Table Of Contents

- Understanding the NASDAQ

- Who Is Included?

- Criteria for Inclusion

- The Importance of the Index

- How the NASDAQ Differs from Other Indices

- Why Choose NASDAQ

- How to Invest in the NASDAQ

- How to Trade the NASDAQ

- What is the Average Return of the NASDAQ?

- Benefits and Risks of Investing in the NASDAQ

- Strategies for Investing in the NASDAQ

- Risk Management

- The Bottom Line

Understanding the NASDAQ: A Guide to Getting Started with Investing

Stock traders are always trying to diversify their holdings. There are many important bourses around the world. The NASDAQ is one of those. It is a major benchmark for technology and growth stocks, reflecting the health and direction of the tech-heavy sector globally. This makes it one of the most followed stock indices worldwide, as many traders want a piece of high-growth tech stocks.

The NASDAQ has a deep influence on market strategies and investment decisions for many stock traders trying to turn a profit. Its significance lies in its concentration of tech giants and innovative companies, making it a key indicator for traders seeking exposure to the high-growth sectors.Our experts at Arincen set out to explain the most important parts of the NASDAQ. This article will provide you with a comprehensive understanding of this tech-heavy bourse and offer guidance on how to trade or invest effectively in it. By understanding the index's composition, importance, and how to trade on it, you can potentially get in on the action.

The NASDAQ Composite tracks over 3,000 companies and is known for its strong focus on technology and growth sectors

It was launched in 1971 as the world’s first electronic stock exchange

The index includes both US and global companies that meet criteria for market capitalization liquidity and financial performance

Technology and biotech dominate the NASDAQ while healthcare consumer services and telecommunications also play key roles

Larger companies like Apple Microsoft and Tesla have a bigger influence on the index

The NASDAQ reflects overall market sentiment in growth and innovation sectors making it a popular barometer for tech-driven industries

Investors can gain exposure to the NASDAQ through ETFs like QQQ or ONEQ mutual funds futures options CFDs and leveraged products

While the index has delivered average annual returns of around 14 percent historically it carries higher volatility and sector concentration risk

Understanding the NASDAQ

The NASDAQ, the short version of the National Association of Securities Dealers Automated Quotations, is a stock market index that tracks the performance of over 3,000 companies, with a heavy emphasis on technology and innovation-driven sectors.

Like the S&P 500, the NASDAQ is an index, not a direct marketplace for trading individual stocks. This means it does not manage the buying or selling of shares. It reflects the performance of many of the world's best-known companies, particularly those in tech, biotech, and other high-growth industries.

Launched in 1971, the NASDAQ was the world’s first electronic stock exchange and has since become a global benchmark for technology stocks. Unlike the S&P 500, which focuses on 500 of the largest U.S. firms across various sectors, the NASDAQ’s concentration in tech makes it one of the most important indicators to watch for the performance of technology-focused companies and a crucial gauge for growth in these industries. It’s also an index that is not only limited to U.S. companies.

Who Is Included?

As you imagine, many of the world’s high-flying companies are listed on this prestigious stock index. As we’ve said, the NASDAQ includes over 3,000 companies, with a strong emphasis on the technology sector. Companies listed in the NASDAQ are selected based on their market capitalization, which represents the total market value of their outstanding shares.

While technology and biotech firms dominate the index, such other sectors as consumer services, healthcare, and telecommunications also contribute to its makeup.

Owing to its tech-heavy composition, the NASDAQ is often seen as a reflection of the performance of the high-growth and innovation-driven sectors of the U.S. economy. This focus on emerging industries provides you exposure to companies at the sharp edge of technological advancement, making it different from broader indices like the S&P 500. Here's a graphic that illustrates the industries that make up the NASDAQ.

Criteria for Inclusion

For a company to be included in the NASDAQ Composite, it must meet certain key criteria. Unlike the S&P 500, which only includes U.S.-based companies, the NASDAQ index welcomes both domestic and international firms, offering a broader global perspective.

