Table Of Contents

- An Important History of FOREX

- What are FOREX Signals?

- Top 10 FOREX Signals Providers 2026

- 1) Arincen

- Who Provides FOREX Signals?

- How to Choose a FOREX Signal Provider

- What is the Difference Between a Signals Provider and a Broker?

- What is the Difference Between a FOREX Signals Provider and Social Trading Brokers or Platforms?

- Why Do Traders Use FOREX Signals?

- Understanding FOREX Signal Systems

- Using FOREX Signals

- Manual Vs. automated FOREX signals

- Paid FOREX signals service Vs. Free FOREX signals service

- Algorithmic FOREX signals

- Entry Vs. exit FOREX signals

- Three Important Signal Types

- Action signals

- Take-profit signals

- Current market price

- Advantages and Disadvantages of FOREX Signals

- Advantages

- Disadvantages

- FOREX Signals in Action

- What You Need to Know Before You Use FOREX Signals

- Know a good signals provider from a bad one

- Understand your risk appetite

- Understand the market

- The Bottom Line

Top 10 FOREX Signals Providers

The FOREX market is fast-moving and hyper-competitive. FOREX signals providers play an important role in this area as they offer a way for traders to get ahead. FOREX signals are pieces of important information that tell you to act on a trade within a specific time window. Think of them as a reliable alert that tells you that now is a good time to place a trade or to sell up.

FOREX signals can be generated either by human analysts or by an automated signal platform or tool. Signals help unsure traders by giving them information that, if acted upon, can allow them to make a trading profit.

The FOREX market is very daunting at first, and many traders struggle to get to grips with the overwhelming amounts of information they need to synthesize to make a winning trade. Rather than have traders disillusioned by constantly making losing trades, signals can help investors extend their careers by giving them a better chance of early wins. We have written this article to introduce you to the top eight FOREX signals providers on the market today.

The top brokers offering high-quality FOREX signals are Arincen, Autochartist, MetaTrader, 1000pip Builder, Learn2Trade, Forexsignals.com, Forex GDP, and AvaTrade

A good FOREX signal provider offers clear entry and exit points, stop-loss and take-profit levels, and supports multiple delivery formats like SMS, app notifications, and email

Providers use either manual strategies based on expert analysis or automated systems driven by algorithms to generate trading signals

The best signals are backed by technical indicators, economic data, and sometimes sentiment tools to improve timing and accuracy

Traders should evaluate signal reliability by checking verified past performance and win-loss ratios before committing capital

Customization is important so traders can adjust risk levels, trade frequency, and pair focus to fit their strategy and goals

Some platforms like Arincen provide social trading features that let users follow and copy seasoned traders in real time

Signals are only as effective as the trader using them so good risk management and platform integration are essential for consistent gains

An Important History of FOREX

To understand the role of FOREX signals today, we need to look back at what trading was like before signals. Modern FOREX trading arguably has its roots in the great depression, when, in the early 1930s, ordinary people in the US and Europe wanted to exchange their depreciating currencies for gold.

The prevailing way to peg a value to currency at that time was via the gold standard, a monetary system in which a country’s currency had its value directly linked to the amount of gold it had in its reserves. However, many major economies decided to abandon that method in the early 1930s, leading to the birth of fiat currencies as we know them today.

The most modern FOREX trading system we know today began in the early 1970s when the US allowed its currency to float freely in the FOREX market. This gave rise to traders and brokers taking up this activity on a more professional level. Why is this relevant to signals? Well, it simply underscores that the FOREX market is highly developed and very mature, and every trading trick in the book has been tried many times over. So, when new traders enter the market, they need every tool to assist them to succeed. Hence the rise of FOREX signals.

What are FOREX Signals?

In any mature market, such as FOREX, participants are always looking for an edge. One important driver of this need for innovation is the idea that participants are playing against the system. As we know, market makers across the industry help determine the price of FOREX pairs, with most of the prices being determined by the economic standing of the countries whose fiat currency it is. These exogenous price factors are far beyond the influence of the individual retail FOREX trader, whose job it is to understand the market and profit from it.

