Pepperstone Review for 2026

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

Pepperstone Evaluate - research result

Key Takeaways

Pepperstone was founded in Australia in 2010.

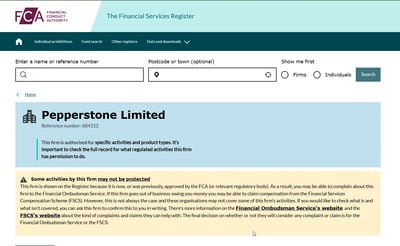

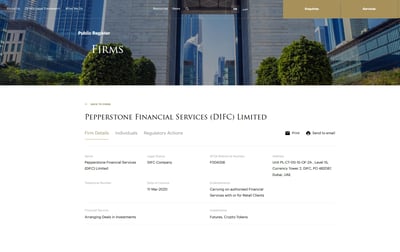

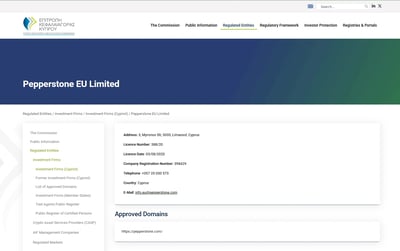

The broker is regulated in Australia by the Australian Securities and Investments Commission (ASIC), in the UK by the Financial Conduct Authority (FCA), and in the European Economic Area (EEA) by the Cyprus Securities and Exchange Commission (CySEC), as well as the by the European Securities and Markets Authority (ESMA). At the same time, it is regulated in Germany by the Federal Financial Supervisory Authority (BaFin), in Dubai by the Dubai Financial Services Authority (DFSA), and finally in Kenya by the Capital Markets Authority of Kenya (CMA).

EEA traders are protected by the Investor Compensation Fund (ICF), with a maximum coverage of €20,000.

UK traders are protected by the Financial Services Compensation Scheme (FSCS) up to £85,000.

Pepperstone offers two account types that are suitable for both retail and professional traders.

Pepperstone offers market access covering four asset classes and 1,350 Contract for Difference (CFD) instruments.

Pepperstone customers can trade in CFDs or purchase the underlying asset in classes such as FOREX, indices, cryptocurrencies, and commodities.

Pepperstone offers mostly competitive spreads and commissions across its account types.

Pepperstone customers can access high-quality research and education materials.

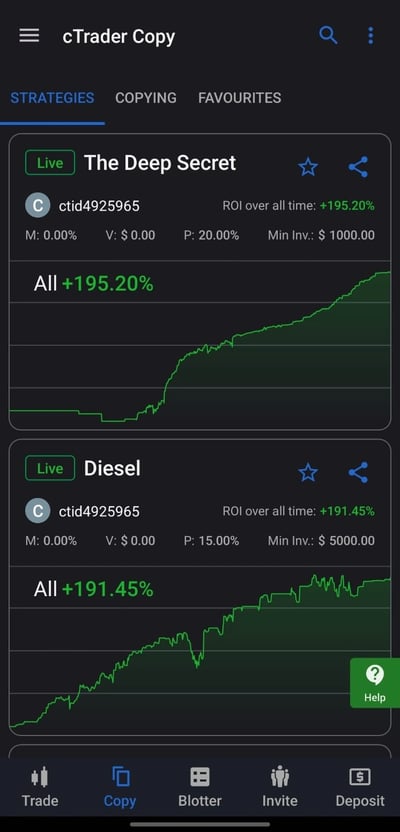

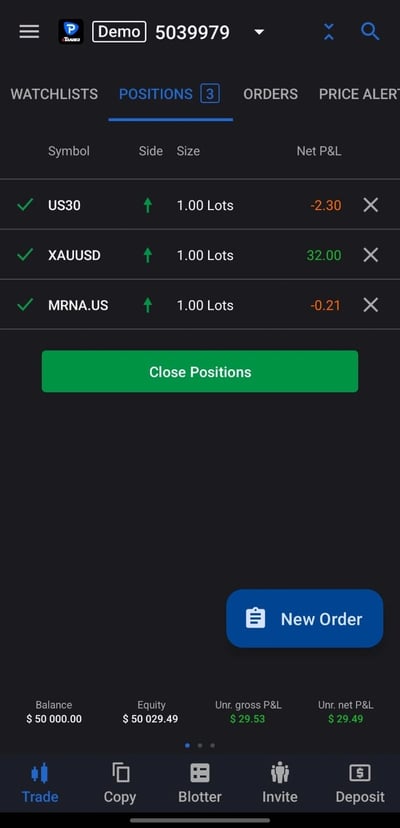

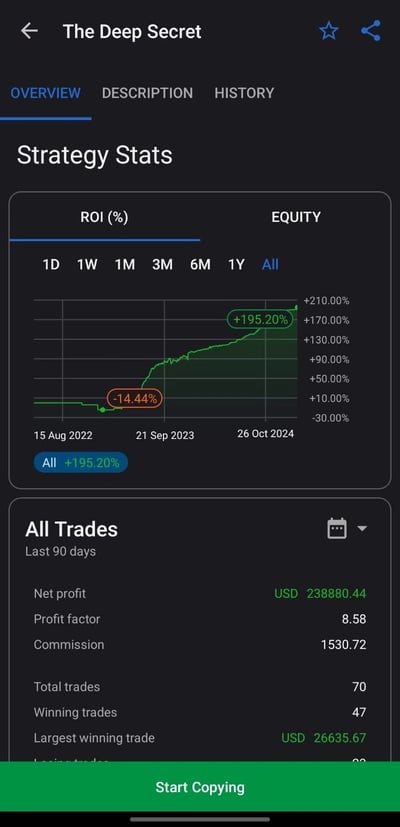

Traders can follow and copy the trades of designated top investors on the social trading-enabled platforms.

