From IPO to Stock Market Champions: The Rise of Big Tech Firms

Key Findings

As a stock trader, if you invest in the right company at the IPO stage, you often have the potential to make significant gains as the company grows from its early stages into a major player in its industry.

Very few investments will be an overnight success. Viewing investments from a long-term perspective is vital, as it allows you to ride out volatility and benefit from the long-term growth trajectory of your chosen companies.

Diversify beyond high-profile stocks. Yes, the stock market giants are appealing, but there are many other viable growth options in the market. Diversification in an investment portfolio is never a bad idea.

The success of companies often hinges on the quality of their overall management. While we know about visionary leaders like Steve Jobs, all levels of company management must be strong to lead it to success through innovation and resilience.

Many companies with a long record of solid performance have demonstrated the ability to withstand economic downturns and market shocks, proving that resilience is a critical factor for long-term investment success.

Companies that consistently innovate or disrupt traditional industries tend to create substantial value for shareholders, as shown by Tesla's impact on the automotive industry and Amazon's on retail and cloud computing.

There is no guarantee of future returns. Past performance is not indicative of future returns. You must always thoroughly analyze the companies you invest in through technical and fundamental research.

Strong leadership and strategic vision have played a pivotal role in turning IPOs into iconic big‑tech stocks.

Apple’s IPO valuation approached $1.8 billion and its long‑term success has been anchored by successive visionary leaders.

Microsoft’s transformation under leadership change, from software to cloud and AI, has driven its market dominance.

Stock price growth often correlates with a company’s ability to innovate and expand

Strategic acquisitions such as LinkedIn and GitHub have strengthened Microsoft’s ecosystem and influenced investor confidence.

Tesla’s five‑year return exceeded 900%, highlighting both its disruptive business model and market-leading integration.

Investors should view IPOs as the start of a long‑term journey rather than quick profit chances.

Evaluating executive leadership, market positioning, growth drivers, and historical resilience helps identify companies that can become market champions.

From IPO to Stock Market Champions: The Rise of Big Tech

What do we like about investing in stocks? Besides the potential profits and the thrill of playing in a dynamic market, there is something to be said about watching a company start from humble beginnings and do well.

As stock owners, we are not just watching from afar; we are taking an active stake in the fortunes of the companies in which we buy shares. No matter how small our stake is, we have an influence.

Like anything in life, it’s always good to take a step back and view things from a different perspective. This article is meant to do just that – we will look at some of the most profitable public companies in the world and chart their progress from often humble beginnings to the juggernauts they are today.

Why? Because every young stock you invest in today could be wildly successful in a few year's time. It’s good to look at the transformative possibilities of a company that does well. We’ll start with the Initial Public Offering (IPO) and track the stocks all the way to the present day.

Focusing on these stocks does not mean they are the only growth options. There are many great stocks out there; it's just that these are the most high-profile. Additionally, although we cover US stocks, there are many prestigious bourses around the world with their own success stories. Finally, this article is not meant to be investment advice; it’s a taste of how alluring these stocks can be. Past performance is no guarantee of future returns.

What is stock investing?

In case you didn’t already know, investing in the stock market involves purchasing shares of publicly traded companies. This offers you the opportunity to own a slice of these entities and perhaps share in their profits. You should note at this time that this article concentrates on direct share ownership, which is not the only way to invest in shares. You could also invest in shares through contracts for difference, but this investment type is not the focus of this article.

High-performing stocks often represent companies that consistently demonstrate strong financial performance, innovative products, or leadership in their respective industries, making them attractive for their ability to generate sustained growth and profitability.

What is an IPO?

These companies typically begin their journey with an IPO, which marks their transition from a private company to a public one. An IPO allows a firm to raise capital by selling shares to the general public for the first time, facilitating broader market investment.

This influx of cash is crucial for funding expansion, research and development, or debt reduction, thus setting the stage for future growth. By participating in an IPO, you gain the opportunity to buy into a company at what could potentially be the starting point of a period of strong returns. Why? An injection of public capital often provides the resources needed to propel the company to new heights.

It’s why you should pay attention to IPOs even now. It’s a chance to get in on the action as early as possible so you can potentially own shares in a company that grows from strength to strength. This is why you should do your own research, study the financial reports of these companies, and be on the lookout for sound investment advice. That said, it should come as no surprise that not all companies succeed on the stock market, which is why you need to do your research.

