Oanda Review 2026

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

Oanda Evaluate - research result

Key Takeaways

OANDA was founded in 1996 and is one of the longest-standing names in online trading.

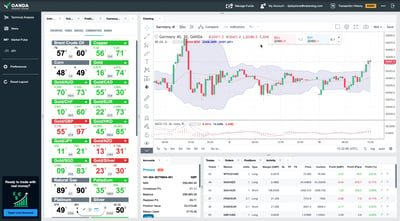

The broker offers access to MetaTrader 4 (MT4) globally and MetaTrader 5 (MT5) in select regions, alongside its proprietary OANDA Trade platform for desktop, web, and mobile.

OANDA’s website supports multiple languages, including English, Spanish, Chinese, German, and Japanese.

As far as client fund protection goes, you are protected under the Canadian Investment Protection Fund (CIPF) and the UK’s Financial Services Compensation Scheme (FSCS).

Customer support is available five days a week in several major languages, offering live chat, email, and phone support in select regions.

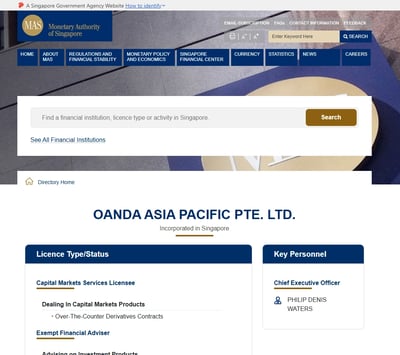

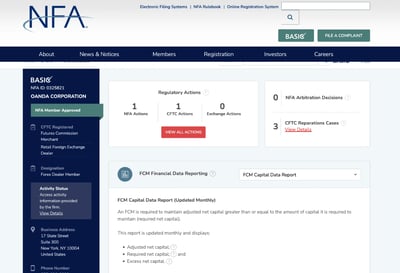

The broker maintains strong Tier-1 regulation through authorities like the FCA (UK), CFTC/NFA (U.S.), ASIC (Australia), CIRO (Canada), and MAS (Singapore).

OANDA offers two main retail account types: the Standard account and the Core Pricing account, both supporting FOREX, indices, commodities, metals, bonds, and cryptocurrencies (where regionally available).

Traders have access to 6 asset classes: FOREX, stock indices, commodities, CFD shares, CFD cryptocurrencies, and ETFs.

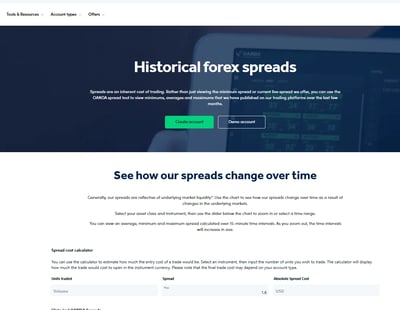

OANDA delivers competitive spreads, particularly for Core Pricing accounts, with raw spreads starting from as low as 0.0 to 0.4 pips plus commission.

Clients can access an extensive library of research and educational content, including Autochartist tools, economic calendars, and TradingView chart integration.

Last Reviews

Overall Summary

During my research on this broker, I discovered that it was founded in 1996, and is a highly active FOREX and CFD broker well-known to clients in over 196 countries. You can access more than 3,900 financial instruments with this broker, including 68 FOREX pairs, stock CFDs, indices, commodities, bonds, and cryptocurrencies in select regions. One thing to note, though, is that real stocks and ETFs are only available to EU clients.

OANDA supports household trading names like MT4, and MT5 in selected regions. The broker offers its proprietary OANDA Trade platform across web, desktop, and mobile, with no significant platform gaps. TradingView is also integrated in the broker’s technology stack

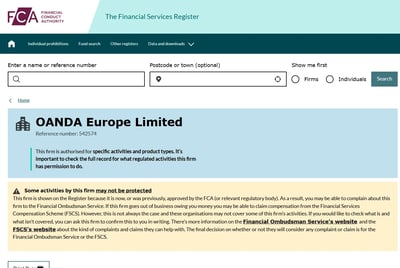

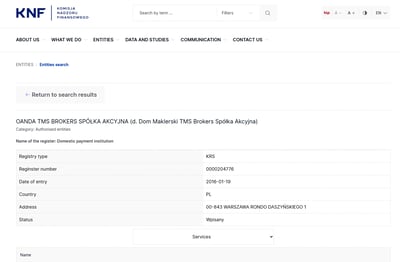

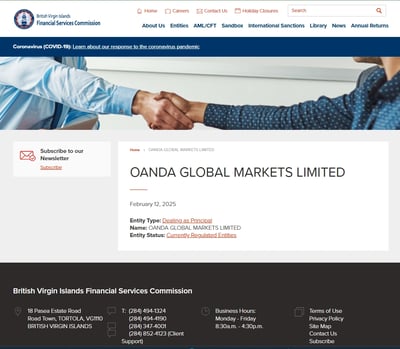

The broker holds Tier-1 licenses from regulators such as the FCA (UK), CFTC/NFA (US), ASIC (Australia), CIRO (Canada), MAS (Singapore), and JFSA (Japan), meaning you can deal with the broker with a high level of trust. You should note that investor compensation schemes like FSCS in the UK and CIPF in Canada apply only in those regions, while clients of offshore entities, like the British Virgin Islands, don’t get protection of any kind. Negative balance protection is available for EU retail clients but varies elsewhere.

