Table Of Contents

- What is EPS?

- How to Read an Earnings Report

- The Importance of EPS

- How to Use The EPS Formula

- How to Calculate EPS

- How do Investors Use EPS?

- Types of EPS

- Basic Earnings and Diluted Earnings

- The Difference Between EPS and Adjusted EPS

- What Is a Good EPS Ratio?

- What Factors Affect EPS?

- Tips for Reading EPS

- Conclusion

The Power of Earnings Per Share for Retail Stock Investors

In my trading career, I have found Earnings Per Share (EPS) to be a useful tool for stock traders to better understand the value of stocks. This important measurement simplifies the complexity of the stock market, providing insight into a company's financial health.

Understanding EPS is crucial for new retail traders, as it not only indicates a company's earnings but also influences investor decisions and stock prices. In this article, In this article, I will clarify the concept of EPS, demonstrate its significance with real-world examples, and show why it's a fundamental metric for assessing a company's financial health.

Earnings per share or EPS shows how much profit a company generates for each outstanding share

EPS allows investors to compare profitability between companies of different sizes by focusing on per-share earnings

Companies report EPS in their financial statements and analysts often compare it to forecasts to judge performance

Basic EPS uses current outstanding shares while diluted EPS factors in stock options or convertible securities that may increase the share count

Adjusted EPS removes one-time events like asset sales or legal expenses to reflect core profitability more accurately

EPS growth over time helps investors track a company’s performance

Revenue growth cost management taxes interest expenses share buybacks and currency fluctuations all influence EPS levels

EPS has limitations since it can be manipulated and does not account for factors like inflation or the quality of reported earnings

What is EPS?

I've heard many traders ask, "How do you define earnings per share"? EPS is a key financial indicator that measures the profitability of a company on a per-share basis. It is calculated by dividing the company’s net income (the profit after all expenses and taxes have been deducted) by the total number of outstanding shares of its stock. EPS is important because it gives investors a sense of how much money the company is making for each share they own, making it easier to compare the profitability of different companies, regardless of their size. For example, if a company has an EPS of $2, it means that for every share, the company has earned $2 in profit during a specific period. Generally, a higher EPS is considered a sign of a more profitable company.

How to Read an Earnings Report

I’ll start by admitting that the people who can make the most of earnings reports are often highly trained financial professionals. Still, there’s no reason a curious retail investor cannot try to educate themselves about this area and use it to their advantage.

Reading an earnings report of your favorite stock can seem daunting at first, but breaking it down into key sections makes it much easier to understand. Here’s a simple guide for beginner to intermediate traders on how to read an earnings report:

Income statement

Revenue (Top line)

This shows the total amount of money the company has earned from its operations during a specific period. Look for trends—are revenues growing, stable, or declining?

Net income (Bottom line)

This is the company’s profit after all expenses, including taxes and interest, have been deducted from revenue. It’s a crucial number to determine the company's profitability.

Earnings per share

EPS shows how much profit is allocated to each share of stock. Compare the EPS to previous periods and to analysts' expectations to gauge the company’s performance.

Balance sheet

Assets

This includes everything the company owns—like cash, inventory, and property. A strong asset base is a good sign.

Liabilities

These are the company's debts and obligations. Compare liabilities to assets to see if the company is on solid financial footing.

Shareholders’ equity

This represents the net value or "book value" of the company, calculated as Assets minus Liabilities. Growth in equity over time generally indicates a healthy company.

Cash flow statement

Operating cash flow

This section shows how much cash the company generated from its core business activities. Positive and growing operating cash flow is a good sign of business health.

Investing cash flow

This includes money spent on investments in the business, like purchasing equipment or acquiring other companies. Negative cash flow here isn't necessarily bad if the investments are likely to generate future returns.

Financing cash flow

This reflects cash in or out from activities like issuing or repurchasing shares, or paying dividends. This section can give you insights into how the company finances its operations and rewards shareholders.

