Swissquote Review 2026

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

Swissquote Evaluate - research result

Key Takeaways

Swissquote Bank Ltd. is a well-recognized public bank that is a member of the Swiss Bankers Association and has offices in multiple global locations. It serves customers in multiple countries.

Swissquote Ltd. is an online provider of FOREX and contract for differences (CFD) trading, authorized by multiple tier-1 regulators, including Switzerland’s own Financial Market Supervisory Authority (FINMA) and the UK’s Financial Conduct Authority (FCA). Swissquote traders are among the most protected in the industry.

Swissquote is considered low-risk. It is a publicly traded company, operates a regulated bank, and is authorized by several high-trust (tier-1) regulators.

Without regard to a trader's level of experience, Swissquote’s range of services can be suitably recommended for nearly any trader.

Swissquote provides more than 160 FOREX and CFD instruments, including more than 80 major, minor, and emerging currency pairs. Also, it offers dozens of stock indices, comprising the FTSE 100 and CAC 40, a selection of commodities and precious metals, in addition to three bonds. Swissquote’s Swiss investment arm offers gold Exchange-Traded Funds (ETF), as well as stocks, themes trading, options, cryptocurrencies, funds, and futures.

Traders can choose from four live accounts: Standard, Premium, Prime, and Professional. Also available is a demo account valid for 30 days.

Funds can be deposited into an account via credit cards or bank transfer.

Fees and other charges traders encounter on Swissquote stem from the spreads, which vary primarily between the Swiss accounts and EU accounts, and then between each account tier.

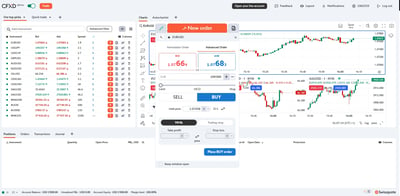

“Advanced Trader,” Swissquote’s in-house platform, comes with a fully customizable interface and allows trading in synthetic CFD, among other instruments. Also, traders of any level can enjoy automated e-trading capabilities, as well as complimentary plugins, with the award-winning MetaTrader4 (MT4) platform and the newer MetaTrader5 (MT5).

Regarding research and education, the broker goes well beyond most in terms of quality, helping to differentiate itself from competitors; and, Swissquote's learning center offers the knowledge every trader should have, as well as directing its educational material to clients of all levels of trading experience.

Swissquote offers its proprietary Advanced Trader app along with MT4 and MT5 mobile.

Last Reviews

Overall Summary

In my analysis of Swissquote Bank Ltd, I found it to be a top quality broker. In this review, I'll you all about this broker's platforms, regulations, number of assets, commissions, fees, and more, so you can make an informed choice. Swissquote holds a banking license with the Swiss Financial Market Supervisory Authority (FINMA) and is a member of the Swiss Bankers Association. The company acts as both a bank and a retail trader and operates from its headquarters in Switzerland.

This major financial player offers a comprehensive suite of financial services, including trading in equities, funds, bonds, warrants, options, futures, and cryptocurrencies. The bank also provides services in FOREX and CFDs of up to 160 instruments.

Traders can access these assets via the broker’s proprietary platform CXFD, or the award-winning MT4 and MT5. Swissquote is serious about the rules, as it is governed not just by FINMA, but its affiflates are covered by other big hitters like the UK's FCA.

Owing to its success, the company has been able to establish strategic partnerships to enhance its market presence. From 2015 to 2021, the bank was the official partner of Manchester United FC. More recently, it became a partner of the UEFA Europa League and the UEFA Europa Conference League in 2021.

In my research, I discovered that through continuous innovation and growth, Swissquote has solidified its position as a leading provider of online financial services, catering to a diverse and growing global client base.

Yes, Swissquote is a low-risk broker with oversight from four tier-1 regulators, including FINMA and the FCA . Traders in the UK benefit from negative balance protection and deposit protection up to £85,000, while client funds are held in segregated accounts for added security. Swissquote is required to provide regular financial reports and governance audits, meaning that its affairs are more likely to be in order.

Is Swissquote Safe?

We at Arincen are particularly sensitive about the importance of good regulation, as we've heard from so many of our clients how unregulated entities have burned them in the past. Swissquote is widely considered a low-risk broker, thanks to its strong regulatory framework and financial stability. It is a publicly traded company that, as we have said, operates as a fully regulated bank.

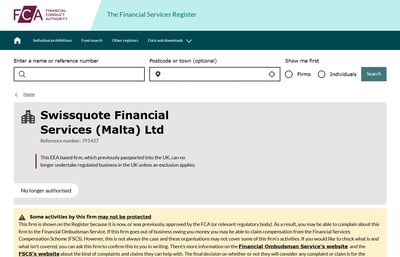

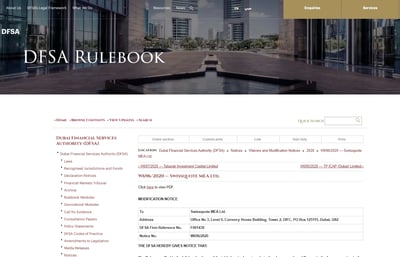

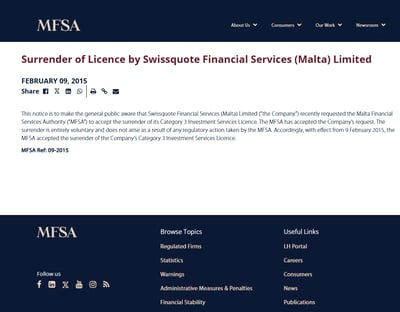

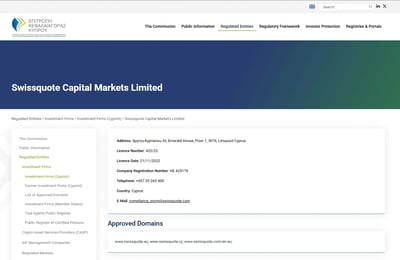

The broker holds licenses from four tier-1 regulators:

