Table Of Contents

- What is Cryptocurrency Trading?

- How Do Crypto Markets Work?

- What Are the Different Ways to Buy Crypto?

- How Do I Pick the Right Exchange?

- Best Crypto Exchanges

- Account Setup, KYC, and Funding

- Wallets and Custody: Hot vs Cold, Self-Bustody Basics

- Core Trading Mechanics: Orders and Execution

- Trading Strategies for Beginners

- How Do I Use Technical Analysis to Trade?

- Fundamental and On-Chain Analysis

- Futures and Perpetuals Explained

- How to Use Risk Management and Position Sizing

- Tax and Legal Basics

- Security Checklist and Fraud Avoidance

- DeFi Basics for Traders (Pools, AMMs, Impermanent Loss)

- What Is the Psychology of Trading and Journaling?

- Advanced Tools and Platforms

- Conclusion

How to Trade Cryptocurrency: The Ultimate Guide for Beginners

As a long-time trader, I have seen that crypto trades 24/7, moves quickly, and experiences near-constant large swings. Its defining feature is volatility, which is why it is crucial to understand how to trade it safely, and, hopefully, profitably. I have written this comprehensive crypto trading guide to help you understand many facets of this trading space, including how to set up secure accounts and wallets, pick an exchange, and understand stablecoin on-ramps, fees (maker/taker), spreads, and slippage.

Further, I will demystify order types such as market, limit, stop, stop-limit, and OCO, so that you can place entries and exits in an informed manner.

Our experts at Arincen have also delved into the technical analysis elements, including MAs, RSI, MACD, on-chain and flow signals, and detailed playbooks for trend, breakout, and mean-reversion trades.

After reading this guide, you will have a step-by-step checklist for placing a trade from start to finish, a template for managing risk, and a repeatable process for reviewing results. With practice, you can develop a disciplined, structured way to trade this volatile financial asset. A word of caution: this information is meant to be educational content, not financial advice.

Crypto trades 24/7 and is highly volatile, so plan for big swings and treat indicators as evidence, not certainty.

Microstructure matters. Order books, spreads, liquidity, and slippage drive your real fill and total cost, including fees, spread, slippage and any funding or gas.

Choose access that fits your goals. Spot means you own coins, while CFDs and ETFs give exposure without on-chain use. Centralized vs decentralized venues trade off custody, compliance and user experience.

Pick exchanges on security first. Look for proof of reserves plus liabilities, strong cold storage practices, hardware key or TOTP 2FA, clear jurisdiction, reliable fiat on and off ramps, deep liquidity and transparent fees.

Lock down accounts and funding. Complete KYC, enable 2FA, use withdrawal allowlists, send test transfers, match networks and memos, keep only working capital on the exchange and store savings in a hardware wallet.

Execute with intent. Know when to use market or limit orders, stop loss, stop limit, OCO and trailing stops. Attach brackets on entry and avoid paying the spread unnecessarily.

Systematize risk. Risk a fixed per cent of equity per trade, set stops where the thesis fails, aim for at least 2 to 1 reward to risk, cap total open risk, keep leverage modest and review results in R multiples.

Broaden your toolkit and stay compliant. Combine technical analysis with fundamentals and on-chain data such as active addresses, fees, TVL and exchange flows.

Keep tax records, follow a security checklist and use pro tools like charting platforms, scanners and trackers before scaling up.

What is Cryptocurrency Trading?

Cryptocurrency trading is the act of buying and selling digital assets for profit. The price of cryptos typically moves over minutes, hours, or days. So, in effect, you are managing risk and timing. Many crypto traders do it for a living, spending their waking hours in front of trading screens.

If we think of investing in the typical sense, which is slower, as you buy assets with a multi-month or year horizon, we can consider various strategies. Crypto trading is different. Traders are often looking for opportunities in even the tiniest price changes, and, of course, traders can make money whether crypto is going up or down, because they can go long or short.

In my experience, there are two main types of what you can trade in crypto. In short, you can either buy crypto on the spot or you can trade crypto through downstream markets like contracts for difference (CFD), which allow you to speculate on whether the asset will go up or down, without actually owning the asset itself.

Recommended Brokers

24/7 market and volatility basics

One of the defining things about crypto is that it trades all the time – 24/7/365. Unlike, say, the stock market, there is no opening bell, so round-the-clock swings replace price gaps between opening and closing bells seen by other assets.

Volatility runs hot within the crypto world for a few reasons:

Leverage accelerates moves and forces other traders into liquidations, meaning the market is always active

Crypto has fragmented liquidity, which thins out during off-hours, leading to some traders always prowling the markets looking for an opportunity to short.

There is headline risk. Unlike more stable assets, crypto is a hostage to policy changes or hacks, which tend to reprice assets quickly.

Reflexivity. This refers to the fact that trading momentum invites more momentum. High volatility is a feature of this space, not an exception.

How Do Crypto Markets Work?

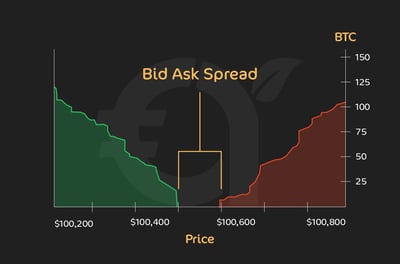

From all the trading I've done, I know it starts with what is known as an Order book. On a centralized crypto exchange (I will talk about these later), the order book is basically a constantly open trading register that lists bids (buy limits) and asks (sell limits). For example, look at this graphic to understand the role of bid/ask/spreads:

BTC/USDT (this shows a deep and liquid market)

Best Bid: 100,500.00 | Best Ask: 100,600.00

Spread = 100,600.00 − 100,400.00 = $200.00

Mid-price = (100,600.00 + 100,400.00) / 2 = 100,500.00

The highest bid and lowest ask form the top of the book. The midpoint between these two is, unsurprisingly, called the mid-price. The gap between the highest and lowest is the spread.

The term “depth” indicates how many coins are available at each price, essentially serving as shorthand for liquidity, which, as we know, measures how vibrant and active a market is with buyers and sellers. Remember, if you have a combination of tight spreads and a deep number of coins, you are most likely to get access to cheaper, steadier fills.

