CMC Markets Review 2026

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

CMC Markets Evaluate - research result

Key Takeaways

CMC Markets (CMC), established in 1989, is a global Contract for Differences (CFD) and FOREX broker. It is regulated by several formidable authorities worldwide, including the top-tier UK Financial Conduct Authority (FCA). CMC is also listed on the London Stock Exchange (LSE) under the ticker symbol CMCX.

CMC Markets is suited for a variety of traders, from the novice retail trader looking to begin with the online trading arenas of FOREX, CFDs, and spread-betting, to the experienced veteran seeking to expand to a broad portfolio of products.

CMC Markets offers access to over 12,000 tradable instruments, covering roughly 330 FOREX pairs, 100 commodities, 80 indices, 20 cryptocurrencies, 12,000 shares and ETFs, and 40 treasuries. Its product catalog is among the largest in the online FOREX brokerage community.

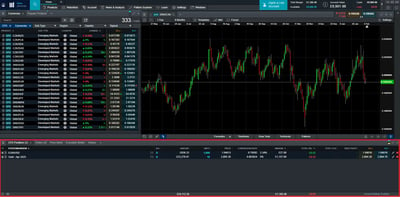

The broker’s proprietary Next Generation platform offers such powerful tools as performance analytics, automatic chart pattern recognition, and customizable interfaces.

CMC Markets recognizes the importance of customer support and prioritizes efficiently and satisfactorily meeting its customers' needs.

The minimum deposit required at CMC Markets is $0, which is ideal for traders who want to start with less money.

When choosing a mobile platform, clients can choose between Next Generation and MetaTrader4 (MT4) for iOS and Android.

CMC Markets shines in the research category, with extensive research and analysis from in-house analysts and third-party materials.

Last Reviews

Overall Summary

CMC Markets is a global CFD and FOREX broker, established in 1989. It is regulated by several authorities globally. The company is also listed on the LSE under the ticker symbol, CMCX.

CMC Markets is a globally trusted broker that delivers a formidable offering for traders, thanks to excellent pricing, nearly 12,000 tradable instruments, and the Next Generation trading platform. The platform comes packed with quality research, innovative trading tools, and powerful charting. This, along with the ubiquitous downloadable MT4 platform and a highly functional mobile application, comprises CMC's entire online offering to the consumer.

CMC provides traders access to an extensive range of offerings, both CFDs and spread betting, across several different asset classes. Further, the broker offers competitive spreads that dynamically widen or contract with trade sizes, and clients' accounts are protected from going into negative balance.

Trading professionals and institutions have access to a dedicated site that highlights CMC's added commitment to skilled traders. In the rest of this article, our experts explain why CMC Markets might be right for you.

Is CMC Markets Safe?

CMC Markets is considered low-risk, being publicly traded and regulated by Tier-1 authorities, with client funds segregated from corporate funds and UK clients protected up to £85,000 under the FSCS. The broker employs advanced security features, including two-factor and biometric authentication, auto-logout timers, and partnerships with top-tier banks to safeguard client funds.

Yes. CMC Markets is considered low-risk. The broker is publicly traded and is authorized by Tier-1 regulators. As with retail broking best practice, the broker also makes an effort to ensure client funds are not co-mingled with corporate funds. In the unlikely event that CMC becomes insolvent, UK clients have additional asset protection through the Financial Services Compensation Scheme (FSCS), up to £85,000.

Negative balance protection has been mandated under European Securities and Markets Authority (ESMA) rules since 2018. The broker's dealing desk acts as the initial counterparty on all CFD trades and spread bets, but pricing is automated through the platforms, reducing the potential for conflict of interest.

CMC's software security is comparable to the best the industry offers. In addition to two-factor and biometric authentication, a timer logs the user out of the mobile application if it is not being used.

How CMC Markets Protects You from Reckless Leverage and Margin Trading

Leverage and margin are two tools in the trader’s arsenal that, if misused, can lead to heavy losses for the trader. Many irresponsible brokers offer high leverage that can ruin uninformed traders. As with many of the best brokers, margin levels vary depending on the trader, the trading account, and the instruments being traded.

The maximum trading leverage while using CMC Markets depends on the jurisdiction under which the account operates. For UK-registered accounts, FCA rules tightly control leverage and caps it at 30:1. However, professional clients, or clients in different jurisdictions can enjoy leverage as high as 500:1.

CMC Markets has a deep resource of trading information that is available to anyone interested in learning. Its detailed and up-to-date educational resources come as trading guides for traders of any level.

How you are protected

CMC Markets is a large and successful broker, boasting a market presence in 12 countries on four continents. At last count, the broker serves over one million investors. A broker of this scale will almost always take your security very seriously, and that is what this broker does.

