Table Of Contents

- The pace of change

- The Rise of Technology Stocks: Powering the Future

- Artificial Intelligence: Investing in the Future of Our World

- Green and Sustainable Technologies: The New Frontier

- Microchips and Processors: The Heartbeat of Modern Technology

- Cloud Computing: The Backbone of Digital Transformation

- How to Start Investing in Future Technologies

- The Bottom Line

The Top Emerging Technologies in Which to Invest in 2026

Sometimes, it’s hard to appreciate how fast our world is changing. The rate at which new technologies enter the world is enough to get your head spinning. With all this new technology comes the opportunity to ride the wave and invest in the companies.

That’s why our investing experts at Arincen decided to write an article to help educate retail investors on the key emerging technologies that will likely shape the global economy's future. We will explore the industries driving this transformation, provide examples of leading companies in each sector, and explain why now is the perfect time to invest in these future-oriented stocks.

Understanding these technologies is crucial for making informed investment decisions if you're looking to diversify your portfolio or capitalize on the next big trend.

Rapid innovation in artificial intelligence green technologies semiconductors and cloud computing is reshaping industries

Artificial intelligence is transforming healthcare finance transportation and other sectors with companies in software and hardware development well positioned to benefit

Green and sustainable technologies such as electric vehicles, renewable energy and energy storage are expanding as governments and consumers push for lower emissions

Microchips and semiconductors are the foundation of modern technology

Cloud computing enables digital transformation by providing scalable infrastructure for businesse,s with large providers driving significant revenue growth

These emerging sectors offer high growth potential but carry risks including high valuation,s rapid competition, supply chain challenges, and regulatory shifts

Investors can access these technologies through individual stocks or diversified funds like ETFs and mutual funds focused on A,I green tech, cloud computing, or semiconductors

Successful investing in emerging technologies requires staying informed about industry trends, regulatory changes and managing risk with portfolio diversification

The pace of change

From artificial intelligence revolutionizing decision-making processes to green technologies leading the charge in combating climate change, innovations like these set new standards for how businesses operate and consumers interact with products and services.

As traditional industries adapt to these technological advancements, the growth opportunities are unprecedented, with sectors like cloud computing, microchips, and sustainable technologies poised to lead the next wave of economic expansion in global stock markets.

The potential for these emerging technologies to drive significant growth in the coming years cannot be overstated. Companies around the globe are heavily investing in research and development, which is accelerating the pace of innovation and creating new markets while expanding existing ones. You only have to think how artificial intelligence (AI) has permeated so many of everyday products you use.

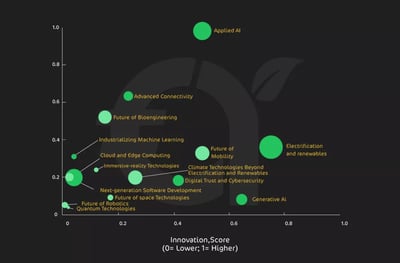

This presents a unique opportunity for retail investors to tap into the early stages of these transformative trends. By investing in companies at the forefront of technological advancements, you can benefit from the exponential growth these sectors are expected to deliver.We’ve broken down the five most attractive industries and will give you a peek into what’s happening in them. Here’s a graphic that describes major tech trends:

The Rise of Technology Stocks: Powering the Future

The technology sector has become a cornerstone of the global economy, consistently driving market growth and setting the pace for innovation across industries. Over the past decade, tech stocks have outperformed many other sectors and played a pivotal role in lifting the broader market.

Even amid economic uncertainties, the consistent performance of these stocks shows their resilience and the central role technology now plays in our lives. From transforming how we communicate to revolutionizing entire industries, technology companies are at the forefront of change, offering investors like you unparalleled growth opportunities.