The Magnificent Seven

As a stock trader, you may have heard of these companies. The latest craze is to call the seven highest-profile stocks on US exchanges the “Magnificant Seven.” It’s a shorthand name for a clutch of major technology companies that have shown robust financial performance and also for their trailblazing innovations and dynamic leadership. The companies are:

Microsoft Corp. (MSFT)

Amazon.com Inc. (AMZN)

Meta Platforms Inc. (META)

Apple Inc. (AAPL)

Nvidia Corp. (NVDA)

Tesla Inc. (TSLA)

Each of these firms has consistently pushed the boundaries of technology and services, profoundly shaping their industries. We don’t have time to discuss all seven, but we have chosen four on which to concentrate for this article. We could have chosen any of them, but here are just a few reasons we selected the ones we did:

Apple's introduction of user-centric products like the iPhone and iPad has revolutionized personal technology and mobile computing.

Amazon has redefined retail with its vast online marketplace and pioneering work in cloud computing.

Microsoft's legacy in software innovation continues to expand into cloud services and artificial intelligence.

Tesla has disrupted the automotive industry with its electric vehicles and renewable energy solutions.

These companies have also demonstrated resilience in the face of market shocks—be they economic downturns, regulatory challenges, or technological disruptions—showing an impressive ability to adapt and thrive. This is not a slight on Meta, Alphabet, and Nvidia, who are all market leaders in their own right.

The cult of leadership

Leadership is a fascinating part of investing in large-cap stocks. One of the things you often hear is how you should measure the management of the companies in which you invest. As a casual investor, it is almost impossible to make a call on the management capabilities of a small start-up or an unfancied stock in an industry that is not as glamorous as technology.

Perhaps that’s why we pay attention to the personalities of massive companies whose leaders we can observe. Visionary leaders such as Steve Jobs (Apple), Jeff Bezos (Amazon), Bill Gates (Microsoft), and Elon Musk (Tesla) have been instrumental in steering their respective companies through periods of uncertainty and innovation. Some leaders, like Elon Musk, court controversy, adding to their appeal. Steve Jobs was revered as a business genius. Many of their actions generate headlines.

One thing to note is that their leadership styles, while distinct, share a common focus on long-term strategic goals, a commitment to innovation, and an ability to anticipate or create market trends that keep their companies at the forefront of the global economy.

These attributes make Apple, Amazon, Microsoft, and Tesla exemplary in the stock market, attracting investors drawn by the potential for significant growth and the excitement of being part of transformative enterprises.

In the following sections, we will take a deep dive into each company.

Apple Inc. (AAPL)

Apple Inc., renowned for its innovative products and visionary leadership, is an excellent example of corporate success in the technology sector. For this reason, the company’s market cap is often the highest in the world. It trades places with other members of the Magnificent Seven.

Since its inception, Apple has revolutionized multiple industries, from personal computing to mobile phones and digital music, largely due to the strategic vision of leaders like Steve Jobs and his successors. This visionary approach has not only entrenched Apple as a leading brand globally, but also made it one of the most bankable stocks in the market.

It’s probably hard to think of someone you know who doesn't own an Apple device. With a robust product ecosystem that continues to expand and adapt, Apple consistently demonstrates its capacity to lead market trends and deliver substantial returns to its investors, making it a go-to choice for those looking to secure a position in a high-performing stock.

IPO and Early Years

Apple Inc. launched its IPO in December 1980. Priced at $22 per share, Apple’s initial offering generated more capital than any IPO since Ford Motor Company in 1956, reflecting strong market interest. That interest has hardly ever waned since.

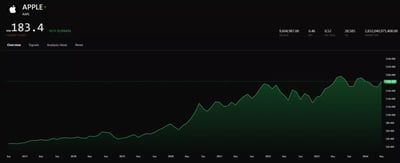

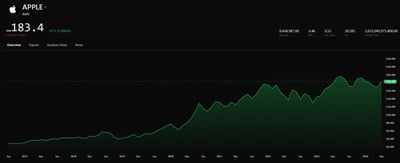

The company sold 4.6 million shares, valuing Apple at $1.778 billion, an unprecedented figure for a technology company at that time. Despite the successful IPO, Apple faced early challenges, including fierce competition in the personal computer market and internal disagreements over product strategies. These challenges were compounded by pressure to continuously innovate and expand its product line to sustain growth and investor interest. Here’s how the price of Apple stock has grown since its IPO:

Rise to Prominence

Apple's rise to prominence was helped by a series of groundbreaking product launches that reshaped entire industries. Yes, the company may have become synonymous with Steve Jobs's energetic product launches, but there has always been real quality behind the antics.

