How to Swing Trade Cryptocurrency: Beginners Guide 2026

In my view, swing trading is a trading strategy that is perfect for newbie traders. Unlike other forms of trading that take place quickly, giving traders less time to mull over their positions, swing trading features generous time horizons during which beginner traders can make decisions under little time pressure. That said, swing trading is not only for beginner traders; advanced traders can also use it as a supplementary strategy.

If you already engage in cryptocurrency trading, is crypto swing trading specifically for you? In this article, I will explore the ins and outs of this form of trading to give you a better idea of whether it suits your needs.

Swing trading in crypto focuses on capturing price swings over a few days to several weeks.

Traders rely on technical analysis and momentum indicators to spot short-term trends in volatile digital markets.

Effective strategies involve identifying support and resistance levels to determine optimal entry and exit points.

Risk management is crucial, and traders use stop-loss orders and position sizing to protect their capital.

A strong swing trading plan blends technical signals with market sentiment and key news updates.

Patience and consistently evaluating market trends help you refine your strategies over time.

Volatility is embraced as an opportunity rather than a setback when following a disciplined approach.

Continuous learning and adaptation are essential as the crypto market evolves rapidly with new technologies and regulations.

What is Swing Trading?

Let me start by explaining swing trading from my own experience. This is a form of trading where traders enter trades with the intention of remaining in them for a medium to long period. In the trading world, a short time frame normally refers to trading that happens on the same day. Anything longer can be referred to as a medium or long-term frame. With swing trading, the intention is to try to catch price swings that happen in a few days to weeks, sometimes years!

While this article is aimed at educating traders on how to deploy swing trading in the cryptocurrency market, you should know that this type of trading can be used to make money from several other asset classes. Indeed, any market that features assets that are characterized by strong trend lines is ideal for swing trading. You might be dealing in stocks, FOREX, or commodities, but if the movement of individual assets is clear enough to be captured on a trendline, then you can confidently employ swing trading.

In the crypto world, this could look like buying a new coin with clear information that it will appreciate due to its sound market fundamentals. You could go long when the coin is first issued and exit that position when the coin has appreciated, and you have made enough money. Read our article on the ins and outs of going long or short. Therefore, you can see how swing trading could easily apply to other markets besides crypto, such as FOREX and stocks. For instance, as a stock trader, if you are confident that your portfolio is going to appreciate because the companies you have invested in are well-run and innovative, then you can sit back and wait for weeks or months before offloading those stocks for a profit.

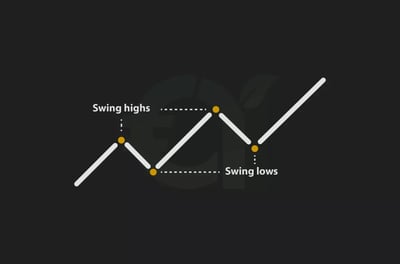

The swing aspect comes about because you have done your research and you know that your chosen asset cannot appreciate or depreciate indefinitely. Rather, history shows that your asset moves within certain price bands, known as “resistance levels,” sometimes touching the upper limit and other times the lower limit.

In the case of crypto, Bitcoin is a case in point. Over the course of its existence, it has surely appreciated overall, but its growth is marked by a series of climbs and dips within defined timeframes. In the case of a sensitive asset class like crypto, breaking news on crypto regulation can easily push the price up or down. The trick is knowing how to anticipate and prepare for these swings.

In trading, there are two broad types of market analysis: fundamental and technical. Fundamental analysis is the process of assessing the overall viability of an asset class, while technical analysis focuses on daily research into how the asset class is performing. Swing traders mostly rely on fundamental analysis as they are not concerned with intraday movements or short-term volatility. A swing trader wants to know in broad terms whether an asset will appreciate or depreciate so they can buy low and sell high. In crypto, a swing trader could buy Bitcoin and hold it for several years despite daily volatility, intending to cash out in the distant future.

Swing trading works best when there is a longer time frame over which you can take advantage of price changes. You might ask what if the market moves sideways or does not operate with predictable trends? This happens, which is why not all asset classes are suited to swing trading. For example, agricultural commodities are known as consolidating markets. This means there can be a price equilibrium over an entire season if nothing unexpected happens. In this case, you would be less inclined to look for market swings because you know ahead of time it is unlikely to happen.

Crypto Day Trading Vs. Swing Trading – What is the Difference?