The Pepperstone Group is independently audited by global top-four audit firm Ernst and Young.

Accounts can be funded in multiple base currencies.

The company has taken professional indemnity insurance through Lloyd's of London.

Last Reviews

Overall Summary

I recently researched the Australian broker Pepperstone so I could share some thoughts on what kind of broker it is. The company was founded in 2010 and has established itself in a short space of time as a quality online broker with much to like about its service offerings. Headquartered in Australia, the company benefits from strong regulation in key markets and allies this strength with its competitive fees and robust market access to create an attractive proposition.

With additional offices in London, Düsseldorf, Dubai, Limassol, Nassau, and Nairobi, Pepperstone serves a diverse global clientele. The broker processes an average monthly trading volume of US$250 billion and is trusted by over 600,000 traders worldwide.

Pepperstone's commitment to excellence has been acknowledged through multiple awards, highlighting its exceptional customer service and trading conditions. The company's dedication to providing a secure and efficient trading environment makes it an attractive choice for traders globally.

It uses a selection of quality third-party trading platforms, like MetaTrader4 (MT4), MetaTrader5 (MT5), cTrader, and Pepperstone’s proprietary app, catering to different trading preferences. Pepperstone offers access to over 1,350 tradable CFD instruments across various asset classes, with access to FOREX, shares, indices, metals, commodities, and cryptocurrencies.

I was interested to discover that the broker has two accessible account types, which it recommends traders capitalize with an opening deposit of 200 units per base currency, although this deposit is not mandatory. The broker offers leverage as high as 1000:1 for professionals, although traders are warned to use this wisely.

Its offering is rounded off by strong trading platforms, good educational resources, and low fees on its well-planned account types. It confirms our finding that this growing broker has no significant weaknesses.

Pepperstone is widely considered a safe and reliable broker, operating under the oversight of top regulators including ASIC, FCA, BaFin, CySEC, DFSA, CMA, and SCB. The company safeguards client funds through full segregation and FSCS coverage up to £85,000 for UK clients. It applies responsible leverage practices based on regulatory jurisdiction, offering 30:1 leverage to retail clients in the UK, EU, Australia, and Dubai, while allowing up to 1000:1 for professional clients elsewhere—though negative balance protection is only guaranteed in certain regions.

Is Pepperstone Safe?

In my view, Pepperstone has implemented enough safeguards for it to be considered relatively safe. The company operates under stringent regulations from multiple respected financial authorities, including ASIC, the UK's FCA, Germany's BaFin, Cyprus's CySEC, Dubai's DFSA, Kenya's CMA, and the Securities Commission of The Bahamas (SCB).

The company has taken the extra step of arranging for professional indemnity insurance through Lloyd's of London. In another show of operating good faith, the Pepperstone Group is independently audited by global top-four audit firm Ernst & Young.

Under ESMA rules, EEA clients, including those in the UK, are entitled to negative balance protection. Trading platforms should be set to deploy automatic stop-out systems in order to eradicate the chances of traders finding themselves with negative balances. Non-UK, EEA, and Australia clients do not receive negative balance protection from this broker. These clients have every reason to feel vulnerable.

I believe that the broker offers excellent website and platform functionality. It operates two-factor authentication (2FA) with access to mobile accounts. Overall, the broker has installed several safeguards that should put traders’ minds at ease.

How Pepperstone Protects You from Reckless Leverage and Margin Trading

Leverage and margin can be powerful tools for traders, but if not used right, they can result in hefty losses. Some unreliable brokers offer simply too much leverage, which can be dangerous for new traders.

How you are protected

Pepperstone is one of those brokers that manages leverage carefully to protect you from too much exposure. The broker adjusts leverage limits based on your location, aligning with local regulatory guidelines to promote responsible trading.

In the European Union and the UK, retail clients face leverage caps set by ESMA and the FCA. Leverage is limited to 30:1 for major currency pairs; 20:1 for non-major currency pairs, gold, and major indices; 10:1 for other commodities and non-major equity indices; and 5:1 for individual stocks.

Pepperstone basically breaks down its leverage as follows - retail client in areas like Australia get as much as 200:1. In contrast, professional traders leverage up to 1000:1. Traders should know that they can lose money quickly at these extreme levels of leverage. They are cautioned to trade carefully, especially as this broker does not offer negative balance protection to traders outside the UK, EEA, and Australia.

The broker encourages clients to manage their risk by carefully choosing the best position size for their situation. The company helpfully and responsibly asks traders to not risk over 1-5% of their capital on any single transaction.

Regulation and other security measures

Pepperstone is committed to the safety of client funds and adheres to the following practices:

Segregation of funds: All client funds deposited with Pepperstone are fully segregated from the company’s own funds and are kept in separate bank accounts. This ensures that client funds cannot be used for any other purpose.

Investor protection: Pepperstone UK Limited is a member of the FSCS, which insures customer deposits up to £85,000 per client.