In 1984, the introduction of the Macintosh revolutionized personal computing with its graphical user interface and mouse, setting a new standard for usability. The launch of the iPod in 2001 marked Apple's expansion into portable music devices, turning the company into a major player in consumer electronics.

The 2007 release of the iPhone, a device that combined a phone, an iPod, and an Internet communicator, revolutionized mobile computing and telecommunications, while the iPad in 2010 solidified Apple’s role in defining the tablet market. Each of these products captured consumers' imaginations worldwide and entered Apple's stock into “Unicorn” territory even before the term became popular.

Challenges and Resilience

However, Apple's rise was not always trouble-free. Throughout its history, it has navigated numerous challenges, including leadership changes and intense market competition.

Steve Jobs' departure in 1985 led to a period of declining innovation and market share, but he returned in 1997 and steered Apple through a transformative revival. Under Jobs' leadership, Apple regained its competitive edge and launched its most successful products, which profoundly impacted technology and culture. It’s hard to imagine a business landscape without products featuring the ubiquitous half-bitten Apple logo.

The company's resilience was further confirmed by its ability to maintain innovation and market dominance even after Jobs’ death in 2011, amidst growing competition from companies like Samsung and Google.

Current Status

Today, Apple continues to lead in technology innovation and market position. Its recent launches, including the Apple Watch, AirPods, and various services like Apple TV+ and Apple Pay, have grown its ecosystem and revenue streams.

These innovations and regular updates to its core products like the iPhone and Mac help maintain its competitive edge and appeal to vast tracts of the global consumer base. For example, Apple is China's dominant mobile phone brand, a famously protectionist country.

Financially, Apple remains one of the most valuable companies in the world, with a stock performance that reflects strong investor confidence.

Apple is not going away any time soon. The company's strategic focus on developing integrated hardware and software solutions, commitment to privacy and security, and expansion into new service offerings continue to drive its growth and market leadership.

What does the future hold for Apple?

It’s hard to predict the future of any stock with absolute certainty. History is littered with stories of many companies that were too big to fail but did. Think of Enron and Lehman Brothers. We repeat, we are not giving investment advice in this article but merely collecting the sentiments of market experts to share a picture with you.

Over the last 5 years, Apple's stock has seen impressive growth, more than tripling in value. Between fiscal 2017 and 2022, Apple's revenue and earnings per share grew at compound annual rates of 11.5% and 21.6%, respectively, driving the stock's strong performance.

As always, one of the main drivers of this has been Apple's ability to introduce successful new products and services. While the iPhone remains Apple's largest business, accounting for 48% of revenue, the company has seen significant growth in its Services segment (App Store, Apple Music, and iCloud), which now makes up 26% of sales.

Apple has also navigated economic ups and downs well. During the COVID-19 pandemic, Apple's stock price initially declined but then rebounded strongly, hitting an all-time high of $180.73 in January 2022. Even with a 30% decline in 2022, Apple's stock is still up 297.91% over the past 5 years.

Peering into the future, many analysts are cautiously optimistic about Apple's ability to continue growing, though they note the company faces challenges as it becomes more mature.

Continued strength in services and potential new product categories, like augmented reality, will be key to driving further stock price appreciation. Overall, Apple has shown an ability to innovate and adapt, time and time again.

Amazon.com Inc. (AMZN)

Amazon, founded by Jeff Bezos, is the least glamorous company we will cover in this article. After all, it started as a modest online bookstore, which does not have the same appeal as electric cars or sleek computer products.

However, through shrewd management, the company has expanded into a behemoth that dominates multiple sectors, including ecommerce, cloud computing, artificial intelligence, and more.

This expansion has been driven by a relentless pursuit of broad-based consumer services and cutting-edge technology, marking Amazon as a company that continually pushes industry boundaries.

