Table Of Contents

- What Is a Candlestick?

- Popular Terms in Candlestick Charts

- Do Candlestick Patterns Really Work?

- Do Chart Patterns Work in all Financial Markets?

- Importance in Modern Trading

- The Success Rate of Japanese Candlesticks

- What to do Before Trading with Japanese Candlesticks

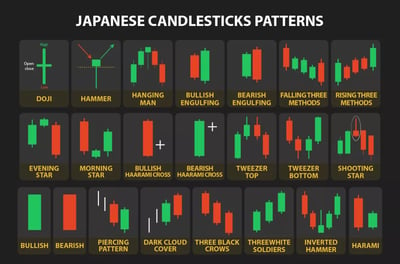

- Overview of The 21 Patterns

- Explanation of the 21 Patterns

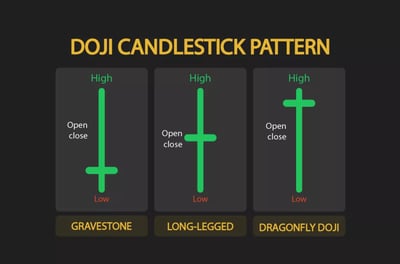

- 1) Doji

- What should I do when faced with a Doji?

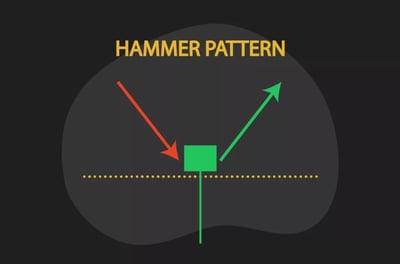

- 2) Hammer

- What should I do when faced with a Hammer?

- 3) Hanging Man

- What should I do when faced with a Hanging Man?

- 4) Shooting Star

- What should I do when faced with a Shooting Star?

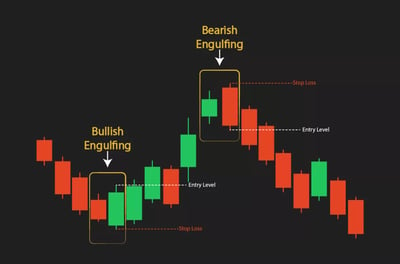

- 5) Engulfing Pattern

- What should I do when faced with an Engulfing Pattern?

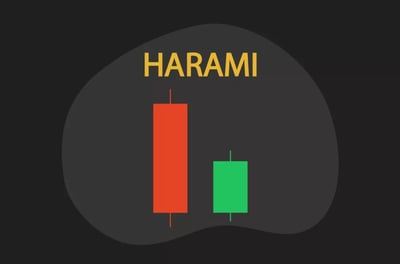

- 6) Harami Pattern

- What should I do when faced with a Harami Pattern?

- 7) Piercing Pattern

- What should I do when faced with a Piercing Pattern?

- 8) Dark Cloud Cover

- What should I do when faced with a Dark Cloud Cover Pattern?

- 9) Morning Star

- What should I do when faced with a Morning Star?

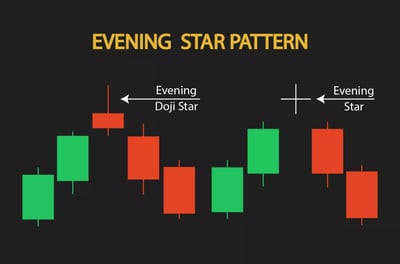

- 10) Evening Star

- What should I do when faced with an Evening Star?

- 11) Three White Soldiers

- What should I do when faced with Three White Soldiers?

- 12) Three Black Crows

- What should I do when faced with Three Black Crows?

- 13) Bullish Marubozu

- What should I do when faced with a Bullish Marubozu?

- 14) Bearish Marubozu

- What should I do when faced with a Bearish Marubozu?

- 15) Tweezer Tops

- What should I do when faced with Tweezer Tops?