The Securities Futures Commission (SFC) of Hong Kong,

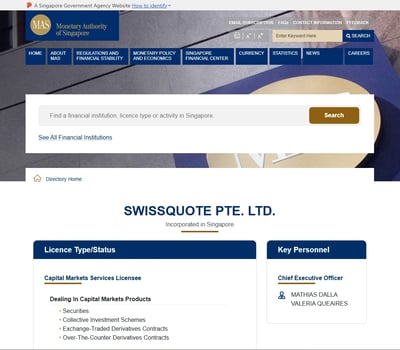

The Monetary Authority of Singapore (MAS),

Switzerland’s FINMA and

The UK’s FCA.

In the UK, traders benefit from negative balance protection and deposit protection up to £85,000 in case of insolvency, adding an extra layer of security. European traders get deposit protection of up to CHF 100,000 under a depositor protection scheme.

All client funds are held in segregated accounts at approved banks, ensuring that client assets remain separate from the company’s operational funds.

This stringent regulation requires Swissquote to provide regular financial reports and undergo corporate governance audits.

While Swissquote accepts clients from over 120 countries, US citizens can’t open accounts due to regulatory restrictions. With its robust financial standing, tier-1 regulatory oversight, and broad market access, Swissquote is one of the safest and most trusted brokers in the industry.

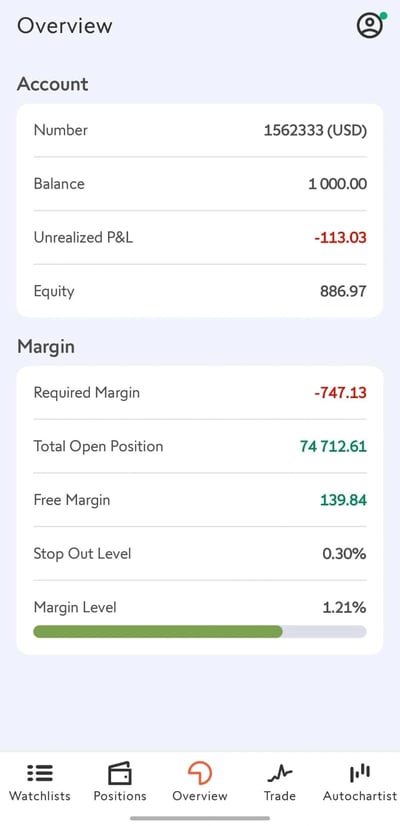

How Swissquote Protects You from Reckless Leverage and Margin Trading

In my experience, leverage and margin can be powerful tools for traders, but if not used right, they can result in hefty losses. Some unreliable brokers offer simply too much leverage, which can be dangerous for new traders.

How you are protected

Swissquote manages leverage carefully to protect you from too much exposure. The broker adjusts leverage limits based on your location, aligning with local regulatory guidelines to promote responsible trading.

In the European Union and the UK, retail clients face leverage caps set by the European Securities and Markets Authority (ESMA) and the FCA. Leverage is limited to 30:1 for major currency pairs, 20:1 for non-major currency pairs, gold, and major indices, 10:1 for other commodities and non-major equity indices, and 5:1 for individual stocks. Swiss FOREX clients under FINMA can get leverage of up to 100:1.

In South Africa, Swissquote offers leverage up to 400:1 on select instruments. Professional clients can also get leverage this high. This is a lot of leverage, but the broker says it maintains otherwise strict risk management practices. In other regions, Swissquote Markets applies a tiered leverage structure based on your equity level. As always, you should check the broker’s website in your region to know what applies to you.

Regulation and other security measures

Besides the main regulators in Europe, Swissquote makes sure its operations comply with Hong Kong’s SFC, the Monetary Authority of Singapore (MAS), and South Africa’s Financial Sector Conduct Authority (FSCA).

Swissquote actively monitors margin requirements and adjusts them to reflect market volatility. If the equity in a trading account falls below the maintenance margin level, Swissquote may trigger a margin call or stop-out to restore balance, helping to prevent major losses and forced liquidations.

Top broker features

Strong regulation and safety: Swissquote is regulated by top-tier financial authorities, providing strict oversight.

Diverse instruments: The broker offers access to over 160 FOREX and CFD instruments, as well as equities, funds, bonds, options, futures, and cryptocurrencies.

Fast and transparent execution: Swissquote uses advanced trading technology to provide low-latency order execution with minimal slippage.

Low-cost trading: Traders can get competitive spreads and low-commission structures, making Swissquote a cost-effective choice for both high-volume and retail traders.