Key terms in crypto trading

Here are some important terms you’ll come across a lot when trading crypto:

Let’s start with some order types. For the avoidance of doubt, an order in trading is when you’ve assessed the market and you want to act out your intentions, also known as making a trade, or simply, making an order. Here are two important order types you’ll see a lot. You can see from the graphic what the main differences are:

Market vs. limit orders:

A market order says, “fill me now.” You cross the spread and take whatever quantity is available, potentially climbing several price levels if your order is big. This is a fast way to place an order, which is beneficial if your opportunity is locked in, but you are not really in control of essential price levers.

A limit order says, “fill me at X or better.” Imagine that you see a price trending in a specific direction. You are sure it will reach a level where it will be good for you to buy/sell. You might wait longer, but you control the price. Resting limits add liquidity (you’re a maker); market orders remove liquidity (you’re a taker).

Slippage:

This is another essential term, simply defined as the difference between your expected price and your actual average fill. To be truthful, you want slippage to be as low as possible. Look at this graphic for an example of how slippage works:

.webp)

I've seen that slippage tends to grow when books are thin, your order is large, or the price is moving fast. In the image, Situation 1 refers to a highly liquid token such as BTC, which has a good market depth of US$80K and a TVL of US$100K. This translates to a small slippage percentage of 0.1%.

On the other hand, in Situation 2, the market for this exotic coin is illiquid, market depth is only US$5K, yet the TVL is USD$100K. In the end, you suffer from 6% slippage in this scenario, which is not ideal.

Liquidity:

When we talk about liquidity, it’s a scenario in which there aren’t enough buyers or sellers at your chosen price, or when the market is moving too fast for your broker’s systems to keep up. This is when we see that your order slips to the next available level.

What Are the Different Ways to Buy Crypto?

Much like signing up with an online trading broker, trading crypto requires that you review many potential candidates before deciding which crypto exchange to use. A crypto exchange is simply a company that provides an online platform to buy and sell cryptocurrencies. There are several crypto exchanges now active. However, no matter the exchange, you will still be able to trade in a few common ways. I explain them here:

Spot vs. derivatives

Here are some of the main features of the two types of crypto trading.

Spot:

You buy/sell the actual coin (e.g., BTC/USDT). There is no expiry date to the trade because you own the cryptocurrency outright, and you can keep it indefinitely.

Why traders use it: Simple, 24/7 access, and there is no liquidation risk from leverage. You can withdraw to self-custody (hardware wallet) and use the asset on-chain.

Costs: You will typically face maker/taker trading fees, spreads, slippage, plus network withdrawal fees.

Risks: It can be dangerous to keep the coin yourself. The dangers include custody mishaps like hacks and lost keys.

Good for: Long-only exposure, on-chain use, dollar-cost averaging (DCA).

If you look at the graphic below, you can see some of the headline differences between spot and derivatives:

Derivatives (CFDs and ETFs):

Here, you trade contracts that track price without owning the coin. As I’ve said, you are speculating whether the asset will go up or down in the future. Derivatives fall into two main types: Contracts for Difference (CFD) and Exchange Traded Funds (ETF).

A CFD is an over-the-counter (OTC) derivative that you place with your broker. You trade the price difference between different cryptos without owning coins. Typically offers leverage, easy long/short, and no wallets.

An ETF is a regulated fund that tracks crypto. You buy ETF shares in a standard brokerage account. If you’ve been following the crypto news, you might remember that the US Securities and Exchange Commission (SEC) first approved Bitcoin futures ETFs in late 2021. Then, in January 2024, after years of delays and rejections, the SEC finally approved Bitcoin spot ETFs.

Here’s more information on the two types of derivative funds:

CFDs

Why traders use it: Convenience and flexibility (one account, many markets), tight operational workflow, shorting without borrowing coins.

Costs: Spread + commission (if any) + overnight financing (“swap”) on leveraged positions; also, wider spreads in fast markets.

Risks: You don’t own the asset. Also, counterparty risk sits with the broker, so it better be legit. Leverage amplifies losses in CFD trading.

It is heavily jurisdiction-dependent because it’s restricted or banned in some countries.

Good for: Short-term trading, hedging, directional views with defined margin.

ETFs

Why traders use it: No wallets/custody to manage. You can hold them in tax-advantaged accounts where allowed.

Costs: Annual fee, bid-ask spread, brokerage commissions (if applicable), and potential tracking difference vs. spot.

Risks: Trades only during market hours (not 24/7), so you could fall foul of volatility swings.

Suitable for: Investors who want regulated exposure, clean reporting, and portfolio integration alongside stocks or bonds.

How Do I Pick the Right Exchange?

I've witnessed firsthand that choosing the best crypto exchange for your needs can be confusing and daunting. The choice is vast. Choosing a crypto exchange is effectively selecting a platform. Unlike the online broking space, crypto trading has not yet developed a universally trusted third-party trading interface such as the well-known MetaTrader. Each crypto exchange develops its own platform. You will need to conduct thorough research to find out which is the best. Here are some key things to remember as you try to select the best crypto exchange for you:

1. Do your research

Being a cautious investor is one of the first things you will learn from trading in crypto. When searching for digital currency exchanges and crypto investing in general, many fraudulent companies operate in this unregulated space that even central banks are trying to figure out. Even if they are not out to swindle you, many companies are undercapitalized or inexperienced in this immature industry, and this can lead to them going under.

There is also the danger of crypto companies getting hacked. This happens reasonably often because there are still loopholes, as different companies adopt different security postures. The vulnerability is usually not in the blockchain, but in the crypto wallets that companies use to store funds.

You will need to use all the tools at your disposal to figure out which company is legit. This includes general best practices like confirming physical addresses and the country of operation. If the crypto exchange is located in a faraway jurisdiction that is not regulated, you should feel unsafe. Common red flags include vague custody disclosures, opaque ownership, frequent halts during volatility, inconsistent fee quotes, pressure-sales on “earn” products, or poor support.

2. Concentrate on security

Watch out for telltale signs of weak security. When opening an account, you need to feel as if you are being scrutinized; and from your experience with other know-your-customer processes, you will be able to understand if the company you are dealing with is sticking to the right security protocols. Once you turn the spotlight onto the broker or crypto exchange itself, this is what you are seeking:

Track record: How many years in operation, major incidents, and how they were handled.

