AvaTrade Review 2026

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

Evaluate AvaTrade - research result

Key Takeaways

AvaTrade is regulated by several top-tier authorities, including the CBI, CySEC, ASIC, FSCA, BVI FSC, FSA, FFAJ, FSRA, and ISA.

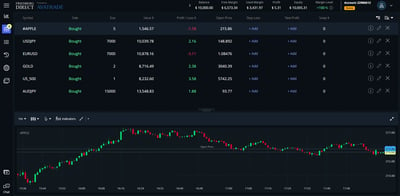

The broker offers a wide variety of platforms, including MetaTrader 4 and 5, AvaTrade WebTrader, AvaOptions, AvaFutures, and the AvaTradeGO mobile app.

A minimum deposit of just $100 makes AvaTrade accessible to new traders.

AvaTrade gives access to more than 1,260 instruments, including CFDs on FOREX, stocks, indices, commodities, ETFs, cryptocurrencies, and options.

The AvaProtect feature allows traders to insure selected trades against losses for a defined time and cost, making it easier to manage risk.

FOREX spreads start at 0.9 pips for retail accounts and can drop to 0.3 pips for professional traders. Swap fees are lower than the industry average.

AvaTrade supports multiple social and copy trading tools, such as DupliTrade, AvaSocial, and MetaTrader Signals.

AvaTrade’s mobile apps deliver a solid trading experience, with advanced indicators, syncing watchlists, and integrated research.

Research content includes Trading Central tools, daily market videos, a news screener, an economic calendar with event charts, and market sentiment tools, though original written analysis is limited.

Account options include standard retail, Islamic (swap-free), professional, AvaOptions, and spread betting (UK and Ireland only), with full support for demo accounts.

AvaTrade charges an inactivity fee of $50 after three months and a $100 administration fee after 12 months of non-use, which is higher than normal in the industry.

Last Reviews

Overall Summary

After a thorough review, I can report that AvaTrade is a reliable and user-friendly broker with strong regulatory backing and a solid reputation. The firm has a nice choice of platforms, from the MetaTrader suite to the in-house AvaTradeGO.

Traders will enjoy features like fixed spreads, negative balance protection, and support for automated trading. We did, however, notice some limitations in product availability depending on the region. But overall, the offering felt secure, intuitive, and well-suited for retail traders of all levels.

Whether you're interested in FOREX, commodities, indices, stocks, or cryptocurrencies, I found that AvaTrade offers a broad selection of CFDs, all accessible through platforms like MT4/5, WebTrader, and its proprietary AvaTrade platforms.

Where AvaTrade really tries to differentiate itself is in the user experience and educational support. Its platforms are intuitive and backed by strong mobile and desktop functionality, while its multilingual support and rich learning resources lower the barrier to entry for new traders. That said, the presence of inactivity fees could be an irritation for low-frequency traders. Still, AvaTrade's overall offering is competitive, especially if you are looking for a regulated environment with a clean, no-nonsense approach to CFD trading.

AvaTrade is considered a safe and regulated broker, established in 2006 and holding licenses from numerous global financial authorities. Client funds are protected through segregated accounts and negative balance protection in most regions. Although direct investor compensation schemes aren't available everywhere, AvaTrade's extensive regulatory compliance and robust internal risk controls should give you comfort that it is a secure platform.

Is AvaTrade Safe?

In my view, AvaTrade is widely regarded as a safe and regulated broker. It was launched in 2006 on a mission to provide accessibility, regulation, and platform diversity. It has built up a reputation as a trustworthy choice for retail traders across multiple regions.

