capital.com review

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

capital.com Evaluate - research result

Key Takeaways

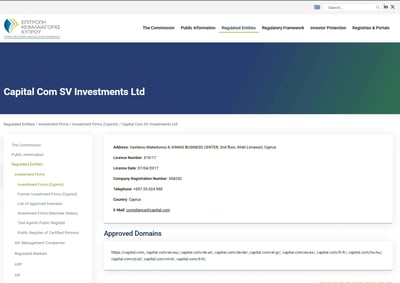

Capital.com was established in 2016 and is headquartered in Limassol, Cyprus.

Capital.com has over 14,000 reviews on the leading global review platform Trustpilot. This level of volume is rare in the industry and reflects both the company's size and credibility.

The broker offers a proprietary web and mobile platform, as well as support for MetaTrader 4 (MT4).

Capital.com's website is accessible in multiple languages, including English, Arabic, Spanish, German, French, and Italian, catering to a diverse global clientele.

For the period 1 Jan 2025 to 31 March 2025, the platform reported $656 billion in client trading volumes.

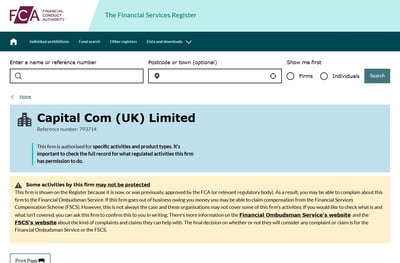

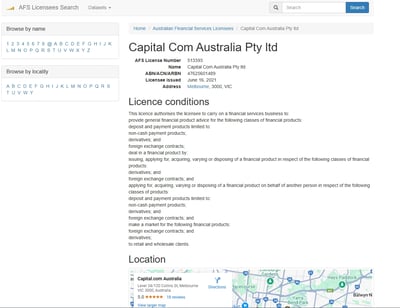

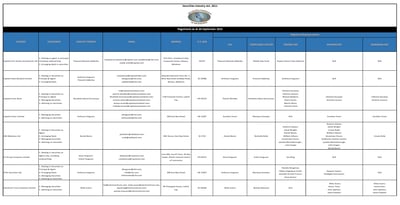

Capital.com is regulated by the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), the Securities and Commodities Authority (SCA) in the UAE, and the Securities Commission of The Bahamas (SCB).

The broker offers two main account types: a Standard account with a low minimum deposit of $20 by card, and a Professional account (not in CCMENA) for eligible traders seeking additional features.

Capital.com provides access to over 4,500 markets, including 128 FOREX pairs, 2,400+ stock CFDs, 20+ indices, 22+ commodities, and 90+ cryptocurrency CFDs*, offering a wide range of trading opportunities.

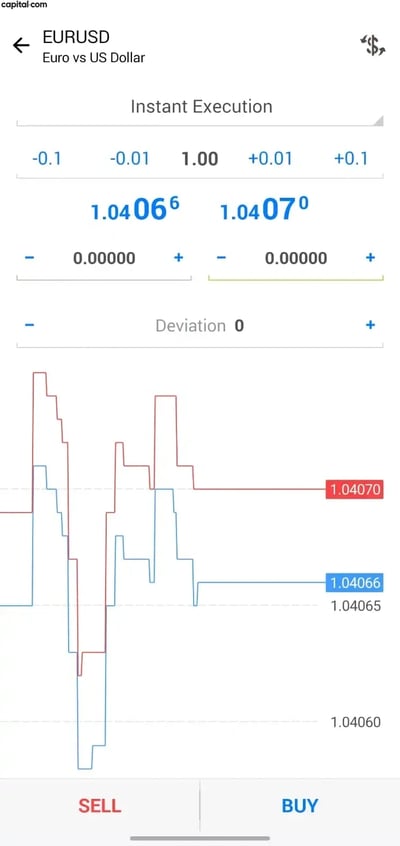

The broker operates on a commission-free model, with competitive spreads starting at 0.6 pips on major FOREX pairs, such as EUR/USD.

Capital.com offers a comprehensive educational platform, featuring in-depth courses, trading guides, and market analysis, designed to support traders at all levels.

Last Reviews

Overall Summary

I recently analyzed Capital.com and its features. This broker was incorporated some 10 years ago and is a fast-growing broker and fintech group. Traders have a choice of over 4,500 instruments, including a broad range of CFDs for FOREX pairs, stocks, indices, commodities, and cryptocurrencies*. For the period 1 Jan 2025 to 31 March 2025, the platform reported $656 billion in client trading volumes.

One of the most important points I noticed was that the broker does not offer real trading asset ownership, because it is exclusively CFD-based. This works for many traders, while others prefer direct ownership.

Capital.com supports a flexible platform setup that includes its proprietary web and mobile trading platforms, MT4 integration, and seamless TradingView access, offering traders strong tools across devices.