The company's aggressive growth strategy and its ability to constantly enter and transform markets make Amazon one of the most bankable stocks to buy. With a proven track record of financial performance and strategic acquisitions, Amazon offers its investors robust growth potential and a compelling investment narrative.

IPO and Early Years

Amazon.com launched its IPO in May 1997, with shares priced at $18 each. This strategic move came when the Internet was still new and just starting to transform traditional business practices. It wasn’t always the undisputed leader it is today.

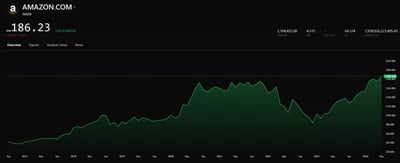

Despite early skepticism about its profitability, Amazon's focus on customer service and efficient logistics proved important in its evolution from a niche online retailer into a global ecommerce powerhouse. When the global pandemic arrived in early 2020, the ecommerce model Amazon had pioneered allowed much of the world to continue to run with a semblance of normalcy. Here’s how the stock has performed over time:

Expansion and Growth

Not content with being just an online bookstore, Amazon rapidly diversified its product lines, venturing into multiple new categories like electronics, apparel, and consumer goods, fundamentally changing retail dynamics.

This diversification strategy was critical in Amazon's transformation into a one-stop online shop, significantly enhancing its market share and revenue streams. In parallel, the development of Amazon Web Services (AWS) in 2006 marked a pivotal expansion into cloud computing. This was a shrewd move, and AWS is still a market leader today.

AWS provided scalable cloud solutions not only to businesses but also powered the infrastructure of Amazon's expanding online empire, becoming a major profit driver and solidifying Amazon’s role as a technology leader.

Economic and Market Influence

Amazon has shown resilience and strategic foresight during various economic downturns. During the dot-com bubble burst in the early 2000s, while many internet startups collapsed, Amazon survived through cautious financial management and by broadening its product base.

Even though that was a big challenge, more was to come with the 2008 financial crisis that tested Amazon’s resilience yet again. Still, the company emerged stronger, capitalizing on consumers' increasing preference for online shopping.

More recently, during the COVID-19 pandemic, Amazon experienced unprecedented growth as global lockdowns accelerated ecommerce adoption, proving its ability to adapt and thrive during market fluctuations and global crises.

Current Status

Amazon continues to explore such new markets as healthcare and grocery, reinforcing its reputation for innovation and aggressive expansion. The acquisition of Whole Foods in 2017 and the launch of Amazon Care, a healthcare service initiative for its employees, show the company’s appetite for combining traditional business models with technology.

The company's stock remains highly valued, reflecting strong growth prospects amidst ongoing investments in technology, logistics, and new service domains like artificial intelligence and autonomous delivery systems.

Where Will Amazon Stock Be in 5 Years?

Looking forward, Amazon is poised to further influence global commerce and technology with continuous improvements in customer service, logistics efficiency, and innovative technology applications.

Analysts expect cloud computing to continue its powerful growth, increasing at a double-digit annual rate. If Amazon can maintain its market share lead as it has in ecommerce, AWS should have many years of growth left ahead.

All things being equal, an exact answer is impossible, but with a strong competitive advantage in both cloud computing and ecommerce, some optimistic analysts believe the stock deserves to trade at an above-market multiple of 30 times earnings, otherwise known as a price-to-earnings ratio (P/E). Read our article about that measurement here.

Microsoft Corporation (MSFT)

It was not for nothing that former Microsoft CEO Bill Gates once said that his company produced “Infinite value.” Considering how it changed the business world forever, it may be true.

Microsoft Corporation has firmly established itself as a cornerstone of the global technology market. With a legacy that spans decades, the company has had a major say in what the modern workplace looks like through its Windows products.

This leadership has strategically steered the company through shifting technological landscapes, championing productivity tools that cater to both businesses and individual consumers. This strategic vision has not only sustained Microsoft's industry dominance but also bolstered its standing as one of the market's most reliable and bankable stocks, offering investors robust growth prospects and stability in a volatile economic environment.