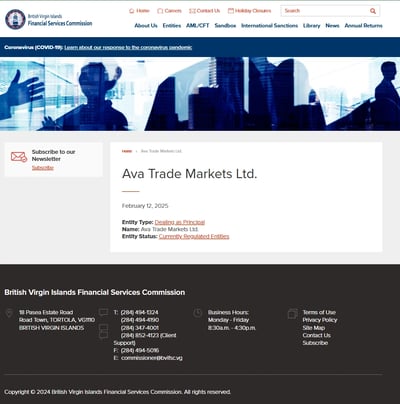

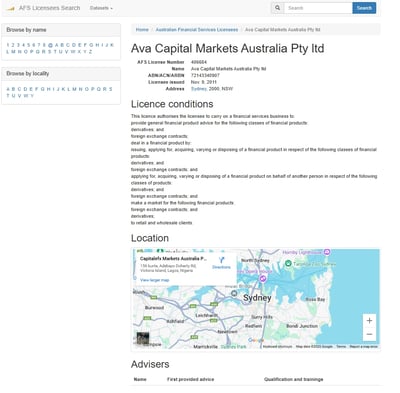

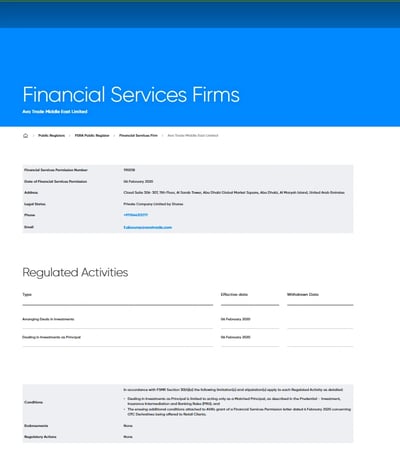

The company operates under licenses from:

● Central Bank of Ireland (CBI)

● Cyprus Securities and Exchange Commission (CySEC)

● Australian Securities and Investments Commission (ASIC)

● Financial Sector Conduct Authority (FSCA)

● British Virgin Islands Financial Services Commission (BVI FSC)

● Financial Services Agency Japan (FSA)

● Financial Futures Association of Japan (FFAJ)

● Abu Dhabi Financial Services Regulatory Authority (FSRA)

● Israel Securities Authority (ISA)

As is best practice, client funds are held in segregated accounts, and the broker offers negative balance protection across most jurisdictions, helping to shield traders from owing more than their deposits.

AvaTrade’s long track record and its adherence to strong operational standards contribute to its reputation as a secure platform for retail and professional traders alike.

Additionally, AvaTrade’s compliance with MiFID II in Europe shows that clients are trading with a firm that meets the regulatory demands of their region.

However, you should know that the broker does not offer direct investor compensation schemes in every jurisdiction, but its internal policies and risk controls add further layers of protection.

While no broker is completely risk-free, I find that AvaTrade’s regulatory footprint and risk management practices suggest that it takes trader security seriously.

How AvaTrade Protects You from Reckless Leverage and Margin Trading

I was happy to discover that AvaTrade takes a safety-first approach to leverage and margin trading, aiming to protect traders, especially beginners, from the dangers of excessive risk.

Leverage is capped at levels designed to align with local rules. What this means is that you will likely see a leverage cap of 30:1 for major FOREX pairs in ESMA-regulated jurisdictions and 400:1 in other areas like South Africa and the British Virgin Islands.

This tiered approach makes sure that users aren’t exposed to blanket high leverage without understanding the risks, as this could sink their trading careers. The broker also offers negative-balance protection across most jurisdictions, meaning you cannot lose more than the money you deposited initially.

Beyond leverage controls, AvaTrade reinforces risk management through a suite of built-in platform tools. Margin alerts and automated stop-out mechanisms are in place to prevent account blowouts, while fixed spreads help limit unexpected cost spikes during turbulent sessions.

How you are protected

Like any good broker, AvaTrade employs a multi-layered protection framework that combines regulatory compliance, platform safeguards, and client-focused policies.

As we have said, the broker is licensed and regulated in multiple jurisdictions, meaning that it follows strict operating rules. Client funds are held in segregated accounts, as you would hope.

Regulation and other security measures

In addition to regulatory oversight and account-level protections, AvaTrade implements a range of technical and operational security measures to keep you and your money safe.

These include robust encryption protocols across its platforms to secure data transmission and prevent unauthorized access. The broker also enforces strict internal procedures for compliance, auditing, and data handling to align with international standards.

Two-factor authentication (2FA) is available for added account security, and all transactions are monitored to detect irregular activity. Combined, these measures help create a secure trading environment that goes beyond minimum regulatory requirements.

Top broker features

In my view, there are many reasons to consider AvaTrade as your trading partner. Here are some of the best ones:

MT4 and MT5 access: These platforms truly are the gold standard of third-party platforms in the retail trading industry, and you cannot go wrong with them.

Fixed and floating spreads: Taking a different approach from most brokers, with AvaTrade you can choose between fixed or variable spreads, providing more control over trading costs depending on market conditions and strategy.

Negative balance protection: With this broker, you cannot lose more than your deposited funds, a critical safeguard during extreme market volatility.