EUR/USD spreads typically average 0.0 to 1.6 pips, depending on the account type. There are no deposit fees, and wire withdrawals can incur high fees.

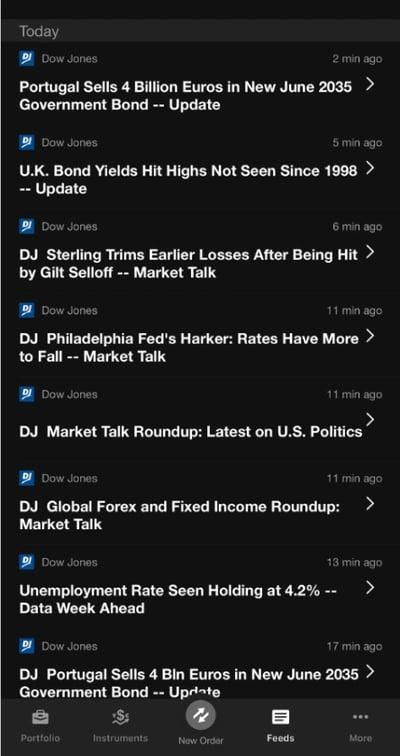

Research tools like Autochartist and Dow Jones Newswire are robust, though educational content remains comparatively thin compared to market leaders. While its fees are mixed and there are some real product gaps, OANDA should be commended for its strong regulatory reputation, superior trading platforms, and suitability for day traders, scalpers, and algorithmic traders.

OANDA is widely regarded as a highly trusted broker. Retail clients in regions like the UK, Canada, and the EU benefit from strong safeguards like investor compensation schemes, strict leverage caps, negative balance protection, and fund segregation, while those under offshore entities like the British Virgin Islands enjoy fewer protections. Backed by encrypted platforms, an internal security team, OANDA combines regulatory strength and modern security practices to offer a safe trading environment.

Who Is OANDA Good For?

In my view, OANDA can be considered a highly trusted broker with a long-standing reputation for safety, but it’s important to dig a little deeper to understand what that really means for you as a retail trader.

OANDA holds multiple Tier-1 licenses from some of the world’s strictest regulators, including the

● Financial Conduct Authority (FCA) – United Kingdom

● Commodity Futures Trading Commission/National Futures Association (CFTC/NFA) – United States

● Australian Securities and Investments Commission (ASIC) – Australia

● Canadian Investment Regulatory Organization (CIRO) – Canada

● Monetary Authority of Singapore (MAS) – Singapore

It also operates entities regulated by Tier-2 and Tier-3 authorities in Japan, Poland, and the British Virgin Islands.

On paper, OANDA’s regulatory coverage is impressive. But, as with many global brokers, the fine print matters. Retail clients in the UK and Canada benefit from investor protection schemes, up to £85,000 under the FSCS and up to CAD 1 million under the CIPF. However, clients onboarded under offshore entities, like the British Virgin Islands operation, have no access to compensation schemes if the broker goes under.

Retail clients in the EU get negative-balance protection, meaning you can't lose more than your deposit. But if you're trading under an offshore entity, you may not have that same guarantee.

How OANDA Protects You from Reckless Leverage and Margin Trading

I found that the maximum leverage you can access depends heavily on the entity under which you’re registered. In major Tier-1 regulated regions like the UK, Australia, and Canada, leverage is capped at 30:1 or 50:1, which helps prevent retail clients from overexposing their accounts with margin. Higher leverage, up to 200:1, is only available through OANDA’s offshore entity in the British Virgin Islands, but this is geared more toward experienced traders who understand the risks.

With OANDA, clients manually adjust their leverage settings. This gives cautious traders the flexibility to reduce their market exposure and manage position sizes more conservatively, a crucial feature for anyone serious about long-term survival in the markets.

OANDA also applies asset-specific leverage caps. Major FOREX pairs enjoy the highest available leverage, while more volatile assets like cryptocurrencies and commodities are automatically assigned lower maximums to reflect their higher risk profiles.

Margin call levels vary depending on your account setup, but retail traders operating under European regulations benefit from negative balance protection, ensuring they can never lose more than their deposit.

How you are protected

All OANDA entities enforce strict fund-segregation policies, ensuring your money is held in separate bank accounts from the broker’s operational funds. This protects client deposits even if OANDA gets into financial trouble.

OANDA does provide negative balance protection, but it’s limited to retail clients in the European Union. Despite these differences, OANDA’s regulatory strength across Tier-1 jurisdictions, strict fund segregation, and long operational history offer retail traders a generally high standard of protection.

