Forex.com Review 2024

| 🏆 Broker Evaluation |

7.92

|

| 🗺️ Regulatory Bodies | FCA |

| 💳 Minimum Deposit | 100$ |

| ⚖️ Islamic Account | yes |

| 💰 Payment Methods | Bank transfer, credit card, Electronic Banks |

| 🏢 Main Branch | United States of America |

| ☎ Customer Service | 24/5 |

| 🎮 Demo account | yes |

| 🖥 Trading Platforms | Proprietary Platform -Web platform-mt4- mt5 |

Key Takeaways

- FOREX.com, established in 2001, is a global FOREX and Contract for Differences (CFD) broker.

- FOREX.com makes the claim as the #1 FOREX broker in the US, which is validated by the latest June 30, 2020, Commodity Futures Trading Commission (CFTC) Retail FOREX Obligation report.

- Although FOREX.com is publicly traded, it does not operate as a bank. It is authorized by four high trust regulators (tier-1) and one low trust regulator (tier-3).

- Although FOREX.com is appropriate for all types of traders in search of a wide array of products and asset classes, it is a particularly good fit for high-volume traders.

- At FOREX.com, you can trade with FOREX, CFDs and cryptos only. Other asset classes, like stocks or funds, are not available.

- FOREX.com offers multiple deposit and withdrawal options, all free of charge.

- The broker's Website lists a number of ways that clients can communicate with FOREX.com, including online chat and live phone support.

- FOREX.com began primarily as a Market Maker, but has since transformed into an Electronic Communications Network (ECN) that generates revenue through customer trades that “cross” the bid/ask spread, or as commissions, which are on par with the industry.

- FOREX.com requires a minimum initial deposit of “at least 100 of your selected base currency,” although it recommends a deposit of 2,500 currency units so that the client has “more flexibility and better risk management” in their trading.

- Clients may choose between the downloadable “Advanced Trading” platform or MetaTrader4 (MT4) for a desktop experience; the “Web Trader” for a browser-based trading experience; or the FOREX.com or MT4 mobile app for trading on portable smart devices.

- FOREX.com has great and diverse research functions. While providing good charting tools and trading tips based on technical analysis and high-quality market reports, it lacks fundamental data.

- FOREX.com's educational offerings are on par with the industry standard and well-organized. Clients may access content according to their experience level or thematically.

- FOREX.com’s overall mobile offering is among the best in the industry. FOREX.com offers a proprietary mobile app along with the full suite of MetaTrader mobile apps, including MT4 and MT5.

Forex.com Evaluate - research result

Overall Evaluation:

7.92

Regulations

8.5

Deposits and Withdrawals

5

Commissions

6.9

Assets

8.3

Trading Platform

9

Research and Development

10

Customer Service

9.5

Mobile App Trading

9

Learning

7

Experience with broker

9.5

Trading Tools

8

Website

6.5

Overall Summary

Established in 2001, FOREX.com is a global FOREX and CFD broker. It is a brand of GAIN Capital, which is listed on the New York Stock Exchange. FOREX.com is regulated by several financial authorities, including the UK's top-tier Financial Conduct Authority (FCA) and America's CFTC. FOREX.com is considered safe because it has a long track record, is regulated by leading financial authorities and its parent company is listed on a stock market.

In 2020, GAIN Capital executed an average daily volume of $8.1 billion for its retail clients. As a pioneer in offering online FOREX trading in the US, FOREX.com remains one of the largest retail FOREX brokers worldwide, with over $1.32 billion in assets and over 93,000 active clients during the second quarter of 2020 (latest available data).

FOREX.com generally offers an extensive range, from CFDs to futures and spread betting, across several different asset classes. Not all, however, are available in every region that it services. Aside from FOREX, from which it derives its name, the broker also offers commodities, individual stocks, indices, Exchange-Traded Funds (ETF), bonds, cryptocurrencies, gold and silver (which are unleveraged in the US) and futures to provide trading opportunities for all types of traders. FOREX.com UK also offers client account protection, such as European Securities and Markets Authority (ESMA)-mandated negative balance protection and guaranteed stop-loss orders (GSLO).

FOREX.com offers US clients leveraged access to over 80 currency pairs with competitive spreads across different account types. A well-organized and navigable Website with fully disclosed services and fees, multiple user interfaces, research tools and education that are on par with industry standards, as well as regulatory oversight, place FOREX.com in the upper echelon of online brokers today.

FOREX.com stakes its claim as the #1 FOREX broker in the US, which is validated by the latest June 30, 2020, CFTC Retail FOREX Obligation report that states, “represents the total amount of funds at a Futures Commission Merchant (FCM), a Retail Foreign Exchange Dealer (RFED), or FCMRFD that would be obtained by combining all money, securities and property deposited by a retail FOREX customer into a retail FOREX account or accounts, adjusted for the realized and unrealized net profit or loss.”

With a wide range of markets available, FOREX.com's multi-asset offering is brightest on its flagship Advanced Trading (desktop) and Web Trading (browser) platforms.

FOREX.com

Broker Evaluation

Year of Establishment

2001

Main Branch

United States of America

Other Branches

United Kingdom

Supported Languages

English

Operating Hours

Market Opening Hours

Is FOREX.com Safe?