The broker holds Tier-1 licenses from the FCA (UK), CySEC (EU), SCA (UAE), and ASIC (Australia). It is also regulated by lower-tier regulators such as the FSB of the Bahamas.

Negative-balance protection applies across all entities, ensuring clients cannot lose more than their deposits, though formal investor compensation is only available under FCA and CySEC registrations.

I found Capital.com’s pricing to be highly competitive, offering commission-free trading across all asset classes, with spreads starting from 0.6 pips on EUR/USD. There are no deposit or withdrawal fees, and no hidden charges like inactivity fees, from what I could tell.

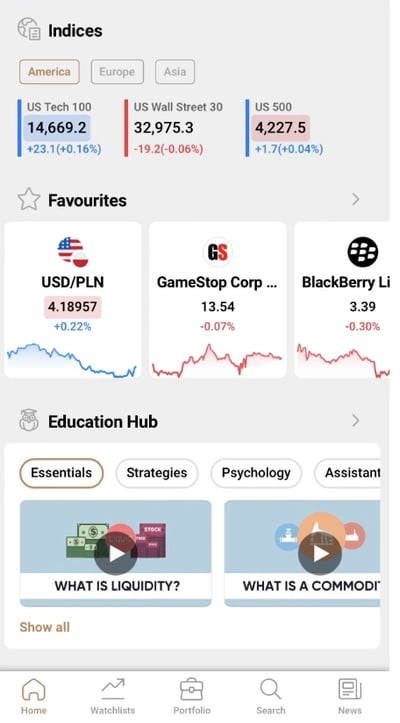

The broker’s proprietary mobile app ranks among the best in the industry, combining an award-winning educational suite with full trading functionality. Research tools, including TradingView charting and news feeds, are strong, though fundamental data and advanced portfolio analytics could be slightly better.

As always, what is contained in this review is not financial advice, simply my recommendations as a regular user of retail trading platforms.

Is Capital.com Safe?

Capital.com is considered a safe broker, holding regulation from bodies like the FCA, CySEC, ASIC, SCA, and SCB, with strong client protections such as fund segregation, negative-balance protection, and, for UK and EU clients, access to investor compensation schemes. Leverage limits are capped based on region and asset volatility to prevent excessive exposure. The broker also backs up its safety credentials with international security certifications, automatic position-closing tools, cyber-protection measures, and a dedicated security team to help protect client funds and information.

Yes, in my view, Capital.com is a safe broker with strong regulatory credentials. As mentioned, the broker is regulated by:

FCA – United Kingdom

CySEC – Cyprus

ASIC – Australia

SCA – United Arab Emirates

SCB – Bahamas

As always, if you are registered under the FCA and CySEC, then you benefit from formal investor compensation schemes, up to £85,000 through the FSCS in the UK and up to €20,000 under the CySEC investor protection fund.

If you live outside these jurisdictions, then unfortunately, you’re not eligible for compensation schemes, but you still receive strong protection, including strict fund segregation and negative balance protection.

How Capital.com Protects You from Reckless Leverage and Margin Trading

The broker takes a risk-conscious approach to leverage and margin trading, aiming to protect retail traders from excessive exposure. Your region and regulatory classification determine leverage at Capital.com.

So, for example, under the FCA, CySEC, and ASIC regulations, retail clients are capped at a maximum leverage of 30:1 on major FOREX pairs, 20:1 on minor pairs and indices, and as low as 2:1 on cryptocurrencies*. This ensures that you don’t overextend yourself with margin in volatile markets.

Professional clients must meet strict eligibility criteria, but they give up access to retail protections such as negative balance protection and investor compensation schemes. Note that the broker does not offer Professional accounts in CCMENA.

Capital.com does not allow you to adjust leverage at will within the platform manually, but by offering tiered leverage based on asset volatility, it indirectly enforces smarter exposure limits. High-risk assets such as cryptos*, stocks, and minor FOREX pairs carry lower maximum leverage ratios by default.

How you are protected

The exact level of protection depends on the regulatory entity with which you are registered. All Capital.com entities enforce strict fund-segregation policies, meaning your money is held in separate accounts from the broker’s own operational funds. This segregation makes certain that client deposits are protected even if the broker goes bust.

Capital.com’s combination of Tier-1 regulatory oversight, enforced fund segregation, mandatory negative balance protection, and its commitment to compliance should provide you with a high standard of client protection.

Regulation and other security measures

Capital.com supports its regulatory strength with a firm commitment to platform and data security. First, the broker makes a point to protect your money with in-app tools that close your positions automatically.

In addition to this, the broker can claim that your account will always have:

International security standards like ISO 27001 and PCI DSS

Protection against cyber threats by market-leading security solutions

A dedicated, expert team of highly trained professionals, subject to a rigorous permissions system

Risk management tools like guaranteed stop-loss

Encrypted Internet Protocol Security Virtual Private Network (IPSec VPN)

Domain-based Message Authentication, Reporting & Conformance (DMARC) email authentication

In my view, the combination of safeguards means that your funds are likely to be kept safe.