Comprehensive education and support: Swissquote provides a full suite of educational resources, including webinars, trading tutorials, market analysis, and research reports.

Customer support: The broker offers multilingual customer service via phone, email, and live chat, with responsive and knowledgeable support available 24/5 to assist with technical and account-related issues.

Advanced trading platforms: Swissquote supports MT4, MT5, and its proprietary platform.

For Whom Is Swissquote Recommended?

In my research, I found that Swissquote’s services make it suitable for almost any trader, regardless of experience level.

For new traders, the broker offers a safe and controlled environment with low leverage, Expert Advisors (EA), and straightforward trading tutorials, especially for major markets like FOREX and shares.

More experienced traders have higher leverage options, advanced charting tools, and complex trading strategies using MT4 and MT5.

A potential barrier to entry is Swissquote’s higher-than-average minimum deposit. The Premium Account for EU traders requires a deposit of €1,000.

Swissquote’s Swiss accounts appeal to traders looking for more extensive financial services and the added security of holding funds in a Swiss bank account. Swiss accounts benefit from the deep liquidity of a tier-1 network of banks, while the EU and UK platforms can make the most of Swissquote Bank’s deep liquidity.

In my opinion, here are the pros and cons of using this broker:

-

Swiss accounts receive the benefit of funds held in Swiss tier-1 bank accounts, with an IBAN for seamless international trading

-

Many platform types allow members access to more market opportunities

-

Assorted plugins help give traders new functionality for charting and technical analysis

-

Spreads from 0.22 pips

-

Great educational resources

-

Innovative features give retail traders institutional-level insights

-

Fractional trading with low fees

-

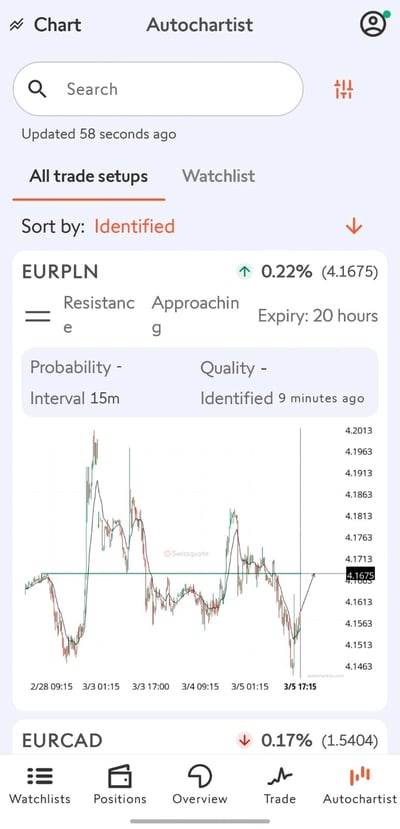

Powerful Autochartist integration

-

High minimum deposits per account

-

Somewhat confusing array of services might confuse beginners

-

Average spreads are higher in Swiss accounts than in EU accounts

-

No US traders

-

Does not accept digital wallet funding methods

Offering of Investments

With Swissquote, what you get is many investment options across asset classes, including FOREX, CFDs, stocks, ETFs, mutual funds, options, futures, and cryptocurrencies. You can trade well over 80 FOREX pairs, and more than 35 cryptos, as well as thousands of mutual funds. The platform supports fractional trading and automated saving plans, making it easy to diversify portfolios with smaller investments.

Swissquote offers a diverse range of investment opportunities across multiple asset classes. These wide-ranging offerings, combined with innovative tools and flexible platforms, make Swissquote a compelling solution for both retail and institutional investors looking for the broadest financial instruments and services.

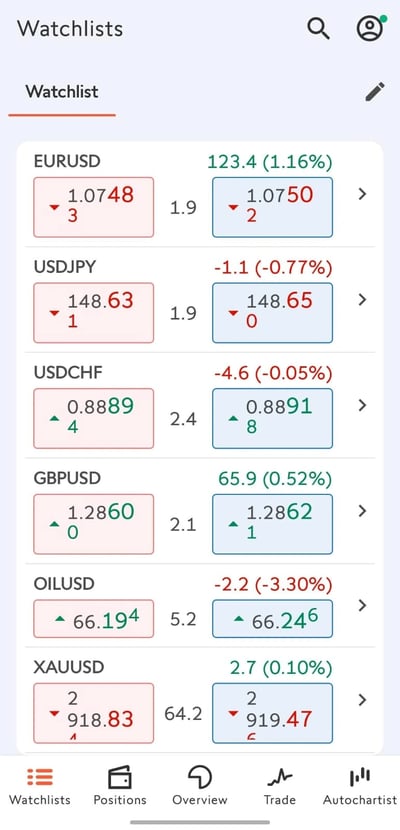

FOREX and CFDs

Get trading over 160 FOREX and CFD instruments, including more than 80 currency pairs that are drawn from major, minor, and emerging markets. Clients can also trade multiple stock indices, such as the FTSE 100 and CAC 40, along with a selection of commodities, precious metals, and bonds. You can get flexible transaction sizes across all trading platforms, and orders can be placed through the trading desk during market hours.

Stocks and ETFs

If stock trading is your thing, you can trade over 9,000 stocks and ETFs across multiple global stock market exchanges. You can easily diversify your portfolio with your choice of equities and exchange-traded funds.

