Plus 500 Review 2026

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

Plus500 Evaluate - research result

Key Takeaways

A Contract for differences (CFD) broker, Plus500 operates from the UK and is recommended for traders seeking a friendly user experience and an easy-to-use platform.

Plus500 offers clients in multiple countries access to a wide-ranging product line, which includes stock indices, FOREX, commodities, individual shares, options, Exchange Traded Funds (ETF) and cryptocurrencies. It was also the first broker, in 2013, to introduce a Bitcoin CFD.

Plus500’s product suite numbers 2,800+ trading instruments and is offered on its proprietary WebTrader with no commissions and competitive spreads. That should entice experienced investors who prefer manual transactions and find the lowered costs worth the lack of added functionality offered by competitors.

Plus500 is authorized by multiple high-trust (tier-1) regulators.

Plus500 offers only one major account type, often called a “Retail Account,” although you can apply for a “Professional Account.”

Plus500’s deposit and withdrawal services are both well-structured, with many options. The processes are both simple and at no charge.

Plus500’s options for customer services are restricted to email support and online chat, and both are available 24/7.

Plus500’s pricing, overall, is in line with the industry average, but it trails the best FOREX brokers in active-trader pricing.

WebTrader, Plus500’s trading platform, is a solid choice for investors. It provides just the necessary, essential tools required for trading. Unlike many of its competitors, Plus500 does not offer the extremely popular MetaTrader4 (MT4) platform.

Plus500 provides videos, courses, and e-books to assist clients in learning about the markets in which they are investing. Plus500 offers none of these services.

Plus500’s mobile trading offers a seamless transition from the WebTrader browsing platform, a great sight. However, as with WebTrader, Plus500’s mobile trading app is considered by users to not offer the advanced tools, analytics, or depth of functionality found in industry‑leading platforms.

Last Reviews

Overall Summary

During my testing of Plus500, I discovered that it is an Israeli-founded, London-based CFD broker. It is recommended for traders seeking an easy-to-use platform that offers a great experience. A major accomplishment for Plus500 is its inclusion in the FTSE 250 index, a status that many a broker will never achieve. As of late 2025, Plus500’s market capitalization was reported in the range of £2.35 billion to £2.44 billion, reflecting strong year‑over‑year growth and solid investor confidence.

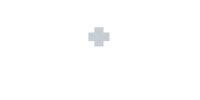

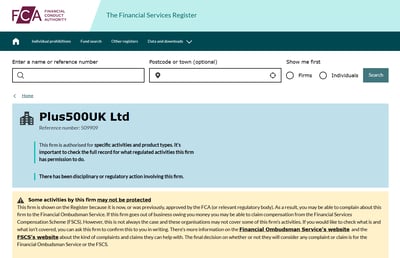

Plus500 is widely regarded as a secure and trustworthy trading platform. It maintains full financial transparency, is publicly listed, and operates under the oversight of several top-tier regulatory authorities, including the UK’s Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC), among others.

It offers clients in a range of countries access to a product line that includes CFDs in stock indices, FOREX, commodities, shares, options, ETFs, and cryptocurrencies.

I discovered that the company offers various account types and platforms tailored to meet its clients' diverse needs. By sticking to industry best practices, Plus500 offers its clients secure deposits and withdrawals, competitive leverage, tight spreads, and rapid execution. Plus500 was also the first broker to offer a Bitcoin CFD in 2013.

I found Plus500’s web-based trading platform to be extremely user-friendly, making it excellent for beginner traders. That aside, the Plus500 platform only offers basic features, rendering it far less attractive for active traders.

Considering pricing, Plus500 appears to offer spreads close to the industry average on most major FOREX pairs. However, discounts are not available to active traders or VIP clients. Further, on the negative side, the broker does not provide extensive research or education. It does, however, attempt to compensate by offering an extremely easy-to-use trading platform.

Yes, Plus500 is considered a safe broker. This is due to its strong regulatory oversight, operating under several top-tier authorities. It offers investor protection features such as negative balance protection (mandated in the UK and EU) and Guaranteed Stop Loss Orders on select instruments. Plus500 safeguards client funds through strict segregation practices, with UK clients covered by the FSCS up to £85,000. Additionally, the platform includes robust security measures like biometric authentication and auto-logouts to protect user accounts.