To be listed, a company must have a specified market capitalization, although the specific threshold can vary depending on the listing tier (Global Select, Global Market, or Capital Market). This ensures that companies of significant size and influence are represented.Liquidity is another essential factor. A company’s shares must be actively traded, which increases the ease of buying and selling on the NASDAQ. Additionally, firms must meet financial viability standards, often requiring positive earnings or clear revenue growth, particularly for companies in growth sectors like technology. This means the NASDAQ will always focus on financially sound and innovative companies that drive market trends.

The Importance of the Index

The NASDAQ is the second-largest stock exchange (behind the New York Stock Exchange) in terms of market capitalization, and the largest electronic stock market. It has the highest trading volume of any U.S. exchange, with approximately 1.8 billion trades per day.

When the NASDAQ rises, it often signals growth and optimism within the technology and innovation sectors simply because these industries dominate the index. On the other hand, a decline is often a bad signal as it can reveal challenges within these high-growth areas or even broader market uncertainty. Given the fact that it is heavily concentrated in tech, the NASDAQ is a key measure for the health of the technology-driven economy.

As the world's first all-electronic trading company, the NASDAQ has been a pioneer in market innovation. Its focus on technology has pushed other exchanges to evolve, improving overall market efficiency. What you might not know is that the NASDAQ's electronic trading system has contributed to reduced costs and errors in trading, while increasing market transparency.

The NASDAQ’s influence extends beyond the tech sector, as investors, analysts, and policymakers monitor it to gauge market sentiment and emerging trends. Many investment vehicles, such as exchange-traded funds (ETF) and mutual funds, track the NASDAQ, making it an attractive option for investors looking to gain exposure to technology and high-growth industries.

How the NASDAQ Differs from Other Indices

Like the S&P 500, the NASDAQ is an index, but its focus and structure set it apart from other major indices.

Comparison with the DOW Jones

While the NASDAQ includes over 3,000 companies, the Dow Jones Industrial Average (DJIA) tracks only 30 large, blue-chip firms. The DJIA represents a smaller portion of the U.S. market and tends to reflect the performance of industry leaders across various sectors, whereas the NASDAQ is more concentrated in technology and innovation.

Further, the Dow is price-weighted, meaning companies with higher stock prices have more influence on the index's movements. On the other hand, the NASDAQ is a market capitalization-weighted index, where larger companies, such as Apple, Microsoft, and Tesla, exert a greater influence based on their total market value.

Comparison with the S&P 500

The NASDAQ’s tech-heavy composition sets it apart from the broader S&P 500, which includes 500 companies from various sectors, offering a more diversified snapshot of the U.S. economy. The NASDAQ, with its focus on technology and biotech, tends to show greater volatility, particularly when these sectors go through major market shifts.

While the S&P 500 provides a more balanced view of market performance across industries, the NASDAQ serves as a barometer for the growth and innovation sectors, making it more sensitive to shifts in technology trends and investor sentiment.

Why Choose NASDAQ

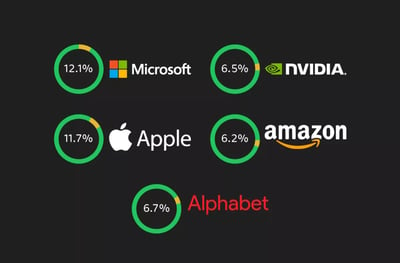

Why should you go with the NASDAQ? Investors and traders often turn to the NASDAQ for exposure to high-growth sectors, particularly technology and biotechnology. With over 3,000 companies listed, the NASDAQ offers a unique opportunity to invest in some of the world’s most innovative and rapidly expanding firms, including industry leaders like Apple, Microsoft, and Amazon. Many times, these are some of the only stocks the casual investor can name, which makes the NASDAQ a friend to new traders.