Mutual funds

Investors can choose from thousands of mutual funds offered by more than 200 renowned investment banks and financial institutions. With this broker, you can get advanced tools like a fund finder with Morningstar ratings and historical performance data.

Options and futures

Swissquote supports trading in options and futures, perfect for those traders interested in hedging ongoing investments. You can access major derivative exchanges, including EUREX and CME Group, to diversify and protect your portfolios.

Cryptocurrencies

Swissquote was an early entrant into the cryptocurrency game. Today, you can get access to 35+ cryptos (spot & CFDs).

Themes trading

Swissquote's Themes Trading feature allows clients to invest in portfolios centered around specific sectors and trends, allowing for targeted investment strategies. For example, if your thing is AI-related stocks, then you can filter for these investments.

Available assets

| Markets | Available | Number of Assets |

| Currency Pairs | 80 | |

| Stocks | 9000 | |

| Commodities | 20 | |

| Crypto | 35 | |

| Indices | 25 | |

| ETFs | 9000 |

Account Types

Swissquote offers four live accounts designed to accommodate different trading volumes and preferences. The Standard account starts with a $1,000 minimum deposit, while the Premium and Prime accounts start with even higher minimum deposits but potentially tighter spreads and lower stock commissions for higher deposits. The Professional account is customized for high-volume traders with tailored spreads, commissions, and leverage.

I found that traders can choose from four live accounts: Standard, Premium, Prime, and Professional. Each account type is tailored to different trading volumes and preferences.

These account options cater to a wide range of traders, from beginners to professionals, offering flexibility in trading conditions and services. You should know that EAs and High-Frequency Trading (HFT) are permitted across all accounts. Also, all accounts attract an inactivity fee of 10 currency units per month after six months of inactivity. Below is an overview of each account type:

Standard Account

Minimum Deposit: $1,000

Minimum Trade Size: 0.01 lots (1,000 currency units)

Maintenance Margin: 100%

Stop-Out Level: 30%

Premium Account

Minimum Deposit: $10,000

Minimum Trade Size: 0.1 lots (10,000 currency units)

Maintenance Margin: 100%

Stop-Out Level: 30%

Prime Account

Minimum Deposit: $50,000

Minimum Trade Size: 1 lot (100,000 currency units)

Maintenance Margin: 100%

Stop-Out Level: 30%

Professional Account

Minimum Deposit: Volume-based; tailored to individual requirements

FOREX Spreads and Commissions: Customized based on trading volume and needs but can go as low as 0.22 pips

Trade Size, Leverage, Maintenance Margin, Stop-Out Level, and Inactivity Fee: Customized

Demo Account

Swissquote offers a Demo Account for traders to practice and familiarize themselves with the platform. Traders should note that they need to make the most of them as all demo accounts automatically expire after 30 days and are not extendable.

| Account Type | Minimum Deposit | Spread Commission | Commission | Swap Commission | Deposit Commission | Withdrawal Commission |

|---|---|---|---|---|---|---|

| Standard account | $1,000 | Starting from 1.7 pip | $0 | Yes | Different commissions according to each account currency type | Different commissions according to each account currency type |

| Premium account | $5,000 | Starting from 1.4 pip | $0 | Yes | Different commissions according to each account currency type | Different commissions according to each account currency type |

| Prime account | $50,000 | Starting from 1.1 pip | $0 | Yes | Different commissions according to each account currency type | Different commissions according to each account currency type |

Account opening

During testing, I learned that Swissquote makes it easy to open accounts. You simply need to complete an online application and must undergo a regular application process.

What is the minimum deposit at Swissquote?

As mentioned, the minimum deposit with this broker is high. The lowest minimum deposit you can start with is $1,000, which is much higher than other brokers. With more advanced account types, the minimum deposit climbs even higher.

How to open your account

Traders can see financial regulation in practice as the questions they answer are Know Your Customer (KYC) questions mandated by regulators. As is normal for a financial institution, Swissquote will require photographic identification and proof of residence from applicants. You will also need access to a camera (phone, tablet, computer) for your digital authentication

Deposits and Withdrawals

The broker allows clients to fund their accounts via bank transfer, and it does not charge fees for deposits via bank transfer. Cryptocurrency withdrawals carry a $10 fee. The broker supports 15 account base currencies and offers quick processing times, with bank transfers completed within one working day and card deposits processed within two hours.

For clients opting to fund their accounts via bank transfer, Swissquote provides all necessary bank details, including SWIFT codes and IBANs, within the Support section of its website. This information is essential for ensuring that funds are correctly and promptly credited to the client's trading account.

The broker advises clients to verify any fees that may be charged by their own banks or intermediary institutions during the withdrawal process. This ensures that clients have a clear understanding of the total costs involved and can make informed decisions when requesting withdrawals.

Crucially, in today’s digital age, I found it noteworthy (and not in a good way) that the broker does not accept any digital payment methods like Skrill, Neteller, Apple Pay, or PayPal. This could be a drawback for some.

Account base currencies

Swissquote offers a multi-currency account in 15 currencies - EUR, USD, JPY, GBP, CHF, CAD, AUD, TRY, PLN, SEK, NOK, SGD, XGD, HUF, CZK.