Top broker features

There are many reasons to consider Capital.com as your trading partner. Here are some of the highlights:

Strong regulation: Capital.com is licensed by multiple Tier-1 and Tier-2 regulators, including the FCA, CySEC, ASIC, and SCA, which means it is much more likely to have strong oversight and client protections.

Commission-free trading: FOREX, stocks, indices, commodities, and crypto* are available to trade with zero commissions.

Powerful trading platforms: Traders can use Capital.com’s proprietary web and mobile platforms, MT4, or connect directly via TradingView for an advanced experience.

Negative balance protection: It is automatic, meaning your account can never go into the negative.

Rich educational ecosystem: The Capital.com mobile app offers a full learning hub, including videos, quizzes, and written guides.

No deposit, withdrawal, or inactivity fees: Funding and withdrawing from your account is free of charge, and you won’t get inactivity penalties either.

User-friendly mobile experience: Capital.com’s mobile app is one of the highest-rated in the industry.

For Whom Is Capital.com Recommended?

Capital.com is a strong choice for a wide range of traders, from complete beginners to more experienced CFD traders looking for competitive pricing and flexible platform options.

New traders will appreciate the low $20 minimum deposit, commission-free trading across all instruments, and the intuitive Capital.com web and mobile platforms. Negative balance protection is also a great safety net for those just starting out.

Active traders and scalpers will benefit from Capital.com’s tight spreads, fast order execution, and access to advanced charting tools through TradingView and MT4 integrations. The broker’s proprietary news and analysis tools can help short-term traders stay on top of evolving market opportunities.

More experienced traders looking for platform flexibility, strong mobile functionality, and broad asset class coverage will find Capital.com highly competitive, especially given its no-fee approach to deposits, withdrawals, and inactivity.

That said, because Capital.com only offers CFD products and not real stock or ETF ownership, it is best suited for traders who are comfortable speculating on price movements rather than those looking for long-term asset investment.

Here are the pros and cons I discovered when using this broker:

-

Regulated by multiple Tier-1 and Tier-2 authorities

-

14,000+ Trustpilot user reviews showing strong trust and a large user base

-

Low minimum deposit requirement of just $20 by card

-

Commission-free trading across all asset classes

-

Negative balance protection for all retail clients

-

Wide range of over 4,500 CFDs across various asset classes

-

Powerful proprietary web and mobile platforms

-

Access to MT4 and direct TradingView integration

-

Award-winning educational mobile app with videos, courses, and quizzes

-

No deposit, withdrawal, or inactivity fees, though some charges may apply

-

Competitive spreads starting from 0.6 pips on major FOREX pairs

-

Only CFD trading is available, no access to real stock or ETF ownership

-

No support for MT5 or cTrader platforms

-

Some major asset classes, like bonds and options, are not available

FCA, CySEC, ASIC, SCA, SCB

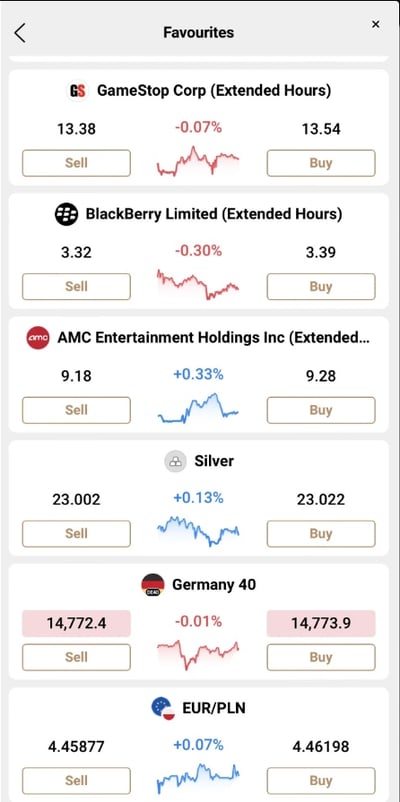

Offering of Investments

Capital.com offers a wide range of over 138 FOREX pairs, 2,400 stock CFDs, 20+ index CFDs, and 22+ commodity CFDs, with competitive spreads starting from 0.6 pips on major currency pairs and 1.0 point on indices. Traders also have access to over 90 cryptocurrency CFDs*, although retail clients in the U.K. are restricted from trading crypto derivatives*, and all trading is conducted via CFDs without owning underlying assets.

Here’s a breakdown of the financial assets offered by Capital.com:

FOREX CFDs

Capital.com offers access to over 138 FOREX pairs, covering a broad mix of major, minor, and exotic currencies. Traders benefit from competitive spreads starting as low as 0.6 pips on major pairs like EUR/USD, with retail leverage capped at 30:1 in Tier-1 jurisdictions.