Regulation and other security measures

OANDA backs its regulatory strength with a strong commitment to platform and transaction security. All financial activity conducted on OANDA’s platforms is protected with up-to-date encryption protocols, ensuring secure deposits, withdrawals, and account management. Whether you’re trading on OANDA Trade, MT4, or through TradingView, data transmission is encrypted to keep your account information safe.

Despite offering 2FA, OANDA doesn’t yet provide biometric login options like Face ID or fingerprint access, which could further enhance the login experience. The broker is proud of its commitment to security and its website mentions that it also offers:

An internal security team

Partnerships with industry-leading security firms

Round-the-clock monitoring by a security operations center

Alignment with regulatory expectations and industry-standard certifications

When you combine OANDA’s multi-jurisdictional regulation, strict fund segregation, and secure technology standards, you get a trading environment designed to protect client funds and information, even for those operating in distant jurisdictions.

Top broker features

In my research, I discovered many reasons to consider OANDA as your trading partner. Here are some of the best ones:

Strong regulation: OANDA is licensed across multiple Tier-1 jurisdictions, including the FCA (UK), CFTC/NFA (US), ASIC (Australia), and CIRO (Canada).

Flexible pricing: You can choose between standard commission-free accounts on the lower end, or you can go for core pricing accounts with super-tight spreads but a $10,000 minimum deposit.

Advanced trading platforms: You can use the proprietary OANDA Trade, MT4 in most regions, and MT5 in select regions, plus a direct TradingView integration.

Negative balance protection: If you live in the EU, you get negative balance protection, meaning that when the market gets very volatile, you won’t lose more than what’s in your account.

Deep research and tools: You can get the most from Autochartist trading signals, Dow Jones news feeds, detailed economic calendars, and over 80 TradingView technical indicators.

Micro-trading: The broker lets you trade as little as 1 unit of currency, giving you unmatched flexibility to scale your trades, test strategies, or manage risk.

Solid mobile trading experience: The OANDA mobile app has a highly intuitive design, powerful charting tools, and smooth order execution.

For Whom Is OANDA Recommended?

OANDA is a strong choice for a wide range of traders, from beginners learning the ropes to experienced professionals running sophisticated trading strategies. Here’s how it breaks down:

New traders will appreciate the $0 minimum deposit requirement, the easy-to-use OANDA Trade platform, and access to micro-trading starting from just 1 unit of currency.

Scalpers and day traders will surely enjoy OANDA’s tight FOREX spreads on major pairs, fast execution speeds, and access to TradingView charting and MT4 platform integrations.

Algo traders and developers can take advantage of OANDA’s advanced API offering, VPS hosting options, and compatibility with automated trading strategies.

Professional traders seeking greater control over costs can access core pricing with a $10,000 deposit, unlocking lower spreads and transparent commissions.

Meanwhile, traders who value high-quality research, strong regulatory protections, and versatile mobile trading will find OANDA’s offering hard to beat.

That said, because retail clients trading under offshore entities won’t have investor compensation protections, OANDA is best suited to those who prioritize robust trading technology and regulatory reputation over guaranteed compensation schemes, which, let’s face it, will most likely never be called upon if you choose a legit broker.

Here are the pros and cons of using this firm:

-

Regulated by multiple Tier-1 authorities

-

No minimum deposit required to open a standard account

-

Offers a wide range of platforms: OANDA Trade, MT4, MT5 (in some regions), and TradingView

-

Strong research tools, including Autochartist and Dow Jones Newswire

-

Negative balance protection for EU retail clients

-

Deep market range with thousands of tradable instruments (depending on region)

-

Access to micro-trading, allowing trades starting from 1 unit of currency

-

Highly rated mobile app with robust charting and trading features

-

Supports algorithmic trading with API access and VPS hosting options

-

Transparent pricing with the option to choose between standard and core pricing

-

Good customer support with live chat and email across major regions

-

Higher spreads on standard accounts compared to some discount competitors

-

Core pricing requires a high $10,000 minimum deposit

-

No formal investor compensation for some clients

-

No real stock or ETF trading available outside of the EU entity

-

Wire withdrawals can incur high fees, depending on the region and currency

-

No dedicated copy trading or social trading platform (only via MT4 signal providers)

Offering of Investments

OANDA offers a broad range of financial assets, including 68 FOREX pairs with flexible leverage up to 30:1 in Tier-1 regions and 50:1 in North America, as well as stock CFDs on over 1,600 equities outside the U.S., and 18 major global index CFDs with competitive spreads. Clients can also trade around 14 commodity CFDs like gold and oil, while access to cryptocurrency CFDs is region-dependent. Additionally, OANDA provides six bond CFDs, allowing traders further portfolio diversification.

Here’s a breakdown of the financial assets offered by OANDA:

FOREX CFDs

OANDA offers 68 FOREX pairs, covering a wide range of major, minor, and exotic currencies. You can access flexible leverage up to 30:1 in major Tier-1 jurisdictions, 50:1 in North America, and up to 200:1 through offshore entities.

Spreads on major pairs like EUR/USD can average around 0.4 – 1.6 pips depending on account type, with even lower costs available under core pricing.

Stock CFDs

OANDA clients outside the U.S. can trade a wide selection of stock CFDs, with over 1,600 individual equities available in some regions.