Multilingual customer support: You will never feel like you don’t belong. With support available in multiple languages, AvaTrade caters to a global client base and enhances accessibility across regions.

Extensive educational resources: The broker goes all out and provides webinars, eBooks, and platform tutorials that support trader development from beginner to advanced levels.

Regulation across multiple jurisdictions: We cannot emphasize how good it is that AvaTrade operates under licenses from several respected regulators.

For Whom Is AvaTrade Recommended?

I would recommend this broker as it has something for everyone:

Beginner traders: AvaTrade’s fixed spreads, negative balance protection, and strong educational resources make it ideal for those just starting out.

Experienced traders: With support for automated trading, MT4/5, and a wide range of instruments, seasoned traders will find all the tools they need in a broker.

Mobile traders: The AvaTradeGO mobile app offers a smooth and intuitive trading experience for users who prefer to manage positions on the go.

Risk-conscious investors: Built-in safeguards like negative balance protection and regulated leverage mean that you can trade with better control over your exposure.

Global clients: AvaTrade goes to the trouble of providing multilingual support, making it a reliable option for traders across different regions.

CFD and FOREX enthusiasts: With a wide selection of CFDs across FOREX, indices, stocks, commodities, and crypto, the broker caters to traders looking for market diversity.

Here are the pros and cons of using this firm:

-

Strong regulatory coverage

-

Good platforms such as MT4, MT5, and AvaTradeGO

-

Negative balance protection

-

Choice of fixed or floating spreads

-

Multilingual customer support

-

Wide range of tradable assets

-

Rich educational resources

-

Commission-free trading as costs are built into the spread

-

Support for automated trading

-

High inactivity fees apply

-

No direct stock or ETF ownership

-

Limited product access in some regions

-

No tiered account options

-

Withdrawal methods may be slower than some competitors

-

Limited customization on AvaTradeGO

Offering of Investments

AvaTrade offers a comprehensive range of CFD trading products including over 60 FOREX pairs with leverage up to 400:1 for offshore clients, hundreds of commission-free global stock CFDs, and over 30 major index CFDs with competitive spreads. The broker also provides commodity CFDs covering energy and precious metals, 24/7 cryptocurrency CFD trading (where permitted), and additional bond and ETF CFDs for portfolio diversification.

Here’s a breakdown of the financial assets I found could be offered by AvaTrade:

FOREX CFDs

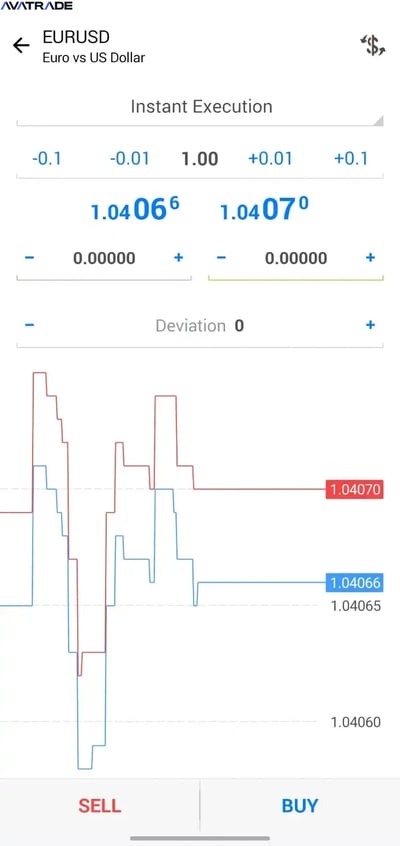

AvaTrade offers over 60 FOREX pairs, including majors, minors, and exotics, making it a competitive option for currency traders. Leverage is available up to 30:1 in regulated jurisdictions like the EU and Australia, while offshore clients can access up to 400:1. The broker offers both fixed and floating spreads, with typical spreads on EUR/USD starting from 0.9 pips under standard conditions.

Stock CFDs

AvaTrade clients can trade hundreds of global stock CFDs covering major U.S., European, and Asian equities, with coverage that includes big names like Apple, Amazon, and Tesla. All stock CFDs are commission-free, with fees integrated into the spread. Traders benefit from access across platforms, including MT and AvaTradeGO.