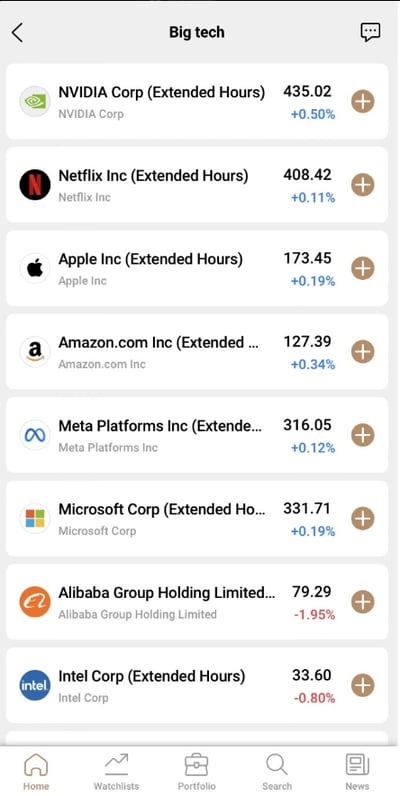

Stock CFDs

Capital.com offers a large selection of 2,400+ stock CFDs, including U.S., European, and Asian equities. You can trade major names like Apple, Tesla, and Alibaba with no commissions, as costs are fully integrated into the spreads. All stock trading is via CFDs, meaning you are speculating on price movements without owning the underlying shares.

Indices CFDs

The broker offers over 20 major global stock index CFDs. Trading conditions on indices are competitive, with spreads typically starting from 1.0 point depending on the instrument and market conditions.

Commodity CFDs

Capital.com offers over 22 commodity CFDs, covering popular metals like gold and silver, energy products like crude oil and natural gas, and agricultural commodities such as wheat and coffee.

cryptocurrency CFDs

Capital.com supports a broad range of crypto CFDs*, offering access to over 90 crypto* markets, including Bitcoin, Ethereum, Litecoin, and altcoin crosses. Like other asset classes, crypto* trading is commission-free, with costs embedded into the spread. Crypto CFDs* are not available to retail clients in the U.K. due to FCA regulations.

ETFs and Bonds

Capital.com does not currently offer direct ETF or bond CFD trading. The broker’s product suite is fully focused on CFDs across major asset classes, geared toward active traders rather than long-term investors.

Available assets

| Markets | Available | Number of Assets |

| Currency Pairs | 128 | |

| Stocks | 2400 | |

| Commodities | 62 | |

| Crypto | 174 | |

| Indices | 42 | |

| ETFs | 300 |

Account Types

Capital.com offers a slimline account structure with a single Standard account for retail traders, featuring a low $20 minimum deposit by card, commission-free trading, and spreads starting from 0.6 pips on major FOREX pairs. The broker also offers a professional account for qualifying traders in selected locations.

Capital.com keeps its account structure streamlined while offering enough flexibility to meet the needs of active traders. The broker focuses on simplicity and equal access, with all clients benefiting from the same competitive trading conditions regardless of deposit size. Just be aware that certain regional differences in account selection apply.

Standard account:

The broker operates a single standard account type for all retail traders. With a low minimum deposit of just $20 by card, this account offers commission-free trading across all asset classes, with spreads starting from 0.6 pips on major FOREX pairs.

What you’ll get with this account is instant execution, full access to the Capital.com web and mobile platforms, MT4, and TradingView integration.

Professional account:

For traders who meet professional client criteria under FCA, CySEC, or ASIC regulations, Capital.com offers a professional account, just not in the CCMENA region.

Professional accounts waive key retail protections like negative balance protection and investor compensation schemes, so eligibility requires careful consideration.

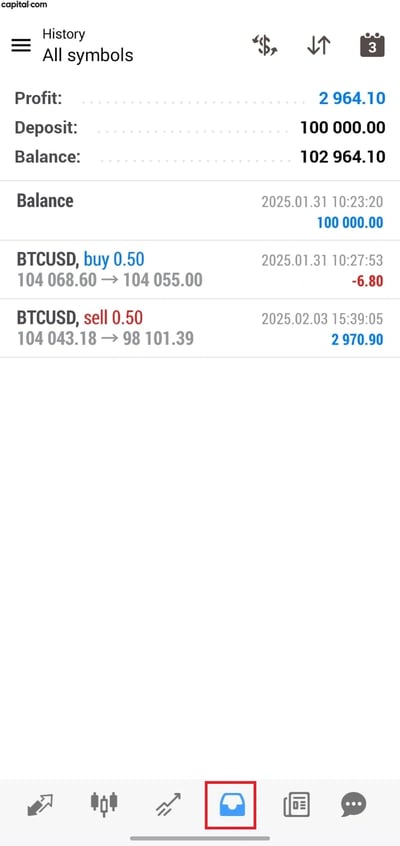

Demo account:

Capital.com provides an unlimited free demo account preloaded with virtual funds. It’s ideal for beginners wanting to practice trading strategies or experienced traders looking to explore the platform’s features without financial risk.