Management’s discussion and analysis

This section provides insights from the company’s management on the financial results, including reasons for changes in revenue, expenses, and profits. It often includes forward-looking statements that give clues about the company’s prospects, which can help you choose whether to invest in them. We’ve written an article about how to choose stocks here.

Guidance

Some companies provide guidance on expected future performance. This can include revenue or earnings projections for the upcoming quarter or year. Compare this guidance with analysts’ expectations to understand market sentiment.

Comparative metrics

Year-over-year (YoY) and quarter-over-quarter (QoQ) comparisons

These metrics show how the company’s performance has changed over time. YoY compares the same quarter from one year to the next, while QoQ compares consecutive quarters. Steady growth is a positive indicator.

Key takeaways

I would recommend that, as a trader attempting to get into financial statements, you should look at the overall trends in revenue, net income, and EPS. Pay attention to whether the company meets or exceeds expectations, and check the balance sheet for financial stability. Positive cash flows from operations are crucial, as they indicate the company is generating enough cash from its core business to sustain operations. By focusing on these sections, you'll get a solid understanding of the company's financial health and performance, which is essential for making informed trading decisions.

The Importance of EPS

You may have heard news anchors talk about EPS when discussing the performance of stocks. What does it mean? As I’ve said, EPS is a simple-yet-powerful number that represents the portion of a company's profit allocated to each outstanding share of common stock, serving as a barometer of profitability.

EPS plays a vital role in shaping stock prices and investor perceptions. It provides a direct measure of a company's profitability on a per-share basis, making it a key indicator for investors assessing the financial strength and performance of a company. Read our article about some of the current stock market champions here and how their finances play a major role in making them a safe bet.

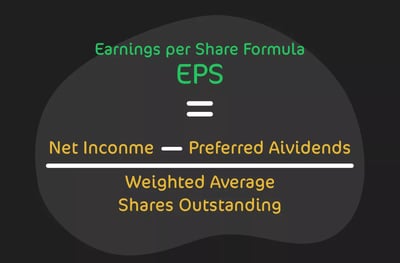

How to Use The EPS Formula

I would encourage you to use this formula for EPS: Company net income or profit divided by the total number of common shares outstanding.

It is a crucial financial metric that indicates a company's profitability and earning potential. A higher EPS generally indicates that a company is performing well and generating more revenue.

EPS is significant because it gives investors insights into a company's:

financial health

profitability

potential for future growth

Companies with consistently increasing EPS over time are often considered more attractive investments, as they demonstrate a track record of steady earnings growth.

A higher EPS typically suggests a more profitable, robust company, often leading to increased investor confidence and potentially higher stock prices. Conversely, a lower EPS can signal financial challenges and may negatively impact investor sentiment.

However, it's crucial to understand that an EPS figure in isolation does not give you much information. The key is to watch how the figure has been changing over time.

However, it's also important to note that EPS alone does not determine a stock's value, and such other factors as revenue growth, industry outlook, and overall market conditions also influence stock prices.

How to Calculate EPS

Example of calculating EPS formula

I will show you how to use the EPS equation based on the activities of a fictional company. Imagine this company specializes in developing innovative software solutions for businesses. The company has been steadily increasing its revenue and has recently reported its annual earnings.

For the fiscal year, our fictional company reported the following financial figures:

Net Income: $2,000,000

Total number of outstanding shares: 500,000 shares

Dividends paid on preferred stock: $100,000 (Note: The company has issued preferred shares, which are entitled to dividends before any dividends are paid to common shareholders.)

Step-by-step calculation:

Determine the net income available to common shareholders:

The first step in calculating EPS is to determine the net income available to common shareholders. This is done by subtracting any preferred dividends from the net income = $1,900,000.

Identify the total number of outstanding shares:

The total number of outstanding shares is provided as 500,000 shares. This includes all shares that are currently held by shareholders and are available for trading.

Calculate the EPS:

Now, divide the net income available to common shareholders by the total number of outstanding shares to calculate the EPS = $3.80.

