Table Of Contents

- Why Lot Sizes Matter in Retail Trading

- How Pip Value and Lot Size Affect Your Gains and Losses

- What Is a Lot Size in Trading?

- Types of lot sizes explained.

- Lot Sizes by Asset Class

- How Lot Size Affects Risk and Leverage

- Choosing the Right Lot Size for Your Trading Style

- Lot Sizes and How Common Trading Platforms Handle Them

- Most Common Questions about Lot Sizes

- Final Thoughts

Lot Size in Trading: Definition, Types, and Importance

In my experience, lot size is a fundamental concept in trading that determines the volume of a position you open in the financial markets. In simple terms, it refers to the number of units of an asset being traded, and it directly affects both the potential profit and the potential risk of a trade. For example, in FOREX trading, one standard lot equals 100,000 units of the base currency. Meanwhile, smaller options, such as mini lots (10,000 units) and micro lots (1,000 units), allow traders to manage exposure with greater flexibility. Understanding lot size is essential because it directly links to position sizing, leverage, and risk management, enabling traders to maintain control over their capital and avoid unnecessary losses.

Lot size defines trade volume and directly determines pip value, influencing both profit potential and loss risk. Standard lots are 100,000 units, mini lots are 10,000, micro lots are 1,000, and nano lots are 100.

Pip value scales with lot size: in most FX pairs, one pip equals $10 for a standard lot, $1 for a mini, $0.10 for a micro, and $0.01 for a nano.

Position sizing is critical to risk management; oversized lots can cause rapid capital loss, while undersized lots limit meaningful returns.

Lot sizes vary by asset class: in commodities, gold often trades in 100-ounce lots and oil in 1,000-barrel lots; in contracts for differences (CFD), lot size may equal one share for stocks but is point-based for indices.

Leverage amplifies lot-size risk, allowing small accounts to control large positions but also magnifying potential losses from relatively small price moves.

Trading style influences optimal lot size: scalpers prefer micro or mini lots for precision, day traders balance mini and micro for consistency, swing traders may use larger sizes with wider stops, and long-term traders often scale in conservatively.

Broker and platform rules differ, with some setting minimum trade sizes, lot increments, or allowing fractional lots; always check specifications before placing trades.

Consistent lot sizing aligned with account size and risk tolerance is essential for longevity; most risk-aware traders limit exposure to 1–2% of capital per trade.

Why Lot Sizes Matter in Retail Trading

Lot sizes are one of those terms I hear many traders talk about. It is interlinked with other common trading terms, such as pips, spreads, and leverage. As a serious trader, it’s in your interest for this term to become second nature as soon as possible.

Be it trading in FOREX, commodities, or indices, lot size fundamentally determines how much you're risking and how much you stand to gain.

A lot size simply refers to the volume, or (unsurprisingly) size, of a trade. It decides on the value of each pip movement, and that affects how much you can win or lose.

If you trade too big on a small account, you could see most of your capital go on one bad trade. On the other hand, if you are too cautious, don’t understand what you are doing, and trade too small, any gains you make will not justify your time or transaction costs.

One way to create a shorthand for lot sizes is to categorise them as micro, mini, or standard, providing traders with more flexibility.

A word of warning: just because you can enter a large position doesn't mean you should. Understanding how lot sizes interact with other such metrics as spreads and margin requirements is crucial if you want to trade accurately.

In this article, I’ll break down the different types of lot sizes, explain how they relate to pip value and other terms, and help you choose the right position size for your trading strategy.

How Pip Value and Lot Size Affect Your Gains and Losses

Let’s start checking how much the lot size and pip value are connected. When you put these two together, they will decide how much you gain or lose on every trade.

As a retail trader, you will know that a pip or "percentage in point," is the smallest possible measure of price movement in most currency pairs. For most pairs, one pip equals 0.0001 of the quoted price.

Example: If EUR/USD moves from 1.1050 to 1.1051, that 0.0001 increase is one pip.If you’re trading one standard lot (100,000 units), each pip is typically worth $10. So, a 20-pip gain would equal $200 profit.

But what that pip is worth in dollars depends entirely on your lot size.

Let’s dig deeper. In FOREX, a standard lot is 100,000 units of your base currency. As I’ve said, on a standard lot, one pip will normally be worth $10. A mini lot (10,000 units) means one pip is worth $1, and a micro lot (1,000 units) makes each pip worth just $0.10.

If you think about it this way, when you trade a larger lot, every pip move becomes more valuable, but at the same time, more risky. You can easily imagine how a 50-pip move on a standard lot could net or lose you $500. But if the same move happened on a micro lot, that would be just worth $5. As you can see, the impact is massive.

