Table Of Contents

- What is Scalping?

- What a “Signal” Really Is

- 8 Best FOREX Signal Providers

- Signals vs Copy Trading vs EAs

- How Scalping Works With Cost Control

- What Are the Best Indicators for Scalping Signals?

- How Providers Show a Scalping Setup

- Due Diligence Checklist Before Following a Scalping Signal

- When Signals Help (And When They Don’t)

- Red Flags and Things to Watch Out For

- Are Scalping Signals Worth It?

- Conclusion

Forex Scalping Signals — Top Providers & How They Work

In any mature market, such as FOREX, participants are always looking for an edge. One important driver of this need for innovation is the idea that participants are playing against the system. As we know, market makers across the industry help determine the price of FOREX pairs, with most of the price being determined by the economic standing of the countries whose fiat currencies it is. These exogenous price factors are far beyond the influence of the individual retail FOREX trader, whose job it is to understand the market and profit from it.

It’s no surprise that traders would jump at the chance of using a tool that cuts through the noise of external market forces to give them useful information on when and how to place their trades. Enter the FOREX trading signal – a tool we will explain further. Used in conjunction with a particular form of trading – scalping – these two phenomena can become a powerful force for traders.

Our experts at Arincen have written this guide to cut through the confusion about what scalping signals are, how providers package them, where they help (discipline, idea flow), where they hurt (slow execution, high costs), and how to test them, on demo, then micro-live, so you can make the most of the signals that come your way.

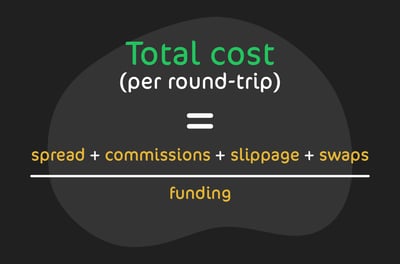

Scalping signals only work if your round-trip cost (spread + commissions + slippage + funding) stays roughly less than 1–2 pips on majors during liquid sessions.

Latency kills edges. If your average entry drift vs the provider exceeds ~0.5-1.0 pip, expect their stats to underperform in your account.

The best setups use volatility/structure-based SL/TP, not fixed pip counts, and include explicit time-in-force to avoid stale fills.

Verification is non-negotiable: look for 6-12 months and 200-500+ trades with third-party stats, and not just win rate.

Choose a delivery method that matches your speed needs. For example, a notification via your broker’s app is faster than email.

Broker fit matters. Look for tight raw spreads, stable market execution, small min stop distance, reliable server-side stops, and transparent financing.

Run a two-phase test. Look to demo for plumbing, then micro-live for 100-200 trades. Scale only if the profit factor is greater than 1.2 and expectancy is greater than +0.05-0.10R after costs.

If you can’t meet these thresholds, step up in timeframe or go self-directed, where you control context and cost and aren’t constrained by provider latency.

What is Scalping?

Scalping is an ultra-short-term trading style where you open and close positions within seconds to a few minutes. You end up doing this dozens or even hundreds of times per session, with profit targets measured in just a few pips and losses kept equally tightly controlled. It’s about exploiting very small price moves through very many round-trips rather than holding for broader trends.

Because each trade only has a tiny edge, market microstructure, the structure behind how orders get quoted and filled, matters more than usual. The spread is your first challenge, as paying the bid–ask on every entry/exit can erase a 2–3 pip target if the pair isn’t highly liquid or your broker widens spreads in volatile moments.

Slippage is another challenge as fast moves and queue priority can push the actual fill away from your intended price, turning a planned +2 pips into breakeven, or worse, especially around data releases. Latency is the third issue, as delays between clicking and matching (or between your platform and execution venue) can have a big bearing on whether you capture or miss the micro-move entirely. In FOREX, these blockages are amplified by a fragmented, electronic market with many venues and non-bank market-makers, so venue quality, routing, and time-of-day liquidity are important to results.

In reality, you should know that successful scalpers focus on the most liquid pairs (like majors) and finding the right sessions in which to keep costs microscopic and optimize execution, platform speed, order type, and consistent fills. This is because, in scalping, microstructure often determines whether a seemingly small edge shows up in your P&L.

What a “Signal” Really Is

So, now that we know what scalping is, what if we were to use signals during our scalping strategy? Well, let’s start by defining signals.