IPO and Early Years

Microsoft's IPO in March 1986 marked a turning point in the software industry, pricing its shares at $21 and closing the day at $27.75, reflecting a robust market optimism. Over time, these shares created three billionaires and approximately 12,000 millionaires among company employees and solidified Microsoft's position in the growing PC software market.

Leveraging the popularity of its MS-DOS operating system, licensed notably to IBM and other PC manufacturers, Microsoft quickly established a dominant position. This early dominance was driven by strategic partnerships and an aggressive business philosophy that prioritized widespread software compatibility across diverse hardware platforms. Here’s how the stock has performed over time:

Technological Advancements

The launch of Windows OS in 1985 revolutionized the PC market by offering a more user-friendly graphical user interface than the command-line interfaces of the time. This was followed by the introduction of Microsoft Office in 1989. This powerful suite of productivity applications became essential for business and personal use worldwide. Today, you can hardly find a computer in any business around the world that does not have a Microsoft product.

Later, Microsoft ventured into cloud computing with the launch of Azure in 2010, which provided a robust platform for businesses to deploy applications and services on the cloud, directly competing with other giants like AWS.

Leadership and Strategic Shifts

Microsoft's trajectory has been significantly shaped by its leadership transitions. Bill Gates, the co-founder, handed over the CEO role to Steve Ballmer in 2000, marking a shift toward scaling new heights in business computing and software development.

Under Ballmer's leadership, Microsoft intensified its focus on consumer markets with products like Xbox and Bing. However, the most transformative shift came with Satya Nadella taking over in 2014, under whom Microsoft embraced cloud computing and AI technologies, redefining the company’s core business and driving significant growth in its stock and market valuation.

Current Status

Today, Microsoft is a leader in the technology sector, with a comprehensive product ecosystem that includes operating systems, cloud services, enterprise solutions, and consumer electronics.

Under Nadella's leadership, strategic acquisitions such as LinkedIn in 2016 and GitHub in 2018 have broadened Microsoft’s influence in social media, open-source software development, and professional collaboration.

The company’s stock continues to perform strongly, reflecting investor confidence in its ongoing innovation and market strategy.

Where will Microsoft be in the next five years?

Over the past 5 years, Microsoft's stock has delivered exceptional performance, significantly outpacing the broader Nasdaq Composite index, surging 219.18%, compared to a 114.78% gain for the composite.

The company's ability to innovate and introduce successful new products and services has driven this strong performance. Key to Microsoft's growth has been the continued success of its cloud computing platform, Azure, which has seen rapid adoption by enterprises.

Microsoft has also seen strong performance from its productivity software like Office 365 and Teams, benefiting from the shift to remote and hybrid work. In terms of navigating economic conditions, Microsoft has demonstrated resilience. During the COVID-19 pandemic, Microsoft's stock initially declined but then rebounded strongly, hitting new all-time highs.

Analysts remain bullish on Microsoft's prospects, citing the company's diversified revenue streams, strong competitive positioning, and ability to capitalize on such emerging technology trends as cloud computing and artificial intelligence.

Tesla Inc. (TSLA)

Under the leadership of Elon Musk, Tesla has emerged as the market leader in electronic vehicles (EV). Musk’s forward-thinking approach has propelled Tesla to significant market success while forcing the entire traditional automotive market to shift toward greener products.

Through relentless innovation, coupled with aggressive growth strategies, Tesla was considered one of the market's most bankable stocks. However, this relentlessly positive outlook has changed recently. We’ll explain why.

IPO and Early Years

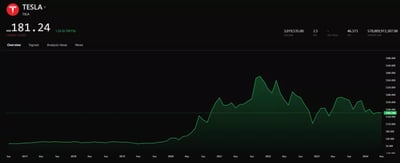

Tesla Motors went public in June 2010, offering shares at $17 each, which was one of the first public offerings by an American carmaker since Ford in 1956. This IPO was a critical step for Tesla to secure the capital necessary to scale its operations and technology development. The company was initially focused on proving that electric vehicles could be desirable and viable. Tesla's early years were marked by the challenge of establishing a new automotive brand in a market dominated by long-established players, coupled with the task of convincing the public and investors about the potential of electric vehicles. Here’s how the stock has performed:

Market Challenges

Tesla has faced numerous production challenges, market skepticism, and financial hurdles throughout its history. The company's ambitious production targets for vehicles like the Model 3 were initially plagued by logistical and manufacturing setbacks, often referred to as "production hell."