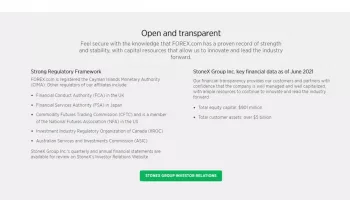

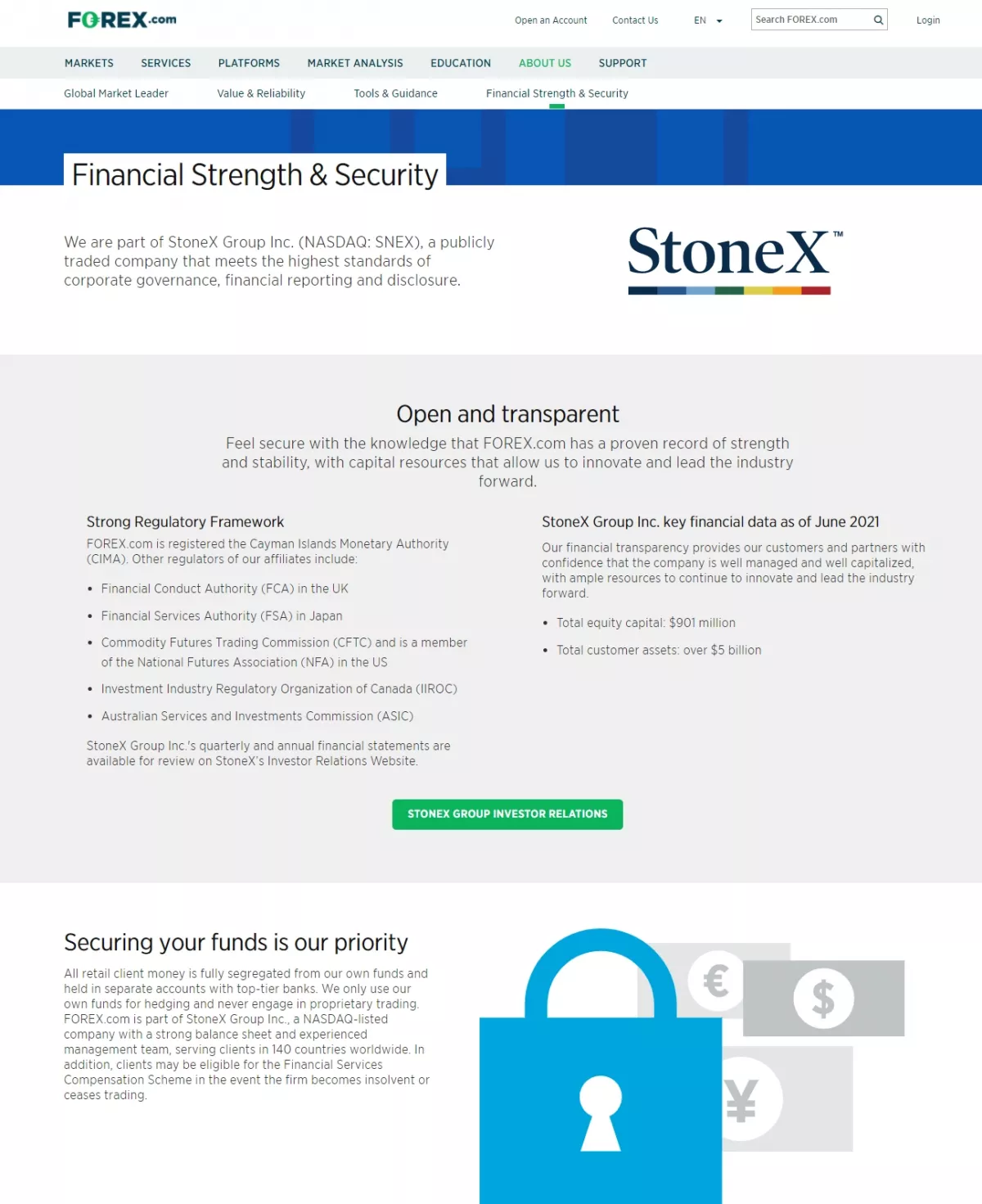

Yes, FOREX.com is looked upon as low-risk. While FOREX.com is publicly traded, it does not operate a bank, but is authorized by four high trust regulators (tier-1) and one low trust regulator (tier-3).

FOREX.com is registered with the CFTC (US), the National Futures Association (NFA) in the US, the FCA in the UK, the Investment Industry Regulatory Organization of Canada (IIROC), the Australian Securities and Investments Commission (ASIC), the Monetary Authority of Singapore (MAS), Japan's Financial Services Agency (FSA) and the Cayman Islands Monetary Authority (CIMA). Plainly, FOREX.com is regulated in several jurisdictions, but because laws vary by country, products offered also differ. For example, CFDs are not available to US clients, but are available outside the US.

FOREX.com segregates client funds, which helps safeguard clients' money in the event the company faces insolvency. UK/EU clients have additional asset protection through the Financial Services Compensation Scheme (FSCS), up to £85,000, while Canadian clients are protected by the Canadian Investor Protection Fund. US clients are not as fortunate, as no additional insurance is provided by the company in terms of safeguarding their funds.

FOREX.com offers negative balance protection, which is mandated under ESMA rules that went into effect in 2018, and GSLOs (although at an additional cost for its UK/EU clients). However, non-UK/EU client accounts can go in the red, as negative balance protection is not offered to them. Thus, US traders with negative account balances are liable for more money than they had initially deposited into their accounts. Also, US clients are not offered GSLO.

FOREX.com has two-factor authentication (2FA) and biometric authentication for its mobile application. It also encrypts data using SHA256, TripleDes and MD5.

Who Is FOREX.com Recommended For?

