Table Of Contents

- What Causes Trends?

- How Can I Identify a Trend on a Chart?

- How Can I Identify and Draw a Uptrend?

- How Can I Identify and Draw a Downtrend?

- How Can I Identify and Draw a Sideways Trend?

- How to Anticipate Trend-Line Length

- What Are the Best Other Indicators for Spotting Trends?

- How Do Trends Look on Different Timeframes?

- When Should I Enter or Exit a Trend Trade?

- Common Pitfalls and How to Avoid Them

- Applying Trend Trading Across Assets and Conditions

- How Do I Build My Own Trend-Trading Strategy?

- Conclusion

Understanding Trends in Trading

The Merriam-Webster dictionary defines the word “trend” to mean a prevailing tendency or inclination. It is an accurate description that also reflects what can happen in retail trading.

A trend in financial markets is simply the direction in which prices are moving over time. When prices make higher highs and higher lows, that’s an uptrend. As a longtime trader, I've seen these cycles firsthand.

When they make lower highs and lower lows, it’s a downtrend. And when prices bounce within a range without clear direction, that’s a sideways trend, often called consolidation.

In this article, I will discuss everything you need to know about trends in trading.

Trends are the backbone of market analysis, defined by sequences of higher highs and higher lows in uptrends, or lower highs and lower lows in downtrends

Sideways trends reflect indecision, where price moves within support and resistance levels, creating range-bound opportunities

Timeframes change how trends appear; what looks bullish on a daily chart can look flat or choppy on an intraday chart

Tools like moving averages, MACD, and RSI help confirm trends, but relying on indicators alone can lead to false signals

Trendlines and channels provide simple visual guides for spotting entry and exit points

Entries often work best on pullbacks within the trend, while exits are guided by trailing stops, profit targets, or reversal signals

Risk management is essential; position sizing, stop-losses, and awareness of economic events keep traders in the game

Combining technical skill with situational awareness transforms trend trading from guesswork into a repeatable strategy

What Causes Trends?

Trends in trading don’t emerge by accident. You need to know that they are the product of:

supply and demand imbalances

shifting macroeconomic conditions, and

fundamental drivers like interest rates, earnings, or commodity prices

Market sentiment and institutional flows add fuel, while herding behavior among traders often extends a move longer than expected. Trends can also be classified by their duration. Secular trends stretch across decades and define the big picture, while primary trends play out over years.

Secondary or intermediate trends can last weeks to months, giving swing traders their setups, while minor trends are short-term moves that intraday traders try to capture.

No matter the timeframe, spotting the prevailing trend is one of the most important skills in trading. It sets the context for every decision that follows.

How Can I Identify a Trend on a Chart?

In my experience, identifying a trend on a chart starts with the basics of price action. It’s about translating some of the most common signs you see on the trading screen into meaning:

Uptrend - When you analyze the candlesticks that represent prices, you’ll see prices (represented by candlesticks) trending toward higher highs and higher lows as buyers stay in control.

Downtrend - here, you see the opposite: candlesticks trending downward reveal lower lows and lower highs mark steady selling pressure. When you can connect these points with a simple trendline, the direction often becomes obvious.

Channels - these signifiers take it a step further by showing parallel lines of support and resistance, giving you a visual map within the channels of how far the price can swing before snapping back.

Support and resistance levels - this series of breaks above resistance (upper) levels is a critical marker, while repeated failures at (lower) support levels can mark the beginning of a reversal.

Chart patterns - these help confirm whether a trend is likely to keep going or run out of steam. We’ve written a highly detailed article about Japanese candlesticks; you can read it here. In that article, you will come to understand visual formations like flags and pennants, for example, which usually signal continuation after a strong move, while double tops or bottoms often warn that momentum is fading.

By combining price action with these tools, you can separate noise from signal and decide whether it makes more sense to follow the trend or prepare for a shift in direction.

How Can I Identify and Draw a Uptrend?