Islamic (Swap-free) account:

Swap-free, or Islamic accounts, are available on request in the CCMENA region for traders who need to comply with Sharia law. These accounts remove overnight swap fees, replacing them with fixed administrative charges where applicable, and are available across all standard instruments.

| Account Type | Minimum Deposit | Spread Commission | Commission | Swap Commission | Deposit Commission | Withdrawal Commission |

|---|---|---|---|---|---|---|

| CFD Trading | $20 | Starting from 0.6 Pips | $0 | No | $0 | $0 |

| 1X | $20 | Starting from 0.6 Pips | $0 | Yes | $0 | $0 |

Account opening

Opening an account with Capital.com was relatively painless. After I provided all my documents, the review process saw my account opened in just over a business day.

What is the minimum deposit at Capital.com?

As mentioned, Capital.com has an attainable minimum deposit requirement of just $20 by card for most funding methods. This makes it a great choice for beginners and casual traders who want to start small.

How to open your account

To open an account, it’s as easy as clicking “Open Account” on the Capital.com website or mobile app. You’ll need to provide such regular information as your email address, create a password, and select your country of residence.

To complete the setup, you’ll typically upload proof of identity (like a passport or driver’s license) and proof of address (such as a utility bill or bank statement). Once verified, you can fund your account via bank transfer, debit/credit card, Apple Pay, Google Pay, or e-wallets like PayPal and Skrill. Just be aware that e-wallets are not available in all regions.

After funding, you can start trading straight away on Capital.com’s proprietary platform or MT4.

Deposits and Withdrawals

Capital.com offers a broad selection of deposit and withdrawal methods with no internal fees. Deposits via cards, e-wallets, and services like Apple Pay and PayPal are usually instant, while bank transfers can take up to five business days. Like deposits, withdrawals are also fee-free, typically processed within 24 hours for e-wallets and cards, and up to five business days for bank transfers.

Capital.com offers a wide range of deposit and withdrawal options designed for flexibility, speed, and cost-efficiency. Remember that while we do our best to report the broker’s latest fees, other fees may apply.

Account base currencies

The broker supports several base currencies, including USD, AED, EUR, GBP, PLN, and AUD, among others. While the list is not as impressive as some brokers, it covers the most commonly used global currencies and helps you cut down on currency conversion fees when matched to your local bank account.

Capital.com deposit fees and options

Capital.com does not charge any deposit fees. You can fund your account via a variety of methods, including bank transfers, debit/credit cards, Apple Pay, Google Pay, PayPal, Skrill, and Neteller. Just be aware that e-wallets are not available in the CCMENA region.

I found that deposits via cards and e-wallets usually occurred instantly. If you need fast access to your trading capital, you should note that bank transfers may take anywhere from one to five business days, depending on the provider. All deposit methods must be linked to accounts registered in the same name as the Capital.com trading account holder.

Capital.com withdrawal fees and options

Withdrawals at Capital.com are also free, with no internal withdrawal fees applied. You’ll be glad to know you can withdraw funds using the same methods as for deposits, subject to regional availability.

Most withdrawals to e-wallets and cards are processed within 24 hours, while bank transfers can take up to five business days.

| Method | Credit Card | Wire Transfer | Skrill | Neteller | Cryptocurrency | PayPal | Apple Pay |

| Deposit fee | $0 | $0 | Unavailable | Unavailable | Unavailable | Unavailable | $0 |

| Deposit fee | $0 | $0 | Unavailable | Unavailable | Unavailable | Unavailable | $0 |

Customer Service

Capital.com offers round-the-clock customer support through live chat, email, and phone in more than 15 languages. The support team is known for being knowledgeable and efficient, enhancing the overall user experience.

Capital.com offers responsive, multilingual customer support designed to provide fast, helpful assistance to traders like you. I found the live chat (available directly on the Capital.com website and mobile app) to be highly responsive, and I was routed to support agents ready to answer questions on account setup, platform navigation, deposits and withdrawals, and trading.

There are other ways to reach the broker: you can contact the support team via email and, in some regions, by phone. Support is available in over 15 languages, meaning that most clients in its global client base will feel comfortable.

| Live Chat | Phone | |||

| Available | Available | Available | Available | Unavailable |

| Quick response | Moderate | Available | Moderate | Unavailable |

Commissions and Fees

Capital.com operates on a fully commission-free model, with competitive spreads starting from 0.6 pips on major FOREX pairs and no trading commissions across FOREX, stocks, indices, commodities, or cryptocurrencies*. Islamic trading is allowed. Capital.com also charges no deposit, withdrawal, inactivity, account maintenance, or platform subscription fees, making it a flexible option for a wide range of traders.

Here’s a breakdown of Capital.com’s spreads, commissions, swap fees, and other charges, bearing in mind that other unreported fees may apply.

Spreads

Capital.com operates on a 100% commission-free model. All trading costs are built into the spread. That said, the broker’s spreads are competitive, starting from as low as 0.6 pips on major FOREX pairs like EUR/USD.