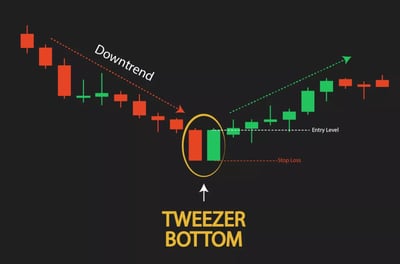

- 16) Tweezer Bottoms

- What should I do when faced with Tweezer Bottoms?

- 17) Rising Three Method

- What should I do when faced with a Rising Three Method?

- 18) Falling Three Method

- What should I do when faced with a Falling Three Method?

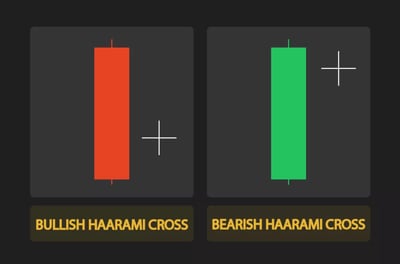

- 19) Bullish Harami Cross

- What should I do when faced with a Bullish Harami Cross?

- 20) Bearish Harami Cross

- What should I do when faced with a Bearish Harami Cross?

- 21) Inverted Hammer

- What should I do when faced with an Inverted Hammer?

- Which Types of Traders Can Get The Most Out Of Candlestick Patterns?

- The Bottom Line

Understanding Japanese Candlestick: 21 Best Patterns for Trading

In my opinion, Japanese candlestick patterns offer a vivid and insightful way to analyze market trends and investor behavior. Originating in 17th-century Japan, these charts have endured for centuries and traveled the world, becoming an essential tool for modern traders across markets. With their unique, clear visual representation of price movements, these distinct formations, known as "candlesticks," provide traders with a tool to quickly identify potential trends, reversals, and continuations.

Whether you're a seasoned investor or just starting your trading journey, understanding Japanese candlestick charts can improve your decision-making process and help you navigate the complex world of financial markets. After all, as a trader, you need any edge you can get. In this guide, I will delve into the fundamental principles of Japanese candlestick charts, demystifying their structure, interpretation, and practical application in today's trading landscape.

Japanese candlesticks visually show open, high, low and close price levels for each timeframe and reveal market psychology

Candlestick patterns should be used alongside technical indicators and confirmation methods

Single‑candle patterns like Doji, Hammer, Shooting Star and Inverted Hammer highlight indecision or potential turning points

Two‑candle patterns such as Engulfing, Harami, Piercing and Dark Cloud Cover reveal shifting momentum and help timing entries when confirmed

Three‑candle formations, including Morning Star, Evening Star, Three White Soldiers and Three Black Crows offer stronger reversal signals if confirmed by follow‑up candles

Continuation patterns like Rising Three Method and Falling Three Method indicate trend bias and can support position‑holding or scaling decisions

You should always confirm candlestick signals with volume, broader trend context and other tools before acting

Candlestick effectiveness varies by market and timeframe, so back‑testing and demo practice help build reliability

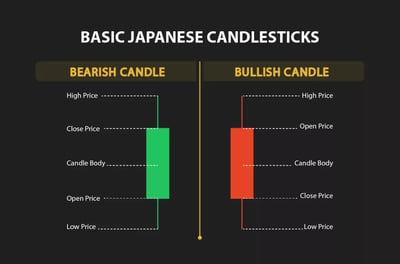

What Is a Candlestick?

A Japanese candlestick is a visual representation of price movements within a certain trading timeframe. In retail trading, candlesticks can provide a clear picture of market dynamics. The beauty of their use is to reflect the concepts of the open, close, high, and low prices in a single candlestick figure. This makes it much easier for traders to read price patterns instantly.

