Trading 212 Review

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

Trading 212 Evaluate - research result

Key Takeaways

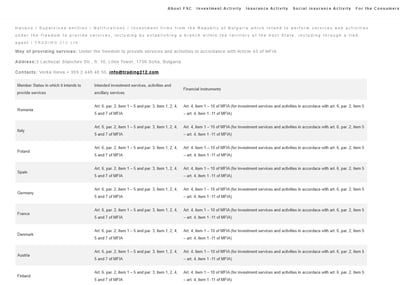

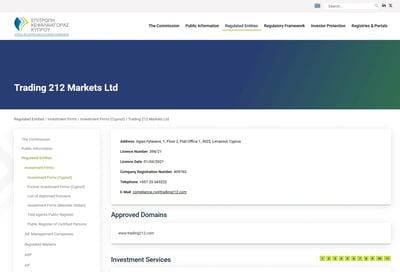

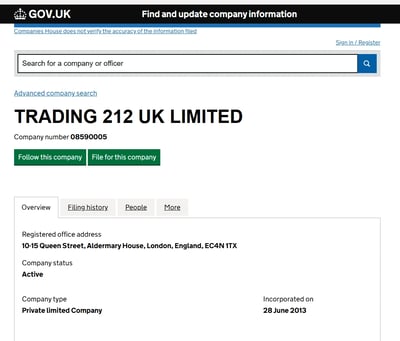

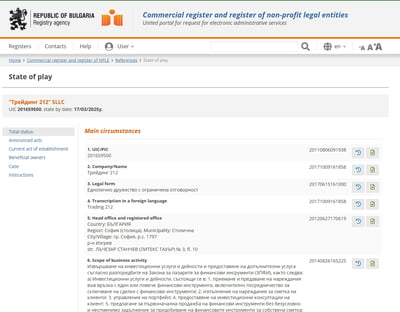

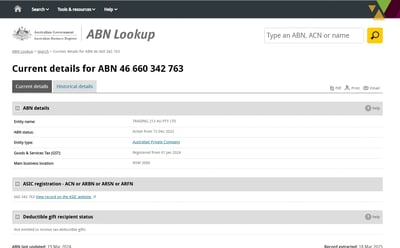

Trading 212 is a UK-based broker founded in 2004 and regulated by the UK’s Financial Conduct Authority (FCA), the German Federal Financial Supervisory Authority (BaFin), the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC).

The broker offers a commission-free trading model for over 13,000 CFD assets, including stocks, ETFs, FOREX, indices, and commodities via its proprietary platform.

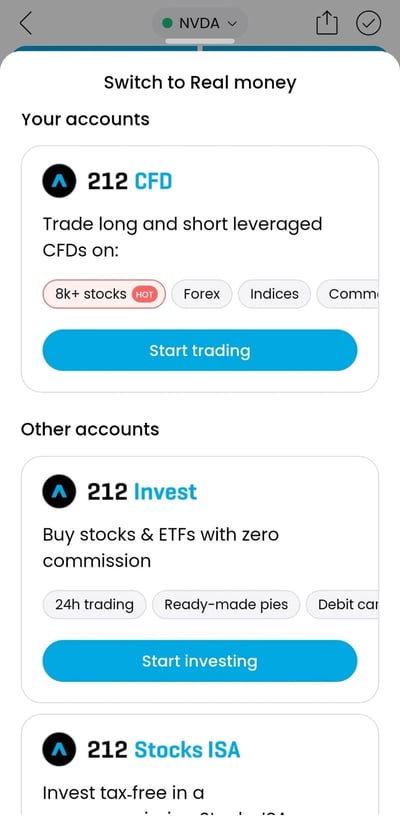

Users can access three distinct account types: Invest, ISA (tax-free for UK clients), and CFD, with zero commissions and no minimum deposit requirement for Invest and ISA accounts.

While CFD trading carries variable spreads and overnight swap rates, Trading 212 does not charge deposit, withdrawal, or inactivity fees, helping keep costs low for retail clients.

The platform is exclusively web-based and mobile-only, with no MT4/MT5 support. It is designed for user-friendliness and simplicity.

Fractional shares and auto-invest features support long-term investment strategies, while stop-loss, take-profit, and negative balance protection are included for risk management.

Traders benefit from instant order execution, tight spreads, and leverage up to 30:1 for retail clients in compliance with ESMA rules.

Trading 212 provides multi-language customer support and a streamlined onboarding process that can be done within minutes through its app.

