Table Of Contents

What Do Market Orders and Pending Orders Mean?

In my view, you can’t call yourself a trader if you don’t trade, and you can’t trade without placing orders. It’s that simple — orders are a natural part of partaking in the trading world.

At the most basic level, an order is an instruction you give your broker to buy or sell an asset. However, the way in which you place that order can have a massive impact on your success or failure.

In the early days of trading, before internet-based trading, one of the first things traders learned to do was to start by “buying” or “selling” manually. How manual? Well, traders would buy and sell assets like stocks and FOREX by placing orders over the phone, with verbal confirmation and often a telex or fax for record-keeping.

This essential type of order was and is called a market order. It’s fast and direct, but it leaves traders exposed to slippage and emotion-driven decisions.

As platform-based trading developed, it became clear that trading didn’t have to be so cumbersome. Common platforms like MT4 and MT5, cTrader, and TradingView were developed to help you automate your entries and exits with different types of orders.

Rather than working with a slow trading lag common to old-style trading, you can now plan ahead, set conditions, and let the platform execute for you. That shift is important because it takes trading from guesswork and impulse toward strategy and discipline.

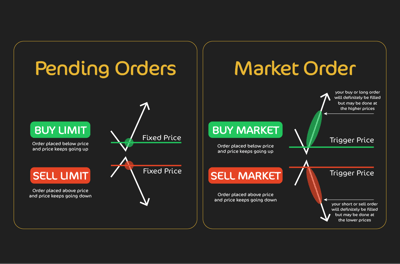

In this article, you will learn that brokers usually classify orders into two broad categories: market orders and pending orders. Market orders mean you’re entering right now at the best available price.

Pending orders are instructions to trade later, once the market reaches a level you’ve defined. In my opinion, mastering these categories and knowing how to attach exits, such as stop-losses (SL) or take-profits (TP), gives you far more control over both your risk and your opportunities.

Trading revolves around two main order types: market orders for instant execution and pending orders that trigger once a defined price level is reached

Market orders are all about speed, useful for scalping or reacting to breaking news, but they carry the risk of slippage in volatile conditions

Pending orders provide precision, with tools like buy limits, sell limits, buy stops, and sell stops, helping traders plan ahead and target exact entry levels

Exits are as important as entries, with stop-losses protecting against downside, take-profits securing gains, and trailing stops locking in profits dynamically

Advanced combo orders, such as OCO, OTO, bracket, and If-done combine entries and exits to automate trades and reduce the need for constant monitoring

Specialized orders like iceberg, all-or-none, and market-on-close cater to specific strategies where liquidity management, discretion, or timing is critical

Time-in-force instructions, such as day, GTC, GTD, IOC, and FOK, define how long an order remains active and help traders align orders with their strategies

Common mistakes include forgetting protective stops, mixing up stop and limit orders, and overusing market orders during volatile events, all of which can lead to costly errors

The Two Main Types of Orders

At their core, orders fall into two main types: market orders and pending orders. Let’s start with the market order, which is the most straightforward. A market order gets you into a trade immediately at the best available price. If you see an opportunity and want to act on it urgently, this is the tool you use. The downside is that acting this quickly can come at the expense of control, especially in volatile conditions where slippage can push your entry a few points away from where you intended.

Pending orders are different. Rather than jumping in right now, you are basically instructing the platform to wait until the price reaches a level of your choosing. It could be below the current market, above it, or even set to trigger only under very specific conditions. The good thing about pending orders is that they give you an element of precision, letting you define the terms of your order in advance rather than reacting in the moment.

Most traders bounce between these two order types depending on their style and strategy. A scalper who wants to go for a fast-moving setup might favor market orders for speed, while a swing trader looking to buy on a dip or sell into strength will be more interested in pending orders.

The key thing you need to know is that both types exist to serve different needs. In the following sections, I will go into greater detail about each type of order.

Common Order Types

Let’s get to know each of these order types better.

Market Order

As I’ve said, this type of order instructs your broker to buy or sell immediately at the best available price. In my experience, it’s the simplest way to get into a trade, and for many beginners, it’s the first order they ever place.

The main advantage is that execution is guaranteed. So, if you click buy, you’ll be in the market right away, no waiting, no conditions attached.

Trade-off: Less price control

In calm markets, this order type usually fills close to the quoted price

In fast-moving markets, slippage can occur, meaning that you might pay more or sell for less than expected. This is especially common during major economic releases when prices can jump several pips in seconds.

The effect is minimal in highly liquid pairs like EUR/USD but noticeable in volatile conditions

Best use cases

When speed matters more than precision.

Lets you participate instantly, but requires careful risk management.

Traders should pair market orders with stop-losses and learn when to use pending orders instead.

Pending Orders (MT4/MT5 standard set)

In my opinion, pending orders let you prepare your trades in advance, telling the platform exactly where you want to enter. There are intricacies to each order, which I’ll discuss below:

Buy limit

A buy limit order gets started at below the current market price. You use it to catch dips in an uptrend. For example, if EUR/USD is trading at 1.0800 and you expect it to retrace to 1.0750 before heading higher, putting a buy limit at 1.0750 allows you to get the entry you planned without watching the screen continually.