Clearly, position sizing is important. If you trade too large a lot, this could lead to oversized losses, even on small market moves. On the other hand, using tiny lots on a well-capitalised account would not move the needle much and would leave profits on the table.

So, how much you gain or lose per trade is expressed as: pip value × number of pips moved. And your pip value is set by your lot size.

What Is a Lot Size in Trading?

As I’ve said, lot size speaks to the amount of an asset you're buying or selling on a trade. It's a standardized unit, which means we can refer to it consistently across platforms and instruments.

Lot sizes are more than simply naming something conveniently. In financial markets, especially in retail FOREX and CFD trading, lot size is very important in understanding position size, pip value, and your overall risk exposure.

A quick refresher:

A standard lot equals 100,000 units of the base currency.

A mini lot is 10,000 units.

A micro lot is 1,000 units.

And a nano lot, offered by some brokers, is just 100 units.

These different sizes give you more control, especially when you want to manage smaller accounts or when you are trying to get a handle on your risk levels.

A larger lot means a larger pip value, which means a greater likelihood of profit or loss. That’s why you cannot separate lot size from risk management. Lot sizes are a crucial part of how much you're risking per trade, and it’s a good way of helping you keep consistent exposure across your strategy.

Types of lot sizes explained.

As a trader, I've worked with all types of lot sizes, so let’s dive deeper into them:

Standard lot: The basic lot size you need to know

In FOREX trading, the standard lot is the original lot size and the most widely recognized unit. Again, it represents 100,000 units of the base currency. So, any time you are calculating pip values, margin requirements, and potential profit or loss, the standard lot size is never far away.

Let’s say you're trading the EUR/USD. One standard lot means you're trading €100,000. On this size, each pip is typically worth $10, depending on the quote currency and your account base. So, a 50-pip move could gain or lose you $500. That’s why we always say that lot size comes with significant exposure.

Who uses standard lots the most? That would be experienced retail traders, institutional participants, or anyone trading a well-capitalized account. The key benefit is greater earning potential.

However, the flip side is clear: you need the capital and discipline to manage the risk. That’s why this lot size is best suited to traders with responsible risk management strategies.

Mini lot: Best for intermediate traders

A mini lot in FOREX trading accounts for 10,000 units of the base currency, or a tenth of a standard lot. That means instead of controlling €100,000 on a EUR/USD trade, you’re working with €10,000, a more manageable amount for retail traders who are still new to the game.

With a mini lot, each pip movement typically equals $1, compared to $10 on a standard lot. The lower exposure makes it a perfect fit for intermediate traders who want to scale up from micro lots without putting their account at serious risk. The good thing is that you still get meaningful gains, but the drawdowns (how much of your capital has been lost after a series of bad trades) aren’t as punishing if the market moves against you.

Micro lot: Useful for new traders

A micro lot represents 1,000 units of the base currency. You’ll realize that this is one-tenth of a mini lot and one-hundredth of a standard lot.

You’ll also realize that a single pip movement on a micro lot is typically worth just $0.10, making it an ideal starting point for new traders learning how to manage risk without the fear of large drawdowns.

Micro lots are especially appealing for those trading with small accounts or testing new strategies. They are great in that they give you granular control over position sizing, allowing you to experiment, tweak, and learn in real time while keeping your capital exposure low. You still experience live market conditions, but with far less financial pressure.

Many retail brokers today support micro lots as part of their flexible lot-sizing structures. Some even allow fractional micro lots, giving you the option to trade 0.03 or 0.07 lots depending on your comfort level. This flexibility is crucial for beginners, especially when paired with demo accounts or micro trading environments.

Nano lot: The smallest step into live trading

A nano lot is the smallest standardized trading unit in FOREX, representing just 100 units of the base currency. At this scale, a one-pip move is worth about $0.01, perfect for the newest of the new traders who want to experience real-market dynamics without risking more than a few cents per trade.

Nano lots are rare compared to micro and mini lots, for understandable reasons. Yes, a lot size this small is good for newbies to understand how spreads, leverage, and volatility affect trades. Still, some brokers believe it’s hardly worth the effort to create infrastructure that supports a learning curve that ultimately doesn’t generate any revenue.

Lot Sizes by Asset Class

Lot size defines your exposure, and your pip value tells you what that exposure means in real money. If you get this wrong, you could lose money by not trading correctly. But if you get it right, you’ve taken a major step toward risk-aware trading.

