FP Markets Review 2026

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

FP Markets Evaluate - research result

Key Takeaways

FP Markets was founded in 2005 and is a trusted multi-asset broker regulated by ASIC, CySEC, and other global authorities.

The broker supports more than 10,000 tradable instruments, including FOREX, indices, shares, commodities, cryptocurrencies, and bonds, mainly via CFDs.

FP Markets offers competitive ECN pricing with Raw spreads starting at 0.0 pips and a $3 commission per side; the Standard account has no commission but wider spreads.

Despite subtle regional variations, the minimum deposit can be said to start at AUD 100, making the platform accessible to a broad range of traders.

Traders benefit from a broad platform selection, including MT4/5, cTrader, TradingView, and the Iress suite for share CFDs, as well as a proprietary mobile app.

FP Markets has strong account flexibility, with Standard and Raw ECN accounts on MetaTrader/cTrader, and multiple tiers for Iress users (Standard, Platinum, Premier).

While the Iress platform unlocks over 10,000 global equities with Direct Market Access, fees and data costs are best suited for active or high-balance traders.

FP Markets offers swap-free Islamic accounts and supports multi-currency sub-accounts for clients needing flexibility across global markets.

Educational resources include webinars, articles, and video tutorials, but advanced learning tools are still limited compared to top-tier brokers.

FP Markets stands out for its cost efficiency: no deposit or withdrawal fees in most cases, no inactivity fee, and industry-average swap rates.

Social trading is supported via Myfxbook AutoTrade, cTrader Copy, and MT signals, allowing users to follow and replicate top-performing traders.

FP Markets consistently wins awards for Commissions & Fees, MT services, and Algo Trading.

Last Reviews

Overall Summary

In the tests I conducted for this review, I found FP Markets to be a high-quality broker that delivers on its promise of low-cost, efficient trading, especially for FOREX and CFD traders.

The broker has carved out a strong reputation for tight spreads, fast execution, and a broad platform offering that includes the MetaTrader suite, cTrader, and TradingView. The broker also offers the Iress Viewpoint platform, which it describes as “an upgraded web-based trading platform with advanced functionalities.”

Founded in 2005 and headquartered in Sydney, FP Markets is licensed by top-tier authorities, including ASIC and CySEC, and offers access to over 10,000 tradable instruments.

I was able to witness firsthand its low spreads, fast order execution, and account types tailored to both casual and professional traders. FP Markets is an excellent choice for those on the hunt for a cost-effective and flexible trading environment.

While its research and educational resources could be meatier, recent improvements and value-added tools like Autochartist, Trading Central, and VPS hosting reinforce its position as a strong all-rounder for active traders.

FP Markets is safe. It is a well-established broker regulated by top-tier authorities, ensuring strong client protection through strict standards, negative balance protection, and segregated client funds. However, be aware that only CySEC-regulated clients receive compensation scheme protection.

Is FP Markets Safe?

In my assessment, FP Markets is a safe and trustworthy broker.

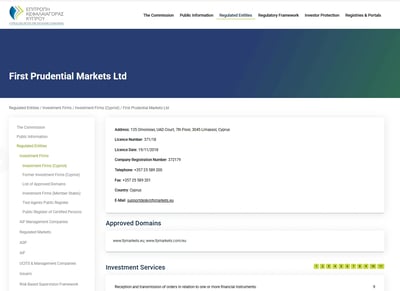

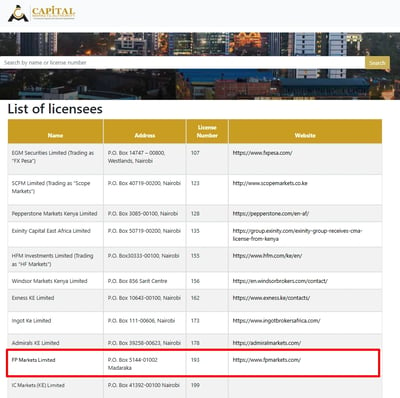

It is regulated by multiple top-tier authorities, including the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC). These Tier-1 regulators enforce strict standards for client protection.

FP Markets offers key safety features across all its subsidiaries, including negative balance protection and segregation of client funds, meaning your money is kept separate from the broker’s operating funds.

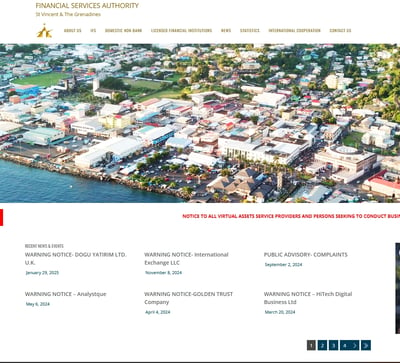

However, it’s worth noting that only clients under the CySEC-regulated entity receive compensation scheme protection (up to €20,000). Other entities, including those regulated in South Africa, Mauritius, Seychelles, and St. Vincent & the Grenadines, do not offer investor compensation.