Is Plus500 Safe?

In my view, Plus500 is a low-risk trading platform backed by strong regulatory oversight and a transparent operating model. The company is authorized and regulated by multiple top-tier financial authorities, ensuring high levels of investor protection.

Brokers regulated by the most stringent authorities are typically seen as reliable because they have demonstrated the ability to comply with high regulatory standards. Plus500 meets this standard through its compliance with key global regulators:

- FCA, UK

- ASIC, Australia

- CySEC, Cyprus

- The Financial Markets Authority (FMA) in New Zealand

- The Financial Sector Conduct Authority (FSCA) in South Africa

- The Monetary Authority of Singapore (MAS)

As with all FOREX brokers or CFD brokers regulated in the UK, Plus500 clients benefit from negative balance protection, meaning they cannot lose more than the funds available in their trading account. However, the broker does not automatically provide negative balance protection for clients trading under other regulatory jurisdictions, such as Australia or South Africa.

Plus500 acts as a principal in transactions and hedges its market exposure through its parent company. This practice minimizes risk and helps ensure the company is not vulnerable to significant trading losses.

I found that although Plus500 does not offer private deposit insurance, it complies with all relevant client fund segregation rules. Under FCA regulations in the UK, client funds must be held in segregated accounts at authorized banks, preventing co-mingling with company funds. This provides an extra layer of protection in the unlikely event of company insolvency.

If Plus500 were to default, eligible clients in the UK could be compensated under the Financial Services Compensation Scheme (FSCS), with coverage up to £85,000 per person.

With regard to investor protection features, the broker offers negative balance protection. As mandated by ESMA regulations since 2018, clients cannot lose more than their account balance, even during volatile market conditions. Plu500 also offers Guaranteed Stop Loss Orders (GSLO) on select instruments, depending on market conditions. These may come with wider spreads due to the added protection.

As far as platform security goes, Plus500 implements several key security features to protect user data and account access. Biometric authentication (e.g., fingerprint or facial recognition) on mobile devices is a key feature, as are auto-logouts for inactive sessions on both web and mobile platforms.

How Plus500 Protects You from Reckless Leverage and Margin Trading

Leverage and margin are two tools in the trader’s arsenal that, if misused, can lead to heavy losses for the trader. Many irresponsible brokers offer high leverage that can ruin uninformed traders.

How you are protected

In my research, I found that Plus500 takes steps to protect traders from the dangers of high leverage by tailoring risk management strategies according to the trader's jurisdiction. The broker imposes region-specific leverage limits to prevent traders from taking on excessive online trading risk. In the European Union and UK, retail clients are subject to regulatory leverage caps of:

30:1 for major currency pairs

20:1 for non-major currency pairs, gold, and major indices

10:1 for commodities other than gold and non-major equity indices

5:1 for individual equities and other reference values

These restrictions are in line with guidelines from the European Securities and Markets Authority (ESMA) and the FCA to promote responsible trading practices. Other international locations can access leverage as high as 300:1.

Regulation and other security measures

Plus500 is subject to strict regulatory standards across its operating regions. As I've said, in the UK and the EU, traders are automatically granted negative balance protection, ensuring that losses cannot exceed the funds available in the account.

Plus500 actively manages margin requirements to reflect market conditions. If the equity in an account drops below the maintenance margin level, Plus500 may initiate a margin call or stop out to restore the necessary balance, reducing the risk of forced liquidations and major losses.

Top broker features

Strong regulation and safety: Plus500 is considered a low-risk trading platform, operating under the supervision of multiple top-tier regulators.

Diverse instruments: Plus500 offers a wide range of CFDs across major asset classes, including FOREX pairs, indices, commodities, shares, ETFs, options, and cryptocurrencies.

Fast and transparent execution: Plus500 acts as principal on trades and hedges market exposure through its parent company, helping ensure stable operations and reduced risk of significant trading losses.

Low-cost trading: Plus500 provides commission-free trading on most instruments, with costs built into competitive spreads. While spreads may widen during volatile periods or when using features like Guaranteed Stop Loss Orders, pricing remains transparent across the platform.