Commissions

Capital.com does not charge any trading commissions on any asset class. Regardless of whether you trade FOREX, stock CFDs, commodities, indices, or crypto CFDs*, you pay only the spread.

Swap fees and Islamic accounts

This broker accommodates Islamic trading in the CCMENA region. Overnight swap fees typically apply to positions held open beyond the close of trading. However, for traders who require swap-free accounts in compliance with Sharia law, Capital.com offers Islamic accounts that remove swap charges and replace them with fixed administrative fees.

Inactivity fee

I was pleased to discover that Capital.com does not charge any inactivity fees. Traders who leave their accounts dormant for extended periods won’t face any penalties, making it a flexible choice for casual or part-time traders.

Other commissions and fees

There are no deposit or withdrawal fees at Capital.com. Funding and withdrawing via cards, bank transfers, and e-wallets like PayPal and Skrill are all free, although e-wallets are not available in CCMENA. Thankfully, there are also no account maintenance or platform subscription fees, helping ensure that trading costs remain transparent and predictable.

| Spread | Commission | Swap | Islamic Account | |

| Currencies | Starting from 0.6 Pips | $0 | No | Available |

| Stocks | Not Mentioned | $0 | Yes | Unavailable |

| Commodities | Starting from 0.25Pips | $0 | Yes | Available |

| Indices | Starting from 0.25 Pips | $0 | Yes | Unavailable |

Platforms and Tools

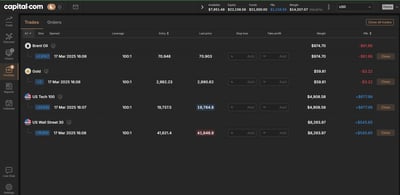

Capital.com delivers a great trading experience through its proprietary web and mobile platforms, offering over 75 technical indicators, TradingView-powered charts, curated newsfeeds, and built-in risk management tools across more than 4,500 markets. For traders who prefer more established options, Capital.com also supports MT4 with customizable multi-window layouts, algorithmic trading capabilities, and premium TradingView integration.

Here is an overview of the Capital.com desktop and web trading platforms in terms of key usability features:

Platforms

Capital.com offers its own proprietary web and mobile platforms, designed to deliver a seamless trading experience with powerful and bespoke features. The web platform includes over 75 technical indicators, TradingView-powered charts, built-in risk management tools, and curated newsfeeds.

If you prefer to work with industry-standard platforms, Capital.com also supports MT4, offering access to advanced charting, algorithmic trading capabilities, and customizable multi-window layouts. You will also get access to TradingView integration, allowing you to use TradingView's premium charting tools while executing trades through Capital.com.

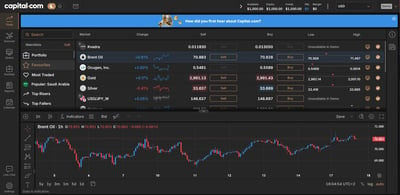

Look and feel

Both the Capital.com web platform and MT4 provide clean, user-friendly interfaces. The proprietary platform has been designed with beginners in mind, offering easy navigation among watchlists, charts, and trading tools.

You can easily customize layouts and switch between dark and light modes, though some advanced users may find customization on the Capital.com platform slightly more limited compared to full MetaTrader environments, which, as we know, are much more mature.

Login and security

I felt reassured that Capital.com’s platforms offer two-step authentication (2FA) for an added layer of login security. One small drawback, though, is that biometric login options like Face ID or fingerprint scanning are not yet available across the web or mobile apps.

Search functions

The search functionality on Capital.com does a good job of helping you find what you need without too much fuss. You can search by instrument name, asset type, or sector categories, making it easy and straightforward to find tradeable assets across more than 4,500 markets.

Placing orders

All major order types are supported, including market, limit, stop-loss, and take-profit orders. Time-in-force options like Good ‘til Canceled (GTC) are available, although you should know that trailing stops are only available on the MT4 platform and not yet native to Capital.com’s proprietary platform.

Alerts and notifications

Capital.com’s proprietary platform allows you to set price alerts, and notifications can be delivered via app push alerts or email. Traders on MT4 can also configure customized alerts within the platform settings, providing flexibility for regular

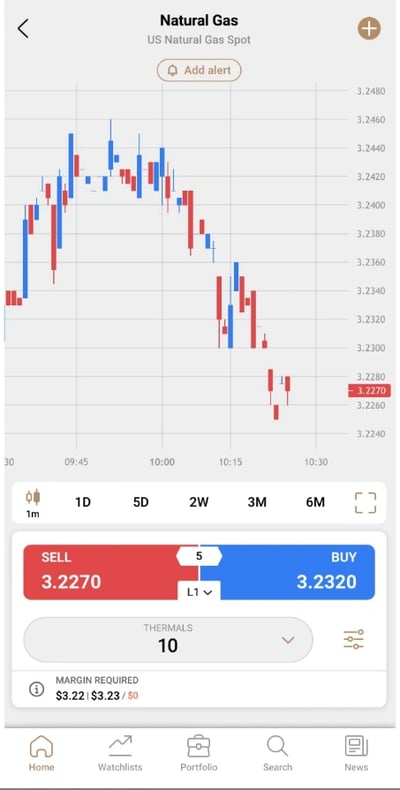

Mobile Trading

Capital.com’s mobile app, available on iOS and Android, gives you a very similar experience to the web platform with over 75 technical indicators, TradingView-powered charting, and strong risk management tools. Mobile traders who need their fix of MT4 mobile and its algorithmic capabilities are also catered to.