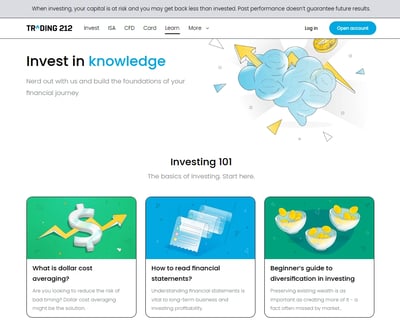

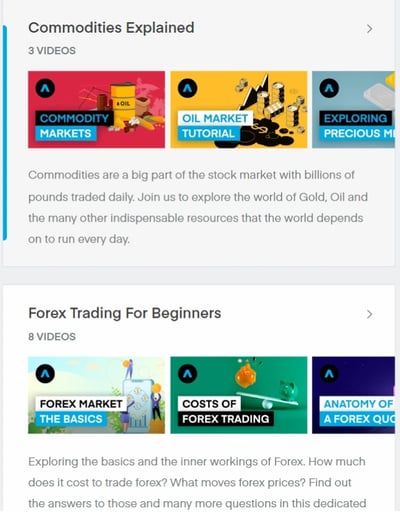

Educational content includes video tutorials and a community forum, though advanced trading tools and research features are somewhat limited.

Social and copy trading features are not available.

Trading 212 has grown rapidly in popularity among European retail investors and consistently ranks high for ease of use and mobile-first innovation.

Last Reviews

Overall Summary

In my analysis of Trading 212, I found it to be a reliable, beginner-friendly broker that delivers an efficient, commission-free trading experience across a wide range of assets.

Founded in 2004 and regulated by top-tier regulators, including the FCA in the UK and the CySEC in Cyprus, Trading 212 gives you access to over 13,000 instruments from stocks, ETFs, indices, commodities, and FOREX.

The broker works through its proprietary web and mobile platforms, and one of its standout features is that it offers zero-commission trading across all its account types. At this point, I should tell you that this broker, although active in many parts of the world, is a UK-focussed entity. This can be demonstrated by the fact that a large part of its value add comes in the form of offering commission-free ISA accounts.

ISA stands for Individual Savings Account and is a special type of savings or investment account that gives UK residents certain tax benefits.

While Trading 212 doesn’t offer third-party platforms like MetaTrader or support advanced features such as copy trading, its fractional share capability, user-friendly interface, and automated investment tools make it a nice choice for newer investors and those focused on long-term portfolio growth.

I found its research tools and educational content acceptable, if fairly basic. The platform’s speed, accessibility, and transparency position it as a good pick for retail traders looking for a cost-effective way to access global markets.

Trading 212 is safe. It is a long-standing broker regulated by top-tier authorities like the UK’s FCA, making sure of high levels of client protection through negative balance safeguards and segregated accounts. However, you should be aware that investor compensation coverage is only available to clients under specific regulatory jurisdictions.

Is Trading 212 Safe?

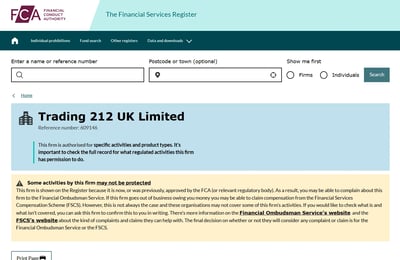

In my opinion, Trading 212 is a safe and transparent broker. It is authorized and regulated by, among other brokers, the FCA in the UK, a Tier-1 regulator known for its tough stance on broker oversight. The FCA and others enforce essential client protection mechanisms, including segregated client funds and negative balance protection, which comes in handy as it protects you from losing more than your deposited amount.

What I found to be a slight dampener is that Trading 212 does not currently offer lost-funds compensation for non-UK and non-Cyprus entities. Clients under the FCA are protected by the UK’s Financial Services Compensation Scheme (FSCS), which covers up to £85,000 in case of broker insolvency. Clients under CySEC are covered by the Investor Compensation Fund (ICF), which provides compensation to clients up to €20,000 per client if a broker goes belly up.

With operations dating back to 2004 and millions of users, Trading 212 has built a reputation for reliability, particularly among retail investors on the hunt for a low-cost, intuitive trading platform.

How Trading 212 Protects You from Reckless Leverage and Margin Trading

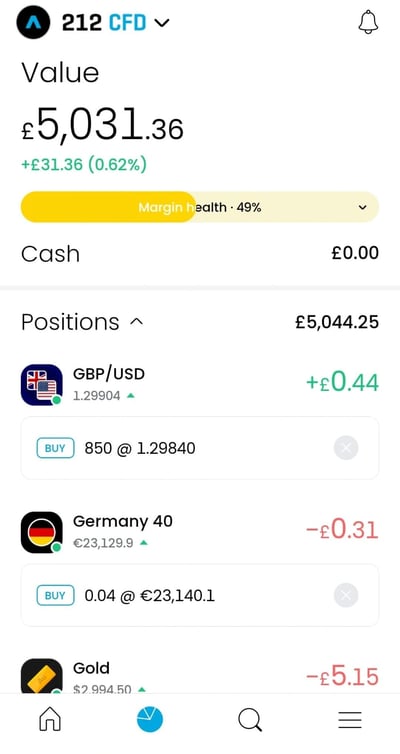

Leverage and margin can magnify gains, but also amplify losses, especially for retail traders who don’t know the risks. Unscrupulous brokers often exploit this by offering dangerously high leverage. Trading 212, however, takes a more responsible approach.