From my experience, traders use these patterns to decide on the best entry and exit points for their trades, giving them the chance to more accurately manage their risk and potentially increase their returns. It’s important to mention at this point that no tool can predict market movements and guarantee success. However, Japanese candlesticks, when used with other technical analysis tools and indicators like Bollinger bands, moving averages, and Fibonacci sequences, can significantly improve a trader's ability to capture market trends. Remember, movements are influenced by an intricate web of factors, and patterns that worked in the past might not always work in the future.

Let’s understand what makes up a Japanese candlestick chart:

Candle body: The "body" of the candlestick shows the range between the opening and closing prices during a specific time period, such as a day, hour, or minute.

If the closing price is higher than the opening price, the body is normally filled or colored (often green or white). This shows a bullish period where buyers were in control.

If the closing price is lower than the opening price, the body is usually a different color or shaded (often red or black), revealing a bearish period where sellers were in control.

Candle wick/shadow: The "wick," also known as the "shadow," represents the price range outside of the opening and closing prices during a specific time period. The wick consists of thin lines extending from the top and bottom of the candlestick's body.

The upper wick extends from the top of the body to the highest price of that time period. It shows how high the price rose above the opening and closing prices, while the lower wick extends from the bottom of the body to the lowest price during that time period.

The wicks tell a story about price volatility and the battle between buyers and sellers during that time frame. Long wicks suggest a high level of indecision or conflict between buyers and sellers, while short wicks often mean there was less volatility.

Candle color: The candlestick colors are not just visual aids; they carry significant meaning, revealing the relationship between the opening and closing prices over a specific time period.

Bullish candlestick: A candlestick that closes higher than its opening price is typically colored green or white, depending on the chart's color scheme. This indicates a bullish period in which buyers controlled the market, pushing prices higher. The body of the candlestick, the fat shape between the opening and closing prices, is filled with this color, confirming the upward movement.

Bearish candlestick: A candlestick that closes lower than its opening price is typically colored red or black. This represents a bearish period where sellers were dominant, driving prices down. Same as the bullish candlestick, the body is filled with this color to highlight the downward trend.

Without spending too much time reading market data, traders can see whether buyers or sellers were in control during the time frame represented by each candlestick, which can be crucial when they must make snap decisions.

Popular Terms in Candlestick Charts

In my experience, here are a few terms based on candlestick charts to revisit whenever you trade:

Emerging patterns: Candlestick patterns that haven’t yet formed but are in progress.

Completed patterns: Normally, these are the patterns that have already developed, and can be regarded as either bullish or bearish signals.

Open: The opening price of a candle.

Close: The closing price of a candle.

High: The highest level the price reached during the period covered by the candle.

Low: The lowest level the price touched during the period covered by the candle.

Candlestick: Represents price movement over a specific time period, with a body showing the open and close prices and wicks showing the high and low prices.

Bullish candle: A candle where the closing price is higher than the opening price, often colored green or white. Buyers had the upper hand here.

Bearish candle: A candle where the closing price is lower than the opening price, often colored red or black. Sellers were in control and drove prices down. We've written an article about how you can react in bearish markets.

Wick/shadow: The thin lines extending from the body of the candlestick, representing the highest and lowest prices reached during the time period.

Engulfing pattern: A two-candle pattern where the body of the second candle completely covers or "engulfs" the body of the previous candle. It can be a sign of a reversal.

Trend: The general direction in which the price of an asset is moving. It can be upward (bullish), downward (bearish), or sideways (neutral).

Support and resistance: Support is a price level where buying tends to occur, and is the lowest price of an asset in a time period. Resistance is a level where selling typically occurs, and is the highest price of an asset in a time period, for more information about support and resistance please click here

Volume: The number of shares or contracts traded during a specific time frame, often used in conjunction with candlestick patterns to confirm signals.

Time frame: The period that each candlestick represents, such as one day, one hour, or five minutes.

Moving averages: A statistical calculation to smooth short-term fluctuations and highlight longer-term trends or cycles.

