ThinkMarkets Review 2026

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

ThinkMarkets Evaluate - research result

Key Takeaways

ThinkMarkets is a well-regulated global online broker founded in 2010.

The broker is an emerging company with a growing presence that serves clients from 165 countries.

ThinkMarkets can cater just as easily to beginners as it can to advanced high-volume traders through its fast and dynamic executions.

ThinkMarkets offers 24/7 customer support in several languages.

ThinkMarkets is subject to stringent regulations in its home bases of London and Melbourne. The UK’s Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC), respectively, ensure that funds are used prudently.

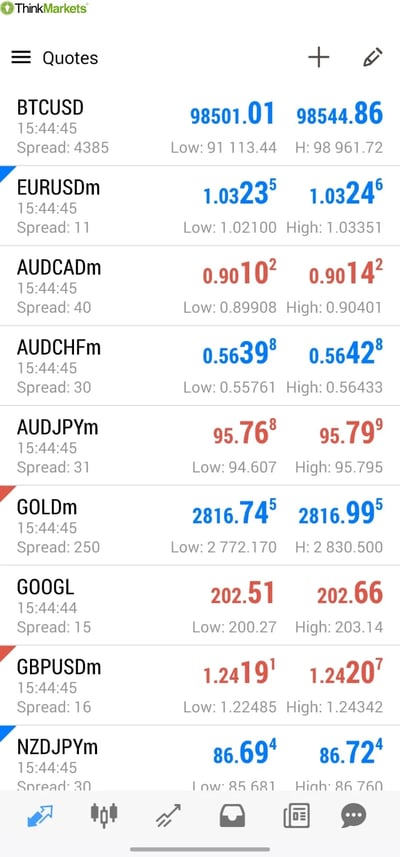

Traders can access a wide choice of products, with a variety of currency pairs, cryptocurrencies, stocks, as well as commodities like gold

ThinkMarkets provides traders with several ways to make deposits into their trading accounts. These can involve bank transfers, cards, as well as e-money transfer services.

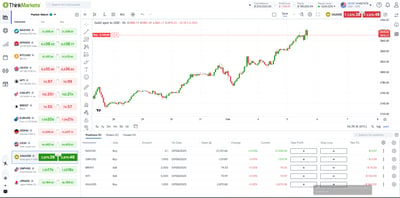

ThinkMarkets makes use of popular third-party trading platforms MetaTrader4 and MetaTrader5. It also uses its in-house product, ThinkTrader.

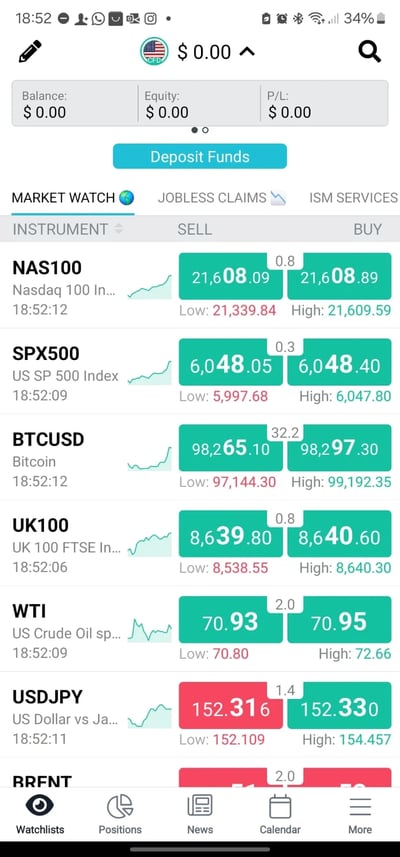

ThinkMarkets’s full-service mobile app, ThinkTrader, is available for download on iOS and Android devices.

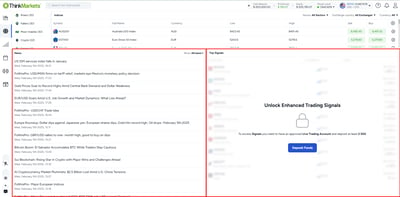

ThinkMarkets has a range of authoritative research tools that help traders stay in tune with global markets.

ThinkMarkets offers helpful beginner support through round-the-clock channels via live chat, email form, or direct phone.

Last Reviews

Overall Summary

ThinkMarkets is an emerging online trader founded in New Zealand in 2010 and moved to Australia two years later. It is a multi-regulated broker with offices around the globe, including Australia, Asia, Japan, Europe, UK, UAE, South Africa, and clients in more than 165 countries.

ThinkMarkets is primarily a Contracts for Difference (CFD) broker, meaning that you do not get to own the underlying assets in which you invest, but you merely hedge your bets on the performance of those assets.

You can trade across 4,000 instruments in FOREX, futures, commodities, indices, ETFs, crypto, and stocks. With an emphasis on superior customer service, ThinkMarkets maintains ruound-the-clock support in several languages. It provides different trading accounts suited to individual trader needs. This includes zero-commission accounts and access to trading guides, analysis tools, and industry news feeds.

ThinkMarkets won awards in such areas as “Best FOREX Trading Experience” and “Best FOREX Trading Innovation” at the UK FOREX Awards. With its headquarters in London and Melbourne, both of which have strongly regulated financial environments, ThinkMarkets is regulated by the FCA in the UK and the ASIC in Australia.