How you are protected

I can attest to the fact that Trading 212 operates under strict Tier-1 regulations from the FCA, which limits leverage for retail clients to a maximum of 30:1 on major FOREX pairs and lower for other asset classes. This conservative leverage cap aligns with European Securities and Markets Authority (ESMA) guidelines, ensuring that clients aren’t exposed to extreme market risk.

To further protect users, Trading 212 offers negative balance protection, which guarantees you can’t lose more money than you’ve invested. This is critical in high-volatility situations, offering a cushion against unforeseen market swings.

The platform also provides clear margin call levels and user-friendly risk management tools, like stop-loss and take-profit orders, which help users set limits before entering trades.

Combined with a straightforward interface and minimal distractions from risky leverage offers, Trading 212 prioritizes long-term trader survival before short-term speculation.

Regulation and other security measures

Trading 212 sticks to the safety practices that you would expect from a well-regulated broker. Client funds are held in segregated accounts, meaning that your deposits are never mixed with the broker’s operating capital.

The broker also offers negative balance protection across its retail trading accounts, meaning you cannot lose more than your initial deposit, even during extreme market swings.

Top broker features

In my view, here are some of the most compelling reasons to go with this broker:

Commission-free trading and tight spreads: If you trade on the Invest and ISA platforms, you can trade real stocks and ETFs with no fees, while the CFD platform offers competitive spreads, although not as tight.

User-friendly proprietary platform: Unlike many brokers that rely on third-party platforms, Trading 212 has created its own excellent platforms that are available via web and mobile.

Fractional shares and auto-investing: With this broker, you can buy fractional shares and, in so doing, invest small amounts into expensive stocks.

Wide asset selection: You can access over 13,000 instruments across stocks, ETFs, FOREX, commodities, indices, and cryptocurrencies (via CFDs).

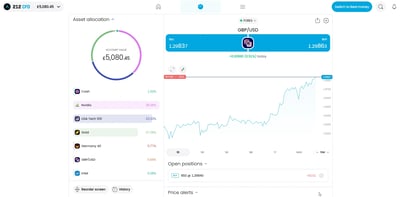

Strong mobile functionality: The mobile app mirrors the desktop experience with nearly full functionality, including chart analysis, order types, and watchlists.

Risk management tools: Trading 212 integrates built-in features like negative balance protection, margin alerts, and easily adjustable stop-loss/take-profit levels to help you manage risk more effectively as you go.

For Whom Is Trading 212 Recommended?

Here’s who benefits most:

Beginner traders: With its intuitive proprietary platform, zero-commission trading, and no minimum deposit, Trading 212 is ideal for newcomers who want to start small and learn by doing.

Long-term investors: The Invest and ISA accounts give you the chance to trade real stocks and ETFs, making Trading 212 one of the few brokers that truly caters to long-term, buy-and-hold strategies—especially in the UK.

Hands-off savers: The AutoInvest feature is a great tool for passive investors. It allows automated, recurring investments into custom-built portfolios. What you end up getting is a low-fee robo-advisor if you are someone who prefers set-and-forget strategies.

Traders interested in a broad market scope: With over 13,000 instruments, including stocks, ETFs, FOREX, indices, commodities, and crypto CFDs, Trading 212 gives you access to global markets across both its CFD and Invest platforms.

Budget-conscious traders: If you want to avoid trading fees and commissions, Trading 212 should appeal to you. While spreads on CFDs might not match ECN-style brokers, the cost structure is still ultra-competitive for retail users.

Not ideal for algorithmic or professional traders: Trading 212 does not support third-party platforms like MetaTrader or advanced tools like VPS hosting, backtesting environments, or API access. This is bad news if you happen to rely on custom algorithms or high-frequency execution.

-

Commission-free trading on stocks and ETFs

-

$1 minimum deposit requirement

-

User-friendly proprietary web and mobile platforms

-

Broad product range including over 13,000 assets

-

Fractional shares and AutoInvest tools

-

FSCS and ICF investor protection

-

No deposit, withdrawal, or inactivity fees

-

Regulated by top-tier regulators

-

CFDs only available under the Trading 212 CFD entity

-

No support for third-party platforms like MetaTrader

-

Limited advanced charting tools and no algorithmic trading support

-

No live chat or 24/7 customer service

-

Investor protection only applies to UK and EU clients

-

No Islamic accounts

Offering of Investments

Trading 212 offers over 13,000 real stocks and ETFs on its Invest and ISA platforms, and a great many CFDs covering FOREX, indices, commodities, and cryptocurrencies. While it provides commission-free trading and access to global markets, advanced tools like bonds, options, or direct market access are not available. The platform is best suited for retail traders and casual investors rather than institutional or high-frequency users.