Client asset segregation: There should be a clear statement that client assets are held separately from the exchange’s own funds.

Proof-of-reserves + liabilities: Clear and preferably independent attestation that the broker is covered.

Cold vs hot storage: The majority should be kept in cold storage. Withdrawal addresses should be allowed, and the broker should support 2FA and hardware-key authentication.

Controls: SOC 2/ISO-type audits, bug-bounty program, real status page with incident history.

Insurance clarity: what (if anything) is insured, and against which events.

3. Be careful of high fees

As an investor, If you are anything like me, you never want to pay fees that are over the top. The two most important aspects that set an exchange apart are the level of fees and the number of currency pairs it offers. Many exchanges charge a fee for transactions, typically based on transaction volume.

It's good advice to understand how fees work, as this is how different exchanges differentiate themselves. It's similar to online broking: companies that charge lower fees are usually the ones that have innovated and streamlined their operations, so they don't have to pass on too many costs to you. In any case, look out for:

Posted fees: What is the broker’s maker/taker schedule? Are there VIP tiers and rebates, and what are their withdrawal/deposit fees?

Hidden costs: Your real cost is fees + spread + slippage (+ financing). Anything outside of that should be queried.

4. Customer service, jurisdiction, and regulation

Although crypto continues as a maturing market, some established exchanges like Binance have been in existence since the arrival of the technology. Pay careful attention to any licensing, awards, and positive reviews that a crypto exchange is willing to share. More than that, look out for these items:

Where is it domiciled and licensed? Know which regulator oversees it and where disputes are resolved.

Geo restrictions: Some products aren’t offered in certain regions.

Tax and reporting: What is the availability of compliant statements/forms for your country?

5. Liquidity and market quality

High liquidity is essential for retail traders because it directly impacts execution quality and costs. Brokers with access to deep liquidity can fill orders quickly at prices close to what traders see quoted, minimizing slippage. You should be asking your broker about this:

Depth and spreads: What does the broker/exchange offer in this regard on the pairs you trade? Is their system stable during volatility, and can it offer fast, reliable matching?

Order types/APIs: The broker should have proper limit/stop/stop-limit/OCO, post-only, and reduce-only order types to ensure all your trading strategies are covered.

6. Fiat on/off ramps

Does the crypto exchange make credible claims about having partnerships with liquidity providers or strategic capital partners? Is the company you are dealing with part of a larger, more formidable group? All these questions will help you understand where the crypto exchange sits in the scheme of things, especially when you want to convert your crypto into fiat money. Look out for these things:

Funding options: Does the broker offer ACH/SEPA/wire/card? What are its settlement times, chargeback risk, limits, and FOREX mark-ups?

Stablecoin rails: What is the availability of major stables and good fiat pairs in your currency?

7. Product coverage

A crypto exchange or broker with a broad asset selection provides traders with meaningful operational advantages. Access to multiple cryptocurrencies allows for more sophisticated portfolio construction and risk management. Here are the key points you would be looking for in this regard:

Tokens: There should be a focus on quality over quantity, along with a transparent listing and delisting policy.

Derivatives: What are the leverage caps, margin modes (isolated/cross), and liquidation engines? Also, insurance fund rules must be explained.

Earn/staking: Who custodies the assets and on what terms?

8. Support and UX

When a company takes the time to invest in its platforms, it positions itself differently from its competitors. These types of companies should be taken seriously as they strive to become market leaders. A quick comparison of trading platforms on the market will give you an insight into which exchange is best positioned to make your trading journey as easy as possible. Always watch out for technical giveaways like the broker’s account recovery SLA, and whether it has 24/7 chat, and clear KYC steps. Also, does it have parity between mobile and desktop strength, with strong session/device controls??

A Word on Two Types of Crypto Exchange

With crypto growing at such a rate, many thousands of new traders around the world start their investment journey every day. The number of crypto trading platforms has also flourished, but you must know a key distinction between the two types of exchanges: centralized and decentralized exchanges.

Centralized exchanges (CEX):

Examples include Coinbase, Binance, etc. They custody assets, match orders, and handle fiat on-ramps. The good thing is that they have deep liquidity, a familiar UX, and customer support. On the other hand, you still face custodial risk, KYC, and occasional withdrawal halts. Here is a graphic that explains a centralized crypto exchange:

- .webp)

You can tell from the image that the steps look like this:

Deposit fiat: User initiates funds transfer. Money leaves the user’s bank and lands in the exchange’s client account. Core ledger credits the user’s fiat balance.

Place order: User submits market/limit buy. OMS locks required fiat, and risk checks run.

Match and execute: The Matching engine fills against the order book, and trade details and fees are posted to the ledger.

Settle internally: Fiat balance decreases, and the crypto balance increases in the user’s custodial wallet (no on-chain move yet).

Hold/trade more: Balances stay on-platform, and further trades settle instantly on the internal ledger.

Withdraw crypto: Address checks, AML/fraud rules, and allow-list, hot wallet builds/broadcasts the on-chain tx, network fees deducted, confirmations credit the external wallet.

Optional sell to fiat: User sells crypto; ledger credits fiat; user withdraws to bank, and funds leave the exchange back to the user’s bank.

Decentralized exchanges (DEX):

Some well-known DEXs include Uniswap and dYdX. Here, you trade from your wallet. You get the advantage of self-custody and open access. However, you must deal with the wallet security burden, gas fees, and DEX-specific mechanics that can widen slippage in thin markets.

On a DEX, there’s no account, no internal ledger, and no custody. You first use a fiat on-ramp to move money from your bank to a self-custody wallet (e.g., USDC in MetaMask). Trades happen on-chain: you approve the token for spending, then sign a swap against an AMM liquidity pool (or aggregator router). Settlement is immediate on the blockchain, not the exchange’s books. You pay network gas, accept slippage or price impact, and your wallet balance updates after confirmations. Withdrawals aren’t a step, as you already hold the assets.

Operational Setup I Recommend

I've gathered anything over time, it's that smart crypto traders balance accessibility with security. It’s a good idea for you to maintain accounts on two exchanges, one primary platform for daily trading and a backup with funds ready to go if the central exchange experiences downtime.