At the outset, we mentioned that the FOREX trading learning curve is steep, so traders need whatever assistance they can get to make winning trades. Signals have been designed to be nothing more than a prompt for a trader to act in a certain way at a certain time. This is enormously beneficial to traders who are unsure how to proceed.

A signal comes as a pulse of information about a certain pair of currencies in the form of a recommendation that the trader must perform an action at a predetermined price and time. Signals are either generated by highly skilled and experienced human traders, or by automated algorithms.

Imagine being a newbie in the market and being able to be profitable while still learning. This is the biggest benefit of signals. Signals can be configured to fit the lifestyle of any trader. The available methods for traders to receive signals include SMS alerts to their phones, email blasts, or even social media alerts. Depending on the platform they choose, traders could receive the notifications natively via their FOREX broker’s platform.

FOREX signals are generated from a complex web of inputs. If you know anything about multifactorial decision-making matrices, then you have an idea about how FOREX signals are generated. Signals could be the result of foundational analysis, combined with everyday technical analysis from chart-based information, supplemented with information from news and current affairs. As with any system of this nature, the longer the system is fed with rich details, the more precedent it has with which to work, making its recommendations more robust.

Technical analysis is one of the most important sources of information to feed into signals. Technical analysis involves reviewing past price activity, a complicated type of analysis that hones in on prior prices and support and resistance levels. This form of analysis is a great way to uncover shorter-term trends that benefit traders who use intraday trading strategies.

By comparison, fundamental analysis is more suitable for longer-term investments based on important country-level macroeconomic information. Much more information goes into a fundamental analysis at a national level, such as inflation data, interest rates, manufacturing output, and unemployment figures.

For the trader, a FOREX signal is useless if not acted upon at the right time. The market is dynamic and fast-moving, meaning that buy-and-sell decisions must be acted upon before the information becomes dated and unreliable.

FOREX signals services come as different utilities to traders. Some are low-grade signals that almost anyone could figure out for themselves, such as a directional move of a currency pair. Others are much more valuable. The best signals include important information, such as information on when is the best time to take a profit or invoke a stop-loss.

Top 10 FOREX Signals Providers 2026

Arincen

Forexsignals.com

Fxleaders.com

Trading Central

MetaTrader signals market

Autochartist.com

Learn2.trade

FxPremiere

1000pip Builder

ZuluTrade

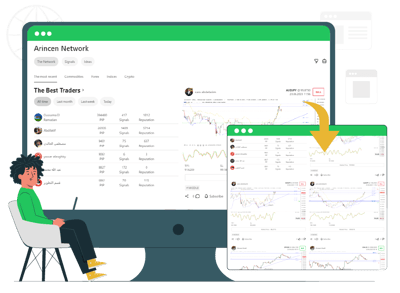

1) Arincen

Arincen is a powerful platform that includes a peerless social network and a thriving trading signals network. Traders of all experience levels can take part in this bustling marketplace where experts lead the way with signals based on their success. Elite traders and newbies alike can rub shoulders in this place, and access to information is democratized. You can access top level signals in the following areas:

There is a range of free FOREX signals; however, if you want to get the full red carpet service, you can subscribe to the VIP signals section, a paid FOREX signals service, where even more features are unlocked.

On Arincen’s network, experts share signals and this is revealed through charts on which the relevant indicators that explain their decision are displayed. There are multiple take profits, such as TP1, TP2 and TP3, where users and experts alike can share signals. The many take-profit signals help you choose the most ideal risk and open period.

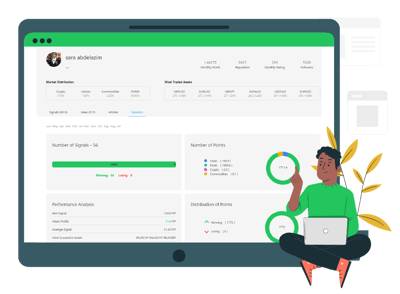

In the highly detailed user-profile section, you can monitor the performance statistics of your chosen signals expert, on which market they are trading, such as crypto, oil or FOREX. Using FOREX as an example, you can track which currency pair gives the expert the most success. You can also monitor the amount of positive pips they have won over a timespan of months or even years. You will also see detailed information such as winning and losing pips, most successful assets, the average winning signals, and a range of other highly informative data.