The EPS for the fiscal year is $3.80. This means that for every share that an investor holds, the company has earned $3.80 in profit after accounting for the preferred dividends. EPS is a key indicator for investors to assess a company's profitability on a per-share basis and compare it with other companies in the industry. This case study demonstrates the basic process for calculating EPS, an essential metric for evaluating a company's financial performance.

How do Investors Use EPS?

I've seen investors use the earnings per share equation as a critical tool to evaluate a company's profitability and financial health, helping them make informed investment decisions. A higher EPS generally indicates that a company is generating more profit per share, making it more attractive to investors seeking growth opportunities.

By comparing a company's current EPS to previous periods, you can assess whether it is improving its profitability over time. Additionally, EPS allows you to compare companies within the same industry, regardless of their size, providing a standardized metric to gauge relative performance. Many investors also consider EPS in conjunction with other financial ratios, such as the price-to-earnings ratio (P/E), to determine whether a stock is fairly valued.

Types of EPS

There are a few different types of EPS. I'll talk about them here:

Reported EPS

Reported EPS is the net income per share that a company discloses in its financial statements, typically after accounting for all expenses, taxes, and one-time items. This figure reflects the company's profitability over a specific period, such as a quarter or a fiscal year. Investors and analysts closely watch reported EPS as it is a key measure of a company’s financial performance and is often compared to analysts’ forecasts to gauge whether a company met or exceeded expectations.

Continuous EPS

Continuous EPS, often referred to as adjusted or normalized EPS in shares, excludes one-time items and non-recurring expenses, such as restructuring costs or gains from asset sales, to provide a clearer picture of a company’s ongoing, core profitability. This metric helps investors focus on the company’s sustainable earnings potential, providing a more consistent basis for comparison over time and across companies.

Retained EPS

Retained EPS is the portion of a company’s net income that is kept or retained in the business rather than being distributed as dividends to shareholders. This retained income is reinvested in the company to fund growth, pay down debt, or reserve for future needs. It is calculated by dividing retained earnings (found in the equity section of the balance sheet) by the number of outstanding shares, indicating how much of the company’s profits is being reinvested per share.

Cash dividends per share

Cash dividends per share in shares is the amount of money a company distributes to its shareholders for each share of stock they own. It reflects the company’s commitment to returning value to its shareholders through cash payments. This metric is important for income-focused investors seeking regular investment returns. It is calculated by dividing the total cash dividends paid by the outstanding shares.

Book value per share

Book value per share represents the net asset value of a company on a per-share basis. It is calculated by dividing the company's total equity (assets minus liabilities) by the outstanding shares. This metric provides a snapshot of the value of a company's assets that shareholders would theoretically receive if the company were liquidated. Investors use book value per share in shares to assess whether a stock is undervalued or overvalued by comparing it to the stock’s market price.

Basic Earnings and Diluted Earnings

I have found it useful to distinguish that there are some characteristics that set these two types of EPS apart:

Basic EPS

This is calculated by dividing net income by the number of common shares outstanding, providing a straightforward measure of profitability. We have been referring to this type of EPS throughout this article.

Diluted EPS

This measure factors in potential shares that could be created through options, warrants, or convertible securities, offering a more conservative perspective.

The Difference Between EPS and Adjusted EPS

Adjusted EPS goes a step further by excluding non-recurring items, like one-time expenses or profits from the calculation, providing a clearer picture of ongoing business performance.

Factors like stock buybacks, which are the re-acquisition by a company of its own shares, represent an alternate and more flexible way of returning money to shareholders.

Buybacks reduce the number of outstanding shares and can artificially inflate EPS, while extraordinary items can lead to temporary fluctuations in EPS, affecting its reliability as a consistent performance metric. Understanding these nuances is crucial for a comprehensive assessment of EPS as an investment tool.

What Is a Good EPS Ratio?

In my opinion, a "good" EPS is relative and depends on several factors, including the industry in which the company operates, the company's historical performance, and the overall market conditions. Here are key considerations to determine what constitutes a good EPS:

Industry comparison

EPS should be compared to the average EPS of other companies within the same industry. Different industries have varying levels of profitability, so a good EPS in one sector may not be considered good in another. For example, technology companies may have higher EPS figures compared to retail companies due to differences in profit margins.