Go short: The practice of entering into a trade where you bet on the decline of an asset's price. By going short, you believe the price of the asset will decrease, and you can profit from the anticipated price drop.

Go long: Means to buy a financial instrument with the expectation that its price will rise in the future.

Understanding these terms and how they relate to each other is essential for effectively using Japanese candlestick charts as a trading tool. Many traders start by familiarizing themselves with these concepts, often through educational materials, courses, or practice on demo accounts.

Do Candlestick Patterns Really Work?

As a longtime trader, I would caution you that Japanese candlestick patterns are not a magic bullet. In fact, no such tool exists in the world of trading. If it did, we would all be rich! For you to be successful, you must make the most of a range of analysis tools, of which Japanese candlesticks are just one type.

The short answer to whether they work is - yes, but with significant caveats. The effectiveness of these patterns often depends on how they're applied, the market context, and a clear understanding of what they represent, especially the tension between bullish and bearish forces.

When using Japanese candlesticks, traders should always pay attention to confirmation and context. While these patterns can provide useful signals, they are rarely foolproof on their own. Successful traders often look for confirmation from other technical indicators, market news, or larger trends. The broader market context can significantly impact whether a pattern leads to a predictable outcome.

Do Chart Patterns Work in all Financial Markets?

Japanese candlestick chart patterns have been applied across various financial trading markets, including stocks, cryptocurrencies, commodities, FOREX and more. The reason for their widespread use lies in their ability to represent the fundamental principles of supply and demand, bullish and bearish forces, that are common across all markets. Here's how they function in different trading markets:

While Japanese candlestick patterns can be used across all financial trading markets, their success depends on proper understanding within the context of the specific market and current conditions. Combining them with other tools and analysis techniques, and applying proper risk-management strategies, will generally help you make more reliable and data-driven decisions.

Importance in Modern Trading

Japanese candlestick charts have become an essential tool in modern trading. Here's why I think this has happened:

Visual clarity: These charts provide a clear visual representation of price movements, showing open, close, high, and low prices within specific time frames.

Market psychology: Candlestick patterns can uncover the underlying emotions and psychology of market players. Traders can gauge the balance between bullish and bearish forces and anticipate potential reversals or continuations.

Versatility across markets: As previously discussed, Japanese candlestick charts are applicable to various financial markets.

Complementing other analyses: Candlestick patterns are often used in conjunction with other technical analysis tools, such as trend lines, moving averages, and oscillators. They can also be combined with fundamental analysis to provide a comprehensive view of market conditions.

The Success Rate of Japanese Candlesticks

In my view, it's vitally important to understand that Japanese candlesticks can be successful, but with so many factors at play, it's very difficult to establish a clear success rate. In fact, Japanese candlestick trading has been the subject of academic journals and papers, with no clear success rate emerging from these studies!

It would be irresponsible for our experts at Arincen Network to promise a defined success rate for a particular candlestick. This is impossible to do as candlestick pattern effectiveness can vary widely, depending on several factors. These include the overall market conditions, the time frame being analyzed, the asset being traded, and the trader's execution of the strategy. Beware of trading packages promising you a defined success percentage.

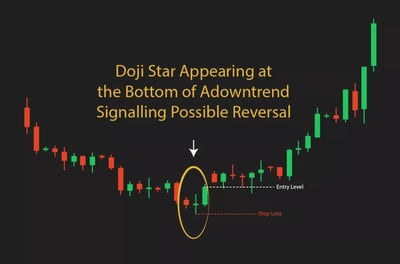

For a start, not all candlesticks give you a trigger to trade. Many neutral potential reversal signals — e.g., doji and spinning tops — will appear that should put you on the alert for the next directional move. Then, bearish or bullish candlesticks could prompt you to act.

Context matters. If a pattern appears randomly within a trend, it may not be as meaningful. Also, confirmation is key. Waiting for additional confirmation, like supportive evidence from other technical indicators, can increase the chances of a successful trade.