I can attest to the fact that with a 20-year operating history, FP Markets is widely regarded as a reliable broker for retail and professional traders alike.

How FP Markets Protects You from Reckless Leverage and Margin Trading

Leverage and margin are two tools in the trader’s arsenal that, if misused, can lead to heavy losses for the trader. Many irresponsible brokers offer high leverage that can ruin uninformed traders.

How you are protected

I was pleased to discover that FP Markets helps you manage risk by offering tailored leverage levels based on where you live. For example, leverage is capped at 30:1 for retail clients under ASIC and CySEC, aligning with strict Tier-1 regulatory standards designed to stamp out excessive exposure.

While higher leverage of up to 500:1 is available through offshore entities like those in Seychelles and St. Vincent & the Grenadines, all FP Markets entities provide negative balance protection, making sure that clients cannot lose more than their deposited funds.

This is crucial in volatile markets, because it offers a safety net against extreme losses. Further, FP Markets supports platform features like margin call alerts, customizable leverage, and educational resources to help you understand the risks of margin trading before it’s too late.

Regulation and other security measures

It was no surprise to learn that, as is standard with all good brokers, client funds are held in segregated accounts, meaning they are kept entirely separate from the broker’s corporate finances, reducing the risk of misuse if the broker faces financial headwinds.

The broker also offers negative balance protection across all its global entities, making sure that traders cannot fall into debt due to market volatility. While FP Markets does not operate its own bank or hold a banking license, its long-standing regulatory compliance and transparent operations contribute to its strong safety profile.

Furthermore, the broker’s CySEC-regulated entity provides investor compensation up to €20,000, offering an additional layer of protection for EU-based clients.

Top broker features

Tight spreads and low commissions: FP Markets offers ultra-competitive pricing, with spreads starting from 0.0 pips and commissions as low as $3 per side on its Raw ECN account.

Multiple platform options: You can choose from a wide range of platforms, including MT4/5, cTrader, TradingView, and the Iress suite, catering to both FOREX and share traders.

MAM and PAMM accounts: Multi-Account Manager (MAM) and Percentage Allocation Money Management (PAMM) accounts are managed by a skilled Money Manager, allowing traders to make passive income.

Over 10,000 tradable instruments: With access to CFDs across FOREX, indices, shares, commodities, bonds, and cryptocurrencies, FP Markets has got it covered.

Advanced trading tools: The broker integrates powerful tools like Autochartist, Trading Central, and VPS hosting, best for strategy testing, market scanning, and algorithmic trading.

Fast execution speeds: Orders are executed with an average latency of just 29 milliseconds. Although I couldn't count the milliseconds myself, I can confirm that FP Markets is a strong choice for scalpers and high-frequency traders.

Copy trading and social features: FP Markets supports copy trading through MT Signals, Myfxbook AutoTrade, and cTrader Copy, allowing you to follow and replicate the strategies of top-performing traders.

For Whom Is FP Markets Recommended?

I believe that FP Markets is tailored for traders who want access to a wide range of financial instruments. Here’s who can benefit:

Beginner traders: Ideal for those new to trading, thanks to user-friendly platforms like TradingView, demo accounts, and an improving library of educational resources.

Day traders and scalpers: Excellent for fast-paced trading strategies with ultra-low spreads, Raw ECN pricing, one-click trading, and average execution speeds of just 29 milliseconds.

Copy traders: Well-suited for users interested in social trading through tools like Myfxbook AutoTrade, MT Signals, and cTrader Copy.

Algorithmic traders: Supports automated trading with VPS hosting, backtesting capabilities, and seamless integration of trading bots (EAs and cBots) on MT and cTrader.

Short- to medium-term traders: Offers a wide range of CFDs and tight spreads, making it attractive for traders focused on frequent market moves and short-term opportunities.

Not ideal for long-term investors: This broker is less suitable for those looking to invest in real shares, ETFs, mutual funds, or managed portfolios, because it simply does not offer these investment products.

-

Tight spreads and low fees

-

Wide range of platforms

-

Extensive asset selection

-

Fast trade execution

-

Robust regulation

-

Useful trading tools and integrations

-

Strong support for copy trading

-

Flexible account types

-

No inactivity fees

-

Limited investor protection outside the EU

-

Somewhat outdated web and desktop interfaces

-

Data fees on Iress platform

-

Weaker long-term investment options

-

Education content needs expansion

-

No two-step login on platforms

Offering of Investments

You can easily access multiple asset classes, including over 70 FOREX currency pairs with spreads starting from 0.0 pips, more than 10,000 share CFDs from global exchanges, and various commodities, indices, cryptocurrencies, ETFs, and bonds. The broker provides access through multiple platforms, including MT4/5, cTrader, TradingView, and Iress, with features like Direct Market Access (DMA) execution and fast execution speeds averaging 29 milliseconds.