Signals have been designed to be nothing more than a prompt for a trader to act in a certain way at a certain time. This is enormously beneficial to traders who are unsure how to proceed.

A signal comes as a pulse of information about a certain pair of currencies in the form of a recommendation that the trader must perform an action at a predetermined price and time. Signals are either generated by highly skilled and experienced human traders or by automated algorithms. Here are some differences between the two:

Human: Discretionary judgment; adaptive to context; slower/less consistent timing.

Algo: Rules-based; consistent and fast; limited to what’s coded.

Imagine being a newbie on the market and being able to be profitable while still learning. This is the biggest benefit of signals. Signals can be configured to fit the lifestyle of any trader. The available methods for traders to receive signals include SMS alerts to your phone, email blasts, or even trading app push notifications.

FOREX signals are generated from a complex web of inputs. Signals could be the result of foundational analysis combined with everyday technical analysis from chart-based information, supplemented with information from news and current affairs. As with any system of this nature, the longer the system is fed with rich details, the more precedent it has with which to work, making its recommendations more robust. When we talk of the inputs into making a signal-based decision, this is what we are talking about:

Price action: Uses structure (breakouts, pullbacks) that are found on charts, for example.

Indicators: Quantifies trend/momentum/volatility movements.

News: Captures catalyst moves, but can create higher slippage and spread risk.

Technical analysis is one of the most important sources of information to feed into signals. Technical analysis involves reviewing past price action, a complicated type of analysis that hones in on prior prices and support and resistance levels. This form of analysis is a great way to uncover shorter-term trends that benefit traders who use intraday trading strategies.

By comparison, fundamental analysis is more suitable for longer-term investments based on important country-level macroeconomic information. Much more information goes into a fundamental analysis at a national level, such as inflation data, manufacturing output and unemployment figures.

For the trader, a FOREX signal is useless if not acted upon at the right time. The market is dynamic and fast-moving, meaning that buy and sell decisions must be acted upon before the information becomes dated and unreliable.

FOREX signals come with different utilities to traders. Some are low-grade signals that almost anyone could figure out for themselves, such as a directional move of a currency pair. Others are much more valuable. The best signals include such important information as information on when the best time to take a profit (TP) or invoke a stop loss (SL).

8 Best FOREX Signal Providers

Arincen — A research-and-signals platform that blends real-time trade setups, expert commentary, and alerts with portfolio-style tracking. Subscribers get notifications on the moves of the best traders on the site. These same experts can be tracked and ranked so the signal recipient feels comfortable they are getting the best signals possible. Arincen also focuses on education and broker reviews aimed at due diligence. This market-leader positions itself as a curated network of traders rather than a single-guru feed.

1000pip Builder — A long-running, single-provider signal service delivering entries, stops, and targets via messaging/email. It is marketed as discretionary trading from one lead trader with third-party reviews around fill quality and ease of follow-along. Suits users wanting a straightforward “do this now” feed rather than a community room.

Learn2Trade — Offers free and VIP signals (often via Telegram) alongside daily analysis and education. It pitches multi-asset alerts and claims a large user base, with tiered subscriptions for higher frequency. It is geared to beginners who want hand-held signals plus basic training.

ForexSignals.com — More “trader room” than pure signal seller. Members get live streams, analysis, tools, and education with occasional trade ideas. Onboarding pushes a free trial and broker integrations. Best for users wanting mentorship and community around signals.

FX Leaders — Publishes free live signals with briefs, plus news and analysis. A broad, open-access portal rather than a closed VIP channel.

MQL5 Signals Marketplace (MetaTrader) — Built-in copy-trading for MT4/MT5 where users auto-replicate providers’ trades on their own accounts. You can find thousands of strategies with stats and mobile tracking, subject to each broker’s execution. It’s an infrastructure layer more than a curated research shop.

Signal Start — A platform that connects followers and providers with automated copying across brokers, accessible via web and mobile. It positions itself as a one-stop hub for subscription management and execution without local software. Good for users wanting simple cross-broker auto-copy.

ZuluTrade — A veteran social/copy-trading network letting investors mirror “leaders” and customize risk, now spanning multiple asset classes. It emphasizes awards, transparency tools, and both manual and automated options. Suited to users prioritizing a marketplace of strategies with broker choice.