Therefore, relying solely on candlesticks without considering market dynamics or technical and fundamental analysis can lead to mixed results. Combining it with other tools and insights usually provides a more robust trading strategy.

Remember, even with a seemingly strong signal, trades can go against you. Implementing sound risk management, like setting a stop-loss order, can protect against significant losses. Also, historical performance does not guarantee future results, so it’s always a good idea to backtest any strategy on historical data and practice in a demo account to understand how it might perform in various market conditions.

What to do Before Trading with Japanese Candlesticks

There are some key steps you should always be following before acting on information from a Japanese candlestick. Let’s start with the simplest and most common candlestick – the Doji. What steps would you take to be confident you are making a good trade? Here are some of the most important ones:

Observe context: Look at the trend preceding the Doji. If it appears after a prolonged uptrend, it may signal exhaustion among buyers, and vice versa for a downtrend.

Wait for confirmation: Instead of taking immediate action, wait for the following candles to confirm the pattern's implication. For example, if a Doji is followed by a bearish candle in an uptrend, it might signal a reversal, and you could consider selling or shorting. If followed by a bullish candle in a downtrend, you might consider buying.

Assess other indicators: Use other technical indicators, like moving averages, to gain a clearer picture of the market's direction. A Doji in conjunction with other bearish signals might strengthen a selling decision, and the opposite for a buying decision.

Consider risk management: If you're already in a position, you might use a Doji as a cue to reevaluate your stop-loss and take-profit levels, tightening or loosening them based on the potential direction hinted at by the Doji.

Avoid knee-jerk reactions: Remember, a Doji doesn't demand immediate buying or selling; it's a sign of uncertainty. Acting hastily without further analysis or confirmation might lead to poor decisions.

Analyze volume: Paying attention to trading volume during the Doji might provide additional clues. High volume may lend more significance to the indecision, while low volume might mean it's less critical.

Overview of The 21 Patterns

Doji

Hammer

Hanging Man

Shooting Star

Engulfing Pattern

Harami Pattern

Piercing Pattern

Dark Cloud Cover

Evening Star

Three White Soldiers

Three Black Crows

Morning Star

Bullish Marubozu

Bearish Marubozu

Tweezer Tops

Tweezer Bottoms

Rising Three Method

Falling Three Method

Bullish Harami Cross

Bearish Harami Cross

Inverted Hammer

Explanation of the 21 Patterns

Here you can find an explanation for all the 22 patterns and how to handle each one of them.

1) Doji

What should I do when faced with a Doji?

2) Hammer

Description: A candle with a small body and long lower wick.

What should I do when faced with a Hammer?

If you see a Hammer after a downtrend, it suggests that the market is attempting to find a bottom. The hammer's long lower wick shows that sellers pushed prices down, but buyers managed to push the prices back up to near the open. This could be a good time to consider entering a long position. The Hammer is an example of a popular reversal indicator. A Hammer signals a bullish reversal after a downtrend. Its limitation is that it is a single-candle pattern, which might lead to false signals.

If you see a Hammer pattern, especially when supported by additional bullish confirmation in the form of a following green candle or other technical indicators, it might suggest a buying opportunity. Traders often see this as a sign to enter a long position, anticipating an upward trend. Before trading, first look for confirmation from following candles, and, if confirmed, consider buying while employing appropriate risk management strategies.

3) Hanging Man

Description: Similar to Hammer but found at the end of an uptrend.

What should I do when faced with a Hanging Man?

A Hanging Man candlestick pattern is often viewed as a bearish reversal signal. It resembles a Hammer with a small body and a long lower wick but occurs during an uptrend. The normal trading response to a Hanging Man candlestick is to recognize it as a potential bearish reversal signal during an uptrend, to look for confirmation in following candles and, if confirmed, to consider selling or shorting.

4) Shooting Star

Description: A small body with a long upper wick.