Historical performance

Evaluating a company’s EPS growth over time is crucial. Consistently increasing EPS over several quarters or years indicates that the company is improving profitability, which is generally seen as a positive sign. A good EPS should show upward momentum relative to the company's own historical data.

Analyst expectations

Companies often set expectations for their earnings, and analysts provide forecasts for EPS. A good EPS meets or exceeds these expectations. If a company consistently beats EPS expectations, it can be a sign of strong management and operational efficiency.

P/E ratio

EPS is often analyzed with the P/E ratio, which compares the current share price to the EPS. A high P/E ratio with a strong EPS might indicate that investors expect future growth, while a low P/E with a good EPS could suggest the stock is undervalued.

Economic and market conditions

Even a stable or slightly declining EPS might be considered good during economic downturns if the broader market is experiencing significant challenges. Conversely, in a booming economy, investors might expect higher EPS growth.

The company's growth stage

A stable or slightly growing EPS might be considered good for mature companies as they have already established their market position. Investors often expect a rapidly increasing EPS for younger, growth-stage companies as they scale up their operations.

A good EPS outperforms industry peers, shows positive growth trends, meets or exceeds expectations, and aligns with the company’s growth stage and the broader economic context. Investors need to consider these factors collectively when evaluating whether a company’s EPS is "good" when making investment decisions.

What Factors Affect EPS?

As a longtime trader, I have come to realize that several factors can affect a company's EPS, influencing its profitability on a per-share basis. Understanding these factors is crucial for investors when evaluating a company’s financial performance. Here are the key factors:

Revenue growth

Sales performance: An increase in sales directly boosts revenue, which can lead to a higher EPS if expenses are controlled. Conversely, declining sales can lower EPS.

Pricing power: Increasing prices without losing customers can enhance revenue and, in turn, EPS.

Cost management

Operating expenses: Efficient management of operating expenses (like salaries, rent, and utilities) can improve net income, positively impacting EPS. High or rising expenses, without corresponding revenue growth, can decrease EPS.

Cost of goods sold (COGS): A company that effectively manages its production costs or procurement costs can increase its gross margin, contributing to a higher EPS.

Interest expenses

Debt levels: Interest expenses on debt reduce net income. A company with high debt levels may have lower EPS due to significant interest payments. Conversely, paying down debt or refinancing at lower interest rates can improve EPS.

Taxes

Tax rates: Changes in tax laws or the company’s effective tax rate can significantly impact net income. A lower tax rate can increase net income, boosting EPS, while higher taxes can reduce it.

Tax strategies: Effective tax planning and strategies can minimize tax liabilities, positively affecting EPS.

Share buybacks

Reduction in outstanding shares: When a company buys back its own shares, it reduces the number of outstanding shares. Since EPS is calculated by dividing net income by the number of shares, buybacks can increase EPS even if net income remains constant.

Dilution: On the other hand, issuing new shares (for raising capital or employee compensation) can dilute EPS by increasing the number of outstanding shares.

Extraordinary items

One-time gains/losses: Events such as asset sales, legal settlements, or restructuring costs can result in one-time gains or losses, temporarily inflating or deflating EPS.

Adjusted EPS: Some companies report adjusted EPS, which excludes extraordinary items to give a clearer picture of ongoing profitability.

Economic and market conditions

Economic downturns: In tough economic times, consumer spending and business investment may decline, leading to lower revenues and, consequently, lower EPS.

Market competition: Increased competition can squeeze profit margins, negatively impacting EPS.

Exchange rates:

Currency fluctuations: For companies with international operations, fluctuations in exchange rates can impact earnings. A strong home currency can reduce the value of foreign earnings when converted back, lowering EPS.

Operational efficiency

Productivity improvements: Enhancements in operational efficiency, such as automation or process improvements, can reduce costs and increase net income, thereby boosting EPS.