Regarding margin requirements, Pepperstone actively monitors and adjusts them to reflect market volatility. Pepperstone adheres to broker best practices by ensuring that, among other things, customer investments are segregated from company cash. It has a well-regarded 24/5 customer support desk. The broker caters to trading novices, experienced investors, and industry professionals alike. In its own words, it wants to “provide institutional grade trading to the online FOREX trader.”

Top broker features

True NDD execution broker: Pepperstone operates as a true No Dealing Desk (NDD) broker, meaning client orders are executed without any dealing desk intervention. This approach enhances transparency and reduces potential conflicts of interest—especially important to experienced and high-frequency traders.

Strong regulation and safety: Pepperstone is regulated by multiple top-tier authorities, including ASIC, FCA, CySEC, BaFin, DFSA, CMA, and SCB.

Fast and transparent execution: Pepperstone is known for its lightning-fast execution speeds, with an average execution time of around 30 milliseconds.

Diverse instruments: Traders have access to over 1,350 instruments, including FOREX, indices, commodities, shares, ETFs, and cryptocurrencies.

Low-cost trading: Pepperstone offers tight spreads starting from 1.0 pip and no commissions.

Comprehensive education and support: Pepperstone provides rich educational content, including webinars, how-to guides, trading strategies, and regularly updated market analysis to help traders improve their knowledge and skills.

For Whom Is Pepperstone Recommended?

Pepperstone provides wide access to markets, allowing traders to concentrate on achieving financial success through several asset classes. This makes, in my opinion, Pepperstone a good fit for traders of all types.

That said, while its market access is solid, it is weighted toward FOREX. The balance of its tradable assets can be called acceptable but unspectacular.

Still, this mid-range market access is complemented by other aspects that could be attractive to traders. Entry-level traders are won over by the competitive fees and low spreads, and sophisticated, high-volume traders are interested in the broker’s advanced trading interfaces.

The two main account types cater to many trading levels, leading to the broker being rewarded by several prize juries for its ease of doing business. Here are the pros and cons of using this broker:

-

NDD execution model speeds up trades

-

Competitive spreads with no commission

-

Real-time news feeds

-

Above-average breadth of product offering

-

Transparent pricing

-

Globally regulated by top-tier regulators

-

Commission-free trading available

-

Wide range of trading platforms available

-

Does not offer guaranteed stop-loss orders

-

CFDs on shares as opposed to direct ownership

-

Narrow global coverage

Offering of Investments

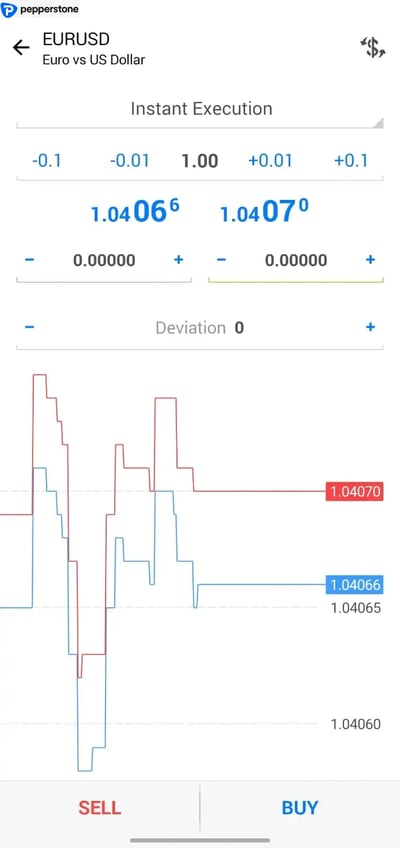

Pepperstone puts significant focus on its FOREX offering, giving traders access to over 90 currency pairs with deep liquidity and competitive spreads. UK clients also benefit from spread betting across major financial markets, which is popular due to its tax-free profits and low commissions—though this is only available within the UK. Beyond FOREX, traders can diversify across share CFDs, indices, commodities, cryptocurrencies, and currency indices.

I was pleased to find that the company puts a lot of effort into its FOREX trading product. This is evidenced by a handsome number of currency pairs. UK clients have access to spread betting across key financial markets. This is typically an appealing proposition for UK traders as it offers tax-free profits with low commissions. It is, however, not applicable in any other market besides the UK. Here are the asset classes that allow traders to run a diversified cross-asset portfolio:

FOREX

Pepperstone gives traders access to over 90 FOREX pairs, including majors, minors, crosses, and exotics—all backed by deep liquidity and tight spreads. You can trade these alongside more than 1,350 CFDs across various asset classes. Whether you're scalping EUR/USD or exploring exotic pairs, the trading environment is built for speed, transparency, and flexibility.

Shares

Pepperstone offers leveraged trading on share CFDs from Australia, the US, the UK, and Germany. With low commissions, deep liquidity, and razor-sharp pricing, you get the tools to trade major global companies with confidence and flexibility.

Currency indices

Unlike traditional currency pairs, currency indices track the value of a single currency against a basket of others. For example, the US Dollar Index reflects how the dollar is performing relative to major currencies like the euro, yen, and pound. These instruments can give FOREX traders unique insights and help spot opportunities that standard pairs might miss.

Cryptocurrencies

Trade crypto CFDs like Bitcoin, Ethereum, Litecoin, Ripple, and more, all without the need for a digital wallet. With leverage up to 1:2 and weekend trading available, you can ride the volatility whenever opportunity strikes. Enjoy fast execution, no dealing desk, and a 99.62% fill rate across all platforms.

