Most Important Financial Ratios in Stock Trading and What They Mean

In my trading experience, I've seen firsthand how important financial ratios are for investors and analysts in evaluating a company's financial health and performance. By comparing financial statement figures, ratios provide an important window into a company's profitability, liquidity, efficiency, and solvency. They allow for easy comparisons among different companies, or you can even track a single company's performance over time.

As a retail investor, understanding how these ratios work and what they mean could be crucial to your trading success. As a longtime trader, I can say with confidence that there is no single ratio that can tell you how a company is doing because each ratio only gives you a sliver of the company’s performance. However, if you come to understand all the different ratios and how to apply them, you can choose the best ones for your trading situation.

Financial ratios assess profitability, liquidity, efficiency, solvency, and market valuation to evaluate a company’s financial health

They allow investors to compare companies of different sizes and track changes over time using consistent metrics

Price‑to‑earnings (P/E) ratio shows how much investors pay for each dollar of earnings and helps flag over‑ or undervaluation

Return on equity (ROE) measures how efficiently a company uses shareholder capital to generate profits

Debt‑to‑equity (D/E) ratio reveals the balance of debt and equity in financing and indicates financial leverage risk

Price‑to‑book (P/B) ratio compares market value to book value, useful for assets‑heavy industries or liquidation assessments

Current ratio gauges short‑term liquidity by comparing current assets to current liabilities and highlights solvency

Earnings per share (EPS) shows profitability per share and forms the basis for several valuation metrics

What are financial ratios?

I've seen how many new retail traders are obsessed with a company's share price; in particular, how that share price moves up and down on a stock exchange. In the crudest terms, up is good and down is bad. However, there are many more subtle and useful ways to measure company performance.

One of them involves financial ratios, which are fundamental tools in stock trading. They give you a clear and concise way to assess a company's financial health and performance by comparing different financial metrics, allowing for informed decision-making.

Understanding financial ratios is essential for weighing up a company's potential for growth, comparing it to industry peers, and identifying trends over time. Whether it’s assessing how efficiently a company uses its assets or judging its ability to meet short-term obligations, financial ratios can help you make strategic investment choices.

The Importance of Financial Ratios

I would not be saying anything new by confirming that financial ratios are critical tools in financial analysis and investment decision-making for several reasons:

Financial snapshot

First, they provide a snapshot of a company's financial health, allowing investors and analysts to quickly assess its financial position without reading extensive financial reports. Ratios condense complex financial data into manageable snapshots that show off a company’s operational efficiency, liquidity, profitability, and solvency. This knowledge can help you better choose which stocks to invest in.

Like-for-like comparison

Second, financial ratios enable comparisons across companies, regardless of size. This standardization is crucial because it enables apples-to-apples comparisons, enabling evaluation of how a company stands relative to its peers in the same industry. For example, comparing the price-to-earnings (P/E) ratios of companies can indicate which stocks are undervalued or overvalued relative to the industry average. We’ve written an article on the top five sectors in which to invest.

Decision-making aids

Third, financial ratios play a significant role in decision-making. Investors rely on these ratios to make informed decisions about buying, holding, or selling stocks. For instance, a high return on equity (ROE) may signal a profitable investment, whereas a high debt-to-equity ratio may indicate financial risk. These metrics help investors gauge the possibility of future returns and the associated risks.

Trend capturing

Finally, tracking financial ratios over time helps highlight trends and potential issues before they become critical. For instance, a declining current ratio over several quarters may indicate worsening liquidity, prompting further investigation. On the other hand, improving profitability ratios may reveal that a company’s strategic initiatives are paying off. By monitoring these trends, you can identify early warning signs and adjust your strategies accordingly.