Stock CFDs are offered with commission-based pricing in select cases, but fees are typically built into the spread. Real stock trading is only available for EU clients through specific OANDA entities.

Indices CFDs

OANDA provides access to 18 major global stock exchange CFDs, including the S&P 500, NASDAQ 100, and the DAX 40. Trading costs on indices like the DAX 40 are competitive, with spreads as low as 0.4 pips, depending on market conditions.

Commodity CFDs

The broker offers around 14 commodity CFDs, including popular instruments like gold, silver, crude oil, and natural gas. You can trade commodities across all major platforms (OANDA Trade, MT4, and TradingView), with differing leverage levels and typically industry-standard spreads.

Cryptocurrency CFDs

In some regions, OANDA offers crypto CFDs on assets like Bitcoin, Ethereum, and Litecoin. U.S. clients access crypto through OANDA’s partnership with Paxos rather than CFDs. Retail clients in the U.K. are restricted from trading crypto derivatives, in line with FCA regulations.

Bond CFDs

OANDA also features 6 bond CFDs, giving traders access to instruments like the U.S. 10-Year Note and German Bunds, offering additional diversification for those interested in fixed-income markets.

Available assets

| Markets | Available | Number of Assets |

| Currency Pairs | 68 | |

| Stocks | 1430 | |

| Commodities | 32 | |

| Crypto | 8 | |

| Indices | 18 | |

| ETFs | 350 |

Account Types

OANDA offers two main pricing models: the Standard account features commission-free trading with typical spreads around 1.6 pips on EUR/USD, while the Core Pricing account provides raw spreads from as low as 0.0, but in practice, up to 0.4 pips, plus a commission of $5 per 100,000 traded. The Core account requires a minimum deposit of $10,000 to qualify.

I found that OANDA keeps it simple with an uncomplicated offering that appeals to both beginners and experienced traders. While there’s no rich menu of different account options like you can find with some competitors, this broker instead focuses on quality and flexibility.

You can open a standard trading account with no minimum deposit as a newbie trader, while high-volume investors can access additional benefits through specialized programs, which we’ll talk about next.

Standard account:

This option is perfect for casual and new traders. It comes with no minimum deposit requirement and offers commission-free trading with spreads starting around 1.6 pips on major pairs like EUR/USD. No commissions, but wider spreads. Ideal for simplicity and small-volume trading.

You also get the benefit of solid market execution, a full suite of platforms, and micro-trading capability down to just 1 unit of currency.

Core Pricing account:

Designed for serious and higher-volume traders, the Core Pricing account requires a $10,000 minimum deposit, which can be high even for established and profitable traders.

This account offers raw spreads starting as low as 0.0 in theory but up to 0.4 pips in practice, with a transparent commission of $5 per $100,000 traded (or about $10 per round turn standard lot). Core Pricing is aimed at traders who are looking for ultra-tight spreads combined with clear execution costs.

Elite Trader program:

For very active traders, OANDA’s Elite Trader program (available in the U.S. and Canada) offers volume-based rebates, starting at $5 per million and rising to $17 per million as your trading volume increases. You’ll get extra perks like free subscriptions to TradingView Pro and Premium tiers.

Demo account:

The broker offers a free demo account that comes with virtual funds, giving you the chance to explore the platform and test strategies without risking real money. Demo accounts can be opened in minutes through OANDA Trade or MT platforms.

Islamic (Swap-free) account:

Available on request for clients who qualify, OANDA offers swap-free accounts compliant with Islamic principles, eliminating overnight interest charges on eligible accounts.

Account types

| Account Type | Minimum Deposit | Spread Commission | Commission | Swap Commission | Deposit Commission | Withdrawal Commission |

|---|---|---|---|---|---|---|

| Standard Account | $0 | Starting from 1.6 pips | 0 | Yes | $0 | $0 |

| Core Pricing Account | $10,000 | From 0.0 to 0.4 pips | $5 per 100,000 traded | Yes | $0 | $0 |

| Elite Trader Program | Higher thresholds | Lower spreads and rebates | Custom commission tiers | Yes | $0 | $0 |

Account opening

Opening an account with OANDA is fast, fully digital, and beginner-friendly. The process typically takes less than 10 minutes to complete, provided you have your documents ready, though final verification can take a couple of business days.

What is the minimum deposit at OANDA?

As we’ve said, OANDA has no minimum deposit requirement for its Standard account, making it an ideal choice for beginners or traders who want to start small.

On the other hand, however, if you want access to the tighter spreads offered by Core Pricing accounts, you’ll need to deposit at least $10,000.

How to open your account

To get started:

Select “Open an Account” on the OANDA website. You’ll need to provide an email address, create a password, and select your country of residence.

After that, you’ll choose your account base currency, complete a short financial and trading experience questionnaire, and upload proof of identity and proof of address.

Once your account is verified, you can fund it via bank transfer, debit/credit card, or e-wallets like PayPal and Skrill.

Next, start trading through OANDA Trade, MT4, or TradingView.

