, 0.5 pips on EUR/USD—and even gives volume-based rebates for high-frequency traders.

Tools to get betterTickmill offers webinars, trading guides, on-demand videos, and even a full Trading Academy.

Support when neededTickmill offers 24/5 customer support through phone, live chat, or email. Its customer support services are quick, responsive, and multilingual.

For Whom Is Tickmill Recommended?

This is a key question. I feel that Tickmill is best suited for traders who are seeking low-cost FOREX and CFD trading, and who don’t need a broad range of assets. High-volume, high-balance traders will benefit most from Tickmill’s Raw account, which offers ultra-competitive spreads.

This makes it particularly attractive to experienced day traders, scalpers, and algorithmic traders who rely on fast execution and cost efficiency. The broker's support for VPS hosting, FIX API access, and advanced MetaTrader plugins further strengthens its appeal to those deploying automated strategies or trading at high frequency.

At the same time, casual traders and newcomers aren’t excluded. A low minimum deposit of $100, a clean account setup process, and a growing education hub with beginner-friendly content make Tickmill approachable for those just beginning. Copy trading is also available for those who want a more hands-off experience. However, traders seeking a broader product range or a more modern platform offering may find Tickmill less competitive compared to leading multi-asset brokers.

From my view, here are the pros and cons of using this broker:

-

Low opening deposit

-

Access to a demo account

-

Simple account opening process

-

Many promotional offers

-

Relatively competitive spreads

-

Good educational tools

-

Zero-fee policy on deposits and withdrawals

-

EAs, hedging, and scalping all allowed

-

Negative balance protection offered

-

Small product basket relative to peer brokers

-

Spreads are not always competitive

-

Only CFD trading offered, no direct ownership

-

Proprietary platform only available in the Seychelles

-

No services offered to US, Japanese, or Canadian traders

Offering of Investments

Tickmill offers a wide range of over 620 tradable CFDs, with a strong focus on FOREX—providing access to more than 62 currency pairs and supporting all trading strategies, including scalping and automated trading. Beyond FOREX, clients can trade global indices, commodities, cryptocurrencies (as CFDs), share CFDs, ETFs, precious metals, and a limited selection of European bonds. While crypto CFDs like Bitcoin and Ethereum are available, they are restricted for retail traders in the UK due to regulations.

From what I could see, Tickmill focuses strongly on FOREX and offers access to over 62 currency pairs, including majors, minors, and exotics. The broker's total product range spans more than 620 tradable CFDs across multiple asset classes, including indices, commodities, bonds, cryptocurrencies, and share CFDs.

In assessing this list, remember that broker's often change the assets they provide, so this information is true at the time of publication.

FOREX

Traders can choose from 62+ currency pairs, including major and minor pairs. The broker uses a hybrid execution model (STP + market making) and advertises an average order execution speed of approximately 0.20 seconds. Importantly, all trading strategies, including scalping and EAs, are permitted.

Indices

Tickmill provides access to a diverse range of over 20 global stock indices. Some of the key indices available include the S&P500, DAX40, UK100, and CAC40.

Commodities

Clients have access to 17 commodity CFDs, which cover metals, energy, and agriculture. This includes instruments such as crude oil, wheat, copper, and natural gas.

Cryptocurrency CFDs

Tickmill offers 10 crypto CFDs, including Bitcoin, Ethereum, and Ripple. These are derivatives only, meaning clients cannot own the underlying asset. Note that crypto CFDs are not available to retail traders in the UK due to regulatory restrictions.

Equities and ETFs

Through CFDs, clients can trade 489 share contracts and 23 ETFs. These instruments cover a mix of financial, retail, and tech names.

Precious Metals

Traders can access nine metal CFDs, including gold and silver.

Bonds

Only four European bond CFDs are available: EUROBOBL, EURBUND, EURBUXL, and EURSCHA.