As I’ve mentioned, spotting an uptrend is straightforward once you know what to look for. On a chart, an uptrend is defined by higher highs and higher lows. To draw it, connect the rising lows with an upward-sloping trendline. This becomes your visual guide for where buyers are deciding to step in and buy a certain asset in large numbers.

Benefit: The good part of trading with an uptrend is simple, you’re moving with the path of least resistance; or, to put it bluntly, you are not trying to conjure some trading miracle the remainder of the market cannot see.

But remember that your potential wins are always tied to the asset type and the specific market conditions. If the asset has a reputation for strength, “buying a dip” during a general uptrend can give you exposure at a discount relative to its usual levels.

How to make money from this: buying dips along that rising trendline gives you better entries while keeping risk under control. Look at the following image, for example. Let’s say you decided to buy the dip in the S&P500 in March 2020. You were confident it was a small dip in the middle of an otherwise steady uptrend, you could have realized gains of 113% over the next year and a half after buying your stocks at a 31% discount!.

Traders who recognize the structure early can ride the wave for as long as momentum holds, turning what looks like small swings into a string of profitable trades.

How Can I Identify and Draw a Downtrend?

Spotting a downtrend is just as easy once you know the signs. On a chart, remember that a downtrend is defined by lower highs and lower lows. To draw it, you simply connect the falling highs with a trendline sloping downward. This line is your visual guide for where sellers are stepping in with enough trading enthusiasm to push the asset lower.

Benefit: the clearest advantage of trading with a downtrend is that, as with an uptrend, you’re not fighting the market. You’re aligning yourself with the dominant flow of selling pressure, rather than trying to predict a turnaround before it actually happens.

If the market has weak fundamentals or is facing negative sentiment, following the trend by “selling the rally” can give you exposure at better levels compared with chasing the move after it’s already sped up.

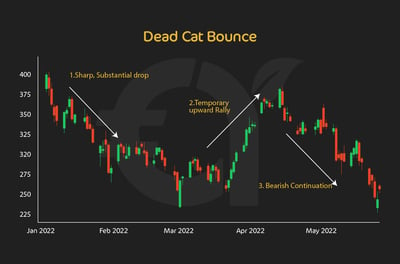

How to make money from this: shorting rallies near a falling trendline can give you stronger entries with more controlled risk. Look at this graphic. It shows the point at which you can “sell the rally” during a downtrend, also known jokingly as the “dead cat bounce.”

You might not remember, but Meta Platforms suffered a hellish 2022. It lost roughly 64% of its market value in 2022, falling from around USD 338 at the start of the year to near USD 120 by November.

If you were looking for a “dead cat bounce” during which to sell the rally, that would have been between March and April 2022, according to the image. You would have at least obtained better value for an otherwise tumbling stock.

From what I've seen as a trader, those who identify the pattern early can ride the bearish momentum for as long as it lasts, turning what looks like tiny pullbacks into a series of profitable short trades.

How Can I Identify and Draw a Sideways Trend?

Spotting a sideways trend means recognizing when the market is not moving in a clear direction. On a chart, this looks like a price moving aimlessly within a horizontal range, with highs and lows around the same levels.

To draw it, connect the relative highs with a flat resistance line and the relative lows with a flat support line. This creates a box-like structure that shows where buyers and sellers are evenly matched.

Benefit: The main advantage of trading a sideways market is predictability. You’re not chasing a runaway move but working within a clear trading range where support and resistance levels act like signposts. Instead of fighting momentum, you’re trying to make the most of the pauses between bigger directional moves.

How to make money from this: buying near support and selling near resistance can give you predictable profits if you manage entries with discipline.

Take a look at this graphic, for example. During much of 2015, the EUR/USD currency pair traded sideways within a range of roughly 1.15 to 1.18. Traders who bought at the bottom of the box and sold at the top of the box could have scored a few pips each time without ever needing a breakout.