FOREX.com is appropriate for all types of traders looking for exposure to a wide array of products and asset classes, and is a particularly good fit for high-volume traders. Product offerings vary by region, but FOREX.com emphasizes fast and reliable execution, a variety of platforms, as well as high account security. In the US, the trader is geared more toward clients who want to trade only FOREX.

Pros

-

Wide range of product offerings.

-

Regulated by the FCA (UK) and the CFTC (US), along with the NFA (also in the US).

-

TradingView charts are built into the Web platform.

-

Rebates for high-volume traders.

-

Offers protection for UK/EU client accounts.

Cons

-

Sub-par Website maintenance.

-

No account protection or GSLO for US clients.

Pros Explained

FOREX.com generally offers clients access to a wide range of product offerings spanning several asset classes. As noted previously, clients have access to FOREX, commodities, equities, bonds, indices, ETFs, cryptocurrencies, industry sectors, gold and silver (unleveraged in the US) as well as futures (through an affiliate).

TradingView is an advanced financial visualization platform that has been integrated into FOREX.com's Web-based platform. TradingView's ease of use and functionality make it, by far, the most impressive aspect of the Web-based platform.

FOREX.com is a registered FCM and RFED with the CFTC and a member of the NFA (#0339826). Further, GAIN Capital UK Ltd is authorized and regulated by the FCA #113942. UK/EU clients also have additional asset protection through the FSCS, up to £85,000, as noted above.

FOREX.com offers its UK/EU clients negative balance protection, as mandated by the ESMA, and GSLO (albeit for an additional charge), which protects against market gap risks. These rules probably resulted from the SNB event of January 15, 2015, that confounded the markets, especially the highly-leveraged retail FOREX market.

FOREX.com advertises fast and reliable execution, which is particularly good for the high-volume trader, who can earn rebates through the Active Trader program thereby lowering trading costs.

FOREX.com advertises fast and reliable execution, which is particularly good for the high-volume trader, who can earn rebates through the Active Trader program thereby lowering trading costs.

Cons Elaborated

FOREX.com does not offer negative balance protection for US clients. Thus, US traders with negative account balances are responsible for more money than they initially deposited into their accounts. Also, FOREX.com does not offer GSLO for US clients.

Crucial for an online broker is an effective Web presence. While FOREX.com's Website has an intuitive feel, there are a few pages with outdated, incorrect and/or incomplete information. This speaks volumes to a general lack of attention to detail.

Trading Account Information

Account Currency

USD

Minimum Deposit

100$

Segregated Accounts

Yes

Payment Methods

Bank transfer, credit card, Electronic Banks

Accepting US Clients

Yes

Available Markets

Currency pairs, Indices, Commodities, Materials and Cryptocurrencies

Demo Account Duration

30 Days

Offering of Investments

At FOREX.com, you can trade with FOREX, CFDs and cryptos only. Other asset classes, such as real stocks or funds, are not available. FOREX.com provides a great number of currency pairs and cryptocurrencies. The stock index, ETF and commodity CFD selections are also considerable. The stock CFD lineup is relatively thin, however. A recent development saw the FCA ban the sale of crypto-derivatives to UK retail consumers, from January 6, 2021. Also, you cannot change leverage levels, which is a drawback.

Globally, FOREX.com provides access to a broad selection of financial instruments across a wide range of different asset classes, including:

4,500+ popular stocks.

90+ currency pairs.

- Indices.

- Commodities.

- ETFs.

- Bonds.

- Gold and Silver.

- Cryptocurrencies.

- Futures and Futures Options – US (FuturesOnline).

In the US, FOREX.com's product line caters solely to spot FOREX trading, as well as to unleveraged gold and silver. Via its affiliate, FuturesOnline, traders may also trade five futures products.

Products and services available at FOREX.com will depend on where the trader is located and the applicable entity that holds their account. For example, CFDs are not offered in the US due to strict regulations, while outside the US, FOREX.com offers over 4,500 CFDs.

Cryptocurrency trading is available through CFDs, but not via trading the underlying asset (e.g., buying Bitcoin). Note that Crypto CFDs are not available from any broker's UK entity, nor to UK residents.

Available assets

| Markets | Available | Number of Assets |

| Currency Pairs | 90 | |

| Stocks | 4500 | |

| Commodities | 11 | |

| Crypto | 8 | |

| Indices | 17 | |

| ETFs |

Deposits and Withdrawals

FOREX.com provides multiple deposit and withdrawal options, all without charge. Withdrawal is not possible, however, with some credit cards. At FOREX.com, you can choose from six base currencies: EUR, GBP, USD, AUD, CHF and JPY.

FOREX.com does not charge deposit fees. In addition to a bank transfer, you can use credit and debit cards, as well as PayPal, for depositing funds. A bank transfer can take several business days, while payment with a credit/debit card is instant. You can only deposit money from accounts that are in your name.

FOREX.com does not charge deposit fees. In addition to a bank transfer, you can use credit and debit cards, as well as PayPal, for depositing funds. A bank transfer can take several business days, while payment with a credit/debit card is instant. You can only deposit money from accounts that are in your name.

Withdrawal at FOREX.com is also without charge. Methods for withdrawal are the same as for deposits. Bank transfers can take two to three business days, while credit/debit card withdrawal can take longer, up to five business days.

Customer Support

FOREX.com's Website lists multiple ways that clients can contact the broker, including online chat and live phone support. FAQs and Website client support are, generally, satisfactory. Social media support is not available, although FOREX.com does have social media accounts where it posts market analysis and company information.

Phone support is the most rapid way to have questions answered by a real person. There is a small menu from which to choose at the beginning of the call. Wait times will vary, based on call volume; during a normal day, you can expect to wait several minutes before being connected with a representative. Email support is available for more in-depth questions, but expect a one-to-three business day wait for a response.