Swissquote deposit fees and options

Swissquote offers various methods for funding your account, including bank transfers and credit/debit cards. Notably, the broker does not impose fees on deposits made via bank transfer.

Deposits made via credit/debit cards are processed instantly. In my case, I found that my deposits typically took no more than 2 hours during business hours. Bank transfers are usually processed within one working day, though the exact timing may depend on the client's bank and the currency involved.

Swissquote allows crypto deposits under certain conditions. Their platform supports a dedicated crypto wallet, allowing users to deposit eligible cryptocurrencies from whitelisted exchanges or personal wallets directly into their Swissquote account.

Swissquote withdrawal fees and options

I found that withdrawals from Swissquote accounts are primarily processed through bank transfers. Clients should be aware that intermediary banks may impose additional fees beyond Swissquote's control.

Cryptocurrencies incur a $10 withdrawal fee for all clients. Withdrawal requests are typically processed within one working day. However, the time it takes for funds to reach the client's bank account may vary depending on the destination country and the banking institutions involved.

| Method | Credit Card | Wire Transfer | Skrill | Neteller | Cryptocurrency | PayPal | Apple Pay3 |

| Deposit fee | $0 | N/A | Unavailable | Unavailable | $0 | Unavailable | Unavailable |

| Withdrawal fee | N/A | Based on currency | Unavailable | Unavailable | $10 | Unavailable | Unavailable |

Customer Support

Swissquote offers customer support from 8:00 to 22:00 CET, Monday to Friday, with 24-hour assistance available for FOREX-related inquiries. Clients can access support through a callback request form, live chat, and a multilingual website covering eight languages, including English, Chinese, and Arabic.

We tested this broker using secret shopper methods, and found that Swissquote provides comprehensive customer support to help clients across various regions. The Customer Care Center operates from 8:00 to 22:00 CET, Monday to Friday for FOREX-related inquiries, clients can contact the FOREX Dealing Desk, available 24 hours. Additionally, Swissquote offers a callback request form and chat support through its website. The Swissquote website is accessible in multiple languages, including English, Chinese, Arabic, German, French, Russian, Italian, and Spanish, catering to a diverse clientele.

| Live Chat | Phone | |||

| Available | Available | Available | Available | Unavailable |

| Quick response | Moderate | fast | Moderate | Unavailable |

Commissions and Fees

Swissquote’s fee structure is designed to be competitive and transparent across all account types and trading instruments. FOREX spreads start from 0.22 pips, with stocks spreads starting from 0.02 per share. FOREX trading commissions come in at $3.5 per lot, and Islamic trading is allowed on FOREX accounts. Swissquote charges a 10-unit inactivity fee after six months of no activity.

In my view, Swissquote's fee structure is designed to accommodate a wide range of trading strategies and preferences, ensuring transparency and competitiveness across all its offerings.

Fees and other charges you will encounter on Swissquote largely stem from the spread, which varies primarily between the Swiss accounts and EU accounts, and then between each account tier.

Swissquote offers a transparent fee structure across its diverse range of trading instruments, catering to both retail and professional clients. Below is an overview of the fees and commissions associated with various asset classes:

Spreads

In FOREX trading, spreads can go as low as 0.22 pips. Other selected spreads are as follows:

Stocks: Spreads start from 0.02 per share

Commodities: Starting from 0.0 pips

Indices: Starting from 2.05 pips

Commissions

Currencies: $3.5 per lot

Stocks: $10

Commodities: $25 per million notional on Spot Metals

Indices: $35 per million notional

Swap fees and Islamic accounts

The broker applies overnight financing charges, commonly known as swap fees, to positions held open beyond the trading day. The specific swap rates can vary depending on the instrument and market conditions.

Swissquote offers Islamic, or swap-free, accounts tailored for FOREX traders who adhere to Sharia law, which prohibits earning or paying interest. To open an Islamic account, traders must contact Swissquote's customer support to request this service.

Inactivity fee

An inactivity fee of 10 units of the base currency is charged monthly after six months of dormancy.

Other commissions and fees

A custody fee of 0.025% is charged quarterly, with a minimum fee of CHF 20 per quarter and a maximum of CHF 50 per quarter. This equates to an annual maximum of CHF 200. Also, a currency conversion fee of 0.95% applies when converting CHF to other common currencies like EUR or USD.

| Spread | Commission | Swap | Islamic Account | |

| Currencies | Starting from 0.22 Pips | $3.5 per lot | Yes | Available |

| Stocks | 0.02 per share | $10 | n/a | Unavailable |

| Commodities | Starting from 0.0 Pips | $25 per million notional on Spot Metals | Yes | Unavailable |

| Indices | Starting from 2.05 Pips | $35 per million notional | Yes | Unavailable |