Is ThinkMarkets Safe?

ThinkMarkets is considered safe. The broker also has a verifiable track record of success and has gone the extra mile with regard to safety, as it segregates your trading funds with tier-1 banks and offers compensation to eligible traders, to mention just two security measures.

ThinkMarkets is safe mainly because two of the most stringent regulatory entities in the world: the UK’s FCA and the ASIC in Australia, regulate it. This means it must keep client funds in segregated accounts with premier banks. Traders can enjoy the supreme peace of mind that their funds are safe and will be used diligently.

The UK’s Financial Services Compensation Scheme (FSCS) also covers ThinkMarkets. The FSCS guarantees clients a maximum payment of £85,000 should an online broker become insolvent. If a client complaint exceeds this threshold, ThinkMarkets has also taken out investor protection and compensation rights of up to £1 million through an insurance policy with Lloyd’s of London.

How ThinkMarkets Protects You from Reckless Leverage and Margin Trading

Leverage and margin are two tools in the trader’s arsenal that, if misused, can lead to heavy losses for the trader. Many irresponsible brokers offer high leverage that can ruin uninformed traders. As with many of the best brokers, margin levels vary depending on the trader, the trading account, and the instruments being traded.

The maximum trading leverage while using ThinkMarkets depends on the jurisdiction under which the account operates. For UK-registered accounts, FCA rules tightly control leverage and caps it at 30:1. However, traders in selected jurisdictions can go as high as 500:1 on FOREX instruments.

ThinkMarkets has a deep resource of trading information that is available to anyone interested in learning. Its detailed and up-to-date educational resources come as webinars or online tutorials for traders of any level.

How you are protected

ThinkMarkets walks the talk when it comes to the security of client funds. Here are some of the primary measures the broker takes to protect your funds and information:

Segregated funds: your capital is segregated from the company’s funds and is never used for the company’s business interests.

Top-tier banks: the broker only partners with top-tier, low-credit-risk banks to ensure clients’ funds are protected.

Capital adequacy: ThinkMarkets maintains sufficient liquid capital to safeguard clients’ funds and assets.

Security of funds: the broker is licensed by multiple financial regulatory bodies worldwide. This oversight means that it sticks to strict guidelines to protect our clients and their funds.

Security of accounts: The broker offers a range of measures to detect and prevent potential security breaches.

Two-factor authentication: ThinkMarkets promotes using 2FA – a security enhancement feature to improve your account’s protection against unauthorized access.

One-time password verification: using an OTP gives you the chance to verify the agent contacting you by phone as an additional measure to prevent clients from being contacted by fraudsters.

Risk awareness and education: ThinkMarkets encourages responsible trading, ensuring all its clients are informed and educated about potential risks a trading activity may involve.

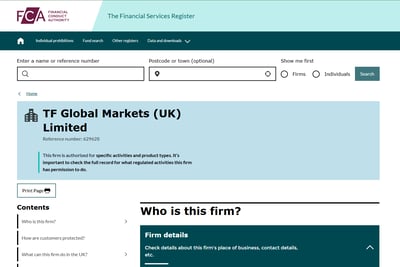

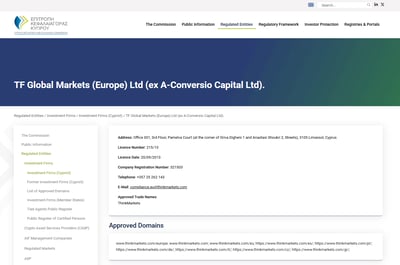

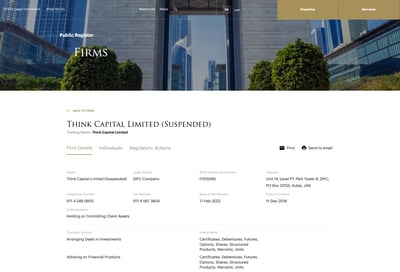

Regulation and other security measures

ThinkMarkets is a safe broker that provides a wide range of protections for its clients. Here is the broker’s regulation and licensing information:

Licensed by the Dubai Financial Services Authority (DFSA)

Regulated by the New Zealand Financial Markets Authority (NZFMA)

Regulated by the Cyprus Securities and Exchange Commission (CySEC)

Licensed in South Africa by the Financial Sector Conduct Authority (FSCA)

Regulated under the Financial Conduct Authority (FCA) in the UK

Regulated under the Australian Securities and Investments Commission (ASIC)

Other regulators the broker complies with include the JFSA, CIMA, FSA, FSC, and NZFMA. Unfortunately, scam activity is a reality in retail trading, so it’s always sound advice to work with a regulated broker. In totality, ThinkMarkets shows a high degree of dedication to being regulated by some of the strictest regulators in the business.

Top broker features

Ultra-tight spreads

Dynamic leverage up to 500:1 and as much as 500:1 in some areas

Deep liquidity for large order sizes

Fast & reliable execution through Equinix data centers

Multiple funding options

Round-the-clock award-winning support

For Whom Is ThinkMarkets Recommended?