Indices CFDs

AvaTrade gives access to over 30 global index CFDs, including the S&P 500, FTSE 100, NASDAQ 100, and Nikkei 225. Spreads on index CFDs are competitive, as low as 0.5 pips, and traders can take long or short positions without additional commissions. Leverage varies by region, in accordance with local regulations.

Commodity CFDs

The broker offers a wide selection of commodity CFDs, including energy products like Brent crude and natural gas, as well as precious metals such as gold and silver. Commodities are available across all platforms, with tight spreads and flexible leverage that align with trader profiles and jurisdictional rules.

Cryptocurrency CFDs

AvaTrade supports crypto CFD trading on popular digital assets like Bitcoin, Ethereum, Ripple, and Litecoin. Crypto trading is available 24/7 in permitted regions, for spreads as low as 0.3 pips, but is restricted in jurisdictions such as the U.K. due to regulatory bans on crypto derivatives for retail traders.

Bond and ETF CFDs

AvaTrade also provides a selection of bond CFDs and ETF CFDs, allowing traders to diversify into fixed income and basket instruments. While more limited than FOREX or equity CFDs, these products enhance portfolio breadth and are available via MT4/MT5 and WebTrader.

Available Assets

| Markets | Available | Number of Assets |

| Currency Pairs | 60 | |

| Stocks | 609 | |

| Commodities | 30 | |

| Crypto | 20 | |

| Indices | 31 | |

| ETFs | 10 |

Account Types

AvaTrade offers a simple-yet-versatile account structure, accommodating traders of all levels with commission-free options and built-in protections. The Standard, Professional, Islamic, and Demo accounts each serve distinct needs, from everyday trading to advanced leverage, Sharia-compliant transactions, and risk-free strategy testing. By streamlining access and balancing flexibility with risk management, AvaTrade makes trading more accessible while maintaining essential safeguards.

I can report that AvaTrade offers an account structure that is easy to understand and will surely appeal to a wide range of traders. This includes newcomers looking for a simple entry to the trading world, to more experienced users on the hunt for advanced features.

While it doesn’t offer tiered account levels like some brokers, what you’ll get with this broker is ease of access and built-in protections across all accounts. With no commissions on trades and the option to choose between fixed and floating spreads, AvaTrade’s standard offering is flexible without being too complicated.

Standard account:This is where most AvaTrade clients will start and is ideal for everyday traders. Trading is commission-free, with costs built into the spread.

You can access all supported platforms, including MT 4/5, WebTrader, and AvaTradeGO, along with key features like negative-balance protection and risk-management tools.

Professional account:This is a more complicated account type that is only available to qualified traders in specific jurisdictions, like the EU. Users of this account get higher leverage (up to 400:1) but they will first have to prove their trading experience or financial qualifications.

This account is best suited for seasoned traders who understand the risks associated with increased exposure.

Islamic (Swap-Free) account:AvaTrade also provides Islamic trading accounts upon request, adhering to Sharia principles by cutting out overnight interest charges. These accounts have the same features as the standard account while making sure that no swap or rollover fees are applied.

Demo account:AvaTrade offers a free, no-risk demo account that comes preloaded with virtual funds. This allows you to test strategies and explore platform features across all devices without spending real money.

| Account Type | Minimum Deposit | Spread Commission | Commission | Swap Commission | Deposit Commission | Withdrawal Commission |

|---|---|---|---|---|---|---|

| Professional account | $100 | Spread only pricing | None | Not mentioned | None | None |

| Retail account | $100 | Spread only pricing | None | Not mentioned | None | None |

Account opening

I found that opening an account with AvaTrade is fast, fully digital, and beginner-friendly. The process should take you less than 20 minutes to complete, provided you have your documents ready. Final verification though, might take a couple of business days.

What is the minimum deposit at AvaTrade?

AvaTrade keeps things accessible with a somewhat low minimum deposit requirement. Most regions require just $100 to open a live trading account, making the broker a practical choice for beginners or those starting with smaller capital. That said, minimums may be slightly different depending on your funding method or jurisdiction, so it's best to confirm the exact requirement with your local AvaTrade entity.

How to open your account

Opening an account with AvaTrade was straightforward and could be completed online in just a few steps. Like me, you'll start by selecting your region and filling out a registration form with basic personal details.

After verifying your identity and submitting required documentation, such as a government-issued ID and proof of address, you can fund your account with as little as $100. Once approved, you'll have full access to AvaTrade’s platforms, including MT4/5, WebTrader, and AvaTradeGO, and can start trading right away.