Platforms and Tools

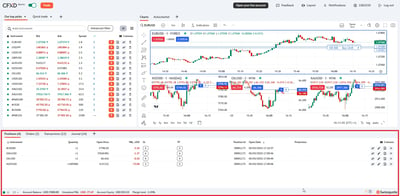

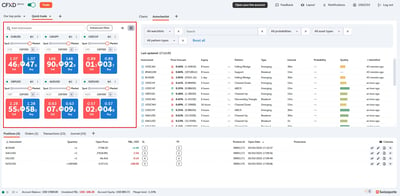

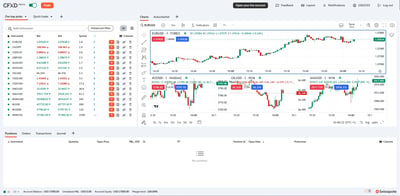

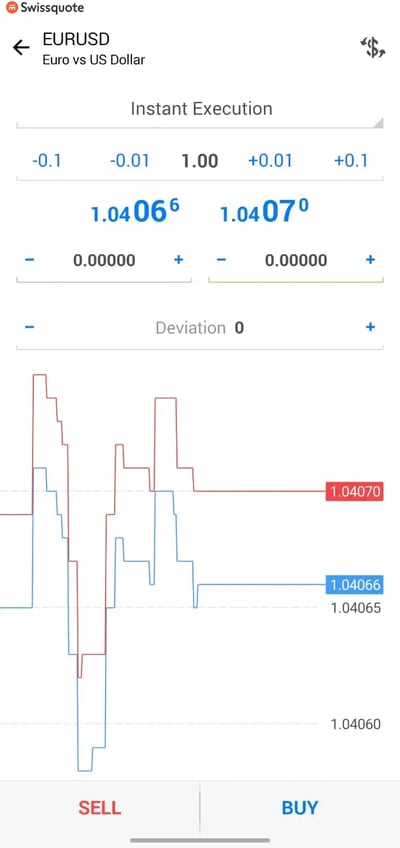

Swissquote offers a range of trading platforms, including Advanced Trader, MT4, MT5, and CFXD, each designed to suit different trading styles and preferences. Advanced Trader provides a user-friendly yet powerful interface with unique order types, CFXD is a snappy in-house platform, while MT4 and MT5 are known for their customizable layouts and advanced technical indicators. Swissquote also integrates Autochartist, providing real-time alerts and pattern recognition to help traders identify market opportunities.

I was please to find that Swissquote offers a diverse selection of trading platforms, each tailored to meet the unique needs of traders. Below is an overview of these platforms:

Platforms types

Advanced Trader

Swissquote's proprietary platform, Advanced Trader, is designed for traders looking for a customizable and intuitive trading experience. It is a simple yet highly powerful interface offering excellent order types that can’t be found anywhere else.

MT4

MT4 is a globally recognized trading platform renowned for its user-friendly interface and robust functionalities. It features customizable charts with nine timeframes, 30 built-in technical indicators, and supports automated trading through EAs. Traders can also access a vast library of additional tools and plugins to enhance their trading strategies.

MT5

MT5 provides an expanded suite of features that are meant for traders wanting advanced analytical tools and multi-asset trading capabilities. You will find 21 timeframes, 80 built-in technical indicators, and 44 analytical objects, offering comprehensive tools for in-depth market analysis. MT5 also supports automated trading, too.

CFXD

Swissquote's CFXD platform is designed for FOREX and CFD trading, offering a simple interface with powerful functionalities. It integrates seamlessly with TradingView, providing advanced charting functions and a user-friendly experience. The platform supports over 50 intelligent charting tools and more than 80 technical indicators.

Look and feel

Advanced Trader has an intuitive user interface designed for both new and experienced traders. The platform supports advanced charting tools, technical indicators, and automated trading capabilities through its connection with TradeView.

You can get more than 50 intelligent charting tools, plus in excess of 80 technical indicators, all in a synchronised layout for multiple charts.

MT4 and MT5 are renowned for their customizable layout and extensive range of plugins, appealing to traders who prefer a tailored trading environment. The integration with TradingView offers a modern, web-based interface with advanced charting and social trading features.

Login and security

Each of these platforms is securely encrypted with SSL technology, ensuring the protection of traders' data and transactions. You will also find that you have to use 2FA to get in.

Search functions

The platforms feature comprehensive search functionalities, allowing users to quickly locate financial instruments, indicators, and tools. In Advanced Trader, the asset search is straightforward, allowing you to efficiently navigate across various markets. MT4 and MT5 also give you robust search capabilities.

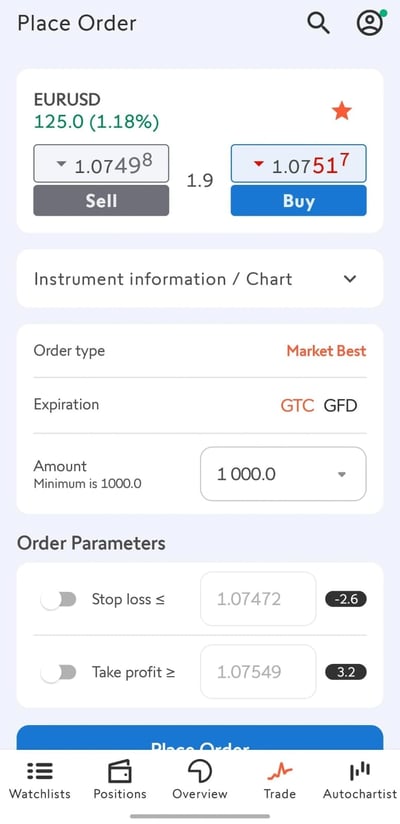

Placing orders

More than just the traditional order types, you can quickly execute complex order types, also, in Advanced Trader. For example, the Order Cancels Other (OCO) combines a stop order with a limit order. When one is executed, it automatically cancels the other.

