Alphabet Shares Surge as Google Advances Quantum Computing

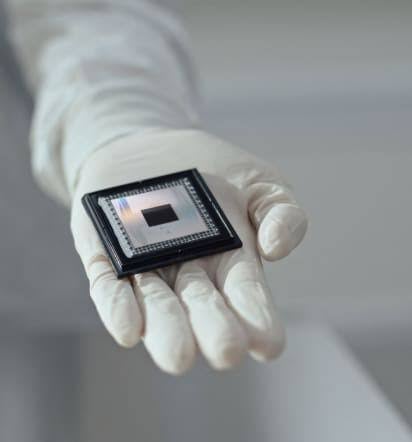

Alphabet shares jumped 6% following Google’s announcement of “Willow,” its latest quantum computing chip. It is a meaningful leap in the race for quantum supremacy. The chip, which boasts a staggering 100 qubits, outperformed its predecessor from 2019 in key benchmarks, offering improved error correction and paving the way for future systems with up to 1 million qubits.

Apart from the share surge, advances in quantum chips like Willow are good for the world. The unbridled computing power unleashed by these chips holds the key to making breakthroughs in a range of applications, something that conventional computers cannot replicate.

Google says Willow is the second step in a six-phase plan to develop quantum computers capable of tackling real-world challenges. CEO Sundar Pichai highlighted its promise in practical applications, including drug discovery, fusion energy, and advanced battery design. While full quantum computing maturity is admittedly years away, Willow's advancements mark a critical milestone toward commercial viability.

The unveiling drew widespread acclaim from leading technology figures, underscoring Google’s role at the forefront of this cutting-edge field. Quantum computing, with its ability to revolutionize areas like large-scale simulations and code-breaking, continues to attract investment and innovation from major players like Nvidia, Microsoft, and IBM, as well as university researchers and startups.

What Does This Mean for Me?

While challenges remain, Google’s progress with Willow reinforces its position as a leader in quantum computing research. As quantum technology evolves, breakthroughs like this hold the potential to redefine industries, making Alphabet’s 6% share price surge a reflection of investor optimism about its long-term prospects.

More News

From Comeback to Contender: Can Europe’s Banks Deliver Again in 2026?

Oracle’s Miss Stirs Fresh AI Bubble Jitters

Netflix’s $72bn Power Play Sets Up a Streaming Shockwave

HP Bets on AI as Cost Pressures Mount and Layoffs Deepen

SoftBank Cashes Out of Nvidia to Double Down on AI Bets

Amazon Rallies 13% as Cloud and AI Power Record Earnings

Apple Is Now a $4 Trillion Company