If you are ready to go up a notch and get into more elite territory, you can sign up to the experts page, where you will find a detailed list of experts from which you can pick according to your preferences.

The Arincen signals edge in a nutshell

Arincen’s signals stand out because they bring together a truly global network of trading experts, each sharing strategies, trade setups, and insights in real time. Subscribing to a signal unlocks even more value: you’ll be notified when a trade hits its take profit or stop loss level, or if the expert decides to close it manually.

What makes this system powerful is transparency. Every expert on the platform comes with detailed statistics, win rates, risk-to-reward ratios, average trade duration, and historical performance, all displayed in easy-to-read dashboards. Locked signals also add an extra layer of intrigue: they’re visible only to subscribers, creating a premium experience that rewards active participation.

Signals aren’t just numbers. Experts often provide explanations of the reasoning behind each trade, showing the strategy and chart patterns they used. This means every signal is also a learning opportunity, helping traders sharpen their skills while taking actionable positions. Real-time prices and live profit calculations keep users on top of performance as the markets move.

Arincen also runs an affiliate and referral program built on a “win–win” philosophy. Experts and everyday users alike can earn by referring others, while the new joiners benefit from access to the full ecosystem of signals, insights, and tools. This model builds a community where trust, shared growth, and consistent rewards are central.

2) Forexsignals.com

This firm has a tagline that claims that “Trading alone is boring.” It goes on to claim that FOREX trading signals alone are not enough and that traders can learn how to read and forecast the markets. Traders can also discover how to find trade opportunities and manage risk and make smarter decisions with experienced trading coaches guidance.

3) Fxleaders.com

FX Leaders offers FOREX signals services across a wide range of timeframes, suited for both short term as well as long term trading. FX Leaders is a top provider of real-time market news, market analysis, trade ideas, trade recommendations and FOREX signals for FOREX trading. FXL has become a gateway to the FOREX market for millions of traders worldwide. The FX Leaders FOREX signals system delivers real-time alerts on the major currency pairs along with in-depth analysis and trade ideas and recommendations.

4) Trading Central

This firm indicates that its “...award-winning analytical solutions compress unstructured, big data into compact insights and iconic visuals that increase engagement, confidence and action.” Its online broker solutions harness an award-winning mix of automated AI analytics, beautiful user interfaces and registered investment adviser expertise.

5) MetaTrader signals market

Trading signals in MetaTrader allow traders to automatically copy the deals performed by other traders in real time. The showcase of 3,200+ free and commercial signals can be found on the website and on the Signals tab. All signal providers are sorted by their trading results. The most successful ones are displayed at the top of the list. Select your signal provider, subscribe to their signal and start copying their deals both on demo and real accounts without leaving MetaTrader.

6) Autochartist.com

Autochartist is a renowned technology partner that provides real-time market analysis for traders. It offers powerful trading signals to traders. These signals are trade recommendations that suggest when to enter or exit a trade, based on various analysis techniques. Autochartist focuses on generating and delivering trading signals to its subscribers, who can then execute trades based on the provided signals.

7) Learn2.trade

This firm offers to help you learn to trade as a beginner, stating its website will arm you with all of the required tools to get your trading career off on the right foot. The company can provide signals notifications in the form of immediate alerts to your email inbox. It also provides daily technical analysis and trading tips and between 4-5 accurate signals per day.

8) FxPremiere

This firm does not provide any free signals, but starts charging from the get go. The basic paid FOREX signals service starts at $37 per month, rising to the premium service of $199 over 12 months. The company says that while FOREX trading can be lucrative, traders need to utilize the most reliable FOREX tools available to stop them spending hours of watching and waiting for possible entry and exit points. FXpremiere offers daily FOREX signals services from more than 50 signal sources.

9) 1000pip Builder

This company lets traders replicate the moves of a seasoned FOREX specialist directly on their own platform. Led by a veteran trader, who brings over a decade of London-based trading experience, this signal service delivers high-probability trade ideas straight to your inbox, Telegram, or SMS. Subscribers receive full precision, entry price, stop loss, and take-profit levels, for each setup in near real time, whether you’re trading on a demo or live account.