Advantages of Trading

Maximum Leverage

1:50

Minimum Lot Size

0.01 Lot

Available FOREX Pairs

90+ Currency Pairs

Scalping

Yes

Hedging

Yes

Spread

Starting from 0.6 pips

Trailing Stop

Yes

Islamic Account

Yes

Trading Platforms

Proprietary Platform, Web platform, MT4, MT5

Regulatory Bodies

Broker Type

STP

Commissions and Fees

FOREX.com began primarily as a Market Maker, but has since converted into an ECN that generates revenue either through customer trades that “cross” the bid/ask spread, or as commissions, which are on par with the industry. Pricing is transparent and easily found on the FOREX.com Website.

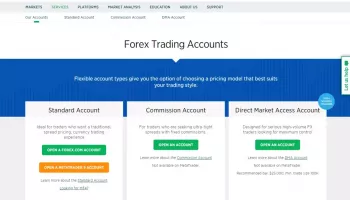

Spreads vary depending on the type of account the client chooses. For example, the minimum EUR/USD spread for US clients on a “Standard” Account is one pip, while “Commission” and “STP Pro” Accounts will show spreads of 0.2 and 0.1, respectively. The latter two, however, have commissions of $50 and $60 per million added to the displayed spread. Regions outside the US also offer Direct Market Access (DMA) Accounts for larger account sizes (25,000+). The DMA Account offers no markup on spreads, although a commission is charged.

Standard Account and Commission Account traders may also benefit from the Active Trader Program, which is open to anyone who opens an account with at least $10,000 or who trades $25 million of volume in one month. The program is not open to DMA Account holders, however, as that account already has volume-based fee reductions.

Maximum leverage is 1:20 for minors and 1:50 for majors, notably less than what well-established international brokers offer. The Commission Account pays 1.5% annually on the available margin.

Functional demo accounts are provided at no charge, giving potential clients time to assess the pricing structure before committing real capital. The one criticism of the broker's demo accounts is that they expire in 30 days and there is no option to extend or apply for a new one under the same credentials.

Relative to account ownership, FOREX.com has additional options:

- Individual – owned by an individual.

- Joint – owned by two or more individuals.

- Corporate – owned by a legal entity.

FOREX.com requires the minimum initial deposit to be “at least 100 of your selected base currency," although it recommends a deposit of 2,500 chosen currency units so clients have "more flexibility and better risk management” in their trading.

As is the norm in the FOREX industry, clients may be charged swap fees on positions held overnight, which can be subject to currency conversion charges if they trade in a currency other than the account's base currency.

In terms of other fees, accounts with no trading activity for more than 12 months are subject to a $15/month inactivity fee. The Website does not list additional fees for deposits or withdrawals.

It is worth noting that the Standard Account is the only option for MetaTrader clients. FOREX.com provides an upgrade-suite, which consists of 20 Expert Advisors (EA) and custom indicators, via a partnership with FX Blue. Overall, traders seeking the benefits of Market Maker execution and who are willing to pay a premium in the form of a higher spread will choose FOREX.com's Standard Account.

| Account Type | Minimum Deposit | Spread Commission | Commission | Swap Commission | Deposit Commission | Withdrawal Commission |

|---|---|---|---|---|---|---|

| Standard account | 100$ | Starting from 0.6 pip | 0$ | Yes | 0$ | 0$ |

| Commission account | 100$ | Starting from 0.2 pip | 5$ | Yes | 0$ | 0$ |

| Direct Market Access Account | 25,000$ | Starting from 0.2 pip | Starting from 4$ | Yes | 0$ | 0$ |