Available assets

| Markets | Available | Number of Assets |

| Currency Pairs | 62 | |

| Stocks | ||

| Commodities | 17 | |

| Crypto | 10 | |

| Indices | 20 | |

| ETFs | 24 |

Account Types

Tickmill currently offers two main account types—Classic and Raw—each requiring a $100 minimum deposit and supporting swap-free (Islamic) trading. The Classic Account is commission-free but has wider spreads, making it better suited for casual traders, while the Raw Account targets active traders with tighter spreads and a $4 round-turn commission per lot. Tickmill also provides demo accounts, promotional bonuses, and trading contests. Opening an account is a fast, fully digital process.

Tickmill offers two primary account types: Classic and Raw. The previously available Pro and VIP accounts have been discontinued. Both current account types require a minimum deposit of $100 and allow for swap-free trading.

Classic Account: This entry-level option charges no commission, instead incorporating fees into the spread. Spreads can be as low as 0.5 pips on major currency pairs, but realistic average spreads can be around 1.6 pips, which is considered high, especially compared to industry peers. This account may suit casual traders who prefer simplicity over cost efficiency.

Raw Account: Aimed at more active traders, this account offers much tighter spreads, alongside a commission of $2 per side (or $4 round-turn) per standard lot.

While the commission increased recently, the total trading cost remains highly competitive. All trading strategies are permitted, including scalping and algorithmic trading.

Demo and Islamic Accounts: I came to learn that Tickmill also provides demo accounts for practice trading and testing strategies without financial risk. Islamic accounts, compliant with Sharia law, are available on both Classic and Raw account types. Instead of overnight swap charges, these accounts apply an admin fee under certain conditions, particularly on exotic pairs held for more than three nights.

You should know that trading conditions and account offerings may vary depending on your region and the specific Tickmill entity with which you are registered. That’s why you should always consult Tickmill's official website for the most current and region-specific information.

Account Types

| Account Type | Minimum Deposit | Spread Commission | Commission | Swap Commission | Deposit Commission | Withdrawal Commission |

|---|---|---|---|---|---|---|

| Classic | $100 | Starting from 0.5 pips | $0 | Yes | $0 | $0 |

| Raw | $100 | Starting from 0 pips | $3 | Yes | $0 | $0 |

| Trader Raw | $100 | Starting from 0 pips | $3.5 | Yes | $0 | $0 |

Account opening

In my opinion, opening an account with Tickmill is a fast, fully digital process that traders can complete in just a few minutes. To get started, traders must choose their relevant Tickmill entity—such as Tickmill UK or Tickmill Europe—based on their country of residence.

What is the minimum deposit at Tickmill?

The minimum deposit is $100 across all account types, and the platform supports both individual and corporate accounts. Naturally, traders are advised to trade with more funds if they can afford it so they are not limited by inadequate capital. In saying that, the minimum deposit invites traders to trade with what they are comfortable.

How to open your account

The steps are straightforward: users input personal details like name, date of birth, nationality, and address. They also select their preferred account type (Classic or Raw) and base currency from among EUR, USD, GBP, PLN, or CHF.

Traders must then verify their email, complete a questionnaire on financial status and trading experience, and pass a short CFD knowledge quiz. To finalize the process, traders upload proof of identity (such as a national ID or passport) and proof of address (like a utility bill or bank statement). Tickmill typically verifies accounts within one business day, offering traders quick access to its platform.

Deposits and Withdrawals

Tickmill offers a wide range of fee-free deposit and withdrawal options, including bank wires, credit/debit cards, e-wallets, and cryptocurrencies, with most methods processed instantly or within 24 hours. Traders can fund accounts in multiple currencies such as USD, EUR, GBP, ZAR, IDR, and CNY, and deposits over $5,000 via bank transfer come with no fees. Withdrawals are processed through the same channels as deposits with no internal fees.

Here’s a breakdown of Tickmill’s deposit and withdrawal options:

Account base currencies

Traders can choose from four base currencies: USD, EUR, GBP, and ZAR. A 100% margin call and a 30% stop-out level apply across both accounts, and there are no minimum distance restrictions on stop-loss or take-profit orders, enabling more precise risk management.