CMC Markets has developed an extensive range of risk-management features to help you manage trading risk effectively, helping to secure potential profits and minimize losses. Here are some of the primary measures the broker takes to protect your funds and information:

Guaranteed stop-loss orders (GSLO): If you want 100% certainty that a trade will close at an exact price if it moves against you, the broker offers GSLOs at a premium, which is refunded in full if the GSLO is not triggered.

Segregated funds: Your capital is segregated from the company’s funds and is never used for the company’s business interests.

Top-tier banks: The broker only partners with top-tier, low-credit-risk banks to ensure clients’ funds are protected.

Capital adequacy: CMC Markets maintains sufficient liquid capital to safeguard clients’ funds and assets.

Security of funds: The broker is licensed by multiple financial regulatory bodies worldwide. This oversight means that it sticks to strict guidelines to protect our clients and their funds.

Security of accounts: The broker offers a range of measures to detect and prevent potential security breaches.

Risk awareness and education: CMC Markets encourages responsible trading, ensuring all its clients are informed and educated about potential risks a trading activity may involve.

Regulation and other security measures

CMC Markets is a safe broker that provides its clients with a wide range of protections. Here is the broker’s regulation and licensing information:

Regulated under the Australian Securities and Investment Commission (ASIC)

Regulated by the Monetary Authority of Singapore (MAS)

Regulated under the FCA in the UK.

Licensed by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) in Germany

Unfortunately, scam activity is a reality in retail trading, so it’s always sound advice to work with a regulated broker. In totality, CMC Markets shows a high degree of dedication to being regulated by some of the strictest regulators in the business.

Top broker features

Ultra-tight spreads and good fees.

One of the largest product catalogs available in the online FOREX brokerage community. with over 12,000 tradable instruments.

Regulated by several top-tier regulators.

Excellent customer service, which includes 24/5 telephone support with access to live brokers and chat service.

Stellar educational offerings that continually grow.

Offers negative balance protection, which is vital in the highly-leveraged retail FOREX market.

Offers GSLO to ensure that client orders are placed.

For Whom Is CMC Markets Recommended?

CMC Markets is suited to all types of traders, from the novice retail trader looking to begin in the online trading arenas of FOREX, CFDs, and spread-betting, to the experienced veteran seeking exposure to a broad portfolio of products. The firm's fees are competitive within the industry and it ranks high on several of our lists.

Traders should know exactly what type of broker CMC Markets is so they can align its products with their preferences. The main item to consider is that CMC Markets is predominantly a CFD broker. This means that the broker allows you to speculate on the price movements of financial instruments without owning the asset itself.

Additionally, CMC Markets offers spread betting, which is another tax-efficient way to trade financial markets, enabling you to speculate on price movements without owning the underlying asset. With CMC Markets, you place a bet on whether a market will rise or fall using the broker's precise bid/ask prices. The profit or loss is determined by the difference between your opening price and the closing price, multiplied by your stake per point.

Here are some major considerations of which you should be aware before you invest with this broker:

-

Extensive range of offerings.

-

Regulated by the FCA (UK) and other top regulators.

-

Low FOREX fees.

-

Emphasis on education and customer service.

-

Great Web and mobile platforms.

-

Offers protection for client accounts.

-

Research amenities are industry leading.

-

Does not accept US clients.

-

High CFD spreads for certain indices.

-

It only offers CFD trading, so traders cannot own the underlying asset.

-

Does not support deposits and withdrawals through electronic payments.

Offering of Investments

CMC Markets offers an extensive product catalog, including 330+ FOREX pairs, 80+ global indices, 100+ commodities, 12,000 shares and ETFs, and 40+ treasury instruments. FOREX trading features spreads starting at 0.0 pips on the FX Active account, 0.003-second execution, and exclusive indices for diversified positions.

While we strive to provide the most accurate information on financial assets at the time of writing, brokers frequently adjust their trading offerings in response to market conditions.

CMC Markets offers clients among the largest product catalogs available in the online FOREX brokerage community. The broker grants access to:

330 FOREX instruments

80 Indices

20 Cryptocurrencies

12,000 Shares & ETFs

100 Commodities

40 Treasuries

Note that cryptocurrency trading is available through CFDs, but not available via trading the underlying asset (e.g., buying Bitcoin). At the same time, Crypto CFDs are not available from any broker's UK entity, nor to UK residents, as the FCA banned the sale of crypto-derivatives to UK retail consumers from January 6, 2021. Here is a further breakdown of the financial instruments the broker offers.

FOREX

CMC Markets excels in FOREX trading, offering an unmatched selection of over 330 currency pairs. Whether you’re trading major pairs like EUR/USD or exotic combinations, spreads start from 0.0 pips on their FX Active account. With a trading execution speed of just 0.003 seconds and no partial fills, the broker caters to even the most demanding FOREX traders.