Types of Financial Ratios

In my career, I've worked with several types of financial ratios. Here I discuss some of them by theme:

Evaluation Ratios

These are financial metrics used to measure a company's performance and valuation. They help you compare a company's current financial status with its historical data, industry benchmarks, or other companies. Here are some of the most common evaluation ratios:

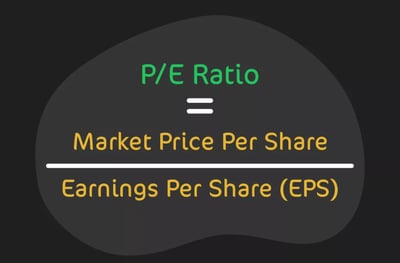

P/E Ratio

The P/E ratio is one of the most widely used valuation metrics in stock trading. It measures the current share price relative to the per-share earnings, providing information on how much investors are willing to pay today for a dollar of earnings. For example, a P/E ratio of 20 means that investors are willing to pay $20 for every $1 of earnings the company generates.

A P/E ratio of 8 could be considered low. This might suggest that the market perceives the stock as undervalued, possibly because the company is facing such challenges as declining sales, increasing competition, or other operational difficulties. However, it could also indicate a potential opportunity if the company's fundamentals are strong and the market is simply overlooking it.

A P/E ratio of 40 could be considered high. This might indicate that the market expects significant future earnings growth from the company. Investors may be willing to pay a premium for the stock, anticipating that the company will continue to perform well and increase its profits over time. However, a high P/E ratio also comes with risks, as it might mean the industry is in a bubble waiting to burst, such as the dot-com bubble of the early 2000s.

At the time of writing, the darling of the stock market, Nvidia, had reached a peak P/E ratio of 100 (which has since returned to roughly half of that)! Be aware that the P/E ratio should be considered alongside other financial metrics and within the context of industry norms, as different sectors have varying average P/E ratios.

Price/Earnings Growth (PEG) Ratio

I would say that the PEG ratio refines the P/E ratio by incorporating earnings growth rates into the analysis. It is designed to provide a more complete picture by evaluating whether a stock's high P/E ratio is justified by its growth prospects. A PEG ratio of 1 indicates a perfect correlation between market value and earnings growth, while a PEG greater than 1 may signal overvaluation, and less than 1 may suggest undervaluation. At the time of writing, Nvidia’s PEG ratio was 1.33, showing that the stock was likely overvalued.

This metric is especially useful for comparing companies in high-growth industries like tech where high P/E ratios are common. This type of shorthand is very useful when you are considering putting money on a highly valued stock.

Price to Sales (P/S) Ratio

The P/S ratio measures the value investors put on a company’s sales or revenues. Unlike the P/E ratio, the P/S ratio can be useful for measuring companies that do not have positive earnings, such as startups or companies in cyclical or seasonal industries. For example, you would expect a coffee broker to make more sales in the winter than you would in the summer.

It helps investors determine how much they pay for a dollar of sales. A lower P/S ratio might suggest that the stock is undervalued, while a higher P/S ratio could suggest the stock is overvalued. However, it’s important to compare this ratio with industry peers to get a better sense of relative valuation.

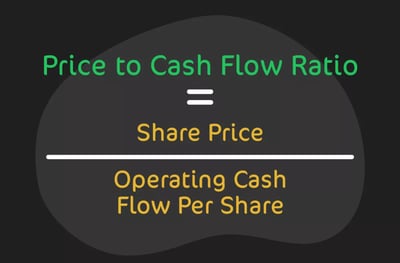

Price to Cash Flow (P/CF) Ratio

In my experience, I've seen that the P/CF ratio compares a company’s market price to its cash flow per share, providing insight into the valuation relative to the actual cash generated by the company. This ratio is particularly useful for assessing companies with significant non-cash expenses, such as depreciation, which can distort earnings.

An example of this is Amazon, which is known for its significant capital expenditures and substantial depreciation costs due to its vast infrastructure investments, such as data centers and logistics facilities. These non-cash expenses can significantly impact the company's earnings, making traditional valuation metrics like the P/E ratio less effective.