Tickmill deposit fees and options

Tickmill offers traders a wide range of deposit methods. Clients can choose from traditional bank wires and credit/debit cards to digital wallets like Skrill and Neteller, as well as cryptocurrency payments. The deposit fee for credit cards is 1.5%, but it is free for bank cards, notwithstanding any fees from your bank.

I found that most methods, especially e-wallets and cards, are processed instantly, while bank transfers could take up to 24 hours depending on the user’s banking institution. Tickmill supports deposits in multiple currencies, including USD, EUR, GBP, ZAR, IDR, and CNY, helping traders reduce conversion fees. Notably, Tickmill covers bank transfer fees for deposits over $5,000, offering a small edge for high-volume funders.

Tickmill withdrawal fees and options

I found that withdrawals at Tickmill mirror the deposit channels and are also processed without internal fees. Funds can be withdrawn via the same methods used for deposits—ensuring consistency and convenience for users. Withdrawals are free of fees for credit cards, but wire transfer withdrawals attract a $12 fee.

Processing times are typically under 24 hours, with e-wallets and crypto transactions among the fastest. All withdrawal requests must be made to accounts in the trader’s name, adding a layer of account security. Tickmill maintains a transparent and straightforward withdrawal policy, avoiding hidden fees and offering traders full control over their capital movement.

| Method | Credit Card | Wire Transfer | Skrill | Neteller | Cryptocurrency | PayPal | Apple Pay |

| Deposit fee | 1.5% | $0 + Bank commission | $0 | $0 | $0 | Unavailable | Unavailable |

| Withdrawal fee | $0 | $12 | $0 | $0 | $0 | Unavailable | Unavailable |

Customer Support

Tickmill provides multilingual customer support 24 hours a day, five days a week, through live chat, email, and phone, including local numbers for various regions. It also offers a comprehensive FAQ section and a dedicated team for Futures and Options support, ensuring timely and tailored assistance for all clients.

Tickmill offers comprehensive customer support through multiple channels to help you with your trading needs. Clients can reach the support team via live chat on the Tickmill website, email or phone.

Tickmill takes customer support seriously, offering traders multilingual help 24 hours a day, five days a week. Clients can reach out through various support channels, including live chat, email, and international phone lines, with local numbers for multiple regions.

Additionally, Tickmill provides a detailed FAQ section on its website, covering a wide range of topics to help clients find answers to common questions. For clients seeking assistance with Futures and Options markets, Tickmill has a dedicated professional client services team. These multiple support options ensure that you can receive timely and relevant assistance tailored to your needs.

| Live Chat | Phone | |||

| Available | Available | Available | Available | Unavailable |

| Quick response | Fast | Very Fast | Moderate | Unavailable |

Commissions and Fees

Tickmill offers two main account types with different fee structures: the Classic Account, which is commission-free with spreads starting from 0.5 pips, and the Raw Account, which features lower spreads (as low as 0.0 pips advertised) but charges a $4 round-turn commission per lot. Swap fees apply to overnight positions, but swap-free Islamic accounts are available, which may instead incur a handling fee after three nights. Inactivity fees of up to 50 units of the account's base currency are charged after 12 months of dormancy.

Tickmill's trading costs and fees vary depending on the account type and instruments traded. The broker offers two primary account types: Classic and Raw. The broker works hard to provide good fee options set up differently for each account type.

Spreads and Commissions

● Classic Account: This account features commission-free trading with spreads starting from 0.5 pips. It suits traders who prefer a straightforward pricing structure without additional commission charges.

● Raw Account: Designed for more experienced traders, the Raw account offers tighter spreads advertised to start from as low as 0.0 pips, although this can be 0.5 pips in practice. A commission of $3 per lot per side is charged.

Swap fees and Islamic accounts

Swap fees (rollover charges) apply to positions held overnight. However, Tickmill provides swap-free Islamic accounts for traders who cannot receive or pay interest due to religious beliefs. Instead of swaps, these accounts may incur a handling fee if positions are held open for more than three consecutive nights.