Indices

Index CFDs let you trade price movements on global stock markets like the US500, UK100, and JPN225—without needing to own the underlying assets. Whether the market goes up or down, you can speculate in either direction and use leverage to open larger positions with less upfront capital. It’s a flexible way to trade major market sentiment across continents.

Commodities

Trade gold, silver, oil, and natural gas without the hassle of physical delivery, ownership, or rollovers. Pepperstone’s commodity offering spans metals, energy, and other key markets, with spreads from as low as 0.1 points on gold and no commissions. With a 99.62% fill rate and ultra-low latency execution, this setup suits both short-term speculators and long-term position traders.

Available assets

| Markets | Available | Number of Assets |

| Currency Pairs | 92 | |

| Stocks | 1000 | |

| Commodities | 40 | |

| Crypto | 30 | |

| Indices | 23 | |

| ETFs | 108 |

Account Types

Pepperstone keeps things straightforward by offering two main account types: the Standard account for beginners with zero commissions and the Razor account for experienced traders seeking ultra-low spreads and fast execution, though it includes a commission. All accounts feature no minimum deposit, access to up to 200:1 leverage, for retail traders and allow for strategies like scalping, hedging, and the use of expert advisors.

Pepperstone has kept its accounts simple and offers traders the choice between one of two account types. Both Pepperstone trading accounts come equipped with a consistent set of features designed to support traders of all styles and experience levels.

I found that I could open an account with no minimum deposit and start trading from as little as 0.01 lots, with a maximum position size of 100 lots. Leverage is available up to 200:1 for retail traders and 1000:1 for pros, giving clients the flexibility to manage their capital more efficiently.

Pepperstone supports multiple base currencies, including AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, and HKD. All account types allow scalping, hedging, news trading, and the use of expert advisors, ensuring traders can apply their preferred strategies without restriction. With no dealing desk intervention, execution remains fast and transparent across all platforms.

Its technology-driven account types are split as follows:

Standard account: The broker recommends this account for new traders. This zero-commission account claims to have institutional-grade Straight Through Processing (STP). Spreads on this account are low, but still high enough to counteract the lack of commissions.

Razor Account: The broker notes this account is an excellent choice for scalpers and algorithmic traders. Spreads are consistently thin and start from as low as zero pips. Commission is chargeable on this account.

The accounts are well-structured and offer an obvious point of difference for entry-level traders and elite traders. In the hyper-competitive world of bonuses, promotions, and perks, we found that this broker’s account offerings suffered from a lack of enticing add-ons to catch the eye of high-rolling mega traders.

The broker uses its growing footprint to secure competitive interbank pricing and deep liquidity from high-quality providers. Scalping and hedging are allowed.

Pepperstone offers an unlimited demo trading account available to all prospective clients. The account comes preloaded with up to £50,000 in virtual funds and allows traders to practice strategies in real market conditions without risking real capital. Demo accounts are available on all major platforms offered by Pepperstone, including MT4, MT5, and cTrader, giving users the flexibility to choose the platform that suits them best.

I can confirm that the broker offers Islamic accounts, also known as swap-free accounts, for clients who are unable to receive or pay interest due to religious beliefs. These accounts are available on both MT4 and MT5 platforms and are structured to avoid overnight swap or rollover charges on positions held open for more than 24 hours.

To open an Islamic account, traders must first open a standard account and then request the swap-free status through Pepperstone’s customer support. Once approved, the account operates without interest-based fees, although an administration fee may apply, depending on the instrument and duration the trade is held.

| Account Type | Minimum Deposit | Spread Commission | Commission | Swap Commission | Deposit Commission | Withdrawal Commission |

|---|---|---|---|---|---|---|

| Standard account | $0 | Starting from 1.0 pip | $0 | No | $0 | $0 |

| Razor account | $0 | Starting from 0 pip | Starting from 3$ | Yes | $0 | $0 |

Account opening

This is a simple process. All I needed to do was enter my email address into the website and select a password to begin. The application process is fast and secure. As is normal, traders will need to confirm their identity and address details via the appropriate documentation. Once approved, you can fund your account using the broker’s affordable funding methods and start trading.

What is the minimum deposit at Pepperstone?

Pepperstone does not require a minimum deposit to open a live trading account. However, it recommends starting with at least AUD $200 (or equivalent) to ensure sufficient margin for trading. This amount is a guideline rather than a fixed requirement, giving traders flexibility depending on their risk tolerance and trading strategy.

How to open your account

Traders can see financial regulation in practice as the questions they answer are Know Your Customer (KYC) questions mandated by regulators. As is normal for a financial institution, Pepperstone will require photographic identification and proof of residence from applicants. You will also need access to a camera (phone, tablet, computer) for your digital authentication

Deposits and Withdrawals

Pepperstone supports deposits and withdrawals in 10 base currencies, including AUD, USD, GBP, EUR, and JPY, allowing clients to avoid conversion fees when using a matching bank account. Funding methods include bank transfers, credit/debit cards, and popular e-wallets like PayPal, Skrill, and Neteller, with most transactions processed instantly or within a few business days. The broker does not charge internal fees for deposits or withdrawals, though third-party providers may apply their own charges.

During my testing, I found that Pepperstone clients can deposit funds in one of 10 base currencies drawn from the AUD, the USD, the GBP, the JPY, the EUR, the CAD, the NZD, the CHF, the SGD and the HKD. Withdrawals are carried out from the secure client area. If the withdrawal request is actioned by 9 p.m. GMT, it can be processed on the same day. Accepted deposit methods are:

Bank wire transfer.