It’s a standard method that you will find with all brokers.

Deposits and Withdrawals

OANDA supports fast and flexible deposits and withdrawals, offering nine base currencies including USD, EUR, and GBP to help cut down conversion fees. Deposits can be made via bank transfer, debit/credit card, PayPal, Skrill, or Neteller, with most card and e-wallet deposits processed instantly, though bank transfers can take a few days.

Like many other brokers, OANDA gives you the option to execute deposits and withdrawals designed for speed, flexibility, and cost-efficiency.

Account base currencies

OANDA offers nine base currencies for trading accounts: USD, EUR, GBP, AUD, CAD, CHF, HKD, JPY, and SGD. While not as extensive as some brokers, this selection covers most major global currencies and helps clients minimize unnecessary currency conversion fees when matched to their local bank accounts.

OANDA deposit fees and options

Traders can fund their accounts using multiple methods including bank transfers, debit/credit cards, PayPal, Skrill, and Neteller, depending on regional availability. I found that deposits made by card or e-wallet were processed instantly, while bank transfers tended to take several business days. All deposit sources must be registered in the same name as the OANDA trading account holder.

OANDA withdrawal fees and options

Withdrawals are generally straightforward at OANDA, but not entirely fee-free. Debit or credit card withdrawals are free; however, wire transfer withdrawals incur fees of $10, depending on region and currency. Withdrawals are processed using the same methods as deposits, and like deposits, they must come from accounts in the trader's name. Processing times vary, but many withdrawals via card or PayPal are completed within one to three business days.

| Method | Credit Card | Wire Transfer | Skrill | Neteller | Cryptocurrency | PayPal | Apple Pay |

| Deposit fee | 1.5% | $0 | Unavailable | Unavailable | Unavailable | Unavailable | Unavailable |

| Withdrawal fee | $0 | $10 | Unavailable | Unavailable | Unavailable | Unavailable | Unavailable |

Customer Service

OANDA offers good customer support via live chat, email, and in some regions by phone, with service available in major languages like English, Spanish, Chinese, and German. Although support operates five days a week rather than around the clock, the team is known for being helpful and knowledgeable, contributing to a strong overall trading experience.

I was pleased to discover that OANDA provides a reliable and multilingual customer support system. Live chat is available directly on the OANDA website, giving you quick access to support agents for immediate help with account issues, platform bugs, or trading queries.

You can also reach OANDA’s support team through email and, in some countries, by phone. You can get support in several major languages, including English, Spanish, Chinese, and German. Support is available round-the-clock.

| Live Chat | Phone | |||

| Available | Available | Available | Available | Available |

| Quick response | Moderate | Very Fast | Moderate | Very Fast |

Commissions and Fees

OANDA’s fee structure varies by account type, with Standard accounts offering commission-free trading but wider spreads around 1.6 pips on EUR/USD, while Core Pricing accounts offer raw spreads as low as (0.0 advertized) but in reality, 0.4 pips with a $5 per $100,000 commission and a $10,000 minimum deposit.

Here’s a breakdown of OANDA’s spreads, commissions, swap fees, and other charges.

Spreads

Spreads at OANDA depend heavily on your pricing model. You will find that even though Standard accounts are commission-free, they come with wider spreads, with the average EUR/USD spread around 1.6 pips, which is not particularly competitive in the industry.

Traders who go for the Core Pricing account can access raw spreads starting as low as 0.0 to 0.4 pips, with tighter costs aimed at high-volume traders. But remember, the minimum deposit here is $10,000.

Commissions

Commissions only apply to Core Pricing accounts. Traders pay $5 per $100,000 traded (or roughly $10 per round trip on a standard lot).

Standard accounts remain commission-free, with all trading costs built directly into the spread.

Swap fees and Islamic accounts

OANDA applies standard overnight swap fees for positions held past the trading day’s close. However, Islamic (swap-free) accounts are available on request for eligible traders, removing interest charges in compliance with Sharia law. These accounts may still carry fixed fees on some instruments to maintain operational fairness.

Inactivity fee

OANDA charges an inactivity fee of $10 per month (or equivalent currency) after 12 months of no trading activity. This is something to keep in mind if you are not sure that you’ll be trading very often.

| Spread | Commission | Swap | Islamic Account | |

| Currencies | Starting from 0.4 Pips | $0 | Yes | Available on request |

| Stocks | Not Mentioned | 0.10% of the trade value | Yes | Unavailable |

| Commodities | Starting from 0.2 pips | $0 | Yes | Unavailable |

| Indices | Starting from 0.4 pips | $0 | Yes | Unavailable |

Platforms and Tools

OANDA offers a strong mix of trading platforms, supporting MT4 globally and MT5 in select regions for professional-grade customization, alongside its proprietary OANDA Trade platform. Its in-house platform is powered by TradingView and features over 80 technical indicators, Autochartist analytics, and integrated economic calendars.