Although there are many examples of ragingly successful companies, we’ll briefly discuss only one of them. After all, this article is about the sectors and not the companies that are hot right now. One of the standout performers in this sector is Apple. Known for its continuous innovation in consumer electronics, Apple has consistently pushed the boundaries of technology. Beyond its iconic products, like the iPhone and Mac, Apple is now expanding into new areas such as augmented reality (AR). This commitment to innovation ensures that Apple remains a dominant force in the tech sector. As an investor, this is how you should be viewing these companies – as a potential vehicle to your financial success..

Why Technology Stocks Now?

The relentless pace of digitalization, the rapid expansion of e-commerce, and the increasing importance of global connectivity have all converged to create a fertile environment for technology stocks. As more aspects of daily life and business operations move online, the demand for advanced technology solutions grows exponentially. This digital transformation is not just a trend but a fundamental shift in how the world operates, ensuring that technology remains at the heart of economic growth for years to come.

Some analysts believe we are in a technology stock bubble, but these voices tend to be in the minority, with most experts expecting continued stellar performance from tech companies. Investing in technology stocks now means positioning yourself at the forefront of this ongoing transformation.

These companies are not only leading the charge in creating the tools and platforms that will define the future, but they are also ready to capture significant market share as digital adoption continues to rise. This sustained growth potential for retail investors makes tech stocks an essential component of any future technology stock portfolio, offering both stability and the promise of strong returns in an increasingly digital world.

Pros of Investing in Tech Stocks

High Growth Potential:

Tech companies often experience rapid growth, leading to significant returns on investment.

Innovation and Disruption:

Tech stocks are typically at the forefront of innovation, which can result in groundbreaking products and services.

Market Leadership:

Many tech companies dominate their respective markets, providing stability and long-term growth opportunities.

Global Reach:

Tech companies often have a global presence, diversifying revenue streams across different regions.

Resilience During Economic Downturns:

Certain tech sectors, like cloud computing and cybersecurity, may remain strong even during economic downturns.

Scalability:

Tech companies can scale quickly due to their ability to leverage digital platforms and global distribution networks.

Cons of Investing in Tech Stocks

High Volatility:

Tech stocks can be highly volatile, with prices often fluctuating significantly in response to market news or changes in investor sentiment.

Valuation Concerns:

Tech stocks are often priced at high valuations, which may not always be justified by their earnings or growth prospects.

Regulatory Risks:

Tech companies may face increasing scrutiny and regulation, particularly in areas like data privacy, antitrust, and taxation.

Competition:

The tech industry is highly competitive, with new entrants constantly emerging, which can erode market share and profitability.

Dependence on Market Trends:

Tech stocks are often heavily influenced by market trends and consumer preferences, which can change rapidly.

Technological Obsolescence:

Rapid technological advancements can render a company's products or services obsolete, leading to declining revenue and profitability.

Artificial Intelligence: Investing in the Future of Our World

AI is emerging as one of the most transformative technologies of our time, revolutionizing industries ranging from healthcare to finance to autonomous vehicles. Some people say it’s as consequential as the invention of the wheel. This might be hyperbolic, but there’s no denying that AI is a big deal.

AI’s ability to process vast amounts of data, learn from patterns, and make decisions autonomously drives significant advancements in how businesses operate and consumers interact with technology. The impact of AI is far-reaching, as it not only enhances efficiency and innovation across multiple sectors but also opens up entirely new markets and opportunities for growth.

One of the standout companies in the AI space is Nvidia. The company has established itself as a leader in AI hardware, particularly by developing powerful graphics processing units (GPU) that are essential for AI applications. These GPUs are the backbone of AI systems, enabling complex computations for deep learning, data analysis, and autonomous systems. Nvidia’s ongoing innovation in AI hardware has positioned it as a key player in the AI revolution and the single hottest stock anywhere in the world.

Why AI Stocks Now?

The adoption of AI is accelerating across consumer and enterprise applications, signaling that we are only at the beginning of AI’s growth curve. AI technologies are becoming increasingly integrated into everyday life, from voice assistants and recommendation engines to complex enterprise solutions that optimize business operations.