I would say that swing trading and day trading have many differences, but they do share one key similarity. The area where they overlap is the method by which traders try to earn profits. In both instances, traders are seeking to take advantage of the fluctuations in value that an asset undergoes while it is in their portfolio. The similarities largely end there.

As for the differences, day trading is conducted within the confines of one trading day, meaning that traders must enter and exit positions on the same day for the practice to be called day trading. For this to happen successfully, many factors must be in place. First, the trader needs to have access to strong technical analysis that allows them to understand what price changes are happening and why. Second, the trader needs to be working with the best broker they can find, who has the tools in place to facilitate the rapid exit from positions. Finally, the trader must be experienced in the act of day trading while acting according to a cogent strategy for them to make the most of these swings.

Day traders must be actively involved in monitoring their positions. On the opposite end of the scale, swing traders can afford to go on holiday and not worry about their portfolio until they are due for a periodic check-in.

Day trading has its risks, which include the trader losing money through the very volatility from which they are trying to profit. On the other hand, swing traders face the risks that come with taking their eye off the ball for too long, like missing an unexpected market event.

Advantages and Disadvantages of Crypto Swing Trading

Advantages of Swing Trading

Swing trading does not require active attention from the trader. It is unlike day trading, where traders know they must invest several hours a day actively watching the markets and executing trades.

All a swing trader must do is make sure they have put in place the right strategy up front. Their strategy needs to be underpinned by solid research. This could involve periodically checking the moving average of their asset. From there, they can sit back and know the strategy will play out. Swing trading could require no more than a few hours of work a week. Naturally, the longer the time horizon, the more passively the trader can sit back.

Swing traders must also think less about when to sell an asset. Usually, a swing trader relies on foundational analysis to decide if an instrument is what they are going to trade. This could mean that they undertake concentrated research, but only do it once. On the other hand, a day trader must rely on technical analysis that requires them to constantly analyze tools like Japanese candlesticks and price charts to stay on top of their investments.

Swing trading gives traders greater control over market risk by removing them from the daily volatility that can often confuse inexperienced traders. Swing trading is a less intense trading form that requires traders to keep tabs on fewer assets rather than having to keep tabs on hundreds of day-trading assets, using complicated technical analysis.

Disadvantages of Swing Trading

Because swing trading requires traders to sit back and wait for moves to develop, they may miss a major market swing. Naturally, they are exposed to these large, volatile events because they have intentionally chosen to sit back. The day trader does not face any nasty surprises as they exit most, if not all, their positions at the end of each trading day.

Depending on how passively a trader trades, they may miss important market trends. Let’s say a swing trader does not intend to look at an asset for another few months. In that time, with their eye off the ball, important market signals could become obvious, but the trader would be none the wiser if they intend not to watch the markets for a while.

As for the research required, while a swing trader does not need extensive technical analysis, they still need to be able to quickly refer to technical charts if they become aware of a concerning market trend. So, in effect, it is not that swing traders are totally absolved from ever having to improve their research skills. To this end, we've prepared a helpful article on the best swing trading indicators to watch.

Best 4 Swing Trading Crypto Strategies

For traders just getting into crypto swing trading, here are some strategies from my experience to increase your chances of making a profit and succeeding.

Stuck In a Box

With this strategy, the trader trades within defined lower and upper resistance levels. This is where the term “stuck in a box” comes from, as the trader only operates in the space below the upper line and above the lower line.

This trading method is useful in many instances, such as when an asset is rapidly depreciating. As soon as the price falls below a certain level, the trader seeks to exit the trade before selling pressure becomes excessive. Having well-placed stop-loss and take-profit orders in place will ensure the trader does not get caught outside these bands.

Catch the Wave

With this strategy, the trader’s plan is to catch the wave of an appreciating asset to benefit from the upswing before the pullback. To “catch the wave,” traders look out for trends that alert them to promising price surges. One example of this is a moving average, which is a method of deciphering a series of averages of different data points, or subsets.

In practice, this could look like identifying where the price of Bitcoin is hovering within a certain timeframe. This timeframe could be a holiday season when people have more time to make the trade they have been delaying. Therefore, the trick is to find out what is the moving average for the asset during the holiday season. Furthermore, there could be other seasons that are related to low or high traffic.

Buy the Pullback

I would say that this swing trading crypto strategy is best for traders who have missed the initial breakout when an asset changes value. To be clear, a breakout is when the price of an asset moves outside what is considered a normal price range. This is often caused by a sudden surge of buying or selling that sees the price change.