Platforms and Tools

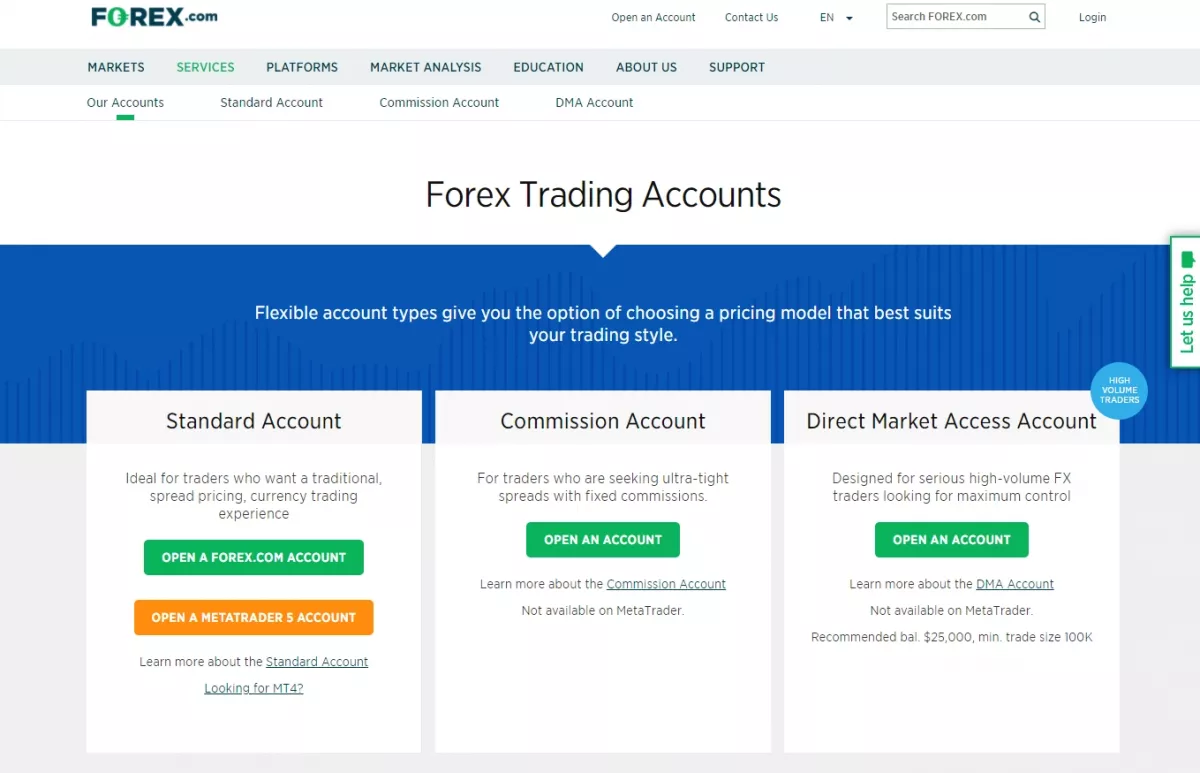

FOREX.com's trading platforms accommodate both the active-day trading professional and the occasional longer-term trader. Clients may choose between the downloadable advanced trading platform or MT4 for a desktop experience; the Web Trader for a browser-based trading experience; or the FOREX.com or MT4 mobile app for trading on portable smart devices.

Within the different platforms, traders can access charts, news, economic calendars, trade/order history, positions, trade signals as well as research reports, in addition to market analysis from FOREX.com analysts. There are few drawbacks to the platforms. Offered are a sufficient number of indicators and drawing tools to satisfy the avid technical analyst, and the platforms are functional enough to make rapid-fire trades, if needed. The charting package is provided by TradingView and is, by far, the most impressive aspect of the Web-based platform.

Placing trades on the Web Trader or the downloadable advanced trading platform is intuitive. Clients may trade directly from charts by right-clicking and selecting the “trade” option or by clicking on the “buy” and “sell” buttons along the top of the chart. This brings up an order window, where the entry, stop-loss and profit target are set. One-click trading can be enabled for rapid-trade execution.

FOREX.com's platform has four basic order types, with the option of attaching “take profit” and/or “stop-loss” orders to them. Additionally, the trader may choose to make the stop-loss a trailing stop-loss order. One difference between the Web-based and downloadable offering is that GSLOs are only available on the latter and, furthermore, only for UK/EU clients. The four types are:

Market – The simplest order, where a trader signals that their trade request should be executed at the prevailing market rate.

Limit – A pending order, where the entry is at a predetermined point above or above the prevailing market rate, depending on whether it is a buy or sell. The trader also has the option of selecting the expiration time of this order.

Stop – A pending order, where the entry is at a predetermined point above or below the prevailing market rate, depending on whether it is a buy or sell. The trader also has the option of selecting the expiration time of this order.

One-Cancels-the-Other (OCO) – A pair of pending orders (the first an entry-stop while the second is an entry limit), where the execution of one automatically cancels the other. The trader also has the option of selecting the expiration time of this order.

A FOREX.com account can also be integrated with NinjaTrader, a popular third-party trading platform. A Virtual Private Server (VPS) is available for MT4 accounts. Clients may use FOREX.com's Application Programming Interface (API) to connect for their own strategies. MT4 and MT5 connectivity allows the use of automated strategies using the MetaTrader algorithms.

Between the broker's flagship Advanced Trading desktop and Web Trading platform, along with the full MetaTrader suite, MT4 and MT5, there are plenty of options available. In the following, we further elaborate on each.

Advanced Trading: FOREX.com's flagship desktop platform, Advanced Trading, is best suited for seasoned traders and comes with a robust charting package loaded with a large selection of technical indicators (139 total), drawing tools and over 100 pre-defined automated strategies. Technical analysis and research tools are powered by Trading Central and include its suite of Market Buzz, Technical Insight and Analyst Views modules. The layout is well-designed and easy to use, yet rich with features.

Web Trading: Best suited for casual traders, FOREX.com's Web Trading platform makes it easy to browse through markets, conduct research and place trades. Charts are powered by TradingView and come loaded with nearly 100 indicators, 14 timeframes and 10 chart types.

Creating a new layout can be tedious, as windows do not automatically rearrange and can quickly become cluttered. Aside from that small nuance, along with a lack of predefined layouts, there are advanced order types and features such as the “close all” button, amalgamated positions and the ability to set a price tolerance (deviation parameter for slippage) for trade executions. The platform provides a rich experience. We really like how charts can be saved and used as a default template for new charts, although requiring manual loading each time.

FOREX.com provides only a one-step login. Two-step authentication would be safer.

The Web Trading platform has good search functions. You can search by typing the name of the product for which you are looking or by browsing a categorized product list.

You can use many order types, including some more sophisticated:

Within the different platforms, traders can access charts, news, economic calendars, trade/order history, positions, trade signals as well as research reports, in addition to market analysis from FOREX.com analysts. There are few drawbacks to the platforms. Offered are a sufficient number of indicators and drawing tools to satisfy the avid technical analyst, and the platforms are functional enough to make rapid-fire trades, if needed. The charting package is provided by TradingView and is, by far, the most impressive aspect of the Web-based platform.

Placing trades on the Web Trader or the downloadable advanced trading platform is intuitive. Clients may trade directly from charts by right-clicking and selecting the “trade” option or by clicking on the “buy” and “sell” buttons along the top of the chart. This brings up an order window, where the entry, stop-loss and profit target are set. One-click trading can be enabled for rapid-trade execution.

