The Trader’s Guide to Using the Relative Strength Index

As a longtime trader, I've realized that we could all do with any helpful tools that help us understand what is happening in the markets. The endless graphs with the oscillating candlesticks can be intimidating if you don’t know how to read them.

One of the most helpful tools for market analysis is the Relative Strength Index (RSI). This measure is a staple in technical analysis as a reliable momentum indicator that captures the speed and change of price movements. It’s a quick pulse check on whether a market is running too hot or too cold.

Fundamentally, RSI operates on a scale of 0 to 100, with key levels at 30 and 70. When RSI dips below 30, the market is likely oversold, which could signal opportunities to buy. On the flip side, when it rises above 70, the market could be overbought, suggesting it's time to sell. These levels aren’t guaranteed. No such thing exists, but they do give you valuable clues that help you anticipate market reversals or confirm trends.

In my opinion, while RSI is a useful indicator, its power can be magnified when you use it with other indicators like Bollinger Bands or Fibonacci retracements, both of which we have written about in detail in other articles on this site. By combining tools, you get a clearer picture of the market, filtering out false signals and improving your chances of making smarter trading decisions. In this article, I will give you a detailed breakdown of how you can use RSI.

RSI is a momentum oscillator ranging from 0 to 100 that helps traders identify overbought conditions above 70 and oversold conditions below 30.

The indicator calculates momentum by comparing average gains to average losses over a set period, 14 periods is the default.

Readings above 70 suggest a potential reversal or profit-taking phase, while readings below 30 may signal a buying opportunity.

Midline crossovers around 50 can confirm trend direction, with a move above indicating bullish momentum and below indicating bearish momentum.

Bullish divergence occurs when price makes a lower low but RSI forms a higher low, hinting at weakening downside momentum.

Bearish divergence happens when price records a higher high while RSI posts a lower high, flagging a possible trend reversal.

RSI delivers its best signals when used alongside tools like moving averages, Bollinger Bands, MACD, or Fibonacci levels to reduce false alarms.

Effective RSI use includes adjusting its period length to match your trading timeframe, avoiding over-reliance on single signals, and pairing stop-loss levels with technical support or resistance.

The History of RSI

J. Welles Wilder Jr. was a mechanical engineer turned trader who was looking for a way to read the markets better. He developed and introduced the RSI in the late 1970s, and it quickly became a hit. It was taken up more broadly by the trading community and became a cornerstone of technical analysis. Finally, traders had a way to measure the momentum of price movements and identify overbought and oversold conditions with accuracy.

.webp)

The reading is easy to understand, as I will explain, and is also pretty accurate. After its introduction, RSI became a standard across global financial markets. It works across all financial assets. Whether it is stocks, FOREX, commodities, or even cryptocurrencies. Traders rely on the RSI to gauge market sentiment and fine-tune their strategies. The versatility of the tool, as well as how easy it is to use, has solidified RSI’s place in the toolbag of many traders. Let our Arincen experts tell you why.

What is RSI?

I've come to learn that at its simplest, RSI operates on a 0–100 scale. The goal of the measure is to capture buying or selling momentum. RSI does this by comparing the average of recent price gains to the average of recent price losses over a given period. This period is most commonly 14 days.

A reading above 70 suggests that an asset could be overbought, and therefore primed for a downward correction. On the other hand, a reading below 30 hints at an oversold market, signaling a potential upward bounce. Naturally, any reading between these two extremes should be viewed as inconclusive. However, these midway readings are still useful, as they can confirm trends. A move above the midpoint of 50 generally supports an upward trend, while a drop below 50 suggests a downward trend. We can therefore see how this straightforward scale is for traders.

One of the best things about RSI is its flexibility. Even though 14 days is the most common timeframe, you can apply it across various timeframes. It doesn’t matter if you are trading on a 1-minute chart or analyzing weekly trends. As I’ve also noted, RSI works seamlessly across different asset classes. This high level of adaptability makes RSI a strong favorite among traders who want a simple way to inform their trading strategies and stay ahead of market trends.

How RSI Works

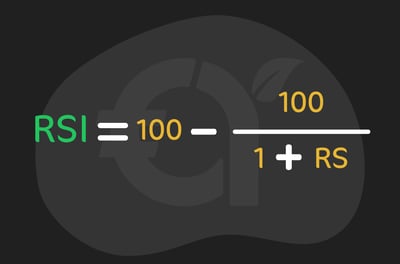

For anyone interested in the formula that underpins RSI, it works as follows:

Where RS stands for the relative strength, which, as we know, is the ratio of average gains to average losses over a set period. By using this formula, you can transform raw price data into a clear, actionable metric on a scale of 0 to 100. Anyone worried about doing these calculations themselves needn’t worry, as all of the best brokers provide RSI readings on their platforms.