Signals vs Copy Trading vs EAs

Signals are sometimes confused with copy trading or even expert advisors. Here are some of the key differences:

Classic signals are trade ideas you receive and execute manually. You keep full control of timing, size, and order type, but every click costs milliseconds, so fills can trail the provider’s price.

Copy trading automates the replication of another trader’s positions in your account, proportionally and in real time. It removes manual steps, which can add latency and produce price drift, partial fills, or sizing mismatches, issues that are especially punishing when targets are only a few pips.

Expert Advisors (EA)/algos are rule-based programs that place and manage trades automatically on your platform/venue. For scalpers, EAs can minimize human reaction time and standardize execution (e.g., instant bracket orders), but your actual edge still depends on spreads, queue priority, and venue speed.

How Scalping Works With Cost Control

In scalping, your edge is only a few pips, so the round-trip cost must be microscopic. Think of every trade as:

This equation applies to FOREX, but with slight adjustments, is just as applicable to other assets like stocks, which we will show below.

Spread is the bid–ask gap you pay to get in/out. It’s an immediate, implicit cost. Narrower spreads come with higher liquidity and tighter markets.

Commission is explicit on ECN-style accounts (often charged “per side” and quoted per standard lot).

Slippage is the fill difference vs. your requested price, and is common in fast markets. It can be positive or negative, but scalpers must assume a small adverse drift.

Swaps/funding (overnight financing) may be zero for same-day exits, but apply if you hold past rollover. Note that rates depend on the pair and broker schedule.

Worked example (AAPL Stock)

Look at the example as shown in the graphic below:

.webp)

Looking at the chart, there is an opportunity for a quick long into $218.1825. In stock scalping, you’re chasing cents, so round-trip costs matter as much as the setup.

Position size: 100 shares of AAPLPlan: Buy the pullback, exit at $218.1825, hard stop a few cents below the swing.

Assumptions (intraday, flat by close):

Spread: ~$0.01 in liquid hours.

Commissions/fees: “$0 commission” brokers still pass tiny regulatory/venue fees (pennies per 100 shares).

Slippage: assume $0.01 adverse total across entry/exit if using marketable orders.

Financing/borrow: not applicable for a same-day flat long (shorts may incur borrow).

Example fills:

Entry: Limit buy at $217.92 (worked near bid to avoid paying full spread).

Exit/TP: $218.1825.

Gross move captured: $218.1825 − $217.92 = $0.2625 × 100 = $26.25.

Round-trip cost (conceptual):

Effective spread: ≈ $0.01 × 100 = $1.00.

Slippage: ≈ $0.01 × 100 = $1.00.

Regulatory/venue fees: a few cents per 100 shares.

Total est. cost: ~$2.05–$2.20, which is ~2–3¢/share.

Net result: $26.25 gross − ~$2.10 costs ≈ $24.15 net. Even with a larger target, costs still bite, which is why stock scalpers trade high-liquidity names (AAPL fits), prefer limit/queue priority to avoid crossing the spread, keep latency/routing tight, and size stops/targets by current volatility.

Bottom line: Same equation as FX—price move − (spread + fees + slippage). Keep that bundle to only a few cents per 100 shares, or even a statistically sound setup won’t show in P&L.

What Are the Best Indicators for Scalping Signals?

For scalpers, the core toolkit is simple:

a trend filter (MA/EMA)

a momentum gauge (RSI or stochastic)

volatility envelope (Bollinger Bands)

MACD can add momentum/trend confirmation when you need it

EMAs react faster than SMAs, which helps on seconds-minute horizons. Many traders pair a fast EMA (e.g., 8-12) with a slower EMA (e.g., 20-26) to define short-term direction.

You should know that RSI frames momentum and mean-reversion. For example, default 14-period settings are common, but scalpers often tighten thresholds around 60/40 in trends to avoid counter-trend traps.

Bollinger Bands surface volatility compression/expansion, useful for “squeeze to break” entries when price rides the band with the trend. Read our detailed Bollinger Bands article here.

MACD blends trend and momentum via EMA spreads. Histogram inflections or zero-line crosses can confirm follow-through after a fast trigger. The stochastic oscillator is another fast momentum tool. Read our article on MACD here.