10) ZuluTrade

This veteran social trading platform enables users to automatically copy the trades of experienced signal providers in real time, whether following established FOREX traders or peer-generated strategies. ZuluTrade stands out for its nearly 1 million users and execution of over $800 billion in trade volume. It has safeguards like ZuluGuard, which automatically disengages if a signal provider’s strategy changes.

Who Provides FOREX Signals?

By now, you know the difference between manual and automated signal providers. Manual analysis is a more intensive exercise usually carried out by experienced traders, professionals, or broker-appointed in-house signal experts. Manual providers give you trading opportunities that are derived from their trading experience. They may all use the same fundamental and technical analysis tools, but many companies claim to have a "secret sauce" that is linked to their verifiable success rates.

On the other hand, automated signal providers rely on the power of software that is specifically developed to create trading instructions under the right conditions. Each of these types of signals has its place. EAs are well known in the market and are just another kind of automated signaling system. Their power and convenience come from their ability to make rapid sense of data-rich sources, such as moving averages, Fibonacci levels and stochastics.

Automated signal providers can choose to rely on only these highly technical sources, or they can supplement their analysis with more traditional methods, such as watching economic news releases and market sentiment. In some cases, certain FOREX brokers collaborate with third-party signal providers to supplement their own analysis.

Automated trading is so popular that there are several so-called auto-trading communities in the world of FOREX. In these communities, anyone can become a signal generator, provided they fulfill several conditions, such as proving their trading experience and success. Over time, community members develop reputations for success or failure. Some traders can be criticized for simply being inactive on the platform as the community exists to provide copy trading opportunities to other traders, so signal generators must be seen to be active.

How to Choose a FOREX Signal Provider

There are several factors to consider before choosing a FOREX signal provider. Remember that some platforms ask for a fee, and other platforms offer signals as a value-added service. The first thing you need to do is to ensure that you choose a good broker or a good signal provider. How do you know who is good? In the case of brokers, you would be looking for proof of regulation and a track record of success and sound management. With other types of signal providers, you can try to access the communities that frequent these platforms to hear what they have to say.

Making the right choice among all available FOREX signal providers is paramount. Remember, by embracing signals, you are deferring to the expertise of the partner you choose. You give up your right to complain once you have entrusted them with your money if you stick to their signals closely.

You need to choose well because the result of choosing badly will become obvious–you will lose money by making bad trades. Generating signals is not a part-time job, and your partner needs to take it seriously and have a track record backed up by credible expertise in the field.

You are looking for reliability and reputation. Communities are some of the best ways to learn about the entity you want to entrust your trading career to. Devote some time to studying their trading performances and trading strategies.

The best signal providers will give you a generous trial period with no obligations because they believe in their product. Having access to a trial period means you can conduct back-testing of trading signals, which is an important way to weed out good signal providers from average ones.

Another factor for which you should be looking is customizability. There are so many data points that are involved in creating a FOREX signal. You can choose to go minimalist or comprehensive, but your partner should be able to support the direction in which you want to go. Once you get going, the rest is simple: select a currency pair, determine an entry point, insert a stop-loss order, and insert a take profit, then you are good to go.

What is the Difference Between a Signals Provider and a Broker?

A FOREX signals provider and a FOREX broker are two different entities involved in the FOREX market. A FOREX signals service offers trading signals to traders in the form of trade recommendations or alerts that suggest when to enter or exit a trade, which currency pair to trade, and at what price.

The best FOREX signals providers deploy various analysis techniques, such as technical analysis or fundamental analysis, to generate these signals. Traders can subscribe to these services to receive the signals via email, SMS, or through dedicated platforms. The job of a FOREX signals service is to offer insights and recommendations to traders, helping them make informed trading decisions.

A FOREX broker, on the other hand, is a firm that facilitates the execution of trades in the FOREX market. FOREX brokers provide a trading platform or software that allows traders to access the market and trade various currency pairs. They act as a link between the trader and the market liquidity providers, which may include banks, financial institutions, or other brokers. Of course, the best FOREX brokers offer both signals and platforms, and there are such brokers out there.

Recommended Brokers

What is the Difference Between a FOREX Signals Provider and Social Trading Brokers or Platforms?