By using the P/CF ratio, you can better assess Amazon's valuation based on the actual cash it generates, providing a clearer picture of the company's financial health and operational efficiency. This ratio helps to understand whether Amazon's stock price is justified based on its ability to generate cash, which is a critical factor for a company with high levels of reinvestment and non-cash expenses.

A lower P/CF ratio might indicate that the stock is undervalued based on its cash-generating ability, whereas a higher ratio could suggest overvaluation. It is often preferred over the P/E ratio for evaluating companies with substantial capital expenditures.

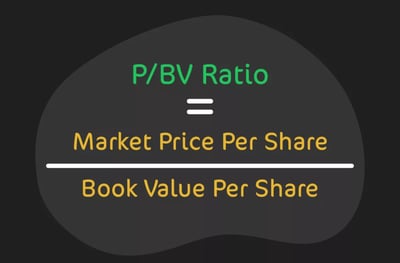

Market Value to Book Value (P/BV) Ratio

The P/BV ratio compares a company's market value to its book value, reflecting the value investors place on the net assets of the company. The book value is the net asset value according to the balance sheet, and the market value is the current share price. A P/BV ratio less than 1 could indicate that the stock is undervalued, suggesting that the market value is less than the company’s actual net asset value. Conversely, a P/BV ratio greater than 1 might suggest overvaluation. This ratio is especially useful in industries with significant physical assets, such as manufacturing and real estate.

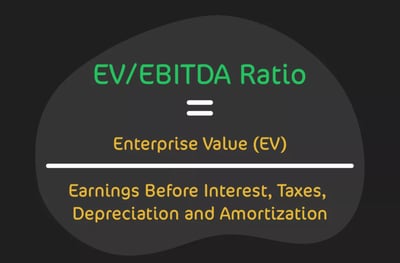

Enterprise Value to Earnings Before Interest, Taxes, Depreciation, and Amortization (EV/EBITDA) Ratio

The EV/EBITDA ratio measures the value of a company, including debt and excluding cash, relative to its earnings before interest, taxes, depreciation, and amortization. This ratio is useful for comparing companies with different capital structures because it provides a clearer picture of valuation irrespective of leverage.

An example of such a stock is Netflix (NFLX). Netflix operates with a capital structure that includes significant debt, which it uses to finance its original content production and global expansion.

The EV/EBITDA ratio is valuable in assessing Netflix because it accounts for the company's debt in its valuation, providing a more comprehensive view of the company's value compared to traditional metrics like the P/E ratio.

Since Netflix's earnings can be influenced by its debt levels and interest expenses, the EV/EBITDA ratio allows investors to compare Netflix's valuation more fairly against other companies in the media and entertainment industry that may have different capital structures. This ratio helps to focus on the core profitability of the company, excluding the effects of financing decisions.

A low EV/EBITDA ratio may show that a company is undervalued, while a high ratio could suggest overvaluation. This ratio is particularly useful for comparing companies within the same industry, as it normalizes differences in capital structure and tax environments.

Profitability Ratios

These ratios give you an insight into a company’s ability to generate profit relative to its revenue, assets, equity, or other financial elements. Once you understand how to read them, you can learn how effectively a company is managing its operations to produce earnings. Here are some of the most common profitability ratios:

Return on Equity (ROE)

This ratio may be more familiar to a broader range of traders. ROE measures a company's profitability by revealing how much profit a company generates with the money shareholders have invested. It shows how efficiently the management is using the company’s assets to create profits.

A higher ROE suggests that the company is more effective in generating income from new investment dollars. However, it’s important to compare ROE within the same industry, as norms can vary significantly across sectors.

ROE is the ultimate litmus test for a company's ability to generate profits from shareholders' investments. It reveals not just how efficiently management is using equity but also how well the company is poised to grow and reward its investors. In the world of finance, ROE isn't just important—it's the gold standard by which a company's financial strength is judged.