FOREX lot sizes

Remember, as your lot size increases, so does the pip value:

1 pip on a standard lot = $10

1 pip on a mini lot = $1

1 pip on a micro lot = $0.10

1 pip on a nano lot = $0.01

This scaling matters. It determines how much profit (or loss) you make for every movement in price. Larger lots amplify gains but also raise the stakes when markets move against you. FOREX is the original asset class in which many of the position sizes we know today were first trialled. That’s why you must choose the right lot size for your account balance, risk appetite, and strategy.

Commodity lot sizes

When it comes to trading commodities like gold, oil, and natural gas, lot sizes can vary quite a bit, and unlike FOREX, there’s no universal standard.

At this point, I will introduce you to the differences between fixed and variable lot sizes. This is essential if you want to trade these assets with confidence.

Let’s talk gold. Most brokers define a gold lot as 100 ounces. So if gold is trading at $2,000 an ounce, a single lot represents a $200,000 position, making leverage and margin requirements critical to watch.

However, if we look at another asset, such as crude oil, one lot typically equals 1,000 barrels, but some brokers allow trading in mini contracts of 100 barrels or even less.

Some commodities have fixed lot sizes based on contract specifications, while others may offer variable lot sizes that let you scale your exposure. This flexibility is great for managing risk, but it also makes margin calculations more challenging, especially when different assets have different tick values and leverage caps.

One important thing to understand about lot sizes is that they directly affect the margin you need to open a trade. Now, we know that commodities are often volatile, and that margins can swing fast. That’s why trading a larger lot size on a high-volatility commodity like oil increases not just your potential returns but also the risk of losing money quickly.

Index and stock CFDs

Trading any CFDs, including index and stocks, means you're not buying the actual asset, but instead you are speculating on price movements using CFDs.

One thing to know is that lot sizes in stock CFDs don’t always translate directly to share quantity, especially with indices.

For stock CFDs, many brokers offer a 1:1 contract-to-share ratio. That means buying one lot of a particular stock CFD is normally the same as owning one share of the underlying stock.

In this example, if you are trading Apple shares, then one CFD lot is equivalent to one Apple share.

But with indices, things change. For major indices like the S&P 500, NASDAQ, or DAX, brokers define lot sizes based on index points, not underlying share quantities. Here’s an example:

1 lot of the US30 (Dow Jones) might represent $1 per point

1 lot of the NAS100 (NASDAQ-100) might be $1 or $10 per point, depending on the broker

Some platforms allow fractional contracts (like 0.1 lots), letting traders scale their exposure. However, because index CFDs are highly leveraged, your lot size significantly affects the required margin and potential loss.

A simple thing to remember when trading CFDs is that lot size = contract exposure (although not necessarily the number of shares).

How Lot Size Affects Risk and Leverage

In my view, if you take nothing else from this article, just remember that lot size is the single most important factor in how much you risk on any given trade.

Lot size determines your:

pip value,

your exposure, and

how your account responds to both winning and losing positions

If you get this wrong, even a good strategy can fail. On the other hand, if you can get it right, then your trades have the best opportunity to make you good money.

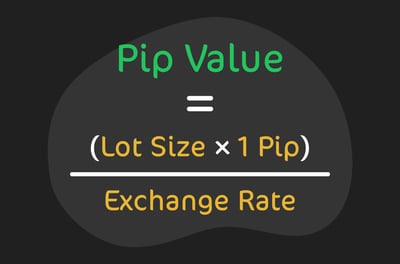

So, how do you calculate pip value? The formula is simple:

This example looks very much like some of the trading decisions I've had to make as a trader using lot sizes. Let’s look at a standard lot (100,000 units) on EUR/USD, one pip is typically worth $10. On a mini lot (10,000 units), it’s $1, and on a micro lot, it’s $0.10. The bigger the lot, the bigger the pip value, and the bigger your potential gain or loss per move.

This is why your lot size must match your account size. Trading standard lots on a $1,000 account with 100:1 leverage might look appetizing, but you could eviscerate your capital after just a few wrong trades. Smart traders risk only 1–2% of their capital per trade, adjusting lot sizes accordingly.

Now let’s talk about leverage and how it fits into this picture. With 50:1 leverage, a small lot lets you control a much larger position. That’s powerful, but also dangerous. A 50-pip loss on a leveraged standard lot could mean as much as a $500 hit, even if you only had a few hundred dollars in margin!

Let’s take an example and look at two traders:

Trader A has a $10,000 account and trades 0.5 lots (mini size), risking 2%. One bad trade under these conditions would lead to a manageable $100 loss.

Trader B trades two standard lots on a $500 account using high leverage. This could lead to as much as a 30-pip loss, which would be catastrophic.