FOREX signals providers and social trading brokers are different in terms of the services they offer and the way they operate. The best FOREX signals providers, as mentioned earlier, are entities or individuals that offer trading signals to traders. Social-trading brokers, such as eToro, provide a different approach to FOREX trading by incorporating social and community elements into the trading experience. These platforms typically offer features like copy trading, social interaction and trade transparency in the form of detailed information about the performance, trading history and risk profile of traders.

Why Do Traders Use FOREX Signals?

FOREX signals services have many advantages. First, they offer unrivaled convenience. For traders who use different types of strategies, signals can help cut through the noise of having to study technical analysis or keep a handle on charts. It also helps traders not have to manually watch the news and keep an eye on sentiment and geopolitical maneuvers that could alter the course of a country’s currency.

Trading through signals is a huge time saver. With the FOREX market open 24 hours every weekday, it pays for a trader to have a smarter and more reliable surveillance system. Very few traders trade FOREX full-time, so they are always in the middle of something else. Opportunities to make a profit present themselves around the clock. If you think about it, most people who hold full-time jobs can only devote meaningful attention to their trading app at the end of the day. If you only trade in a limited time window, you are exposing yourself to a fraction of the opportunities you could find if you only had more time.

This is where signals come in handy. They provide a detailed trading suggestion made up of a suggested entry point, stop-loss, and take-profit price levels. If the traders trust the signal, they can immediately act on the advice and perform the trade execution.

All this being said, FOREX signals are not infallible. One key item to note is that as signals are merely an aggregation of information that constitutes an informed suggestion, sometimes they are wrong. For example, signals work best with major currency pairs that are relatively stable. They are less effective for minor and exotic pairs as they are subject to variability that even the signal cannot sense. So, you should know that it is best to trade in larger lots with established currencies, and smaller lots with minor pairs. Then, there is also the matter of data releases. As much as a signal can give you useful information, it can never truly predict market sentiment when important information, like central bank announcements or GDP figures, are released. At these times, it is best to give the market time to breathe and see the direction it is taking.

Signals become buy-or-sell suggestions based on technical indicators that are commonly used across the FOREX world. Established analysis tools, like Japanese Candlesticks, Fibonacci levels, Bollinger bands, moving averages, trend-determining oscillators, and charts, are the technical indicators that come in most handy when trying to get to reliable signals.

Understanding FOREX Signal Systems

Using FOREX Signals

The best FOREX signals providers transmit information about whether it is a good time to buy or sell. This can be done via a manual or automated system. Signals are not only a FOREX tool, but can also be used to find out the best time to trade stock prices, commodity prices, and bond prices.

As mentioned, FOREX signals can be sent over a variety of platforms, depending on the software used and the trader's preferences. The best FOREX signals don't just tell a trader when to buy or sell, they also provide detailed information on why the action is the right one now. Here we explain the main types of signals:

Manual Vs. automated FOREX signals

FOREX signals can either be manual or automated. A manual system features an in-house FOREX trading expert hovering over their computer screen, searching for signals and advising other traders whether to buy or sell. With manual signal trading, it is up to the trader who receives the signal to make the decision on whether to buy or sell, and the human factor plays a large role. Manual signals rely a lot on human intelligence and experience. It is often said that if someone has had enough exposure to an activity, and they have been successful at it, they develop a "nose" for it, which is simply a combination of experience, knowledge and intuition.

Manual signals often recommend bigger take-profit levels. They can offer better risk-to-reward outcomes simply because they are more adaptable and in tune with market fluctuations and volatility. Automated signals serve a real purpose, no doubt, but they cannot replicate the human experience that sometimes causes a trader to slow down on a trade when an automatic signal would recommend flying in. This is because humans can interpret and synthesize incoming news in a way that is much more nuanced than a machine.

Automated trading, after the parameters have been set, allows traders to function on autopilot, without the perils of human emotion creeping in. Automated trading signals are created by a computer or software that monitors and analyzes price action based on coded algorithms. Much like how using a map app to get to a new destination makes a driver inattentive to the road, automated signal trading is said to make new traders lazy and inattentive.

Automated FOREX signals strip away the human element from trading and provide recommendations with no emotional involvement. This often works out well in the FOREX trading world. Often, the biggest success factor of a signal is getting the trader to act in a speedy fashion before the market changes. Automated trades can also be back-tested to give users a greater sense of comfort.

