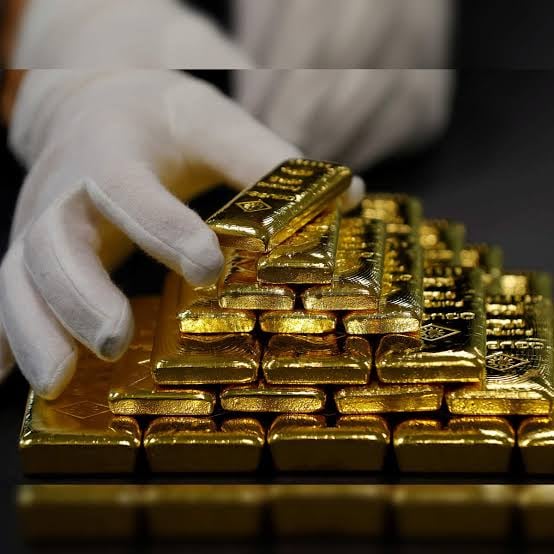

Gold Shines as Copper Loses Its Luster Amid Economic Uncertainty

Gold prices have reached historic highs, driven by expectations of lower interest rates and growing demand for safe-haven assets. In contrast, base metals like copper have faltered due to sluggish economic growth, particularly in China.

Last Friday, gold spot prices soared to an unprecedented $2,500 per ounce, while futures climbed above $2,540. This rally reflects increasing market anticipation of central banks cutting rates, with gold prices holding steady in early Asian trading on Monday.

Copper, however, has struggled, with futures plunging to a five-month low of $3.93 per pound in early August. A slight recovery to $4.18 per pound was seen on Monday, but overall, copper has declined by 18% over the past three months, highlighting the contrast between investor sentiment towards gold and copper.

The surge in gold prices is underpinned by macroeconomic factors, including softer consumer prices and slowing global growth, which have heightened expectations of looser monetary policies. As gold is priced in US dollars, a weaker dollar makes it more affordable in other currencies, boosting demand. Moreover, lower interest rates make gold more attractive as a value store than interest-bearing assets like cash.

What Does This Mean for Me?

Copper's struggles reflect China's tepid economic data and ongoing concerns about a US recession. Despite some recovery, China's weak property sector continues to weigh on copper demand. However, the long-term outlook for copper remains positive, driven by its critical role in renewable energy, electric vehicles, and AI technologies. Analysts forecast that copper demand will double to 50 million metric tons by 2035, with significant demand coming from the US, China, Europe, and India.

More News

.webp)

Japan’s Rate Shift Is Rippling Through Global Bond Markets

1 week ago

China’s Growth Engine Stalls as Consumers and Investors Pull Back

1 week ago

Egypt’s Recovery Gains Traction as Household Pressure Lingers

2 weeks ago

OECD Warns AI and Tariffs Will Test the Global Economy

3 weeks ago

Zero Tariffs, Higher Drug Bills as US and UK Reset Pharma Trade

3 weeks ago

Catastrophe Bonds Go Global as Climate Risk Meets Yield Hunting

3 weeks ago

.webp)

Canada Shields Steel and Lumber Industries From Tariffs

4 weeks ago

Trump Drops Selected Tariffs in Response to Inflation Pressures

1 month ago