Sell limit

The sell limit works in the opposite way. You place it above the current price which makes it so useful for shorting rallies in a downtrend. If GBP/USD is sliding but you think it will touch a higher level before falling again, a sell limit lets you time the bounce accurately.

Buy stop

A buy stop sits above the current market price. It’s designed to catch upward momentum, triggering only if the market breaks higher. Traders often use it to ride a breakout through resistance.

Sell stop

The sell stop lies below the market, ready to trigger on a breakdown. If the support level fades, the order activates automatically, letting you catch the downside move without delay.

Buy/sell stop limit

This hybrid order blends the two concepts. The stop triggers the order, but instead of executing at market, it becomes a limit order. It’s a popular tool for breakout traders who still want control over slippage during volatile spikes.

Exits and Attachments

You should know that when you place an order, that’s only half the job. The other half of the job is deciding how you’ll get out of the trade. So, let’s talk about where exits and attachments fit in, because you are going to want to pair your entries with protective and profit-locking tools without leaving everything to chance.

Stop-loss

An SL is the safety net. It closes your position automatically once the price hits a level you’ve defined, putting a natural limit on how much you can lose. If you’re long EUR/USD at 1.0800 and set a SL at 1.0750, you know your maximum risk is 50 pips. Without this tool, one bad move can wipe out days of progress.

Take-profit

A TP does the opposite. It closes your position at a target of your choosing, locking in gains before the market can turn bad for you. For example, a buy at 1.0800 with a TP at 1.0850 secures 50 pips automatically once that level is reached. It’s the easiest way to make sure you don’t lose your results.

Trailing stop

A trailing stop continues with the concept of the SL. Instead of staying fixed, it moves with the market when the price moves in your favor. If you buy at 1.0800 and trail the stop by 30 pips, once price reaches 1.0830 your stop immediately shifts to 1.0800, turning risk into a break-even position. If price keeps rising, the stop follows, letting you ride the trend while protecting profits.

Combo Orders and Advanced Orders

Many brokers offer advanced combinations that bundle entries and exits together. These are designed to give you more control and reduce the need for constant monitoring.

The names of each combo order might vary by platform, but the logic remains the same that you’re setting conditions not just for getting in, but also for what happens next.

Trailing stop order

A trailing stop order moves with the market, protecting profits as price goes in your favor. Unlike a fixed SL, this one adjusts dynamically, ensuring gains are locked in without cutting your trade short too early.

One-cancels-the-other (OCO)

An OCO order places two instructions at once. Here’s an example: imagine a buy stop above resistance and a sell stop below support. If one gets filled, the other is canceled automatically. It’s an essential tool for breakout traders who watch support and resistance levels closely who want to be ready for either direction without risking double exposure.

One-triggers-other (OTO)

With an OTO order, one instruction only activates after another is executed. For instance, entering long on EUR/USD can trigger a second order to sell later at a predefined level. This allows you to go about sequencing your trades so one action leads naturally into the next.

Bracket order

A bracket order packages everything together. You place an entry, and the system automatically attaches both a SL and a TP. This is the type of “set and forget” style that keeps the risks defined while giving profits a clear target.

If done (IFD)

An IFD order works sort of the same. The main order goes in first, and only if it’s executed does the secondary instruction kick in. It’s another way to automate your follow-ups without leaving positions unprotected.

Specialized Orders That are Less Common

Beyond the standard set of market and pending orders, some of the best brokers and platforms offer more specialized tools.

These are less common in retail trading but can be useful for specific strategies, especially when precision or discretion is key.

Iceberg order

An iceberg order hides the true size of a trade by splitting a large position into smaller visible parts. Only a fraction shows on the order book at any time, keeping market impact low and preventing other traders from spotting the full intent.

All-or-none (AON)

An AON order will only execute if the entire order can be filled at once. Traders use this when partial fills would undermine their strategy, though the risk is that the order may never be executed if liquidity is thin.

Market-on-close (MOC)

A MOC order is designed to execute at the closing price of the day, whatever that may be. It’s often used by traders or funds that want to ensure their position matches end-of-day valuations.

Limit-on-close (LOC)

A LOC order works similarly, but with a price condition attached. It executes at the close only if the price is at or better than the limit you’ve set, giving more control than a pure MOC order.

Stop-on-quote / Limit-on-quote

These orders are triggered by the bid/ask quotes rather than the last traded price. They offer tighter control in fast-moving markets, making sure that your order responds directly to the quoted spreads instead of waiting for a trade print.

Time-in-Force Instructions

In my opinion, traders should know that every order needs to be furnished with the instructions relating to what happens at the end of the order. This means telling the broker how long the order should remain active.

This particular instruction is known as a time-in-force instruction. Choosing the right instruction ensures your orders behave exactly as you plan, whether you want them to sit in the market for days or disappear if not executed instantly.

Day

A day order is valid only for the current trading session. If it hasn’t been filled by the close, it automatically expires.