ThinkMarkets can cater just as easily to beginners as it can to advanced high-volume traders. Having fostered a fast and dynamic trading environment, ThinkMarkets traders can enjoy the benefits of rapid order execution, intuitive platforms, competitive fees, and a range of instruments to trade. You should be aware that the broker does not serve the United States, Canada, Russia, and Japan.

-

Beginner assistance is offered through round-the-clock channels.

-

Spreads are as low as 0.0 pips.

-

Round-the-clock expert customer service.

-

CFD shares and indices come at no extra fee.

-

Zero broker fees for FOREX trading.

-

Technical analysis and quality market information.

-

No binary options are offered.

-

Commissions are charged for two account types.

-

Range of tradeable assets is not as wide as some competitors.

-

No US clients allowed.

Offering of Investments

ThinkMarkets is recognized as a broker offering diverse financial instruments to accommodate various trading preferences. You can expect ready access to FOREX, futures, indices, commodities, crypto, stocks, and ETFs. As far as indices, you will get access to 18 global bourses, while fill rates are consistently as high as 99.9%.

ThinkMarkets traders can choose from an array of markets by way of CFD trading. Here are the major investments you can access through this broker:

FOREX

With ThinkMarkets, you can trade FOREX with spreads as low as 0 pips, leverage of up to 500:1, and even 500:1 in some areas, and fast execution with 99.9% fill rates. The broker promises rapid execution, with 95% of orders completed in under 0.2 seconds.

Popular currency pairs include AUDUSD, EURUSD, GBPUSD, USDCAD, USDJPY, and XAUUSD. With over $7.5 trillion traded daily, the FOREX market is the world’s most liquid and volatile market. The broker offers you deep liquidity, with which you can trade the upward and downward price movements of currencies by going long or short.

With an emphasis on easy access, you can open positions in full, mini, and micro-lots, meaning you can trade even with a small amount of capital.

Indices

You can trade a wide range of global indices from the US, UK, Europe, Asia, Australia, and more with spreads from 0.4 points, leverage of up to 200:1, and fast and reliable execution. Access competitive spreads as low as 0.4 points on SPX500, 0.6 on GER40, and 1.2 on AUS200. With flexible contract sizes, you can open a position on indices with a minimum trade size of just 0.1.

ThinkMarkets provides access to 18 of the largest and most popular global indices. You can trade major world stock market indices without having to buy the underlying asset. The wide variety of stocks in an index provides traders with greater exposure than any other financial market and is an excellent source of diversification.

Popular indices to trade include AUS200, BetaShares Australia 200 ETF, French CAC 40 Index, Euro Stoxx 50 Index, SPX500, Dow Jones Industrial Average, Nasdaq 100 Index, and many more.

Commodities

Trade CFDs on a wide range of commodities, including Gold, Silver, WTI, BRENT, NGAS, and more, with tight spreads, no commission, instant execution, and access to leverage of up to 400:1.

Benefit from tight spreads from as low as $0.02 on WTI and BRENT. Choose a contract size that meets your trading needs, starting from just 0.01. Go long or short on all the commodities offered.

Cryptocurrencies

With this broker, you can trade on up or down swings on a wide range of crypto CFDs and benefit from zero commission, instant execution and leverage of up to 50:1. Lower your transaction costs with commission-free cryptocurrency trading.

You can get ultra fast execution with 99.9% fill rates and no manual intervention. The broker also allows you to open trades quickly without the need or risks of managing your own digital wallet. Popular crypto to trade include Bitcoin, Binance Coin, Dogecoin, Polkadot, Ethereum, Shiba Inu Coin, and many more.

CFD Stocks

Trade CFDs on a wide range of popular stocks from around the world, including the US, Europe, Asia, and Africa. ThinkMarkets gives you access to accounts with zero commission. You can also get fractional trading and access to leverage of up to 10:1.

Open short positions on stocks without incurring borrowing fees. You can trade a wide range of global stocks and limit your risk exposure to one economy. Due to the volatility of markets, you can make the most of potential trading opportunities. Although you won’t own the underlying stocks, with ThinkMarkets, you can still make informed bets on the performance of well-known stocks like Alphabet, Tesla Motors, Microsoft, Amazon, Airbnb, Nvidia, and many more.

ETFs

Access a large range of popular ETF CFDs from around the world, including the US, Australia, and Africa, with no commission, fractional trading, and access to leverage up to 10:1. As evidence of its dependable platforms, and you can make the most of the 99.87% uptime on the ThinkTrader platform.

Build a diversified portfolio across many different sectors and countries with 300+ ETFs. The broker operates a no-dealing desk, meaning your orders are executed automatically with no manual intervention. ETFs are great for traders who want to gain exposure to a wide range of assets and speculate on their price fluctuations.

Available assets

| Markets | Available | Number of Assets |

| Currency Pairs | 43 | |

| Stocks | 2985 | |

| Commodities | 12 | |

| Crypto | 21 | |

| Indices | 15 | |

| ETFs | 325 |

Account Types

ThinkMarkets offers access to MetaTrader products as well as the broker’s proprietary platform, known as ThinkTrader and ThinkZero. Access as many as 350 assets on MT4 and 1,800 assets on MT5 across FOREX, commodities, indices, crypto, stocks, ETFs, and futures

ThinkMarkets offers its clients the option of three comprehensive accounts:

Standard Account:

This is the broker’s most popular trading account, with zero commission and tight spreads across several markets. With this account, traders can select FOREX spreads from 0 pips. They can also select CFDs from 0.4 points. No commission is charged, and there is a minimum deposit of $50.