What should I do when faced with a Shooting Star?

A Shooting Star candlestick pattern is often considered a bearish reversal signal. It appears during an uptrend and has a small body with a long upper wick and little or no lower wick, resembling a shooting star. The classical trading response to a Shooting Star candlestick is to recognize it as a potential bearish reversal sign during an uptrend, to seek confirmation from the following candles, and to consider selling or shorting.

5) Engulfing Pattern

Description: A two-candle formation where the body of a candle engulfs the previous one.

What should I do when faced with an Engulfing Pattern?

In my experience, this pattern is bullish if it occurs after a downtrend and bearish if it occurs after an uptrend. It can signal a reversal in trend. There are two types: Bullish and Bearish Engulfing.

Bullish Engulfing: Confirming a downtrend. Ensure that the Bullish Engulfing pattern appears during a downtrend, with the second candle completely engulfing the first. Consider buying. If confirmed, it may signal a long position, anticipating a bullish reversal.

Bearish Engulfing: Confirming an uptrend. Ensure that the Bearish Engulfing pattern appears during an uptrend, with the second candle completely engulfing the first. Look for a subsequent bearish candle or other confirming signals. If confirmed, it may signal a short position or the sale of existing long positions, anticipating a bearish reversal.

6) Harami Pattern

Description: A small candle followed by a larger one.

What should I do when faced with a Harami Pattern?

7) Piercing Pattern

Description: A bullish candle following a strong bearish candle.

What should I do when faced with a Piercing Pattern?

8) Dark Cloud Cover

Description: The opposite of the Piercing Pattern.

What should I do when faced with a Dark Cloud Cover Pattern?

The Dark Cloud Cover is a bearish reversal candlestick pattern that consists of two candles and is often thought of as the bearish counterpart to the Piercing Pattern. It normally appears at the end of an uptrend. The classical trading response to a Dark Cloud Cover pattern is to recognize its potential as a bearish reversal signal at the end of an uptrend. After supplementing your decision with other research, you should consider entering a short position or selling long positions.

9) Morning Star

Description: A three-candle pattern signaling the start of an uptrend.

What should I do when faced with a Morning Star?

10) Evening Star

Description: The opposite of the Morning Star.

What should I do when faced with an Evening Star?

Recommended Brokers

11) Three White Soldiers

Description: Three consecutive long-bodied bullish candles.

What should I do when faced with Three White Soldiers?

12) Three Black Crows

Description: The opposite of Three White Soldiers.

What should I do when faced with Three Black Crows?

13) Bullish Marubozu

Description: A candle without wicks, signaling strong buying pressure.

What should I do when faced with a Bullish Marubozu?

From my experience as a trader, this pattern is often used to confirm an existing uptrend. The Bullish Marubozu is a single candlestick pattern that can signify strong buying interest. It has a long body with little to no shadows or wicks, meaning the open is equal to or very near the low, and the close is equal to or very near the high of the session. Your best bet in this case is to recognize it as a potential bullish continuation or reversal signal, depending on the context. Traders might consider buying or adding to long positions. Just remember to use other technical indicators to reinforce the decision.

14) Bearish Marubozu

Description: The opposite of Bullish Marubozu.

What should I do when faced with a Bearish Marubozu?

15) Tweezer Tops

Description: Two or more candles with matching highs.

What should I do when faced with Tweezer Tops?

16) Tweezer Bottoms

Description: Two or more candles with matching lows.

What should I do when faced with Tweezer Bottoms?

17) Rising Three Method

Description: A pattern within an uptrend with three small bearish candles.

What should I do when faced with a Rising Three Method?

18) Falling Three Method

Description: Opposite of Rising Three Method.

What should I do when faced with a Falling Three Method?