I found that Trading 212 offers many investment products designed to appeal to both retail traders and long-term investors. Its product lineup spans real shares and ETFs on the Invest and ISA platforms, and a diverse range of CFD instruments for those seeking leverage or short-term exposure.

Stocks and ETFsTrading 212 provides access to more than 13,000 real stocks and ETFs across major global exchanges, including the NYSE, NASDAQ, LSE, and Euronext. These are available through its commission-free Invest and ISA accounts.

Besides real stocks, the broker also offers CFD stock trading. You can go long or short on thousands of stocks, including popular ones like Tesla, GameStop, and AMC.

FOREXFOREX trading is available exclusively on the Trading 212 CFD platform, with access to over 178 currency pairs, including majors, minors, and exotics. Spreads are variable and competitive, although not ECN-tier, and there are no commissions.

IndicesYou can access CFDs on major global indices like the S&P 500, Dow Jones, NASDAQ 100, FTSE 100, and DAX 40. These allow you to speculate on the broader market or specific sectors without owning individual components.

CommoditiesThe broker offers CFDs on commodities, covering a range of popular instruments including gold, silver, oil (Brent and WTI), and natural gas.

Cryptocurrency CFDsCrypto enthusiasts can trade a selection of cryptocurrency CFDs, including Bitcoin, Ethereum, Litecoin, and Ripple. These instruments allow for long and short positions but are only available on the CFD platform and are subject to regional availability.

LimitationsBe aware that Trading 212 does not offer bonds, options, or mutual funds. Advanced order types and algorithmic trading tools are also absent, pushing the broker more toward casual investors and traders rather than institutional or high-frequency users.

Available assets

| Markets | Available | Number of Assets |

| Currency Pairs | 178 | |

| Stocks | 2000 | |

| Commodities | 29 | |

| Crypto | 15 | |

| Indices | 17 | |

| ETFs | 3000 |

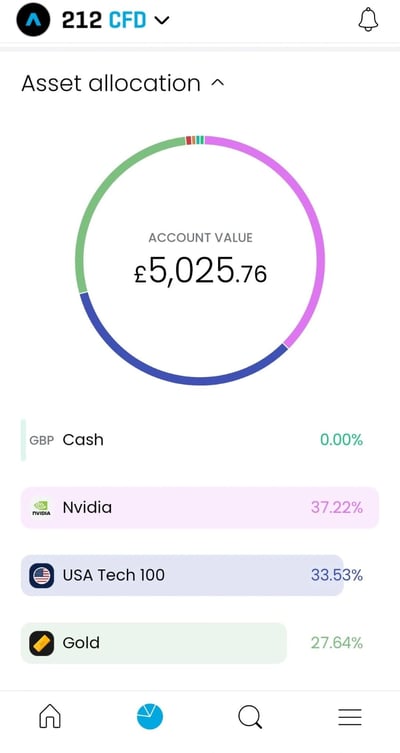

Account Types

Trading 212 offers three distinct account types tailored to different user needs: Invest, ISA, and CFD. Each is built into the broker’s proprietary platform, allowing clients to toggle between long-term investing and short-term trading from a unified interface. There are no commission fees on trades, no minimum deposit requirements, and all accounts get negative balance protection and segregated client funds.

Here are the account types you will find when trading with Trading 212:

Invest accountThis account is designed for those looking to buy and hold real stocks and ETFs. Trades are commission-free, and the great thing is that you can buy fractional shares, making this account ideal for newbies or those building diversified portfolios with smaller capital.

ISA account (UK Only)Available only to UK residents, the ISA account offers all the features of the Invest account but with the added benefit of tax-free gains and dividends, in line with the UK government’s Individual Savings Account regulations.

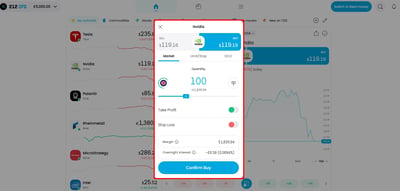

CFD accountIf you are interested in leveraged trading, the CFD account provides access to over 2,500 instruments, including FOREX, indices, commodities, cryptocurrencies, and stock CFDs. Spreads are variable, and while there are no commissions, fees are built into the spread. The account supports margin trading, short selling, and market orders with risk management tools like stop loss and take profit.