For capital management, keep long-term holdings in self-custody using hardware wallets, while working capital stays on exchanges for quick deployment. Security protocols matter: restrict API keys to reading data and executing trades only, never allowing direct withdrawals. Set up withdrawal allowlists to ensure funds move only to pre-approved wallet addresses, and enable alerts for any transfer requests. Before moving significant amounts, always test the process with a small withdrawal to catch potential problems early.

Best Crypto Exchanges

Account Setup, KYC, and Funding

Once you have chosen your crypto exchange, you will need to open an account. To do this, you will need to provide your personal identification details as part of the application process. Normally, you won’t have any trouble opening the account, which happens after a day or two of vetting. The remainder of the process should look much like this:

Sign up

Create your account with an email you control long-term.

Use a unique password from a password manager.

Lock it down (before you deposit)

Turn on 2FA with an authenticator app or hardware key. Avoid SMS if you can.

Save backup codes offline.

Enable withdrawal address allowlisting, new-device delays, and an anti-phishing code for exchange emails.

Pick your funding route:

A. Deposit fiat to the exchange

Bank transfer: lowest fees, may take hours to days. Wires are faster but costlier.

Card/Apple Pay: offers near-instant transactions, higher fees, and cash-advance/chargeback rules may apply.

Check deposit limits/fees, bank crypto policies, and whether first deposits carry a hold period.

B. Use a fiat-to-crypto on-ramp

Third-party providers (e.g., Ramp/Transak/MoonPay) let you buy crypto to send to your exchange or self-custody wallet.

You’ll do a light KYC there, too. Compare total cost (spread + fee) and supported networks.

C. Funding with stablecoins (popular, low-drama)

Choose a widely supported stablecoin (USDC/USDT) and the exact network your exchange/wallet supports (e.g., ETH (ERC-20), Arbitrum, Solana, Tron).

Match networks exactly on both sides because an incorrect network can result in the loss of funds.

Send a $10 test first, then the remainder.

Some assets require a memo/tag (e.g., XRP, XLM, BNB, EOS); omitting it may result in funds not being credited.

After arrival, transfer internally to the correct account before trading.

After funding

Set your base currency (USD/CAD/EUR) and fee tier, and apply for fee discounts (volume/VIP or holding the exchange token, if you choose).

If you use derivatives, choose isolated vs cross margin and set max leverage conservatively.

Good hygiene going forward.

Keep working capital on the exchange, move savings to self-custody (hardware wallet).

Label addresses, keep an allowlist, and test withdrawals periodically.

Export statements monthly for tax and P&L tracking.

Common pitfalls to avoid

Mixing up networks (ERC-20 vs TRC-20 vs Solana, etc.).

Forgetting memo/tags on tag-required chains.

Using only SMS 2FA.

Funding by card, then trying to withdraw immediately (often flagged).

Sending from a third-party bank account that doesn’t match your name.

Choose your Investments well.

Bitcoin and Ethereum are two of the biggest cryptos in the world, and it's no surprise that they are the most traded. If you are attracted to smaller cryptos or altcoins, make sure that these do not make up the bulk of your portfolio. The crypto market is volatile enough while trading the two biggest cryptos, so you don’t need to bring on too much risk by throwing your weight behind altcoins alone.

Some traders use various reasoning to determine what they want to trade. Some are concerned about the environmental impact of crypto mining, which leads them to altcoins with a low ecological footprint. Other traders are attracted to altruistic promises of some cryptos, like equitable wealth distribution. This is to say nothing of the emerging trend of exotic cryptos linked to cultural items like art and music.

As there are so many cryptocurrencies, and the number just keeps growing, you will soon realize that crypto investing is not a passive exercise, but it's something you need to watch actively. Besides the inherent volatility of the asset class, there are always news events and market developments that contribute to its volatility swings. You will need to become skilled at reading these.

Wallets and Custody: Hot vs Cold, Self-Bustody Basics

When it comes to custody of actual crypto coins, the rule is that whoever controls the private key controls the coins. You will be asked to generate a seed phrase (12–24 words) that is a human-readable backup of that key. If someone gets it, they can move your assets. If you lose it, no helpline can ever recover your funds.

Hot wallets and cold wallets are differentiated by whether the wallet is connected to the internet. Hot wallets are internet-enabled and are therefore constantly online. This is often useful for active investors who need to receive and send funds all the time. However, this type of wallet is vulnerable to hacking, as demonstrated in 2019 when Binance’s hot wallet was hacked, affecting over 7,000 Bitcoin, which was worth roughly $847 million at today’s prices.

Hot wallet security can be enhanced through multi-signature functionality, which means that multiple parties, not just a single party, must sign off on transactions before funds leave the wallet.

Cold wallets are not connected to the internet and therefore pose fewer security risks, but are also less user-friendly. Your private keys are stored offline, making them safer from hacks. Cold wallets are used to store large amounts of crypto for long periods of time.

Self-custody basics

Private key vs. seed phrase: The private key signs transactions. The seed phrase is the master backup.

Hardware wallets: These are purpose-built devices that keep keys offline and let you verify the address and amount on-device before you sign.

Multisig (e.g., 2-of-3): Requires multiple keys to move funds (e.g., laptop key + hardware key + backup key). Reduces single-point-of-failure risk and theft; adds setup complexity.

You might wonder if it is better to keep the keys in self-custody (you store them) or whether you should leave the coins on an exchange. It depends on your preference. Keeping keys on an exchange guarantees ast trading, fiat on/off-ramps, and customer support. On the other hand, the exchange is at risk from hacks, insolvency, and withdrawal freezes over which you have zero control. If you must hold on exchange, use allowlisted withdrawal addresses, strong 2FA (app/hardware key), and small balances.

Best Practice Tips for Crypto Trading Beginners

Hot storage is for working capital. Cold storage is for savings.

Back up the seed phrase on paper or metal (fire/water resistant). Store in two places, but never in cloud/email/photos.

Consider a passphrase (“25th word”) for hardware wallets. Remember, it is part of the backup (lose it, and lose funds).

Permission hygiene (EVM chains): Regularly review/revoke token approvals, and avoid signing blind signatures.

Phishing defenses: bookmark exchange/wallet URLs. Never follow links from DMs and set an anti-phishing code in exchange settings.