Another type of order is the IF DONE, a two-step order where the second step cannot be executed until the conditions of the first are met.

Alerts and notifications

Swissquote enhances the trading experience by integrating Autochartist, a premier market scanner and analysis tool. This feature helps you identify trading opportunities by providing real-time alerts on emerging chart patterns, key support and resistance levels, and potential market movements.

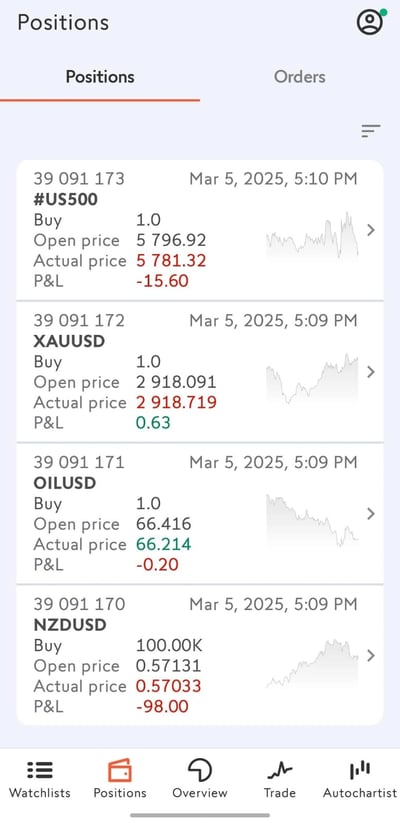

Mobile Trading

Swissquote offers its proprietary Advanced Trader app alongside MT4 and MT5 mobile, providing a seamless trading experience across desktop and mobile. The Swissquote app allows access to thousands of financial instruments, including stocks, ETFs, and cryptocurrencies, with real-time updates and sophisticated charting tools. Swissquote ensures strong security with two-factor authentication. The app supports various order types, advanced search functions, and customizable alerts.

Swissquote offers traders its proprietary Advanced Trader app along with MT4 and MT5 mobile. Generally, the Advanced Trader mobile app is easy to use and is cleanly designed.

Swissquote’s Advanced Trader platform is available for iOS and Android smartphones and supports multiple languages. Traders can easily transition between mobile and desktop versions of the platform, with access to sophisticated charting tools, real-time streaming quotes, and complex order types. The app generally receives positive customer ratings online.

Also, both the MT4 and MT5 platforms are available as mobile apps. Thus, traders who prefer automated trading strategies can enjoy all the same algorithmic capabilities and technical analysis tools while away from their PC.

Platforms

Swissquote App

The Swissquote App is a comprehensive platform that manages various financial instruments, including stocks, cryptocurrencies, ETFs, and more. You can access prices, charts, and information for thousands of financial instruments, establish watchlists, receive notifications on prices and news, and execute trades across global markets. The app is available for both iOS and Android devices, offering a seamless and intuitive user experience.

CFXD mobile

The CFXD mobile version provides powerful tools within a customizable, user-friendly interface. The platform is accessible via web browsers and mobile apps, ensuring that you can manage your positions anytime, anywhere.

MT4 and MT5

Both mobile versions of these platforms offer extensive charting tools, technical indicators, and support for automated trading strategies through EAs.

Look and feel

Swissquote's mobile app boasts a user-friendly interface designed for intuitive navigation. The platform is organized into four main sections: Home, Trade, Bank, and Plan, each providing a clear and consolidated overview of respective functionalities. You can access prices, graphics, and information for thousands of financial instruments, with dynamic graphics and real-time price updates enhancing the trading experience.

Login and security

To ensure robust account protection, Swissquote implements a two-factor authentication process known as Mobile Level 3. This feature requires users to confirm logins, transactions, and other critical actions via their smartphones, adding an extra layer of security against unauthorized access. The authentication process is integrated within the Swissquote app, making it faster and more secure than traditional methods like email or SMS.

Search functions

The app's Smart Search feature anticipates user needs, delivering accurate results fast. An Advanced Search engine allows you to locate any investment product rapidly, while the Scanner tool allows for filtering and browsing of a broad range of investment products based on preferred criteria.

Placing orders

Swissquote's mobile app supports various order types, including Market, Limit, Stop, and Stop Limit orders. Users can set specific order terms and expiries, such as Good 'til Date (GTD), providing flexibility in trade execution. The app also offers fast trade features for quick order placements, giving you the best shot of capturing market movements.

Alerts and notifications

To keep users informed, the app provides notifications about prices, news, and executed trading orders. Users can set up price alerts to monitor specific financial instruments and receive timely updates, which is so helpful when trying to make informed decisions.

Research and Development

I believe Swissquote stands out in research and development, offering a comprehensive suite of high-quality resources that are perfect for both institutional and retail clients.

The firm's dedicated quantitative research team plays a major role in structuring innovative products, for example, exchange-traded certificates for cryptocurrencies. In 2023, Swissquote expanded its Themes Trading offering to include an Impact Investing portfolio, allowing clients to invest in quality stocks while directing 50% of dividends toward real-world projects, which is an amazing new feature.

Clients benefit from daily market briefs and morning news updates provided by Swissquote's strategy desk, complemented by a weekly live-analysis report.