Lot sizes can range from 1.0 to 100k. Traders will get access to a maximum leverage of 500:1 if the account is not based in Europe. Clients can choose whether to use ThinkTrader, MT4, or MT5 as their preferred trading platform. ThinkMarkets also allows traders to combine these platforms for different accounts.

ThinkTrader:

This is another one of the broker’s most popular trading accounts, where you can trade up to 4,000 instruments across seven global markets. The minimum deposit is $250, and the maximum leverage is 500:1. Spreads start from 0.4 pips, and base currencies include USD, AUD, GBP, EUR, NZD, SGD, CHF

ThinkZero Account:

Traders can upgrade their trading to marginal spreads that start from zero, combined with tight commissions. Raw FOREX spreads start from 0 pips. The account requires a minimum of $500 deposit upon opening. Access as many as 350 assets on MT4 and 1,800 assets on MT5 across FOREX, commodities, indices, crypto, stocks, ETFs, and futures.

Base currencies include USD, AUD, GBP, EUR, SGD, and CHF. This account offers swap-free trading and has been designed specifically for our traders of religious faith who can open an Islamic Sharia-compliant account. An interesting feature of this account is that you can share your trading account with a family member or a friend you can trust. Available only on request.

| Account Type | Minimum Deposit | Spread Commission | Commission | Swap Commission | Deposit Commission | Withdrawal Commission |

|---|---|---|---|---|---|---|

| Think Trader account | $50 | Starting from 0.4 pip | $0 | $0 | $0 | $0 |

| Standard account | $50 | Starting from 0.4 pip | $0 | $0 | $0 | $0 |

| ThinkZero account | $500 | Starting from 0.0 pip | $3.50 | $0 | $0 | $0 |

Account opening

Opening new accounts is through a four-step online application process. Account verification is mandatory to comply with regulator-mandated Anti-Money Laundering (AML)/Know Your Customer (KYC) requirements. Opening an account with ThinkMarkets is easy, as it is with most brokers these days. The process is entirely online, user-friendly, and can be completed on a phone, tablet, or computer.

What is the minimum deposit at ThinkMarkets?

The minimum deposit varies by account type and is $50 for the Standard account, $250 for the ThinkTrader account, and $500 for the ThinkZero account.

How to open your account

The ThinkMarkets review process is fully digital, easy, and fast. An account should be ready within one to two business days. To open an account at ThinkMarkets, follow these steps:

Sign up on ThinkPortal and choose your preferred account.

Fill out the application form.

Submit identification documents

Fund your account with at least $50 or the equivalent in your currency.

Begin trading from a wide range of instruments.

If you need any assistance during the account opening process, you can contact ThinkMarkets's customer support.

Deposits and Withdrawals

This broker offers a standard range of deposit and withdrawal options, allowing you to use the normal range of funding options, from bank cards to electronic wallets. Accounts can be opened in a wide range of currencies, including, but not limited to, USD, AUD, GBP, EUR, SGD, CHF.

ThinkMarkets Bank will only accept funds if they originate from an account or card belonging to the client. Still, the broker offers multiple ways to deposit and withdraw funds from your trading account. There are some intricacies you need to get to know.

ThinkMarkets accepts these deposit payment options:

Bank Wire.

Credit/Debit Card.

Neteller.

Skrill.

BitPay

INR

MPesa

You should know that your funds are safe and secure in segregated customer accounts. Deposit and withdraw seamlessly with zero fees on all funding methods.

Account base currencies

ThinkMarkets offers you a wide range of account base currencies, depending on where you live and where your account is based. Accounts can be opened in a wide range of currencies, including, but not limited to, USD, AUD, GBP, EUR, SGD, CHF.

In FOREX trading terminology, the “base” currency is always listed first in a FOREX pair, with the “quote” currency listed second. The base currency is always equal to one, while the quote currency represents the current price of the pair.

ThinkMarkets Deposit fees and options

Bank wire transfer takes 1-3 business days and costs $0. Supported currencies include AUD, EUR, CHF, GBP, and USD. If depositing crypto, you can deposit funds into your account using popular cryptocurrencies, typically processed within 4 hours.

Major debit and credit cards are also supported, and you can instantly fund your trading account in popular currencies such as AUD, EUR, CHF, GBP, and USD. The broker does not charge any fees for this method.

The broker also allows seamless transactions with Apple Pay and Google Pay. As far as digital wallets go, ThinkMarkets works with Neteller and Skrill. If you reside in India, you can use Indian Net Banking via Netbanking, a straightforward method for depositing funds in India. For Kenyan traders, you can use MPesa, a money transfer solution in Kenya.

Here are some important points you need to know about the broker’s deposit and withdrawal rules in general:

Third-party deposits and withdrawals are prohibited

Withdrawals are usually processed within 24 hours

Withdrawals via bank wire require 1 - 3 business days to complete

The broker does not typically charge any fees, but banks or intermediaries may

Trading profits or any account balance exceeding the initial deposit amounts will be processed, preferably via Bank Wire.