Typical combos for scalpers:

Trend + pullback: price above a rising EMA pair. This means you enter on a brief dip toward the fast EMA when RSI stays >50 and stochastic turns up.

Volatility break: Bollinger squeeze, then breakout in EMA direction. Seek to confirm with MACD histogram rising from zero to reduce fakeouts.

Range fade (advanced): flat EMAs, band touches with RSI divergence — tight targets only, due to spread/slippage sensitivity.

Top tip:

A key trap is overfitting, stacking too many indicators until a backtest “looks perfect” but fails when tried under real trading conditions. Keep tools limited, roles distinct (trend/momentum/volatility), and validate with out-of-sample and walk-forward testing before risking capital.

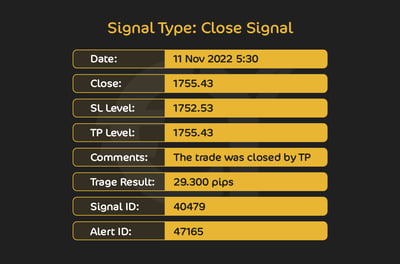

How Providers Show a Scalping Setup

Most reputable signal providers publish a compact “payload” so you can execute fast and know the rules of engagement. A typical scalping ticket includes: pair, direction, entry (market/limit), SL, TP, time-in-force (how long the order lives), and a risk note (position size or % of equity to risk). Better providers also add context: session, news blackout, and what invalidates the idea.

Example payload (scalping):

Pair: EUR/USD

Direction: Long

Entry: Limit 1.0752 (valid for 3 minutes)

SL: 1.0745 (≈7 pips below)

TP: 1.0764 (≈12 pips above)

Time-in-force: GTD (good-’til-date/time) – auto-cancel in 3 minutes if not filled

Here is what an actual scalping ticket issued by a signals provider could look like:

Why fixed SL/TP can be inferior for scalpers

Fixed “5-pip stop / 5-pip target” rules ignore regime changes. Scalpers live inside microstructure where spread, slippage, and volatility shift minute by minute. A static 5-pip SL can be too tight during high-vol windows (you get whipped out by normal noise) and too loose when markets are dead (you wait forever to hit TP while costs bleed). It also fails to adjust when spreads widen (your effective stop shrinks) or when the pair transitions from range to breakout behavior.

Top tip:

For scalpers, your edge = tiny. Costs and noise = big. Volatility- and structure-aware SL/TPs keep your stop outside routine chop and your target within what the market is actually paying now, improving fill quality and realized expectancy versus one-size-fits-all pip counts.

Due Diligence Checklist Before Following a Scalping Signal

Here are some important elements you need to watch out for before you follow a scalping signal:

1) Verified track record (independent analytics)

Look for third-party verification (e.g., Myfxbook/FX Blue with Track Record Verified and Trading Privileges Verified).

Prefer live accounts over demo. Check for consistent broker/timezone stamps and no gaps around news.

Scan equity curve vs. balance curve to spot hidden martingale/grids.

2) Broker compatibility (costs and execution)

Spreads: On your intended pairs, your live spread should be within ~0.1-0.3 pip of what the provider claims during the same session.

Execution policy: Confirm “market execution” vs “instant” (requotes), min stop distance, and whether stops are server-side.

Infrastructure: If signals are fast, plan a low-latency setup (VPS near broker). Test your average slippage in the overlap session.

3) Time zone & delivery speed

Match provider’s active session (e.g., London/NY overlap) to your local time.

Delivery: Push (app/Telegram/API/MT copier) beats delayed email. Measure end-to-end delay: signal time to your fill time must ideally be less than a few hundred ms for market orders, and preferably less than 1-2 seconds for limits.

4) Sample size & drawdown profile (not just win rate)

Try to get at least 6-12 months and 200-500+ trades to judge edge stability.

Prioritize max drawdown, average R, profit factor, and expectancy per trade over headline win rate.

Watch for asymmetric risk (tiny wins, rare big losses), widening average loss, or frequent equity dips post-news.

5) Clear risk method

Provider should state position sizing (fixed fractional or volatility-based), R-multiples for TP/SL, and max open risk (e.g., ≤2% total across all open trades).

Define your caps, such as per-trade risk, daily loss limit, and pause rules after N consecutive losses or after hitting daily DD.