Basic education and support: Plus500 offers foundational trading resources such as articles, video tutorials, and platform guides. While the educational material is not as extensive as some competitors, it provides the essential tools for getting started.

Customer Support: Plus500 offers 24/7 customer support via live chat and email, ensuring users have access to assistance whenever needed across time zones.

Entry into the US market: Yes, Plus500 entered the US market in 2021 by acquisition. This strategic move enabled Plus500 to offer futures trading services to U.S. clients, providing access to a wide range of instruments, including FOREX, indices, commodities, bonds, and cryptocurrencies.

For Whom Is Plus500 Recommended?

I recommend Plus500 for individuals or entities seeking broad access to global financial markets through a low-cost, easy-to-use trading platform.

The broker offers over 2,800 CFD instruments across a wide range of asset classes, including FOREX, indices, commodities, shares, ETFs, options, and cryptocurrencies. All trading is conducted via its proprietary WebTrader platform, which is known for its clean interface and user-friendly functionality. Trades are commission-free, with costs built into competitive spreads.

This setup makes Plus500 particularly appealing to experienced traders who prefer manual trading and prioritize simplicity, transparency, and cost efficiency over advanced charting tools or deep integrations offered by other platforms. While it lacks features like third-party analytics or algorithmic trading capabilities, its stability and low-friction execution are ideal for self-directed investors

Following are the pros and cons of using this broker:

-

Easy-to-use and functional platform

-

Access to 2,800+ trading instruments

-

Regulated by the FCA and other top regulators

-

Great account-opening process

-

Guaranteed Stop-Loss Orders available

-

Negative balance protection for client accounts

-

Quick customer support

-

The broker recently entered the US market

-

CFD fees are average

-

Limited product range: only CFDs

-

Education and research resources are limited

-

No advanced charting or algorithmic trading

-

Proprietary platform cannot be paired with other trading platforms

-

Does not offer trading statistics or trading signals

Offering of Investments

Plus500 offers access to over 2,800 financial instruments, all traded as CFDs. Traders can choose from a wide range of asset classes, including FOREX pairs, global indices, individual company shares, commodities, ETFs, options, and cryptocurrencies. Each asset class comes with real-time data, built-in risk management tools, and such flexible trading features as leverage and the ability to go long or short.

I was impressed to discover that Plus500 gives traders access to over 2,800 CFD instruments across a diverse set of global asset classes. All products are offered as CFDs, allowing users to speculate on price movements without owning the underlying assets. This offers flexibility in both rising and falling markets, along with leverage options—though it also involves risk. Here’s a breakdown of the asset classes available on Plus500:

FOREX

Plus500 offers dozens of major, minor, and exotic currency pairs, including EUR/USD, GBP/JPY, and AUD/CAD.

All FOREX trading on Plus500 is conducted through CFDs, not through physical currency ownership.

Traders can speculate on price movements using leverage (within regulatory limits), with tight spreads and no commission fees.

Real-time charts and built-in risk management tools like stop-loss and take-profit orders are included.

Indices

Trade CFDs on major global stock indices such as the S&P 500, NASDAQ 100, FTSE 100, DAX 40, and others.

Plus500 also includes sector-specific indices in certain regions, providing more targeted exposure to industry trends.

Index CFDs are popular for traders who want to speculate on entire economies or sectors without picking individual stocks.

Share CFDs

Plus500 offers CFD trading on hundreds of international company shares, including major players like Apple, Tesla, Amazon, and Microsoft, as well as stocks from European, Asian, and Australian markets.

You can go long (buy) or short (sell) without owning the stock.

Share CFDs include real-time quotes, corporate action adjustments, and flexible position sizing.

Commodities

Trade CFDs on a range of popular commodities, including:

Precious metals: Gold, Silver, Platinum

Energy products: Crude Oil (Brent and WTI), Natural Gas

Agricultural: Wheat, Cotton, Sugar

Options

Plus500 offers simplified "call" and "put" option CFDs, similar in principle to exchange-traded options but more flexible:

These are non-standardized, allowing users to tailor them based on risk tolerance and market outlook.

Available on selected instruments, including indices, shares, and commodities.

Traders can use options for hedging or directional speculation.