Many traders enjoy the Capital.com mobile trading experience, and it is easy to see why. The broker’s proprietary app offers a high level of ease of use, strong charting features, and fast, responsive trade execution. Here’s how Capital.com performs across other essential metrics:

Platforms

Capital.com offers its proprietary mobile app, available for both iOS and Android devices. Using the app is just like using the web interface, and you can make the most of more than 75 indicators for technical analysis and the always-excellent TradingView charts.

If you prefer the MT4 mobile app, it is also fully supported, so you can access professional-level technical analysis, pending orders, and algorithmic trading options.

Look and feel

The Capital.com mobile app has a visually pleasing design. During my testing, I found it easy to navigate among watchlists, charts, and trade-execution panels. The broker’s international client base will be happy to find that the app is localized in more than 20 languages, making it accessible to most clients.

Login and security

Capital.com’s mobile app supports 2FA for enhanced login security.

Search functions

The search function on the Capital.com app is efficient and easy to use. You can search directly by instrument name or browse categories like FOREX, stocks, indices, commodities, and crypto CFDs*.

Placing orders

All major order types are supported on the mobile app, including:

Market orders

Limit orders

Stop orders

GTC time-in-force options.

However, you should know that trailing stops are not supported within the proprietary mobile platform, so you will have to find them on the MT4 app.

Alerts and notifications

With the Capital.com mobile app, you can set native price alerts, with notifications sent via push alerts or email. This functionality helps traders stay informed about key market movements as often as needed.

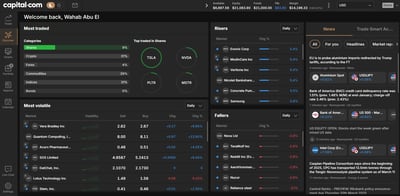

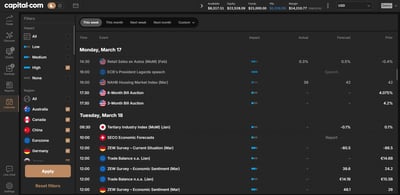

Research and Development

I was impressed with Capital.com’s strong research and analysis suite aimed at keeping traders informed and enhancing decision-making across its platforms. All clients have access to TradingView-powered charts directly within the Capital.com platform, offering more than 75 technical indicators, multiple chart types, drawing tools, and advanced timeframes for detailed technical analysis.

Market news offers news articles, analyst insights, and educational content to each trader’s behavior and interests.

An integrated economic calendar is available within the Capital.com web and mobile platforms, providing real-time updates on upcoming macroeconomic data releases, categorized by expected market impact. Historical data can also be reviewed to better plan trading strategies around major economic events.

While Capital.com’s research offering is modern and easy to use, it focuses more on real-time news curation and technical charting rather than offering deep in-house analysis or proprietary trading signals, as do some competitors.

Trading statistics

Capital.com provides a suite of trading tools designed to support better pre-trade planning, smarter risk management, and ongoing trading transparency. One highlight is the built-in trading calculators available on the platform, including margin requirement, profit/loss projections, and pip value calculators. These tools help traders clearly assess potential costs and outcomes before opening a position, making them valuable for disciplined and strategic trading.

For deeper market insight, the broker offers access to detailed market data, including real-time spread information and daily trading volume statistics across major instruments. This helps traders better understand how market conditions may affect execution costs and liquidity.

Through its TradingView integration, Capital.com significantly enhances charting transparency, offering real-time price overlays, volatility metrics, and access to TradingView’s social idea-sharing community.

Trading signals

One slight disappointment was that the broker does not provide traditional trading signals in the form of automated trade recommendations. Instead, traders benefit from news alerts, real-time technical indicator analysis via TradingView, and personalized market updates tailored to individual trading behavior.

Through TradingView integration, traders can access a broad library of community-shared trading ideas and technical setups, offering a form of social-sourced trading signals. Additionally, Capital.com’s platform features suggestive educational pop-ups and technical event alerts that highlight key price movements, trend shifts, and potential breakout patterns across major assets.