I found FP Markets to be a broker offering diverse financial instruments to accommodate various trading preferences. Here is an overview of the available primary asset classes and some regional considerations. Remember that the FP Markets UK office has its own website, while the rest of the world gets to trade from its international site.

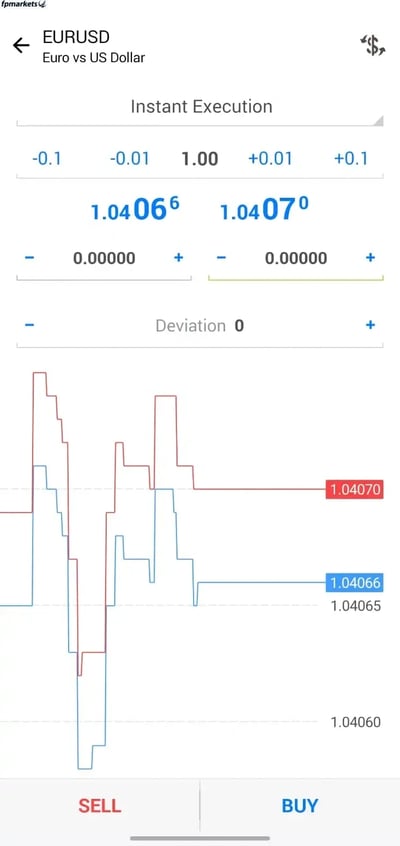

FOREX

Conduct FOREX trading with over 70 currency pairs, including majors, minors, and exotics. You can benefit from tight spreads, starting as low as 0.0 pips on Raw ECN accounts, and fast execution speeds averaging 29 milliseconds. Trading is supported on MT 4/5, cTrader, and TradingView, with customizable leverage and advanced charting tools.

Indices

The broker provides indices CFDs on major global stock indices like the DAX 40, Dow Jones 30, and US Tech 100. Index trading allows traders to speculate on the broader performance of a country's economy or sector, and FP Markets offers competitive spreads, 0.8 pips on DAX, for example, with access through both MT and Iress platforms.

Stocks (CFDs)

FP Markets offers an impressive stocks trading offering of over 10,000 CFDs across global exchanges. These are primarily accessible via the Iress platform, with Direct Market Access (DMA) execution, making it a great choice for experienced traders.

Commodities

You can access a diverse selection of commodities, including precious metals like gold and silver, and energy products like WTI and Brent crude oil. Commodities are available as CFDs with both spot and futures exposure, providing flexible options for hedging or speculation.

Cryptocurrencies

FP Markets offers 12 cryptocurrency CFDs, including popular coins like Bitcoin, Ethereum, Polkadot, and Solana. While these products allow traders to speculate on crypto price movements without owning the underlying asset, they are not available to retail clients in the UK because of FCA regulations.

ETFs (CFDs)

You can trade on ETF CFDs like SPDR 200 Financials and Betashares Gold, giving you the chance to diversify or hedge your portfolios.

Bonds

FP Markets also offers CFD trading on a small selection of global government bonds, like U.S. 10-year Notes and the U.K. Long Gilt. Bond CFDs give you opportunities to speculate on interest rate movements and economic cycles without the hassle of owning the underlying asset..

Available assets

| Markets | Available | Number of Assets |

| Currency Pairs | 68 | |

| Stocks | ||

| Commodities | 29 | |

| Crypto | 12 | |

| Indices | 18 | |

| ETFs | 46 |

Account Types

FP Markets offers the Standard account for beginners with no commission and the Raw ECN account for experienced traders on the hunt for tighter spreads. For those interested in CFDs and real shares, there are Iress accounts (Standard, Platinum, and Premier) with varying deposit requirements and fee structures. Additionally, FP Markets provides an Islamic account for Sharia compliance and a Demo account for risk-free practice.

Here are the account types you will find when trading with FP Markets:

Standard account (MT4/5 and cTrader)

The Standard account at FP Markets is commission-free and designed for beginner to intermediate traders who prefer a simple cost structure. Spreads start from 1.0 pips, and there’s no commission on trades, which makes it easier to manage trading costs upfront. This account is available on MT4, MT5, and cTrader platforms.

Raw ECN account (MT4/5 and cTrader)

The Raw ECN account is aimed at more experienced traders and scalpers who prioritize tighter spreads and direct market access. Spreads start from 0.0 pips, and a low commission of $3 per side (per standard lot) is charged. It requires the same minimum deposit as the Standard account, $100 AUD, but offers significantly lower all-in trading costs.