This widespread adoption and ongoing advancements in AI capabilities suggest that AI will continue to drive substantial market growth in the coming years. This makes now an ideal time for you to invest in AI-related stocks, as the sector is poised for sustained expansion and innovation. Investing in AI today offers the potential to capitalize on a technology that is not just shaping the future but is set to dominate it. If you want to read our article on how to get started with investing in stocks, go here.

Pros of Investing in AI Stocks

High Growth Potential:

The AI industry is rapidly expanding, with significant opportunities for growth as AI technologies become more integrated into various sectors.

Wide Range of Applications:

AI is being adopted across diverse industries, including healthcare, finance, manufacturing, and automotive, leading to multiple revenue streams.

Innovation and Leadership:

Companies at the forefront of AI innovation can establish themselves as market leaders, potentially delivering strong long-term returns.

Increased Efficiency:

AI technologies drive efficiency and productivity gains, making companies that leverage AI more competitive and profitable.

Strategic Importance:

AI is considered a key technology for the future, with governments and large corporations heavily investing in its development and adoption.

Global Impact:

AI has the potential to transform global markets and economies, offering opportunities for growth beyond traditional industries.

Cons of Investing in AI Stocks

High Volatility:

AI stocks can be highly volatile due to the speculative nature of the technology and its perceived future potential.

Regulatory Risks:

As AI becomes more prevalent, it may face increased regulation concerning data privacy, ethics, and employment impacts, which could affect profitability.

Technological Uncertainty:

AI is a rapidly evolving field, and the success of specific technologies or companies is uncertain, leading to potential investment risks.

Ethical and Social Concerns:

The ethical implications of AI, such as job displacement and decision-making transparency, could lead to public backlash or regulatory restrictions.

High Valuations:

Many AI companies are valued based on future potential rather than current earnings, which can lead to overvaluation and market corrections.

Intense Competition:

The AI industry is highly competitive, with numerous companies and startups vying for dominance, which could dilute market share and impact profitability.

Green and Sustainable Technologies: The New Frontier

The world is currently undergoing a significant shift toward sustainability. This shift is driven by the urgent need to address climate change and reduce carbon emissions. Governments, corporations, and consumers are increasingly recognizing the importance of green technologies in creating a more sustainable future.

This global movement has sparked a growing demand for innovative solutions to reduce environmental impact, leading to a surge in investment opportunities within the green-tech sector. As the transition to a low-carbon economy accelerates, green technologies are helping to mitigate climate change and are emerging as powerful drivers of economic growth.

One of the most prominent examples of this trend is Tesla. The company has revolutionized the automotive industry with its EVs, leading the global shift away from fossil fuels. Tesla’s commitment to sustainability extends beyond EVs, as the company also plays a significant role in the energy sector through its solar power and energy storage solutions.

However, as we will explain in the pros and cons section, Tesla’s position of market dominance is under threat from Chinese competitors like BYD. Not only that, at the time of writing, EV sales globally were unstable as demand for EVs was softening. Despite that, Tesla’s influence on the automotive and energy sectors underscores the vast potential of green technologies to reshape industries and contribute to a more sustainable world.

Why Are Green Stocks Hot?

The current landscape presents a great moment for investing in green and sustainable technologies. There is increasing regulatory support worldwide as governments implement policies to encourage the adoption of renewable energy, electric vehicles, and other green technologies.

Consumer demand for sustainable products is also growing as more individuals seek to reduce their environmental impact. These factors, combined with technological advancements and economies of scale, make the green tech sector an attractive option for long-term investment. As the world continues to prioritize sustainability, investing in green technologies now offers the potential for significant returns while contributing to a more sustainable future.

Pros of Investing in Green and Sustainable Stocks

It’s Good for the Planet:

Investing in green stocks supports companies focused on sustainability, contributing to environmental conservation and the fight against climate change.

Growing Market Demand:

As awareness of environmental issues rises, demand for green and sustainable products and services is increasing, driving potential growth in these stocks.