Firmware and app updates: only from official sites; double-check URLs and certificates.

Separation of concerns: one wallet for DeFi experiments, another for long-term assets. Don’t mix.

Core Trading Mechanics: Orders and Execution

I’ve already touched on market orders and limit orders. As a quick refresher, when you place a market order, you’re saying “fill me now at the best available price,” which is fast but can cost more if the spread is wide or the book is thin. A limit order sets your price: “buy/sell only at this level or better,” giving you price control but potentially delaying execution. A stop-loss is a safety net: once the price hits your stop, it fires a market order to get you out quickly. A stop-limit order is similar to a limit order, but converts to a limit order at your chosen price ceiling/floor. It offers more control, but it might not fill in a fast move. An OCO pairs a take-profit and a stop-loss on the same position. When one fills, the other auto-cancels, so you’re covered both ways. A trailing stop moves with the market, locking in gains as price rises (or falls, if you’re short) until a reversal of your chosen distance trips the exit.

Practical cheat sheet (when to use what)

Enter now, small size: Market

Enter at your level: Limit

Hard exit regardless of slippage: Stop-loss (market)

Exit with price floor/ceiling: Stop-limit

Pre-set both exit paths: OCO (TP + SL)

Let profits run, cut reversals: Trailing stop

Trading Strategies for Beginners

You can adopt many different strategies to trade crypto. Whichever strategy you choose, it pays to be consistent in applying it. A good crypto exchange will present you with a range of technical indicators that can help you make better decisions as you trade. Many crypto exchanges offer detailed crypto research and educational facilities, so you are not lost as you start to trade.

It's important to use a trading strategy that is going to keep you in the game for the long term. This strategy must stick to a few basics of trading. These include not committing too much of your portfolio into one trade, and being disciplined enough to take profit when it is there without being greedy. Another good habit is to stop your losses before they become too heavy. Here are some strategies you could try:

Buy & hold

The acronym HODL relates to holding a crypto asset through its ups and downs. It stands for “holding on for dear life,” which means the traders stick to a particular crypto they have purchased and stand with it because they believe in its underlying strength and positive future. This is not for everyone. The trader would need to know something that the market doesn't know to withstand the dips in value without selling off their asset.

Imagine you went this way, you’d still have to arrive at a good sizing model. Sensible sizing for beginners includes keeping total crypto to a small slice of liquid net worth (e.g., 5%-20%, depending on risk tolerance), then tilt toward large caps (e.g., BTC/ETH 70%-90% of the crypto holding, and then the rest in smaller coins). It’s a good idea to balance quarterly so winners don’t dominate.Example: Imagine you bought a niche crypto coin in 2014 at $25 and held on throughout the various news cycles until five years later when it was trading at $192. That would be an example of HODL trading. The graphic below explains it.

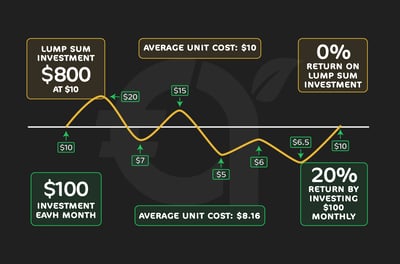

Dollar-cost averaging

DCA spreads entry risk by buying a fixed amount at fixed intervals (e.g., $100 every month), regardless of price. Your average cost = total spent ÷ total coins acquired. It shines in volatile markets because drawdowns buy you more units.Example: You started with a lump sum of $800, over time, it’s possible that you could end up with no return on your initial lump sum amount. However, starting with a $100 lump sum and investing $100/month for 8 months, you could end up with a 20% return, which is way better than several single-shot entries.

Swing trading

Swing traders hunt multi-day moves on the 4H/D1 charts. Keep it simple by using a trend filter (20/50-EMA), momentum check (RSI regimes: >50 bullish, <50 bearish), and a trigger (break/retest or MACD histogram flip). Make sure only to risk a small, fixed percentage of equity per trade (e.g., 1%).Example: In the graphic below, ATA is in an uptrend (price above rising 50-EMA). Plan on the rectangle breakout in August, with a stop-loss of 187.00, and take-profit at 216.00.

Day trading

I've seen that intraday trading requires deep liquidity, which is commonly found in these crypto pairs: BTC/USDT, ETH/USDT. You tend to get tight spreads, fast routing, and low taker fees, because spread + fees + slippage can eat small moves. Use reduce-only OCO brackets the moment you fill.Example: Look at the image below. You can see that in a single day, you could have multiple opportunities to buy and sell within the same uptrend. The key to day trading is discipline. Plan entries and exits in advance, size small, cut losers fast, let winners run, and follow your risk rules without emotion.

Using leverage and margin

By now, you should know that leverage multiplies both profit and loss, as well as risk. Know your exchange’s maintenance margin, liquidation logic, and cross vs isolated (situations where margin rates are shared or isolated, respectively) modes. Beginners should keep leverage conservative (e.g., less than 3:1). Remember always to place a hard stop, and size positions well so a routine swing doesn’t auto-liquidate you.

How Do I Use Technical Analysis to Trade?

Remember that Technical Analysis (TA) doesn’t predict the future, but it frames probabilities. You’re looking for a combination of positive signals, which really means multiple signals pointing the same way, plus a clear entry, stop, and target. Here’s a handy rule of thumb: Use TA to plan trades, use risk management to survive them. Here’s more information about selected indicators:

Candlestick basicsEach candlestick consists of a “body,” which shows the opening and closing prices, and “wicks” or “shadows” at either end, representing the highest and lowest prices reached during the period. Suppose the closing price is higher than the opening price. In that case, the candlestick is typically filled or colored (often green or white), indicating a price increase or a “bullish” or positive market. On the other hand, if the closing price is lower than the opening price, the candlestick is usually empty or differently colored (often red or black), signalling a price decrease or a “bearish” or depressed market. To read our detailed article on candlesticks, go here.

Support and resistanceThe support level is a point at which an asset’s price is expected to stop falling after trending for a period as a function of its plentiful supply. After the price reaches a support level, meaning it has stopped falling, an increase in buyer demand normally pushes the asset value to rise. Resistance levels are reached when demand is in full swing, and the value of the item appreciates until it is concentrated at the upper end. At that point, traders start to sell. By understanding support and resistance levels, you can incorporate them into your crypto trading strategy.