Islamic account

Available for both Standard and Raw ECN accounts, the Islamic account is swap-free and designed to comply with Sharia law. Instead of overnight swap charges, an administration fee is applied.

Demo account

I was pleased to learn that FP Markets offers a free demo account across all major platforms--MT4, MT5, and cTrader--allowing traders to practice with virtual funds in real-market conditions. This is a great tool for beginners to learn the platforms and for experienced traders to test strategies without risk.

Iress Standard account

Designed for those trading CFDs and real shares, the Iress Standard account requires a minimum deposit of AUD 1,000. This account comes with a monthly platform fee of AUD 55 and a data fee unless the trader meets minimum commission requirements. It’s best suited for casual or moderately active share traders.

Iress Platinum account

The Platinum account raises the minimum deposit to AUD 25,000, which is not to be sneezed at for most traders. However, it offers reduced financing costs (base rate +3.5%) compared to the Standard account.

Iress Premier account

FP Markets’ highest-tier Iress account, the Premier account, requires a minimum balance of a whopping AUD 50,000. It offers the most favorable trading conditions, including zero platform and data fees and a financing rate of base +3.0%. This account is perfect for professional or institutional traders who demand premium execution and low-cost access to global equities.

Professional account (Australia only)

Available to qualifying clients under ASIC regulation, the Professional account gives you much higher leverage up to 500:1 and you also get VIP services like personal account managers and rebate programs.

| Account Type | Minimum Deposit | Spread Commission | Commission | Swap Commission | Deposit Commission | Withdrawal Commission |

|---|---|---|---|---|---|---|

| Standard Account | $100 | Starting from 1.0 pips | $0 | not mentioned | $0 | $0 |

| Raw Account | $100 | Starting from 0 pips | $3 each way | not mentioned | $0 | $0 |

Account opening

I found opening an account with FP Markets is easy, as it is with most brokers these days. The process is entirely online, user-friendly, and can be completed on a phone, tablet, or computer.

What is the minimum deposit at FP Markets?

The minimum deposit at FP Markets varies depending on the trading platform and account type:

● MT 4/5 and cTrader Accounts (Standard & Raw ECN): The minimum deposit is 100 AUD or equivalent

● Iress Accounts:Iress Standard: Requires a minimum deposit of 1,000 AUD or equivalent.Iress Platinum: Requires a minimum deposit of 25,000 AUD or equivalent.Iress Premier: Requires a minimum deposit of 50,000 AUD or equivalent.

How to open your account

I found opening an account with FP Markets to be a fast, fully digital process that took around 15 minutes. You’ll start by providing your basic contact information, including your name, email, and country of residence, followed by personal details like your date of birth, address, and occupation. Next, you’ll select your preferred trading platform (MetaTrader, cTrader, or Iress), account type, and base currency.

To comply with regulatory requirements, FP Markets will then ask you to complete a brief questionnaire to judge your trading knowledge and experience with financial products. Once submitted, most accounts are verified and approved on the same day.

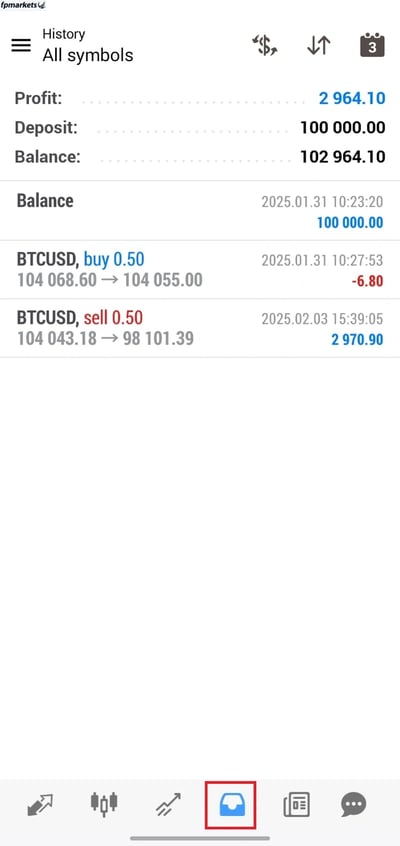

Deposits and Withdrawals

FP Markets offers a wide variety of deposit and withdrawal options, including bank transfers, credit/debit cards, e-wallets, and cryptocurrencies, all across 12 base currencies to help clients avoid conversion fees. Deposits are typically fee-free and often processed instantly, with the broker even covering international transfer fees above USD 10,000 in some cases. Withdrawals are also flexible, with most processed within 24 hours by FP Markets.