Think of lot sizing as a risk dial. It’s essential to understand how to use it and its importance to your trading ambitions.

Choosing the Right Lot Size for Your Trading Style

In my experience, different trading styles call for different lot size strategies. Let’s discuss them.

Scalpers: Precision lot sizing for fast moves

Scalping is all about speed, tight stop-losses, and small but (hopefully) frequent wins. For scalpers, lot sizing needs to be calibrated carefully. Too big a lot size can leave you exposed to even a minor price fluctuation, blowing your trade. If you go too small, then sometimes the profits barely cover your spreads.

We know that scalpers will often work with stop-losses as tight as 5 to 10 pips, which means the lot size needs to be just right to keep risk within a safe range, typically 1% or less of your account balance per trade.

Many scalpers prefer mini or micro lots for better control, particularly when trading volatile pairs or during news events.

Imagine you were working with a $1,000 account and wanted to risk no more than $10 per trade with a 5-pip stop. That means each pip should be worth $2. So, a 0.2 lot (20,000 units) position would be your limit. The tighter the stop, the smaller your lot size needs to be to remain safe.

The key for scalpers is finding the correct lot size and adjusting in real time to match their stop-loss distance and the market's activity.

Another thing to remember is that scalping often involves multiple trades per session, so controlling lot size is vital to preserving capital.

Day traders: Balancing frequency and lot size

For day traders, the ideal balance lies between risk control and profit potential. Day traders hold positions for minutes to hours, not only seconds like scalpers, but also not days like swing traders..

The challenge that day traders face is similar to that of scaplers, although not as acute. It is simply the reality that trade frequency adds up, so even small losses can snowball if your lot sizes are too large. At the same time, going too small and your wins won’t justify the time and effort spent on technical analysis.

Because of this, day traders often trade mini lots (0.1) or micro lots (0.01 to 0.09), depending on account size and strategy. For example, if you have a $5,000 account and risk 1% per trade, that’s $50 risk per trade. If your stop-loss is 20 pips, your pip value should be $2.50, so a 0.25 lot is a sensible size.

Unlike scalping, day trading allows slightly wider stop-losses and larger targets.

Overall, the goal for day traders is consistency: moderate lot sizes, tight execution, and solid risk-reward ratios.

Swing traders: More room to breathe, but choose well

Swing traders hold positions for days or even weeks. That extended time frame gives them the flexibility to use wider stop-losses, which means they can trade larger lot sizes, but only if risk management is well managed.

Because swing traders are targeting moves of 50 to 200+ pips, their stop losses might also range from 30 to 100 pips. This wider margin reduces the chance of getting stopped out by short-term volatility, but it also means they need to carefully adjust their lot sizes to stay within safe risk levels.

Let’s say you’re working with a $10,000 account and are willing to risk 2% per trade ($200). If your stop-loss is 50 pips, your pip value needs to be $4. That’s a 0.4 lot, a sizable position that reflects both the space you are giving the trade and the trust you have in your setup.

Swing trading allows you to scale into positions, use multiple take-profit levels, and take advantage of overnight moves, but only if your lot size doesn’t expose you to unnecessary stress.

Holding trades longer also means dealing with swaps and rollovers, which become more significant as your lot size increases.

Long-term traders: Lot size still matters despite extra time

If you’re a long-term trader, positions can last weeks, months, or even longer. That extended time horizon can smooth out short-term volatility, but lot size still matters.

While daily noise may be less of a concern, long-term trades usually involve wider stop-losses, sometimes in the range of 100 to 300 pips or more. That means even a modest lot size can translate into a significant risk. If your lot is too large, a long-term pullback can tie up your capital or, worse, blow a hole in your account before the trend resumes.

That said, long-term traders often have the luxury of lower trade frequency, which allows for more conservative lot sizing and tighter capital management.

But they still need to calculate their exposure precisely. A slight misjudgment on a multi-week trade can become a significant loss simply due to compounding swap fees or a sudden geopolitical event.

Just because you are holding for the long term doesn't mean you are immune to short-term risk. Even one oversized trade can derail your portfolio if the market turns sharply against you.

That’s why long-term traders often use micro or mini lots to build layered positions while keeping drawdowns manageable.

Lot Sizes and How Common Trading Platforms Handle Them

Whether you're trading on MetaTrader 4 (MT4), MetaTrader 5 (MT5), or cTrader, understanding how your platform handles lot sizing is essential. Each platform may differ, but the mechanics of setting your lot size remain the same.