Shares and ETFs

For those looking to trade shares, CMC Markets offers exposure to 12,000+ companies, including global giants like Apple and Amazon. ETFs are also available, featuring over 1,000 options that track market themes and sectors. Their advanced tools, such as Morningstar’s equity analysis, and lightning-fast execution make share trading intuitive. With zero currency risk in spread betting and reduced costs through CMC Alpha, the broker supports informed and cost-effective trading.

Indices

CMC Markets offers access to over 80 global indices, allowing traders to speculate on the performance of top shares from major markets like the UK 100 and Germany 40. With spreads as low as 1 point and ultra-fast execution, the broker ensures efficient trading with minimal slippage. For traders looking to expand their portfolios, CMC Markets provides exclusive share baskets that aggregate related stocks into a single position.

Commodities

The broker provides extensive coverage of over 100 commodities, including popular options like gold, silver, crude oil, and natural gas. Their bespoke commodity indices offer the ability to trade entire sectors from a single position. For traders keen on timing market opportunities, commodities like Brent oil trade up to 23 hours daily. With tight spreads, historical charting back to 1992, and dedicated support, CMC Markets makes commodity trading accessible and efficient.

Share Baskets

CMC Markets’ share baskets focus on emerging industries like autonomous driving and cybersecurity. These mini-portfolios provide diversification and reduced trading costs, allowing you to gain exposure to growing trends with a single leveraged position. For further information on how to choose which shares to invest in, read our helpful article here.

Rates and Bonds

The broker also facilitates trading in government bonds and interest-rate instruments. With over 40 options, including treasury notes and bunds, traders can speculate on macroeconomic movements. Ultra-fast execution and 24/5 support ensure seamless trading of these traditionally low-risk assets.

Cryptocurrencies

CMC Markets enables CFD trading on popular cryptocurrencies like Bitcoin, Ethereum, and emerging options like TRON. CMC Markets’ exclusive crypto indices provide a convenient way to trade multiple digital assets at once. With no need for a crypto wallet and ultra-precise pricing, the broker simplifies crypto trading for all levels of traders.

Available assets

| Markets | Available | Number of Assets |

| Currency Pairs | 330 | |

| Stocks | 12.000 | |

| Commodities | 100 | |

| Crypto | 20 | |

| Indices | 80 | |

| ETFs | 12.000 |

Account Types

CMC Markets clients can choose from Spread Betting, CFD Trading, and FX Active accounts, offering access to over 12,000 instruments, leverage, and tax-efficient trading benefits, with platforms like MT4, MT5, and CMC’s web and mobile apps. Additionally, CMC offers a Pro Account with higher leverage for qualified traders, Islamic accounts, and a demo account with £10,000 virtual funds for practice.

The account-opening process is fully digital, and there is no minimum deposit. However, confusion about what documents to upload for identification can prolong the verification process. CMC Markets is available all over Europe and most of the rest of the world.

Further, you can open a Pro Account that allows you higher leverage. However, to open a Pro Account, you have to satisfy the following preconditions:

Placed 10 trades in the previous quarter; these trades were relevant with significant size.

You worked in the financial sector for at least one year.

Your portfolio exceeds €500k.

CMC Markets offers its clients the option of three comprehensive accounts:

Spread betting account:

A spread betting account offers a tax-efficient way to speculate on the price movement of over 12,000 global financial instruments. This option is only offered to UK clients. Whether you're looking to go long or short, you can trade with leverage, amplifying your market exposure while only tying up a fraction of your capital.

With platforms like CMC’s web and mobile apps or MT4, you can trade anytime, anywhere, enjoying the flexibility and functionality you need. Spread betting options and schemes like Price+ and Alpha add further customization, ensuring your trading fits your goals.

CFD Trading account:

The CFD trading account lets you trade on the price movement of underlying financial assets without owning them, offering a cost-effective way to access over 12,000 global markets. Platforms like CMC’s web and mobile apps or MT4 ensure seamless trading on the go.

FX Active account:

An FX Active Account is perfect for CFD traders who prefer commission-based FOREX trading and want to focus on pure price action. Enjoy spreads from as low as 0.0 pips on six major pairs, plus a 25% discount on spreads for all other FX pairs, giving you competitive pricing across the board. To find out more about pips in trading, read our article here.