Credit/Debit cards.

Skrill.

Neteller.

The company keeps its fees competitive by not charging withdrawal or deposit fees, although third-party carriers can charge their own fees, as is normal. There is no conversion fee for clients who fund their trading accounts in the same currency as their bank account. Bank transfers can take several business days, while payment with a credit/debit card is instant. Traders can only deposit funds from accounts in their name.

Account base currencies

Pepperstone allows clients to open trading accounts in multiple base currencies, helping reduce conversion costs when depositing or withdrawing funds. Available base currencies include AUD, USD, GBP, EUR, JPY, CAD, NZD, CHF, SGD, and HKD. Choosing a base currency that matches your bank account can help you avoid unnecessary currency conversion fees.

Pepperstone deposit fees and options

I can confirm that Pepperstone supports a wide range of funding methods and, to my pleasant surprise, does not charge internal deposit fees, although third-party fees may apply depending on your payment provider. Deposits can be made via:

Bank wire transfers: Ideal for large amounts; processing times range from 1 to 3 business days.

Credit/debit cards: Visa and Mastercard are accepted. I found deposits to be typically processed instantly.

E-wallets: Accepted options include PayPal, Skrill, Neteller, Apple Pay, and Google Pay (depending on your region), offering near-instant processing.

Clients must fund their trading accounts from payment sources in their own name, in line with anti-money-laundering policies. There’s no conversion fee when funding in the same currency as your account’s base currency.

Pepperstone withdrawal fees and options

During my research, I found that withdrawals are initiated through the secure client area and are usually processed on the same business day if requested before the local cut-off time. Pepperstone does not charge internal withdrawal fees, but as with deposits, third-party fees may apply. Available withdrawal methods include:

Bank wire transfers: Typically take 1–3 business days, depending on your bank and location.

Credit/debit cards: Withdrawals may take 3–5 business days to reflect, depending on your card issuer.

E-wallets: Withdrawals to PayPal, Neteller, and Skrill are typically processed within one business day, making them among the fastest options.

| Method | Credit Card | Wire Transfer | Skrill | Neteller | Cryptocurrency | PayPal | Apple Pay3 |

| Deposit fee | $0 | $0 + Bank commission | $0 | $0 | $0 | $0 | $0 |

| Withdrawal fee | $0 | $12 | $0 | $0 | $0 | $0 | $0 |

Customer Support

Pepperstone’s multilingual support team is available 24/5 through various channels, including live chat, email, callbacks, phone calls, with toll-free options for multiple countries. Additionally, FxPro provides a robust FAQ section and easy access to live support within its mobile app.

The broker offers high-quality 24/5 customer support over a chat service or via phone. Traders can also access the company’s helpful social media accounts, like Twitter, which act as information alert systems. Moreover, traders get account managers to help them make the most of their trading experience.

Australian clients who feel the need to do so can visit an office in Melbourne. All other clients can get equally helpful responses over virtual channels, such as phone, email, and chat. The broker’s Frequently Asked Questions (FAQ) section comes in handy in case there is congestion over the other channels.

| Live Chat | Phone | |||

| Available | Available | Available | Available | Available |

| Quick response | Fast | Fast | Moderate | Fast |

Commissions and Fees

Pepperstone offers both commission-free and commission-based accounts, with the Razor account providing raw spreads from 0.0 pips and low commissions. The broker’s spreads are competitive across asset classes, FOREX spreads start from 1 pip, stock CFDs from $0.02 per share, and commodities and indices from 0.2 pips. Swap fees apply to positions held overnight, but Pepperstone also provides Islamic (swap-free) accounts for traders who require interest-free trading.

Below is an overview of the fees and commissions associated with various asset classes:

Spreads

I discovered that Pepperstone's spread costs vary depending on the account type and trading platform chosen. FOREX spreads start from 1 pip, while stock spreads start from 0.02 USD per share. Commodities and indices start from 0.2 pips.

Pepperstone aims to offer highly competitive conditions so that traders can focus on what really matters. To do so, it uses multiple liquidity providers from Tier 1 Banks and institutions to give you access to competitive quotes and deep liquidity on a wide range of financial instruments, including FOREX, commodities, and Indices.

This allows the broker to offer razor sharp pricing, low commissions on FOREX, and low-latency fast execution to all clients.

Commissions

Pepperstone is a no-commission broker on its standard account. Its Razor account attracts commission.

Swap fees and Islamic accounts

The broker applies overnight financing charges, commonly known as swap fees, to positions held open beyond the trading day. The specific swap rates can vary depending on the instrument and market conditions.

Pepperstone offers Islamic, or swap-free, accounts tailored for traders who adhere to Sharia law, which prohibits earning or paying interest. To open an Islamic account, traders must contact Pepperstone's customer support to request this service.