Although the NASDAQ is more volatile compared to broader indices like the S&P 500, its concentration in tech can lead to significant upside potential for those looking to capitalize on tech growth. Its market capitalization-weighted structure ensures that the largest and most influential companies, many of which are key drivers of modern innovation, have a proportional impact on the index. If you are looking for growth and long-term potential, the NASDAQ can give you a focused yet expansive view of the tech-driven economy.

How to Invest in the NASDAQ

How can you access the NASDAQ as a retail investor? Let's explore the options.

Direct Investment

One of the easiest ways to invest in the NASDAQ is through index funds and ETFs. These financial products are designed to replicate the performance of the NASDAQ by holding a diversified portfolio of companies listed on the index, primarily tech-focused. You can invest in these funds through most brokerage platforms.

Popular NASDAQ ETFs include the Invesco QQQ ETF (QQQ), which tracks the NASDAQ-100, and the Fidelity NASDAQ Composite Index ETF (ONEQ). These ETFs offer exposure to the leading technology and innovation companies while providing low expense ratios and high liquidity, making them an attractive option for investors seeking growth options but also not wanting to spend too much in fees.

Mutual Funds

Investing in mutual funds that track the NASDAQ is another way to gain exposure to this index. These funds pool investor money to buy a portfolio of NASDAQ stocks, offering a diversified approach. Look out for examples like the T. Rowe Price Nasdaq-100 Index Fund (PRSNX) and the USAA Nasdaq-100 Index Fund (USNQX).

These funds are professionally managed to mirror the performance of the NASDAQ index, offering a hands-off investment approach. However, like most mutual funds, they tend to have higher management fees compared to ETFs, which is something you need to consider for when evaluating potential returns.

How to Trade the NASDAQ

Trading on the NASDAQ can be done through futures and options, providing you with opportunities to speculate on its future price movements or to hedge against market volatility.

Futures and Options

What are futures and options? NASDAQ futures contracts are agreements to buy or sell the NASDAQ-100 index at a predetermined price on a future date. These contracts are traded on futures exchanges and offer you the ability to profit from expected changes in the index's value or to hedge against potential losses. By entering into a futures contract, you can speculate on whether the NASDAQ will rise or fall, with profits tied to the accuracy of your market prediction.

Options on the NASDAQ index work similarly, giving you the right, but not the obligation, to buy (call options) or sell (put options) the index at a specified price before the option's expiration date. These instruments allow you to leverage your position with a relatively small initial outlay, meaning that if things go your way, you can amplify any potential profits. As always, we should warn you that the leverage that comes with options and futures also heightens the risks, meaning a strong grasp of NASDAQ market trends and trading strategies is essential before diving into these complex instruments.

CFDs

Contracts for Difference (CFD) allow you to speculate on the price movements of the NASDAQ without needing to own the underlying assets. A CFD is a contract between a buyer and a seller, where the buyer agrees to pay the seller the difference between the current value of the NASDAQ and its value at the end of the contract.

If the index rises, the buyer profits; if it falls, the seller benefits. One of the key advantages of CFDs is their use of margin, meaning you can control a large position with a relatively small capital outlay. This leverage can significantly amplify potential profits, but it also increases the risk of large losses.

CFDs are especially popular among day traders and short-term investors who aim to capitalize on small price fluctuations in the NASDAQ, allowing for both long and short positions, depending on market movements.

Leveraged ETFs

Leveraged ETFs for the NASDAQ are designed to multiply the daily performance of the index, offering a higher return by using derivatives like futures contracts and swaps. For example, a 2x leveraged NASDAQ ETF looks to deliver twice the daily return of the index, making it possible to magnify gains in a rising market. However, this leverage also magnifies losses, making these instruments highly risky.

Leveraged ETFs are best suited for short-term trades, as their daily rebalancing can cause performance to deviate from the intended multiple over longer periods. Because of their volatility and complexity, leveraged ETFs need active management and a solid understanding of market mechanics. Let’s be honest, not every trader has the time or skill for this. That’s why leveraged ETFs are generally not recommended for long-term investors, given the potential for significant deviations from the index’s performance.