Inactivity fee

Tickmill charges an inactivity fee of up to 50 units of the account's base currency or the remaining account balance, whichever is lower, on accounts that have been inactive for 12 consecutive months.

Other commissions and fees

The broker offers VPS hosting at a cost of 30 units of the account's base currency (e.g., $30 for USD accounts) per month. However, traders who maintain a notional volume averaging 500K of their base currency per month over the previous three months are eligible to have this VPS fee reimbursed.

Tickmill also offers interest on unused funds held in USD, EUR, and GBP wallets. To qualify, clients must have a total wallet balance exceeding 100 USD (or equivalent) and have executed at least one trade or held an open position within the last 30 days. Note that Islamic (swap-free) accounts are not eligible for this interest.

| Spread | Commission | Swap | Islamic Account | |

| Currencies | Starting from 0.5 Pips | $0 | No | Available |

| Stocks | Not Mentioned | $0 | Yes | Available |

| Commodities | Starting from 0.25Pips | $0 | Yes | Available |

| Indices | Starting from 0.25 Pips | $0 | Yes | Unavailable |

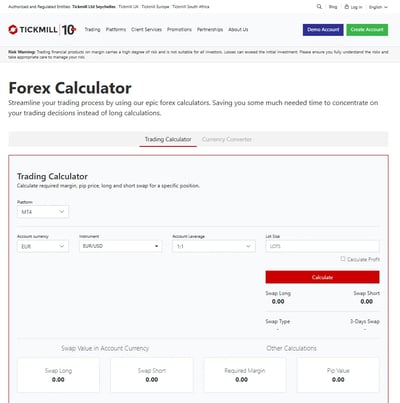

Platforms and Tools

Tickmill offers a versatile range of trading platforms tailored to different experience levels, including TradingView, MT4, MT5, and its proprietary Tickmill Trader platform. TradingView provides advanced charting, social trading, and backtesting tools, while MT4 and MT5 offer strong support for automated strategies and technical analysis, with MT5 including more timeframes and order types. Tickmill Trader, currently available only in the Seychelles, features a sleek design, trading from charts, and performance analytics, with plans for future expansion.

Tickmill’s platform offering is versatile and caters to a broad spectrum of traders, from beginners to pros needing institutional-grade tools.

Platform types

Tickmill offers a variety of trading platforms to cater to the diverse needs of its clients. Here's an overview of each:

TradingView

A relatively recent addition to Tickmill’s trading stable, this respected third-party platform offers innovative charts and tools coupled with exceptional trading conditions and a global community of traders, all in one platform.

TradingView is a slick and modern platform with in-depth analysis and a social network of millions. Traders can access 400+ built-in technical indicators and 100,000+ user-generated strategies. You can spot trends as they happen with market updates, breaking news, and economic data. Backtesting is also available.

MT4Tickmill supports MT4 on desktop, web, and mobile. This platform offers basic technical analysis, simple order execution, and automated trading through EAs. On desktop, MT4 includes features like trailing stops and price alerts, and it supports customisation for charting and workspace layouts. Mobile versions for iOS and Android are intuitive and allow for market, limit, and stop orders. However, MT4 lacks two-factor authentication and does not support biometric login on mobile devices.

MT5MT5 is Tickmill’s more advanced offering and is also available across desktop, web, and mobile. It includes one-click trading, an expanded range of timeframes, a depth-of-market tool, and improved order-execution capabilities. MT5 is well-suited for algorithmic traders thanks to its built-in strategy tester and compatibility with EAs. The desktop version also supports setting alerts and notifications, while the mobile app allows for managing open positions on the go, though it shares some of MT4’s login limitations.

Tickmill Trader (Proprietary Platform)Tickmill has introduced its own web-based platform called Tickmill Trader, which offers a modern layout, trading from charts, performance analytics, and a customizable dashboard. While currently available only in the Seychelles, it’s a promising addition with a strong foundation. Traders can expect expanded features as development continues.