I’ve said RSI is flexible, but it is also highly sensitive. Its reading is adept at sensing both price gains and losses, giving you a balanced view of market momentum. By combining simplicity with precision, RSI gives you everything you need to sniff out the slightest shifts in market behavior, whether you’re on the lookout for reversals or riding established trends.

The Most Common RSI Trading Signals

There are four common trading signals that RSI reveals. Each of these signals is straightforward yet powerful and will guide your trading decisions if used correctly. Any trader could strongly benefit from knowing about potential reversals, corrections, and trend confirmations. The RSI provides this, making it a go-to tool for traders.

Overbought Conditions

In my experience, overbought conditions occur when an asset's price rises significantly in a short period. A telltale sign that an asset is overbought is when its price exceeds its intrinsic or market-accepted value.

This short-term overperformance is often referred to as a “bubble,” driven by emotional buying when technical indicators suggest it is unsustainable. At times like these, the asset is often overvalued, driven by frenzied and unwarranted demand, and could be due for a price correction or pullback.

When using RSI to guide your decision, watch out for when the value crosses above 70. This is a strong suggestion that the market might be overbought. Now could be a good time to be alert for selling opportunities or for you to tighten stop-loss levels.

Oversold Conditions

On the other side of the coin, oversold conditions occur when the price of an asset falls sharply over a short period, potentially below its intrinsic value. This sometimes happens when a market overreacts to bad news or when a spate of short selling spooks the market.

Oversold conditions suggest the asset is undervalued and might be primed for a rebound or price recovery. In times like these, an RSI reading below 30 often signals that the asset is oversold. It’s typically a sign of a buying opportunity, but just remember that this doesn’t guarantee an immediate price reversal. Why? Well, in some cases, the asset's downward momentum might even continue.

For this reason, I would always recommend that you combine RSI readings (or any individual indicator readings, for that matter) with other indicators confirming a market signal.

Divergences

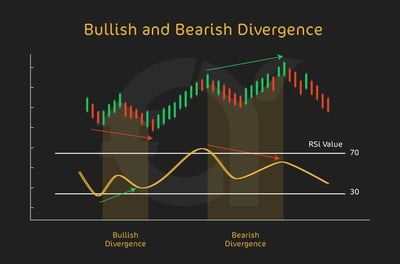

Divergences happen when the movement of an asset and the RSI indicator don't align. This is a warning of a possible reversal or a continuation of a trend. There are two main types of divergences:

Bullish Divergence: This happens when the price of an asset makes a lower low, but the RSI forms a higher low. It could mean a weakening downward momentum and a potential trend reversal to the upside. You would not be wrong to view this as a buying opportunity, especially when the RSI is below 30 and near oversold levels below 30.

Bearish Divergence: This happens when the price of an asset makes a higher high, but the RSI indicates a lower high. This is likely because of weakening upward momentum which could mean a potential reversal to the downside. If these conditions occur, it could be a good time to consider selling or tightening stop-loss levels.

Divergences are useful for spotting trend exhaustion or hidden market strength. As always, they work best when confirmed by other technical indicators, as they don’t always guarantee a reversal.

Centerline Crossover

A centerline crossover in the context of RSI refers to when the RSI value passes above or below the midpoint of its scale, which lies at 50. This crossover is a good way to confirm the direction of the momentum that the asset is enjoying.

A bullish centerline crossover typically occurs when the RSI crosses above 50, signaling that buying momentum is increasing and the asset may be heading into an uptrend. A bearish centerline crossover is when the RSI falls below 50. This often means that selling momentum is increasing and the asset might be heading into a downtrend.

Always use the centerline crossover in tandem with other indicators to confirm trend direction or signals, as it is a good tool for reflecting a shift in the balance between buyers and sellers.

How RSI Helps Identify Market Momentum

In my view, momentum is crucial in retail trading. Capturing and understanding the market's direction gives you precious insights to make timely trades. Let’s break down exactly how useful RSI is and how it can help you identify market momentum.

Spotting overbought and oversold levelsThis information is not to be sneezed at. Knowing when an asset might be overbought (above 70) or oversold (below 30) is crucial to making informed, winning trades. Knowing when an asset is overbought or oversold can tell you when to buy or sell.

Identifying divergencesAgain, divergences are important to know as they can reveal hidden shifts in market momentum. A bullish divergence tells you that selling pressure is weakening. On the flip side, a bearish divergence suggests fading buying momentum. These signals are invaluable for anticipating reversals.

Centerline crossoverA centerline crossover is a straightforward yet powerful momentum indicator. Once you know whether a trend is bullish or bearish, this crossover helps you align with the prevailing trend rather than betting against it.