6) Strategy transparency (minimum viable clarity)

Know the setup archetype (trend-pullback, breakout, range fade), time-in-force, and when signals are invalidated.

Prefer volatility-based SL/TP over fixed pip counts. Always confirm how levels adjust during spread spikes.

Follow only when the provider’s verified stats, your broker’s microstructure (spread/latency/slippage), your time zone, and a documented risk framework all line up — and prove it first with a low-risk replication test.

When Signals Help (And When They Don’t)

Signals, like many indicators in this world, don’t always work. This is what you need to know about when it can work or not work:

Where signals shine:Signals can shortcut idea generation and impose welcome discipline. You get a defined setup (pair, direction, entry, SL/TP, time-in-force), a clear invalidation point, and fewer “impulse trades.” For busy traders, they’re a way to outsource scanning to someone who lives on the lower timeframes. If your pipeline is tight, including low spreads, low latency, and consistent execution, then signals can keep you focused on risk and process instead of hunting entries. The best FOREX brokers for scalping will give you the right conditions in which to trade.

Where signals disappoint:Scalping lives in seconds and tiny targets. If you can’t click fast (or your copier adds delay), your fills drift and the edge evaporates. If you’re not comfortable with microstructure noise like wicks, spread spikes, and/or partial fills, you’ll bail early or widen stops until costs eat you. And if round-trip costs sit above ~1-2 pips on majors during the liquid sessions, even good signals won’t translate into your P&L.

Viability vs. self-directed scalping:

Signals are viable when you can replicate the provider’s environment. That means the same session, similar spreads, similar latency, same order types, and a verified edge that still shows positive expectancy after your costs. They’re best for traders who value structure, can follow rules, and have broker/tech tuned for speed.

Self-directed scalping is preferable if you can read tape/structure in real time, adapt stops/targets to volatility, and iterate your own playbook. You avoid provider lag, choose only the cleanest conditions, and optimize entries to your broker’s fill behavior.

Top tip:If your logged entry drift often exceeds ~0.5-1.0 pip or your expectancy over 100+ replicated trades is ≤0 after all costs, signals aren’t a fit for your setup — either re-architect the pipeline (broker/VPS/sessions) or switch to self-directed methods where you control timing, context, and cost.

Red Flags and Things to Watch Out For

You could be looking for a pot of gold at the end of the rainbow without realizing that you are making some classic mistakes in this area. Here are some important red flags about which to be on the alert:

Too-good promises

“Guaranteed profits,” fixed daily returns, or >80–90% win rates without third-party verification (e.g., Myfxbook/FX Blue with both Track Record and Trading Privileges Verified). Screenshots, PDFs, or hand-picked trade logs don’t count.

Martingale / grids / no real stop

Averaging into losers, “equity protection only,” or moving/widening stops. Equity curves look smooth — until one outsized move wipes months of gains.

No independent stats or tiny samples

Backtests or 2–3 week demos in ideal conditions. Insist on 6–12 months and 200–500+ trades with full metrics (drawdown, profit factor, expectancy, not just win rate).

High-pressure upsells

“Seats closing today,” costly VIP rooms, or paywalls to see basic rules. Real edges don’t need urgency tactics.

Broker or copier conflicts

“Use our broker” with undisclosed rebates/IB deals, unexplained slippage, or signals that only “work” on one venue. If your live spread/latency is worse, your results won’t match.

Opaque risk management

No stated per-trade risk, no max open risk, no daily loss cap. If the provider can’t express targets in R-multiples with clear invalidation, skip.

Hypey reviews

Testimonials vary wildly by broker, geography, latency, and session. Treat Trustpilot/Discord praise as noise; your pipeline may not replicate their fills (survivorship and selection bias are real).

Data and operational risk

Signal delivery via unstable channels (email delays, throttled Telegram), permissioned trade copiers that ask for broad API rights, or no uptime/SLA. Missed or late alerts = negative expectancy for scalpers.

Cherry-picking & curve-fitting

Only posting winners, deleting losing calls, or endlessly tweaking parameters to “fit” last month’s regime. Demand a continuous, timestamped history.

Costs hidden in the fine print

Wide effective spreads during news, extra commissions/swaps, or minimum stop distances that break the stated method. Reconcile fee tables with your live tickets.