What is the Average Return of the NASDAQ?

The NASDAQ enjoys a lot of interest from new traders, and for good reason. It has historically delivered a higher average annual return compared to broader indices like the S&P 500. Over the past few decades, the average annual return of the NASDAQ-100, which tracks the largest non-financial companies listed on the exchange, has been around 14%, including dividends. We’ll remind that this is not a guarantee of future performance, but it certainly does showcase the growth potential in the tech-driven NASDAQ.

This impressive return is the result of compounded growth over many years, fueled by the rapid expansion of innovative companies in such sectors as technology, biotechnology, and communications. The NASDAQ has experienced significant booms, particularly during the tech rally of the 1990s and the more recent AI-driven surge. However, it has also seen periods of volatility, such as the dot-com bubble burst in the early 2000s and the financial crisis of 2008, when returns were far less favorable or even negative.

If you are considering the NASDAQ, understanding this historical context is essential for setting realistic expectations. While its higher average return can be attractive, the increased volatility and sector concentration should be factored into long-term investment strategies.

Here is a graphic representation of the NASDAQ's average annual returns over the course of history..

Benefits and Risks of Investing in the NASDAQ

Now that you understand the basics of the NASDAQ, let's dive into its benefits and risks, with a closer look at additional advantages and potential downsides.

Benefits

Growth Potential

One of the biggest benefits of investing in the NASDAQ is access to some of the fastest-growing sectors. Investing in the NASDAQ offers the opportunity to participate in the rapid growth and innovation that characterize these industries, leading to the potential for higher returns compared to broader market indices.

Sector-Specific Focus

The NASDAQ's emphasis on technology allows you to take a targeted approach by investing in industries that are driving global economic change. While other indices may dilute tech exposure by covering multiple sectors, the NASDAQ’s tech-centric nature lets you focus on the cutting edge of innovation. This focus has proven a great advantage during tech booms, such as today’s surge in artificial intelligence and cloud computing.

Liquidity

The NASDAQ is highly liquid, meaning that you can easily buy and sell shares of its listed companies, as well as ETFs and mutual funds that track the index. This liquidity usually means low transaction costs and makes it easier to react to market changes by entering or exiting positions without significant price impact. For both short-term traders and long-term investors, liquidity is a key benefit when managing portfolios.

Diversified Access to Tech Giants

Although the NASDAQ is heavily weighted toward technology, it is still diversified within this sector, offering exposure to different subsectors such as semiconductors, software, and hardware. This internal diversification allows you to benefit from a broad range of tech innovations, from AI and cloud services to cybersecurity and biotech advancements. This way, you can feel like you are not being left out of any exciting part of the market.

Innovation and Future-Proofing

Investing in the NASDAQ can be seen as future-proofing your portfolio. Many of the companies listed are involved in creating next-generation products and services that are likely to shape the future economy, such as electric vehicles, renewable energy, and artificial intelligence. This makes the NASDAQ attractive to investors looking for exposure to long-term megatrends.

Risks

Volatility

The NASDAQ is more volatile than broader indices like the S&P 500. Its tech-heavy composition means that when the technology sector experiences a downturn, the NASDAQ can suffer sharp declines. This volatility can make it a riskier option, particularly for investors with a lower tolerance for risk or those seeking more stable returns.

Sector Concentration Risk

While the NASDAQ’s focus on technology and innovation can drive growth, it also poses a significant risk due to its lack of diversification across other sectors. Unlike the S&P 500, which includes companies from pretty much all industries, the NASDAQ’s performance is closely tied to the fortunes of tech stocks. If the technology sector underperforms or faces regulatory or economic challenges, the NASDAQ is likely to underperform as well.