Good-’til-cancelled (GTC)

A GTC order remains active until you manually cancel it. Traders often use this for swing setups where the entry may take days or weeks to materialize.

Good-’til-date (GTD)

With GTD, you specify a date and time for the order to expire. It gives more flexibility than a day order but still keeps a natural endpoint.

Immediate or cancel (IOC)

An IOC order must be filled immediately. If the full amount isn’t available, whatever can be filled is executed, and the remainder is canceled on the spot.

Fill or kill (FOK)

An FOK order takes the IOC idea further; it must be filled in its entirety immediately, or the whole order is canceled. This is typically used when partial fills would undermine the strategy or add unnecessary risk.

What are Some Practical Usage Scenarios?

In my view, trading isn’t just about knowing order types; it's about knowing when to use them. Different orders give you the flexibility to match execution with strategy and keep risk under control. Use the following points as a “cheat sheet” to understand how the main types of orders work.

Market orders, speed first:

Best when instant execution is critical

Common in scalping, or catching a few pips quickly. Also, in surprise data releases or reacting in seconds to price moves

Pending orders, patience, and precision:

Useful when waiting for a specific setup

Examples: a swing trader sets a buy limit below the current price to catch a pullback. A breakout trader uses a buy stop above resistance to confirm momentum

Risk management is always part of the picture. A market or pending entry is rarely left unmanaged. Most traders attach a SL and TP from the start. This way, the maximum loss and potential reward are known clearly in advance, and there’s no need for you to constantly watch the screen. Trailing stops add another layer, locking in gains if the market runs further than expected.

How trading styles use orders:

Scalpers rely on market orders and tight stops, while prioritizing speed

Swing traders prefer pending orders and let the market come to them.

Breakout traders often combine buy/sell stops with bracket orders, executing entry, stop-loss, and take-profit together

What Are The Most Used Orders?

While brokers offer a wide menu of order types, in practice most traders stick to a few.

Market orders are the workhorse, used when speed matters and traders want in or out immediately. Limit orders are next in line, giving traders the precision to buy at or below the current market price or sell at or above it.

Stop orders, whether buy stops or sell stops, are also heavily used for breakout strategies or to trigger trades once the market shows momentum.

Stop-limit orders add a layer of control by turning a stop trigger into a limit entry, reducing slippage risk during volatile moves. And trailing stops have become a favorite among both retail and professional traders because they protect profits while allowing winning trades to keep running.

Together, these five order types: market, limit, stop, stop-limit, and trailing stop are the backbone of most trading strategies. The more exotic instructions have their place, to be sure, but these are the ones you’ll see used day in and day out across FOREX, stocks, and futures markets.

What are Some Common Mistakes Traders Make?

I've been there before. Even experienced traders can trip up when it comes to order placement. Mistakes in trading can cost money and strip away your confidence in yourself as a trader. The good news is that with practice and planning, you can avoid them. But first, you need to know what the most common errors are:

Forgetting SL or TP

Leaves trades unprotected

A sudden move can wipe out gains or magnify losses beyond plan

Mixing up stop and limit orders

Buy stop should be above the current price

The buy limit should be below the current price

Misplacement can trigger unintended trades

The same risk applies to sell orders, potentially flipping a strategy on its head

Overusing market orders in volatility

Market orders guarantee execution, not price

During news events or rapid swings, slippage can be severe

What looks like a smart entry can quickly become costly

Sometimes it’s better to step back and use pending orders instead

Conclusion

In my experience, trading orders are the building blocks of every strategy. Market orders give speed, pending orders give precision, and tools like SLs, TPs, and trailing stops bring discipline to both entries and exits.

Advanced combinations, such as OCO or bracket orders, add flexibility, while time-in-force settings determine how long your instructions remain in the market.

In the end, mastering these order types is about knowing when and why to use each one. Scalpers lean on market orders, swing traders prefer pending setups, and breakout traders often rely on stops and brackets. Whatever your style, the right order ensures your trade is executed on your terms, not by chance.

The market will always be noisy and unpredictable, but order management gives you control where it matters most, defining risk, locking in profits, and sticking to a plan. That control is what separates amateurs chasing price from professionals building consistency.

FAQ

A market order executes immediately at the best available price, while a pending order waits until price reaches a level you’ve chosen before it triggers.

Pending orders let you plan in advance and enter with precision. Instead of chasing price in the heat of the moment, you define the terms and let the platform execute for you.

Slippage. In fast-moving markets, you may get filled a few pips away from the quoted price, which can distort your risk-reward setup.

A stop-loss caps your downside by closing the trade at a set level if the market moves against you, while a take-profit locks in gains once your target is reached.

A trailing stop is a dynamic stop-loss that moves with the market when price goes in your favor. It protects profits while still allowing a winning trade to run.

A buy limit sits below current price, used to buy dips. A buy stop is placed above current price, used to catch a breakout.

The core set includes market orders, limit orders, stop orders, stop-limit orders, and trailing stops. These cover most trading needs.

Forgetting to attach stop-loss or take-profit levels, confusing stop and limit instructions, and overusing market orders during volatile conditions.