Paid FOREX signals service Vs. Free FOREX signals service

FOREX signals can cost you money, or they can come for free. Naturally, there is work that goes into producing these signals. Some of the best FOREX signals providers use their expertise in creating signals as something they can monetize, hence the fee. Other firms simply want to drive engagement and loyalty or position themselves as experts in the field. They might offer free FOREX signal services as a trial for a long period of time to encourage users to frequent their site.

Algorithmic FOREX signals

Some traders find it easier to use trading robots or Expert Advisors (EA) to generate their FOREX signals. An EA is created when a set of rules is input into an algorithm that places trades under certain criteria.

Entry Vs. exit FOREX signals

This category of signals is based on how much detail is in the signal. Some signals only provide entry information, which is a cue for the trader to enter the market. Other signals only provide exit information. Now that we know how signals are created, it is easy to see how customizable they are. Exit signals work best with long-term FOREX trading signals for investors who engage in position trading. Of course, it is no surprise to learn that the utility of a signal increases when there is more information contained in the signal, so a combination of entry and exit signals is to be welcomed.

Three Important Signal Types

Action signals

These signals prompt the trader to buy or sell. The purpose of the signal is not too confusing, as its intention is clear. For example, a signal could give an unambiguous indication that price movement is about to change, so the trader should act. One of the best examples of an exit signal is the stop-loss signal, which simply tells the trader when to exit the trade in the best interests of the trader. The stop-loss function should be well known by all traders as it will be a tool that limits their losses.

Take-profit signals

This signal does what it says on the label. It prompts the trader to take profit once a certain profit point has been crossed. Human emotions often betray us, leading to many traders thinking they can continue to ride a winning position beyond the point at which it makes sense. This is where the take-profit signal from the best FOREX signals providers comes in so handy.

Current market price

This type of signal is a notification signal that tells the trader what the current market price (CMP) is. A CMP-focused signal will help you compare the price of the currency pair at the time of signal issue with the actual price at the time of submitting the order. In the hustle and bustle of trading, this simple signal is surprisingly useful, as it stops traders from having to refer to the current market price on a different platform or in a different trading window.

Advantages and Disadvantages of FOREX Signals

The best FOREX signals providers can give you invaluable information on the market and how to proceed. Here are some of the most important advantages and disadvantages related to this activity.

Advantages

Signals Are Highly Customizable

Each trader is on their own journey. Granted, there are vibrant trading communities and copy trading is a popular activity, but parting with your capital is a personal act. Therefore, traders may have their own timelines for when they want to open and close trades, and they may have their own risk tolerance. The ability to customize trading information is highly valuable. Each trader needs to be comfortable that they are trading based on what is important to them.

They Are Easy to Track

FOREX signals are easy to track because you can automate alerts via email, text, or other communication channels. Rather than remain on your trading platform indefinitely, you can use signals as pulses of useful information to keep you in touch with the market, even if you are out with family or friends.

They Provide Recommendations

In such a fast-moving and dynamic marketplace, it is not uncommon for traders to be confused about how to proceed. The term "analysis paralysis" could capture the dilemma of the new trader trying to figure out what to do next while studying reams of information on FOREX trading theory. A recommendation gets you started. It can give your career that vital impetus that breaks the mystery of trading and provides you with a first trading win or loss. The value of a recommendation to an undecided trader can be huge.

Disadvantages

Signals Are Not Exact

If you have developed the sense that signals are infallible, they are very much not. Even if you input the correct information all the time, the market contains enough variability and volatility to make even the best-researched signals miss the mark.

False Signals Are a Constant Threat

Garbage in, garbage out. This common mantra captures one of the biggest risks of following signals. If the analysis is incorrect because of dated or inaccurate data, then the signals will surely be incorrect. Therefore, choosing a good partner is the best thing you can do for yourself. Your FOREX signal partner needs to have shown they have been active in the market learning their stripes as this reduces the likelihood of error.

Over-Reliance on Signals Can Make You Lazy

Using the map app analogy, if you spend all your time on your driving journey looking at a map on a screen, you will lose sight of the scenery around you. Relying on signals is a good strategy, but until a trader can remove the training wheels and make at least some of their trades using their own experience and knowledge, they can never be truly independent.