Market Sensitivity

The NASDAQ is highly sensitive to global economic conditions, particularly those affecting the technology sector. Regulatory shifts, geopolitical tensions, or changes in consumer demand can quickly impact tech stocks, leading to rapid price movements. This sensitivity can lead to more frequent and pronounced corrections compared to broader indices. Think about how the latest AI craze has led to a bullish market sentiment over tech stocks.

Overvaluation Risk

The technology sector often sees companies with high valuations based on future growth expectations rather than current profitability. This can result in inflated stock prices and increase the risk of sharp corrections if investor sentiment changes. This is what trading experts call a “bubble waiting to burst.” The NASDAQ is particularly prone to this risk, as it has many high-growth, high-valuation companies that could see significant price plunges.

Leverage and Speculative Behavior

The high growth potential of NASDAQ-listed companies attracts speculative traders who often use leverage to maximize returns. Needless to say, this can amplify volatility and lead to exaggerated price swings, especially during market sell-offs. If you’re not prepared to handle the amplified risks associated with leverage and speculative trading in tech stocks, the NASDAQ might be a challenging environment.

Dependence on Innovation Cycles

The NASDAQ’s reliance on the tech industry makes it dependent on innovation cycles. During periods when technological breakthroughs are less frequent or capital becomes harder to access for startups, growth may slow. This dependence can limit the index’s performance compared to more diversified indices during phases when other sectors, like energy or consumer goods, are leading the market.

While the NASDAQ offers exciting growth opportunities, particularly for investors focused on technology and innovation, it carries significant risks due to its volatility and concentration in tech stocks. Investors must weigh these benefits and risks when considering the NASDAQ as part of their investment strategy.

Strategies for Investing in the NASDAQ

What are some of the best strategies for investing in the NASDAQ? Let's explore several approaches that can be used to maximize your returns.

Long-term Investing

Buy-and-Hold Strategy

One of the most effective long-term strategies for the NASDAQ is the buy-and-hold approach. This involves purchasing shares or ETFs that track the NASDAQ, such as the Invesco QQQ ETF, and holding them for an extended period, regardless of market volatility. Given the NASDAQ’s strong historical performance, particularly in the technology sector, this strategy allows you to benefit from long-term growth trends.

By maintaining a long-term perspective, you can avoid getting caught up in short-term price swings and instead focus on the NASDAQ’s ability to deliver significant returns over time. This strategy leverages the compounding effect, where reinvesting dividends and capital gains boosts portfolio growth over the years.

Dollar-Cost Averaging

Dollar-cost averaging (DCA) is another reliable long-term strategy for investing in the NASDAQ. This method involves consistently investing a fixed sum at regular intervals, regardless of the NASDAQ’s current price. The advantage of DCA is that it smooths out the highs and lows of market fluctuations, helping to mitigate the risk of investing large sums during market peaks.

By spreading out your investment, you buy more shares when prices are low and fewer shares when prices are high, averaging your cost over time. This reduces the temptation to try timing the market, which is notoriously difficult, especially in volatile sectors like tech.

Short-term Trading

Day Trading and Swing Trading

For more active traders, the NASDAQ offers opportunities for both day trading and swing trading. Day trading involves buying and selling NASDAQ stocks or ETFs within the same trading day to profit from short-term price movements, while swing trading focuses on holding positions for several days or weeks to capture medium-term trends.

Given the NASDAQ’s volatility, especially in tech stocks, day traders and swing traders can find significant price movements within short timeframes. However, these strategies require in-depth market knowledge and quick decision-making skills, as tech stocks can experience rapid price shifts based on news, earnings reports, or broader economic factors.

Technical Analysis and Market Trends

Success in short-term NASDAQ trading often relies on strong technical analysis skills. You can study historical price charts and use such technical indicators as moving averages, MACD, and Fibonacci retracement levels to predict future price movements. Since the NASDAQ tends to experience major movements, technical analysis can be highly effective in identifying entry and exit points.