FOREX.com's platform has four basic order types, with the option of attaching “take profit” and/or “stop-loss” orders to them. Additionally, the trader may choose to make the stop-loss a trailing stop-loss order. One difference between the Web-based and downloadable offering is that GSLOs are only available on the latter and, furthermore, only for UK/EU clients. The four types are:

Market – The simplest order, where a trader signals that their trade request should be executed at the prevailing market rate.

Limit – A pending order, where the entry is at a predetermined point above or above the prevailing market rate, depending on whether it is a buy or sell. The trader also has the option of selecting the expiration time of this order.

Stop – A pending order, where the entry is at a predetermined point above or below the prevailing market rate, depending on whether it is a buy or sell. The trader also has the option of selecting the expiration time of this order.

One-Cancels-the-Other (OCO) – A pair of pending orders (the first an entry-stop while the second is an entry limit), where the execution of one automatically cancels the other. The trader also has the option of selecting the expiration time of this order.

A FOREX.com account can also be integrated with NinjaTrader, a popular third-party trading platform. A Virtual Private Server (VPS) is available for MT4 accounts. Clients may use FOREX.com's Application Programming Interface (API) to connect for their own strategies. MT4 and MT5 connectivity allows the use of automated strategies using the MetaTrader algorithms.

Between the broker's flagship Advanced Trading desktop and Web Trading platform, along with the full MetaTrader suite, MT4 and MT5, there are plenty of options available. In the following, we further elaborate on each.

Advanced Trading: FOREX.com's flagship desktop platform, Advanced Trading, is best suited for seasoned traders and comes with a robust charting package loaded with a large selection of technical indicators (139 total), drawing tools and over 100 pre-defined automated strategies. Technical analysis and research tools are powered by Trading Central and include its suite of Market Buzz, Technical Insight and Analyst Views modules. The layout is well-designed and easy to use, yet rich with features.

Web Trading: Best suited for casual traders, FOREX.com's Web Trading platform makes it easy to browse through markets, conduct research and place trades. Charts are powered by TradingView and come loaded with nearly 100 indicators, 14 timeframes and 10 chart types.

Creating a new layout can be tedious, as windows do not automatically rearrange and can quickly become cluttered. Aside from that small nuance, along with a lack of predefined layouts, there are advanced order types and features such as the “close all” button, amalgamated positions and the ability to set a price tolerance (deviation parameter for slippage) for trade executions. The platform provides a rich experience. We really like how charts can be saved and used as a default template for new charts, although requiring manual loading each time.

FOREX.com provides only a one-step login. Two-step authentication would be safer.

The Web Trading platform has good search functions. You can search by typing the name of the product for which you are looking or by browsing a categorized product list.

You can use many order types, including some more sophisticated:

1. Market.

2. Limit.

3. Stop.

4. Trailing stop.

5. OCO.

Also, several order terms are available:

1. Good 'til canceled (GTC).

2. Good 'til end of the day (GTD).

3. Good 'til time (GTT).

Meanwhile, the alert function lets you know when an asset reaches a price target. You also get a notification when your orders are fulfilled. This is a push notification, available on both Web and mobile platforms. It is easy to set the alerts and notifications.

MetaTrader: Although FOREX.com's platform suite is already robust and ranks highly in our testing, the broker also offers the complete MetaTrader suite, including both MT4 and MT5. Further, it is worth noting that there are barely 600 instruments available on the broker's MT5 platform, compared to more than 4,500 on its non-MetaTrader platforms.

Research Overview: Multiple news channels, automated pattern-recognition modules from Trading Central and blog updates from FOREX.com's global research team are all available within the Advanced Trading platform. Headlines stream from Reuters and an economic calendar is integrated across the site and platforms.

Our research showed that FOREX.com produces a variety of quality written content each day across multiple markets and sector themes, including weekly posts, such as its “Currency Pair of the Week” and “Week Ahead” series (more details below). There are many articles each day from across the firm's in-house analysts, coupled with content from third-party providers. Surprisingly, market-based research in video form is practically non-existent at FOREX.com. Experimenting with video, for example, by syndicating the written content into video would help FOREX.com reach a wider audience.

FOREX.com has nearly 100 written articles about FOREX trading that are conveniently organized by experience level. The educational content ranges from 19 beginner articles (excluding platform tutorials), 34 intermediate pieces and 17 for advanced users. Lessons are a combination of written content, videos and images, and are well explained with examples. Taken together, they provide all clients, at all trading levels, with exceptional educational value. Overall, the articles are of good quality and in line with the industry average, but not quite best in class.

Other than dozens of platform tutorials available on its YouTube channel, FOREX.com does not offer a comprehensive selection of educational videos, which is where competitors like CMC Markets gain a clear upper hand over FOREX.com.

1. Good 'til canceled (GTC).

2. Good 'til end of the day (GTD).

3. Good 'til time (GTT).

Meanwhile, the alert function lets you know when an asset reaches a price target. You also get a notification when your orders are fulfilled. This is a push notification, available on both Web and mobile platforms. It is easy to set the alerts and notifications.

MetaTrader: Although FOREX.com's platform suite is already robust and ranks highly in our testing, the broker also offers the complete MetaTrader suite, including both MT4 and MT5. Further, it is worth noting that there are barely 600 instruments available on the broker's MT5 platform, compared to more than 4,500 on its non-MetaTrader platforms.