If a breakout happens and you have not been attuned enough to take advantage of it, you can still make money by “buying the pullback.” This means that once many traders begin to take profits when the breakout happens, something you missed doing, you can buy more assets when the inevitable pullback brings the price back toward its established low.

In effect, you missed the opportunity to sell when the price was high, but you were able to buy more assets at a competitive price during the pullback when it was low. Of course, this only helps if you are alert to the next breakout, so you can sell the assets you bought at a low price during the pullback.

Follow the Crowd

In this strategy, a trader identifies what the lower and higher resistance levels of an asset are over a period like a week or month. The resistance level, as I have mentioned, is the upper price that an asset will climb to, without breaking out. The support level is the price that the asset will fall back down to during the pullback

So, an asset is normally traveling upward, downward, or sometimes even sideways in the daily act of traders buying and selling. Following the crowd is effectively following the asset price. Once you know these levels and the intervals at which they rise and fall, all you need to do is follow the pattern.

When the asset nears the upper resistance level, take profit, or even take a short position on the asset falling back down. Once the asset reaches the level to which your research tells you it will get, it will reverse direction. Then, as the asset nears the lower support level, you simply take up a long position with the intention of selling again when it is back up to the upper resistance level.

Top 10 Crypto Swing Trading Rules

1. Do your foundational analysis

A crucial part of crypto swing trading is choosing which asset to buy, based on how you feel about its prospects. Usually, you would arrive at a decision on the prospects of an asset, not on a whim, but based on sound foundational analysis such as how national interest rates affect your coin. Remember, when interest rates rise or fall, it sets off an economic domino effect that makes certain assets more or less attractive to take part in.

2. Have technical analysis in the bag

You may think that engaging in a passive form trading absolves you from having to understand technical analysis. This is not the case, as you may frequently need to dip into the technical analysis information stream to check if an asset is trading abnormally. This allows you to be prepared in the event of an unplanned market swing. That's why you need to have a solid risk management plan.

3. Go passive, but know the risks of going too passive

One of the biggest benefits of swing trading is that you can do it without having to work extremely hard at watching the markets. This is a great benefit, but do not forget that it is dangerous to fall asleep at the wheel. You could ignore a market breakout, and you could also miss the opportunity to correct your mistake if you are not paying enough attention.

4. Insert stop-loss and take-profit orders

This evergreen advice relates to swing trading as much as it does to any other type of trading. By taking control of the emotional trader within all of us, you are ensuring that you take profit when it is there to be taken, and you avoid making extensive losses by inserting a stop-loss order at the appropriate time.

5. Decide on your strategy

We have discussed the diverse types of strategies you can employ. Whether it is catching a wave or buying a breakout, you need to understand how you wish to trade and you must practice it extensively. Use a demo account, if possible, then practice in the real world.

6. Stick to your strategy

As important as choosing your strategy is the need to stick to it. The most experienced traders know the value of exercising discipline to stick to a strategy. Swing trading requires patience and planning, two much-needed traits that will set you on your way. That's why it's a good idea to understand human trading psychology.

7. Choose a broker with strong market intel

As a new trader, it can be overwhelming to assess different brokers and decide which one to go with. In the beginning, you can make the mistake of not taking your broker’s research and educational responsibilities seriously enough. The truth is that trying to invest with inaccurate or dated information puts you at risk of making losses. In time, you will look for brokers with only the best market intelligence.

8. Choose the right asset

Ideally, you want your chosen asset to have strong trends back and forth with definable upper and lower bands. You should be able to understand how it works so you can make the most of it. Also look out for highly capitalized and liquid markets.

9. Diversify

As with all forms of trading, it is best that you diversify your portfolio. Not only does your experience and expertise increase as you trade different instruments, but you can balance earnings and losses by spreading your risk across different asset classes.

10. Don't bet too much on one trade

This is always the best advice for any trader. There will be enough time to make more profits if you have a sustainable approach that is backed by a strong strategy. It is always good advice not to bet too much of your portfolio at any one time, no matter how sure the bet looks. These safeguards should be built into your trading plan.

Recommended Brokers

Tips for Beginners in Swing Trading Crypto

Make the most of your demo account

I recommend that you always start with a demo account. Under these conditions, you can “lose” money safely without having to part with your own cash. It is a way to improve your skills with minimal risk. There is really no downside to practicing on a demo account.