Demo accountTrading 212 also offers a free demo account that copies live market conditions. This allows you to test strategies and get familiar with the platform without risking real capital. It’s available across all account types and is accessible directly from the web or mobile platform.

Islamic or Professional accountsTo my disappointment, I found that Trading 212 does not offer swap-free Islamic accounts or tiered professional accounts with enhanced features or leverage.

Account opening

I found that opening an account with Trading 212 is straightforward, fully digital, and optimized for use on any device, be it phone, tablet, or desktop. The process typically takes no more than 10 to 15 minutes and can be done entirely online without printing or mailing any documents.

What is the minimum deposit at Trading 212?

One of Trading 212’s best features is its low minimum deposit (as low as $1) requirement across all account types. Whether you’re opening an Invest, ISA, or CFD account, you can start trading or investing with any amount you choose, no matter how small, making the platform particularly appealing for new or budget-conscious traders.

How to open your account

The onboarding process starts with entering your basic personal details, like your name, email address, and country of residence. You’ll then specify the type of account you want: Invest, ISA (UK only), or CFD.

You’ll also need to submit identity verification documents, typically a photo ID and a proof of address, which are uploaded directly through the platform. Most applications are verified and approved within a few hours.

Deposits and Withdrawals

Trading 212 offers a simplified deposit and withdrawal experience designed for retail traders who value ease of use and low costs. With zero deposit fees, fast processing times, and a no-frills structure, the platform supports the major basics: bank cards, bank transfers, and select local payment methods. Withdrawals are free and typically processed within one business day.

Trading 212 offers multiple ways to deposit and withdraw funds from your trading account. Please be sure to consult the broker’s rate card closely to know where you stand.

Account base currencies

Clients can choose from 13 base currencies depending on their region, including:

● GBP

● USD

● EUR

● CAD

● CHF

● DKK

● NOK

● PLN

● SEK

● CZK

● RON

● BGN

● HUF

This flexibility allows you to avoid unnecessary currency conversion fees, especially when funding accounts in their local currency.

Trading 212 deposit fees and options

I was pleased to find that deposits can be made via:

● Credit and debit cards (Visa, Mastercard)

● Bank transfers

● Apple Pay

● Skrill and PayPal

● Other regional payment methods (depending on where you live)

All deposit methods are fee-free from Trading 212’s side. However, you should always verify with your own bank or card issuers to check for potential external charges or currency conversion fees.

Trading 212 withdrawal fees and options

Withdrawals are processed using the same method as the original deposit to comply with anti-money laundering regulations. While the broker does not charge any fees for withdrawals, clients must withdraw to an account in their name.

I found that most of my withdrawals were processed within 24 hours, although bank transfers may took a few additional business days. Trading 212 also imposes no minimum withdrawal amount, making the platform accessible even to those trading in small volumes.

Important to know:

● Withdrawals must be made to accounts in the same name as the Trading 212 trading account.

● While Trading 212 does not charge fees for most withdrawal methods, third-party fees might attract more fees.

● There is no minimum withdrawal amount set by Trading 212 but your own bank might impose its own minimum limits

| Method | Credit Card | Wire Transfer | Skrill | Neteller | Cryptocurrency | PayPal | Apple Pay |

| Deposit fee | $0 | $0 | $0 | Unavailable | Unavailable | $0 | $0 |

| Withdrawal fee | $0 | $0 | $0 | Unavailable | Unavailable | $0 | $0 |

Customer Support

Trading 212 offers customer support through in-app chat and email, with a strong focus on efficient self-service and mobile responsiveness. While it does not provide 24/7 phone support or a callback service, its help center and ticketing system are designed to handle most retail trading queries promptly and with clarity.

I discovered that Trading 212's support team can be contacted directly via the mobile app or web platform, using an integrated chat function that routes users through a brief help bot before connecting with a live agent if needed. You can also submit support requests via email or through an online contact form.

The broker is big on user autonomy by offering a comprehensive FAQ and help center filled with articles, platform tutorials, and policy information. Though Trading 212 does not offer round-the-clock service or regional phone lines like some competitors, the existing channels are enough for most standard queries, especially for clients familiar with digital-first platforms.

| Live Chat | Phone | |||

| Available | Available | Available | Unavailable | Unavailable |

| Quick response | Moderate | fast | Unavailable | Unavailable |

Commissions and Fees

Trading 212 uses a zero-commission model across its Invest and CFD platforms, with variable spreads based on asset class and market conditions; for example, EUR/USD spreads start at 0.6 pips. There are no volume-based or tiered fees. The broker does not charge inactivity fees but lacks Islamic accounts.

Trading 212 principally offers variable fees depending on the asset class with which you are working.

Spreads

Trading 212 structures its pricing around a zero-commission model and variable spreads that adjust based on market conditions. For FOREX trading on the CFD platform, the average spreads for EUR/USD start at 0.6 pips, competitive figures indeed in the zero-commission segment.