Deposits and Withdrawals

AvaTrade provides a secure and flexible deposit and withdrawal process, supporting various base currencies like USD, EUR, GBP, and AUD to minimize conversion costs. Deposits are fee-free and processed swiftly via credit/debit cards, wire transfers, and e-wallets, while withdrawals follow the same methods with processing times of one to three business days, though third-party fees could apply.

I feel that AvaTrade offers an easy and safe deposit and withdrawal process designed to be flexible while staying on the right side of regulators.

Account base currencies

Base currencies include USD, EUR, GBP, and AUD, depending on your location and the platform used. While the selection may not be as broad as some multi-currency brokers, it still allows most clients to fund their accounts in their local currency, helping to avoid conversion costs.

AvaTrade deposit fees and options

During testing, I learned that deposits at AvaTrade are fee-free, and the broker supports a variety of funding methods like credit/debit cards and wire transfers, although where you live will influence the services you can use.

Most e-wallet and card deposits are processed instantly, while bank transfers may take several business days. To comply with anti-money laundering rules, deposits must come from an account in the same name as the AvaTrade trading account holder.

AvaTrade withdrawal fees and options

I can report that withdrawals follow the same methods as deposits and, in my experience, were handled within one to three business days, though timelines may be a little different based on the method used.

AvaTrade does not charge withdrawal fees, but your payment provider may impose its own charges. All withdrawal requests must be made to accounts in the trader’s name, as is standard with most brokers.

| Method | Credit Card | Wire Transfer | Skrill | Neteller | Cryptocurrency | PayPal | Apple Pay |

| Deposit fee | $0 | $0 | $0 | Unavailable | Unavailable | Unavailable | Unavailable |

| Withdrawal fee | $0 | $0 | $0 | Unavailable | Unavailable | Unavailable | Unavailable |

Customer Service

AvaTrade provides extensive customer support globally through live chat, email, phone, and WhatsApp in over 14 languages, complemented by an in-depth FAQ and Help Centre for self-service assistance.

I discovered that AvaTrade offers comprehensive customer support across multiple channels to assist its many clients all over the world. Clients can reach out via live chat, email, phone, and WhatsApp, with services available in over 14 languages to cater to a global clientele.

The English support desk operates Monday through Friday from 05:00 AM to 09:00 PM GMT, while support in other languages such as Spanish, French, Italian, Arabic, Russian, Portuguese, and German is available between 06:00 AM and 03:00 PM GMT.

Additionally, AvaTrade's extensive FAQ and Help Center offers a treasure trove of information on account management, trading platforms, and technical issues, making sure that you have access to immediate help and resources whenever needed.

| Live Chat | Phone | |||

| Available | Available | Available | Available | Unavailable |

| Quick response | Moderate | Fast | Moderate | Unavailable |

Commissions and Fees

AvaTrade operates on a commission-free model, with trading costs inserted into spreads, which start at 0.9 pips for major FOREX pairs but can widen during market volatility or low liquidity. Islamic (swap-free) accounts eliminate overnight interest fees for up to five days, while inactivity fees apply after three months of no trade. Other costs include currency conversion fees for non-base currency transactions and futures trading commissions.

Here’s a breakdown of AvaTrade’s spreads, commissions, swap fees, and other charges.

Spreads

For FOREX trading, typical fixed spreads start around 0.9 pips for major pairs like EUR/USD, though floating spreads are also available depending on the platform and account type. This easy-to-understand costing model makes budgeting easier.

While spreads are generally competitive, especially for a fixed-spread broker, you should know that spreads can widen during periods of high market volatility or low liquidity.

Commissions

AvaTrade operates on a commission-free trading model, meaning traders are not charged per trade; instead, the broker’s revenue is built into the spreads.

The broker doesn’t charge additional commissions on CFDs for stocks, indices, commodities, or cryptocurrencies, and all trading costs are included in the bid-ask spread.

Swap fees and Islamic accounts

AvaTrade offers Islamic (swap-free) trading accounts tailored for Muslim traders observing Sharia law, which bans earning or paying interest. These types of accounts are common in the industry and remove overnight swap fees on positions held for up to five days, aligning with Islamic financial principles. One thing to note is that after the five-day period, standard swap charges apply, even on Islamic accounts.