Advanced Trading Toolkit (Add-on)For MetaTrader users, Tickmill offers an Advanced Trading Toolkit developed by FX Blue. It enhances the trading experience with deep-market data, improved order execution, and extra technical indicators. It’s particularly useful for experienced traders seeking more granular control over their trades.

Other toolsHigh-frequency and institutional traders can access VPS hosting for low-latency trading and FIX API protocols for Direct Market Access (DMA) to global exchanges. These tools are available to clients with substantial account funding and trading volumes.

Look and feel

During my research, I discovered that less is known about the Tickmill Trader platform, which is only available in the Seychelles. However, MT4 and MT5 are renowned for their customizable layouts and extensive range of plugins, appealing to traders who prefer a tailored trading environment. The addition of TradingView offers a modern, web-based interface with advanced charting and social trading features.

Login and security

Tickmill platforms use standard security protocols, including password protection and data encryption.

Search functions

The platforms feature comprehensive search functionalities, allowing users to quickly locate financial instruments, indicators, and tools. MT4, MT5, and TradingView also give users robust search capabilities.

Placing orders

Tickmill platforms support a variety of order types, including market, limit, stop, and trailing stop orders. TradingView offers one-click trading from where you can execute trades directly from charts, enhancing the trading experience. MT4 and MT5 provide similar functionalities with the extra benefit of EAs for automated trading strategies.

Alerts and notifications

You can set up price alerts and notifications across Tickmill platforms, giving you access to customizable alerts based on price movements or technical indicator conditions.

Mobile Trading

Tickmill offers mobile trading through Tickmill Trader, MT4, MT5, and TradingView, all available on iOS and Android devices. These platforms provide responsive and user-friendly experiences, allowing traders to manage accounts, execute trades, and analyze markets on the go. While Tickmill Trader supports full account-management features, including deposits and withdrawals (for Seychelles-based users), MT4 and MT5 lack advanced login features like biometric authentication or two-factor authentication.

Tickmill offers mobile trading through its proprietary platform, Tickmill Trader, and the widely used MT4 and MT5 platforms. Tickmill’s mobile platforms are available for both iOS and Android devices, providing a flexible and responsive trading experience on the go.

Platforms

TradingView mobile app

The broker indicates on its website that this well-regarded and modern platform is available on mobile as well as desktop, offering traders the same exceptional charting and analysis experience as the desktop version. I found that the broker's tools were easy to use and very intuitive.

MT4The broker supports MT4 on mobile for iOS and Android, which are intuitive and allow for market, limit, and stop orders. However, MT4 does not support biometric login on mobile devices.

MT5MT5 is also available on mobile. The mobile app allows for managing open positions on the go, though it shares some of MT4’s login limitations.

Tickmill Trader mobile appWith the Tickmill Trader mobile app, I found that I could manage my account from anywhere at any time. I could easily create accounts, deposit, withdraw, and transfer money through the app.

Look and feel

TradingView and the MetaTrader platforms offer a clean and intuitive user interface. TradingView mobile is designed for ease of use, featuring responsive touch controls, straightforward navigation, and customizable chart layouts. MT4 and MT5 mobile retain their familiar look, making it easy for experienced traders to transition to mobile.

Login and security

Tickmill’s mobile platforms use standard security measures, such as password protection and data encryption, to protect user accounts. However, MT4 and MT5 do not offer 2FA.

Search functions

Tickmill’s mobile platforms allow traders to search for financial instruments quickly, using keywords or market categories.

Placing orders

Tickmill’s mobile platforms enable one-click trading directly from charts. MT4 Mobile offers similar capabilities and includes automated trading through EAs, which can execute trades based on predefined criteria.

Alerts and notifications

TradingView mobile, MT4 mobile, and MT5 mobile support alerts through push notifications, ensuring that traders stay updated on market changes in real time.

Research and Development

Tickmill offers a strong and expanding suite of research tools tailored to both beginner and experienced traders. The broker publishes daily video market breakdowns and maintains a robust blog with hundreds of articles covering technical and fundamental analysis.