Government Support and Incentives:

Many governments offer incentives, subsidies, and favorable policies for green and sustainable companies, which can enhance profitability.

Long-Term Growth Potential:

Sustainable practices are becoming essential for future business success, positioning green companies for long-term growth and stability.

Diversification:

Green stocks offer a way to diversify an investment portfolio, especially in sectors like renewable energy, electric vehicles, and sustainable agriculture.

Aligning with Values:

Investing in green stocks allows investors to align their portfolios with their personal values and ethical beliefs.

Cons of Investing in Green and Sustainable Stocks

High Volatility:

Green stocks can be volatile due to their reliance on emerging technologies and regulatory environments, leading to fluctuations in stock prices.

Regulatory Risks:

Changes in government policies, such as the reduction or removal of subsidies, can negatively impact the profitability of green companies.

Market Uncertainty:

The green and sustainable sector is relatively new and still evolving, leading to uncertainties in long-term profitability and market leadership.

Higher Valuations:

Green stocks often trade at high valuations due to their growth potential, which may not always be justified by current earnings.

Technological Risks:

The success of green companies often depends on new technologies, which may not always succeed or be adopted widely, leading to potential investment risks.

Limited Track Record:

Many green companies are relatively young and may have limited financial histories, making it harder to assess their long-term viability and stability.

Microchips and Processors: The Heartbeat of Modern Technology

Microchips and processors are the foundational components of nearly every technology that powers our modern world. From the smartphones in our pockets to the massive data centers that run the internet, these tiny-but-powerful chips are integral to the functionality of countless devices and systems.

The importance of microchips extends across industries, making them a critical element in everything from consumer electronics to automotive manufacturing to advanced scientific research. As the demand for technology continues to expand, the role of microchips and processors in driving innovation and enabling new applications simply grows and grows.

The global chip shortage that has emerged in recent years has underscored these components' critical role in the global economy. Supply-chain disruptions and soaring demand have led to significant shortages, impacting the production of everything from cars to gaming consoles. This shortage has highlighted the vulnerability of supply chains and the essential nature of chip manufacturing, making it a focal point for future investment. As industries and governments alike work to address these challenges, the companies leading the way in chip development and production are poised to benefit from increased demand and investment. As a retail investor, there’s never been a better time to catch the microchip train!

Why Microchips and Processors Now?

The increasing demand for computing power, driven by trends such as cloud computing, artificial intelligence, and the Internet of Things (IoT), makes the microchip and processor sector a prime area for investment.

The ongoing global chip shortage has further intensified the focus on chip production, highlighting the strategic importance of this industry. As digital infrastructure continues to expand, the need for powerful, efficient processors will only grow, making companies like Intel, AMD, and Nvidia crucial to the future of technology. Investing in this sector now gives you an opportunity to capitalize on the rising demand for cutting-edge computing solutions.

Pros of investing in microchips and processors

High Growth Potential:

The demand for microchips and processors is growing rapidly due to advancements in technology, including AI, IoT, cloud computing, and 5G networks. Companies in this sector often experience strong revenue growth.

Industry Essential:

Microchips and processors are critical components in nearly all modern technology, making the sector essential across various industries (automotive, healthcare, consumer electronics, etc.), ensuring consistent demand.

Innovation-Driven:

The sector is characterized by constant innovation, leading to new products and technologies that can drive stock prices higher.

Global Market:

The microchip and processor industry is globally diversified, providing exposure to international markets and economies, which can help mitigate the risks associated with any single market.

Potential for High Returns:

Successful companies in this space, such as Nvidia or AMD, have provided significant returns to investors, especially during periods of high demand for their products.

Cons of investing in microchips and processors

High Volatility:

The sector can be highly volatile, with stock prices reacting sharply to changes in technology trends, competition, and supply-chain issues.