However, it’s not just about technical tools. Staying informed on market trends, news, and technological advancements is crucial for short-term traders. Tech-driven companies in the NASDAQ are sensitive to innovation cycles, product launches, and regulatory changes, which can create both opportunities and risks for traders seeking to capitalize on shifts in market sentiment.

Risk Management

Setting Stop-Loss Orders

Effective risk management is essential for both NASDAQ long-term investors and short-term traders, and one of the most practical tools is the stop-loss order. A stop-loss order automatically triggers the sale of an asset when it reaches a specified price, thereby limiting potential losses. This is particularly useful in the NASDAQ, given its volatility.

Let’s imagine you set a stop-loss order 10% below your purchase price, your position will be sold if the stock price drops to that level, preventing further losses from unexpected market declines.

Stop-loss orders allow you to protect your capital, especially in the NASDAQ, where prices can swing dramatically in response to market news, earnings reports, or sector-specific developments. This tool helps you maintain discipline by exiting a position before a small loss turns into a substantial one.

Diversifying the Investment Portfolio

Diversification is another key strategy for managing risk, even within the NASDAQ. Although the NASDAQ has a strong focus on technology, investors can still diversify their portfolios by spreading investments across different industries, such as biotech, communications, and healthcare. This reduces your exposure to any single sector and mitigates the risk of sector-specific downturns.

Additionally, diversification across asset classes, such as bonds or commodities, and geographic regions can further balance risk. By holding a variety of investments, you reduce the chance that poor performance in one area will significantly affect your overall portfolio, making your investment strategy more resilient against market volatility.

The Bottom Line

The NASDAQ represents an incredible opportunity for investors like you to tap into the heart of innovation and technology. Its potential for high returns, driven by some of the world’s most influential companies, is what makes it a preferred choice for those looking to capitalize on future economic trends. Just remember, with great potential comes great volatility, and understanding the risks and rewards is crucial for long-term success. Whether you opt for a steady buy-and-hold strategy or pursue short-term trading opportunities, a well-informed approach will allow you to take advantage of the power of the NASDAQ while managing its unique risks.

FAQ

The NASDAQ is a stock market index that tracks over 3,000 companies, primarily in the technology and innovation sectors. It is important because it serves as a benchmark for technology and growth stocks.

The NASDAQ is more tech-heavy compared to the S&P 500 and Dow Jones. While the S&P 500 includes companies from various sectors and the Dow tracks just 30 blue-chip firms, the NASDAQ focuses on technology, biotechnology, and other high-growth industries, making it more volatile but also offering higher growth potential.

You can invest in the NASDAQ through index funds, ETFs, and mutual funds that track the NASDAQ. Some popular ETFs include the Invesco QQQ ETF and Fidelity NASDAQ Composite Index ETF, which offer diversified exposure to NASDAQ-listed companies.

The NASDAQ offers access to some of the fastest-growing sectors, particularly technology and biotechnology. It provides exposure to innovative companies like members of the Magnificent Seven offering significant growth potential.

Investing in the NASDAQ carries risks, including high volatility due to its tech-heavy composition. Sector concentration risk is also a concern, as the NASDAQ’s performance is closely tied to the technology sector. Also, the market is sensitive to global economic conditions, and speculative behavior can amplify price swings.

Companies must meet certain requirements, such as a minimum market capitalization and liquidity standards, to be included in the NASDAQ. The index includes both domestic and international companies, with a focus on financial viability, such as positive earnings or clear revenue growth.

Long-term strategies, like buy-and-hold and dollar-cost averaging, are popular for the NASDAQ. For more active traders, day trading swing trading based on technical analysis can capitalize on short-term price movements. Diversification and risk management tools, such as stop-loss orders, are crucial for handling the NASDAQ’s volatility.

Historically, the NASDAQ-100, which tracks the largest non-financial companies on the exchange, has delivered an average annual return of around 14%. However, this is subject to market fluctuations, and past performance does not guarantee future results. The NASDAQ has experienced periods of both significant growth and sharp declines.