For detailed information on specific fees and any additional charges, it is recommended to check ThinkMarkets's official website or contact its customer support.

ThinkMarkets withdrawal fees and options

To withdraw money, traders must initiate a withdrawal by submitting a request through their trading account. For safety, ThinkMarkets monitors deposits and withdrawals to ensure that they are processed through the same channels. Third-party deposits and withdrawals are forbidden. Withdrawals are processed within 24 hours, but funds may reach the trader within one to seven business days, depending on the payment method.

E-wallet services like Skrill and Neteller can be used to make withdrawals. Skrill fees are 5.5%, while Neteller withdrawal fees are 0-7.5%. For detailed information on specific fees and any additional charges, we recommend that you check ThinkMarkets's official website or contact its customer support.

| Method | Credit Card | Wire Transfer | Skrill | Neteller | Cryptocurrency | PayPal |

| Deposit fee | $0 | $0 + Bank commission | $0 | 2.5% | Not mentioned | Unavailable |

| Withdrawal fee | $0 | $0 + Bank commission | $5.50 | 0-7.5% | Not mentioned | Unavailable |

Customer Support

ThinkMarkets offers comprehensive multilingual customer support to ensure a smooth experience for its clients. Support is available round-the-clock through various channels, including live chat, phone lines, and email. Users can also reach customer support through popular social media platforms such as Telegram, X, or Messenger.

ThinkMarkets offers expert, always-on customer service. Their multilingual support options include round-the-clock live chat, phone and email. Its live-chat responses are fast and informative. The broker also offers a comprehensive Help Centre on its website, providing answers to frequently asked questions and detailed guides on various topics.

For users of the ThinkTrader web platform, customer support can be contacted via telephone, email, and live chat. The phone number and email can be found in the Account Menu under the 'Contact Us' section, and live chat can be initiated from the icon at the bottom of the sidebar.

| Live Chat | Phone | |||

| Available | Available | Available | Available | Unavailable |

| Quick response | Moderate | Fast | Moderate | Unavailable |

Commissions and Fees

You can find good value from ThinkMarkets’s range of accounts. Be sure to check the contract specifications of your trade, as this could affect how attractive you think a deal is. Spreads start from 0 pips for currencies, while stocks attract a spread of 0.1%. For commodities, the spread starts from $0.19.

ThinkMarkets offers some attractive pricing options for FOREX spreads and fees. It does not charge any FOREX commission costs on the Standard Account option. The ThinkZero Account, however, attracts a fee of $7 per trade as it is a higher-level account. The Standard Account option does not have an opening balance requirement, while the ThinkZero account comes with a $500 account opening fee.

Here is a detailed breakdown of the different types of fees:

Spreads

ThinkMarkets offers competitive spreads starting from 0 pips for currencies. Stock trading, on the other hand, attracts a spread of 0.1%. For commodities, the spread starts from $0.19. The spreads on indices start at 0.4 pips. To read more about pips in trading, go here.

Commissions

The broker does not charge any commissions for trading in currencies, commodities, or indices. Stocks, on the other hand, attract a commission of $10.

Swap fees and Islamic accounts

The broker allows Islamic accounts tailored for traders who adhere to Sharia law, which prohibits earning or paying interest. These accounts do not accrue or pay swaps or interest on trades.

To get started, first, create a standard trading account with ThinkMarkets to apply for an Islamic account. After your account is approved, you can request a swap-free account within the Client Portal under Support Requests > Swap-free account request. If approved, your trading account will be converted to a swap-free account.

It's important to note that swap-free accounts will incur an administrative fee for positions held for seven calendar days or more. No administrative fee is charged for the first six days. Fees are applied at rollover for positions held through seven consecutive rollover periods. Positions held open are charged once a week for the preceding seven days.

Inactivity fee

ThinkMarkets applies inactivity fees for trading accounts that have been inactive for at least 6 months. Inactivity fees will be debited from any remaining trading account balance. Please note that at no stage will your trading account be put below zero by the application of an inactivity fee. ThinkMarkets may reimburse an inactivity fee when a redeposit is received and trading recommences.

Withdrawal fee

The broker charges withdrawal fees. You can consult the deposit and withdrawal section of this article to know more, or you can consult the ThinkMarkets website for full detailed information.

| Spread | Commission | Swap | Islamic Account | |

| Currencies | Starting from 0 Pips | $0 | Yes | Unavailable |

| Stocks | Starting from 0.1% | $10 | Yes | Unavailable |

| Commodities | Starting from $0.19 | $0 | Yes | Unavailable |

| Indices | Starting from 0.4 Pips | $0 | Yes | Unavailable |

Mobile Trading

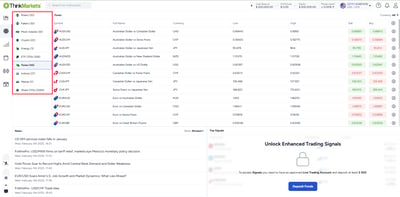

Traders can choose between the retail-favorite MT4/MT5 trading platform or the proprietary and award-winning ThinkTrader trading platform. You can expect to achieve a trading 99.9% fill rate on as many as 350+ instruments on MT4. The number of trading instruments you’ll access on MT5 is 1800.