Supply-Chain Risks:

The microchip industry is sensitive to supply-chain disruptions, which have been highlighted during global events like the COVID-19 pandemic. These disruptions can lead to production delays and impact company revenues.

Intense Competition:

The sector is fiercely competitive, with companies constantly striving to out-innovate each other. This can lead to price wars, reduced margins, and fluctuating stock prices.

It’s Capital-Intensive:

The development and production of microchips are highly capital-intensive, requiring significant investment in R&D and manufacturing facilities. Companies may face financial strain, especially during downturns.

Regulatory and Geopolitical Risks:

The industry is subject to regulatory changes, including export restrictions, especially concerning technology transfer to certain countries. Geopolitical tensions, particularly between the U.S. and China, can also impact the sector.

Cyclical Nature:

The semiconductor industry is cyclical, with periods of high demand followed by downturns. Investors need to be prepared for potential fluctuations in stock prices during these cycles.

Cloud Computing: The Backbone of Digital Transformation

Cloud computing has become the essential foundation for modern digital businesses, enabling various functions from remote work and collaboration to massive data processing and storage. The ability to access computing resources on-demand, scale operations quickly, and reduce IT costs has made cloud services indispensable for companies across all industries.

As businesses continue to digitalize, the role of cloud computing in driving innovation, efficiency, and growth has only become more clear. This technological shift is not just a trend but a fundamental change in how companies operate and compete in the global market. As recently as a few years ago, the word “cloud computing” was a term for IT nerds, but now everyone knows about it. Here are some important facts about the sector.

Headline Cloud Computing Statistics for 2026

12-month revenues between the start of 2021 and 2022 for cloud infrastructure services reached $191 billion.

AWS had the largest market share of cloud infrastructure services at 33% in Q1 2022.

Microsoft Azure had a market share of 22% in Q1 2022, with Google at 10% and all other companies at 35%.

In total, Amazon, Microsoft, and Google accounted for 66% of the cloud market at the start of 2023.

Public cloud Platform-as-a-Service (PaaS) revenue in 2022 was $111 billion.

The cloud market is projected to be worth $376.36 billion by 2029.

It’s estimated that the world will store 200 zettabytes (2 billion terabytes) in the cloud by 2026.

The average cloud user spends around $400 monthly for a single server. Hosting the entire back-office infrastructure costs an average of $15,000 per month.

Just 11% of organizations have encrypted between 81-100% of the sensitive data they store in the cloud.

Why Cloud Computing Now?

The shift to cloud-based services shows no signs of slowing, especially as businesses increasingly recognize the benefits of the cloud's scalability, flexibility, and cost efficiency. The COVID-19 pandemic started this shift, pushing even more companies to adopt cloud solutions to ensure business continuity.

It goes without saying that the cloud computing sector is poised for continued growth, making now a great time for investors like you to capitalize on this trend. With their leading positions in the cloud market, companies like Amazon and Salesforce offer significant investment potential as the backbone of the ongoing digital transformation. Investing in cloud computing now provides an opportunity to be part of a sector that is vital today and will continue to shape future tech stocks and business operations worldwide.

Pros of Investing in Cloud Computing Stocks

Growth Potential:

The cloud computing industry is expanding rapidly, driven by the increasing demand for digital transformation, data storage, and remote working solutions. Companies in this sector often experience high growth rates.

Resilience and Stability:

Cloud services have become essential for businesses of all sizes. This creates a stable revenue stream for cloud companies, even during economic downturns, making them relatively resilient investments.

Innovation and Technology Leadership:

Cloud computing companies are often at the forefront of technological innovation, offering new services and improving efficiency. This can lead to significant competitive advantages and long-term profitability.

Diversification:

Investing in cloud computing can diversify a portfolio, particularly if an investor is already focused on traditional industries. The tech sector often behaves differently from other sectors, helping to balance risks.

High Margins:

Many cloud computing companies operate with high-profit margins due to the scalability of their services. This can lead to strong financial performance and potentially higher returns for investors.