I discovered that FP Markets offers multiple ways to deposit and withdraw funds from your trading account. We can, however, report that we found this broker’s fee schedules to be more detailed and filled with conditions than most brokers. Please be sure to consult the broker’s rate card closely to know where you stand.

Account base currencies

With FP Markets, you can choose from a selection of 12 account base currencies, giving you a much better chance to swerve unnecessary currency conversion fees.

The available base currencies include AUD, USD, EUR, GBP, SGD, CAD, CHF, HKD, JPY, ZAR, MXN, and BRL. This broad range is particularly useful for international traders looking to manage multi-currency portfolios.

FP Markets deposit fees and options

FP Markets offers many flexible funding options, ensuring convenience for traders worldwide.

Available deposit methods:

● Credit/debit cards (Visa, Mastercard)

● Bank wire transfers

● E-wallets (Neteller, Skrill)

● Online banking and local payment solutions

● Cryptocurrency payments

While FP Markets does not charge deposit fees, you should know that your payment providers may impose charges, like currency conversion fees or processing fees.

One other good thing I discovered about the broker is that for international bank wire transfers of more than USD10,000, FP Markets may cover international fees up to USD50, provided you show a receipt for the transaction.

FP Markets withdrawal fees and options

The broker supports multiple withdrawal options across many currencies, including traditional bank transfers, credit/debit cards, e-wallets, and cryptocurrencies. As for e-wallets, a popular payment form, here is what you need to know:

● Neteller: Up to a 2.99% fee.

● Skrill: Between a 1% and 3% fee.

Important to know:

● Withdrawals must be made to accounts in the same name as the FP Markets trading account.

● While FP Markets does not charge fees for most withdrawal methods, third-party fees might attract more fees.

● There is no minimum withdrawal amount set by FP Markets but your own bank might impose their own minimum limits

| Method | Credit Card | Wire Transfer | Skrill | Neteller | Cryptocurrency | PayPal | Apple Pay |

| Deposit fee | $0 | $0 + Bank commission | Up to 1% | Up to 2.99% | Blockchain fees applicable | Unavailable | Unavailable |

| Withdrawal fee | $0 | $10-$50 | 1%-3% | Up to 2.99% | Blockchain fees applicable | Unavailable | Unavailable |

Customer Service

FP Markets provides award-winning, multilingual customer support available round-the-clock through multiple channels, including live chat (with 24-second average response times), email, dedicated regional phone lines with toll-free numbers, and callback services.

I learned that FP Markets offers multilingual customer support available round-the-clock across multiple channels to ensure that you get prompt and personalized assistance. Clients can reach the support team via live chat, email support, phone support, callback service, and by accessing an extensive FAQ section on its website.

| Live Chat | Phone | |||

| Available | Available | Available | Available | Unavailable |

| Quick response | Fast | Very Fast | Moderate | Unavailable |

Commissions and Fees

The broker offers competitive spreads and commissions, with two main account types: Standard, which has no commission fees but higher spreads, and Raw ECN, which features tight spreads starting from 0.0 pips and a $3 commission per side. The broker provides swap-free Islamic accounts and does not charge an inactivity fee, making it a flexible and cost-effective trading option.

FP Markets principally offers variable fees depending on the asset class with which you are working. The broker was recognized in the 2025 Annual Awards for excellence in “Commissions and Fees,” underlining its competitiveness.

We found FP Markets to deliver highly competitive spreads and commissions, especially through its Raw account, making it a strong choice for active and professional traders on the lookout for low trading costs.

Spreads

FP Markets offers two main account types, Standard and Raw ECN, each with distinct pricing models tailored to different trader needs.

Average spreads on the Standard account are 1.2 pips for EUR/USD, which is higher but easier to manage for beginners preferring an easy-to-understand pricing structure.

On the other hand, the Raw ECN account is designed for more cost-sensitive or high-frequency traders. It features tighter spreads starting from 0.0 pips, and charges a $3 commission per side (or $6 round-turn) per standard lot.

Commissions

The Standard account has no commission fees, with all costs baked into the spread.

On the other hand, the Raw ECN account, with its tight spreads starting from 0.0 pips, charges a $3 commission per side (or $6 round-turn) per standard lot.

Looking past FOREX, traders of share CFDs on MT5 face additional exchange-specific commissions, for example, $0.02 per share with a $2 minimum on U.S. exchanges, or 0.10% per side with a £2 minimum in the U.K.

Swap fees and Islamic accounts

For traders who observe Islamic finance principles, FP Markets offers swap-free Islamic accounts on both Standard and Raw MT4/MT5 accounts. Instead of interest-based swaps, these accounts charge an administration fee after a grace period, with the amount varying based on the instrument and duration the position is held. This structure ensures compliance with Sharia law while still offering access to competitive spreads and ECN pricing.