It's important to note that certain instruments, such as cryptocurrencies and specific FOREX pairs like ZAR, TRY, RUB, and MXN, are not available on Islamic accounts. Additionally, Islamic accounts may feature slightly wider spreads compared to standard accounts to compensate for the absence of swap fees.

Inactivity fee

AvaTrade charges an inactivity fee on dormant accounts. If your trading account remains inactive for three consecutive months, a fee of $50 (or the equivalent in your account's base currency) is applied. This fee recurs after every three months of continued inactivity.

Additionally, if the account remains inactive for 12 consecutive months, an annual administration fee of $100 (or equivalent) is charged. These charges are heavier than you’ll find with most brokers, so be aware of that when you enroll.

Other commissions and fees

Currency conversion fees: Deposits and withdrawals made in a currency different from the account's base currency are subject to a conversion fee of 0.5% of the transaction amount.

Futures trading commissions: For clients trading futures via AvaFutures, there are specific commissions: $0.75 for micro contracts and $1.75 for mini and standard contracts. Also, applicable exchange and regulatory fees may apply.

| Spread | Commission | Swap | Islamic Account | |

| Currencies | Starting from 0.9 Pips | $0 | Yes | Yes |

| Stocks (CFDs) | Average 0.13% per trade (varies by equity) | $0 | Yes | Yes |

| Commodities | Average 0.3 (Gold), 0.04 (Crude Oil) | $0 | Yes | Yes |

| Indices | Average 0.5 (S&P 500), ~1.0 (FTSE 100) | $0 | Yes | Yes |

Platforms and Tools

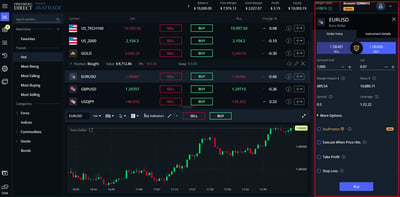

AvaTrade offers a comprehensive trading ecosystem, supporting MT4, MT5, WebTrader, AvaOptions and the AvaTradeGO mobile app, each tailored to different trader needs. Security measures include two-factor authentication (2FA) and encrypted transactions, while fast search functions, diverse order types, and customizable alerts enhance trading efficiency.

Here’s what you can expect when it comes to trading platforms within the AvaTrade ecosystem:

Platforms

AvaTrade supports both MT4 and MT5 across most regions, giving traders access to robust tools for technical analysis, Expert Advisors (EA), custom indicators, and advanced order types.

These platforms are highly regarded among professional and algorithmic traders for their reliability and depth. AvaTrade also offers its proprietary AvaTradeGO mobile app, which is known for its intuitive interface, live market trends, and a unique feature called AvaProtect that allows users to hedge against losses on specific trades.

AvaOptions is the broker’s proprietary platform designed for FOREX options trading. It allows users to trade spot, calls, puts, and combination strategies with a user-friendly interface that includes historical charts, profit/loss visualizations, and implied volatility curves.

Look and feel

I believe that the MT platforms retain their professional, data-dense interface, ideal for experienced traders who want customization and depth. AvaTradeGO, on the other hand, is designed for simplicity and speed, offering a simpler layout for new or mobile-first traders. WebTrader balances functionality and user-friendliness, though it doesn’t have some of the more advanced features found on downloadable platforms.

Login and security

AvaTrade’s platforms support two-factor authentication (2FA) for account security, though biometric login options such as fingerprint or Face ID are not universally available across all devices. Regardless, strong encryption and secure login protocols protect user data and transactions.

Search functions

I learned that the search function across AvaTrade platforms is fast and effective. You can search by asset name or filter by category, making it easy to find instruments whether trading on desktop, web, or mobile.

Placing orders

All standard order types are supported, including market, limit, stop-loss, and trailing stop orders. Time-in-force conditions like Good ‘til Canceled (GTC) are available, offering the flexibility needed to manage trades across different strategies.

Alerts and notifications

The WebTrader and MT platforms rely more on third-party or platform-specific notification systems. While alerting features are functional, more advanced in-platform customization could improve the experience for high-frequency or event-driven traders.