Share CFDs typically carry spreads starting at 0.01%, while commodity and index CFDs start from 0.3 and 0.4 pips, respectively. Spreads can vary depending on the asset, with gold and crude oil offering tighter ranges during peak hours.

Commissions

As we have said, Trading 212 operates on a zero-commission model across its Invest and CFD platforms, meaning there are no explicit charges for placing trades on stocks, ETFs, or CFDs. Instead, the broker builds its costs into the spreads and applies a modest currency conversion fee for trades involving non-base currencies.

Unlike some competitors, there are no tiered pricing structures or volume-based fees: what you see in the spread is what you pay. This simplicity makes Trading 212 especially appealing to casual investors and new traders looking to avoid complex fee models.

Swap fees and Islamic accounts

Trading 212 does not currently offer Islamic or swap-free accounts tailored to Sharia-compliant trading, which will be a big limitation for Muslim traders.

Inactivity fee

Trading 212 does not charge an inactivity fee, making it an appealing option for casual or infrequent traders.

| Spread | Commission | Swap | Islamic Account | |

| Currencies | Starting from 0.6 Pips | $0 | Yes | Unavailable |

| Stocks | Starting from $0.01 | $0 | Yes | Unavailable |

| Commodities | Starting from 0.3 Pips | $0 | Yes | Unavailable |

| Indices | Starting from 0.4 Pips | $0 | Yes | Unavailable |

Platforms and Tools

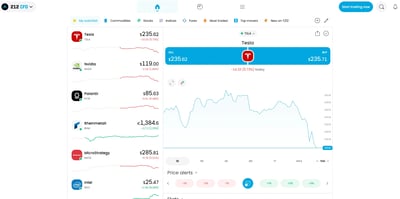

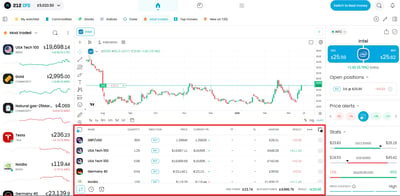

Trading 212 offers an intuitive and sleek proprietary platform available on web, iOS, and Android, targeting retail investors who value simplicity and speed. While it lacks support for third-party platforms like MT4/MT5 or cTrader, it compensates with built-in analytics, fractional share trading, and user-friendly navigation that lowers the barrier for entry-level and intermediate traders alike.

Here’s what’s happening with regard to Trading 212 platforms:

Platforms types

I was interested to learn that the broker has opted to go all-in on its proprietary trading platform, offering a clean, modern interface tailored to newcomers and casual traders. Available across web, iOS, and Android, the platform facilitates both CFD trading and real stock/ETF investing within the same environment.

The design is all about ease of use, featuring watchlists, interactive charts with technical indicators, and simple order placement. It also supports fractional share trading, giving you limited capital access to high-priced stocks.

Advanced tools include economic calendars, custom alerts, and in-platform market news. While it doesn't offer algorithmic trading, copy trading, or plug-ins like Autochartist or VPS hosting, Trading 212 still meets the core needs of most retail traders. Its auto-invest feature supports recurring investments and portfolio pies, aimed at long-term planning and passive investing.

However, for more experienced traders on the lookout for deeper technical analysis, advanced order types, or the flexibility of third-party platforms, Trading 212 may feel limiting.

Look and feel

In my view, Trading 212’s proprietary platform stands out for its minimalist design that prioritizes usability over complexity. Both the mobile and web versions feature a clean, modern interface with smooth navigation, responsive charts, and intuitive layouts.

We found the visual design is polished and inviting, with thoughtfully organized menus and custom watchlists that avoid the clutter often found in some legacy platforms. The broker’s aesthetic also includes a unique and pleasing-to-the-eye graphic style.

While it may not offer the deep customization or multi-screen setup flexibility of professional-grade platforms, the user experience is still fast, frictionless, and easy to learn.

Login and security

Biometric authentication, such as fingerprint or facial recognition, is supported on mobile devices, adding a layer of convenience for users who value quick access. However, like many brokers with proprietary platforms, Trading 212 does not offer two-factor authentication (2FA) as a default security measure.