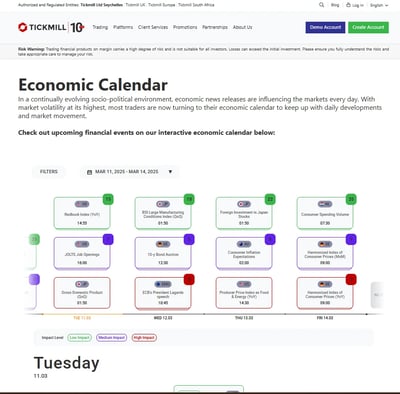

The content includes advanced market sentiment indicators and trading signals powered by Signal Centre and Acuity, which provide actionable insights derived from Dow Jones news feeds. Tickmill’s research hub also integrates an economic calendar from Dow Jones and trading signals sourced from Myfxbook, providing real-time updates and market analysis.

In addition, Tickmill maintains a presence across YouTube, Telegram, and Facebook, ensuring traders receive timely insights in various formats. Notably, the "Chart Hits" video series delivers concise one-minute technical updates, while the “Weekly Live Markets & Trade Analysis” segment offers deeper dives into market trends.

Trading statistics

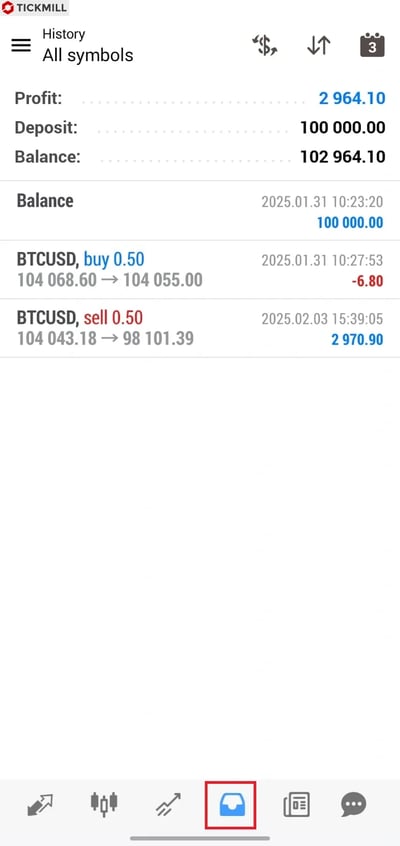

Tickmill gives you detailed trading statistics through its client portal and trading platforms. Users can track performance metrics such as win/loss ratios, average trade duration, profit factor, and historical trade data, helping them evaluate and refine their strategies.

Trading signals

Tickmill supports trading signals via the MetaTrader platform, where clients can subscribe to third-party signal providers directly within MT4 and MT5. This feature allows users to automatically copy the trades of experienced traders in real-time. Tickmill carefully integrates this functionality to ensure transparency, with traders able to review provider performance, risk levels, and trading history before subscribing.

Education

I was pleased with this portion of the broker's offering. Tickmill delivers a comprehensive educational experience that has something for both novice and advanced traders. The broker’s learning centre offers hundreds of in-house resources, including written articles, infographics, and several in-depth eBooks. A standout feature is the regular schedule of live webinars in multiple languages such as English, Spanish, and German, all of which are archived for on-demand access.

Tickmill's education offering includes video content for both beginner and advanced traders, a FOREX glossary, and a newly launched Masterclass series available on YouTube. Additional initiatives like the Bright Minds and T-Show podcast-style segments add variety and depth to the educational material.

In my view, tickmill is a well-regulated broker with a clean safety record and a competitive edge in FOREX trading. It offers solid account protection, fair pricing for high-volume traders, and strong research and educational tools. It is best suited to traders focused on FOREX and looking for a secure, budget-friendly environment.

Final Thoughts on Tickmill

For all its positive aspects, Tickmill presents a mixed picture. It’s regulated in key jurisdictions like the UK and Cyprus, and offers negative balance protection, client fund segregation, and insurance-backed coverage—clear wins for risk-conscious traders. But the further you move from its top-tier regulators, the thinner the protections become. Its Seychelles and offshore arms are bolstered by Excess of Loss policies, but there is no substitute for robust regulatory oversight.