Traders who spot the sideways structure early can take advantage of repetitive patterns, using range-bound setups to generate consistent returns until the market finally chooses a direction.

How to Anticipate Trend-Line Length

The bad news is that no trader can perfectly predict how long a trend line will hold, but the good news is that there are ways to set expectations.

The strength and length of a trend line usually depend on how many times the price respects the trend line as well as the fundamentals driving the market. A trend line that connects three or more swing points is far more reliable than one drawn from a single bounce. The longer it has been in place, the more traders are watching it, which adds to its staying power.

However, the universal truth is that all trend lines eventually break. In FOREX, an uptrend might last weeks if backed by central bank policy shifts, while in stocks, earnings momentum from good product launches can fuel rallies for months.

Commodities and crypto tend to see shorter-lived trend lines because volatility is higher. The benefit of understanding these guidelines is that you don’t chase the trend forever, but use the line as a guide until price action clearly tells you otherwise.

What Are the Best Other Indicators for Spotting Trends?

As trading experts often say, it’s never a good idea to base your trading decisions on a single indicator in isolation. Besides the indicators I’ve discussed so far in this article, there are others.

Moving AveragesSimple moving averages (SMA) and exponential moving averages (EMA) smooth out price action to give you a clearer picture of the underlying trend. A rising 50-day EMA signals momentum is strong, while a 200-day SMA defines the big picture.

If we think of Japanese candlesticks, the famous golden cross (50-day rising above the 200-day) suggests a new long-term uptrend, while the death cross does the opposite.

Momentum Indicators: MACD, RSI, StochasticThe MACD shows both trend direction and momentum through its moving-average crossovers. A bullish crossover above zero tells you definitively that there is an uptrend, while a bearish crossover below zero signals weakness.

RSI helps identify whether a trend is overextended. By reading our comprehensive article on RSI here, you will come to know that readings above 70 suggest overbought conditions, while readings below 30 point to oversold. Stochastic oscillators are similar, highlighting potential pullbacks.

Volume-Based Indicators: On-Balance Volume (OBV) and Volume OscillatorsVolume often moves before price. OBV tracks buying and selling pressure. If the price is flat but OBV is climbing, it hints that buyers are quietly building positions. Volume Oscillators compare short-term vs. long-term volume averages to confirm strength.

How Do Trends Look on Different Timeframes?

There are charts for all sorts of timeframes, ranging from mere minutes to even years. Trends don’t look the same on every chart. What might look bullish on a daily chart might look like noise on a five-minute chart.

Traders break trends into four broad categories. I discuss them here:

Short-term trends

Minor trends: Short swings visible intraday or over a few sessions, often lasting hours to days. An example of this could be something a scalper watches, a EUR/USD on a 15-minute chart may call a 40-pip rally a trend, even though it’s invisible on the weekly chart.

Medium-term trends

Intermediate trends: These stretch over weeks or months, giving swing traders multiple entry points on pullbacks. Think of a chart showing the price of crude oil grinding higher from $75 to $85 over two months.

Long-term trends

Primary trends: These go on for years and set the broader direction. A classic example of this is the S&P 500 climbing steadily through the 2010s despite short-term volatility.

Very long-term trends

Secular trends: These can last decades, shaped by macroeconomic cycles and institutional flows. You might wonder why you need to know about these trends when you are trading in the present, but having historical information about gold’s bull market from the early 2000s to 2011 could give you clues in today’s bull market.Timeframes matter because they change what you see. A daily chart might show a clear uptrend in Tesla stock, while the hourly chart reveals a choppy sideways consolidation. FOREX traders often use a top-down approach: checking the weekly to define the big picture, then drilling into the four-hour or one-hour chart to time entries.

Commodity traders do the same: wheat might look bullish on the weekly but bearish on the daily. Recognizing that each timeframe tells a different story helps you avoid getting trapped by short-term noise and ensures that your entries line up with the bigger trends.