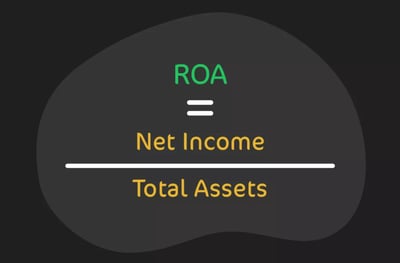

Return on Assets (ROA)

ROA shows a company's profitability relative to its total assets. It gives an idea of how efficient a company's management is at using its assets to generate earnings. A higher ROA indicates a more efficient company in terms of asset utilization. This ratio is particularly useful for comparing companies within the same industry and is a good indicator of operational efficiency.

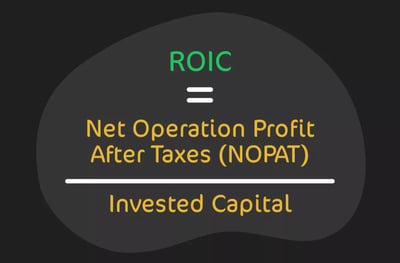

Return on Invested Capital (ROIC)

ROIC measures the return that a company earns on the capital invested in its business. It’s a more comprehensive metric than ROE because it includes both debt and equity capital. This ratio helps investors understand how well a company is using its capital to generate profits. A higher ROIC indicates a company is using its capital effectively and can be an indicator of a strong competitive position.

Gross Margin

Gross margin indicates the percentage of revenue that exceeds the cost of goods sold (COGS). It shows how well a company is managing its production costs relative to its sales. A higher gross margin means that the company retains more capital for each dollar of sales, which can be used to cover other operating expenses. This ratio is crucial for assessing a company’s core profitability.

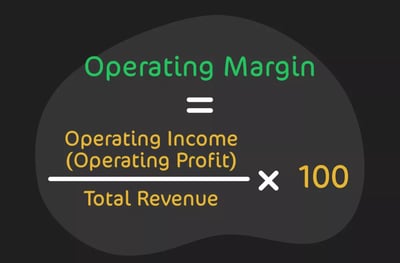

Operating Margin

Operating margin measures the proportion of revenue left after paying for variable costs of production, such as wages and raw materials. It indicates how much profit a company makes on a dollar of sales before interest and taxes. A higher operating margin means the company is more efficient at controlling its costs relative to sales. It’s an essential metric for assessing the overall operational efficiency of a company.

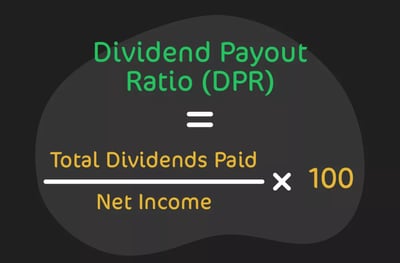

Dividend Payout Ratio (DPR)

This is an interesting ratio if you want regular dividends from your investment. DPR shows the percentage of earnings distributed to shareholders as dividends. It shows how much of the company’s profits are returned to shareholders versus how much is retained to fund growth.

A lower DPR might suggest that the company is reinvesting most of its earnings into growth opportunities, while a higher DPR indicates a mature company that is returning more income to shareholders. This ratio helps you understand a company’s dividend policy and sustainability.

Liquidity Ratios

Liquidity ratios are financial metrics used to judge a company’s ability to meet its short-term obligations using its most liquid assets. These ratios can tell you a lot about a company’s short-term financial health in case it needs to quickly convert assets into cash to pay off liabilities. Here are the liquidity ratios you need to master:

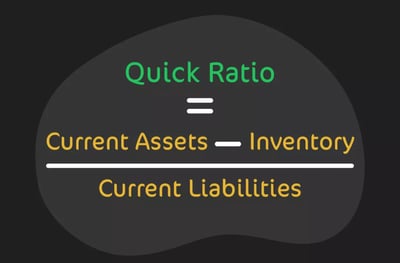

Quick Ratio

The quick ratio, also known as the acid-test ratio, measures a company's ability to meet its short-term liabilities with its most liquid assets, excluding inventories. It is a stringent liquidity measure because it excludes inventory that may not be readily convertible to cash.