Trendlines and channelsA channel, closely related to a trendline, tells you whether your asset is in the middle of an uptrend, a downtrend, or just moving sideways within a stable range. For example, in an ascending channel, the price is generally moving up, as you would expect, making it a clear signal for bullish (optimistic) opportunities. On the other hand, a descending channel shows the price is trending down, a bearish (pessimistic) signal often indicating a need to consider shorting positions.

VolumeBreakouts on rising volume are more reliable because fades on shrinking volume lack fuel. In crypto, volume is fragmented, so focus on your venue and a major index/perpetual futures (perp) for confirmation. Simple tools include volume profile (where trading is clustered) and OBV (direction of volume flow).

Moving averages (MA)In basic terms, a moving average is a calculation that helps smooth out price data over a specific period of time. What does this mean? Well, the direction of the average gives the trader an overall understanding of how a certain price is travelling.

Relative Strength Index (RSI)RSI operates on a 0–100 scale. The goal of the measure is to find a way to capture buying or selling momentum. RSI does this by comparing the average of recent price gains to the average of recent price losses over a specific period of time. This period is most commonly 14 days.

A reading above 70 suggests that an asset could be overbought, and therefore primed for a downward correction. On the other hand, an RSI Indicator reading below 30 hints at an oversold market, signaling a potential upward bounce. Naturally, any reading between these two extremes should be viewed as inconclusive.

MACDAt its core, MACD helps you understand two key things: momentum and trend direction. When you look at a MACD chart, you will see two trendlines, one at support and one at resistance. Between the two lines, you will see a set of bars jostling up and down. That’s the MACD in action. Each up and down movement tells a story about momentum and reversals, and gives a clue about what you could do next.

Fibonacci retracements and extensionsTo use Fibonacci levels effectively, first identify the trend direction, whether the price is in an uptrend or a downtrend. Then, place the Fibonacci retracement indicator from the starting point (either the swing low in an uptrend or the swing high in a downtrend) to the end of the current move. This setup will show the Fibonacci levels—23.6%, 38.2%, 50%, 61.8%, and 78.6%—which act as potential support and resistance points within the trend.

Common mistakes to avoid when trading with TA

Trading one indicator in isolation. You want confluence.

Curve-fitting settings for the last month and expecting miracles.

Ignoring costs (spread + fees + slippage) and liquidity.

Skipping a stop-loss or moving it wider “just this once.”

Dropping to the 1-minute to “find” a setup that isn’t there.

Fundamental and On-Chain Analysis

When you're trying to decide whether a cryptocurrency is worth investing in, you can use two powerful tools: Fundamental Analysis and On-Chain Analysis.

Fundamental Analysis

This method looks at the “big picture,” the crypto’s purpose, team, technology, market potential, and real-world use cases. It’s like asking, “Is this crypto solving a real problem, and is it built to last?” Remember that some of the most exotic cryptos are plain weird and have no value beyond novelty (meme coins like Garlicoin (GRLC), a coin for lovers of garlic, is a classic example). So, use fundamental analysis to ask:

Project mission and utility: What problem does it solve?

Team and leadership: Are they experienced and transparent?

Tokenomics: How is the token distributed and used?

Partnerships and adoption: Is it gaining traction?

Regulatory risks: Is it compliant or facing legal hurdles?

On-Chain Analysis

This method dives into blockchain data to establish details like how many people are using the network, how active wallets are, how much crypto is being moved, and whether big investors (called “whales”) are buying or selling. Here, you would seek to find answers to questions like:

Active wallet count: More users = more network health

Transaction volume: High volume = strong usage

Whale activity: Big buys or sells can move the market

Staking and holding trends: Are people locking up tokens or dumping them?

Example in Action

Let’s say you’re comparing Ethereum (ETH) and Solana (SOL).

With Fundamental Analysis, you might notice Ethereum has a massive developer ecosystem, supports thousands of decentralized apps (dApps), and is transitioning to a more energy-efficient model (proof-of-stake). Solana, meanwhile, boasts faster transaction speeds and lower fees, but has faced some network outages.

With On-Chain Analysis, you could look at Ethereum’s high transaction volume and steady growth in active wallets. If you see whales accumulating ETH while SOL is being sold off heavily, that might influence your decision.

Futures and Perpetuals Explained

You may have heard either of these terms mentioned in a trading context and wondered what they meant. Let’s unpack what they mean:

Futures

There are contracts dated for a future point in the future, when a contract will be actioned to buy or sell an asset at a set price on a set date. For example, you may have heard of a term like “March BTC futures.” You don’t need to touch the underlying coin; your trade is simply actioned at the projected future price on that date.

Perpetual futures (“perps”)

These are futures with no expiry. Because there’s no settlement date to force prices back to spot, exchanges use a funding rate, a small, periodic payment between longs and shorts, to keep the perp price anchored to an external index/mark price (a basket of spot prices across venues). How it works, in practice:

If the perp trades above spot, funding turns positive and longs pay shorts. This discourages crowded longs and pulls the price toward the spot.

If the perp trades below spot, funding turns negative and shorts pay longs—nudging bears to back off.

Funding is charged at set intervals (commonly every 8 hours). The payment = position notional × funding rate for that interval.

Funding is variable: it can spike during volatility, flip sign intraday, and differ by exchange/pair.

Liquidations and P&L are usually based on the mark price (index-derived) to reduce manipulation, not the last traded price.

How to Use Risk Management and Position Sizing

I can tell you that a good way to approach crypto trading when you start is to aim to survive long enough to let your skill compound. That means capping losses, sizing positions by risk (not by “how confident you feel”), and running a playbook you can repeat on autopilot.

The harsh reality of trading is that even experienced professionals lose money on 40-50% of their trades. What separates successful traders from those who blow up their accounts is how much they risk on each position. Position sizing is the mathematical approach to determining exactly how much capital to allocate to any single trade based on your risk tolerance and account size.