When Should I Enter or Exit a Trend Trade?

In my experience, timing is everything in trend trading. The best entries usually come on confirmation, but knowing how to read those confirmations is a skill in itself. Here are some key guidelines you could do with knowing:

Spotting the right entryTiming is everything in trend trading. Clean confirmation signals could look like a moving average crossover, a bullish MACD trigger, or a clean pullback to a rising trendline. Buying into strength after price bounces from support, or shorting after a rejection at resistance, stacks the odds in your favor.

Momentum indicators like RSI or Stochastic help confirm whether the move still has energy, so you’re not chasing a trend that’s already running out of steam.

Here’s an example of how you can spot the right entry. Study the graphic below, which applies to daily timeframes on the DAX 40.

You are tracking the DAX 40, and you see the 50-day moving average sliding under the 200-day moving average. This “death cross” is widely seen as a bearish signal, suggesting that momentum could be shifting to the downside. With the index trading around 2,600, you interpret the crossover as a trigger to short the market by selling futures, for example

Over the following periods, the index does slip lower, confirming the bearish stance. But instead of a sustained downtrend, buyers slowly return. Prices stabilize, volatility narrows, and the 50-day average begins to curve upward. Eventually, it climbs back through the 200-day line, creating a “golden cross” that signals renewed bullish strength. The DAX 40 is now trading near 2,800.

At this point, you would exit your short, banking profits from the earlier decline, and flip your position long. You see the second crossover as confirmation that momentum has shifted back in favor of the bulls, with the potential for the index to rally toward fresh highs.

In this way, you are first triggered to sell when the 50-day sinks beneath the 200-day, and then triggered again to buy once the 50-day climbs back above it. Each crossover is a clear technical signal to adapt to the changing market trend on the DAX 40 daily chart.

Planning your exitExits are just as critical as entries. A trailing stop lets you secure profits while leaving room for the trend to continue. Setting profit targets at the edge of a trend channel is another disciplined way to lock in gains.

If an indicator shows a reversal, such as MACD crossing against you or a double top forming, that’s usually your cue to step aside.

Managing riskRisk control ties the strategy together. Never risk more than your account can handle on a single trade. Position sizing, a consistent risk-to-reward ratio, and the discipline to avoid overtrading ensure you stay in the game long enough for trend-following math to work in your favor.

Remember that false breaks are part of trading, which is why backtesting and demo practice are vital. They help filter weak entries and refine your system before real money is on the line.

By combining smart entries, disciplined exits, and strong risk management, you can transform trend trading from guesswork into a repeatable strategy.

Common Pitfalls and How to Avoid Them

Even experienced traders stumble when working with trends, and most problems stem from relying too heavily on tools without context. By combining technical skill with situational awareness, you can swerve some of the biggest pitfalls. Here are some of those biggest pitfalls:

Don’t rely on lagging indicators

Tools like moving averages often give signals after much of the move has already passed. By the time a crossover flashes, the price may already be extended.

Solution: combine indicators with price action and volume to avoid chasing late entries.

What do to in choppy, sideways markets?

What looks like a breakout can quickly reverse. This creates false signals and whipsaws.

Solution: Use multiple timeframes to confirm direction and filter out noise.

Beware of relying on a single indicator

Example: a trend confirmed by MACD but contradicted by RSI should be a warning, not a green light.

Solution: look for convergence among tools rather than dependence on a single one.

Watch for macro shocks

Even clean charts can be overturned by central bank decisions, geopolitical events, or surprise data.

Solution: always check the economic calendar, be aware of key events, and size positions to withstand volatility.

Applying Trend Trading Across Assets and Conditions

Trend trading isn’t one-size-fits-all. In FOREX, major pairs like EUR/USD often show smoother, longer-lasting trends because liquidity is deep, while exotic pairs can be erratic and prone to sharp reversals.