On platforms like MT4 and MT5, lot sizes are set directly in the order window before placing a trade. If you enter "1.00," you're trading one standard lot (100,000 units). "0.10" is a mini lot, and "0.01" is a micro lot. Most brokers offer flexible lot sizes down to a micro level, but some restrict the minimum to 0.10 or even 0.01, depending on your account type or the asset class.

cTrader, while offering similar functionality, often displays position sizes in units or currency value, especially on stock and index CFDs. Some brokers allow you to toggle between viewing size in lots or units, which is helpful for precise risk management. cTrader also features a built-in risk calculator, allowing you to set the lot size based on the dollar amount you want to risk.

Keep in mind that lot-sizing rules can vary by broker. Some may:

Set minimum trade sizes per asset (e.g., 0.10 lots for gold or oil)

Restrict lot size increments (e.g., in steps of 0.01 or 0.10)

Offer fractional lot sizing for greater flexibility

In my opinion, before you place a trade, always double-check the lot-size field, understand your margin requirements, and use tools like position size calculators to align your lot with your trading strategy. Platforms don’t stop you from overexposing your account, but they do give you all the tools to prevent it. It's up to you to use them wisely.

Most Common Questions about Lot Sizes

What is the best lot size for beginners?If you’re just starting out, micro lots (0.01) are usually the safest choice. They allow you to trade with minimal capital at minimal risk, with each pip move worth around $0.10. This gives you room to learn how the market behaves, test strategies, and make mistakes without blowing up your account.

Once you’re more confident, you can gradually increase your lot size in line with your risk tolerance and account balance.

Can I change my lot size mid-trade?No, you can’t change the lot size of an open position. Once a trade is executed, the lot size is locked in. If you want to adjust your exposure, you’ll need to open a new trade, partially close your existing position, or use hedging strategies if your broker allows it.

That’s why it’s critical to plan your lot size before entering the trade, especially if your stop-loss and take-profit levels are tightly managed.

What is the minimum lot size I can trade?The minimum lot size depends on who your broker is and the asset you’re trading. Most brokers allow micro lots (0.01) as a minimum on major FOREX pairs. Some beginner-friendly brokers even offer nano lots (0.001 or 100 units), which are ideal for learning with minimal capital.

Always check your broker’s rules, as commodities, indices, and stocks may have different minimums.

Are lot sizes the same across all brokers?Not always. While FOREX lot sizes are mostly standardized (e.g., standard, mini, micro), how they're implemented can vary by broker and platform. Some brokers may only offer certain lot sizes on specific account types, or they may round trade sizes based on instrument liquidity.

CFD contracts on stocks or indices, in particular, can differ in contract size from broker to broker. Always review your broker’s lot size rules before placing trades.

Final Thoughts

From what I've seen as a trader, lot size is one of the most important decisions you’ll make when entering the market. It determines your pip value, your risk exposure, and, ultimately, your profit or loss. If you get it right, you can often give your strategy the breathing room it needs to succeed. Get it wrong, and even the best trade idea can spiral out of control.

Choosing the correct lot size is your risk dial, your sizing tool, and your safety net. And it needs to reflect your account size, trading style, and market conditions. As with many things in retail trading, practice makes perfect. So, do your research up front, then practice your strategies repeatedly until you start making regularly profitable trades.

FAQ

A lot size is the standardized number of units of the base currency in a trade. It determines the pip value, which directly affects how much you gain or lose per price movement. Standard lots are 100,000 units, mini lots are 10,000, micro lots are 1,000, and nano lots are 100.

Larger lot sizes increase your pip value, meaning each price movement has a greater impact on your profit or loss. Choosing an oversized lot can cause rapid capital loss, while too small a too-small lot may make trading returns negligible.

Micro lots (0.01, or 1,000 units) are generally the safest starting point. They keep risk and pip values low while still allowing traders to experience live market conditions.

No. Once a trade is placed, its lot size is fixed. To adjust exposure, you need to open a new position, partially close an existing one, or hedge if your broker allows it.

No. While FOREX lots are standardized, commodities, indices, and stock CFDs have different definitions. For example, gold often trades in 100-ounce lots, and oil in 1,000-barrel lots.

Match lot size to your account balance, risk tolerance, and stop-loss distance. Scalpers usually use smaller lots, swing traders may go larger, and long-term traders often scale in conservatively.

Leverage lets you control larger positions with less capital, but it magnifies the effects of your lot size. A small price move in a large, leveraged lot can cause significant losses.

This depends on your broker and asset type. Many brokers allow micro lots (0.01) on major FOREX pairs, and some offer nano lots (0.001) for minimal risk exposure.