Counter-signals and copy risk still carry market risk

Even “hedged” or “uncorrelated” signal mixes can correlate in stress. Copying (or counter-copying) does not remove market risk; slippage and gaps can blow through stops.

Are Scalping Signals Worth It?

At the highest level, yes, they are worth it, but you need to be aware of a few things:

Only if your costs and speed don’t consume the edge. Benchmark it. Replicate 100+ of the provider’s trades at micro size and compute your expectancy after costs. If your round-trip cost (spread + commissions + slippage + funding) stays ≤ 1-2 pips on majors during London/NY overlap, your entry drift averages < 0.5 pip, and your expectancy remains >0 (in R) with a tolerable drawdown, signals can be viable. If not, the edge you see on their dashboard won’t show up in your P&L.

Quick rule:

Viable: your realized profit factor ≥ 1.2, expectancy ≥ +0.05–0.10R per trade, and daily loss controls keep max DD within 5–10× your per-trade risk.

Not viable: your entry price trails by ~1 pip or more, round-trip costs > 2 pips, or expectancy ≤ 0 after 100+ trades.

If you can’t meet those thresholds because spreads are wider, slippage is frequent, or latency is high, step up in timeframe. Higher-timeframe signals (e.g., 15-60m) tolerate slightly worse microstructure, let you use limit/stop orders more effectively, and reduce click pressure.

Always remember that scalping signals are worth it only when your pipeline (broker, VPS, session) reliably preserves the provider’s small edge. Otherwise, switch to slower setups where costs are a smaller slice of the move.

Conclusion

Scalping signals in FOREX aren’t a shortcut, but rather a process. The edge is tiny, so microstructure decides everything. Like we’ve said, this includes spread, slippage, and latency, which must stay small enough that your round-trip cost is ≤1-2 pips on majors during liquid hours.

Signals help if they bring discipline and repeatable setups you can execute fast with volatility-aware SL/TP. They hurt when fixed targets meet shifting spreads, when latency adds a pip, or when risk rules are fuzzy. Remember some of the red flags we noted, which include baseless guarantees, martingale, no verified history, and high-pressure upsells. These must be deal breakers.

If your data shows profit factor ≥1.2, expectancy ≥ +0.05-0.10R, and drawdowns contained by daily loss caps, you could have a viable pipeline. If not, step up in timeframe or build a self-directed playbook where you control context and cost. Follow signals only when your infrastructure preserves the edge on paper, otherwise, the market will tax it away.

FAQ

If done well, then yes, but only if your costs (spread + commissions + slippage + funding) and latency are tiny.

Microstructure. Wider live spreads, copier delays, or fast-market slippage can eat a 2-3-pip target. The provider’s stats assume their venue and speed, so yours must be comparable.

Look for third-party verification (e.g., Myfxbook/FX Blue with Track Record + Trading Privileges Verified), at least 6-12 months of data, 200-500+ trades, clear drawdown history, and stated risk rules (SL/TP in R-multiples, max open risk).

Each is valuable in a different way. Manual signals give you maximum control, but there is a risk of click latency. Copy trading is convenient, but adds routing latency. EAs are best for speed if hosted near the broker, but require rigorous testing. Choose the path that gives you the lowest realized costs and fastest, most consistent fills.

Generally no. Fixed 5-pip SL/TP ignores changing volatility and spread. Use volatility/structure-based levels (e.g., ATR or recent micro-swings) and time-in-force so orders auto-cancel when conditions change.

Do it in two phases. First a demo account to debug plumbing, then micro-live (0.1× size) for 100-200 trades. Log your alert to click to fill times, your fill vs provider entry, effective spread, commissions, slippage, and expectancy in R. Remember to only scale if the profit factor ≥1.2 and expectancy ≥+0.05-0.10R.

Tight raw spreads, stable market execution (no requotes), small/zero minimum stop distance, reliable server-side stops, fast data center (or your VPS nearby), and transparent swaps/commissions should all be in order.

Profit guarantees, martingale/grids, tiny or unverified samples, high-pressure upsells, “works only with our broker,” moving stops, or refusal to share a full, timestamped trade log. Even verified copy/counter-signals still carry market risk as gaps and slippage can exceed planned losses.