Inactivity fee

It’s good to know that FP Markets does not charge an inactivity fee, which makes it a cost-effective choice for traders who may not trade regularly.

| Spread | Commission | Swap | Islamic Account | |

| Currencies | Starting from 1.0 Pips | $3 | No | Available |

| Stocks | Unavailable | Unavailable | Unavailable | Unavailable |

| Commodities | Starting from 0.2 Pips | $0 | No | Available |

| Indices | Starting from 0.05 Pips | $0 | Yes | Unavailable |

Platforms and Tools

FP Markets offers the popular MT4 and MT5 for FOREX and CFD trading, which are robust but have an older interface. cTrader and TradingView offer more modern, intuitive interfaces, catering to day traders and those who prioritize visual analysis. For share and CFD trading, Iress platforms (ViewPoint, Trader, and Investor) provide extensive market access and tools, though they may incur fees.

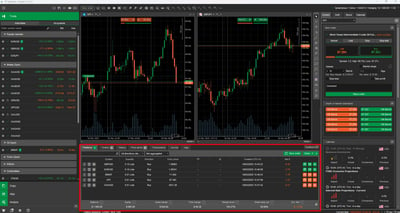

I can attest that FP Markets clients can enjoy the widely popular MT range, as well as a few other options.

Platforms types

FP Markets provides a robust selection of trading platforms designed to suit all types of traders, from beginners to professionals. You should know that the broker offers MAM and PAMM accounts, where a Money Manager simultaneously manages multiple individual CFD trading accounts, or sub-accounts, on behalf of their clients.

MAM and PAMM are both FOREX investment accounts that allow retail investors to leverage the expertise of Money Managers and enjoy a passive income stream.

MT4

This household name of a platform is ideal for FOREX and CFD traders who prefer a simple, stable, and widely supported interface. It offers features like 30 technical indicators, 23 analytical tools, 9 timeframes, one-click trading, and EA support for algorithmic strategies.

One of the most interesting tools the broker has newly revealed is the TradeMedic tool, which is integrated into both MT4 and MT5. TradeMedic, according to the broker, is an “AI-powered analytical tool that generates hyper-personalised data-driven insights and behavioural and cognitive patterns to help you make more informed decisions.”

MT5

It builds on MT4 with more advanced tools, including 38 indicators, 21 timeframes, 8 order types, and a multi-threaded strategy tester. It also supports depth of market (DOM), economic calendars, and improved backtesting capabilities, making it better for serious traders.

cTrader

This is a modern, user-friendly platform that caters to day traders, scalpers, and algorithmic traders. It features advanced charting with 76 indicators, 26 timeframes, market sentiment tools, depth-of-market view, and support for automated trading using cBots.

TradingView

It is newly integrated into FP Markets, allows for intuitive, cloud-based charting with over 100 indicators for technical analysis and deep community engagement. It's especially appealing to traders who prioritize visual analysis and idea-sharing.

Iress ViewPoint, Iress Trader, and Iress Investor

These are advanced web-based platforms focused primarily on share and CFD trading. They offer access to over 10,000 instruments and support direct market access. These platforms include tools like real-time streaming data, module linking, customizable layouts, and market depth. However, they come with data and platform fees unless a minimum trading volume or balance threshold is met.

Look and feel

I found that the MT 4 and 5 platforms are functionally robust but visually outdated when compared with the newest proprietary platforms because their design hasn’t changed much in years.

Meanwhile, cTrader and TradingView offer a cleaner, more modern interface with intuitive navigation, making them more appealing to newer traders or those who value ease of use.

The Iress ViewPoint platform is well-suited for professional share traders, offering a customizable workspace, real-time streaming data, and advanced charting.

Login and security

Across all platforms, FP Markets supports basic one-step login. This applies to MetaTrader, cTrader, and the broker’s proprietary mobile app. Unfortunately, 2FA is not available by default, which is a drawback compared to industry leaders offering this additional layer of security.

On the mobile app, users can log in using fingerprint or biometric authentication, which adds convenience but still falls short of full 2FA protection.

Search functions

I learned that the search functionality on FP Markets’ platforms is generally efficient, particularly on mobile. In MetaTrader, users can search by typing an asset’s name or browsing through categorized folders like FOREX, indices, and commodities.

cTrader and TradingView offer more dynamic search experiences, including asset filtering and sorting by such criteria as popularity or performance.

The Iress platform’s watchlist and search tools are powerful but tend to feel overwhelming to beginners due to the sheer depth of available instruments.

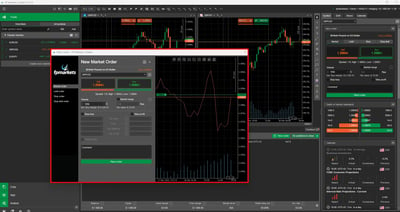

Placing orders

Placing orders is simple across all FP Markets platforms. MetaTrader supports all standard order types: market, limit, stop, and trailing stop orders.