Economies of scale: As companies grow, they often benefit from lower per-unit costs, which boost EPS.

Tips for Reading EPS

In my experience, understanding how to interpret EPS can help investors make more informed decisions. Focus on trends, compare against industry standards, and consider the broader financial context.

Read between the lines:

Look beyond the headline EPS number. Consider the factors contributing to the EPS, such as one-time events or changes in accounting practices, to get a clearer picture of the company's true profitability.

Compare based on industry standards:

EPS varies across industries. Comparing a company's EPS to its industry peers provides a more accurate assessment of its performance.

Be aware of potential limitations:

EPS has its limitations; it doesn’t account for differences in company size, capital structure, or one-time events, so it should be considered alongside other metrics.

Analyze EPS over longer periods:

Reviewing EPS over several quarters or years helps identify trends, revealing whether a company's earnings are consistently growing, stable, or declining.

Disadvantages of EPS

EPS doesn’t capture the complete financial picture. It can be influenced by factors like share buybacks or accounting changes, which might not reflect the company's actual performance.

Possibility of manipulation

Companies can manipulate EPS through accounting tricks, such as adjusting depreciation schedules or timing the recognition of revenue, to present a more favorable view of their profitability.

Not taking inflation into account

EPS is reported in nominal terms and does not account for inflation, which can erode the real value of earnings over time, making past EPS figures less comparable to current ones.

Not reflecting the quality of earnings

EPS doesn’t distinguish between high-quality earnings from core operations and low-quality earnings from one-time gains or accounting adjustments, potentially misleading investors about the company's true performance.

Conclusion

From my years as a retail trader, I have learned that EPS is an undeniably powerful and insightful tool for investors like you, offering a clear snapshot of a company's profitability per share. For retail traders, especially those new to the market, once you learn how to define earnings per share, you get an accessible way to gauge a company's financial health and potential growth. The higher the EPS, the more profitable a company appears, often leading to greater investor confidence and possibly higher stock prices.

However, it's crucial to approach EPS with a balanced perspective. While a high EPS can be encouraging, it should not be viewed in isolation. Moreover, EPS does not account for broader economic conditions or the quality of earnings, which are essential for a well-rounded investment strategy. You should use EPS as one part of a broader analysis, incorporating other financial metrics and considering the company's overall market position.

FAQ

EPS is a reliable indicator of profitability on a per-share basis, but it has limitations. Factors such as share buybacks, one-time events, and accounting adjustments can distort EPS. Therefore, it’s important to consider other metrics and the context in which EPS is reported to get a complete picture of a company's financial health.

Comparing EPS with industry peers provides context, as different industries have varying levels of profitability. A good EPS in one industry might not be considered good in another. Comparing within the same industry helps you assess how well a company is performing relative to its competitors.

Yes. If the company shows strong growth potential, is in a high-growth industry, or has other favorable financial indicators. EPS should be considered alongside such other factors as revenue growth, market conditions, and the company’s overall strategy.

Share buybacks reduce the number of outstanding shares, which can artificially inflate EPS by spreading the same net income over fewer shares. This can make a company appear more profitable on a per-share basis without an actual increase in net income.

One-time events, such as the sale of an asset or a large legal settlement, can temporarily boost or reduce EPS. These events do not reflect the company’s ongoing operations and should be excluded when evaluating the company’s core profitability. Adjusted EPS, which excludes such items, provides a clearer picture of the company’s regular earnings performance.

A higher EPS generally indicates greater profitability, but it’s not always better. A sudden increase in EPS might result from non-recurring events, cost-cutting that isn’t sustainable or other factors that don’t reflect long-term growth. Analyzing the reasons behind the EPS and looking at trends over time is important.

The P/E ratio, which compares a company’s stock price to its EPS, is a common tool for assessing whether a stock is overvalued or undervalued. Using EPS with the P/E ratio helps investors understand how much they pay for each dollar of earnings. A low P/E ratio with a strong EPS might indicate a good buying opportunity, while a high P/E ratio might suggest that the stock is priced for future growth.