Demo account:

The broker offers the option of a demo account with £10,000 of virtual funds that allows you to trade without risk.

| Account Type | Minimum Deposit | Spread Commission | Commission | Swap Commission | Deposit Commission | Withdrawal Commission |

|---|---|---|---|---|---|---|

| CFD account | $0 | Starting from 0.3 pips | Starting from $7 | Available | $0 | $0 |

| FX Active | $0 | Starting from 0 pips | Starting from $7 | Available | $0 | $0 |

| Spread betting | $0 | Starting from 0 pips | $0 | Available | $0 | $0 |

Account opening

Opening new accounts is through an online application process. Account verification is mandatory to comply with regulator-mandated Anti-Money Laundering (AML)/Know Your Customer (KYC) requirements. Opening an account with CMC Markets is easy, as it is with most brokers these days. The process is entirely online, user-friendly, and can be completed on a phone, tablet, or computer.

What is the minimum deposit at CMC Markets?

CMC Markets requires no minimum deposit to open an account, allowing you to start trading with any amount that works for you. This flexibility enables traders to embark on their trading journey without needing a large initial investment. Although there is no enforced minimum, it is advisable to deposit at least $100 to ensure you have adequate funds for managing your trades effectively.

How to open your account

The CMC Markets review process is fully digital, easy, and fast. An account should be ready within one to two business days. To open an account at CMC Markets, follow these steps:

Go to the broker’s website and choose your preferred account.

Fill out the application form.

Submit identification documents

Fund your account with at least $100 or the equivalent in your currency.

Begin trading from a wide range of instruments.

If you need any assistance during the account opening process, you can contact CMC Markets's customer support.

Deposits and Withdrawals

CMC Markets offers multiple deposit and withdrawal options, including bank transfers and credit/debit cards, with many transactions being free of charge. Bank transfers take 1–3 business days, while card payments are instant, supporting major currencies like GBP, USD, EUR, AUD, and CAD. While CMC Markets does not charge fees for most methods, clients should check with their bank or intermediaries for potential charges.

Multiple deposit and withdrawal options, as well as CFD account-based currencies, may be used. Withdrawals are mostly free. In addition to bank transfers, clients can use credit and debit cards. A bank transfer can take several business days, while payment with a credit/debit card is instant. Clients can only deposit money from accounts that are in their name.

Account base currencies

CMC Markets offers you a wide range of account base currencies, depending on where you live and where your account is based. Accounts can be opened in a wide range of currencies, including, but not limited to, GBP, EUR, USD, AUD, CAD, NOK, NZD, PLN, SEK, and SGD.

In FOREX trading terminology, the “base” currency is always listed first in a FOREX pair, with the “quote” currency listed second. The base currency is always equal to one, while the quote currency represents the current price of the pair.

CMC Markets Deposit fees and options

Bank wire transfer takes 1-3 business days and costs $0. Major debit and credit cards are also supported, and you can instantly fund your trading account in popular currencies such as AUD, EUR, CHF, GBP, and USD. The broker does not charge any fees for this method. Remember that while the broker does not typically charge any fees, banks or intermediaries may.

For those wondering whether the broker allows deposits via cryptocurrencies - the answer would be no. They offer crypto trading only through CFDs, meaning you do not own the underlying coins and cannot directly fund or withdraw via crypto.

CMC Markets withdrawal fees and options

To withdraw money, traders must initiate a withdrawal by submitting a request through their trading account. Third-party deposits and withdrawals are forbidden. E-wallet services like Skrill and Neteller are not supported through the broker’s UK office. For detailed information on specific fees and any additional charges, we recommend that you check CMC Markets's official website or contact its customer support.

| Method | Credit Card | Wire Transfer | Skrill | Neteller | Cryptocurrency | PayPal | Apple Pay |

| Deposit fee | $0 | $0 + Bank commission | Unavailable | Unavailable | Unavailable | Unavailable | Unavailable |

| Withdrawal fee | $0 | $0 + Bank commission | Unavailable | Unavailable | Unavailable | Unavailable | Unavailable |

Customer Support

CMC Markets prioritizes customer support, offering 24/5 local phone assistance, email communication, and a well-organized FAQ library. Live chat, accessible through the Next Generation platform, responds quickly, with wait times averaging 30–40 seconds. Support is available in multiple languages, ensuring accessibility for a global client base.

In this fiercely competitive age, an online broker that does not pay attention to its customers may be doomed to failure. CMC Markets is well aware of the importance of customer support and places high priority on addressing the needs of its customers in an efficient and satisfactory manner. Contact options cover all bases, with email for clients and prospective clients, 24/5 local phone support, and comprehensive Frequently Asked Questions (FAQ) and support libraries.

Live chat can also be launched from within the Next Generation platform, which is very convenient. The FAQs are very informative and well-organized. Chat waiting times averaged 30 to 40 seconds during several contact attempts.

CMC Markets customer services are available in multiple languages:

Chinese.

English.

French.

German.

Italian.

Norwegian.

Polish.

Spanish.

Swedish.