FOREX Signals in Action

Imagine you are at a family dinner and your phone buzzes. The following message flashes on the screen - “Buy EUR/JPY at CMP 143.24 - SL 142.76 - TP 142.98.”

This message would be meaningless to anyone else in the room, but you would automatically know that your FOREX signal provider is prompting you to buy the EUR/JPY at a current market price of 143.24, with the stop-loss being 142.76 and a take-profit level of 142.98.

If the deal makes sense, you could enter the trade on your mobile app without fuss and go back to the dinner conversation thereafter. That is the power of a FOREX signal when it works at the best of times. It is the power of convenience in your hands that the earliest retail FOREX traders could only have dreamt of. It also partly solves the eternal question of what is the best time of day to trade FOREX, which is a hotly contested topic.

What You Need to Know Before You Use FOREX Signals

When choosing the best FOREX signals provider, you should focus on transparency, performance, and reliability. Look for providers who share verified trading results rather than unverified screenshots. Assess their track record over several months, not just a few lucky trades, and check for realistic risk–reward ratios that match your trading style. Reliable providers explain their strategy logic, whether it’s technical, fundamental, or algorithmic, and clearly define entry, exit, and stop-loss levels.

Signing up for a FOREX trading signal platform is simple. Getting your account running is some of the easiest work. The hard work comes in staying true to your strategy and being discerning about which signals to which you listen. Here are some of the things you need to consider:

Know a good signals provider from a bad one

No two FOREX signal providers are exactly the same. You will likely find large disparities in quality. A good success rate for a signal provider is considered to be in the 60% range. Many signal providers provide much lower success rates. As the popularity of signals takes off, many fly-by-night operators are taking advantage of their popularity by entering the game ill-prepared.

Understand your risk appetite

This advice is true of all forms of trading. Financial speculation is risky. Signals expose you to the possibility of suffering a loss. If they were a sure-fire route to profit, every trader would be using them to get rich. You must understand how much risk with which you are willing to live as you delegate your trade opening and closing process to manual or automated signal systems. One thing to know about signals is that they can help you implement a strong risk management strategy.

Understand the market

Any advice that is devoid of context contains an important flaw. Signals can provide highly accurate and dependable action prompts, but they can also miss the mark if the market is acting in a way a signal was not designed to read. Emotionless advice is generally the strength of a FOREX signal. It is always a good idea to use signals in conjunction with a wide-eyed appraisal of what is happening in front of you.

The Bottom Line

FOREX traders are in a constant battle to take advantage of every available edge. FOREX trading is the biggest market in the world and has rightly made many traders wealthy. FOREX signals providers are just another way of eking out another bit of efficiency in decision-making. However, you should know that signals, as helpful as they can be, are not infallible, and not all FOREX signal providers or even FOREX brokers are created equal.

FAQ

With an experienced and capable FOREX signals provider, signals can be a very reliable source of information. However, you should remember that signals can be unreliable if they are fed with the wrong information or if your service provider is not very skilled at generating reliable signals. It is always best to test signals in a demo environment and back-text them as much as you can.

They save you lots of time. They take away the need for constant technical analysis, which is sometimes repetitive and mundane. They can be scaled into a high-frequency trading model that allows you to reliably enter hundreds, if not thousands, of trades per day.

Every trading activity is risky, but if used correctly, FOREX trading signals can help you reduce the risk of losses by suggesting the right time to either enter or exit a trade. They can also give you vital cues about when to take profit and where to set your stop-loss.

The biggest danger of using trading signals is that the suggested action is not always accurate. However, you can minimize this risk by taking some precautions. First, make sure you choose your signal provider well, as this will take away much of the risk of working with an inexperienced partner. Secondl make sure that you practice how to read and decipher trading signals, and be sure to keep a record of your wins versus losses when using signals.

Each signal type has its place. Manual signals expose you to making bigger trades as they are very in tune with the market. Automated signals are useful because they provide unrivaled convenience by saving you time. Remember that you don’t have to choose one or the other. You can use a combination of these two types of signals in the same portfolio.