ThinkMarkets uses its own ThinkTrader platform in addition to popular, feature-rich platforms MT4 and MT5. ThinkMarkets allows traders the option of using more than one trading platform at the same time. This is useful, as traders can leverage the best of each trading platform and use it with their chosen accounts.

Platforms types

ThinkMarkets offers the following trading platforms:

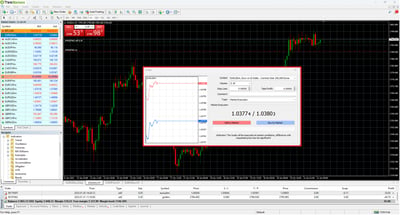

MT4:

This popular trading platform can seamlessly run many automated trading strategies. It allows users to optimize their trading strategies through its backtest function. MT4 can be downloaded on Android, iOS, and Windows. Here are just some benefits when it is used in collaboration with selected ThinkMarkets accounts:

Advanced trading intelligence and indicators.

Customizable options for any level of trader.

Rapid order execution.

Attractive low spreads.

99.9% fill rate

350+ instruments access to a range of global markets.

Not only that, you can access a demo account to test your trading strategies inside a simulated market environment. You can try Expert Advisor trading, where you can create or download an EA program to place trades for you automatically. You can also access three fully customizable charts, four pending order types, 30 technical indicators, and 31 drawing tools.

MT5:

This futuristic upgrade on MT4 has a wide selection of useful extra features. Here are just a few:

Six pending order types.

Options for hedging and netting.

Multi-thread strategy tester for Expert Advisors (EA).

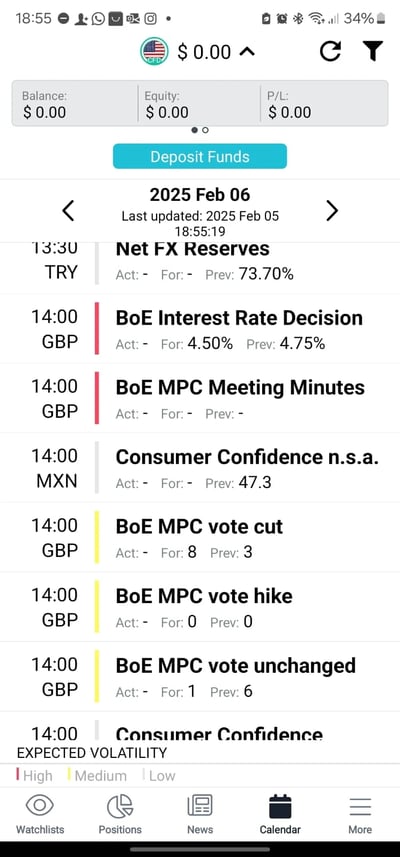

Native economic calendar.

Attractive FOREX spreads.

Free access to Virtual Private Server (VPS) hosting.

Access to over 1,800 tradable instruments.

High leverage of up to 500:1.

With MT5, you can perform EA trading, three fully customizable charts, 38 technical indicators, 21 timeframes, and a multi-thread strategy tester. You can also get access to automated execution.

ThinkTrader:

This is ThinkMarkets’s internal platform. It has been designed to give traders access to benefits they might not find elsewhere. These include:

Access to over 100 indicators and 50 drawing tools for analysis.

Multiple cloud-based alerts are delivered even when the trader is not actively online.

TrendRisk scanner that scans the market for attractive opportunities on several timeframes.

Always-on, mobile ThinkTrader app is packed with features.

Multiple order execution with a single confirmation.

One-time login on approved devices.

Trading toolkit for market analysis on mobile devices and desktops.

With ThinkTrader, you can access the world's markets directly from your web browser or on the go with its mobile app for iOS and Android.

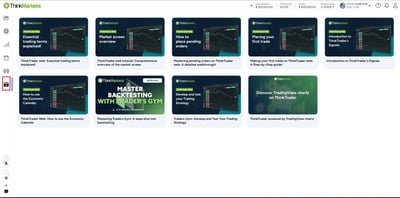

This platform can access 100+ technical indicators, 50 drawing tools, and 10+ chart types. You can also access the broker’s Traders’ Gym, an exclusive tool that allows you to test your trading strategies on real historical data in a simulated market environment.

TradingView:

The broker recently added this helpful feature. Now, you can connect your ThinkMarkets account to TradingView and trade on an advanced charting and trading platform.

TradingView is the world's largest charting platform and is used by 60 million people in over 200 countries. The trading conditions will give you tight spreads, fast execution, and no dealing desk intervention. As far as charting goes, you can use over 20 chart types, multi-chart mode, and custom timeframes from 1 second to 12 months. The benefits do not end there. You can also join a network of traders from around the globe and share your trades, strategies, and ideas.

Look and feel

Each of the platforms on offer has intuitive and user-friendly interfaces that make analyzing and navigating the markets a walk in the park, no matter your skill level. You can enjoy seamless trading

on platforms that give you unrivaled control.