These issues clearly showed the difficulties of scaling up automobile production at the pace Tesla intended. Financially, Tesla has experienced periods of significant cash burn, driven by massive investments in technology, manufacturing facilities, and global infrastructure, leading to several close calls with bankruptcy.

Current Status

At the time of writing, Tesla remains the clear leader in the EV market by volume sold. The company continues to expand its influence in the renewable energy and automotive sectors. Notable developments include its ventures into solar energy products and large-scale battery storage solutions, aligning with its mission of sustainable energy consumption.

However, storm clouds are on the horizon regarding stock performance. Analysts are finally worried about the company’s future after recent reports indicated that Tesla was the worst-performing stock on the NASDAQ in early 2024. Indeed, it has been rocky ever since. With traditional automakers beating down Tesla’s door through a combination of scale and pricing, its days of market leadership may be numbered. In fact, Chinese automaker BYD may have already unseated Tesla.

Where will Tesla Be in Five Years?

This is the hardest stock to call among the companies covered in this article. Tesla has been the clear market leader for some time, with excellent vertical integration and a strong product line. As such, Tesla's stock has seen remarkable growth over the past five years, rising by over 900%. Even with a 36.49% decline in 2022 amidst broader market volatility, Tesla's 5-year total return remains impressive.

Indeed, looking further back, Tesla stock has accumulated gains of 8,535% over the past 10 years, compared to 348.9% and 187.6% returns from the Nasdaq 100 and the S&P 500 index, respectively, during that same period.

Analysts remain cautiously optimistic about Tesla's long-term prospects, citing the company's technological leadership, vertical integration, and ability to capitalize on the global shift toward electric vehicles.

However, they also note that Tesla faces increasing competition from legacy automakers and new EV startups. Other variables that could shape Tesla's stock price in 5 years include macroeconomic factors, such as interest rates, as higher rates typically lead to lower equity valuations. In addition, higher rates may depress demand for vehicles, as borrowing costs tend to increase.

Conclusion

When you consider the world of investing, there is much to be excited about. A company's journey from its initial public offering to becoming a market juggernaut offers the thrill of potential high returns and a stake in its transformative innovations and industry leadership.

We should remind you that not all stocks perform well, and taking a view of the Magnificent Seven is not a comprehensive approach to stock investing. The technology sector is not the only formidable and profitable one; there are many more. Also, investing in large-cap stocks is not the only way to make money; you can be successful in small- and mid-cap stocks if you do your research.

While the stories of companies like Apple, Amazon, and Microsoft show the value of visionary leadership and strategic innovation, they also hand out lessons on the importance of diversity and resilience in investment portfolios. As we have said, paying attention to IPOs, understanding the importance of strong management, and maintaining a long-term perspective are major strategies that could lead to significant growth. Take this information with a balanced view, and remember that while the stock market offers exciting opportunities, it also demands careful research and informed decision-making.

FAQ

An IPO is when a company first sells shares to the public to raise capital. This event is crucial for investors as it provides an opportunity to buy shares early in a company’s growth trajectory, potentially leading to significant returns as the company expands.

Leadership profoundly impacts a company's direction, culture, and success. Visionary leaders like Steve Jobs and Elon Musk have demonstrated the ability to innovate and steer their companies through challenges, significantly enhancing shareholder value.

A high-profile stock typically belongs to a well-known, often large-cap company with substantial market visibility, media coverage, and investor interest. These stocks are usually considered leaders in their respective industries and have robust financial performance.

Understanding how companies have navigated past market shocks can give you insight into their resilience and ability to manage future crises. This knowledge can help you create better investment strategies.

Investing in stocks involves such risks as market volatility, economic downturns, and potential loss of capital. Companies might also face internal challenges like management issues or external pressures such as regulatory changes, all of which can affect stock prices.

Diversification helps reduce risk by spreading investments across various financial instruments, industries, and other categories. It can prevent possible significant losses from investing too heavily in a single stock or sector.

No. Investing in IPOs is not a guaranteed way to make money. While IPOs can offer substantial returns if a company grows, they can also be risky, as initial stock performance can be volatile. You need to carry out thorough research and consider your risk tolerance before participating in an IPO.