ETFs

Gain exposure to baskets of assets through ETF CFDs, including popular funds like:

SPDR S&P 500 ETF (SPY)

iShares MSCI Emerging Markets

Vanguard Total Stock Market ETF

Cryptocurrencies

Plus500 allows CFD trading on major cryptocurrencies like:

Bitcoin (BTC)

Ethereum (ETH)

Litecoin (LTC)

Ripple (XRP)

Crypto CFDs are not available to UK residents or clients trading through Plus500’s UK entity due to FCA regulations.

Available Assets

| Markets | Available | Number of Assets |

| Currency Pairs | 65 | |

| Stocks | ||

| Commodities | 22 | |

| Crypto | 14 | |

| Indices | 29 | |

| ETFs | 104 |

Account Types

Plus500 offers a standard Retail Account for most users, providing access to all available instruments with leverage capped between 2:1 and 30:1. Eligible clients can apply for a Professional Account if they meet at least two of three criteria: a portfolio over €500,000, active trading history, or relevant financial industry experience. Professional accounts allow for significantly higher leverage—up to 300:1 for FOREX, 100:1 for indices, and 5:1 for options.

Plus500 primarily offers a single standard account type known as the Retail Account, but eligible clients can apply for a Professional Account if they meet specific criteria.

Retail account

Designed for the majority of users.

Offers access to the full range of instruments.

Leverage is capped between 2:1 and 30:1, in accordance with ESMA and other regulatory restrictions.

Includes such important protections as negative balance protection, margin close-out rules, and access to the FSCS in the UK (if applicable).

Professional account

Available to qualified traders who meet at least two of the following three criteria:

A financial instrument portfolio (including cash and deposits) exceeding €500,000 (or currency equivalent).

Sufficient trading activity in the past 12 months (e.g., 10 significant trades per quarter).

Professional experience in the financial services sector.

You should know that the Professional account offers higher leverage compared to the Retail account. For example, leverage on major FOREX pairs is as high as 300:1, while it is 100:1 for indices and 5:1 for options. Professional account holders waive certain retail protections, such as negative balance protection and FSCS eligibility (depending on jurisdiction). It’s also worth noting that Plus500 in Australia allows leverage up to 300:1 for Standard accounts, making it attractive for high-volume or professional traders.

| Account Type | Minimum Deposit | Spread Commission | Commission | Swap Commission | Deposit Commission | Withdrawal Commission |

|---|---|---|---|---|---|---|

| Retail Account | $100 | starting from 0.6 pips | $0 | Available | $0 | $0 |

| Professional Account | $100 | starting from 0.4 pips | $0 | Available | $0 | $0 |

Account opening

I can attest that opening a Plus500 account is fast, simple, and fully digital. Most users can complete the process within one business day, depending on verification requirements.

Plus500 accepts clients from many countries around the world, but there are key exclusions such as the United States, Canada, Iran, Syria, and Cuba.

What is the minimum deposit at Plus500?

As of 2025, the minimum deposit at Plus500 typically starts at $100 USD (or equivalent in your local currency) for most regions and payment methods.

How to open your account

The Plus500 review process is fully digital, easy, and fast. An account should be ready within one to two business days maximum. In addition to providing personal and account details, new clients are required to verify their identity and prove their place of residence, as is customary with modern KYC regulations.

Deposits and Withdrawals

Plus500 offers a smooth and fee-free deposit and withdrawal experience with multiple funding options, including credit/debit cards, bank transfers, and e-wallets—though availability may vary by region. Supported base currencies include both major and minor ones such as USD, EUR, GBP, AUD, CAD, and SGD, with the default currency assigned based on your country of residence. Deposits via cards and e-wallets are typically instant, while bank transfers can take 2–5 business days.

Both Plus500’s deposit and withdrawal services are very good. There are many options, and the process is simple and free of charge.

Account base currencies

Plus500 supports a wide range of base currencies, including both major and some minor currencies. While the broker doesn't publish an exhaustive list, these account currencies are confirmed to be supported: USD, EUR, GBP, CHF, AUD, JPY, PLN, HUF, CZK, CAD, TRY, SEK, NOK, and SGD.

Your default base currency is automatically assigned based on your country of residence. If you wish to change your base currency, you must contact customer support before making your first deposit.