Inactivity fee

The broker does not charge an inactivity fee. Traders can leave their accounts dormant without incurring any penalties or maintenance costs. However, it's always a good idea to check periodically in case policy changes occur, especially under different regulatory jurisdictions. Accounts with balances below 10 units of account currency (e.g., $10 USD) that haven't been used for trading in over 90 days will be archived.

| Spread | Commission | Swap | Islamic Account | |

| Currencies | Starting from 1.0 Pips | $0 | Yes | Available |

| Stocks | 0.02 USD per share | $0 | Yes | Available |

| Commodities | Starting from 0.20 Pips | $0 | Yes | Available |

| Indices | Starting from 0.20 Pips | $0 | Yes | Available |

Platforms and Tools

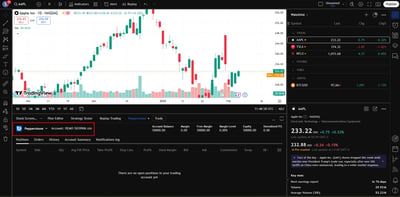

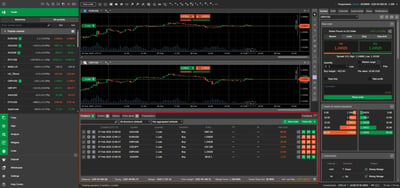

Pepperstone has significantly expanded its platform offering, launching its own proprietary trading platform to complement its existing support for industry standards like MT4, MT5, and cTrader—each available on desktop, web, and mobile. The new Pepperstone Trading App gives users access to over 1,350 CFD instruments, including more than 1,000 share CFDs, and includes features like real-time market data, multiple charting tools, customizable watchlists, and risk management functionality. MT4 and MT5 remain staples, offering advanced charting, Smart Trader Tools, Autochartist integration, and support for Expert Advisors (EA), with MT5 adding faster processing, hedging, and an integrated economic calendar.

I learned that the broker has provided a range of tools to enhance the trading experience. It previously did not have its own proprietary platform, but it has recently launched one of its own. Clients are also well served by tried and tested industry favorites, such as MT4, MT5 and cTrader on desktop, web and mobile.

Platforms types

Pepperstone Trading App

Pepperstone’s proprietary trading platform is built to streamline your trading experience and help you seize opportunities across global markets. Trade CFDs on FOREX, commodities, indices, and cryptocurrencies with razor-sharp spreads, deep liquidity, and fast, reliable execution—all backed by award-winning support.

The platform gives you access to over 1,350 CFD instruments, including more than 1,000 share CFDs, and lets you monitor, manage, and execute trades using live streaming prices. With features like Quick Switch between charts, multiple charting tools, technical analysis indicatorss, and real-time updates on spreads, margins, and market hours, the platform delivers a powerful and flexible trading environment. Traders can create and follow customized or public watchlists, easily search instruments, and use risk management tools for smarter decision-making.

MT4

Most traders will know this instantly recognizable platform. The bespoke Pepperstone version is customizable, and traders can get access to EAs. With the combined knowledge of third-party Autochartist and EAs, traders can use powerful indicators to identify trades with a high chance of success. They can also backtest their strategies.

The system offers a user-friendly interface, where traders can improve their performance with the help of 85 pre-installed indicators. Traders can spot market trends and make information-rich decisions according to strategies that are based on movements spotted by pattern recognition tool Autochartist. There are also 28 additional Smart Trader Tools to complement the charting tools.

MT5

Traders can go short or long, implement and run code, and get the benefit of faster processing and custom indicators with MT5. As with MT4, traders on MT5 can use the advice of EAs and the many indicators from Smart Trader Tools and Autochartist. Traders who are used to cutting-edge functionality and market-leading analysis tools will get the most benefit from MT5. With rapid processing speeds, hedging of positions, and a built-in economic calendar, traders can maximize their chances of success.

cTrader

This platform boasts a sleek design that replicates an institutional trading environment. It is an easy-to-use platform with advanced customization tools and superior order capabilities. Traders can manage slippage and order fills with intuitive and responsive features. Advanced traders can use tools such as rapid entry and execution.

There is a comprehensive set of analysis and educational resources to help traders make better decisions. Clients using this platform will also get access to EAs and indicators. The platform is perfect for both new and advanced traders. It has a detailed trade analysis feature designed to study your strengths and weaknesses. The extensive range of indicators will help traders make faster and more informed decisions.

Social Trading Partners

Pepperstone has expanded its social trading offerings to provide clients with a variety of platforms for copy trading. Notably, the broker integrates with MetaTrader Signals and DupliTrade, allowing traders to replicate the strategies of seasoned professionals directly within their accounts.

Additionally, Pepperstone supports Myfxbook AutoTrade, enabling users to mirror trades from a curated selection of systems. These platforms are designed to seamlessly integrate with Pepperstone's trading environment, ensuring a cohesive experience. It's important to note that access to certain services, such as DupliTrade, may require a minimum deposit of AUD$5,000. Clients are encouraged to review the specific terms and conditions associated with each social trading platform to determine the best fit for their trading objectives.

Look and feel

Pepperstone’s trading platforms—including MT4, MT5, cTrader, TradingView, and its proprietary web platform—are designed with a clean, intuitive interface that keeps functionality front and center. Whether you're customizing charts on TradingView or using the fast layout of cTrader, the platforms strike a balance among speed, simplicity, and depth. Visual clarity and responsive performance make navigating the trading environment feel seamless, whether you're on desktop or mobile.

Login and security

Logging into any of Pepperstone’s platforms is both quick and secure. The broker uses encrypted connections across all platforms and supports two-factor authentication (2FA) for an added layer of protection. On mobile, biometric logins like fingerprint or facial recognition are available, offering a fast but secure way to access your account without compromising safety.

Search functions

Finding the instrument you want to trade is hassle-free. All Pepperstone platforms include efficient search bars that let you filter by asset class or symbol. Whether you're looking for a FOREX pair, a specific stock CFD, or a niche commodity, the system responds quickly and accurately, helping you get into position with minimal delay.