The broker also has 14 satellite offices on four continents to support licensed operations in other venues. This broad coverage contributes to a strong customer support offering.

| Live Chat | Phone | |||

| Available | Available | Unavailable | Available | Unavailable |

| Quick response | Moderate | Unavailable | Moderate | Unavailable |

Commissions and Fees

CMC Markets offers competitive pricing with spreads starting at 0.5 pips on EUR/USD pairs, 0.5 pips on indices, and 0.2 pips on commodities. Commissions apply to Stocks CFD trading at a rate of $10.

CMC Markets aims to provide tight spreads regardless of market volatility, delivering competitive and reliable pricing. The broker provides attractive spreads right across its product range. Here is a detailed breakdown of the different types of fees:

Spreads

CMC Markets generates most of its income from spreads, which are built into the buy and sell prices of instruments. Key spreads include:

Indices: Starting from 0.5 pips with no commissions.

Shares: Starting from $10 for share CFD trading.

Commodities: Starting from 0.2 pips.

FOREX: Starting from 05 pips.

Commissions

FOREX, commodities, and indices are commission-free. For stock CFD trading, a minimum commission of $10 applies.

Swap fees and Islamic accounts

The broker does not allow Islamic accounts tailored for traders who adhere to Sharia law. This means that traders adhering to Sharia law, which prohibits earning or paying interest, may find it challenging to trade with this broker.

Inactivity fee

There's a monthly charge of £10 (the amount depends on your account currency) on dormant accounts, but no deduction is made if there are no funds in the account. An account is considered dormant if there has been no trading activity for a continuous period of one year.

Other costs

Rollover Costs: Forward positions can be rolled over at the mid-price, saving 50% on the spread cost.

GSLOs: A premium fee applies to GSLOs, but if not triggered, the fee is refunded.

Market Data Fees: Monthly fees apply for access to certain share CFD market data, depending on the subscription and account type.

These transparent fee structures ensure that traders know what costs to expect, with the broker providing savings opportunities like GSLO refunds and reduced rollover costs.

| Spread | Commission | Swap | Islamic Account | |

| Currencies | Starting from 0.5 Pips | $0 | Yes | Unavailable |

| Stocks | Starting from $0.2 | $10 | Yes | Unavailable |

| Commodities | Starting from 0.2 Pips | $0 | Yes | Unavailable |

| Indices | Starting from 0.5 Pips | $0 | Yes | Unavailable |

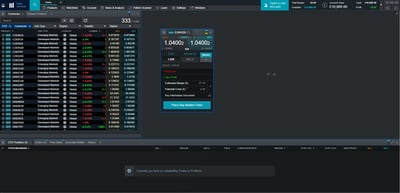

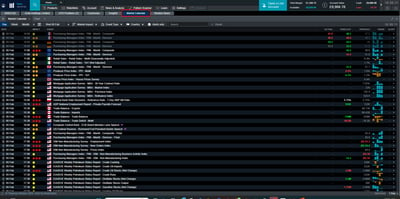

Platforms and Tools

CMC Markets’ Next Generation platform is a powerful, intuitive tool offering fast execution and advanced charting. It ensures precise pricing with over 225 million price updates daily and robust risk management tools, including trailing stops, boundary orders, and guaranteed stop-loss orders. The MT4 platform enhances trading with access to 175+ FOREX pairs, indices, and commodities while supporting automated strategies through 12 premium Expert Advisors and 18 advanced indicators like pivot points and Renko charts.

The CMC Markets Next Generation trading platform is fast, reliable, and comes full of extensive tools and features, making it a market leader that will impress even the pickiest of traders. During our testing, we were extremely impressed with the Next Generation platform’s design, which focuses on speed and usability.

Platforms types

CMC Markets offers the following trading platforms:

Next Generation web platform

CMC Markets’ Next Generation platform is the UK's best online trading platform, designed to be powerful, intuitive, and packed with advanced features that support traders at every level. It combines cutting-edge tools, fast execution, and robust security, with insightful analysis, helping traders execute their strategies effectively and efficiently. Here are some key features:

Performance Analytics: You can analyze your trading history with intuitive tools that highlight profitable behaviors and areas for improvement. This feature is available to all live account holders.

Powerful Charting and Pattern Recognition: Traders can automatically scan over 120 instruments every 15 minutes for chart patterns, like wedges, channels, and head and shoulders formations.

Customizable Interface: Tailor your workspace with editable auto stop-loss orders, default trade sizes, charting templates, and custom dashboards.

Fast, Reliable Execution: 100% automated execution with no dealer intervention, ensuring trades are fully executed, regardless of size. One-click trading lets you set default position sizes and enter positions with a single click.

Precise and Transparent Pricing: Over 225 million prices crunched daily from up to 14 tier-one liquidity providers to deliver pinpoint pricing. Guaranteed stop-loss orders provide certainty by ensuring trades close at the specified price.