Learn as much as you can about swing trading

You can never have too much information about crypto swing trading. Having as much knowledge as possible will ensure that you use all of it to become a better trader. Believe us, your knowledge will be tested in the real world. Therefore, it needs to be entrenched because as you start making trades, you will hardly have the time to go back and refer to fundamental teachings.

Settle on the right asset in which to invest

There are a great many cryptocurrencies in the world right now. The distribution of these types of coins is skewed toward a small number of well-established, well-capitalized coins, such as Bitcoin. These coins have a history of data that can inform future models.

For swing trading, it is normally best to work with currencies that have the largest market capitalization. These actively traded instruments ensure that there is always enough liquidity in the market and enough buyers and sellers when you need to offload your assets.

Find the best crypto exchange for you

Deciding on a crypto exchange is also a major step in your decision-making process. Your crypto exchange must be safe and have a long track record of performance. In the same way that you search for a broker, make sure you perform similar levels of due diligence as you search for a crypto exchange. Essential elements to look out for include the strength of its features, the number of users, and the fees and charges.

Learn how to choose the moment

This is a trait that you can get better at with experience. As a swing trader, you are betting on the volatility of your chosen coin to make money. Unpredictability is simply a part of the landscape. As such, you need to become better at mastering the art of timing. In general, you would rather exit slightly earlier than you needed to in hindsight. When you exit a deal too late, it is often the case that you have missed an opportunity to make money. Choosing the right moment is as much about learning how to be better at it as it is about learning to live with the consequences.

Stay up to date with trends

With technology advancing so rapidly, new trends emerge in how to trade crypto. Novel approaches, technologies, and schools of thought are constantly evolving. Algorithms are getting unimaginably faster and more powerful, meaning you can never rest on your laurels and think the trading world will not pass you by. Therefore, you need to stay up to date with trends.

The Bottom Line

In my opinion, there is a space for every type of trader out there. You can use several strategies and approaches and still be successful. There is no one-size-fits-all solution. Once you learn the basics, you will come to understand that swing trading can be a highly rewarding exercise. If you are not ready to lead the frenzied life of a professional trader, you can input your strategies and sit back to concentrate on other things in your life while still being a trader.

I would say that the most important thing is to learn as much as you can about swing trading, decide on your strategy, and practice holding true to your plans. Also, you will need to choose the best crypto asset and the best broker or crypto exchange. Doing the groundwork is essential. Once you do that and you stay true to your strategy, you can make swing trading a success.

FAQ

Yes. Despite the various legislative moves to monitor crypto trading, if crypto trading is legal in your jurisdiction, then swing trading is legal, as it is an accepted method of trading crypto.

It is not right to say it is better than day trading. Each trading form has its advantages. Swing trading is certainly slower paced and more forgiving, therefore it is suited to new traders. That said, many traders move to day trading and never look back. If you are new to the markets and you are trying to learn how to trade on limited capital and time, swing trading could be the right approach for you.

As with any type of trading, there is risk in crypto swing trading. You can lose money and you can earn money. You simply need to make sure that you work hard on understanding what your strategy is and apply it as consistently and as free of emotion as you can

Once again, there is no prescribed amount. You can start with a modest amount that you build up as you gain experience. Also remember that with leverage, you can start placing larger trades than what you actually have in your account. Of course, it is important to know that you can lose money as easily as you can make it.

This is the million-dollar question. The truth is that you can make money from all cryptocurrencies. You simply need to master the fundamentals of that crypto, which involve understanding its upper and lower levels and the length of time it stays in those bands. From there, it is all about applying your strategy as faithfully as you can.

This depends on the jurisdiction in which you operate. Fundamentally, you are taxed on your overall earnings, not simply because you used swing trading.

The short answer is yes, and yet with a significant caveat. Becoming an expert at anything takes time, dedication and often money. All three are required for swing trading crypto. There are most certainly traders who do this for a living, so why can't you be one of them? You just need to start swing trading with a healthy dose of realism that it is an extremely competitive space with a steep learning curve.

There are many strategies you can employ, with catch the wave, buy the pullback and follow the crowd being but three of the most popular. You can employ one or multiple approaches. No single method is better than the other. With experience, you will come to understand which one works best for you.

You can swing trade within intervals that are as short as a few days or as long as several years. You simply need to decide on your asset and your strategy and stick to it with all the conviction you have. You can be successful with any approach if it is based on sound research and the market moves in your favor.