Research Overview: Multiple news channels, automated pattern-recognition modules from Trading Central and blog updates from FOREX.com's global research team are all available within the Advanced Trading platform. Headlines stream from Reuters and an economic calendar is integrated across the site and platforms.

Our research showed that FOREX.com produces a variety of quality written content each day across multiple markets and sector themes, including weekly posts, such as its “Currency Pair of the Week” and “Week Ahead” series (more details below). There are many articles each day from across the firm's in-house analysts, coupled with content from third-party providers. Surprisingly, market-based research in video form is practically non-existent at FOREX.com. Experimenting with video, for example, by syndicating the written content into video would help FOREX.com reach a wider audience.

FOREX.com has nearly 100 written articles about FOREX trading that are conveniently organized by experience level. The educational content ranges from 19 beginner articles (excluding platform tutorials), 34 intermediate pieces and 17 for advanced users. Lessons are a combination of written content, videos and images, and are well explained with examples. Taken together, they provide all clients, at all trading levels, with exceptional educational value. Overall, the articles are of good quality and in line with the industry average, but not quite best in class.

Other than dozens of platform tutorials available on its YouTube channel, FOREX.com does not offer a comprehensive selection of educational videos, which is where competitors like CMC Markets gain a clear upper hand over FOREX.com.

Research and Development

FOREX.com has great and diverse research functions, providing good charting tools, trading tips based on technical analysis and high-quality market reports. On the other hand, it lacks fundamental data.

FOREX.com provides trading ideas based on technical analysis. They are found on the platform by clicking “Trading Central.” Trading ideas are also available through Autochartist.

FOREX.com has a Reuters news feed in the trading applications, and also provides an economic calendar that lists important upcoming macro events. When you select an event, you can view a short summary and check historical data. You can also read market analysis written by FOREX.com's research team, which is found under the “Market Analysis” tab. We liked how news articles can be filtered, based on various criteria.

Additionally, a margin calculator, as well as an array of other trading and charting tools, can be found on all of its trading platforms. The broker's premium accounts have the option of receiving research tailored to the client's needs.

FOREX.com's educational offerings are on par with the industry standard and are well-organized. Clients can access content according to their experience level or thematically. All content, with the exception of “technical analysis” topics that are available on the platform, can only be accessed through the Website.

Client experience is divided into three categories: “beginner,” “intermediate” and “advanced,” while themes range from the industry norm of providing market basics, such as fundamental and technical analysis, risk management and trading strategies, to platform tutorials. A comprehensive glossary is also available.

New investors will find helpful background information, but relying solely on FOREX.com's education to become proficient in the markets is unlikely. The material covers all the major topics that a beginner should need to know.

In sum, FOREX.com does a great job in education, offering many ways to learn, although there are no Webinars available. Notwithstanding, we liked the quality and structuring of the videos. You can choose from different topics, like fundamental analysis or risk management. Further, the quiz and trading glossary are unique educational tools. We found them really fun and useful.

FOREX.com provides trading ideas based on technical analysis. They are found on the platform by clicking “Trading Central.” Trading ideas are also available through Autochartist.

FOREX.com has a Reuters news feed in the trading applications, and also provides an economic calendar that lists important upcoming macro events. When you select an event, you can view a short summary and check historical data. You can also read market analysis written by FOREX.com's research team, which is found under the “Market Analysis” tab. We liked how news articles can be filtered, based on various criteria.

Additionally, a margin calculator, as well as an array of other trading and charting tools, can be found on all of its trading platforms. The broker's premium accounts have the option of receiving research tailored to the client's needs.

FOREX.com's educational offerings are on par with the industry standard and are well-organized. Clients can access content according to their experience level or thematically. All content, with the exception of “technical analysis” topics that are available on the platform, can only be accessed through the Website.

Client experience is divided into three categories: “beginner,” “intermediate” and “advanced,” while themes range from the industry norm of providing market basics, such as fundamental and technical analysis, risk management and trading strategies, to platform tutorials. A comprehensive glossary is also available.

New investors will find helpful background information, but relying solely on FOREX.com's education to become proficient in the markets is unlikely. The material covers all the major topics that a beginner should need to know.

In sum, FOREX.com does a great job in education, offering many ways to learn, although there are no Webinars available. Notwithstanding, we liked the quality and structuring of the videos. You can choose from different topics, like fundamental analysis or risk management. Further, the quiz and trading glossary are unique educational tools. We found them really fun and useful.

Mobile Trading

Overall, FOREX.com’s mobile offering is among the best in the industry. FOREX.com offers a proprietary mobile app along with the full suite of MetaTrader mobile apps, including MT4 and MT5. FOREX.com's mobile app saw a complete transformation in 2020, bringing it up to speed with the responsive design found in its Web-based counterpart, Web Trading.

The mobile app is functional and provides traders with access to all their account information. Traders can add or withdraw funds, create watchlists, view trade history, access news and view charts from the mobile app. It is also easy to navigate and set up.

The charting feature is one of the drawbacks of the mobile app. There are a limited number of common indicators available, such as the Relative Strength Index (RSI), the Moving Average Convergence-Divergence (MACD) and other moving averages, but drawing functions and more advanced technical tools are missing. Full order functionality is available, including conditional orders and the ability to easily place stop-losses and profit targets at the time of a trade.

Further, the app supports complex order types, such as OCOs, trailing-stops and a “close all” button to exit multiple positions quickly in a given instrument. The search function is also great. There is no two-step login, however, and you cannot log in using biometric authentication. Offering this feature would make the login process more convenient.

The FOREX.com app automatically syncs watchlists and includes easy-to-use charts powered by TradingView, with over 80 indicators and 75 drawing tools. While chart settings do not sync with the Web, the indicators added in landscape mode save upon exiting the app.