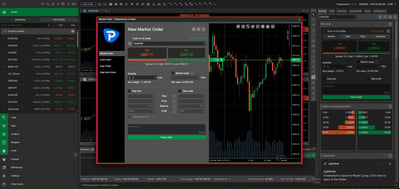

Placing orders

Order execution is fast and flexible, with one-click trading available across all major platforms. Whether you’re placing market, limit, stop, or trailing stop orders, execution is clean and without dealing desk interference. Razor account users, in particular, benefit from low-latency order processing ideal for scalping or high-frequency trading.

Alerts and notifications

Pepperstone makes it easy to stay informed. You can set custom price alerts directly on your charts and receive notifications via email, mobile, or desktop. On cTrader and TradingView, alerts can even be tied to technical conditions, giving traders real-time updates when key market levels are hit or when specific indicators trigger.

Mobile Trading

In my opinion, Pepperstone’s mobile trading offering is robust, giving traders the flexibility to manage their accounts and trade global markets from anywhere. Clients can access the broker’s suite of platforms—MT 4, MT5, cTrader, TradingView, and Pepperstone’s proprietary app—via Android and iOS. Whether you’re tracking FOREX, commodities, indices, or crypto, the mobile apps offer the same speed and efficiency found on desktop, with reliable order execution, real-time data, and full trading functionality.

Platforms

Pepperstone supports mobile trading across the industry’s most trusted platforms. MT4 and MT5 remain the go-to options for many traders, while cTrader provides a sleek and advanced alternative. TradingView integration offers charting and social sharing features for those who want more interaction, and Pepperstone’s proprietary mobile app brings everything together in a unified trading experience tailored specifically for mobile use.

Look and feel

I found that across all platforms, the mobile experience is polished, responsive, and intuitive. The design emphasizes usability without sacrificing power—traders can access charting tools, order types, and watchlists without clutter or lag. Navigation is clean and simple, even when switching among markets or tools, and customization options allow traders to tailor their layout to suit their strategy.

Login and security

Pepperstone prioritizes account security with secure login protocols and encrypted data transmission across all mobile platforms. Traders can activate 2FA for an added layer of protection, and biometric login—such as fingerprint or face ID—is supported on devices that allow it, making it both secure and user-friendly.

Search functions

The mobile apps feature streamlined search tools that allow traders to quickly locate instruments by name, symbol, or asset class. Filters help narrow the choices, and real-time quotes make it easy to take action immediately. The search function is designed to support fast decision-making, even in volatile market conditions.

Placing orders

Order placement is simple and flexible on mobile. Traders can enter market, limit, stop, or trailing stop orders with a few taps. One-click trading is available on supported platforms like cTrader, enabling rapid execution—a must for scalpers and active traders who need low-latency performance on the go.

Alerts and notifications

Pepperstone’s mobile platforms allow traders to set custom price alerts and receive notifications when key market levels are reached. On cTrader and TradingView, alerts can be tied to technical indicators or chart conditions. Notifications come via push, email, or in-app pop-ups, keeping traders informed of market changes in real time—even when they’re away from their screens.

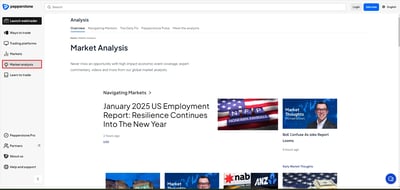

Research and Development

From my perspective, Pepperstone offers a well-rounded suite of research tools and market insights that meet—and often exceed—industry standards. Its “Market Analysis” section provides real-time commentary on key economic events, market-moving news, and macro trends, helping traders stay informed across asset classes.

The popular “Daily Fix” report offers concise, expert commentary on market themes, while the integrated “Economic Calendar” helps traders plan ahead for major data releases and central bank events. Pepperstone also delivers regular technical and fundamental analysis via its team of in-house analysts, many of whom bring institutional-level experience to their commentary. The broker’s social media channels, especially its active Twitter feed, provide accessible updates and short-form insights ideal for traders on the move.

Trading statistics

I believe that Pepperstone’s platforms offer detailed trading statistics and performance metrics that give traders insight into their own trading behavior. Through platforms like cTrader and MetaTrader, users can track execution speed, slippage, win/loss ratios, and strategy performance over time. These data-driven tools support deeper self-assessment and allow traders to refine their approach with real-time and historical metrics.

Trading signals

Pepperstone has partnered with third-party providers such as Autochartist and MetaTrader Signals to deliver high-quality trading signals, which is not unlike Arincen’s own signals platform. Autochartist integrates directly into MT4 and MT5, scanning markets for price patterns, key levels, and breakout opportunities. Meanwhile, MetaTrader Signals allows traders to copy the strategies of successful traders directly within the platform. Together, these tools offer a powerful blend of automated and community-driven analysis to help traders identify high-probability trade setups.

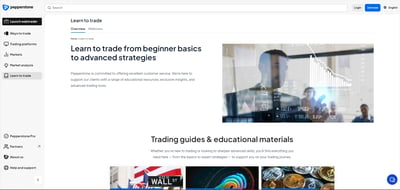

Education

I liked that Pepperstone’s website features a well-organized and comprehensive education hub aimed at helping traders of all experience levels build their skills. Key sections include “Learn to Trade FOREX,” “Learn to Trade CFDs,” detailed trading guides, archived and live webinars, as well as platform-specific courses such as the MT4 and TradingView tutorials.