Plus500 deposit fees and options

I found bank transfers to take several business days, while payments with a debit/credit card and electronic wallets are instant. Of course, you can only deposit money from accounts that are in your name. E-wallet option availability is based on your region, e.g., at the time of this review, Neteller was not available for us as a depositing option, only Skrill, PayPal, and Apple Pay.

Deposit Fees: No deposit fees are charged by Plus500.

Available methods (may vary by region):

Credit/Debit Cards (Visa, Mastercard)

Bank Transfers

E-wallets (availability varies — e.g., not available in all countries at the time of review)

Processing times:

Cards and e-wallets: Typically instant

Bank transfers: Can take 2–5 business days

Plus500 withdrawal fees and options

Withdrawal of funds from Plus500 is free of charge. There is a minimum withdrawal amount: $50 for PayPal and $100 for bank transfers as well as credit and debit cards. For withdrawals, use the same methods as for deposits. We tested the debit card transfer withdrawal, and more than three business days were required. Again, you also only are able to withdraw money to accounts in your name. Withdrawals must be made using the same method as your deposit (when possible).

Withdrawal times:

E-wallets are typically faster than traditional bank methods.

During my testing, a debit card withdrawal took over three business days to process.

| Method | Credit Card | Wire Transfer | Skrill | Neteller | Cryptocurrency | PayPal | Apple Pay |

| Deposit fee | $0 | $0 + Bank commission | $0 | Unavailable | Unavailable | $0 + Paypal commission | Unavailable |

| Withdrawal fee | $0 | $0 | $0 | Unavailable | Unavailable | $0 + Paypal commission | Unavailable |

Customer Support

Plus500’s customer service is efficient and reliable, even if somewhat minimalist. For most users, especially self-directed traders, the support options provided are sufficient for resolving typical issues.

Plus500 offers 24/7 customer support via live chat and email, accessible through its integrated “Contact Us” page on the website and platform. While support channels are limited—with no phone line available for sales or service inquiries—the response times are typically fast and efficient.

I can confirm that my experience with Plus500’s customer service was positive. All inquiries were answered within minutes, and responses were clear, courteous, and helpful. While initial chat interactions may appear automated, the system is efficient at addressing common questions. When needed, I was quickly connected to a human support agent.

Plus500 has fast response times and consistent service quality. This is reflected in user feedback, with thousands of reviews praising the platform’s overall support experience.

| Live Chat | Phone | |||

| Available | Available | Available | Available | Unavailable |

| Quick response | Moderate | Fast | Moderate | Unavailable |

Commissions and Fees

Plus500 primarily earns revenue through the bid/ask spread on trades rather than commissions, offering a simple and transparent pricing structure across all its products. While spreads are competitive—starting from 0.6 pips for FOREX and 1 pip for indices—Plus500 also charges overnight funding fees (swap fees) and applies a $10 inactivity fee after three months of no login activity. The broker offers swap-free Islamic accounts on request, with fixed markups applied in place of overnight charges.

Following the norm in the brokerage industry, Plus500 generates its revenues primarily from customer trades that “cross” the bid/ask spread, which is competitive within the industry. Plus500 does not charge commissions on any client transaction, and all trading costs are contained within the spread of the instrument. While the spread does not vary with trade size, the company does offer high-volume traders a discount.

Further, the broker also generates revenues by charging premiums, effectively a “financing charge” on positions held overnight by clients that may be subject to currency conversion charges if they trade in a currency other than the account’s base currency; and, there are fees for GLSO, and inactivity fees kick-in following an account being deemed idle for three months.

Overall, Plus500’s pricing is in line with the industry average, although it trails the best FOREX brokers when it comes to active trader pricing.

Spreads

The broker tries its best to keep spreads low. Spreads start from 0.6 pips for FOREX, 0.3 pips for commodities, and 1 pip for indices.

Commissions

Plus500 charges no commissions on any of its trading products, such as CFDs, FOREX, Indices, Commodities, Shares, ETFs, Options, and Cryptocurrencies. All costs are included within the bid/ask spread. This makes Plus500’s fee structure simple and transparent, especially for traders who prefer straightforward pricing.