Comprehensive Risk Tools: Define exit prices with stops, take-profit orders, and advanced options like trailing stops, boundary orders, and partial close-outs. Price alerts notify you of key market movements, keeping you informed in real time.

Hedging Options: Hedge physical positions or open simultaneous buy and sell positions for maximum flexibility in volatile markets.

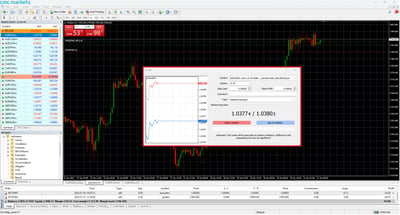

MT4:

MT4 is a globally renowned online trading platform that is widely used for FOREX trading, as well as spread betting and trading CFDs on indices and commodities. CMC Markets enhances the MT4 experience with robust features, competitive offerings, and a suite of advanced tools designed to meet the needs of both beginner and experienced traders. Here are some key features:

Wide Market Access: Trade 175+ FX pairs, popular indices, and commodities with competitive spreads.

Automated and Reliable Execution: 100% automated execution ensures trades are filled without dealer intervention; 99.9% order fill rate, delivering trades at quoted prices whenever possible.

Enhanced Functionality: No scalping restrictions or penalties for high-frequency trading. Unrestricted trading with no minimum stop-loss or take-profit distances.

Trading Tools and Indicators:

Access 12 premium Expert Advisors (EA), including mini terminal and sentiment trader.

Utilize 18 advanced indicators, such as pivot points and renko charts, to enhance technical analysis.

Features like stealth orders, advanced money management tools, and auto-generated tweets for market updates ensure an edge in dynamic markets.

Integration with Excel via the RTD plugin for real-time data analysis.

Look and feel

Each of the platforms on offer has intuitive and user-friendly interfaces that make analyzing and navigating the markets a walk in the park, no matter your skill level. Next Generation’s layout wizard lets you choose between floating or fixed windows, in addition to predefined layouts or custom setup. Further, module linking is supported with five levels color-coded, which helps save time when clicking a watchlist symbol and seeing the corresponding chart update to that instrument.

Login and security

CMC Markets follows industry-standard security procedures, including website encryption, to protect sensitive client data.

Search functions

The Next Generation platform is full of features and well-suited for advanced traders. While beginner traders may find the level of features daunting, video tutorials and quick-start manuals are available. The search function is intuitive and provides comprehensive findings.

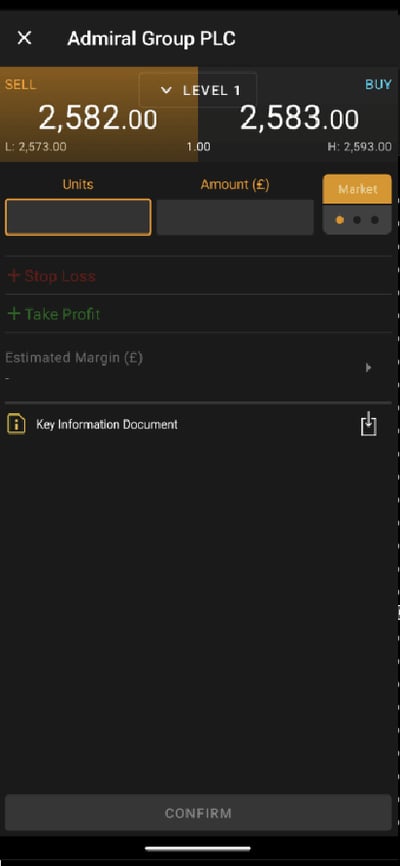

Placing orders

For pending orders, traders can choose both guaranteed and/or trailing options when filling out the order ticket prior to execution. Here are common order types supported:

Market: The simplest order, where a trader signals that their trade request should be executed at the prevailing market rate.Limit: A pending order where the entry is at a predetermined point below or above the prevailing market rate, depending on whether it is a buy or sell. The trader also has the option of selecting the expiration time of this order.Stop: A pending order where the entry is at a predetermined point above or below the prevailing market rate, depending on whether it is a buy or sell. The trader also has the option of selecting the expiration time of this order.

Alerts and notifications

You can set up push, SMS, or email notifications for important market events, price changes, or order updates so you never miss a critical moment.