Login and security

ThinkMarkets follows industry-standard security procedures, including website encryption, to protect sensitive client data.

Search functions

The ThinkTrader platform is full of features and well-suited for advanced traders. While beginner traders may find the level of features daunting, video tutorials and quick-start manuals are available. The search function is intuitive and provides comprehensive findings.

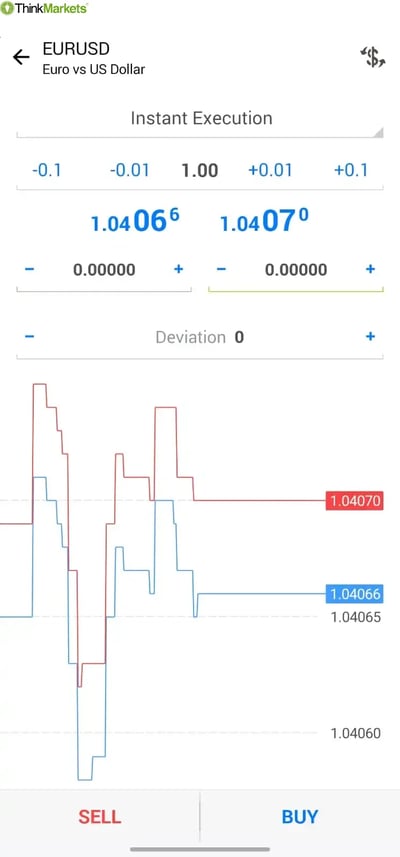

Placing orders

With ThinkTrader, as well as MT4 and MT5, you can get support for a wide range of trading orders, including up to 6 types of pending orders, including stop loss, take profit, and limit orders.

Alerts and notifications

The broker offers up to 200 cloud-based alerts where you can receive real-time trading signals straight to your phone via push notifications, ensuring you never miss trading opportunities.

ThinkMarkets’s mobile trading platforms are well-suited for traders looking for a robust, feature-rich environment with advanced tools and a user-friendly interface. You can expect to use basic order types like Market, Limit, and Stop orders. You can also get real-time alerts and notifications.

Mobile Trading

ThinkMarkets offers a powerful market-leading mobile app available to download to iOS and Android devices. ThinkTrader.com provides a superior mobile trading experience. The award-winning mobile program provides multiple markets, in-app chat support, and a wide range of analysis tools and market indicators.

Platforms

ThinkTrader app:

Enjoy a seamless trading experience with the broker’s ThinkTrader mobile app for iOS and Android. ThinkTrader's intuitive and user-friendly interface makes analyzing and navigating the markets an easy proposition, no matter your skill level.

MT4 and MT5 apps:

As noted, ThinkMarkets also offers the well-known MT4 and MT5 trading platforms with a direct connection to the SWFX Marketplace. This allows traders already familiar with the platform to move over seamlessly for manual trading or through EAs that are popular with MetaTrader.

Look and feel

Both mobile versions offer a streamlined experience with essential features for trading on the go. ThinkMarkets’s ThinkTrader mobile platform is for instant market access with similar trading features as the ThinkTrader desktop platform and is well-suited for traders who prefer easy access to trade, but with fewer features.

All platforms are designed to provide a professional trading experience with intuitive navigation. A wide range of advanced charting tools, technical indicators, and order types that cater to both novice and experienced traders.

Login and security

Secure login and authentication processes to protect user accounts. These features are in line with industry norms.

Search functions

The search function on the ThinkTrader app and the MT4 and MT5 apps is intuitive and provides comprehensive findings.

Placing orders

ThinkMarkets’s apps strongly support automated trading strategies through visual constructors and Expert Advisors. You can use basic order types like Market, Limit, and Stop orders.

Alerts and notifications

All the mobile apps in the ThinkMarkets stable provide real-time alerts and notifications to keep traders updated on market movements and order statuses.

Research and Development

ThinkMarkets covers traders with different levels of experience and knowledge. Its website has a broad range of research and educational tools of which clients can take advantage. Tutorials are split into beginner, intermediate, and advanced tiers so that nobody is left behind.

Through webinars and web content, ThinkMarkets provides information, such as indicators, a trading glossary, and a detailed knowledge repository. Users can select information based on markets, categories, and contributors. New traders will be interested in the built-in market sentiment indicator based on client positions.

New traders will find large amounts of material into which they may sink their teeth. Meanwhile, the technical analysis section, bolstered by insightful indicators and chart patterns, provides in-depth value to traders of any level.

Signal Center

With the broker’s patented Signal Center, you can receive up to 50 free daily AI and human signals straight to your chosen platform. This analytics tool can be accessed on ThinkTrader, MT4/5, and ThinkPortal. The signals come from all types of markets, such as FOREX, indices, commodities, stocks, and cryptocurrencies. The Signal Center is is much like Arincen’s own signals platform.

Copy Trading

The broker has a bespoke tool called ThinkCopy that allows you to copy trades from experienced investors. You can learn from experienced traders and diversify your portfolio by leveraging traders’ expertise.

The tool features trading groups from all over the world. If you are successful and your trades are worth copying, you can even earn additional income by allowing traders to copy your trading activity. Whether you're a beginner trying to figure out how to trade or an established trader with years of experience, ThinkCopy connects traders worldwide.