Using RSI with other indicators for confirmationOne thing to know about every technical indicator is that none is foolproof. If that were the case, traders could find ways to vast riches with no missteps. Indicators are just that – an indication of how the price of an asset is behaving. To improve accuracy, always pair RSI with tools such as moving averages, Bollinger Bands, or Fibonacci retracements.

For instance, if RSI signals an overbought market and the price is near a key resistance level, it strengthens the case for a pullback. By confirming this from multiple indicators, you get fewer false signals, allowing you to trade with more confidence.

Practical Applications of RSI in Trading

So, now that we know what RSI can do for traders, how can we apply this in a real trading scenario?

Entry and exit pointsRSI helps you figure out when to enter or exit trades. Without this type of intelligent insight, you are simply relying on guesswork. As I’ve said, any time you get an RSI near 30, you should view it as a buying opportunity during a downtrend. Similarly, a reading above 70 suggests it may be time to sell or tighten stop-loss orders.

Risk managementRSI also helps you set stop-loss levels that make sense. You don’t want a stop-loss level that is incorrectly set so that you lose out on profits. By identifying overbought or oversold zones, you can place stops beyond these levels, protecting your positions from sharp reversals while giving your trades room to develop. This is the crux of good risk management.

Combining RSI with Other Indicators

In our technical analysis series at Arincen, we’ve written articles on Fibonacci sequences, Bollinger Bands, and now RSI. The truth is that, while any of these tools can work on their own, they become much more effective when paired with other technical indicators. Using multiple indicators helps you confirm signals and build confidence in your trading decisions.

RSI and Moving AveragesCombining the RSI with moving averages can provide a clearer view of market trends. Look at it this way: if the RSI crosses above 70, showing overbought conditions, but the price remains above its 20-day or 50-day moving average, it suggests that the trend could still be strong. Moving averages help determine whether the RSI signal is consistent with the overall market direction or a passing fluctuation.

RSI and Bollinger BandsBollinger Bands measure price volatility, while RSI gauges momentum. Together, they can give you a comprehensive view of how the market is performing. If RSI falls below 30, indicating an oversold market, and the price touches the lower Bollinger Band at the same time, this confirmation strengthens the idea that an upward correction is on the cards. Similarly, if RSI is above 70 and the price hits the upper Bollinger Band, a pullback might be on the way.

RSI and MACDThe Moving Average Convergence Divergence (MACD) is a powerful tool for confirming the strength and direction of trends. When RSI reveals overbought or oversold conditions, checking the MACD histogram or signal line crossover can often confirm the signal. In one example, if RSI suggests an upward reversal but MACD shows falling momentum, you would be advised to wait for stronger confirmation before entering the trade. Look at this graphic to see how you can use these two indicators together.

RSI and Fibonacci RetracementsFibonacci retracements are powerful mathematical signals that can help identify support and resistance levels. As we know, RSI reveals the strength of price movements. Taken together, if RSI plummets under 30 and the price approaches a key Fibonacci retracement level, this pairing can mean a high probability buy opportunity. In the same vein, combining an overbought RSI with a price approaching a resistance level strengthens the case for a sell trade.

RSI With Live Examples

The following examples show how RSI can help you to spot opportunities, manage risk, and make timely decisions. Whether it’s identifying reversals, confirming trends, or acting on divergences, RSI is a versatile and useful tool for handling dynamic market conditions.

Overbought Signal Leading to a ReversalIn our first example, imagine a tech stock that has been on a solid uptrend, with its RSI rising to a reading above 70. By now, you know that is an overbought condition, suggesting the stock rally might be losing steam. Not long after, the stock price starts to flatten, and a bearish candlestick pattern shows up. This is a classic setup for a price reversal. A smart and alert trader would use this signal to exit long positions or consider shorting the stock as they have information suggesting a downward correction.

Bullish DivergenceLet’s say you are trading gold and its price experiences a sharp decline. While the price forms lower lows on the chart, the RSI begins forming higher lows, meaning that a bullish divergence is at play. This suggests that selling momentum is getting weaker, even though the price is still falling. As soon as you see this divergence, you could take a long position, anticipating a reversal. As the price stabilizes and moves higher, you can cash in.

Centerline BreakoutNow, take the case of a cryptocurrency like Bitcoin recovering from a bearish trend. As the price stabilizes and starts rising, the RSI crosses above the 50 level. From what you know, this centerline breakout confirms a shift in momentum from bearish to bullish. You could use this signal to enter a long position, riding the new uptrend.

Tips for Beginners

Here are some tips I think will help you achieve the best trading results with RSI.