I like to work with the rule of thumb that the quick ratio greater than 1 indicates that the company has more liquid assets than short-term liabilities, which is a positive sign of financial health. On the other hand, a quick ratio below 1 could indicate potential liquidity issues. When it comes to understanding a company's short-term financial health, the Quick Ratio isn't just important—it's absolutely critical.

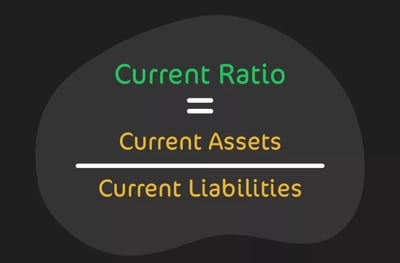

Current Ratio (General Liquidity Ratio)

The current ratio measures a company’s ability to pay off its short-term obligations with its current assets. It is a broader measure of liquidity compared to the quick ratio as it includes all current assets.

A current ratio above 1 indicates that the company has more current assets than current liabilities, suggesting good short-term financial health. However, an excessively high current ratio might indicate that the company is not using its assets efficiently to generate revenue.

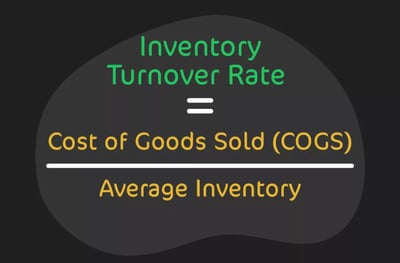

Inventory Turnover Rate

The inventory turnover rate measures how often a company sells and replaces its inventory over a period. A higher turnover rate indicates efficient inventory management and strong sales, while a lower rate may suggest overstocking or weak sales. This ratio helps businesses understand how well they are managing their stock and can indicate potential issues in the supply chain or sales process.

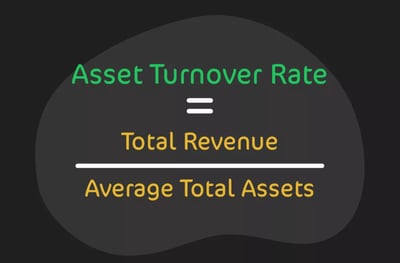

Asset Turnover Rate

The asset turnover rate measures how effectively a company uses its assets to generate sales. A higher asset turnover ratio indicates efficient asset use in generating revenue, whereas a lower ratio may suggest inefficiencies. This ratio is particularly useful for assessing companies in asset-intensive industries, where managing and optimizing asset use is critical to profitability.

These liquidity and efficiency ratios provide critical insights into a company's operational effectiveness and its ability to manage resources and obligations efficiently. They are essential tools for investors and analysts evaluating a business's financial stability and performance.

Solvency Ratios

Solvency ratios evaluate a company’s ability to meet its long-term obligations and sustain operations over the long term. Here are some key solvency ratios to keep track of:

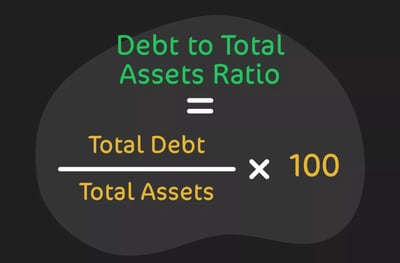

Debt to Total Assets Ratio

The debt-to-total assets ratio measures the proportion of a company's assets that are financed by debt. This ratio provides insight into the level of financial leverage a company is using. A higher ratio indicates that a larger portion of the company's assets are financed through debt, which can imply higher financial risk.