The foundational rule most professional traders follow is never risking more than 1-2% of their total trading capital on a single trade. Other key risk management principles include:

Stop-loss orders: as we know, these are predetermined exit points that automatically sell if the price moves against you

Risk-reward ratio: Only take trades where potential profit is at least 2- 3x your potential loss

Portfolio allocation: Don't put all your capital into crypto, but diversify across asset classes

Avoiding overleveraged positions: Using borrowed money (margin/leverage) magnifies both gains and losses dramatically

Practical example

I had a $5,000 trading account and wanted to buy Cardano (ADA) at $0.50. Following the 2% risk rule, I knew I could only afford to lose $100 on the trade. I set $0.45 as my stop-loss—the price at which I would accept that the trade was wrong and exit. That meant I was risking $0.05 per ADA.

To calculate my position size, I divided my maximum risk of $100 by the $0.05 risk per coin. That gave me a position of 2,000 ADA tokens, or a total investment of $1,000.

Importantly, I wasn’t committing the full $5,000 in my account. I was sizing the trade so that if ADA fell to my stop-loss at $0.45, my loss would be exactly $100, not a devastating hit to my capital.

I also identified a profit target of $0.65, representing a $0.15 move in my favour. That gave me a 3:1 risk-to-reward ratio—risking $100 for a potential $300 gain. By trading this way, I accepted that I could be wrong several times in a row and still preserve enough capital to keep trading.

So when I look at the quadrants in the graphic below, what I had effectively done was place myself in the high win-rate, small position-size quadrant, which is designed for moderate but steady growth over time.

Tax and Legal Basics

I will repeat that this is not financial advice, but educational material. Tax rules are jurisdiction-specific and change all the time. Check your local authority’s guidance (e.g., IRS “Digital Assets,” CRA “Cryptoassets,” HMRC “Cryptoassets Manual”) or a qualified tax professional. For what it’s worth, I cover some of the accepted positions here:

Tax fundamentals (high level, not advice)

Taxable events often include: Selling crypto for fiat, swapping one coin for another, and spending crypto on goods/services. Each creates a capital gain/loss = proceeds − cost basis.

Income vs capital: You earn income at fair market value when received (winnings or earnings from staking yield, mining, referral bonuses, and interest). When you sell them later on and dispose of them, this action triggers a capital gain/loss from that basis.

Keep records: To stay on the right side of your tax authorities, make sure that you document every trade or transfer. Be sure to note date-time, asset, quantity, price in your reporting currency, fees, transaction IDs, wallet/exchange, and purpose (trade vs transfer). Send yourself these CSVs monthly, as your tax authority will most likely want to see this..

When in doubt, ask: For taxes or legal matters related to crypto, consult a qualified professional in your country.

Security Checklist and Fraud Avoidance

Crypto crime keeps evolving; 2025 has already seen multi-billion-dollar losses, led by the Bybit hot-wallet breach (≈$1.5B), while researchers note a shifting focus among attackers toward wallets and users, not just code. Read our article on crypto scams here.

Security is a process, not a product. Layer your defenses (device, account, wallet, protocol). When working on the internet, always assume links are traps until proven otherwise, and cap position sizes so that one bad click or one hot-wallet incident can’t take you out. I understand this sounds scary and dire, but it is a reality of crypto trading. Here are some other safety tips:

Phishing and social engineering (biggest real-world risk)

Bookmark exchange or wallet URLs. Never click links from DMs, ads, or “support” emails.

Set an anti-phishing code in exchange settings. Verify it appears in official emails.

Use a password manager + TOTP app or hardware key (avoid SMS).

Assume urgent messages about “withdrawal holds,” “airdrop claims,” or “security updates” are bait.

Smart-contract and dApp risks

Prefer audited protocols with active bug bounties. Read the latest audit date (fresh audits are better than old ones).

Check admin powers (upgradeability, pause, mint) and whether control sits with multisig (who are the signers?)

Before signing, simulate the tx (many wallets or scan tools show “Transfer From You?” warnings).

Rug pulls and “rug-check” habits.

Verify the token contract by analyzing that it is on the correct chain from a verified source.

Look for liquidity lock or vesting. Beware of large unlocked insider wallets and steep emissions/unlocks.

Cross-check listings and Total Value Locked (TVL) on neutral aggregators. Don’t trust a project’s own numbers; verify them on independent data sites. In crypto, “neutral aggregators” are third-party trackers (e.g., CoinGecko/CoinMarketCap for listings, DeFiLlama for TVL) that compile data across many exchanges and chains.

DeFi Basics for Traders (Pools, AMMs, Impermanent Loss)

Decentralized Finance (DeFi) represents a fundamental shift in how cryptocurrency trading works. Instead of placing orders on a traditional exchange with a central order book, DeFi platforms use automated market makers (AMM) and liquidity pools, essentially robot market makers powered by smart contracts. This system allows anyone to trade 24/7 without relying on a centralized company, and it creates opportunities for traders to earn passive income by serving as liquidity providers.

However, this new model introduces risks that don't exist in traditional trading, most notably impermanent loss. A liquidity pool is a smart contract that holds two cryptocurrencies and enables traders to swap them. For example, an ETH/USDC pool might hold $1 million in Ethereum and $1 million in USDC. When you want to trade ETH for USDC on a platform like Uniswap or PancakeSwap, you're not buying from another trader; you're buying from this pool.

The AMM algorithm automatically adjusts prices based on the pool's asset ratio. As people buy ETH, the pool has less ETH and more USDC, so the algorithm raises ETH's price as a balance. Anyone can deposit equal amounts of both tokens into these pools to become a liquidity provider (LP) and earn a share of trading fees, typically 0.25-0.3% per trade.

When trading on a traditional exchange, you buy and sell from other traders. DeFi is different because you trade through a DEX.

What Is the Psychology of Trading and Journaling?

Most crypto losses don’t come from bad charts. They come from good charts traded badly. Your job is to keep emotions from hijacking execution. That means a repeatable process, small fixed risk, and a journal that shows (in black and white) what works and what leaks.

Navigating the volatile world of crypto requires more than just knowing how to read charts; it demands mastering your own mind. The Psychology of Trading refers to the emotional and mental state that influences your decision-making, and Journaling is the tool you use to manage it. These emotions lead to common mistakes:

Fear of Missing Out (FOMO): This drives traders to enter a coin late, usually at a high price, simply because they see it going up quickly, abandoning their strategy.