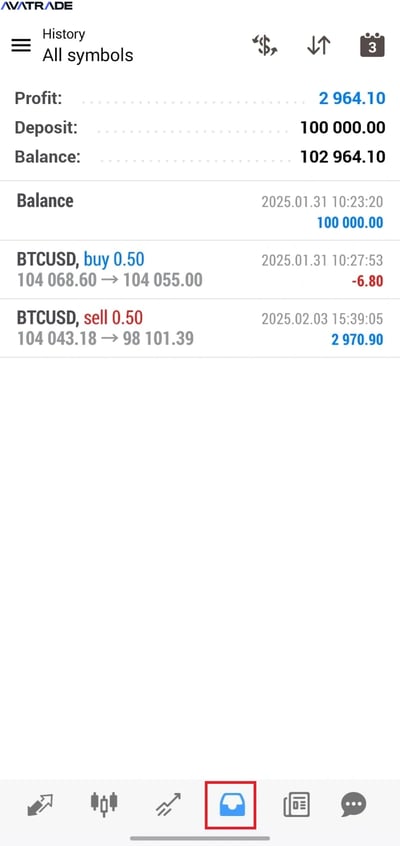

Mobile Trading

AvaTrade delivers a strong mobile trading experience through its proprietary AvaTradeGO app and the industry-standard MT4 and 5 mobile platforms. With smooth execution, intuitive navigation, and built-in risk tools, AvaTrade’s mobile offering caters well to both beginner and experienced traders.

Based on my experience, here’s what you can expect when trading on the go with this broker:

Platforms

Traders using AvaTrade can choose between the AvaTradeGO app and the MT4/MT5 mobile apps, all available on iOS and Android. The AvaTradeGO app is built for accessibility and speed, featuring interactive charts, real-time price feeds, and AvaProtect, a unique risk management tool that allows users to hedge trades for a fixed fee.

For more advanced trading functionality, the MT4 and MT5 apps include in-depth charting tools, multiple order types, and live account tracking, making them ideal for technical traders on the move.

Look and feel

AvaTradeGO is designed with a clean, modern interface that mirrors its web counterpart, offering seamless navigation between charts, open positions, and account metrics. The user experience is geared toward simplicity, with responsive charting and intuitive tap-to-trade features that make it easy to manage trades from anywhere. The app also supports multiple languages, including English, Spanish, French, and Arabic.

Login and security

Mobile account access is protected by 2FA, ensuring secure logins and account integrity. However, biometric authentication like fingerprint or Face ID is not yet universally supported, which may be a drawback for users who prefer quicker, device-native login options.

Search functions

Instrument search is simple and effective on both AvaTradeGO and MT platforms. Users can quickly locate tradable assets by typing the symbol name or browsing through categorized asset classes.

Placing orders

The mobile apps support all major order types, including Market, Limit, Stop, and Trailing Stop orders. Time-in-force settings like GTC and GTD are also available, providing flexibility for active and swing traders alike.

Alerts and notifications

AvaTradeGO allows users to set custom price alerts directly within the app, helping traders stay informed without having to monitor their screens constantly.

While the MT platforms offer notification features as well, AvaTradeGO’s built-in alerts are especially useful for those who rely on real-time signals while on the go.

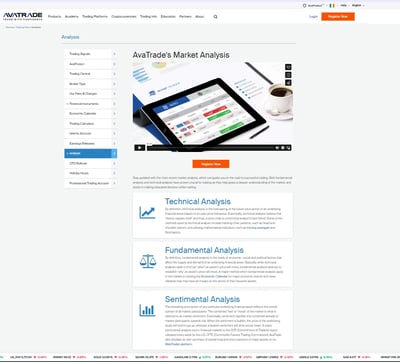

Research and Development

During testing, I found that AvaTrade offers a well-rounded suite of research and educational resources aimed at both newbie and experienced traders. The broker provides daily market analysis, economic calendars, and trading signals, which is powered by its integration with Trading Central, to help users make informed decisions. What more could the average trader want?

While the research tools may not match the depth of institutional-grade platforms, the combination of actionable insights and structured learning materials makes AvaTrade a strong choice for those looking to improve their trading knowledge while staying current with market movements.

Trading statistics

With AvaTrade, you can get detailed analytics through its integration with MT4 and 5 platforms. These well-known platforms offer detailed visualizations of trading performance, including useful metrics like growth, equity, and balance over time.

Traders can access these statistics to keep an eye on their trading history, judge the effectiveness of their strategies, and make informed decisions based on past performance. The ability to track and analyze these metrics is crucial for both novice and experienced traders aiming to refine their trading approaches.