Swap fees and Islamic accounts

Plus500 offers swap-free Islamic accounts on request but substitutes the lack of overnight financing with fixed markups to its spreads. FOREX traders pay 0.4 pips over swap-based alternatives or $4.00 per day per 1.0 standard round lots.

Traders holding positions overnight may incur a swap fee (also called an overnight funding fee), which varies by instrument, position size, and direction.

Inactivity fee

Plus500 charges a $10 (or equivalent) inactivity fee per quarter after 3 months of no login activity. Simply logging into your account prevents the fee — no need to place a trade, unlike some other brokers.

Other commissions and fees

No fees are charged for deposits, withdrawals, and account maintenance.

| Spread | Commission | Swap | Islamic Account | |

| Quick response | Starting from 0.6 Pips | $0 | Yes | Available |

| Stocks | Unavailable | Unavailable | Unavailable | Unavailable |

| Commodities | Starting from 0.3 Pips | $0 | Yes | Available |

| Indices | Starting from 1.0 Pips | $0 | Yes | Unavailable |

Platforms and Tools

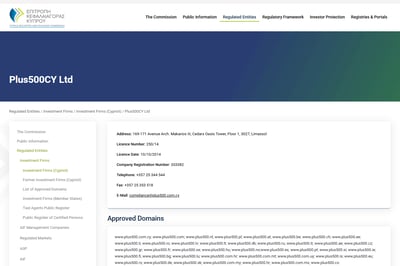

Plus500 WebTrader is best suited for retail traders who prefer a clean, self-contained platform with essential tools, transparent pricing, and intuitive design. While it lacks the advanced features sought by algorithmic or professional traders, it excels in ease of use, accessibility, and reliability for day-to-day CFD trading.

I believe that Plus500’s web trading platform, WebTrader, is an excellent choice for casual investors because of its ease of use and focus on providing only the essential and necessary tools required for trading.

Platforms types

Plus500 offers a single proprietary trading platform called WebTrader, available on web, desktop, and mobile devices.

WebTrader offers access to 100+ technical indicators, along with multiple timeframes—from tick charts to weekly views. While the charting tools are solid for visual analysis, the platform does not support custom indicators, plug-ins, or algorithmic strategies.

You should note that, unlike many competitors, Plus500 does not support MT4, TradingView integration, or any other third-party trading software. This means that you have no access to:

Expert Advisors (EA)

Automated trading

Backtesting

PAMM or MAM account management tools

This is because WebTrader is a closed system, suitable for self-directed manual traders but not ideal for those who rely on external tools or automation.

Look and feel

I found the broker's system to be user-friendly and simple, making it especially appealing to casual or intermediate traders who value efficiency over complexity. While the platform lacks advanced customization and third-party tool integration, it offers a clean, intuitive environment for manual trading across more than 2,800 CFD instruments.

Login and security

Plus500 employs industry-standard security measures, including password protection, encrypted data transfer, and automatic logout after inactivity. While two-factor authentication (2FA) is available on mobile devices, it is not automatically enforced across all platforms. Users are encouraged to enable available security features for enhanced protection.

Search functions

The platform includes a robust and intuitive search tool that allows traders to locate instruments quickly by name or symbol from categories like indices, FOREX, commodities, and more. Navigation is fast and smooth, designed for efficient trade execution.

Placing orders

WebTrader supports three basic order types, all of which can be enhanced with optional risk management features. The order types are market order, which executes immediately at the best available price. Limit order executes at a specified price or better, but can include an expiration time. Finally, a stop order executes once a specified trigger price is reached. As far as risk management tools, you can activate take-profit and stop-loss orders, as well as trailing stops, and, as mentioned, GSLOs.

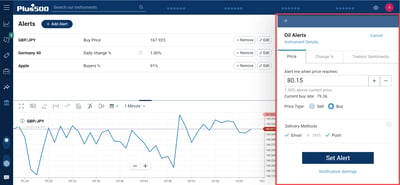

Alerts and notifications

Plus500 allows you to set price alerts and notifications directly within the platform. These alerts can be configured to notify you via in-app notifications and Email (depending on your settings). While not as advanced as SMS or technical-condition alerts available on some third-party platforms, the built-in system provides basic real-time tracking of key price movements.