Conversely, a lower ratio suggests that the company relies more on equity financing and has a lower risk profile. This ratio is crucial for understanding a company's long-term solvency and financial stability, as it reflects the company's ability to meet its long-term obligations.

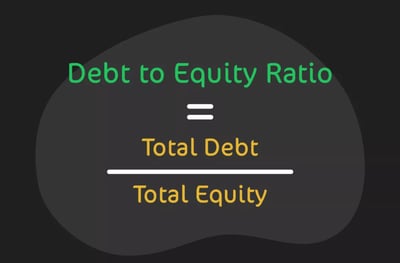

Debt to Equity Ratio

The debt-to-equity ratio compares a company’s total liabilities to its shareholders' equity, indicating the relative proportion of debt and equity used to finance its assets. A higher debt-to-equity ratio indicates greater leverage and may increase financial risk, especially if the company struggles to meet its debt obligations.

A lower ratio suggests a more conservative approach with greater reliance on equity financing. This ratio is a key metric for investors and creditors to assess a company's financial health and risk level, as it shows how much of the company is financed with debt relative to its own funds.

Analysis of Financial Ratios and Their Usefulness

In my view, financial ratios are invaluable for analyzing a company’s performance, assessing risk, and making investment decisions. By comparing ratios over time, you can identify trends, such as improving profitability or deteriorating liquidity. Ratios also allow for benchmarking against industry standards, helping investors determine if a company is performing above or below average.

A word of warning: as a relative newcomer, it’s going to be hard for you to remember how to use all these ratios. Most stock investing experts would advise beginner-to-intermediate retail traders to focus on the following key financial ratios:

P/E Ratio

ROE

D/E Ratio

P/B Ratio

Current Ratio

If you have the time and inclination, you can always try to learn the other ratios, but you would be venturing into the realm of a stock market professional, something to which many new traders aspire but realistically cannot manage.

Conclusion

I've witnessed firsthand that incorporating financial ratios into an investment strategy is crucial for making informed, strategic decisions. These ratios provide a streamlined view of a company's financial health, helping you identify both opportunities and potential risks. Whether you're a novice trader or an experienced investor, mastering these key ratios will enhance your ability to evaluate stocks effectively and navigate the market with greater confidence. By consistently applying this knowledge, you can make more calculated decisions, ultimately improving your trading outcomes and helping you achieve your financial goals.

FAQ

The P/E ratio measures a company's current share price relative to its per-share earnings. It indicates how much investors are willing to pay today for a dollar of earnings, helping to assess whether a stock is undervalued or overvalued.

The PEG ratio adjusts the P/E ratio by incorporating the company’s earnings growth rate, providing a more nuanced view of whether a stock’s high P/E ratio is justified by its growth prospects. A PEG ratio of 1 suggests a fair valuation, while a PEG greater than 1 may indicate overvaluation.

The P/CF ratio is useful for companies with significant non-cash expenses like depreciation, as it provides a clearer picture of the company’s valuation based on the actual cash generated, rather than earnings that may be distorted by these expenses.

A low P/BV ratio, particularly below 1, may indicate that the stock is undervalued, suggesting that the market value is less than the company’s actual net asset value, which can signal a buying opportunity.

The EV/EBITDA ratio provides a clearer picture of valuation by including debt and excluding cash, making it easier to compare companies with different levels of debt, as it focuses on core profitability without the influence of capital structure.

ROE measures how effectively a company is generating profits from shareholders' equity. It’s considered the gold standard for evaluating a company’s financial strength, as it reveals how well management is using equity to grow the business.

The Quick Ratio is stringent because it excludes inventory from current assets, focusing only on the most liquid assets to assess a company’s ability to meet short-term liabilities. This makes it a critical metric for evaluating a company’s immediate financial health.

A high Inventory Turnover Rate suggests that the company is efficiently managing its inventory, with strong sales and frequent stock replacement, which indicates effective supply chain management and strong demand for its products.