The cTrader and TradingView platforms enhance this with depth-of-market, one-click trading, and chart-based trading.

Iress offers Direct Market Access for share CFDs, allowing execution directly on exchange with full market visibility.

You’ll be pleased to know that across all platforms, order execution is fast, with an average latency of just 29 milliseconds.

Alerts and notifications

On the MetaTrader desktop platform, traders can set price alerts and notifications, which can be pushed to mobile or email. However, the MetaTrader mobile app does not support in-app alert creation, instead forcing you to configure alerts from the desktop version.

The cTrader platform and TradingView offer advanced, user-friendly alert systems, including custom alert conditions and integrated push notifications.

During our testing, we found alerts on the Iress platform to be functional but more oriented toward professional share trading.

Mobile Trading

FP Markets supports mobile trading on all major platforms (MT4, MT5, cTrader, and Iress) for both iOS and Android. The cTrader mobile app stands out with its modern, sleek interface, advanced search functions, and one-tap order execution, while MT4/MT5 apps are functional but visually outdated. All platforms support quick order placement with major order types (market, limit, stop, trailing stop) and offer biometric authentication, though 2FA is not supported by default.

FP Markets also supports mobile trading on all major platforms (MT4, MT5, cTrader, Iress) for iOS and Android, making sure you can keep an eye on and manage positions on the go.

Platforms

FP Markets offers mobile trading through its primary apps: MT4, MT5, cTrader, and Iress mobile, all available for both iOS and Android.

These apps are well-designed, responsive, and stable, with cTrader offering the most modern and intuitive interface. With Iress mobile, you can manage your accounts, view market data, access real-time news, track portfolios, and place orders on the go.

Look and feel

The MT4/MT5 apps are functional but visually outdated, with limited customization, whereas cTrader’s sleek, touch-optimized layout includes advanced charting and one-click trading, making it ideal for traders who prioritize usability and real-time analysis on the go.

While Iress platforms are incredibly functional and feature-rich, their designs might not be as "modern" or "sleek" as newer, more user-friendly platforms like cTrader.

Login and security

Login on all FP Markets mobile platforms is limited to a single-step process, meaning 2FA is not supported by default. However, fingerprint or biometric authentication is supported on the mobile apps.

Search functions

In MT4 and MT5, traders can search by typing the name or symbol of an instrument or browse through folders categorized by asset class. The cTrader app offers a more advanced search function, allowing users to filter and sort instruments quickly, which is particularly useful given FP Markets’ broad product range.

Placing orders

Order placement on the mobile platforms is quick and efficient. All major order types are supported, market, limit, stop, and trailing stop, with execution directly from the chart or quote screen.

I found that the cTrader mobile app stands out with its depth-of-market view and fast one-tap order execution.

Alerts and notifications

As a mobile trader, I could receive push notifications for account activity and price alerts, but there are limitations depending on the platform. In MT4/MT5, you are forced to set alerts via the desktop version, which are then forwarded to the mobile app.

In contrast, cTrader allows alerts to be set directly from the mobile app, making it more user-friendly and autonomous for traders who rely heavily on real-time market cues.

Research and Development

In my opinion, FP Markets offers a good, but not industry-leading, research and development footprint, with tools and content that cater mostly to active and intermediate-level traders.

The broker integrates third-party solutions like Autochartist and Trading Central, providing technical analysis tools, pattern recognition, and trading signals that help you identify opportunities in real time. These services are embedded in the MT platforms and also accessible via the FP Markets client portal, making usability easier.

The broker also maintains an in-house research team that produces daily market commentary, technical and fundamental analysis, video updates, and trading ideas. While the frequency and format are respectable, the depth and originality of the content lag behind top-tier brokers that offer more comprehensive macroeconomic coverage, interactive research dashboards, or personalized insights.

Trading Statistics

FP Markets offers trading statistics and performance analytics tools designed to support both manual and algorithmic traders. These tools are integrated across various platforms and services, providing traders with insights to optimize their strategies.

For TradingView, FP Markets provides access to the Strategy Tester feature. This tool allows for the backtesting of trading strategies using historical data.

FP Markets integrates with Myfxbook AutoTrade, a social-trading platform that allows users to copy trades from selected systems.

Through its partnership with Trading Central, FP Markets offers clients access to advanced analytical tools that provide Technical Views, Featured Ideas, and Market Buzz.

Trading Signals

FP Markets offers trading signals through multiple platforms and tools. Autochartist and Trading Central are both technical analysis tools integrated into FP Markets' MT4 and MT5 platforms. They both continuously scan the markets to identify chart patterns, key levels, and potential trading opportunities in real-time.