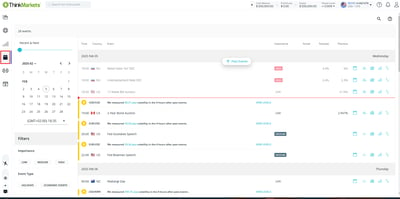

Economic calendar

This excellent economic calendar provides real-time updates on economic events and indicators that can impact the financial markets. It includes detailed information about each event, such as the time, country, and expected impact. Traders can filter events based on their preferences and focus on the most relevant data.

ThinkMarkets’s research and development tools and features are designed to provide traders with comprehensive market insights, advanced trading tools, and educational resources. These tools help traders make informed decisions, manage risk effectively, and enhance their trading strategies.

Education

The ThinkMarkets Trading Academy provides a comprehensive range of educational tools and resources to help traders enhance their knowledge and skills. You will find handy resources from all sorts of markets, such as FOREX, commodities, indices, crypto, and stocks.

The broker’s focus on international news updates allows you to stay up to date with all the global economic and financial events that are moving the markets. The education sector has a helpful trading glossary where you can learn all the key terms, abbreviations, and definitions used in trading.

Final Thoughts on ThinkMarkets

ThinkMarkets is improving all the time and has a high-quality service offering when compared to many of its peers in the emerging trader space. The company is setting itself apart with sound technology, expert customer service, competitive pricing, and platform innovations.

The ThinkMarkets website layout is easy to follow, and even new clients can navigate their way around the core website functionalities, such as account opening and trading. Educational tools are also well-marked and easy to access.

This growing company offers robust platforms that will get new users started in a safe trading environment. Though not at the leading edge of trading diversity and market penetration, ThinkMarkets can still offer a distinctive and reliable service in a competitive marketplace.

Conclusion

ThinkMarkets continues to mature into a dependable online broker. Though not the biggest player, the company offers solid access to markets through innovative platforms and superior client service. Its trading technologies are at the upper end of the market, and with its expanding global reach, it has a reason to continue to grow.

ThinkMarkets in Brief

ThinkMarkets is a well-regulated emerging broker that offers superior platform access and competitive fees with tight spreads. Its educational facilities are well-designed and will upskill the novice trader in no time. Featuring expert customer service and strong market access, this broker is set to continue expanding its global reach.

Review Methodology

The team at Arincen collected more than 120 pieces of data covering more than 100 licensed FOREX companies. Data collection was done in three ways:

Companies’ websites.

Other websites that have ranked FOREX companies.

A survey questionnaire (referred to here as Survey “1”) was sent to the companies invited to participate in the exercise.

We have identified 12 criteria for our assessment, each containing several aspects and carrying its relative weight. These include licensing, deposits and withdrawals, number of assets, etc.

Afterward, we validated the data by:

Registering with FOREX companies as a secret shopper and as Arincen.

Survey number “2,” in which we asked these companies’ customers for meaningful feedback and past experience.

The next step saw us evaluate and rank each company, relying on the hard work of 15 Arincen employees. We were cautious in ensuring the most accurate assessment possible, including considering different languages and the various mobile-app operating systems, e.g., Apple, Samsung, etc.

To add credibility to our research project, we sent a final and third survey (referred to here as Survey “3”) to enable participating FOREX companies to evaluate our research and whether it accurately reflects the realities on the ground. We were fortunate enough to receive a mark of 9.9 out of 10! We have kept the margin of error to a minimum, which stood at a measly 1%. Please click here to learn more about how we came up with the evaluation.

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

FAQ

You can trade over 4,000 instruments, including FOREX, futures, commodities, indices, ETFs, cryptocurrencies, and stocks. Popular instruments include currency pairs like EUR/USD, commodities like gold and Brent crude, and cryptocurrencies such as Bitcoin and Ethereum.

Yes, ThinkMarkets is considered safe. It is regulated by leading financial authorities like the UK's FCA and Australia's ASIC. Client funds are segregated in tier-1 banks, and additional protections include coverage under the UK's FSCS and insurance policies up to £1 million.

ThinkMarkets provides three account types: the Standard Account (zero commission, minimum deposit $50), ThinkTrader Account (minimum deposit $250), and ThinkZero Account (minimum deposit $500, raw spreads from 0 pips).

The maximum leverage varies by jurisdiction. In the UK, it is capped at 30:1 due to FCA regulations, but in other regions, it can go as high as 500:1 for FOREX instruments.

Yes, ThinkMarkets offers Islamic accounts for traders who adhere to Sharia law. These accounts do not charge or earn interest but may incur administrative fees for positions held longer than seven days.

ThinkMarkets provides 24/7 multilingual customer support via live chat, email, phone, and social media platforms like Telegram and Messenger.

ThinkMarkets offers MT4, MT5, and its proprietary ThinkTrader platform. Each platform supports advanced trading features, including automated strategies and technical analysis tools.

ThinkMarkets has competitive spreads starting at 0.4 pips for FOREX. The ThinkZero Account incurs a $7 commission per trade, while other accounts are commission-free for most instruments. There are no fees for deposits, but withdrawal and inactivity fees may apply.