Mobile Trading

The Plus500 mobile trading app closely mirrors the WebTrader platform, offering a smooth, user-friendly experience on both iOS and Android devices. It allows users to monitor prices, place and manage trades, set alerts, and use basic charting tools. Its functionality is best suited for casual or intermediate traders rather than advanced users.

In my experience, the Plus500 mobile trading app presents a seamless transition from the WebTrader browser platform, which is good to see.

Platforms

Plus500’s trading platform is also available as a mobile app for iOS (iPhone, iPad) and Android devices. The app mirrors the WebTrader’s functionality and design, allowing you to:

Monitor real-time prices

Open and manage trades

Set alerts and notifications

Access charts and basic indicators

The mobile version is well-rated for usability, speed, and security.

Look and feel

The look, feel and functionality of the mobile trading app are similar to WebTrader. At the same time, like WebTrader, the Plus500 mobile trading app lacks the advanced tools and all-around functionality to challenge industry leaders.

Login and security

Plus500’s mobile platforms use standard security measures, such as password protection and data encryption to protect user accounts. However, Trading Station Mobile does not offer 2FA. MT4 Mobile also relies on password-based security without 2FA.

Search functions

I found that the Plus500 Mobile platform allowed me to search for financial instruments quickly, using keywords or market categories.

Placing orders

WebTrader mobile supports three basic order types, all of which can be enhanced with optional risk management features. The order types are market order, limit order, and stop order.

Alerts and notifications

Alerts can be configured to notify you via in-app notifications and email (depending on your settings). The built-in system provides basic real-time tracking of key price movements.

Research and Development

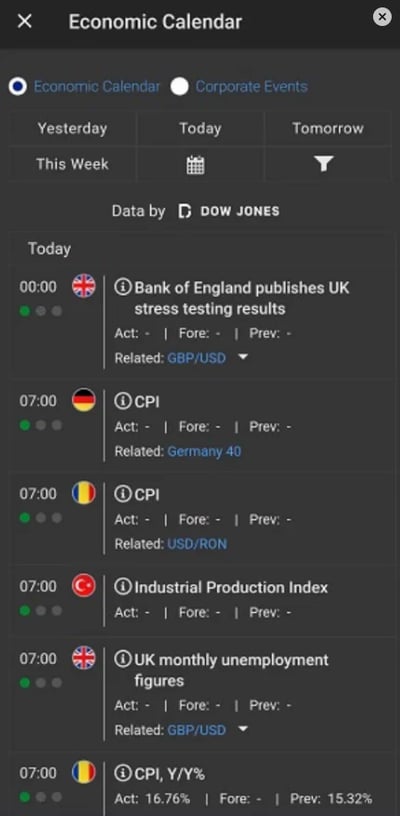

As far as investment research goes, Plus500 leaves something to be desired, particularly when compared to research leaders. The broker could step up its game by offering more daily market commentary, FOREX news, or weekly webinars.

Somewhat lacking is technical or fundamental analysis content. That aside, Plus500 allows you to place alerts on a percentage change in client sentiment data. We found this to be creative and something above basic price alerts. Further, the broker provides a “Live Statistics” indicator that shows the instrument’s performance for five-minute, 60-minute, and one-day time frames. At the same time, the broker’s charting tool is of good quality, with over 100 technical analysis indicators and great editor tools. You also can save the charts. We also liked the feature to use multiple charts simultaneously.

Although many brokers provide videos, courses, quizzes, e-books and more – all to help clients learn about the markets in which they are investing – Plus500 does not provide many of these services, as it assumes that traders know what to do already. No doubt, Plus500 should expand its offering of educational content to improve its score in this category.

Trading statistics

The platform does not provide in-depth performance analytics, portfolio insights, or tools to track trading metrics (e.g., win/loss ratio, average return per trade).

Trading signals

Plus500 does not currently provide daily trading signals, trade ideas, or analyst recommendations.

Education

I found that Plus500 offers a basic educational offering that is primarily geared toward beginner and casual traders. The available resources include short articles, video tutorials, and a simple FAQ/help center that covers essential topics such as how to use the platform, risk management basics, and trading terminology.

