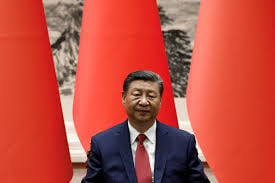

Can Xi Revive China’s Economy?

As China celebrated its Golden Week and the 75th anniversary of the People’s Republic, the government unveiled significant economic measures. These aimed to address the troubled property market, boost the stock market, and provide support for the poorest citizens. Notably, the People's Bank of China introduced a $114 billion fund for insurers and asset managers to purchase shares and plans to cut borrowing costs and encourage corporate stock buybacks.

Despite these efforts, economists remain cautious about the impact of these policies on China’s broader economic challenges. Stock markets in Shanghai and Hong Kong surged after the announcements, with the Shanghai Composite Index jumping over 8% on its best day since 2008, capping a five-day rally of nearly 20%. Hong Kong’s Hang Seng index followed with a 6% rise the following day.

President Xi Jinping, in a surprise Politburo meeting, emphasized increased government spending to bolster economic growth. However, the government provided limited details on the size and scope of this fiscal stimulus. Experts caution that while interest rate cuts and mortgage adjustments could ease pressures, deeper reforms are needed to address structural issues in real estate and consumption.

What Does This Mean for Me?

The real estate market, a key drag on growth, continues to struggle, with falling house prices undermining consumer confidence. Economists suggest that more significant support for household incomes, alongside pension and social security improvements, is required to sustain consumption. China’s leadership is working to balance transitioning from property-led growth to a more sustainable, high-quality development model. Still, this shift poses long-term challenges intertwined with the old economic drivers.

More News

.webp)

Japan’s Rate Shift Is Rippling Through Global Bond Markets

1 week ago

China’s Growth Engine Stalls as Consumers and Investors Pull Back

1 week ago

Egypt’s Recovery Gains Traction as Household Pressure Lingers

2 weeks ago

OECD Warns AI and Tariffs Will Test the Global Economy

3 weeks ago

Zero Tariffs, Higher Drug Bills as US and UK Reset Pharma Trade

3 weeks ago

Catastrophe Bonds Go Global as Climate Risk Meets Yield Hunting

4 weeks ago

.webp)

Canada Shields Steel and Lumber Industries From Tariffs

1 month ago

Trump Drops Selected Tariffs in Response to Inflation Pressures

1 month ago