When it comes to fees, Tickmill is competitive but not market-leading. The Raw account offers tight spreads paired with reasonable commissions, but only if you’re trading high volume. The Classic account’s spreads are simply not attractive compared to zero-commission offerings from other brokers. Platform support remains limited to MetaTrader 4 and 5, and while the Tickmill Trader web platform is promising, it’s not yet widely available or feature-rich enough to change the game.

Market access is another area where Tickmill falls short. While the broker claims to support five asset classes, its actual range is limited, especially in commodities, cryptos, and bonds. There’s decent coverage for FOREX and stock CFDs, but traders looking for deeper variety will have to look elsewhere.

Conclusion

My assessment of this broker is that it presents itself as a no-frills, well-regulated broker that delivers a focused yet somewhat narrow trading experience. It benefits from regulation in top-tier jurisdictions like the UK and Cyprus and offers meaningful safety features, including negative balance protection, segregated client funds, and Excess of Loss insurance even in offshore jurisdictions. However, these strengths are somewhat undercut by gaps in product diversity and platform innovation.

While its Raw account pricing is competitive, I found that Tickmill doesn't lead the pack in cost or execution tech. The lack of a proprietary platform for most users and reliance on MT4 and MT5, with no major enhancements, leaves it behind competitors who’ve pushed ahead in usability and feature depth. Its asset offering is clearly FOREX-centric, and though there’s been recent expansion into commodities, crypto CFDs, and equities, coverage remains limited compared to the industry’s best.

That said, Tickmill’s education and research suite is genuinely impressive, with multilingual webinars, live market videos, and solid third-party integrations like Acuity and Autochartist. The broker also stands out with its clean withdrawal/deposit policy and transparency in customer fund handling.

Review Methodology

The team at Arincen collected over 120 pieces of data covering in excess of 100 licensed FOREX companies. Data collection was done in three ways:

1. Companies’ websites.2. Other websites that have ranked FOREX companies.3. A survey questionnaire (referred to here as Survey “1”) we had sent to the companies invited to participate in the exercise.

We have identified 12 criteria for our assessment, each containing several aspects and carrying its own relative weight. These include licensing, deposits and withdrawals, number of assets etc.

Afterward, we validated the data by:

1. Registering with FOREX companies as a secret shopper and/or as Arincen.2. Survey number “2,” in which we asked these companies’ customers for important feedback and past experience.

The next step saw us evaluate and rank each company, relying on the hard work of 15 Arincen employees. We were very careful in ensuring the most accurate assessment possible, including taking into account different languages, as well as the various mobile-app operating systems, e.g., Apple, Samsung etc.

To add credibility to our research project, we sent a final and third survey (referred to here as Survey “3”) to enable participating FOREX companies evaluate our own research and whether it accurately reflects the realities on the ground. We were fortunate enough to receive a mark of 9.9 out of 10! We have kept to a minimum the margin of error, which stood at a measly 1%. To learn more on how we came up with the evaluation, please click here.

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

FAQ

Tickmill’s affiliates are regulated by the UK’s FCA and the CySEC of Cyprus. It also enjoys additional regulations in emerging markets such as the Seychelles, Malaysia and South Africa.

Due to the broker’s licensing by the FCA and the CySEC, it offers default investor protection through the FSCS and the ICF, respectively. However, this broker does not take out additional protections such as third-party investor fund insurance.

The broker serves clients from 200 countries. However, services are not offered to US, Japanese or Canadian traders.

Yes — Tickmill does offer cryptocurrency trading, but only as CFDs

Tickmill accepts deposits and withdrawals through several methods. These include: Credit/debit card, Skrill, and Neteller.

The broker gives its clients access to a simple bespoke version of MT4.

Customer support times are typically listed as Monday to Friday from 08:00 hours to 17:00 hours. During the contact window, traders can call one of the company’s support lines listed on its Website.