You can use the following order types:

1. Market.

2. Stop.

3. Limit.

4. OCO.

5. Trailing stop.

6. OCO.

We did not, however, find an option to set order time limits. You can easily set price alerts on the FOREX.com mobile platform.

Final Thoughts on FOREX.com

FOREX.com is a trusted FOREX broker that sparkles, thanks to its extensive product offering, excellent platform options and trading tools, as well as its wide selection of both in-house and third-party market research. While its pricing is not rock bottom, FOREX.com delivers a great experience to FOREX traders from all walks of life.

Conclusion

FOREX.com is an online broker that can service all types of traders, although its emphasis on fast, reliable execution makes it a good fit for the high-volume trader who can, in turn, earn rebates that would otherwise lower their trading costs.

The broker offers access to a variety of financial instruments with spread and commission costs that are on par with the industry, multiple user interfaces, a choice of account types, as well as educational and research resources. Customer service is available and adequate, although sub-standard Website maintenance shows a lack of attention to detail.

Being NFA/CFTC/FCA-regulated lends credibility, underscoring FOREX.com's status as a global online broker. That said, the inconsistency in not offering negative balance protection and GSLOs in the US is a bit disconcerting, given that the former gives clients peace of mind while the latter offers a viable risk-management tool in volatile market conditions. At the same time, popular assets like real stocks or bonds are not available. Stock CFD fees are quite high, and the desktop platform is not easy to use.

Overall, FOREX.com checks off most of the boxes needed to be considered a good broker. The impression that one gets, however, is that it could be so much better if a bit more attention was paid to its primary revenue generators – the customers.

FOREX.com in Brief

FOREX.com is the oldest brokerage house in the world. A US-based company, it allows Americans to trade, given it has obtained NFA licensing. The company is known for its excellent educational courses. Further, it offers traders the ability to use MT4, a relatively low spread, and excellent customer service.

Review Methodology

The team at Arincen collected more than 120 pieces of data covering in excess of 100 licensed FOREX companies. Data collection was done in three ways:

- Companies’ Websites.

- Other Websites that have ranked FOREX companies.

- A survey questionnaire (referred to here as Survey “1”) we had sent to the companies invited to participate in the exercise.

We have identified 12 criteria for our assessment, each containing several aspects and carrying its own relative weight. These include licensing, deposits and withdrawals, number of assets etc.

Afterward we validated the data by:

- Registering with FOREX companies as a secret shopper and/or as Arincen.

- Survey number “2,” in which we asked these companies’ customers for important feedback and past experience.

The next step saw us evaluate and rank each company, relying on the hard work of 15 Arincen employees. We were very careful in ensuring the most accurate assessment possible, including taking into account different languages, as well as the various mobile-app operating systems, e.g., Apple, Samsung etc.

To add credibility to our research project, we sent a final and third survey (referred to here as Survey “3”) to enable participating FOREX companies evaluate our own research and whether it accurately reflects the realities on the ground. We were fortunate enough to receive a mark of 9.9 out of 10! We have kept to a minimum the margin of error, which stood at a measly 1%. To learn more on how we came up with the evaluation, please click here.

FAQ

Where is FOREX.com regulated?

FOREX.com is authorized by four tier-1 regulators (high trust), one tier-2 regulator (average trust) and one tier-3 regulator (low trust). These brokers are drawn from the CFTC in the US, the FCA in the UK, the IIROC, the ASIC, the MAS as well as Japan's FSA.

In what other ways does FOREX.com protect me?

Client funds are kept segregated from broker funds, which helps safeguard clients' money in the event the company faces insolvency. UK/EU clients also have additional asset protection through the FSCS, up to £85,000, while Canadian clients are protected by the Canadian Investor Protection Fund. FOREX.com offers Negative Balance Protection, which is mandated under ESMA rules. GSLOs are available at an additional cost for UK/EU clients.

Which countries does FOREX.com serve?

FOREX.com accepts traders from most countries, the US included. Clients from Hong Kong and New Zealand are notable exceptions.

Does FOREX.com offer Cryptocurrency trading?

Cryptocurrency trading is available through CFDs, but not via trading the underlying asset (e.g., buying Bitcoin). It is noteworthy that Crypto CFDs are not available to UK residents.

Does FOREX.com provide any extra offerings?

Traders who open a FOREX.com account are eligible for a bonus of up to $5,000. Traders are advised to visit the broker’s Website for terms and conditions.

How do I fund my account?

FOREX.com provides multiple deposit and withdrawal options, all free of charge. Besides a bank transfer, you can use credit and debit cards, as well as PayPal for depositing funds.

Which trading platforms does FOREX.com offer?

Clients can choose between the FOREX.com Web Trader platform, or MT4 for a desktop experience.

How can I access customer service?

Traders can make use of online chat and live phone support. FAQs and Website client support are, for the most part, satisfactory. Phone support is the quickest way to have questions answered by a real person. Email support is available for more in-depth questions.

May be interesting for you

Written by

Adrian Ashley

Adrian Ashley is a seasoned business and finance writer. With a corporate career spanning over 20years, he has developed deep experience in such diverse areas as investing, business, finance,technology and macroeconomics. He is passionate about captu...

Edited by

Marwan Kardoosh

The Editorial Department at Arincen makes an important contribution to the world-class content that...

Fact Checked by

Bahaa Khateeb

Bahaa Khateeb is currently the CEO of Arincen, a start-up Fintech company based in Haifa. Baha...

What’s your opinion of forex?

To Comment You Must