Here’s what you can expect when it comes to trading platforms within the OANDA stable:

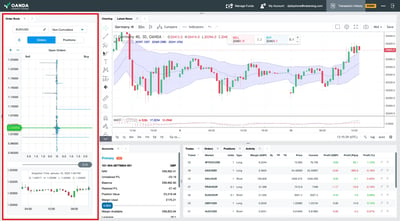

Platforms

As far as desktop platforms go, OANDA supports MT4 in all regions and MT5 in select regions, giving you access to well-known charting tools, algorithmic trading capabilities, custom indicators, and multi-window layouts. These platforms remain the gold standard for professional traders who want customization and depth.

For browser-based trading, OANDA offers its proprietary OANDA Trade platform, which is powered by TradingView’s charting engine. OANDA Trade combines well-designed functionality with over 80 indicators for deep technical analysis, integrated Autochartist analytics, economic calendars, and a range of order-management tools.

Direct TradingView integration is also available for U.S., U.K., and Canadian clients, offering access to advanced charting and social trading features.

Look and feel

Both the OANDA Trade platform and MetaTrader platforms feature clean, professional interfaces. OANDA Trade is all about simplicity, making it a good choice for beginners who want a design that is easy to learn.

You can customize layouts easily, although some functions, like research and news tools, open in separate browser tabs rather than being fully integrated into the platform.

Login and security

OANDA’s platforms support two-step authentication (2FA) for added login security. However, biometric login options like Face ID or fingerprint access are not yet available, a feature that some newer brokers have started to include.

Search functions

The search functionality across OANDA platforms is efficient and works well. Traders can easily search by typing asset names or browsing asset classes, making it quick to locate instruments whether you're using the web, mobile, or desktop platforms.

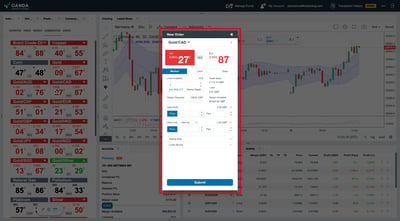

Placing orders

All the main order types are supported, including market, limit, stop-loss, and trailing stops. Time-in-force options like Good ‘til Canceled (GTC) and Good ‘til Date (GTD) are available, so that you can managed your positions in whichever way you want.

Alerts and notifications

With the OANDA mobile app, you can easily set price alerts, but the web and desktop platforms currently do not support native alerting within the platform interface. This is a small but noticeable gap, particularly for those seasoned traders with high expectations who rely on automated notifications.