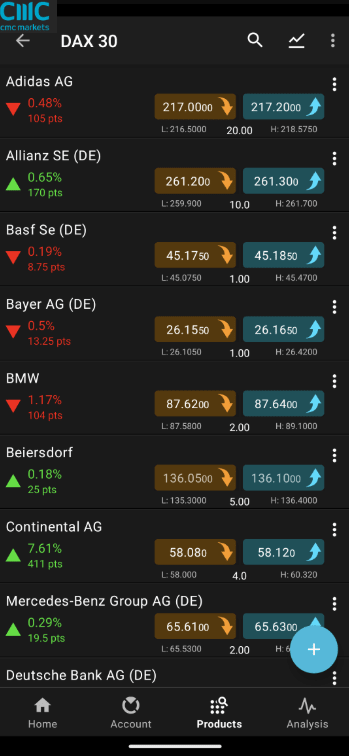

Mobile Trading

The CMC Markets mobile app offers access to 12,000 markets and advanced charting tools with over 40 technical indicators. Designed for iOS and Android, it mirrors the web-based Next Generation platform with features like complex order building, chart-based trading, and push/email alerts, though it includes fewer features than the desktop version. Clients can also choose MT4 mobile for CFDs, which lacks share trading but supports automated strategies and basic trading tools.

The CMC Markets' mobile app is cleanly designed and comes filled with multiple research tools, pre-defined watchlists for scanning, powerful charts, integrated news and educational content, and much more.

CMC Markets delivers a terrific mobile app experience. The overall look and feel of the Next Generation mobile app closely resembles the web-based version of the Next Generation platform.

Clients may choose between Next Generation and MT4 for iOS and Android when picking a mobile platform. The homegrown app outshines MT4 in nearly all aspects but includes fewer features than its Web version. More importantly, chart optimization has been emphasized. Clients can build complex orders and generate customized alerts through push notifications or emails. MT4 is offered as an add-on or standalone account option, but is limited to CFDs and has no share capacity.

Platforms

CMC Markets Mobile App:

The CMC Markets mobile app is a comprehensive trading tool designed to cater to both new and experienced traders, offering powerful features in an intuitive and mobile-optimized platform. Whether you're managing trades or analyzing markets, this app ensures you can stay connected and in control of your trading journey anytime and anywhere.

Access to 12,000 Markets: Spread bet and trade CFDs on a variety of instruments, including indices like the UK 100, FOREX pairs like EUR/USD, and commodities like Gold.

Mobile-Optimized Trading and Analysis: Advanced order ticketing and charting capabilities, including over 40 technical indicators and drawing tools. Place, edit, and close trades directly from charts, with access to over 25 technical indicators and 15 drawing tools.

Exclusive Market Insights: Free access to market news and analysis from award-winning in-house analysts. Commentary and updates from Reuters, an economic calendar, and equity valuation data from Morningstar.

Commitment to Development: CMC Markets continually enhances its mobile trading tools, equipping traders with cutting-edge features to maximize opportunities in the markets.

Look and feel

The mobile version offers a streamlined experience with essential features for trading on the go. CMC Markets’s Next Generation mobile platform is for instant market access with similar trading features as the Next Generation desktop platform and is well-suited for traders who prefer easy access to trade, but with fewer features.

Login and security

Secure login and authentication processes to protect user accounts. These features are in line with industry norms.

Search functions

The search function on the Next Generation app and the MT4 apps is intuitive and provides comprehensive findings.

Placing orders

CMC Markets’s apps strongly support automated trading strategies through visual constructors and Expert Advisors. There are three basic order types with the option of attaching "take profit" and/or "stop-loss" orders to them. Additionally, the trader can set an initial stop-loss at the time of execution for market orders and then amend it to a GSLO after execution.

Alerts and notifications

All the mobile apps in the CMC Markets stable provide real-time alerts and notifications to keep traders updated on market movements and order statuses.

Research and Development

CMC Markets has a strong emphasis on research and innovation, offering traders tools that rival the best in the industry. Exclusive features like the Chart Pattern Scanner and the Client Sentiment Tool give traders an edge by allowing them to identify opportunities and gauge market trends effectively.

Additionally, the broker's commitment to precise execution is evident in its lightning-fast trade processing speeds, which minimize slippage and ensure trades are completed without partial fills. By combining these tools with 24/5 customer support, CMC Markets ensures that both novice and experienced traders have the resources needed to thrive in dynamic markets.

You can get extensive research and analysis from both in-house analysts and third-party materials that include Morningstar quantitative equity research reports (live accounts only). This feature alone might entice a serious trader to open a live account with CMC Markets. Many resources may be accessed directly through the website, while news sources are able to be filtered by region and asset class.

Economic calendar

This excellent economic calendar provides real-time updates on economic events and indicators that can impact the financial markets. It includes detailed information about each event, such as the time, country, and expected impact. Traders can filter events based on their preferences and focus on the most relevant data.

CMC Markets’s research and development tools and features are designed to provide traders with comprehensive market insights, advanced trading tools, and educational resources. These tools help traders make informed decisions, manage risk effectively, and enhance their trading strategies.