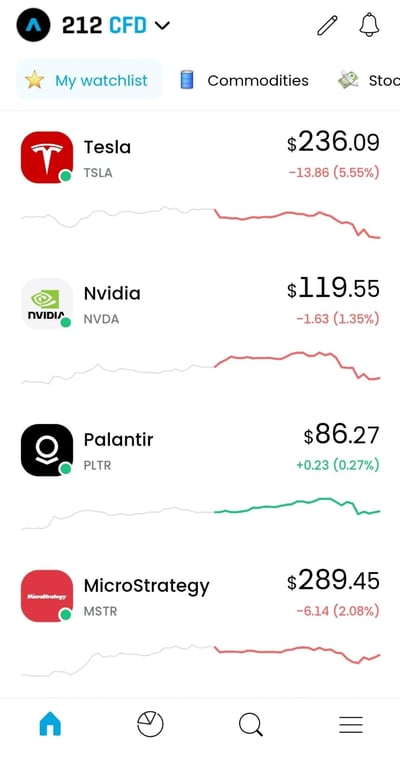

Search functions

I found that Trading 212 provides a smooth and user-friendly search experience across its mobile and web platforms. Users can search for assets simply by typing the name or ticker symbol into the search bar, with results populated in real-time. The interface is clean and intuitive, especially on the mobile app, where traders can explore markets using categories like stocks, ETFs, FOREX, and cryptocurrencies.

The platform also gives you the option of basic filtering by region or asset class, helping you narrow investment opportunities efficiently. While not as deep or customizable as platforms like cTrader or TradingView, Trading 212’s search function is ideal for novices and intermediate traders who value speed and simplicity over advanced filtering tools.

Placing orders

The platform supports all essential order types, including market, limit, and stop orders, with a clean interface that makes execution feel effortless. One-click trading is also available, allowing for fast order placement, a key advantage in volatile markets.

While advanced features like trailing stops or depth-of-market views are absent, the app compensates with intuitive chart-based trading and easy navigation among asset classes. Execution is nearly instantaneous under normal conditions, making Trading 212 a go-to platform for simple, fast, and accessible order handling.

Alerts and notifications

You can set price-based notifications directly within the app. Alerts can be created quickly by tapping on an asset and selecting a price level, with push notifications delivered instantly when conditions are met. This feature is especially useful for traders monitoring fast-moving markets on the go.

Mobile Trading

Trading 212’s mobile app offers a streamlined, user-friendly trading experience with intuitive navigation, clean visuals, and core features like market and limit orders, real-time data, and customizable alerts. While it lacks advanced tools like trailing stops, depth-of-market views, and two-factor authentication, it excels in simplicity and responsiveness, which is ideal for retail traders on the go.

Here is what you can expect from the mobile trading platform:

Platforms

Trading 212 delivers a simple and uncluttered mobile trading experience via its proprietary app, available on both iOS and Android. The app has a great clean user interface, quick responsiveness, and ease of navigation.

You can place market and limit orders, set price alerts, view interactive charts, and access real-time market data, all within a few taps. If you’ve been trading for a while, you might miss the third-party platforms like MT4 or cTrader, but Trading 212’s app brings refreshingly tight integration and a cohesive user experience across all devices.

Look and feel

I enjoyed the fact that Trading 212’s mobile app strikes a strong balance between usability and performance. While it doesn’t boast the advanced charting or touch-optimized layout of cTrader, it caters exceptionally well to retail traders looking for intuitive navigation, simple order execution, and on-the-go portfolio watching.

Compared to some of the more complex, feature-dense interfaces, Trading 212 keeps things straightforward and is perfect for traders who prefer a sleek experience over head-spinning customization or professional-grade toolsets. This platform is built more for simplicity and accessibility than for granular control.

Login and security

Login and security could use stronger safeguards. The app supports basic login credentials and biometric authentication, such as fingerprint or facial recognition, offering a layer of convenience. However, there’s no mention of built-in 2FA, which places it behind industry leaders where 2FA comes standard.

Search functions

I could easily look up instruments by name or ticker symbol, and the app provided categorized asset lists, such as stocks, FOREX, and ETFs, for quick browsing.

The platform also features trending assets and popular searches, which help guide user discovery, although it lacks the deeper filtering tools found in more advanced platforms like cTrader.

Placing orders

The app supports key order types, including market, limit, and stop orders, with an easy-to-navigate interface that allows for execution directly from the asset’s detail screen.

While the platform does not currently offer trailing stop or depth-of-market views like some of the more established platforms out there, order placement is still fast, intuitive, and responsive, making it ideal if you prioritize simplicity and speed.

Alerts and notifications

You can set up and receive push notifications for such key events as order execution, margin calls, and price movements. Alerts can be customized directly within the app, which is a step up in convenience compared to platforms like MT4/MT5 that require desktop setup.

While the alert system is functional, it does not have the advanced conditional alerting features found in more specialized trading apps, but it still offers more than enough for the average retail trader.

Research and Development

The broker offers a streamlined research and development footprint that suits casual to moderately active traders, but doesn’t quite match the depth provided by top-tier brokers. The platform’s in-house research is limited to news updates and basic analysis, and it does not currently integrate leading third-party tools like Autochartist or Trading Central.

While the broker provides some useful educational and market content through its blog and news feed, you won’t find any particularly robust technical research tools or personalized analytics.