In my opinion, the Falling Three Method is a strong bearish continuation candlestick pattern that likely means there is a continuing downtrend in play. Like all candlestick patterns, it's crucial to remember that the Falling Three Method should be used in conjunction with other indicators and analysis techniques. Given that the Falling Three Methods is a bearish continuation pattern, the best action would be to consider taking a short position or adding to an existing short position. This is because the pattern suggests prices will likely continue to decline.

19) Bullish Harami Cross

Description: A large bearish candle followed by a Doji within its body.

What should I do when faced with a Bullish Harami Cross?

20) Bearish Harami Cross

Description: The opposite of Bullish Harami Cross.

What should I do when faced with a Bearish Harami Cross?

21) Inverted Hammer

Description: Similar to Shooting Star but appears after a downtrend.

What should I do when faced with an Inverted Hammer?

Which Types of Traders Can Get The Most Out Of Candlestick Patterns?

In my opinion, Japanese candlestick patterns are versatile and can be used by a wide range of retail traders. Here's how different traders might benefit from using them:

Swing traders: Swing traders, who typically hold positions for several days to weeks, might find candlestick patterns helpful in identifying short-term momentum and potential reversals. These patterns can provide insights into market psychology over the short- to medium-term.

Day traders: These active traders buy and sell within a single trading day, often using candlestick charts to recognize intraday trends and reversals.

Technical traders: Experts and elite traders who rely primarily on technical analysis find Japanese candlestick patterns particularly useful. These traders often look for complementary signals to confirm trends they may have spotted elsewhere, and candlestick charts can provide good visual representations of these.

FOREX traders: Japanese candlesticks are very popular in the FOREX market to analyze currency pairs. They are very helpful to FOREX traders operating in markets where sentiment and direction are key.

Beginners: For newbie traders, Japanese candlesticks offer a much easier way to understand price action than other chart types. They visually represent open, close, high, and low prices in a way that is simple to interpret.

I’ve said it before, but it is worth repeating. While Japanese candlesticks can be a valuable tool, they are not foolproof and should be used in conjunction with other forms of analysis, like technical indicators, fundamental analysis, or macroeconomic factors. Combining these methods provides a more holistic view of the market and can lead to better trading decisions, regardless of your trading style or focus.

The Bottom Line

From my own experience as a trader, I can attest that Japanese candlesticks offer a clear way to read price movements across specified time frames. These patterns, ranging from simple one-candle formations to more detailed multi-candle setups, provide insights into the underlying market psychology and potential future price direction. Their widespread adoption among traders worldwide is a testament to their usefulness.

Mastering these patterns is a crucial step in your trading journey, but it's equally important to remember that no single tool or method is infallible. Combining candlestick patterns with other technical indicators, chart patterns, and solid risk management strategies can ensure you have a long trading career.

FAQ

Japanese candlesticks are a method of charting and analyzing the price movement of financial instruments. Each candlestick represents a specific time frame and shows the opening, closing, high and low prices during that period. The body of the candlestick shows the price range between the open and close, while the wicks (or shadows) display the highest and lowest prices during the period.

While both provide similar information about price movements, candlestick charts more strongly and intuitively underscore the relationship between the opening and closing prices.

Some fundamental patterns include the Doji (indicating indecision), Bullish Engulfing (potential bullish reversal), Bearish Engulfing (potential bearish reversal), Hammer and Inverted Hammer (potential trend reversals), and the Morning Star and Evening Star (bullish and bearish reversal patterns, respectively).

While candlestick patterns provide valuable insights into market sentiment, no single pattern guarantees a particular price movement. They are best used together with other technical analysis tools and good old fundamental analysis.

Yes, candlestick patterns can be applied to any time frame, from 1-minute charts to monthly charts. However, the significance of a pattern might vary based on the timeframe. Patterns on longer time frames, like daily or weekly charts, may have a more prolonged impact than those on shorter time frames.

Absolutely! While originally developed for rice futures trading in Japan, candlestick charting can be applied to stocks, FOREX, commodities, cryptocurrencies and many other financial instruments.