To enhance technical analysis capabilities, Swissquote gives customers access to Trading Central, which powers its daily technical reports with automated chart pattern analysis and expert commentary.

There’s more - Autochartist is available as a plugin for MetaTrader, offering advanced pattern recognition tools. Real-time headlines from the Dow Jones Newswire are integrated across all Swissquote platforms, meaning you can stay informed of market-moving events at a glance.

Swissquote maintains an active YouTube channel, delivering daily market analysis through series such as "Morning Bull" (French) and "Börsentalk" (German), providing valuable insights into market trends and developments.

Trading statistics

Swissquote provides detailed trading statistics through its platforms, offering insights into trading volume, market sentiment, and historical performance. Clients can access in-depth data on their trading activity, including profit-and-loss analysis, trade frequency, and success rates.

Trading signals

The broker delivers real-time trading signals through Trading Central and Autochartist, providing automated chart pattern recognition and expert analysis. Signals cover major FOREX pairs, indices, and commodities, helping you spot market opportunities and make informed decisions quickly.

Education

This broker offers a comprehensive educational suite tailored to traders of all experience levels. Its online courses, excellent for beginners, provide step-by-step guidance to help users familiarize themselves with the trading landscape.

If you are looking to deepen your knowledge, Swissquote's webinars, led by finance professionals, dive deep into specific markets, products, and advanced platform tools.

You’ll also find a selection of free eBooks covering a wide array of topics, including stock trading, options strategies, and cryptocurrencies, allowing you to grow your knowledge bank at your own pace.

To further support continuous learning, Swissquote's “Inspire” section provides expert insights through blogs, podcasts, and a YouTube channel.

Swissquote is a mature and highly regulated broker that has been in the industry for many years. The broker has developed a towering reputation for advanced tools and excellent customer service. If you are looking for a safe, high-quality trading partner, you cannot go wrong with Swissquote.

Final Thoughts on Swissquote

For good reason, this broker is a highly trusted global brand with a strong regulatory foundation and a diverse range of financial products. While the cost to engage with Swissquote is relatively higher than some competitors, the company offers a multi-asset platform that extends beyond FOREX and CFDs, providing access to stocks, ETFs, options, futures, and cryptocurrencies.

Conclusion

After a thorough review, I believe this broker is a high-quality option for well-funded traders seeking a well-regulated, feature-rich platform. Swissquote, as a regulated Swiss bank and retail broker, maintains a strong reputation in global financial markets. The company offers an impressive selection of products and services, all backed by advanced technology and investor protection rules.

EU-based traders under ESMA regulations have access primarily to FOREX and CFD trading at highly competitive rates, although they miss out on the broader banking and investing services available through Swiss-based accounts.

Swissquote’s range of platforms, including MT4, MT5, and the proprietary CFXD platform, provides flexibility to suit different trading styles, even if most newbie traders will find MT4 enough for their needs.

If you are looking to trade from a Swiss-regulated account with access to more markets and financial products, you should consider Swissquote’s Swiss accounts, while FOREX and CFD traders seeking tighter spreads and lower costs will find better value in Swissquote’s EU-based accounts.

Review Methodology

The team at Arincen collected more than 120 pieces of data covering in excess of 100 licensed FOREX companies. Data collection was done in three ways:

Companies’ websites.

Other websites that have ranked FOREX companies.

A survey questionnaire (referred to here as Survey “1”) we had sent to the companies invited to participate in the exercise.

We have identified 12 criteria for our assessment, each containing several aspects and carrying its own relative weight. These include licensing, deposits and withdrawals, number of assets etc.

Afterward we validated the data by:

Registering with FOREX companies as a secret shopper and/or as Arincen.

Survey number “2,” in which we asked these companies’ customers for important feedback and past experience.

The next step saw us evaluate and rank each company, relying on the hard work of 15 Arincen employees. We were very careful in ensuring the most accurate assessment possible, including taking into account different languages, as well as the various mobile-app operating systems, e.g., Apple, Samsung etc.

To add credibility to our research project, we sent a final and third survey (referred to here as Survey “3”) to enable participating FOREX companies evaluate our own research and whether it accurately reflects the realities on the ground. We were fortunate enough to receive a mark of 9.9 out of 10! We have kept to a minimum the margin of error, which stood at a measly 1%. To learn more on how we came up with the evaluation, please click here.

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

FAQ

Swissquote is a Swiss-regulated bank and online broker offering FOREX, CFDs, stocks, ETFs, mutual funds, options, futures, and cryptocurrencies.

Yes, Swissquote is regulated by tier-1 authorities, including FINMA, FCA, and MAS.

Swissquote offers Standard, Premium, Prime, and Professional accounts, plus an Islamic account and a demo account.

The Standard account requires $1,000, Premium requires $10,000, and Prime requires $50,000.

FOREX trading is commission-free, but stock and ETF trading have tiered commissions. Custody fees and currency conversion fees apply.

Yes, Swissquote offers trading on major cryptocurrencies like Bitcoin and Ethereum.

Retail clients get up to 1:30 leverage on major pairs, while professional clients can access up to 1:400.

Yes, Swissquote offers webinars, video tutorials, market analysis, and Autochartist for automated chart analysis.

Deposits are available via bank transfer and credit/debit card.

Swissquote offers Advanced Trader, CFXD MT4, and MT5, available on desktop, web, and mobile.