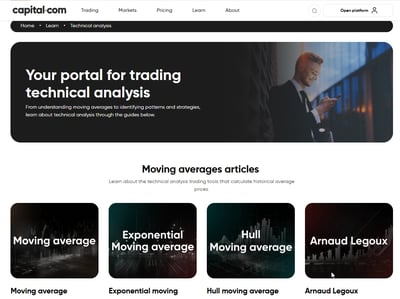

Education

Capital.com offers an extensive and award-winning educational suite aimed primarily at beginner and intermediate traders, although highly advanced trading content is more limited. Educational materials are available through the Capital.com Learn Hub and mobile app, covering essential topics such as trading fundamentals, technical analysis, risk management, and financial market basics.

The platform's text-based lessons are well-organized into progressive courses. Capital.com’s mobile app also includes interactive learning tools, quizzes, and glossary features, making it easy for users to test their knowledge on the go.

While Capital.com’s educational content is thorough for beginners and intermediate traders, it does not yet offer specialist modules on algorithmic trading, advanced strategy-building, or trading certifications, as some premium competitors do.

Capital.com offers a comprehensive CFD trading environment spanning FOREX, stocks, indices, commodities, and cryptocurrencies*. The broker distinguishes itself with its commission-free pricing model, tight spreads starting from 0.6 pips, and a powerful platform lineup that includes Capital.com’s proprietary web and mobile apps, MT4, and TradingView integration.

Final Thoughts

Capital.com is a globally regulated broker that stands out for its strong regulatory footprint, low $20 minimum deposit by card, and a commission-free trading model that appeals to both new and experienced traders. With access to over 4,500 CFDs across FOREX, stocks, indices, commodities, and cryptocurrencies*, Capital.com provides a flexible and cost-efficient trading environment.

FOREX traders benefit from tight spreads starting at 0.6 pips, no trading commissions, and access to advanced platforms like Capital.com’s proprietary web and mobile apps, MT4, and direct TradingView integration.

Conclusion

My recommendation is to give this broker a try, as it is a globally recognized CFD broker that has rapidly built a strong reputation for regulatory security, transparent pricing, and client-focused technology. Since its launch in 2016, Capital.com has grown to deal in billions of dollars worth of trades, offering access to more than 4,500 CFDs across FOREX, stocks, indices, commodities, and cryptocurrencies* through its proprietary platform, MT4, and direct TradingView integration.

The broker distinguishes itself with commission-free trading, tight spreads, an award-winning educational app, and research tools, making it highly attractive to beginners and intermediate traders. Its strong regulatory framework ensures client fund safety and operational transparency.

As part of my research, I should point out that there are some trade-offs. Capital.com offers CFD trading only; there is no access to real stock or ETF ownership, and traders seeking highly advanced portfolio analytics or direct social trading features might find its offering somewhat limited compared to a few larger competitors.

* Crypto Derivatives are not available to Retail clients registered with Capital Com (UK) Ltd.

Review Methodology

The team at Arincen collected more than 120 pieces of data covering in excess of 100 licensed FOREX companies. Data collection was done in three ways:

Companies’ websites.

Other websites that have ranked FOREX companies.

A survey questionnaire (referred to here as Survey “1”) we had sent to the companies invited to participate in the exercise.

We have identified 12 criteria for our assessment, each containing several aspects and carrying its own relative weight. These include licensing, deposits and withdrawals, number of assets etc.

Afterward, we validated the data by:

Registering with FOREX companies as a secret shopper and/or as Arincen.

Survey number “2,” in which we asked these companies’ customers for important feedback and past experience.

The next step saw us evaluate and rank each company, relying on the hard work of 15 Arincen employees. We were very careful in ensuring the most accurate assessment possible, including taking into account different languages, as well as the various mobile-app operating systems, e.g., Apple, Samsung etc.

To add credibility to our research project, we sent a final and third survey (referred to here as Survey “3”) to enable participating FOREX companies evaluate our own research and whether it accurately reflects the realities on the ground. We were fortunate enough to receive a mark of 9.9 out of 10! We have kept to a minimum the margin of error, which stood at a measly 1%. To learn more on how we came up with the evaluation, please click here.

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

FAQ

Yes, Capital.com is regulated by multiple respected authorities. It follows strict fund segregation rules and provides negative balance protection for all retail clients.

The minimum deposit at Capital.com is just $20 by card for most payment methods, making it highly accessible for beginners.

Capital.com offers its proprietary web and mobile trading platforms, as well as support for MT4 and direct TradingView integration for more advanced charting and trading features.

You can trade over 4,500 CFDs across FOREX pairs, stocks, indices, commodities, and cryptocurrencies*. However, real ownership of stocks or ETFs is not available; only CFD trading is.

No, Capital.com offers commission-free trading across all asset classes. All trading costs are built into tight spreads, and there are no deposit, withdrawal, or inactivity fees.

Yes, Capital.com offers free, unlimited demo accounts preloaded with virtual funds.

Yes, swap-free (Islamic) accounts are available on request for eligible clients in the CCMENA region, ensuring compliance with Sharia law by eliminating overnight interest charges.

Yes, the Capital.com mobile app allows you to set price alerts and receive push or email notifications, helping you stay on top of market movements without having to constantly monitor your screen.