Trading signals

AvaTrade offers signals through its AvaSocial app offering. Thess signals are seamlessly integrated into the AvaTrade WebTrader and AvaTradeGO platforms, giving you real-time, actionable “buy” and “sell” suggestions based on technical and fundamental analysis.

This integration ensures that traders have immediate access to expert analysis, allowing them to make confident social trading decisions across various financial instruments, including FOREX, stocks, commodities, and indices.

Education

I can report that AvaTrade offers a comprehensive range of educational facilities tailored to support traders at all experience levels. The broker has curated an excellent learning environment that includes in-depth video tutorials, platform walkthroughs, and a glossary of key trading terms.

If you want a more immersive experience, AvaTrade hosts regular webinars that cover everything from basic trading strategies to market-specific insights. Its eBook library further supports self-paced learning, with resources designed to build trader confidence and technical know-how. Educational content is also integrated directly into platforms like AvaTradeGO.

Founded in 2006 and regulated across multiple jurisdictions, AvaTrade offers CFD trading on FOREX, stocks, indices, commodities, cryptocurrencies, ETFs, and bonds. Traders benefit from commission-free accounts, fixed or floating spreads, negative balance protection, and a range of platforms. With a $100 minimum deposit and multilingual support, it caters to a global retail audience while maintaining a strong focus on regulation, education, and risk management.

Final Thoughts on AvaTrade

AvaTrade does a good job of balances’ accessibility with robust trading features. From its strong global regulatory footprint to its variety of platforms, including MT 4/5 and the AvaTradeGO app, it offers something for nearly every type of trader.

With a choice between fixed and floating spreads, negative balance protection, and commission-free trading, what you get is a stable and transparent environment for managing risk. While its inactivity fees and limited product availability in some regions may be a drawback, AvaTrade’s commitment to education, customer support, and secure trading makes it a solid choice for retail traders seeking a regulated and feature-rich broker.

Conclusion

In my opinion, whether you're just starting out or already executing advanced trading strategies, AvaTrade delivers a secure and reliable environment backed by years of industry success and regulatory compliance.

The broker's emphasis on trader protection, straightforward pricing, and cross-platform flexibility gives it an edge in a crowded market. It’s not the flashiest platform around, but it offers substance where it counts, especially for traders who want structure, safety, and education.

Review Methodology

The team at Arincen collected more than 120 data points across more than 100 licensed FOREX companies. Data collection was done in three ways:

Companies’ websites.

Other Websites that have ranked FOREX companies.

A survey questionnaire (referred to here as Survey “1”) was sent to the companies invited to participate in the exercise.

We have identified 12 criteria for our assessment, each containing several aspects and carrying its own relative weight. These include licensing, deposits and withdrawals, and the number of assets. Afterward, we validated the data by:

Registering with FOREX companies as a secret shopper and/or as Arincen.

Survey number “2,” in which we asked these companies’ customers for critical feedback and experience.

The next step involved evaluating and ranking each company, relying on the work of 15 Arincen employees. We were very careful to ensure the most accurate assessment possible, including consideration of different languages and mobile operating systems (e.g., Apple, Samsung).

To add credibility to our research project, we sent a final and third survey (referred to here as Survey “3”) to enable participating FOREX companies to evaluate our own research and whether it accurately reflects the realities on the ground. We were fortunate enough to receive a mark of 9.9 out of 10! We have kept the margin of error to a minimum, which stood at a measly 1%. To learn more on how we came up with the evaluation, please click here.

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

FAQ

The minimum deposit at AvaTrade is typically $100, though this may vary slightly depending on your region or chosen payment method.

Yes, AvaTrade is regulated in multiple jurisdictions, including Ireland, Australia, Japan, South Africa, and the UAE, among others.

No, AvaTrade operates on a commission-free model for most instruments, with costs built into the spreads.

AvaTrade supports MT4, MT5, its proprietary WebTrader platform, and the mobile-focused AvaTradeGO app.

Yes, AvaTrade offers Islamic accounts that comply with Sharia law by removing overnight interest charges, though some instruments are excluded.

Yes, AvaTrade charges $50 after three months of inactivity and an additional $100 annual fee after 12 months of continuous inactivity.

Yes, AvaTrade supports EAs on MT4 and MT5, allowing for algorithmic and automated trading.

AvaTrade provides a comprehensive range of educational tools, including video tutorials, webinars, eBooks, and platform guides to help traders at all levels.