While these materials are useful for getting started, Plus500 does not provide in-depth market analysis, advanced trading strategies, webinars, or expert insights like some of its competitors. There is no dedicated research portal or live educational events, making it less suitable for traders seeking structured learning or ongoing skill development.

Based in the UK, this CFD broker has much going for it, despite not offering the MetaTraders suite and/or falling short on all-important research and education aspects of this industry. An easy-to-use platform, rich offerings and solid regulation make it attractive to many traders worldwide.

Final Thoughts on Plus500

Even though it could improve its educational content, Plus500 is a winner for less-experienced traders who desire ease of use and simplicity. On the other hand, active traders will be left wanting more as research is mostly absent and advanced tools are nowhere to be found.

With 2,800+ CFDs available, along with a low minimum deposit to open a live account, Plus500 provides new market entrants an easy way to explore the world of online trading.

Conclusion

In my opinion, Plus500 is a solid CFD broker. It is recommended for traders who are aware of the risks of CFD trading. The broker is regulated by several financial authorities globally, including the UK’s FCA, and is listed on the LSE. If you are not from the UK, however, you most likely will be served by alternative regulators, like Plus500 Cyprus.

Plus500’s platform is easy to use, offers a great user experience even for first-timers, and account opening and customer support both work well. On the other hand, CFDs are the only product offered, the research tools are limited, and the CFD fees are average.

The lack of educational and research resources and not providing MT4 as an alternate platform (along with no auto-trading) make this broker unsuitable for technically oriented traders. Experienced investors who prefer to enter and exit their trades manually, however, may find that the functionality trade-off results in lower expenses.

Review Methodology

The team at Arincen collected more than 120 pieces of data covering in excess of 100 licensed FOREX companies. Data collection was done in three ways:

1. Companies’ websites.

2. Other websites that have ranked FOREX companies.

3. A survey questionnaire (referred to here as Survey “1”) was sent to the companies invited to participate in the exercise.

We have identified 12 criteria for our assessment, each containing several aspects and carrying its own relative weight. These include licensing, deposits and withdrawals, number of assets, etc.

Afterward, we validated the data by:

1. Registering with FOREX companies as a secret shopper and/or as Arincen.

2. Survey number “2,” in which we asked these companies’ customers for important feedback and past experience.

The next step involved evaluating and ranking each company, relying on the work of 15 Arincen employees. We were very careful in ensuring the most accurate assessment possible, including taking into account different languages, as well as the various mobile-app operating systems, e.g., Apple, Samsung, etc.

To add credibility to our research project, we sent a final and third survey (referred to here as Survey “3”) to enable participating FOREX companies to evaluate our own research and whether it accurately reflects the realities on the ground. We were fortunate enough to receive a mark of 9.9 out of 10! We have kept the margin of error to a minimum, which stood at a measly 1%. To learn more on how we came up with the evaluation, please click here.

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

FAQ

You can open a live trading account with a minimum deposit of $100 USD or the equivalent in your local currency. This amount may vary slightly depending on your country and chosen payment method.

Yes, Plus500 is considered a low-risk and well-regulated broker. It is licensed by such top-tier regulators as the FCA, ASIC, CySEC, and others. Client funds are kept in segregated accounts, and negative balance protection is provided for retail clients in most regions.

No, retail clients are protected by negative balance protection, which means you cannot lose more than your account balance—even during high market volatility. However, this does not apply to Professional Account holders.

Plus500 offers over 2,800 instruments as CFDs, including FOREX, commodities, indices, shares, ETFs, options, and cryptocurrencies. All trading is done through CFDs—you don’t own the underlying asset.

No, Plus500 is a commission-free broker. All trading costs are built into the bid/ask spread. However, there may be overnight fees (swap fees) and a $10 quarterly inactivity fee after 3 months of no login activity.

No, Plus500's WebTrader platform is a closed system and does not support automated trading, algorithmic strategies, or third-party integrations like MT4/MT5.

You can withdraw funds using the same method you used to deposit, such as credit/debit card, PayPal, Skrill, or bank transfer. Plus500 does not charge withdrawal fees, but there are minimum withdrawal amounts.

Yes. Plus500 offers a free demo account with virtual funds, allowing you to explore the platform and practice trading in real market conditions—no deposit or time limit required.