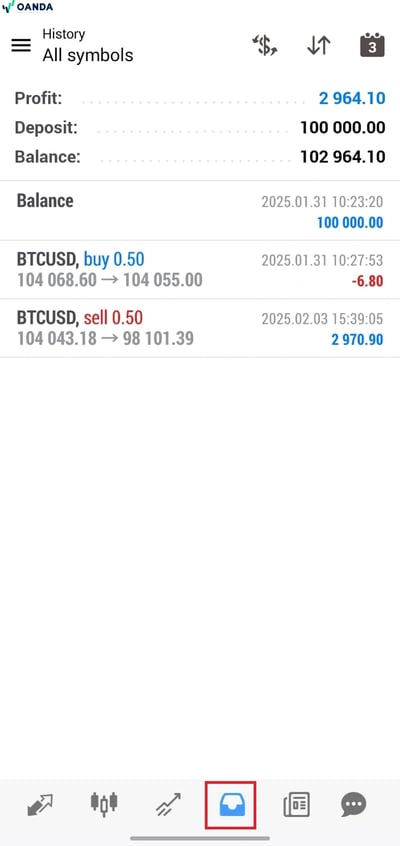

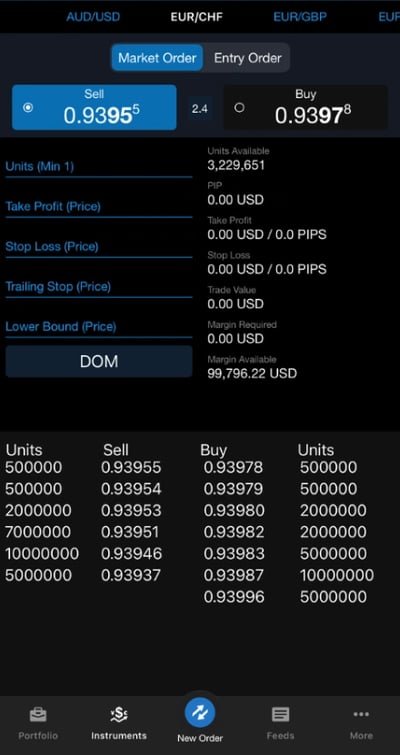

Mobile Trading

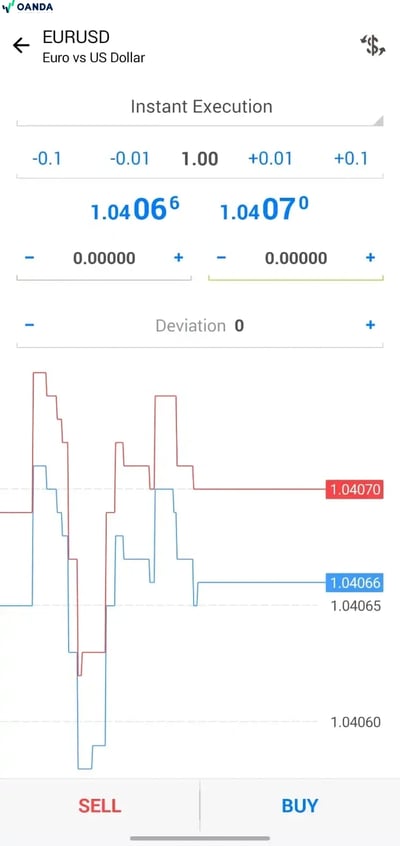

OANDA offers two strong mobile trading options: the proprietary OANDA Trade app and the MT4 app. OANDA’s mobile app offers 32 built-in indicators, 11 drawing tools, 16 timeframes, and smooth navigation across iOS and Android devices. The app delivers fast order execution, flexible trade management, and multilingual support. You can easily search for instruments by name or asset category and the look and feel of both platforms is smooth and easy to navigate.

I enjoyed the OANDA mobile trading experience and appreciated it for its usability, charting power, and smooth order execution. Here’s how the broker stacks up across key mobile trading metrics:

Platforms

With OANDA, you get the choice between two core mobile apps: its proprietary OANDA Trade app and the popular MT4 app. The OANDA Trade app, available for iOS and Android, is designed for intuitive trading, offering 32 built-in indicators, 11 drawing tools, and 16 available timeframes.

For more advanced needs, the MT4 mobile app supports a full range of technical analysis tools, pending order types, and real-time account monitoring. Both apps deliver fast execution speeds and flexible trade management, although OANDA does not currently offer a dedicated social trading app.

Look and feel

The OANDA Trade mobile app offers a clean, modern design that is similar in look and function with its web platform. You can navigate among watchlists, charts, and order panels in a fast and fluid manner and you can find support for multiple languages, including English, German, Japanese, and Chinese.

In our testing, we found the chart responsiveness to be particularly strong. The screen was responsive enough that you could zoom, pan, and modify trades easily on the go.

Login and security

While basic security is solid, I found that the lack of biometric support may disappoint users who prioritize seamless mobile authentication.

Search functions

The mobile search function is straightforward. You can either search for instruments directly by name or browse organized asset categories, making it simple to find tradable products quickly.

Placing orders

OANDA’s mobile app supports all major order types, including Market, Limit, Stop, and Trailing Stop. Time-in-force options like GTD are also available, giving you the flexibility you need when setting orders.

Alerts and notifications

Unlike the desktop version, with the OANDA Trade app, you can set native price alerts directly from your mobile device. This is a valuable feature if you want to stay updated without constantly looking at your screen.

Research and Development

While trading, I saw that all OANDA users have access to Autochartist, which provides automated technical analysis, trade setups, and chart pattern recognition directly within the OANDA Trade and MT4 platforms. Autochartist also includes volatility analysis and key levels monitoring, adding depth to pre-trade planning.

Market news at OANDA is powered by Dow Jones Newswire, delivering professional-grade financial news feeds and economic updates in real time.

An integrated economic calendar is available across OANDA Trade and MT4, allowing you to track upcoming macroeconomic data releases and plan trading strategies around major events. You’ll find that the calendar is detailed, user-friendly, and categorized by impact level.

For charting and technical analysis, OANDA Trade benefits from TradingView-powered charts, offering over 80 indicators, dozens of drawing tools, and full-screen interactive features. Traders using the direct TradingView integration can access an even broader social and technical ecosystem, including crowd sentiment data.

Trading statistics

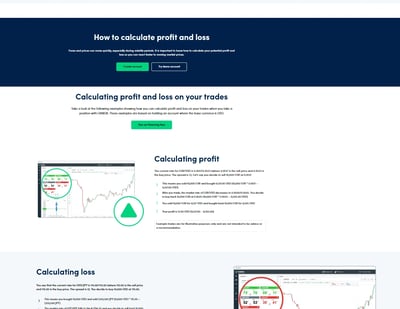

One standout feature is OANDA’s comprehensive range of trading calculators, including pip value, margin requirement, and profit/loss calculators. These tools allow you to assess potential costs, risks, and outcomes before entering a position.

For those wanting deeper market insights, OANDA offers access to historical spread data. While full historical tick data for backtesting is not offered directly through OANDA Trade, traders using MT4 can utilize built-in historical data tools to backtest strategies within the MT environment.

Trading signals

In terms of trading signals, OANDA delivers Autochartist-generated trading setups and pattern alerts, integrated directly into the platform experience. These include clear visual overlays, directional indicators, and volatility analysis, all designed to make it easier for you to spot potential opportunities and manage risk proactively.

Although OANDA doesn’t offer a formal copy trading service or proprietary social trading app, traders using TradingView can access community ideas and signals published by other users, which serves as a form of crowd-sourced strategy inspiration.

Education

I found that OANDA offers a decent range of educational resources primarily aimed at beginner and intermediate traders, though more advanced content is relatively limited. Educational materials are available through the OANDA Academy and the broker’s YouTube channel, covering essential topics like FOREX basics, technical analysis, risk management, and platform tutorials.