Education

With regard to education, CMC Markets competes with the best in the industry by offering FOREX and CFD traders a diverse selection of education in a variety of formats, including written articles, video updates, podcasts, and live webinars.

CMC Markets provides an extensive range of educational guides tailored to traders at all levels. Their library includes 76 guides covering such diverse asset classes as FOREX, commodities, and indices, offering insights into specific markets like FAANG stocks and gold trading.

The guides delve into both fundamental and technical analysis, providing insights on how to interpret economic indicators, company fundamentals, and chart patterns. Additionally, the platform offers specialized guides on trading with leverage, day trading, and developing a trading edge. For those new to trading, there are essential articles that explain key concepts and definitions, such as direct market access (DMA) and over-the-counter (OTC) trading.

Final Thoughts on CMC Markets

CMC Markets is an excellent fit for all types of traders, with a wide product offering along with an accessible, feature-rich platform (Next Generation), a plethora of research amenities, useful educational resources, and an emphasis on customer service.

New traders will be well taken care of, and professionals and institutions will find broadly attractive feature sets that make the broker an all rounder in the retail trading game.

Conclusion

With competitive pricing and nearly 12,000 instruments from which to choose across nearly every market and asset class, CMC Markets is a great choice for global FOREX and CFD traders. Furthermore, the CMC Markets Next Generation platform is powerful and versatile, with plenty of configuration options and tools for traders to customize the platform to meet their needs.

Being highly regulated lends credibility, as does the extent to which CMC emphasizes account security. Negative balance protection gives clients peace of mind, and the premium GSLO execution is reasonable, given the account-saving risk management it provides in volatile market conditions. All in all, this is a strong global broker that has been successful over many years and has shown that it can handle all types of traders.

CMC Markets in Brief

CMC Markets is considered one the best trading brokers around, offering some 12,000 asset classes that encompass currencies, commodities, indices, cryptocurrencies, bonds, and stocks. The company offers a relatively low spread, the MT4 platform, and fast customer service. It is most suited for traders looking for diversity in asset classes.

Review Methodology

The team at Arincen collected more than 120 pieces of data covering more than 100 licensed FOREX companies. Data collection was done in three ways:

Companies’ websites.

Other websites that have ranked FOREX companies.

A survey questionnaire (referred to here as Survey “1”) was sent to the companies invited to participate in the exercise.

We have identified 12 criteria for our assessment, each containing several aspects and carrying its relative weight. These include licensing, deposits and withdrawals, number of assets, etc.

Afterward, we validated the data by:

Registering with FOREX companies as a secret shopper and as Arincen.

Survey number “2,” in which we asked these companies’ customers for meaningful feedback and past experience.

The next step saw us evaluate and rank each company, relying on the hard work of 15 Arincen employees. We were cautious in ensuring the most accurate assessment possible, including considering different languages and the various mobile-app operating systems, e.g., Apple, Samsung, etc.

To add credibility to our research project, we sent a final and third survey (referred to here as Survey “3”) to enable participating FOREX companies to evaluate our research and whether it accurately reflects the realities on the ground. We were fortunate enough to receive a mark of 9.9 out of 10! We have kept the margin of error to a minimum, which stood at a measly 1%. Please click here to learn more about how we came up with the evaluation.

There is a high degree of risk involved in trading securities like FOREX, or CFDs, which are highly complex instruments. As a trader, you could be exposed to excessive leverage, questionable broker tactics, market volatility, and limited regulatory protection. Despite your best trading techniques and risk management strategies, your efforts may not be profitable, and you could suffer losses.

FAQ

CMC Markets provides several account types, including CFD, Spread Betting, and FX Active accounts. It also offers demo accounts with virtual funds for practice.

There is no minimum deposit required to open a CMC Markets account, but starting with at least $100 is recommended for effective trade management.

CMC Markets offers its proprietary "Next Generation" platform and the widely used MetaTrader 4 (MT4). Both platforms are available for web and mobile devices, featuring advanced tools and user-friendly interfaces.

Yes, the CMC Markets mobile app is available for iOS and Android. It provides access to 12,000 instruments, advanced charting tools, and customizable alerts, ensuring seamless trading on the go.

CMC Markets offers one of the largest product catalogs, including FOREX, indices, shares, ETFs, commodities, treasuries, and cryptocurrencies via CFDs.

Client funds are segregated from the company’s funds and held with top-tier banks. CMC is regulated by authorities like the FCA and offers negative balance protection to safeguard against losses beyond your deposit.

CMC Markets provides competitive spreads, starting as low as 0.5 pips for major FOREX pairs. Other fees may include inactivity fees, GSLO premiums (refunded if not triggered), and market data fees for specific instruments.