Adjust RSI settings for different markets and timeframesThe default RSI setting of 14 days works well for many traders, but markets and strategies can be different. For those who like a faster-paced environment, like day trading, a shorter period of perhaps 7 or 9 days can give you quicker signals. On the other hand, longer periods (e.g., 20 or 30 days) offer smoother signals for swing traders or position traders. I would advise you to experiment with settings to help tailor RSI to the specific behavior of the asset and timeframe you’re trading.

Don’t rely on RSI aloneRSI is a valuable indicator, but it works best as part of a broader strategy. Pair it with tools like moving averages, Bollinger Bands, or Fibonacci retracements to validate signals. For example, if RSI suggests an oversold condition, confirm the signal by checking for support at a Fibonacci level or watching for a reversal candlestick pattern. Relying solely on RSI can lead to false signals, so always seek confirmation.

Manage your risk better with stop-loss levelsEven with a well-tuned RSI strategy, market moves can leave you wondering what just happened. Protect yourself by setting stop-loss orders at logical levels. For instance, when entering a trade based on RSI’s oversold signal, it’s a good idea to put your stop just below a recent support level. This limits potential losses if the market keeps moving against your position. You need a disciplined risk-management approach that prevents any single trade from significantly impacting your overall performance.

Common Mistakes to Avoid

I wouldn’t want you to fall victim to common errors. Here’s what you should know.

Misinterpreting overbought/oversold conditions as guaranteed reversalsOne of the most common mistakes traders make is assuming that an RSI reading above 70 or below 30 always signals a reversal. While these levels show underlying overbought or oversold conditions, they are not foolproof predictors.

During strong trends, RSI can remain above 70 or below 30 for extended periods. For example, in a strong uptrend, RSI might hover above 70 without the price reversing. Don’t act hastily and do look for additional confirmation, such as divergence or candlestick patterns, before entering a trade.

Ignoring divergences and other key RSI signalsDivergences are a crucial aspect of RSI, yet many traders overlook them. For instance, a bullish divergence—where RSI forms higher lows while the price makes lower lows—can signal weakening bearish momentum and a possible reversal.

Likewise, bearish divergence, where the RSI forms lower highs while the price makes higher highs, could signal a possible downtrend. If you ignore these signals, you could be missing significant trading opportunities. Always analyze the full RSI picture, including divergences and centerline crossovers, to sharpen your decision-making.

Overcomplicating trades with tight stop-loss settings based only on RSIAnother common pitfall is setting very tight stop-loss orders based solely on RSI signals. For example, you might put a stop-loss just outside the 70 or 30 levels, assuming the price won’t cross either level.

However, as we all know, markets are unpredictable, and brief spikes beyond these levels can lead to unnecessary stop-outs before the trade has a chance to play out. Instead, make sure your stop-loss levels are in sync with key support or resistance levels, giving your trades room to breathe while managing risk at the same time.

Conclusion

In my experience as a trader, RSI is a powerful tool that any trader could use. It provides crucial insights into where the market is heading and what the potential turning points could be. However, like any tool, its true strength lies in how it’s used.

By combining RSI with other indicators and integrating them into a comprehensive trading strategy, you can filter out noise and improve your decision-making. Remember, no indicator is guaranteed, and trading always involves risk. That’s why you should approach RSI with a balanced mindset. Leverage its strengths while staying mindful of its limitations. This way, you can navigate the markets more confidently.

FAQ

The RSI is a momentum indicator used in technical analysis to measure the speed and change of price movements. It works on a scale of 0 to 100, helping you to see overbought or oversold conditions in the market.

An RSI below 30 indicates that an asset is probably oversold, which tells you there is a potential buying opportunity. An RSI above 70 suggests that an asset could be overbought, meaning it might be time to sell. However, these levels are not guaranteed and should be used alongside other indicators.

Yes, RSI is often combined with such other indicators as Bollinger Bands, Fibonacci retracements, and moving averages to confirm signals and reduce false positives.

A bullish divergence occurs when the price makes a lower low while RSI forms a higher low, indicating weakening downward momentum and a potential upward reversal. A bearish divergence happens when the price makes a higher high, but RSI shows a lower high, signaling fading upward momentum and a possible downward reversal.

RSI helps traders identify potential entry and exit points by highlighting overbought or oversold conditions. For example, an RSI below 30 during a downtrend could signal a buying opportunity, while an RSI above 70 in an uptrend could suggest it’s time to sell or tighten stop-loss levels.

Yes, the default 14-day RSI setting can be adjusted. Shorter periods (e.g., 7 or 9 days) offer quicker signals that are suitable for day trading, while longer periods (e.g., 20 or 30 days) provide smoother signals for swing or position trading.

Assuming overbought/oversold levels always guarantee reversals, especially during strong trends. Ignoring divergences, which provide critical insights into market momentum. Setting overly tight stop-loss levels based solely on RSI, can lead to premature exits during market fluctuations.