Trading Statistics

Trading 212 does not offer advanced trading statistics or detailed performance analytics tools within its platform. Here, I am talking about features like strategy testing, trading journals, or third-party analytics partnerships.

Trading 212 remains more focused on simplicity and accessibility for retail users. Traders looking to backtest strategies or review performance metrics in detail will likely need to rely on external tools or platforms outside the Trading 212 environment.

Trading Signals

Unfortunately, you won’t find built-in trading signals or third-party integrations like Autochartist, Trading Central, or signal services such as xsee or Signal Start.

The platform is designed to appeal primarily to new and intermediate traders through simplicity and low-cost trading, rather than through technical tools or advanced analytics.

Education

Trading 212 provides a modest educational offering that’s more aligned with beginner traders than advanced market participants. The platform features a dedicated “Learn” section, which includes bite-sized lessons covering basic trading concepts, investment principles, and tutorials on how to use the platform itself.

While this material is helpful for newcomers, it lacks the depth and structure seen in top-tier brokers that offer full-scale trading academies, advanced strategy guides, or live expert-led sessions. However, with its eye focussed on offering an affordable, clean, and no frills experience, this is probably not surprising.

Founded in 2004 and based in London, Trading 212 is a commission-free broker regulated by some top-tier regulators. It offers CFD and real stock and ETF trading, with standout features like fractional shares, zero-commission investing, and an intuitive and simple mobile app. With no account minimums, a user-friendly interface, and competitive spreads for CFDs, Trading 212 is a popular choice for retail traders who want low-cost access to global markets.

Trading212 in Brief

Trading 212 stands out as a newbie-friendly broker with commission-free trading on stocks, ETFs, and a solid selection of CFDs. Some of its best features are intended for its home market of the UK, but its intuitive mobile and web platforms make it easy for new investors to get started, and fractional share investing adds accessibility for those with smaller budgets. While its in-house platform is easy to use, more advanced traders may find its tools and educational content somewhat limited.

Conclusion

In my opinion, Trading 212 delivers a compelling package for retail traders, especially those new to the market. With zero-commission stock and ETF trading, a clean mobile-first platform, it lowers the barrier to entry for everyday investors. While I feel it lacks the depth of tools seen in more advanced brokers, Trading 212’s regulated environment, straightforward pricing, and focus on accessibility make it a reliable springboard for newcomers looking to gain trading experience without too much complexity.

Review Methodology

The team at Arincen collected more than 120 pieces of data covering in excess of 100 licensed FOREX companies. Data collection was done in three ways:

Companies’ websites.

Other websites that have ranked FOREX companies.

A survey questionnaire (referred to here as Survey “1”) was sent to the companies invited to participate in the exercise.

We have identified 12 criteria for our assessment, each containing several aspects and carrying its own relative weight. These include licensing, deposits and withdrawals, number of assets, etc. Afterward, we validated the data by:

Registering with FOREX companies as a secret shopper and/or as Arincen.

Survey number “2,” in which we asked these companies’ customers for important feedback and past experience.

The next step involved evaluating and ranking each company, relying on the work of 15 Arincen employees. We were very careful to ensure the most accurate assessment possible, including consideration of different languages and mobile operating systems (e.g., Apple, Samsung).

To add credibility to our research project, we sent a final and third survey (referred to here as Survey “3”) to enable participating FOREX companies to evaluate our own research and whether it accurately reflects the realities on the ground. We were fortunate enough to receive a mark of 9.9 out of 10! We have kept the margin of error to a minimum, which stood at a measly 1%. To learn more on how we came up with the evaluation, please click here.

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

FAQ

There is a low minimum deposit of $1 required to open an Invest or ISA account. For CFD accounts, Trading 212 recommends a deposit of at least €10 to start trading effectively.

Yes, Trading 212 is regulated by the UK’s FCA, Australia’s ASIC, and CySEC of Cyprus, offering strong oversight and client fund protection.

Trading 212 provides its own proprietary platform, available on both desktop and mobile. It’s user-friendly, visually clean, and tailored to both beginners and experienced traders.

No, Trading 212 does not charge inactivity fees.

No, Trading 212 does not currently offer traditional copy trading or signal services, focusing instead on self-directed trading with tools like price alerts and analyst ratings.

Trading 212 offers three types of accounts: Invest (for real stocks and ETFs), ISA (tax-free investments for UK residents), and CFD (for leveraged trading across various asset classes).

Deposits and withdrawals can be made via bank transfers, credit/debit cards, Apple Pay, Google Pay, and several e-wallets. Most transactions are fee-free and processed quickly.

Trading 212 offers thousands of instruments, including stocks, ETFs, indices, FOREX, commodities, and cryptocurrencies (on CFD accounts), allowing access to both real and derivative markets.