Educational content is clearly labeled by skill level—beginner, intermediate, or advanced—allowing traders to progress logically through their learning journey. Unlike some brokers that scatter content without structure, Pepperstone presents its material in an intuitive layout, supported by clean design and practical explanations.

The broker’s educational area covers a wide range of topics, including core trading concepts like slippage, margin, leverage, and hedging, alongside platform tips and strategy development. Webinars—hosted by experienced market analysts—are available on-demand, and traders can access tutorials on how to use tools like Autochartist and Smart Trader. The resources are also linked to broader support services, including account setup guidance and platform comparisons, giving users a seamless experience from education to execution.

Pepperstone’s website contains several helpful sections, such as:

Learn to trade FOREX.

Learn to trade CFDs.

Trading guides.

Archived Webinars.

FOREX trading course.

MT4 course.

Each resource is well-structured and detailed. They follow a simple design, and traders can get a feel for where they are in their learning journey through helpful naming conventions like beginner and expert. Some brokers dump their educational material haphazardly, but not this broker.

The educational area is filled with tutorials, many archived and live webinars, and an impressive list of trading guides. Every instrument is comprehensively covered. Also, common terms like slippage, hedging, and margin are covered as well. The broker has made painstaking efforts to link the information to in-house support options, such as trading platform comparisons and account-financing procedures.

Pepperstone is a sound choice of broker for traders looking for a dependable and low-cost partner that combines attractive pricing with excellent platforms, responsive customer service, and a wealth of educational materials. The company is safe and has been consistently recognized for its excellent service, platforms and security.

Final Thoughts on Pepperstone

Pepperstone is growing fast, and for good reason. It is a broker that sticks to what is good. It has prioritized its home base of Australia while placing significant focus on its UK and EEA operations. It has a wealth of FOREX trading tools, which is to be expected as this is the broker’s main asset class.

The broker is well-regulated. It goes to reasonable lengths to protect trader funds. It has good market access, even if it is weighted toward FOREX, as already established. Its tools and platforms will serve novice traders and sophisticated, future-looking traders alike.

It is reasonably transparent about its fees; and by most estimates, Pepperstone offers fees that are at the lower end of the market. Its add-ons and broker help tools, such as indicators and market analysis, are possibly its strongest point.

It has a powerful research section with well-designed and filled with easy-to-follow educational material. Its customer service desk is available 24/5 and is manned by helpful staff. This is a broker that can be trusted and that will serve its core clientele well.

Conclusion

My final take on this broker is that it is a fast-growing broker with a robust emphasis in Australia, the EU, and the UK. It is regulated in these key areas and abides by the regulatory standards as directed. This includes carefully safeguarding client funds.

I believe that the broker is well served by competitive fees and powerful and diverse platforms. Its broker help tools, such as advanced indicators and charting, will attract new and experienced traders alike. Its social trading offering is packed with helpful tools that are well-placed to drive the broker into the future as social trading continues to grow.

The broker offers deep liquidity and attractive fees backed by powerful partners who can facilitate competitive rates because of their size and scale. Traders will feel catered for by the deep educational material and helpful tools.

Review Methodology

The team at Arincen collected over 120 pieces of data covering in excess of 100 licensed FOREX companies. Data collection was done in three ways:

1. Companies’ websites.2. Other websites that have ranked FOREX companies.3. A survey questionnaire (referred to here as Survey “1”) we had sent to the companies invited to participate in the exercise. We have identified 12 criteria for our assessment, each containing several aspects and carrying its own relative weight. These include licensing, deposits and withdrawals, number of assets etc. Afterward we validated the data by:

1. Registering with FOREX companies as a secret shopper and/or as Arincen.2. Survey number “2,” in which we asked these companies’ customers for important feedback and past experience.

The next step saw us evaluate and rank each company, relying on the hard work of 15 Arincen employees. We were very careful in ensuring the most accurate assessment possible, including taking into account different languages, as well as the various mobile-app operating systems, e.g., Apple, Samsung etc.

To add credibility to our research project, we sent a final and third survey (referred to here as Survey “3”) to enable participating FOREX companies evaluate our own research and whether it accurately reflects the realities on the ground. We were fortunate enough to receive a mark of 9.9 out of 10! We have kept to a minimum the margin of error, which stood at a measly 1%. To learn more on how we came up with the evaluation, please click here.

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

FAQ

This broker is regulated by tier-1 (high trust) bodies in the form of the ASIC in Australia, the UK’s FCA, and CySEC in Cyprus. The broker is also regulated by BaFin in Germany and the DFSA in Dubai.

The FSCS offers investor protections of £85,000. Under ESMA rules, EEA clients, including those in the UK, are entitled to Negative Balance Protection.

The broker accepts clients from all over the world, but US clients are not accepted.

Yes. Pepperstone offers five cryptocurrency CFDs.

No. This broker’s account offerings do not have enticing add-ons to catch the eye of high-volume traders. However, this can change at any time, and traders should keep an eye on the broker’s Website for any new bonuses and promotions.

Accepted funding methods are: bank wire transfer, credit/debit cards, Skrill and Neteller.

The broker does not have its own proprietary platform, but clients are well served by tried-and-tested industry favorites, such as MT4, MT5 and cTrader on desktop, Web and mobile.

The broker offers high quality 24/5 customer support over a chat service or via phone. Traders can also access the company’s helpful social media accounts, like Twitter, which act as information alert systems.