Cons of Investing in Cloud Computing Stocks

Valuation Risks:

Cloud computing stocks can be highly valued, often trading at high PE ratios. This can make them more vulnerable to market corrections or changes in investor sentiment.

Market Saturation:

The cloud computing industry is highly competitive, with major players like Amazon, Microsoft, and Google dominating the market. Smaller companies may struggle to compete or maintain market share, which can affect their stock performance.

Regulatory and Security Risks:

Cloud companies face significant regulatory scrutiny, particularly concerning data privacy and security. Breaches or changes in regulations can lead to increased costs or damage to reputation, impacting stock prices.

Technological Changes:

The tech industry is rapidly evolving, and new innovations could disrupt existing cloud models. Companies that fail to adapt may see their growth stagnate, negatively affecting their stock performance.

Market Volatility:

Technology stocks, including cloud computing companies, can be more volatile than other sectors. Price fluctuations can be significant, making these investments riskier, especially for those with a low-risk tolerance.

How to Start Investing in Future Technologies

Investing in future tech stocks offers exciting growth opportunities, but it’s important for you to approach these investments with a strategic plan. One of the simplest ways to begin is by buying individual stocks of companies that are leaders in such sectors as artificial intelligence, green technologies, cloud computing, and microchips.

If you are looking for broader exposure without the need to pick specific stocks, sector-specific ETFs or mutual funds are excellent options. These funds pool investments into a basket of companies focused on specific industries, providing diversification and reducing the risk associated with single-stock investments. For example, ETFs that focus on technology, AI, or renewable energy can expose you to a wide range of companies driving innovation in these fields.

Staying informed is crucial when investing in rapidly evolving sectors. Keeping up with market trends, regulatory changes, and technological advancements will help you make informed decisions. Following financial news, subscribing to industry reports, and engaging with investment communities can provide valuable insights.

As we’ve said, investing in emerging technologies is not without risks. Market volatility can be higher in these sectors, as they often involve companies still in the growth phase and can experience rapid changes in valuation. Regulatory hurdles, such as government policies or international trade issues, can also impact the success of these technologies. Additionally, technological obsolescence is a real concern.

However, if you know anything as a retail investor, it’s that diversification is key to managing these risks. Spread your investments across different sectors and companies to minimize exposure to any area.

The Bottom Line

The opportunity to invest in the future has never been more promising. The rapid evolution of artificial intelligence, green technologies, cloud computing, and microchips is reshaping industries and creating new frontiers for growth. Not only that, there’s never been a bigger information boom, so you will always be able to do your research.By embracing these innovations today, you position yourself to ride the wave of tomorrow's breakthroughs. If you adopt the advice we always give, which includes working with a regulated stockbroker and going forward with a strategic investment plan, you could be on your way to being able to harness the potential of these transformative technologies and invest in the world of tomorrow.

FAQ

Artificial intelligence, green technologies, cloud computing, and microchips are the key emerging technologies that will significantly influence the future economy.

The ongoing digital transformation, driven by rapid technological advancements and increasing global connectivity, creates a fertile environment for growth in tech stocks, making it an ideal time for investment.

They support environmental conservation, align with growing market demand for sustainability, and benefit from government incentives, positioning these stocks for long-term growth.

AI is revolutionizing industries like healthcare, finance, and autonomous vehicles by enhancing efficiency and creating new markets. Investing in AI offers the potential for substantial market growth as AI becomes increasingly integrated into everyday life.

Microchips and processors are essential to modern technology, powering everything from consumer electronics to advanced scientific research. The increasing demand for computing power and the ongoing global chip shortage make this sector a prime area for investment.

Risks such as high volatility, regulatory challenges, rapid technological obsolescence, and intense competition, which can impact the profitability and stability of tech investments.

You can start by buying individual stocks of leading companies in emerging sectors or by investing in sector-specific ETFs or mutual funds for broader exposure. It also emphasizes the importance of staying informed and diversifying investments to manage risks effectively.