The text-based learning modules are well-structured, offering short lessons grouped into themes like “Getting Started,” “Trading Basics,” and “Platform Tutorials.” Video content supplements this with easy-to-follow explanations, though much of it focuses on using OANDA’s platforms rather than providing broader market education.

A notable aspect of OANDA’s educational approach is its integration of webinars and live trading workshops. These events feature OANDA analysts and guest speakers who walk traders through market updates, trading setups, and technical analysis techniques.

While the material is generally helpful for building foundational skills, it tends to be less comprehensive than the deep educational libraries offered by other leading brokers.

OANDA delivers a well-rounded product offering centered on FOREX and CFD trading, with additional access to stock CFDs, commodities, indices, bonds, and cryptocurrencies depending on your region. Overall, OANDA delivers a highly trusted and capable trading environment, particularly well-suited for disciplined, strategy-driven traders who want regulatory security, flexible platforms, and transparent costs without unnecessary frills.

Final Thoughts

OANDA is a globally trusted broker offering access to over 3,900 instruments across FOREX, indices, commodities, stocks (in select regions), bonds, and cryptocurrencies, OANDA provides a versatile trading environment.

FOREX traders benefit from flexible pricing models, with standard commission-free accounts offering solid spreads, and core pricing accounts delivering raw spreads from as low as 0.0 pips as advertised, but 0.4 pips in practice. OANDA’s advanced platform suite, featuring OANDA Trade, MT4/5, and TradingView integration, caters to both manual and algorithmic traders looking for professional-grade tools.

Conclusion

In my research, I came to learn that OANDA is a recognizable FOREX and CFD broker with a long-standing reputation for reliability, regulatory strength, and client transparency. Since its founding in 1996, this broker has built an infrastructure that supports traders across all experience levels, offering access to over 3,900 instruments through platforms like OANDA Trade, MT4/5, and direct TradingView integration.

The broker is known for its flexible account options, strong research tools, fast execution, and commitment to secure fund handling through Tier-1 regulatory oversight. Its transparent pricing models, offering both standard and core pricing accounts, appeal to traders who value cost control and execution quality.

I found that as a beginner, you can benefit from a no-minimum-deposit entry point, while professional traders can leverage core pricing and API integrations for more advanced strategies.

On the negative side, while well-organized, OANDA’s educational offering is not as extensive as that offered by some larger competitors.

Review Methodology

pairsThe team at Arincen collected more than 120 pieces of data covering in excess of 100 licensed FOREX companies. Data collection was done in three ways:1. Companies’ websites.2. Other Websites that have ranked FOREX companies.3. A survey questionnaire (referred to here as Survey “1”) we had sent to the companies invited to participate in the exercise. We have identified 12 criteria for our assessment, each containing several aspects and carrying its own relative weight. These include licensing, deposits and withdrawals, number of assets etc.

Afterward we validated the data by:1. Registering with FOREX companies as a secret shopper and/or as Arincen.2. Survey number “2,” in which we asked these companies’ customers for important feedback and past experience. The next step saw us evaluate and rank each company, relying on the hard work of 15 Arincen employees. We were very careful in ensuring the most accurate assessment possible, including taking into account different languages, as well as the various mobile-app operating systems, e.g., Apple, Samsung etc.To add credibility to our research project, we sent a final and third survey (referred to here as Survey “3”) to enable participating FOREX companies to evaluate our own research and whether it accurately reflects the realities on the ground. We were fortunate enough to receive a mark of 9.9 out of 10! We have kept to a minimum the margin of error, which stood at a measly 1%. To learn more on how we came up with the evaluation, please click here.

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

FAQ

Yes, OANDA is considered very safe and is regulated by multiple Tier-1 authorities. It enforces strict fund segregation policies and offers investor protection for clients under certain entities, such as the FSCS in the UK and the CIPF in Canada.

OANDA supports a range of platforms, including its proprietary OANDA Trade platform, MT4, MT5 (in select regions), and direct integration with TradingView for advanced charting and social features.

There is no minimum deposit required to open a standard account at OANDA. However, traders looking to access Core Pricing accounts with tighter spreads need to deposit at least $10,000.

OANDA offers over 3,900 tradable instruments, including FOREX pairs, stock CFDs, indices, commodities, bonds, and cryptocurrencies, although real stocks and ETFs are only available to clients in certain regions, like the EU.

Yes, OANDA charges an inactivity fee of $10 per month after 12 months of no trading activity on your account.

Deposits are free of charge, and the first card withdrawal each month is also free. Subsequent card withdrawals or bank wire withdrawals can incur fees, typically between $20–$35, depending on the region.

Yes, but only for retail clients trading under the EU regulatory framework. Clients outside these regions may not automatically receive negative balance protection.

OANDA offers such strong research tools as Autochartist trading signals, Dow Jones Newswire access, TradingView-powered charts, and an integrated economic calendar. Its educational offering is good for beginners but less extensive for advanced traders.