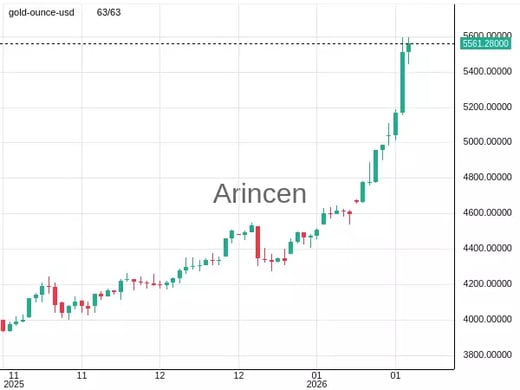

Gold Ounce / United States Dollar

XAUUSD

5,154.94

USD

30.72

(0.60%)

Market Open

Yesterday

5,124.98

Open

5,124.77

Days's Range

5,105.39 - 5,163.79

Ideas

Related Instruments

News

Gold is a precious metal that is traded on a global market around the world. The commodity has a special place in worldwide economics as the one-time base of global currency value during the Gold standard years, before the emergence of fiat currencies. The gold market is traded continuously throughout all time zones. The metal’s different trading centers around the planet are linked as market participants drive local gold prices through trading activity. The gold market is made up of a wide array of participants that includes such stakeholders as producers, refiners, fabricators and end-users. Meanwhile, financial institutions, such as banks, provide an important function in offering financing and providing trading liquidity.

Market players either look to trade physical gold, gain exposure to the gold price, or transfer price risk through hedging. Making sure that this activity takes place transparently and fairly is paramount, so that market participants have confidence in the integrity of their respective gold markets.