Signal Start is a professional signal service integrated with FP Markets, allowing traders to follow and copy trades from top-performing signal providers.

FP Markets has also collaborated with xsee, a next-generation trading signal provider. This partnership enables clients to receive and utilize xsee's trading signals directly within its live-trading accounts.

Education

I believe that FP Markets offers a solid range of educational resources through its FP Markets Academy, including structured video courses for beginners and advanced traders; platform tutorials for MT4, MT5, and cTrader; and detailed eBooks and trading guides covering strategy, risk management, and analysis.

Traders can also access live webinars hosted by market experts, a podcast series for on-the-go learning, and a glossary with a searchable knowledge base to clarify key concepts.

Founded in 2005 and headquartered in Sydney, FP Markets is a multi-asset broker regulated by ASIC and CySEC, among others. It offers competitive pricing, ECN execution, copy trading tools, and a broad selection of CFDs across FOREX, commodities, indices, shares, and crypto. With no inactivity fees, support for 12 base currencies, and a fast digital onboarding process, FP Markets is accessible to both new and experienced traders.

Final Thoughts on FP Markets

I believe that FP Markets is a strong option for cost-conscious traders who want tight spreads, fast execution, and a variety of trading platforms. Its Raw ECN account is especially attractive, offering low all-in costs, with no minimum trade size and a $100 AUD minimum deposit. However, while it excels in pricing and execution for FOREX and CFD trading, users should be aware that premium features like the Iress platform require higher balances and may incur additional fees unless trading activity thresholds are met.

Conclusion

With over 10,000 tradable symbols, top-tier regulation, and a strong platform lineup (MT4, MT5, cTrader, TradingView, and Iress), FP Markets proves itself to be a well-rounded, trustworthy broker for active traders.

I discovered that it has earned multiple accolades in the 2025 broker awards, underscoring its appeal for scalpers, day traders, and algo users. While its research and educational offerings are still developing, and certain services like share trading are confined to the more expensive Iress environment, FP Markets remains a high-value choice for those on the hunt for deep liquidity, low fees, and flexible trading infrastructure.

Review Methodology

The team at Arincen collected more than 120 pieces of data covering in excess of 100 licensed FOREX companies. Data collection was done in three ways:

Companies’ websites.

Other websites that have ranked FOREX companies.

A survey questionnaire (referred to here as Survey “1”) we had sent to the companies invited to participate in the exercise.

We have identified 12 criteria for our assessment, each containing several aspects and carrying its own relative weight. These include licensing, deposits and withdrawals, number of assets etc. Afterward we validated the data by:

Registering with FOREX companies as a secret shopper and/or as Arincen.

Survey number “2,” in which we asked these companies’ customers for important feedback and past experience.

The next step saw us evaluate and rank each company, relying on the hard work of 15 Arincen employees. We were very careful in ensuring the most accurate assessment possible, including taking into account different languages, as well as the various mobile-app operating systems, e.g., Apple, Samsung etc.

To add credibility to our research project, we sent a final and third survey (referred to here as Survey “3”) to enable participating FOREX companies evaluate our own research and whether it accurately reflects the realities on the ground. We were fortunate enough to receive a mark of 9.9 out of 10! We have kept to a minimum the margin of error, which stood at a measly 1%. To learn more on how we came up with the evaluation, please click here.

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

FAQ

The minimum deposit is $100 AUD or equivalent for MT 4/5 and cTrader accounts. Iress accounts require higher deposits, starting at AUD 1,000 for the Standard account.

Yes, FP Markets is regulated by several reputable authorities, including ASIC and CySEC, ensuring strong client protection and operational transparency.

FP Markets supports MT4, MT5, cTrader, TradingView, and the Iress suite. Each platform caters to different trading styles, from FOREX scalping to advanced share CFD trading.

No, FP Markets does not charge inactivity fees. Accounts may be archived after 30 days of inactivity but can be reactivated easily at no cost.

Yes, FP Markets offers trading signals via Autochartist, Trading Central, and social/copy trading integrations through Myfxbook AutoTrade, Signal Start, and xsee.

Traders can choose from Standard and Raw ECN accounts for MT4/MT5 and cTrader, as well as Iress Standard, Platinum, and Premier accounts for share CFD trading. Islamic (swap-free) accounts are also available upon request.

Funding and withdrawals can be made using credit/debit cards, bank transfers, e-wallets (like Skrill and Neteller), and cryptocurrencies. Most deposits are free, and FP Markets covers certain withdrawal fees for large transfers.

FP Markets offers over 10,000 financial instruments, including FOREX, indices, commodities, shares, ETFs, bonds, and cryptocurrencies, giving traders access to a wide range of global markets.