Fear of Loss (FOLO): This causes traders to sell a coin too early, locking in small gains, or to hold a losing position for too long, hoping it will recover, thereby turning a slight loss into a large one.

Overconfidence: After a string of winning trades, traders often increase their position size beyond their risk limits, breaking their own rules, which can lead to catastrophic losses on the next trade.

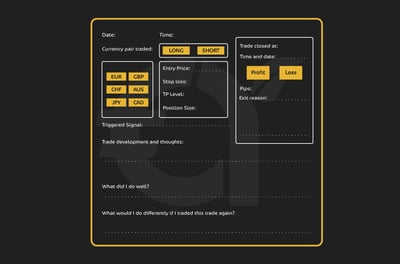

The Power of Trading Journaling

A trading journal is your defense against emotional trading. It turns subjective feelings into objective data, forcing you to confront your own biases and stick to your rules.

Before the Trade (The Plan): Document why you are taking the trade.

Entry Price: At what price will you enter?

SL: Where is your pre-determined exit if the trade goes wrong?

TP: What is your target price?

After the Trade (The Review): Record what actually happened and, crucially, how you felt.

Emotional State: Did you feel euphoria (greed) when the price ran up, or panic (fear) when it dropped?

Deviation from Plan: Did you move your stop-loss or take profit too early? Why?

Lessons Learned: What is the single biggest takeaway from this trade?

I would advise that you journal throughout your crypto trading journey. Even though crypto is a relatively recently established market, journaling has been around for decades. Here’s a graphic of a basic trading journal in the FOREX market:

Practical Example Without JournalingNow contrast this with an unjournalized trade. You see Dogecoin pumping 40% on Twitter/X hype, impulsively buy at the peak without an exit plan, it immediately dumps 20%, you hold hoping it recovers (no stop-loss), and then panic-sell at a 25% loss when the hype dies.

Without a journal, you might repeat this pattern dozens of times. With journaling, you'd quickly identify that your Twitter/X-inspired FOMO trades have a 10% success rate, while your researched, planned trades succeed 60% of the time. That is a massive difference! This data-driven self-awareness is what transforms gambling into disciplined trading. The journal doesn't just track your money, it tracks your growth as a trader and exposes the psychological patterns sabotaging your success.

Advanced Tools and Platforms

In my opinion, understanding how to use the best crypto platforms in the market gives you the best chance to be successful. Here are some important tools to help you as you go along:

Charting (e.g., TradingView)Use charting software for clean levels, alerts, and repeatable templates. Build layouts by timeframe (D/W for bias, 4H for setup, 15m for execution). Save a template with MA20/50/200, RSI, and volume. Add horizontal S/R and alert on crossing or breaking & closing above/below key levels. TradingView’s Pine Script lets you codify rules (e.g., alert only when candle closes above the 50-EMA and RSI>50). Keep the screen minimal. Indicators serve the level, not the other way around.

Paper trading (dry runs that matter)Rehearse your playbook before risking capital. Track fees, spread, slippage, and funding in the notes so your paper P&L resembles reality. Paper-trade one setup (e.g., breakout-retest) for 30–50 iterations. If the expectancy is positive, go live at half size for the first two weeks.

Scanners and alertsScanners surface candidates, while your plan decides which entries to include. Useful filters include when the price crosses MA20/50/200, RSI leaving <30/>70, volume > 2× 20-day avg, new 20/50-day highs, funding spikes, OI changes (derivs), and correlation to BTC/ETH (to avoid overexposed baskets). Route signals to alerts (app, email, webhook).

Portfolio trackers and journalingUse a tracker to consolidate CEX/DEX wallets (read-only API keys) and export tax lots. Tag trades by setup (Trend/Breakout/Mean-rev) and record R-multiple, costs, and notes. Remember to reconcile monthly with exchange CSVs.

Bots & automation (use safely or not at all)Bots can execute your rules 24/7 (DCA, grid, trend-following, hedging), but they also execute your mistakes faster.

Conclusion

I recommend that you take seriously the maxim that crypto trading rewards process, not bravado. Markets run 24/7, volatility is the norm, and costs (spread + fees + slippage + funding/gas) compound quietly. Your edge is a repeatable workflow. You should pick a reputable exchange, secure accounts (2FA, allowlists, hardware wallet), understand spot vs. derivatives, and treat technical/on-chain signals as evidence, not prophecy.

Risk is the lever you control. This means you should size positions by a fixed fraction of equity, place stops where the thesis fails, target ≥2:1 reward, cap total open risk, and enforce drawdown brakes. Journal every trade you make – yes, every trade. Review weekly, and scale only what your data proves. If you follow these, admittedly detailed, tips and pointers, you could have a long and successful crypto trading career.

FAQ

Start small, think $100–$500, to learn execution without tuition-sized losses. Risk a fixed 0.5%-1% of account equity per trade and focus on majors (BTC/ETH), where spreads and slippage are lower.

Use limit orders for entries (cheaper, more control) and attach an OCO bracket (take-profit + stop-loss) immediately after fill—reserve market orders for small, urgent trades in deep pairs.

No. Leverage magnifies both P&L and mistakes. If you must, keep it ≤3x, use an isolated margin, and place a hard stop so your liquidation price is far away from normal noise.

Spot = you own the coins (24/7, on-chain use). CFDs = synthetic exposure with easy long/short and overnight financing (jurisdiction-dependent). ETFs = regulated brokerage exposure with an expense ratio, no on-chain utility, and market-hours trading only.

Prioritize security (proof-of-reserves + liabilities, cold storage, 2FA/hardware-key support), regulation and jurisdiction, deep liquidity on the pairs you trade, clear fee schedules, and reliable fiat on/off-ramps. Keep a pre-funded backup exchange.

Hot wallet for small, active use, and a hardware wallet for savings. Enable TOTP/hardware-key 2FA, withdrawal allowlists, and test every first transfer with a tiny amount. Never type or store your seed phrase online.

Typically, trading/selling/swapping triggers capital gains/losses. Staking/mining/airdrops are income when received (later disposals then create gains/losses). Keep meticulous records (dates, amounts, cost basis, fees). Rules vary by country. Be sure to verify with your local tax authority or a qualified professional.