Equities and indices are primed to respond strongly to earnings, economic cycles, and sentiment shifts, making moving averages and volume indicators highly useful in this case. Commodities, on the other hand, trend on supply/demand shocks and seasonality, where longer-term charts help filter out noise.

Crypto is the most volatile of the group, with trends that can flip overnight. Here, momentum tools like MACD or RSI tend to work better than slower-moving indicators.

It’s worth noting, though, that markets aren’t always trending. In range-bound conditions, trend-following strategies will bleed from repeated false starts. That’s when patience and adaptability matter.

Some traders step aside until a breakout confirms a new trend, while others switch to range tactics, such as buying support and selling resistance. Recognizing when the environment has shifted is as important as spotting the trend itself.

Across assets and conditions, the principle stays the same: align your strategy with the behavior of the actual market with which you are dealing, not the one you wish you were trading.

How Do I Build My Own Trend-Trading Strategy?

Building a trend-trading strategy is about finding the right mix of tools that matches your style. Here’s a handy list of actions that can help you answer the question, “How Do I Build My Own Trend-Trading Strategy?”

Choose your tools

Some traders rely on moving averages and MACD to confirm direction. Others prefer price action with trend lines and channels. The key here is to combine a few reliable signals into a repeatable setup.

Backtest your framework

Run your rules across months or years of historical charts. This shows whether your idea works in different market conditions.

Test in a demo account

Trade your setup live without risking real money. Refine entries and exits, and identify gaps in your plan. Many strategies look perfect on paper but need tweaks in real-time trading.

Keep a trading journal

Record why you entered, how you managed risk, and why you exited. Journaling reveals patterns in your behavior, both strengths and weaknesses. Reviewing notes helps you adapt and improve over time.

Also, over time, reviewing those notes helps you adapt your strategy so it grows with you. A trend trading system doesn’t appear overnight; it’s built through testing, practice, and discipline.

Conclusion

In my experience, trend trading works because it lets you go with the market's flow without fighting it or trying to be too smart. However, success depends on patience and discipline. The traders who thrive are those who wait for clear setups, confirm their signals, and stick to their plan rather than chasing every price move.

Before entering any trade, I would advise you to go through a mental checklist: Is the trend clearly defined? Are indicators or price action confirming it? Does the risk/reward ratio make sense? Does the timeframe align with your strategy? When those boxes are ticked, you are well on your way to trading with structure instead of impulse.

Remember that mindset is just as important as method. The fear of missing out can tempt you into late entries, while refusing to cut losses can turn a small slip into a portfolio hit. Overtrading often erodes the gains from good setups. The best approach is to respect the trend, manage risk with consistency, and treat every trade as just one in a long series.

FAQ

A trend is the general direction of price movement. Uptrends make higher highs and higher lows, downtrends make lower highs and lower lows, while sideways trends bounce between support and resistance.

Look for clear price structure, confirmation from indicators like MACD or RSI, and strong volume backing the move. The more touches and confirmations a trendline has, the more reliable it is.

It depends on your style. Scalpers look at minutes, swing traders focus on daily charts, and long-term investors prefer weekly or monthly charts. A top-down approach, checking higher timeframes before drilling down, works best.

A pullback is a temporary pause or retracement within a trend, while a reversal signals the trend has changed direction. Watching for higher lows in an uptrend or lower highs in a downtrend helps you tell the difference.

Yes. In range-bound markets, you can buy near support and sell near resistance, or wait for a breakout that signals the start of a new trend.

Moving averages, MACD, RSI, Stochastic, and volume-based tools like OBV are popular. Combining two or three for confirmation is better than relying on one alone.

Absolutely. Central bank decisions, earnings reports, or geopolitical shocks can strengthen, weaken, or completely reverse a trend. Always check the calendar before trading.

Start by backtesting your strategy on historical data, then use a demo account to refine your entries and exits. Journaling your trades helps you learn from both wins and losses.